15,000 USD for Ethereum by the end of the year you don't believe? What about within three years, stretching the timeline?

TechFlow Selected TechFlow Selected

15,000 USD for Ethereum by the end of the year you don't believe? What about within three years, stretching the timeline?

Tom Lee has been bullish on Ethereum longer than almost anyone else still active today.

By: David Canellis, Blockworks

Translation: AididiaoJP, Foresight News

Fundstrat's Chief Investment Officer Tom Lee might be the "King of Bulls" in this bull market.

Of course, many people enter the crypto space out of love for the technology.

In fact, truly diving in for the technology—such as blockchain-based digital city-states, smart cities, and real-world asset tokenization—is the most effective path to becoming a "top-tier bull."

Michael Saylor is extremely pro-technology; so are Tim Draper, founding partner of DFJ, Marc Andreessen, co-founder of a16z, Brian Armstrong, co-founder and CEO of Coinbase, and former Coinbase CTO Balaji Srinivasan. Who could be more extreme than them?

The answer is Fundstrat's Chief Investment Officer Tom Lee.

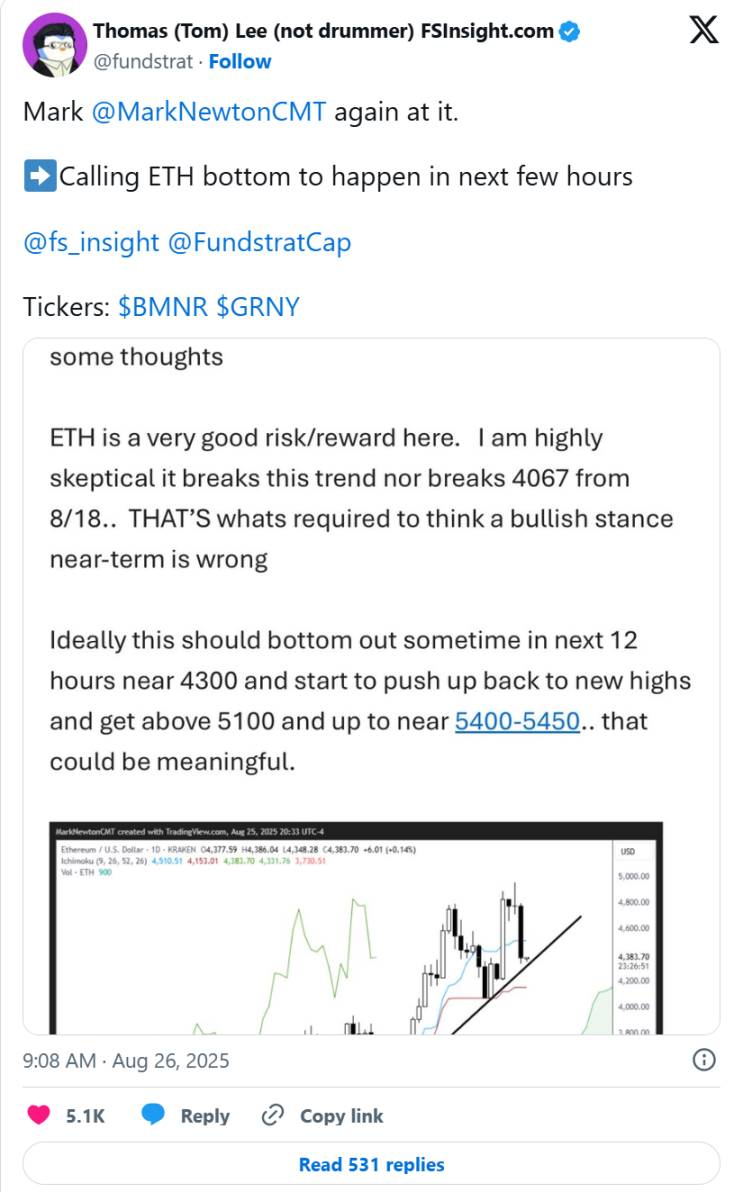

Last night at nine o'clock, Tom Lee began calling that the ETH bottom has already appeared.

In fact, Tom Lee has been bullish longer than almost anyone else still active today.

He first publicly predicted cryptocurrency prices in mid-2017. At that time, Bitcoin had more than doubled in the first half of the year, reaching $2,500, prompting Tom Lee to make at least 10 forecasts on Bitcoin’s future price over the following 10 months leading up to May 2018.

His first prediction actually came true. "Cryptocurrencies are eroding investor demand for gold," Tom Lee wrote in a report to Fundstrat clients eight years ago when Bitcoin was at $2,607. "Bitcoin is becoming a scarcer store of value. Investors need strategies to capture the potential upside from cryptocurrencies."

-

Actual movement: Bitcoin reached $20,000 by 2022—a nearly tenfold increase.

-

Predicted movement: Reach $55,000 by 2022—a 22x gain within five years.

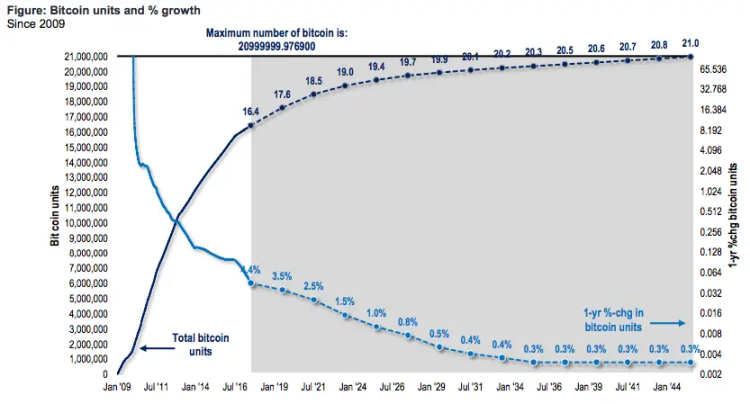

Tom Lee's report included this useful chart on Bitcoin scarcity.

Tom Lee was completely right—Bitcoin first broke $55,000 in February 2021, slightly earlier than expected, and hit a peak above $69,000 nine months later.

What complicates matters is that he continued making predictions after his initial success.

Some predictions ultimately proved correct, but either set price targets too low or called timing too early; others simply did not unfold as he envisioned (for example, the anticipated rally around the 2018 Consensus conference never materialized, or Bitcoin failed multiple times in 2018 to reach $25,000 as predicted).

Yet there were other standout calls. In January 2018, he said Bitcoin could reach $125,000 by 2022—a target achieved three years later.

At the end of 2020, he predicted that by early 2025, Bitcoin would trade between $100,000 and $150,000—a forecast that, overall, isn’t too far off.

But if the harshest critique of Tom Lee’s predictions is that they’ve become history, then you’ll love his recent forecast: Bitcoin could reach $200,000 to $250,000 in 2025 (a prediction made three weeks ago) and exceed $1 million in the coming years.

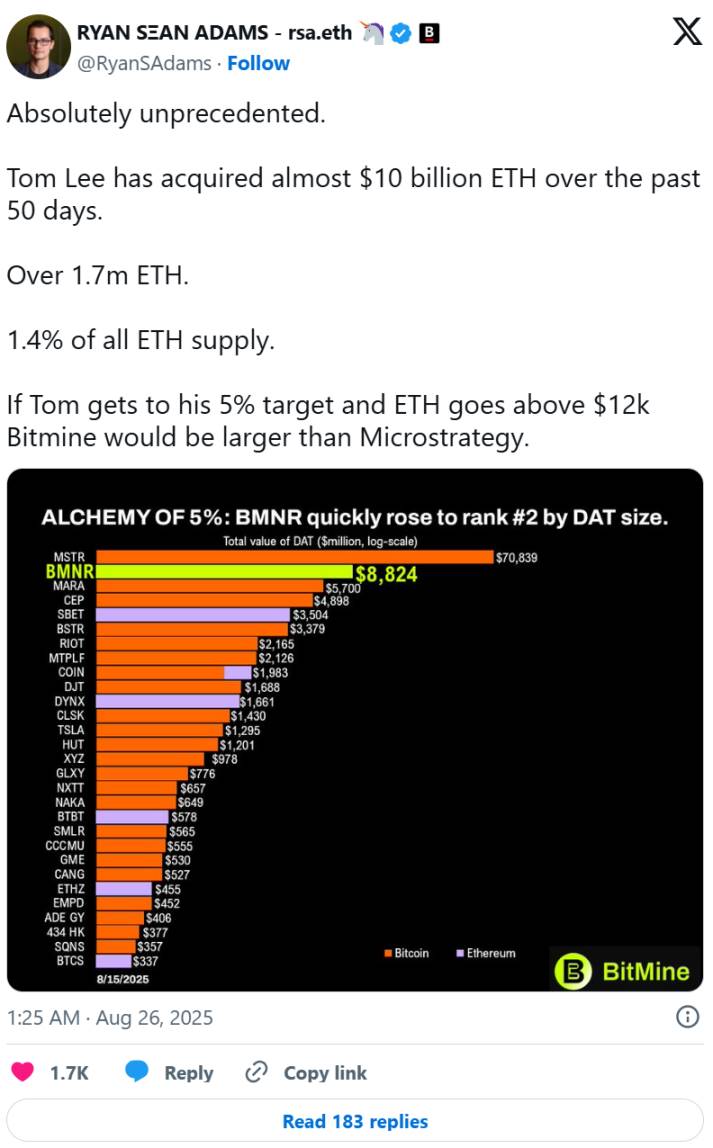

Tom Lee recently made his first public forecast on ETH, shortly after becoming chairman of BitMine about a month ago—a company executing an Ethereum-focused treasury strategy.

Tom Lee predicts that by the end of this year, ETH could reach $15,000 to $16,000 per coin, a threefold increase from current levels.

But just to be safe, perhaps a few more years should be added to that timeline.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News