Up to 100% compensation: OKX C2C merchants launch "freeze protection"

TechFlow Selected TechFlow Selected

Up to 100% compensation: OKX C2C merchants launch "freeze protection"

From "fearing freezes" to "compensation guaranteed if frozen," OKX's move marks the entry of cryptocurrency C2C trading into a new era of secure transactions.

"Your bank account ending in XXXX has been flagged for judicial assistance, and part of the funds have been frozen." Last night, Ah Wei had just withdrawn 10,000 USDT. He planned to pay his mortgage and his daughter's tuition today, but this "frozen card" message left him stunned, throwing all his plans into disarray. He believes he merely followed the platform’s procedures for receiving payments and releasing coins, with no other violations.

Ah Wei immediately called the bank's customer service, only to receive the standard reply: "The bank is only responsible for executing the freeze. For specific reasons and unfreezing timelines, please consult the relevant law enforcement agency." Ah Wei then began a long, tedious process—printing thick stacks of transaction records, queuing at the bank for explanations, visiting police stations for interviews, and submitting nearly a year’s worth of transaction history. This series of complicated procedures left him physically and mentally drained by endless leave requests, queues, commutes, and document stamps.

"Card freezing" is not an isolated case. Many users like Ah Wei are innocently caught up in such issues. These problems mostly stem from the opacity of fund flows under C2C/P2P deposit and withdrawal models: when upstream transactions trigger risk controls, downstream users are unfairly "implicated" and have their accounts frozen. Once a bank card is frozen, funds can be "locked" for months or even longer, severely disrupting daily life. Mortgage and credit card repayments may default, and everyday expenses such as grocery shopping, ride-hailing, or ETC tolls could also be affected. Worse, some users are placed on banks’ high-risk lists due to repeated freezes, resulting in long-term restrictions on their accounts. Moreover, the time and effort required to unfreeze accounts only worsen the situation. Difficult deposits and withdrawals, along with lack of fund security, have become widespread challenges for crypto users.

OKX C2C “Freeze Compensation” Merchants Launch: Get Compensated If Frozen, Up to 100% Refund

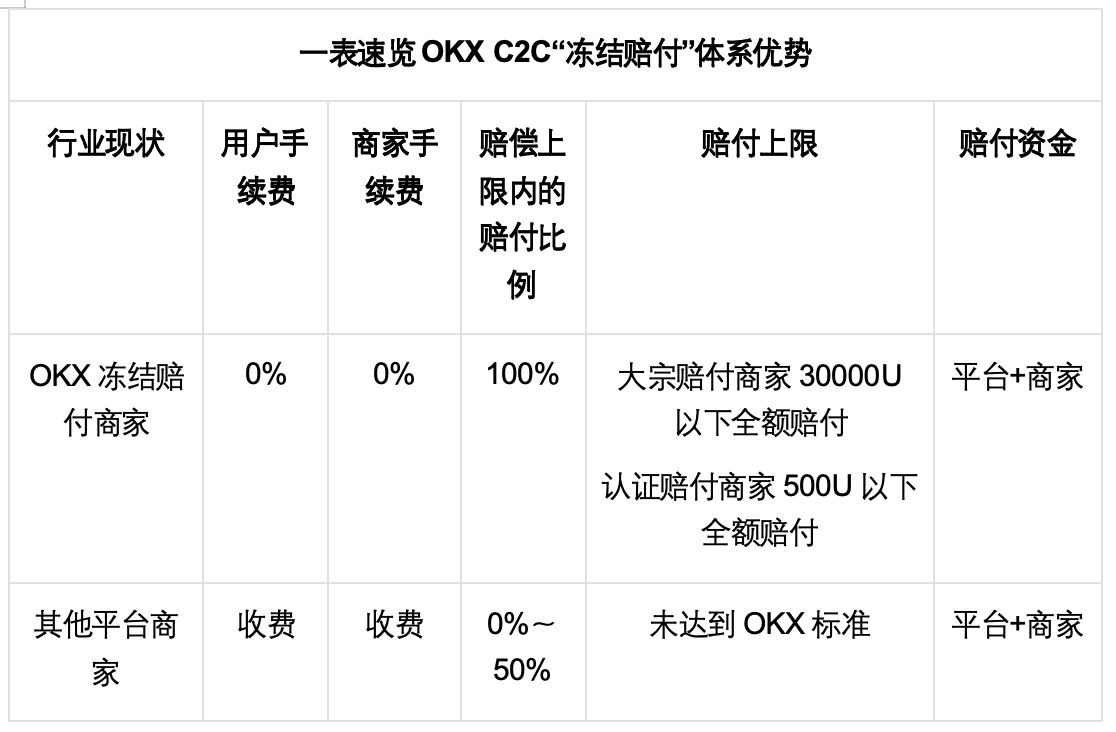

In response to this industry-wide pain point, major trading platforms are attempting to provide solutions, focusing on reducing freeze rates and improving compensation policies to offer users a safer C2C deposit and withdrawal experience. However, there are clear differences among platforms in their specific measures.

OKX C2C has officially launched its new “Freeze Compensation” system. Simply put, users trading in the OKX C2C section with merchants marked with the “Freeze Compensation” badge will not only enjoy zero fees but also be eligible for financial compensation from the platform if their receiving account gets frozen due to the counterparty’s payment—up to 100% compensation, with a single-transaction cap as high as 30,000 USDT. This compensation level far exceeds protections previously offered by other platforms, fully demonstrating OKX’s determination and capability in safeguarding user funds.

Compensation funds on OKX are jointly supported by the platform and merchants, not solely relying on merchant deposits. This ensures sufficient backing even for large claims, so users don’t need to worry about merchants being unable to pay. OKX aims to “create the most trustworthy trading environment, making every transaction secure and stress-free.” For traders plagued by frozen cards, OKX C2C is currently one of the safest and most reliable deposit and withdrawal platforms.

Compensation funds on OKX are jointly supported by the platform and merchants, not solely relying on merchant deposits. This ensures sufficient backing even for large claims, so users don’t need to worry about merchants being unable to pay. OKX aims to “create the most trustworthy trading environment, making every transaction secure and stress-free.” For traders plagued by frozen cards, OKX C2C is currently one of the safest and most reliable deposit and withdrawal platforms.

Another pleasant surprise for users is that OKX promises zero transaction fees on all C2C orders. Regardless of order size, users trading cryptocurrencies via “Freeze Compensation” merchants pay no fees. In an environment where most platforms charge OTC transaction fees, this significantly reduces trading costs and reflects OKX’s genuine commitment to benefiting users.

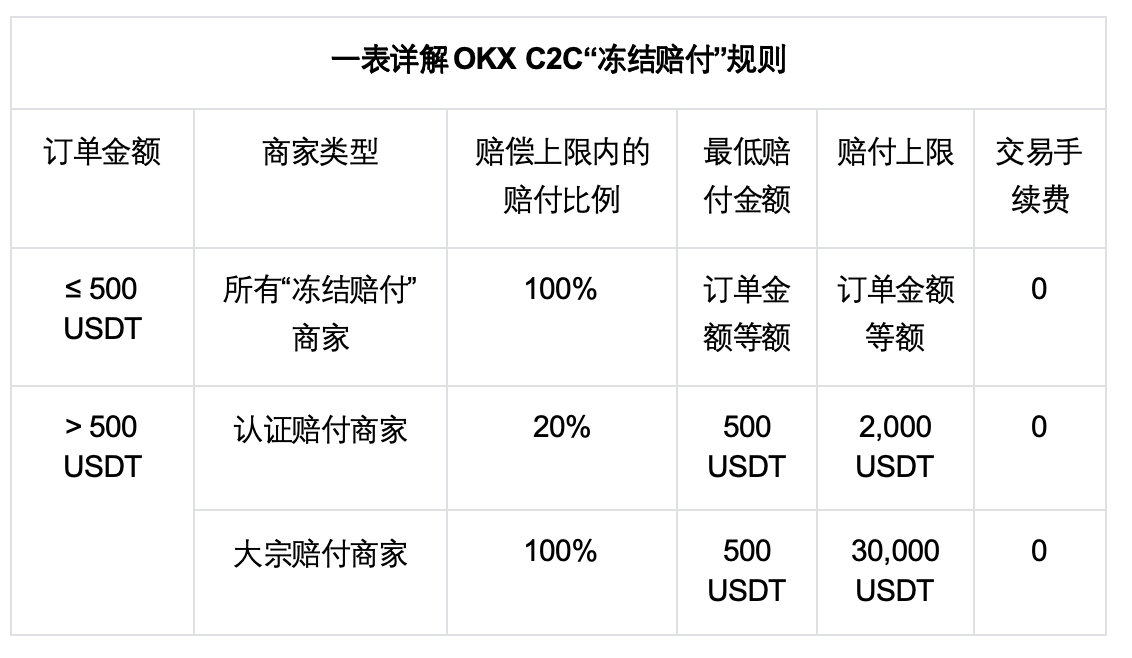

OKX’s newly released “Freeze Compensation” rules are highly detailed, aiming for fairness and transparency. According to official guidelines, compensation amounts are tiered based on order size and merchant type (see table below). In short:

Small Orders (≤500 USDT): Both regular certified compensation merchants and bulk compensation merchants offer 100% compensation of the order amount, with no minimum payout. For example, a 300 USDT transaction triggering compensation would entitle the user to a full 300 USDT refund.

Large Orders (>500 USDT): Regular certified compensation merchants pay 20% on amounts exceeding 500 USDT, with a minimum payout of 500 USDT and a maximum of 2,000 USDT. For instance, a 600 USDT transaction triggering compensation would result in a 520 USDT payout (500 + (600-500)*20%).

In contrast, bulk compensation merchants offer 100% compensation within the claim limit—minimum 500 USDT, maximum 30,000 USDT. This means if a user trades 10,000 USDT with a bulk compensation merchant and faces a freeze, they can receive up to 10,000 USDT in compensation. Even for larger transactions (e.g., 50,000 USDT), the maximum compensation remains capped at 30,000 USDT. This amount generally covers the typical scale of a single withdrawal for average traders, sufficient to handle most risk scenarios.

Merchant准入 and Review: Selecting the Best, Strictly Controlling Risks

Of course, “Freeze Compensation” is not unconditional. This protection only applies when trading with OKX-certified “Freeze Compensation” merchants. These merchants undergo multi-dimensional screening by the platform—either high-performing bulk merchants with substantial deposits, or premium merchants who pass certification and commit to compensating according to rules. They display a prominent “Freeze Compensation” badge on their profiles, clearly visible to users during checkout.

In addition, to help users choose easily, OKX has added a dedicated filter in the C2C trading interface. Users can directly select “Freeze Compensation” merchants for faster and more secure trading.

After becoming a compensation merchant, OKX continues to monitor their performance. For example, merchants must follow the “freeze-covered” service guidelines and must not induce trades through false promises. If user complaints are verified as the merchant’s fault, the platform may penalize them with point deductions, fines, account freezes, or revocation of compensation privileges. Conversely, merchants who actively fulfill compensation duties and perform well receive incentives such as increased traffic exposure and preferential ranking, encouraging higher-quality service.

Through this strict merchant准入 and management system, OKX aims to establish “Freeze Compensation” merchants as benchmark traders within its C2C ecosystem. They not only offer smooth, fast transactions but, more importantly, provide insurance for user funds. For merchants, obtaining compensation status also means enhanced credibility and platform support, helping attract more users.

At the same time, OKX reminds users to still follow platform risk control rules during transactions—such as verifying recipient account details and confirming receipts promptly—to avoid unnecessary disputes. In cases of suspected fraud or fund anomalies, users should immediately request customer support intervention. The platform will assist in resolution and take strict actions against rule-breaking merchants, including compensation.

Overall, OKX’s compensation framework addresses the needs of both small frequent trades and large transactions: small trades are fully covered, allowing retail users to trade risk-free; large trades are protected by financially strong bulk merchants offering high compensation, securing large capital. Combined with zero-fee benefits, OKX aims to encourage more users to trade with certified compensation merchants, reducing frozen card incidents at the source and fostering a healthier C2C trading ecosystem.

User安心 Deposits: OKX C2C Becomes a Safe and Reliable Channel

The launch of OKX C2C’s “Freeze Compensation” system is undoubtedly great news for ordinary users. For a long time, difficult deposits/withdrawals and lack of fund security have been major barriers preventing newcomers from entering the crypto space. Many outsiders hesitate about OTC trading: “What if the other party doesn’t release coins after I pay?” “Who takes responsibility if my bank card gets frozen after receiving coins?” Now, OKX offers a solution, allowing users to buy and sell cryptocurrencies via C2C with greater confidence.

For crypto users, this means a safer funding channel. Whether cashing out during a bull market or buying the dip in a bear market, trading via “Freeze Compensation” merchants adds an extra layer of fund security. This reduces anxiety over frozen cards, enabling users to focus more on trading itself. Some users who previously reduced trading due to freeze concerns may now increase their activity.

For newcomers outside the crypto circle, OKX’s compensation mechanism lowers the psychological barrier to entry. Previously, beginners often hesitated, fearing scams or frozen cards. Now, with trusted merchants available, they can confidently try purchasing assets like Bitcoin and Ethereum, truly achieving “one-click deposits” without worries.

Additionally, OKX’s compensation model may create a “catfish effect,” driving overall industry service improvements. As users realize OKX’s C2C is both safe and cost-effective, they’ll naturally prefer using OKX for fiat transactions. This will push other platforms to improve—by lowering fees, tightening merchant reviews, or offering similar compensation. Ultimately, investors benefit, and the entire crypto market’s deposit/withdrawal channels will become smoother and safer.

That said, OKX reminds users: while the compensation mechanism is beneficial, transaction compliance and safety remain essential. When using C2C services, users must comply with applicable laws and regulations and must not engage in illegal activities such as money laundering or “running points.” While choosing certified merchants, users should also practice self-risk management. Only through joint efforts between platform and users can frozen card risks be minimized. And when risks do occur, OKX’s compensation system stands as a solid backup.

From “fearing freezes” to “freeze? We’ve got you covered,” OKX’s move marks a new era of secure and worry-free cryptocurrency C2C trading.

Disclaimer:

This article is for informational purposes only. The views expressed are those of the author and do not represent the position of OKX. This article does not constitute (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of the information provided. Holding digital assets (including stablecoins and NFTs) involves high risk and values may fluctuate significantly. Past performance is not indicative of future results. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are solely responsible for understanding and complying with local applicable laws and regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News