Crypto Morning Brief: U.S. Initial Jobless Claims Surge, Do Kwon Sentenced to 15 Years in Prison

TechFlow Selected TechFlow Selected

Crypto Morning Brief: U.S. Initial Jobless Claims Surge, Do Kwon Sentenced to 15 Years in Prison

Coinbase announces support for trading all Solana-based tokens through DEX functionality.

Author: TechFlow

Yesterday's Market Dynamics

U.S. Initial Jobless Claims for the week ended December 6: 236,000, vs. expected 220,000

U.S. initial jobless claims for the week ended December 6 came in at 236,000, compared to a previous value of 191,000 and an expectation of 220,000.

SEC Crypto Task Force to host roundtable on December 15 discussing financial regulation and privacy-related policies

According to U.S. SEC Chair Paul Atkins' social media disclosure, the U.S. Securities and Exchange Commission (SEC) Crypto Task Force will host a roundtable discussion on Monday, December 15, focusing on policy matters related to financial regulation and privacy.

Trump: "Golden Card" officially launched; individuals paying $1 million can obtain legal status

According to Jinshi Data, U.S. President Trump announced on Wednesday the official launch of his long-promised "Golden Card." Individuals who pay $1 million, as well as foreign employees sponsored by companies paying $2 million, will be eligible for legal status, paving the way toward U.S. citizenship.

At the Roosevelt Room in the White House, surrounded by business leaders, Trump unveiled the program alongside the launch of an official website accepting applications. The initiative aims to replace the EB-5 investor visa program.

The EB-5 program was established by Congress in 1990 to attract foreign investment, originally requiring investors to contribute approximately $1 million into a company that creates at least 10 jobs.

Trump believes the new "Golden Card" is an effective tool for attracting and retaining top global talent, as well as a significant revenue source for the federal treasury. He has promoted the "Golden Card" for months, initially proposing a price tag of $5 million per card, but recently finalized the pricing structure at $1 million for individuals and $2 million for corporate-sponsored applicants.

Trump pledged that all funds collected through this program will "go entirely to the U.S. government." He expects tens of billions of dollars to flow into a dedicated account managed by the Treasury Department, stating, "These funds can be used for things beneficial to the nation."

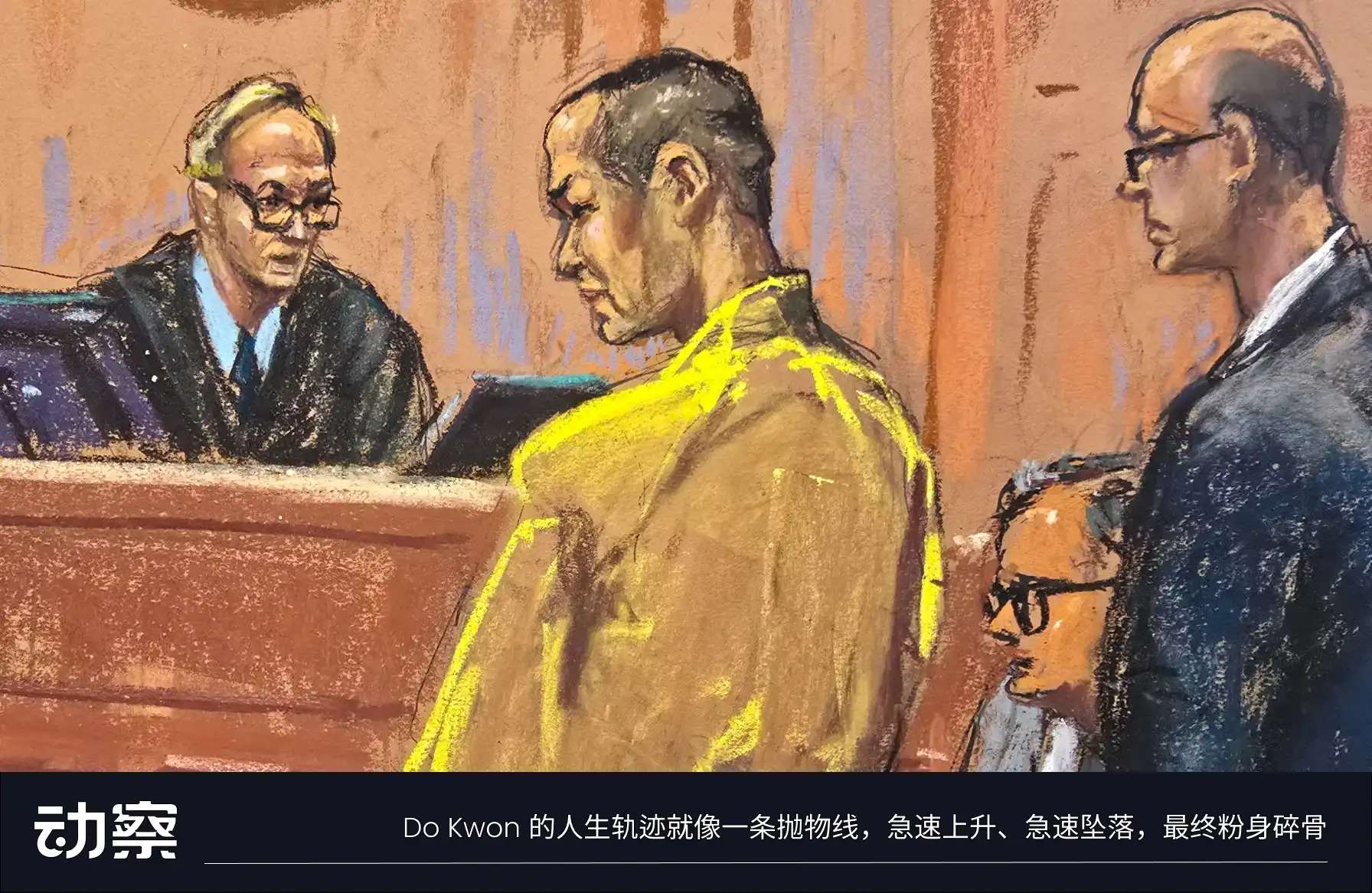

Do Kwon sentenced to 15 years in prison in New York court over Terra-Luna collapse case

According to TheBlock, Terraform Labs founder Do Kwon was sentenced to 15 years in prison on Thursday by a New York court over fraud charges linked to the collapse of the $40 billion Terra-Luna ecosystem.

U.S. District Judge Paul Engelmayer stated that Kwon "chose to lie" and "made wrong choices." Kwon was criminally charged in March 2023 with conspiracy to commit fraud, commodities fraud, wire fraud, securities fraud, fraud conspiracy, market manipulation conspiracy, and money laundering conspiracy. He later pleaded guilty in August 2024 to two counts: wire fraud and fraud conspiracy.

Had he not reached a plea deal, Kwon could have faced up to 135 years in prison if convicted on all nine charges. After agreeing to plead guilty to two counts, the maximum sentence was reduced to 25 years. Prosecutors had previously sought a $19 million fine.

Coinbase announces DEX functionality supporting trading of all tokens on Solana

According to Bitcoin News, Coinbase announced today (December 11) that it now supports trading of all tokens on Solana via its DEX feature, without requiring traditional listing procedures. Users can now trade millions of tokens within the Solana ecosystem through the familiar Coinbase interface, gaining early investment opportunities. For project teams, as long as their tokens have sufficient liquidity, they can directly open trading access to Coinbase’s millions of users. Coinbase stated this move aims to make on-chain assets more accessible and bridge users with developers.

Ant International: AI and blockchain to lead transformation in global payments

According to Forbes, Ant International is applying AI and blockchain technologies in the global payments sector.

The company has launched several technological innovations: Antom Copilot AI agent supports full lifecycle payment management for merchants; collaboration with Google, Mastercard, and Visa to develop AI payment protocols; Falcon predictive model has processed $1.5 trillion in transactions with 90% accuracy, reducing foreign exchange costs by 60%; SHIELD risk management system enhances transaction security.

Peng Yang, CEO of Ant International, speaking at Singapore Fintech Festival 2025, said the company is actively participating in global regulatory initiatives including the Guardian project by Monetary Authority of Singapore and the Ensemble project by Hong Kong Monetary Authority. Peng believes we are currently undergoing a post-internet technology revolution, bringing unprecedented opportunities and challenges for emerging markets and small businesses. The company is committed to democratizing technological innovation, ensuring AI and blockchain promote seamless cross-border payments and a fairer business environment.

Movement Labs co-founder launches $100 million crypto investment initiative

According to The Block, Rushi Manche, former co-founder of MOVE Labs, today announced the establishment of Nyx Group, planning to invest up to $100 million in support of crypto token projects. This investment initiative will provide liquidity and comprehensive operational support—including community building, financial management, and compliance guidance—to projects preparing for token launches.

Manche said Nyx Group aims to fill a "critical gap" in the current crypto market, especially in an environment where founders face difficulties accessing capital. The team will apply strict investment criteria, supporting only founders they deeply trust, with decisions made by an investment committee.

Notably, Manche was previously terminated from Movement Labs due to controversy surrounding a market-making arrangement involving 66 million MOVE tokens. Regarding this new venture, he emphasized that Nyx Group will be the "most founder-friendly partner," offering favorable terms and supporting long-term visions.

Mainland Chinese enterprises’ RWA ventures in Hong Kong freeze, consultation volume drops over 90%

According to Sina Finance, seven financial industry associations jointly issued a risk alert, explicitly prohibiting domestic participation in virtual currency and real-world asset (RWA) token issuance and trading activities. Following regulatory clarification, mainland enterprises’ RWA activities in Hong Kong have completely cooled down. Industry insiders report that consultation volumes have dropped over 90%, and ongoing projects have mostly been asked to pause progress. Related stocks declined sharply, with Langxin Group and GCL Energy Technology falling nearly 50% from peak levels. Some companies have started exploring RDA (real data assets) as an alternative direction.

UAE telecom giant e& pilots dirham stablecoin payment system

According to Cointelegraph, UAE telecom giant e& signed a memorandum of understanding with Al Maryah Community Bank to test the application of the dirham-backed stablecoin (AE Coin) on its payment infrastructure. This pilot project will allow users to pay mobile bills, household service fees, and top-up prepaid lines using this Central Bank of UAE-licensed stablecoin. Hatem Dowidar, CEO of e& Group, said the stablecoin enables "instant settlement, full transparency, and frictionless access."

Jupiter Exchange has acquired RainFi

According to SolanaFloor, Jupiter Exchange (@JupiterExchange) has acquired RainFi (@RainFi_), aiming to advance credit market development on the Solana blockchain. Per the announcement, Droplets users will receive $JUP token rewards by early 2026.

Bloomberg: Coinbase plans to unveil its prediction markets and tokenized stock products on December 17

According to Bloomberg, cryptocurrency exchange Coinbase Global Inc. plans to announce next week the launch of prediction markets and tokenized stock products. Sources familiar with the matter said Coinbase will officially reveal both products during a presentation event on December 17. Notably, its tokenized stock product will be developed in-house rather than through partners.

Market Updates

Suggested Reading

This article discusses how RaveDAO is leading Web3 adoption and mainstream breakthrough through an entertainment-driven, open cultural ecosystem. By organizing global music events, introducing NFT ticketing systems, and launching its ecosystem token $RAVE, it advances the construction of a participatory economic loop while achieving positive revenue and community empowerment. RaveDAO is committed to integrating Web3 technology into the cultural industry, lowering user barriers and promoting ecosystem co-creation.

Rebuttal: I don’t regret spending 8 years in crypto

This article explores the current state and evolution of the cryptocurrency industry, analyzing its original ideals, practical challenges, and future goals. The author reflects on the shift of cryptocurrencies from idealism to casino-like speculation, advocating a pragmatically optimistic view—despite the presence of speculation and negative phenomena, there is evidence the industry is moving in the right direction.

2026 Crypto Investment Landscape: Rise of appchains, AI agents taking over DeFi

This article discusses future trends in blockchain, artificial intelligence, cryptocurrency, and appchains, analyzing innovation and potential in areas such as prediction markets, smart agents, and real-world asset tokenization.

Decoding CoinShares 2026 Report: Moving beyond speculation, embracing the year of utility

This article decodes CoinShares' "Outlook 2026: The Year Utility Wins" report, analyzing the digital asset industry’s shift from speculation-driven to utility-driven development, and explores key changes expected in 2026, including macroeconomic conditions, Bitcoin mainstreaming, rise of hybrid finance, competition among smart contract platforms, and evolving regulatory landscapes.

IOSG | TCG Deep Dive: From gachas to derivatives—the $8 billion on-chain investment landscape

This article provides an in-depth analysis of the current development, market structure, differences between on-chain and off-chain markets, and future directions of trading card games (TCG) as an asset class. It also examines the scale of the TCG market, impact of gray markets, operations of card grading industries, and the potential of on-chain TCGs and derivative market opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News