Strategy's "moonshot" plan

TechFlow Selected TechFlow Selected

Strategy's "moonshot" plan

In-depth analysis of Strategy's (formerly MicroStrategy) Q2 2025 earnings report.

Author: Prathik Desai

Translation: Block unicorn

Today, we dive into Strategy's (formerly MicroStrategy) Q2 2025 earnings report—the first quarter in which the company achieved net positive income after adopting fair-value Bitcoin accounting, marking one of the largest quarterly profits in its history.

Key Takeaways

Strategy’s Bitcoin treasury strategy generated $10 billion in net income (compared to a $102.6 million loss in Q2 2024), driven entirely by $14 billion in unrealized Bitcoin gains under the new accounting standard.

The software business remained stable but secondary, generating $114.5 million in revenue (up 2.7% year-over-year), with narrowing margins, contributing approximately $32 million in underlying operating income.

Aggressive capital raising continued, with $6.8 billion raised through equity and preferred stock issuances in Q2, expanding Bitcoin holdings to 597,325 BTC—3% of circulating supply—worth approximately $64.4 billion.

Following the earnings release, Strategy shares dropped 8%, from $401 to $367; since then, the stock has rebounded above $370.

Strategy stock trades at a 60% premium to Bitcoin net asset value (NAV), meaning investors pay $1.60 for every $1 of Bitcoin on its balance sheet.

Main argument: Strategy’s Bitcoin treasury strategy works as long as Bitcoin prices keep rising and capital markets remain open, but introduces massive earnings volatility and dilution risk, rendering traditional software metrics irrelevant. However, its early entry into treasury management provides ample buffer against a Bitcoin price collapse.

Financial Performance: Bitcoin as the Key Driver

Strategy Analytics reported a GAAP net income of $10.02 billion in Q2 2025, compared to a net loss of $102.6 million in the same period last year. Diluted EPS reached $32.60, versus a loss of $0.57 in Q2 2024.

The 9,870% year-over-year increase in net income was almost entirely due to $14 billion in unrealized Bitcoin gains recognized following the adoption of fair-value accounting in January 2025. This marks a departure from the old regime, where the company had to value its BTC holdings at cost less impairments—gains from Bitcoin price increases were not bookable, while any price declines had to be recorded as impairment charges.

The scale of this accounting impact becomes even clearer when compared to Strategy’s operational revenue. Total revenue from operations in Q2 was only $114.5 million, resulting in a reported net profit margin exceeding 8,700%—an anomaly entirely attributable to cryptocurrency appreciation.

Excluding Bitcoin revaluation, underlying operating income was approximately $32 million, with healthy software margins around 28%, though negligible compared to crypto windfalls.

GAAP operating income reached $14.03 billion, a significant improvement from the $200 million operating loss in the prior-year quarter (which included large Bitcoin impairment charges under the old accounting).

Quarterly swings have been extreme. In Q1 2025, Strategy posted a GAAP net loss of $4.22 billion as Bitcoin dipped to around $82,400 in March. With Bitcoin rebounding to $107,800 in June, Q2 delivered a $10 billion profit—representing a sequential turnaround and over $14 billion in profitability improvement.

Management acknowledged that fair-value accounting makes earnings “extremely sensitive” to Bitcoin’s market price. Strategy’s profitability is now primarily influenced by crypto market volatility rather than software sales.

Adjusted net income (excluding stock-based compensation and minor items) was approximately $9.95 billion, nearly flat with GAAP figures, as Bitcoin-related adjustments dwarf traditional add-backs.

Treasury Financing

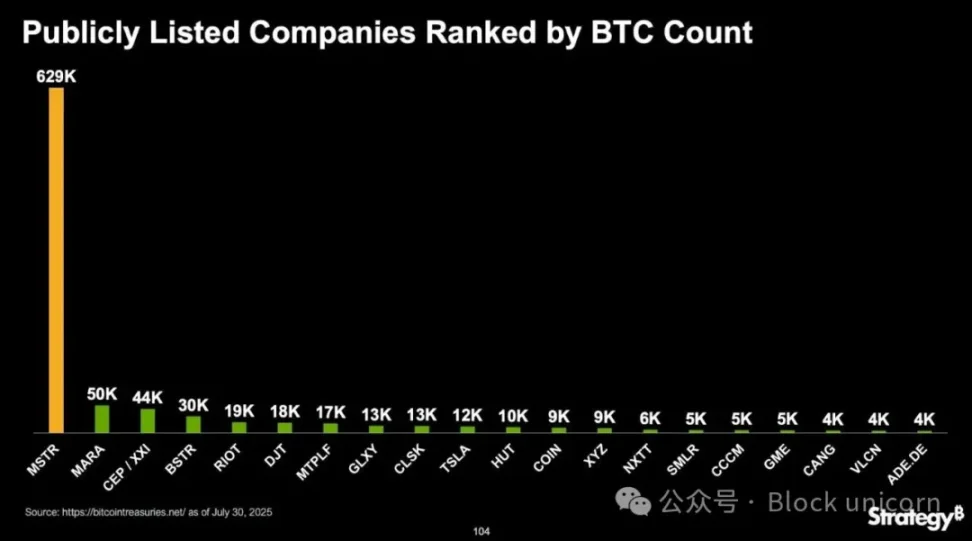

As of June 30, 2025, Strategy held 597,325 Bitcoin, more than 2.5x the 226,331 BTC held a year earlier. With additional purchases in Q3, holdings have since grown to 628,946 BTC. The total cost basis stands at $46.094 billion (average $73,290 per BTC), while market value is approximately $74.805 billion, resulting in unrealized gains of about $29 billion—more than double the amount reported in Q2.

In Q2, Strategy acquired 69,140 BTC for approximately $6.8 billion, matching the total capital raised during the quarter. The average purchase price was around $98,000/BTC, indicating steady accumulation as prices rose from April lows. No Bitcoin was sold, adhering to Chairman Michael Saylor’s “HODL” strategy, with no gains realized.

The financing structure has evolved into complex capital market operations:

Common Stock ATM Program: Raised $5.2 billion in Q2 through the issuance of ~14.23 million shares, followed by an additional $1.1 billion in July. The program still has ~$17 billion in remaining capacity.

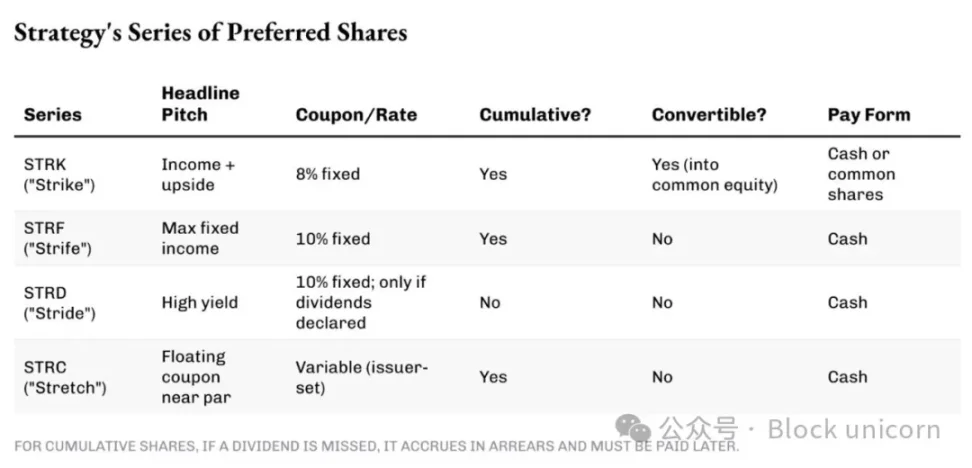

Preferred Share Series: Strategy pioneered multiple perpetual preferred shares to raise funds continuously for Bitcoin purchases under any market condition, while limiting common stock dilution. Different series offer varying yields and terms, aligning funding costs with investor preferences at the time.

Convertible Bonds: In February, Strategy issued $2 billion in 0% convertible senior notes due 2030, with a conversion price of $433.43. While these bonds carry no interest, holders may convert them into Class A common stock if the share price exceeds $433.43. Conversion would further dilute existing shareholders but relieve Strategy of debt obligations. The company already redeemed $1.05 billion in convertible bonds due 2027 in Q1 via equity conversion.

This capital structure supports continuous Bitcoin accumulation but introduces significant fixed costs. Preferred shares carry substantial dividends (8–10% coupon rates, totaling hundreds of millions annually), which must be paid regardless of Bitcoin performance. Strategy maintains a leverage ratio of about 20–30% (debt relative to BTC assets), meaning most purchases are funded through equity/preferred stock rather than debt.

Software Business: Stable but Secondary

The legacy analytics business generated $114.5 million in revenue in Q2 2025, up 2.7% year-over-year, recovering after a 3.6% decline in Q1. Revenue composition continues shifting toward subscription services:

-

Subscriptions: $40.8 million (up 69.5% YoY), now representing ~36% of total revenue, compared to ~22% a year ago.

-

Product licenses: ~$7.2 million, down ~22%, as customers migrate to cloud services.

-

Product support: $52.1 million (down 15.6% YoY), reflecting reduced maintenance revenue during cloud transition.

-

Other services: $14.4 million (down 11.8% YoY), indicating lower consulting demand.

-

Software gross profit: $78.7 million (68.8% margin), versus $80.5 million (72.2% margin) in Q2 2024.

Margin compression stems from higher subscription costs (cloud hosting, customer success) and declining high-margin support revenue.

Operating expenses have historically matched gross profit levels, leaving minimal operating income. The ~$32 million non-Bitcoin operating profit in Q2 indicates modest profitability in the core business after years of cost-cutting. This software contribution helps cover interest obligations ($17.897 million) and part of preferred dividends ($49.11 million), but accounts for less than 1% of total corporate profit.

Strategy is expected to continue running its analytics business similarly in coming quarters, as it remains the company’s only cash-generating operation given its “buy, hold, never sell” Bitcoin policy. However, management commentary focuses on Bitcoin accumulation rather than product roadmaps, suggesting that while software services may persist, they are no longer a meaningful growth engine or valuation component.

Cash Flow Quality and Sustainability

Operating profits and other line items on financial statements can be adjusted through clever accounting, but cash flow cannot be faked. If cash flow doesn’t reflect what the company claims, there’s a problem.

Strategy’s cash flow profile highlights the low quality of its reported earnings. After stripping out $14 billion in unrealized gains, the $10 billion in net income generated almost no cash. Despite reporting $5.75 billion in GAAP net income, the company’s cash balance increased by only $12 million across the first two quarters of 2025.

-

Operating cash flow: The software business likely generated modest positive operating cash flow, barely sufficient to cover basic expenses. After adjusting for non-cash items like depreciation and stock compensation, true cash generation from operations is near breakeven.

-

Investing cash flow: Dominated by ~$6.8 billion in Bitcoin purchases in Q2, fully funded by financing activities, not operations.

-

Financing cash flow: Net inflow of $6.8 billion from equity and preferred stock issuances, immediately deployed into Bitcoin purchases, leaving little cash retained.

This pattern—negative investing, positive financing, and thin operating cash flow—clearly shows Strategy functions as an asset accumulation vehicle, not a cash-generating business.

The company faces rising fixed costs from debt interest (~$68 million annualized) and preferred dividends (~$200 million annualized). If Bitcoin prices stagnate or fall while capital markets tighten, Strategy could face liquidity pressure, potentially forcing Bitcoin sales or further equity issuance, leading to greater dilution.

Market Reaction and Valuation

Despite record earnings, Strategy’s stock declined after the Q2 report, as the market had already priced in Bitcoin-driven windfalls. Subsequently, news of a $4.2 billion STRC stock offering further weighed on the share price. This reaction reflects investor understanding that these are not operating profits, but mark-to-market adjustments that could reverse.

Nonetheless, the stock remains closely tied to Bitcoin’s price trajectory.

Strategy currently trades at a ~60% premium to Bitcoin net asset value (NAV), meaning MSTR investors pay $1.60 for every $1 of Bitcoin value on the company’s balance sheet.

Why pay a premium instead of buying Bitcoin directly? Reasons include:

-

Exposure to Bitcoin upside through a corporate equity structure

-

Michael Saylor’s strategic execution and market timing

-

Scarcity value as a liquid Bitcoin proxy in equity markets

-

Option value of future accretive financings

This premium supports a self-reinforcing strategy: issuing shares above NAV to buy more Bitcoin, potentially increasing BTC per share for existing shareholders. If Strategy’s stock trades at $370 while its Bitcoin NAV is $250 per share, the company can issue new shares at $370 and use the proceeds to buy $370 worth of Bitcoin. Existing shareholders now own more BTC per share post-dilution. Strategy’s “BTC per share” metric has risen 25% year-to-date despite massive dilution, validating the strategy during a Bitcoin bull run.

Evaluating Strategy’s Bitcoin investment requires unconventional methods, as traditional valuation metrics are meaningless. Why?

Strategy’s Q2 revenue ($114 million) implies an annualized run rate of ~$450 million, yet its current enterprise value is $120.35 billion—implying a price-to-sales ratio over 250x, an astronomical figure by conventional standards. But the point is, investors aren’t buying Strategy stock for its software analytics. The market is pricing in Bitcoin’s appreciation potential, amplified by corporate leverage and continuous accumulation.

Investment Perspective

The quarterly results reflect Strategy’s complete transformation from a software company into a leveraged Bitcoin investment vehicle. The $10 billion quarterly profit, while massive, represents unrealized appreciation—not operational success. For equity investors, Strategy offers high-risk exposure to Bitcoin with significant leverage and active accumulation, at the cost of extreme volatility and dilution risk.

During Bitcoin bull markets, this strategy performs well, as favorable conditions enable accretive financing to fund additional purchases, while mark-to-market gains send reported profits soaring. However, the model’s sustainability depends on continuous market access and Bitcoin appreciation. Any major crypto market downturn would quickly reverse Q2’s results, while fixed obligations like debt interest and preferred dividends persist.

Yet among all Bitcoin treasuries, Strategy is best positioned to absorb such shocks. It began accumulating Bitcoin over five years ago, systematically building its position at far lower costs than competitors.

Today, Strategy holds 3% of all circulating Bitcoin.

Strategy’s premium valuation reflects market confidence in Michael Saylor’s Bitcoin vision and execution capability. Investors are betting on Bitcoin’s long-term trajectory and management’s ability to maximize accumulation using the corporate structure.

With Bitcoin holdings now representing over 99% of economic value, traditional software metrics have become largely irrelevant in defining Strategy’s crypto narrative going forward.

This concludes our analysis of Strategy’s Q2 earnings report. We will bring you new coverage shortly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News