40 billion USD stablecoin pioneer collapses 1194 days after crash

TechFlow Selected TechFlow Selected

40 billion USD stablecoin pioneer collapses 1194 days after crash

Do Kwon's life trajectory was like a parabola, rising rapidly, falling swiftly, and ultimately ending in ruin.

Written by: Sleepy, BlockBeats

On August 12, 2025, in a federal courtroom in Manhattan, New York, Do Kwon slowly rose from his seat, dressed in a yellow prison jumpsuit.

Years of fugitive life and imprisonment had thinned his once-rounded cheeks, and his hair was now the standard crew cut worn by inmates. The eyes that once sparkled on camera now showed only exhaustion.

This 33-year-old South Korean man, once the darling of the crypto world, is now the central figure in the largest financial fraud case in history.

In courtroom sketches, Do Kwon bowed his head with hands tightly clasped. He admitted: "In 2021, I made false and misleading statements about the reasons for re-pegging TerraUSD. What I did was wrong, and I want to apologize for my actions."

He now faces years of imprisonment and massive fines, but for the hundreds of thousands of investors who lost $40 billion because of him, this is far from enough.

Time is the cruelest judge. It has not only changed Do Kwon’s appearance but completely destroyed everything he once had.

Prosecutor Damian Williams stated outside the courthouse that this guilty plea marked an "important milestone in the enforcement against cryptocurrency fraud." But the word "milestone" sounds too cold—it cannot rebuild broken families, comfort the elderly who lost everything, or save the young lives who chose to end their suffering.

From elite schools in Seoul to Stanford, from skyscrapers in Singapore to a run-down prison in Montenegro, Do Kwon’s life trajectory resembled a parabola—rising rapidly, falling sharply, and ultimately shattering into pieces.

The Birth of a Genius

From Seoul to Silicon Valley

On September 6, 1991, Do Hyeong Kwon let out his first cry in a hospital in Seoul—no one could have predicted that this infant would become one of the most controversial figures in global financial history thirty years later.

He was born into a typical South Korean middle-class family; his father was an engineer and his mother a teacher—a combination that in South Korea symbolizes reverence for knowledge and ambition for success. South Korea is a country deeply plagued by educational anxiety, where children are thrust into competition from kindergarten. From an early age, Do Kwon demonstrated intellectual abilities far beyond his peers, particularly in mathematics, as if numbers naturally arranged themselves into elegant solutions before his eyes.

He attended Dae Won Foreign Language High School in Seoul, one of the most elite schools in the country. It gathered the brightest students nationwide, who spent the most critical three years of their youth within its ivory walls. Classmates recalled that Do Kwon was always the first to finish assignments and the most eager to challenge teachers’ viewpoints. His intelligence was obvious, but even more so was his confidence. This confidence might have seemed charming in a teenage classroom, but it also planted the seeds for future tragedy.

Even at that age, he already believed himself different, convinced he was destined for greatness. The high school version of Do Kwon was like a star gathering energy, waiting to burst into brilliance on a much larger stage—the stage across the ocean: Stanford.

In 2010, the 19-year-old Do Kwon boarded a flight to the United States. For a young Korean, gaining admission to Stanford University meant a life-altering opportunity. Located in the heart of Silicon Valley, Stanford is the birthplace of countless tech legends.

Computer science courses posed no difficulty for Do Kwon. What truly fascinated him was the pervasive entrepreneurial atmosphere. Here, every student dreamed of becoming the next Jobs or Zuckerberg, believing any idea could become the next world-changing product. Silicon Valley possessed a unique magic—convincing people that technology could solve all problems and empowering young minds to believe they could disrupt the world. Do Kwon was deeply infected by this culture.

Bitcoin had just been born, and the perceptive Do Kwon began diving deep into blockchain technology, reading Satoshi Nakamoto’s white paper and participating in related development projects. While classmates worried about job hunting, Do Kwon was already pondering how to redefine money itself through technology. To him, traditional finance was outdated and inefficient, while blockchain represented the future.

His time at Stanford shaped Do Kwon’s worldview. There, he learned to think in the language of technology and see the world through an entrepreneur’s eyes. More importantly, he solidified a belief: he was here to change the world.

In 2015, Do Kwon graduated from Stanford, no longer the naive teenager from Seoul. He had transformed into a confident young man—a dreamer who believed he could create miracles. His resume listed a Bachelor’s degree in Computer Science from Stanford; his heart burned with ambition to change the world.

The Path of Entrepreneurship

Back in South Korea, Do Kwon faced a choice: follow most of his peers into stable, respectable jobs at companies like Samsung, or take the risky path of entrepreneurship. For a young man steeped in Stanford’s startup culture, the answer was obvious.

In 2016, the 25-year-old Do Kwon founded Anyfi, his first entrepreneurial venture. He aimed to use blockchain technology to allow users to share their WiFi networks and earn token rewards. In his view, traditional telecom operators were monopolists, and Anyfi could break that monopoly through technology, enabling ordinary people to benefit from network infrastructure.

The project gained initial attention and investment. Do Kwon began appearing frequently at tech events across South Korea, passionately presenting his vision. His speeches brimmed with excitement, and his ambitions sounded thrilling. Under the spotlight, Do Kwon reveled in the aura of a startup celebrity. But reality soon struck hard. Anyfi faced numerous challenges, and the existing infrastructure was far from mature enough to support such a complex application. The gap between technological idealism and commercial reality proved much wider than Do Kwon had imagined.

By the end of 2017, Anyfi was declared a failure. For any entrepreneur, this would be an intensely painful experience. Failure is bitter—it makes you question your abilities and reflect on your decisions. But Do Kwon didn’t see it that way. To him, Anyfi failed because the timing was off, the market wasn’t ready for such an advanced concept, and investors lacked the foresight to back such a project.

This mindset is known in psychology as "self-serving bias," where people attribute success to internal factors (like their own ability) and failures to external factors (like bad luck).

For Do Kwon, "self-serving bias" didn’t teach him lessons from failure—it actually boosted his confidence. He shifted his focus to the emerging field of decentralized finance, particularly stablecoins. To him, this was an opportunity to "redefine money itself," a chance to secure his place in history.

In January 2018, a new company arrived in Singapore—Terraform Labs.

Its co-founders were Do Kwon and Daniel Shin, two bright graduates from top universities, both passionate about blockchain technology and convinced they could change the world.

Choosing Singapore as headquarters was a shrewd move. This city-state, not only Asia’s financial hub with robust financial infrastructure and international talent, but also maintained a relatively open regulatory stance toward blockchain. Singapore encouraged innovation and simplified regulation, creating an ideal environment for startups like Terraform Labs.

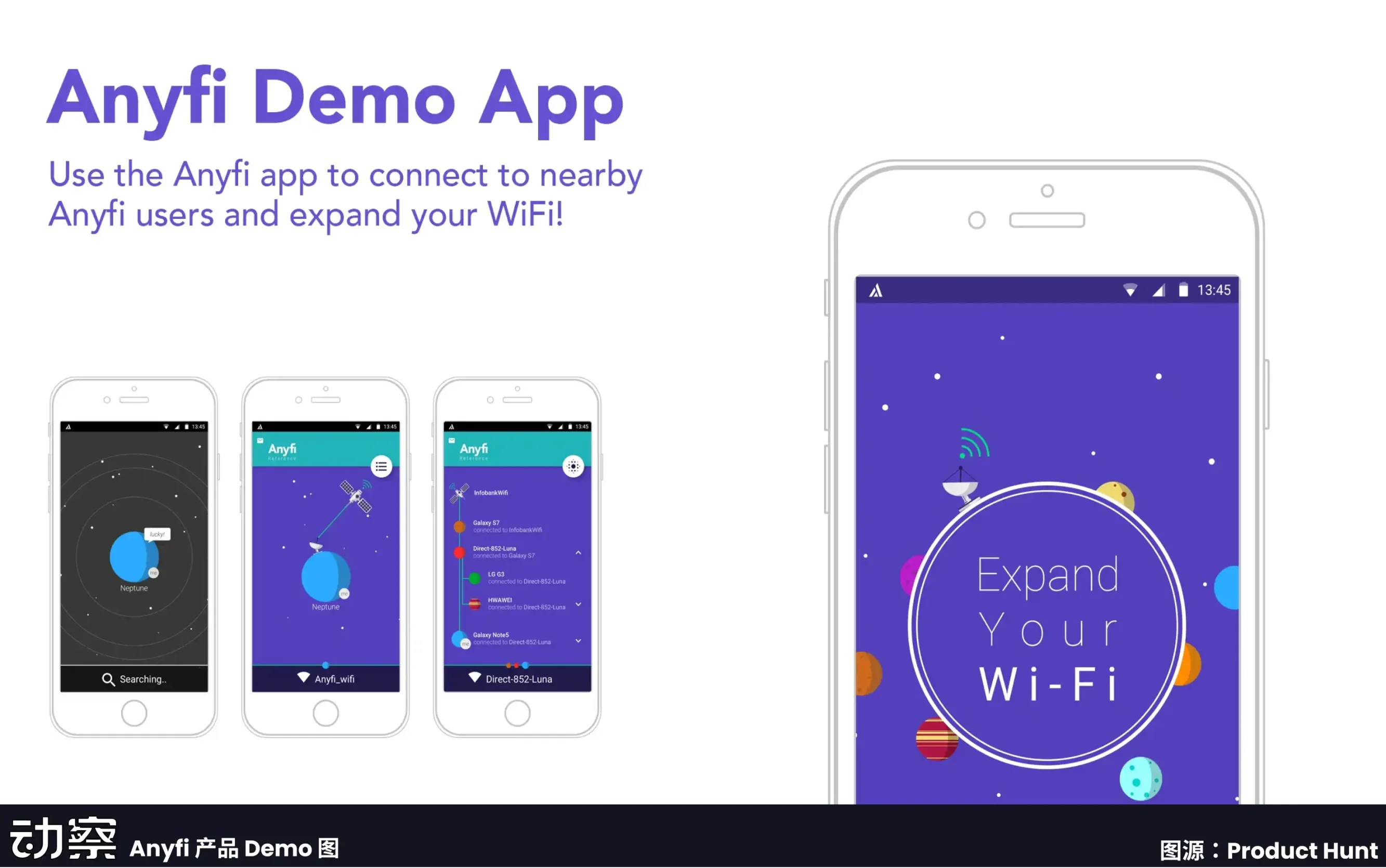

Their core idea sounded simple: build an algorithmic stablecoin system combining Bitcoin’s decentralization with the dollar’s stability. The system consisted of two tokens: TerraUSD (UST), the stablecoin designed to maintain a 1:1 peg with the US dollar; and Luna, the governance token used to stabilize the system.

Their relationship functioned like a seesaw: when UST traded above $1, the system minted more UST and burned Luna, increasing UST supply and lowering its price; when UST dropped below $1, the system burned UST and minted Luna, reducing UST supply and raising its price.

This mechanism required no bank deposits or government bonds as collateral—stability relied entirely on market forces and algorithms.

Do Kwon likened the system to a "gravitational system in the digital world," calling it a revolution in monetary history. In his view, traditional stablecoins were like balloons tied to strings, while UST was like a planet with its own gravity, naturally maintaining a stable orbit.

During fundraising, Do Kwon displayed exceptional persuasive skills. He explained complex technical concepts in clear, simple language and painted a grand, enticing vision. More importantly, he made investors believe he was the one person capable of realizing that vision. In August 2018, Terraform Labs secured a $32 million seed round from prominent firms including Binance Labs, Polychain Capital, and Coinbase Ventures. These investments provided not just capital but also authoritative validation.

In April 2019, the Terra blockchain officially launched. This day held special significance for Do Kwon—it marked his transformation from a failed entrepreneur into a potential world-changer.

Meanwhile, Terraform Labs began building the Terra ecosystem. They launched the Terra Station wallet, making it easy for users to store and transfer Terra tokens. They partnered with South Korean e-commerce platforms, allowing purchases using Terra tokens. They also developed various decentralized applications to increase demand for UST.

By the end of 2020, the Terra ecosystem had taken shape. UST’s market cap reached hundreds of millions of dollars, and Luna’s price steadily climbed. More importantly, growing numbers of users adopted Terra’s services. In the crypto community, Do Kwon was hailed as a pioneer of algorithmic stablecoins, and the Terra project was seen as one of DeFi’s most promising ventures.

Within this environment, Do Kwon and his Terra empire continued expanding rapidly—toward greater success, and deeper downfall.

Rising from Nothing

Gold Outside, Rot Within

2021 was the turning point in Do Kwon’s fate.

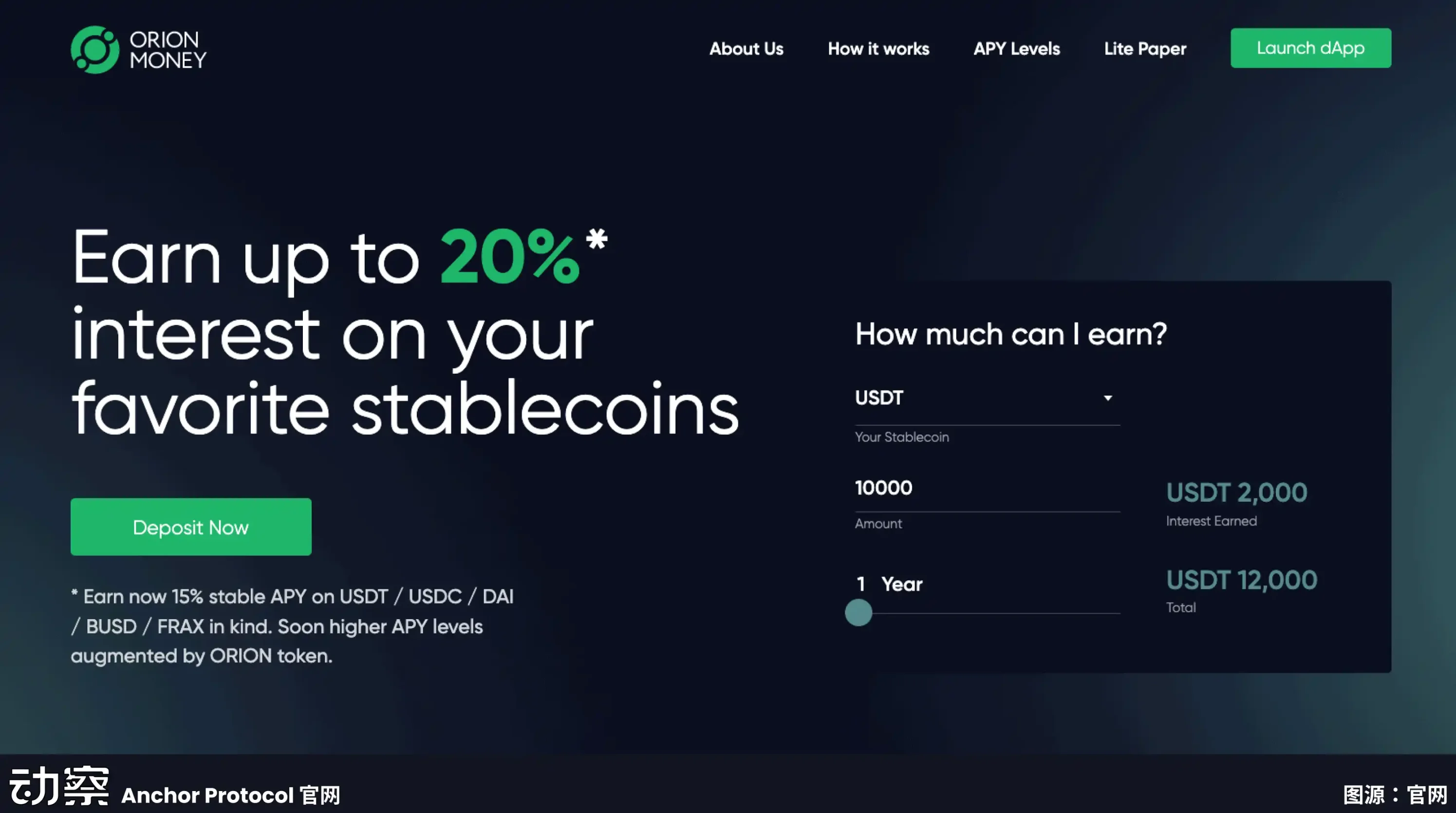

That year, he launched Anchor Protocol, a lending platform promising 20% annual yield on UST deposits. In traditional finance, such returns were unimaginable—even the most aggressive hedge funds struggled to sustain such high yields.

In Do Kwon’s vision, Anchor Protocol was the engine of the Terra ecosystem. High yields would attract massive capital, boost demand for UST, drive up Luna’s price, and create a virtuous cycle.

But this logic had a fatal flaw.

A 20% yield required real economic activity to support it. To fulfill this promise, Anchor Protocol needed approximately $6 million in subsidies daily. These came primarily from the Luna Foundation Guard (LFG), a foundation controlled by Terraform Labs.

In other words, Anchor Protocol’s high yields were essentially a Ponzi scheme—using new investors’ money to pay old investors’ returns. But Do Kwon never described it that way. In his speeches, Anchor Protocol was the "future of decentralized finance" and the "end of traditional banking."

By early 2022, Anchor Protocol’s TVL exceeded $14 billion, making it one of the largest DeFi protocols at the time. Investors flooded in from around the world, pouring their money into the system. Their enthusiasm and trust intoxicated Do Kwon. He began to believe he had truly created a miracle, that he had found the Holy Grail of finance.

At the same time, Do Kwon launched Mirror Protocol, a synthetic assets platform. Publicly promoted as "fully decentralized," with no individual or entity able to unilaterally control the protocol, the reality was different. According to later SEC investigations, Do Kwon secretly retained control over Mirror Protocol. He could unilaterally modify protocol parameters, decide which synthetic assets to add or remove, and even suspend the entire protocol.

An even more serious fraud involved Chai. Starting in 2019, Do Kwon repeatedly claimed in public that Chai processed transactions via the Terra chain, with transaction volumes reaching "billions of dollars." This claim appeared in pitch decks, media interviews, and served as key evidence of Terra’s real-world utility. Investors were genuinely swayed by these figures—after all, most blockchain projects remained conceptual, while Terra seemed to have actual use cases.

According to the SEC investigation, this was also false.

Chai’s transactions were actually processed through traditional financial networks, with no connection to the Terra chain. Do Kwon and Terraform Labs executives were fully aware of this but continued making misleading claims to investors. This was deliberate fraud. Yet in Do Kwon’s view, as long as it attracted more investment and drove up token prices, certain "details" could be overlooked.

Arrogance and Prejudice

Success made Do Kwon extremely arrogant.

In July 2021, when British economist Frances Coppola criticized the design flaws of algorithmic stablecoins on Twitter, Do Kwon responded: "I don’t debate with poor people. Sorry, I don’t have spare change to give her right now."

This remark was not only an insult to a scholar but a declaration of war against all critics. In his mind, wealth equaled correctness—those criticizing him weren’t right; they were merely "poor." The comment sparked outrage on social media. Supporters cheered Do Kwon, seeing it as a powerful rebuttal to traditional academia. Critics saw it as exposing his true nature—a newly rich upstart drunk on success.

There were many similar controversial remarks. When someone questioned Terra’s sustainability, Do Kwon said, "They’re all now poor." When concerns arose about algorithmic stablecoin risks, he mocked, "Have fun staying poor."

Driven by this mindset, Do Kwon grew increasingly isolated. Few around him dared voice dissent, and those who did were quickly silenced by his wealth and success. This environment reinforced his arrogance and distanced him further from reality.

On April 17, 2022, Do Kwon announced his daughter’s birth on Twitter: "Baby Luna, my dearest creation, named after my greatest invention."

The comment stirred controversy again. Supporters saw it as proof of his confidence in the project, but critics viewed it as extreme narcissism. Naming one’s daughter after a business venture was highly unusual. Even more so was his description of the project as his "greatest invention."

To Do Kwon, Terra was not just a business—it was the embodiment of his genius, his legacy to the world.

By April 2022, the Terra ecosystem reached unprecedented heights. UST’s market cap surpassed $18 billion, Luna’s exceeded $40 billion, and the entire ecosystem approached $60 billion in total value.

Do Kwon became a superstar in the crypto world. Major media outlets rushed to cover his story, conference invitations poured in, and investors sought partnerships. At these events, Do Kwon always wore custom-tailored suits, expensive watches, and a confident smile.

Beneath the surface prosperity, risks were mounting.

Some sharp observers began noticing problems. Anonymous researcher FatMan posted a series of analyses on Twitter highlighting Anchor Protocol’s unsustainability. Economist Nouriel Roubini warned of fundamental flaws in algorithmic stablecoins. Even some crypto community influencers started questioning Terra’s long-term prospects.

Do Kwon dismissed these criticisms with contempt. To him, they were merely jealousy from losers. This blind confidence would soon cost him dearly.

In May 2022, springtime Singapore basked in sunshine. Terra’s office buzzed with activity as employees prepared for an upcoming product launch, and investors kept pouring in money. No one realized an unprecedented financial tsunami was about to strike.

Do Kwon leaned back on the office sofa, imagining himself a hero who changed the world—a figure history would remember.

History will indeed remember him—but not as a hero.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News