P kids, ready to prepare for the new battlefield?

TechFlow Selected TechFlow Selected

P kids, ready to prepare for the new battlefield?

Speculation always flows toward anything that can sustain the pace of the narrative.

Written by: @MiyaHedge

Translated by: AididiaoJP, Foresight News

Ben Pasternak, founder of Launchcoin—just mentioning his name gives the entire crypto Twitter PTSD. The fact that a $40 million market cap token occupies such a large mental share tells me one thing: tokenized startups are here to stay, and everyone on crypto Twitter deeply wants this concept to succeed.

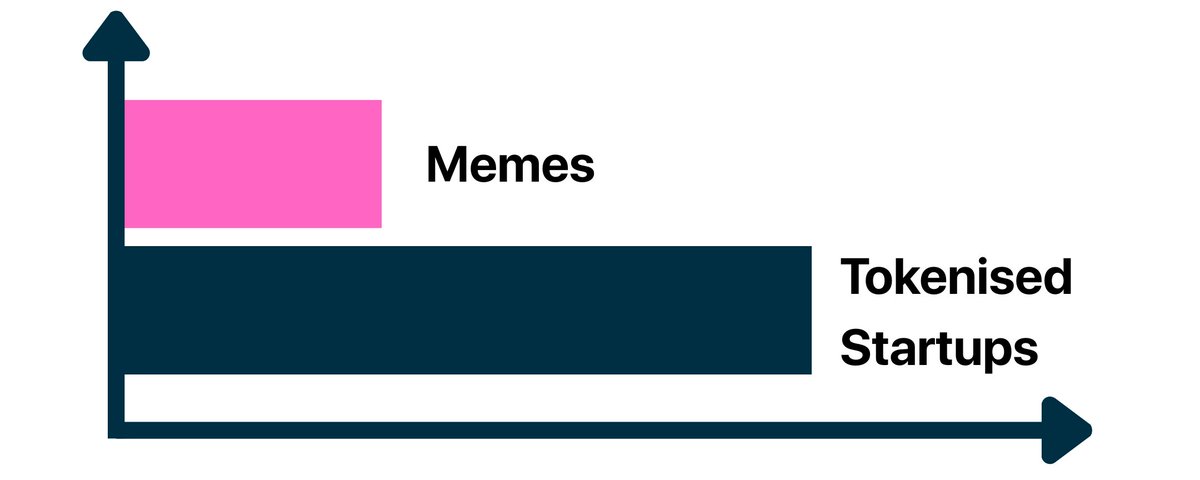

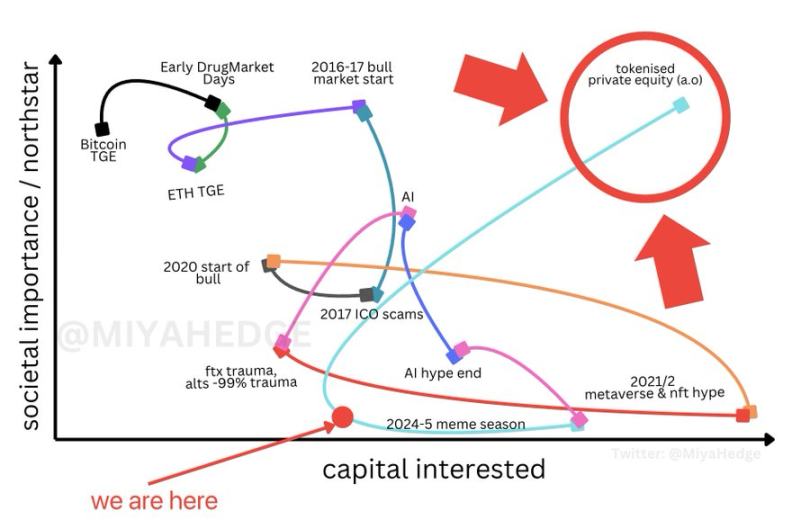

I previously outlined how meme coins were slowly dying, and since then, much has happened; let's quickly recap:

BonkFun died rapidly, as predicted

PumpFun regained market share, as predicted

Heaven emerged, capturing 14% of the meme coin market

Overall activity in the meme coin market? Hit a new low on August 17, with only 124,000 daily active addresses. You might disagree with me, but numbers don’t lie: the meme coin market is dying.

But what won’t die is the generational shift toward gambling, financial nihilism, and taking massive risks for asymmetric returns. We are in the era of hyper-gambling. This is precisely why tokenization never truly took off on crypto Twitter. If you can bet on CHILLHOUSE (projected 10x in 5 days), who would want to bet on an Apple Inc. on Solana? Tokenization remains the biggest traditional finance theme of this cycle, and has been so for over a year.

RWA, while important for society, has never sparked major capital interest within crypto—until Ben Pasternak showed up.

We are somewhere at the end of the meme coin era and the beginning of the ICM (Initial Coin Offerings, referring to tokenized startups or related concepts) era.

Despite all of us loving to mock Ben Pasternak, I believe he is somewhat of a visionary.

Startups + crypto degen culture are a match made in heaven.

You now have the first chance to bet on real founders backed by Tier-1 Silicon Valley VCs, and Believe created a digital version of a startup investment reality show. Most were built on premise and vision, with actual execution falling short in rhythm and framework. Now LAUNCHCOIN has dropped -87% from its peak, and Ben Pasternak has become the laughingstock of crypto Twitter.

So is ICM dead now? Was the digital startup investment reality show always a joke, a bad idea?

I don’t think so.

Speculation always flows toward whatever can sustain narrative velocity.

-

In the 1980s, it was penny stocks.

-

In the 2000s, it was small-cap IPOs.

-

In the 2020s, it was Dogecoin.

Now? It’s tokenized startups.

Why? Because they sit exactly at the intersection every stakeholder wants:

-

Startups need funding + distribution.

-

Investors want liquid exposure to early-stage innovation.

-

Crypto needs a constant inflow of new tokens to sustain the cycle.

Background on Private Equity

In 2025, the global private equity market is a $13 trillion space, projected to reach $12–19 trillion by 2030.

Currently, it’s closed: minimum investments of $1 million, 5–10 year lock-ups, opaque reporting, with trillions concentrated in giants like Blackstone, KKR, Apollo.

Thus, we have trillions in private assets locked away, while retail in crypto craves fresh, non-shell assets. This mismatch is the arbitrage opportunity.

We also have young, ambitious founders eager to stand out. The next generation of founders are perpetually online, masters of attention capture. As AGI draws closer, the only way to generate revenue will be monetizing your "shell" as efficiently as possible. Technology will no longer matter—it’ll become a game of who can best promote their product to gather massive user bases.

These Gen Z founders are fluent in meme grammar, trained since adolescence to navigate algorithmic feeds. They’re not just “founders”—they’re cultural operators. Actual codebases can be forked, outsourced, auto-generated by AI, but packaging them into viral narratives that force millions to click, share, and ultimately pay—that’s the scarce skill. They weaponize network effects and attention maximization by creating a token that automatically drives millions of users to adopt their product. This is why tokenized startups hold an edge over non-tokenized ones.

Look at Murad’s SPX gaming plan: “Promote this coin to one person daily to increase holder count.” For Believe, you should be incentivized to promote the startup to grow its user base, and if the dev team designs the token correctly, token holders should benefit collectively. This user flywheel is crucial for tokenized startups.

This perfectly aligns with the spirit of the times: they’re not selling products, but live narratives with ticker symbols attached. Founders can channel their attention-maximizing skills from day one into a tradable asset. Every tweet, every viral campaign, every market cycle translates directly into liquidity.

Tokenized startups are inevitable because they satisfy the needs of every party in the equation.

Now don’t get me wrong: this isn’t a promo for LAUNCHCOIN. I think Believe screwed it up—they launched a product only 1/10 complete, with poor framing, promoting these tokens like meme coins, when you should actually design them to resemble securities as closely as possible.

ICM is so hot, yet no one holds a token longer than 30 seconds—these two things are mutually exclusive.

I don’t know if this narrative shift will unfold over two months or two years. This month, I invested six figures into building a legal framework allowing startups to tokenize without being classified as securities. To my knowledge, at least five other teams are doing the same. Some people are working quietly, backed by major law firms, having built tokenized equity legal frameworks for nearly a year.

I don’t know when this will happen, but the process will go like this:

-

Tokenized startups via non-security models

-

Mid-to-small cap pre-IPO companies tokenizing via security models

-

Large ($1B+) private companies tokenizing via security models

And you need to be part of it.

Private equity is the largest untapped market crypto hasn’t dared touch.

It fits crypto culture perfectly.

Gambling-like nature, not overly financialized, constant influx of new companies.

Tokenized startups will mark the beginning of tokenized private equity, becoming the degens’ new casino for super-gambling and blowing their life savings.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News