From Crypto to Nvidia: Can Bitget's RWA Index Contracts Activate a Trillion-Dollar New Variable in US Stocks?

TechFlow Selected TechFlow Selected

From Crypto to Nvidia: Can Bitget's RWA Index Contracts Activate a Trillion-Dollar New Variable in US Stocks?

RWA perpetual contracts emerged precisely in this context, not only opening the door to the U.S. stock market for Chinese-speaking investors but also building a bridge between the crypto market and traditional equities.

Author: OneShotBug

RWA continues to bring us more surprises.

The U.S. stock market is an exciting space, consistently giving rise to astonishing unicorns and startup success stories—such as NVIDIA, whose market cap soared to the top, sparking strong interest among Chinese-speaking investors. However, high trading fees, complicated account opening procedures, and foreign exchange controls have made direct participation in U.S. equities challenging.

As one practical application of the RWA concept, stock tokenization offers a new investment pathway. RWA contracts issued by platforms like xStocks and Ondo allow investors to indirectly access U.S. stocks through tokenized assets, bypassing the complex processes and high costs associated with traditional stock markets.

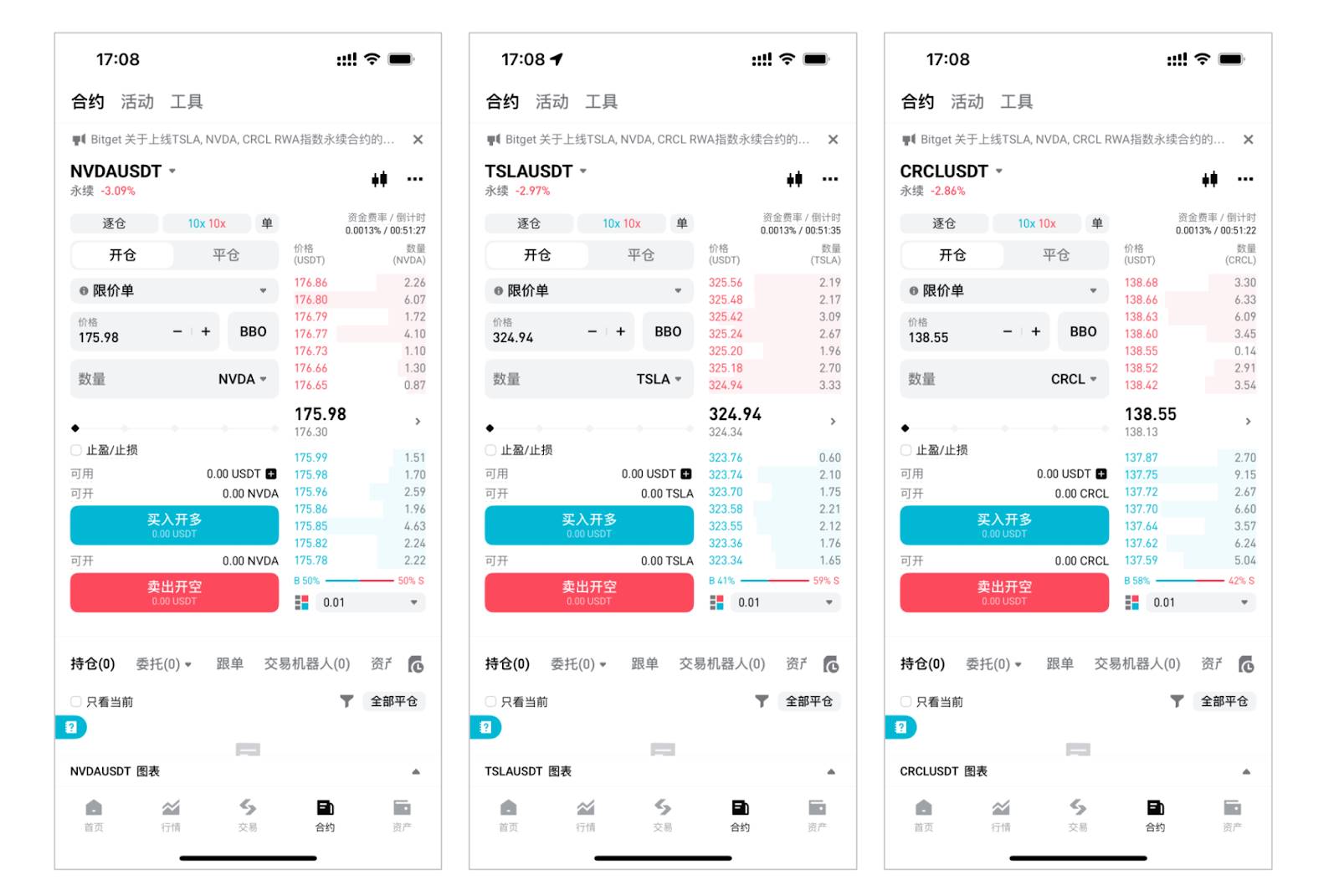

This article focuses on Bitget’s recently launched "RWA Index Perpetual Contracts." The product initially lists popular U.S. stock assets including NVIDIA (NVDA), Tesla (TSLA), and Circle (CRCL), introducing further innovation upon existing RWA contracts: it uses a weighted pricing mechanism across multiple issuers and enables flexible, high-leverage trading. Overall, this appears to be a highly suitable tokenized U.S. stock investment product for Chinese-speaking investors.

Below, I will briefly introduce the RWA Index Perpetual Contract and analyze its product advantages, risk management mechanisms, and market opportunities.

Why is the crypto community interested in stock tokenization?

As one of the brightest stars emerging from the deep integration between cryptocurrency and traditional financial markets, stock tokenization builds a bridge between the two worlds.

With rapid advancements in blockchain technology, nearly all assets that can be tokenized are gradually entering the blockchain ecosystem. From early stablecoins to real estate, bonds, funds, and now the trending tokenized stocks (Tokenized Stocks), each innovation aims to eliminate barriers in traditional finance using blockchain, breaking constraints related to time and geography.

The core of stock tokenization lies in transforming traditional stock assets into digital tokens on the blockchain, enabling 24/7 global trading, fractional share purchases, and more efficient cross-border transactions. This model is especially attractive to retail investors worldwide, particularly those from emerging markets, as it addresses long-standing pain points such as difficult account openings, remittance challenges, and mismatched trading hours.

Although stock tokenization is not entirely new—platforms like FTX and Binance attempted related products as early as 2020—regulatory pressure ultimately halted their efforts. However, with renewed market demand and improved technical conditions, stock tokenization has regained attention in 2024, becoming one of the key areas of investor focus. Today, the continuous development of RWA products is expanding opportunities for investors to participate in U.S. stock markets via tokenization.

What is the RWA Index Perpetual Contract?

The RWA Index Perpetual Contract is an innovative financial product first introduced by Bitget. According to the official website, its most significant innovation lies in adopting a multi-issuer weighted pricing mechanism. Each index aggregates token prices from multiple platforms (such as xStocks and Ondo), combining various tokenized stock assets into a single weighted index. Through this weighted pricing, Bitget consolidates token prices from multiple issuers.

This pricing mechanism makes RWA Index Contracts more flexible and stable while enhancing market transparency. Investors can clearly understand the weight of each token within the contract and obtain a comprehensive market price based on the weighted index.

Trading can be conducted directly on Bitget’s website and mobile app. Simply search for the product name within the contract section. Currently listed are NVDA, TSLA, and CRCL, all available with USDT trading pairs.

Opportunities for Chinese-Speaking Investors: Zero-Barrier Access to the U.S. Stock Market

For investors, the U.S. stock market represents a landscape full of opportunities, home to rapidly growing global leaders like Tesla and NVIDIA. However, for many Chinese-speaking investors, direct investment in U.S. stocks has long been hindered by numerous obstacles. First, investors must open accounts through traditional brokerage platforms—a process often involving cumbersome procedures such as submitting extensive identity verification documents and complex tax filings. Additionally, many face high fees, including account maintenance charges, trading commissions, and wire transfer costs, which significantly erode investment returns.

Beyond these traditional hurdles, foreign exchange controls present another major challenge. Even when willing to pay fees, many investors cannot directly access U.S. market opportunities due to market entry restrictions.

As a result, direct investment in U.S. stocks remains not only a cumbersome process but also one requiring the overcoming of multiple barriers—an environment with such high thresholds that many can only stand aside.

Bitget’s RWA Index Perpetual Contracts offer a zero-barrier investment method, allowing easy participation in tokenized U.S. stock assets directly through the platform. Investors no longer need traditional stock accounts or conventional banking systems for currency conversion. This once again demonstrates Bitget’s strength in enabling investors to access innovative crypto products without complex procedures.

Risks and Opportunities of High-Leverage Trading

Besides overcoming traditional investment barriers, RWA Index Perpetual Contracts also offer a high-leverage trading mechanism. With up to 10x leverage, investors can achieve higher returns from U.S. tokenized assets with relatively small capital outlays.

Of course, in high-leverage trading, even minor market fluctuations can lead to significant financial losses. Therefore, investors must exercise caution when using leverage, closely monitor market movements, and adjust strategies promptly to avoid excessive losses caused by adverse volatility.

To help investors better manage risks in high-leverage trading, Bitget has implemented several risk control measures. These are designed to minimize potential losses during market volatility and protect investors’ capital security.

-

Trading Hours: Available 24 hours Monday to Friday, specifically from 0:00 every Monday to 0:00 every Saturday in U.S. Eastern Time (UTC-4). Additionally, RWA contracts will be suspended during U.S. public holidays when the stock market is closed.

-

Market Closure Freeze: Prices are frozen during weekends and market closures to prevent liquidations. Order cancellations are supported, but new order submissions are paused. Funding fee settlements resume when trading restarts.

-

Leverage Limits: Initial maximum leverage is set at 10x, supporting isolated margin mode.

-

Risk Fund: Bitget has established a dedicated risk fund for each RWA Index Perpetual Contract to mitigate potential risks from extreme market volatility. The initial fund size is 50,000 USDT, used as compensation capital during periods of severe market fluctuation. This fund provides an additional layer of protection, reducing risks associated with high-leverage trading.

-

Position Limits: Bitget also sets position limits per individual account to prevent any single investor from holding excessively large positions that could affect market liquidity and stability. By capping maximum holdings per investor, Bitget can better manage market risks and avoid instability caused by over-trading from any one participant.

These measures strengthen safeguards for investors using high leverage. Regardless of market conditions, investors benefit from a certain level of safety net, reducing potential risks in trading.

Conclusion

From Kraken, Bybit, and Robinhood driving real shares onto the blockchain, to compliant token issuance by xStocks, Dinari, and Ondo, and Tron Inc.’s attempt at “reverse onboarding of on-chain assets,” this round of asset restructuring goes beyond mere innovations in smart contracts or product formats—it hinges on whether a complete on-chain financial ecosystem can be built.

The RWA Index Perpetual Contract emerges precisely in this context. It not only opens the door to the U.S. stock market for Chinese-speaking investors but also bridges the crypto market with traditional equities. As these two domains converge, it remains uncertain whether this integration will truly transform investment behaviors and become mainstream in the future.

I don’t know the answer, but I believe that in the face of an ever-changing market, we should embrace more experimental, innovative products. After all, investing is a game of strategy—every decision is a race between the future and opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News