How Are Stablecoins "Created"? Decrypting the "Mint-as-a-Service" Model

TechFlow Selected TechFlow Selected

How Are Stablecoins "Created"? Decrypting the "Mint-as-a-Service" Model

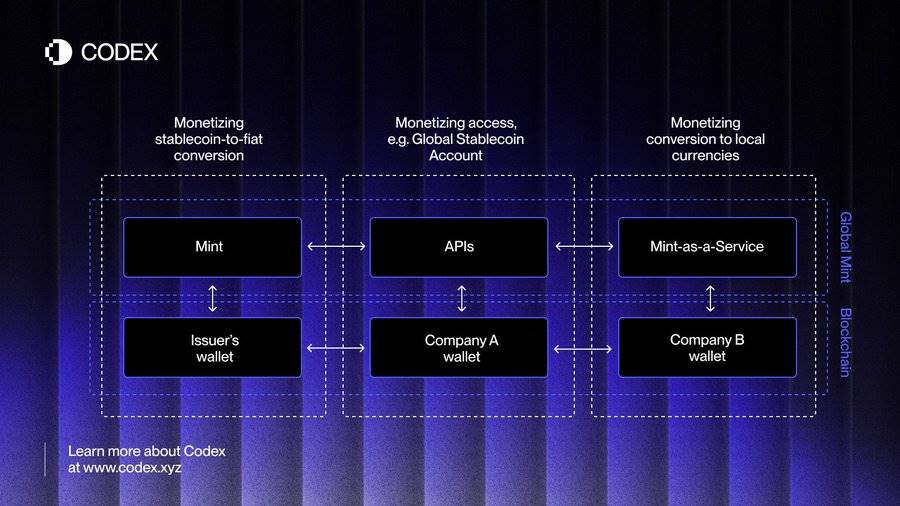

Mint infrastructure empowers stablecoin cross-border payments, achieving global deployment through three models.

Author: haonan

Compiled by: TechFlow

Previously, we proposed the idea of issuing dedicated stablecoins.

One of the most powerful use cases for stablecoins is cross-border payments, such as global merchant settlements. In this area, stablecoins can significantly reduce costs and shorten settlement times compared to traditional payment channels.

To unlock this potential, a global minting mechanism (Mint) is required—a globally distributed infrastructure for creating and managing stablecoins across regions. Next, we will explore what a minting mechanism is and how global stablecoin access can be achieved.

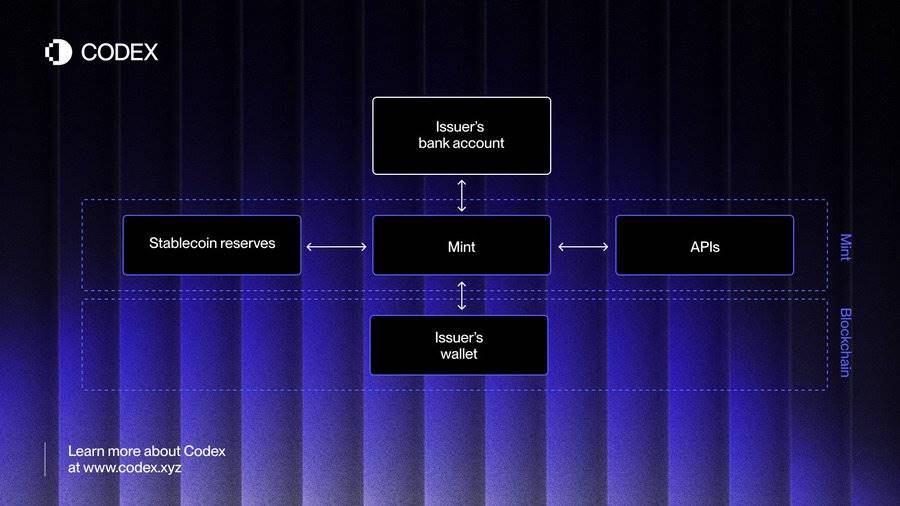

Core Components of the Minting Mechanism

The core of stablecoin issuance lies in the “minting mechanism” (Mint), which serves as the foundational infrastructure driving the entire process. This system supports three core processes:

-

Minting and Burning: This is the fundamental process of stablecoin issuance, referring to the creation and destruction of tokens on the blockchain by the stablecoin issuer. This process is managed by smart contracts on the blockchain, and requires supporting financial infrastructure including bank accounts for fiat deposits and withdrawals, as well as IT systems and APIs to enable automated conversion.

Stablecoins are created through the blockchain minting process and redeemed through burning. The stablecoin issuer controls the smart contract, ensuring exclusive authority over minting and burning stablecoins.

Stablecoins maintain their peg to the underlying fiat currency through reserve assets. These reserves are typically invested in highly liquid, short-term financial instruments and are managed by independent, trusted third parties. The value of circulating stablecoins directly reflects the value of these reserve assets.

-

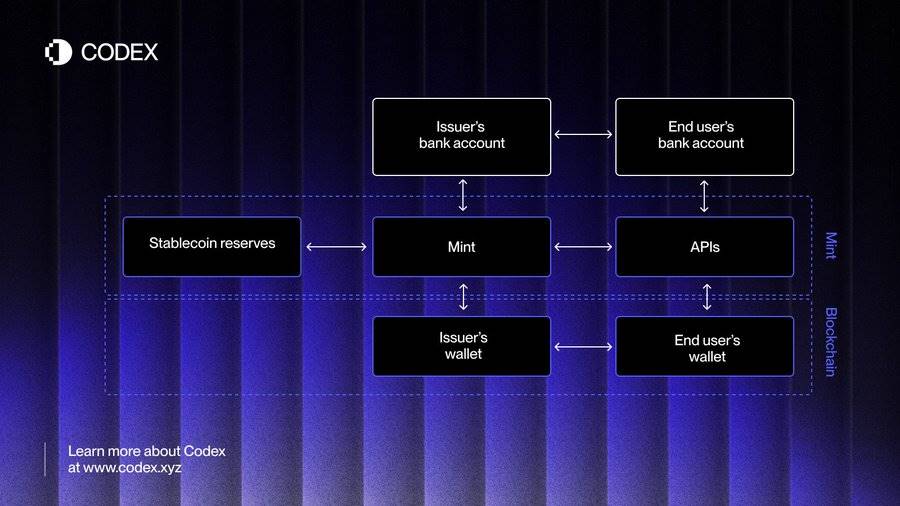

On-ramping and Off-ramping: This refers to how users convert fiat currency into stablecoins and vice versa. This seamless two-way process is central to the utility of stablecoins, enabling end users to easily exchange fiat for stablecoins.

When users want to obtain stablecoins, they simply transfer fiat to the issuer and trigger the conversion via API. The issuer then mints new stablecoins and sends them directly to the user's digital wallet. The deposited fiat is held as reserve assets and invested to generate yield.

Conversely, when users wish to convert stablecoins back into cash, they send the tokens to the issuer. The issuer burns the tokens, liquidates the necessary reserve assets, and transfers the equivalent fiat amount back to the user.

-

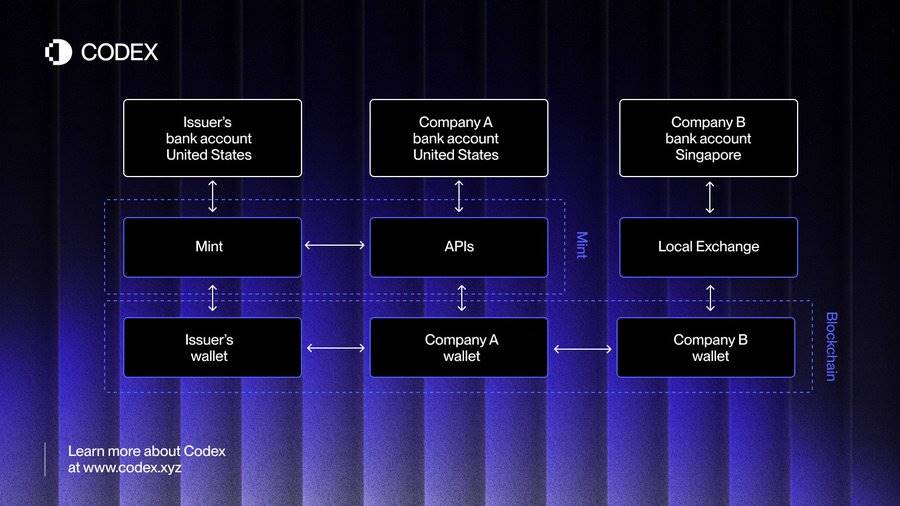

Global On/Off-ramping: This is the third core process of stablecoin operations and also the most transformative. It addresses the critical need for seamless conversion between stablecoins and multiple fiat currencies across different regions.

In practice, this means integrating with local payment channels and maintaining bank accounts in each region to support fiat deposits and withdrawals, enabling stablecoins to be exchanged for any local currency and vice versa.

This capability makes stablecoins truly attractive for global capital flows. Compared to existing cross-border payment solutions, stablecoins often win out by offering faster speeds and lower costs.

Global Access Blueprint

Building a global minting mechanism (Mint) with local on/off-ramping channels is a complex and challenging task. Stablecoin issuers can achieve this through three main approaches:

-

Create regional on/off-ramping channels: This approach requires opening bank accounts and obtaining necessary licenses in different regions. Stablecoin users deposit fiat into these local bank accounts, then convert it into stablecoins via the minting mechanism.

While operationally complex and time-consuming, this method gives the issuer full control over the minting process in each region.

-

Partner with local cryptocurrency exchanges: By collaborating with local exchanges and market makers in target countries, stablecoin users can use these platforms to convert between fiat and stablecoins.

While this strategy expands the issuer’s global reach, it comes at high cost due to listing fees, market-making expenses, and the complexity of managing multiple partnerships.

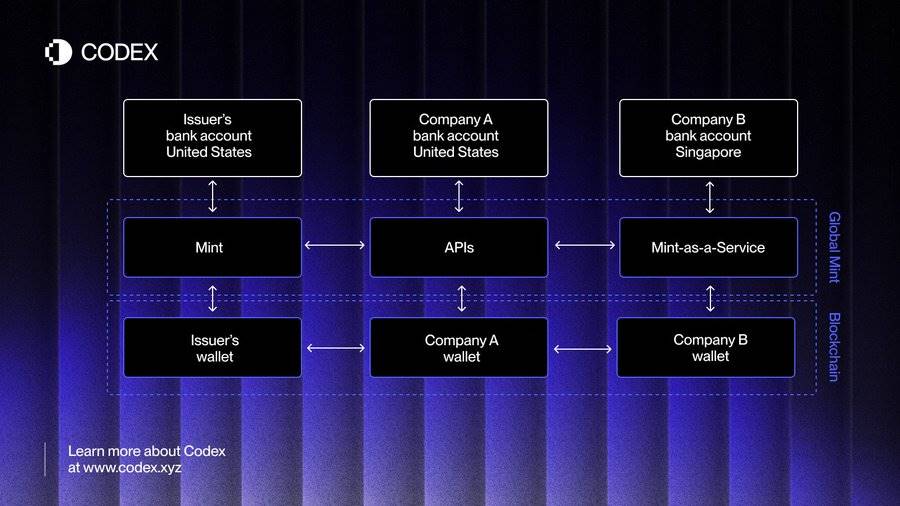

Adopt a Mint-as-a-Service (MaaS) model: A more efficient and scalable alternative is to partner with a Mint-as-a-Service provider (e.g., Codex). In this model, the MaaS provider acts as a trusted local agent. Stablecoin users in specific countries transact with the MaaS provider, who leverages the issuer’s core minting mechanism to handle conversions between fiat and stablecoins.

The MaaS model effectively eliminates the high costs and operational complexities of building a global on/off-ramping network from scratch. High on/off-ramping costs are often seen as the primary bottleneck to stablecoin adoption, and the MaaS model directly addresses this barrier, paving the way for stablecoin globalization.

Key Strategic Considerations

To successfully implement a global stablecoin issuance strategy, stablecoin issuers must focus on the following key areas:

-

Build a robust domestic foundation: First, establish secure and compliant minting infrastructure in major markets. This includes developing and deploying reliable smart contracts, partnering with banks for seamless fiat deposits and withdrawals, appointing asset managers for reserve management, and building a strong suite of APIs.

-

Enable on/off-ramping in strategic regions: Based on demand for cross-border payments, identify key regions where on/off-ramping services are most needed. Partnering with a Mint-as-a-Service (MaaS) provider is the fastest and most cost-effective way to achieve local on/off-ramping capabilities.

-

Develop a competitive pricing model: Issuers can optimize their service through strategic pricing. While they may choose to charge fees for access, minting, burning, or foreign exchange, they can also opt to subsidize these costs for users and instead profit from yields generated by stablecoin reserves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News