Do Kwon denies 9 charges at first U.S. court appearance, case to continue next week

TechFlow Selected TechFlow Selected

Do Kwon denies 9 charges at first U.S. court appearance, case to continue next week

Kwon was extradited from Montenegro to the United States and faces criminal charges.

Author: Luc Cohen

Translation: TechFlow

Summary

Do Kwon, co-founder of Terraform Labs, is facing serious legal challenges over his role in the 2022 collapse of TerraUSD. On December 31 (according to Bloomberg), the Prime Minister of Montenegro said the U.S. extradition process for Do Kwon had been completed. The U.S. Securities and Exchange Commission (SEC) has brought multiple fraud charges against him, including securities fraud and money laundering. How did the hearing go, and what comes next in the case?

TechFlow translates this article to track the latest developments in Kwon’s court hearing following his extradition.

Police escort Do Kwon, co-founder of Terraform Labs, in Podgorica, Montenegro, after being handed over on March 23, 2024, following a sentence for document forgery.

Main Text

Highlights

-

Kwon extradited from Montenegro to the U.S. to face criminal charges

-

Prosecutors allege Kwon misled investors in the TerraUSD project

-

Following the 2022 market crash, several major figures in the crypto industry have been charged

South Korean cryptocurrency entrepreneur Do Kwon, the developer behind the digital currencies TerraUSD and Luna, oversaw a 2022 market crash that cost investors as much as $40 billion. This week, after being extradited from Montenegro to the United States, Kwon pleaded not guilty on Thursday in court to criminal fraud charges.

On Thursday, federal prosecutors in Manhattan unsealed a nine-count indictment charging Kwon, co-founder of Terraform Labs and creator of the TerraUSD and Luna cryptocurrencies, with crimes including securities fraud, wire fraud, commodities fraud, and conspiracy to commit money laundering—allegations directly tied to the collapse of TerraUSD and Luna.

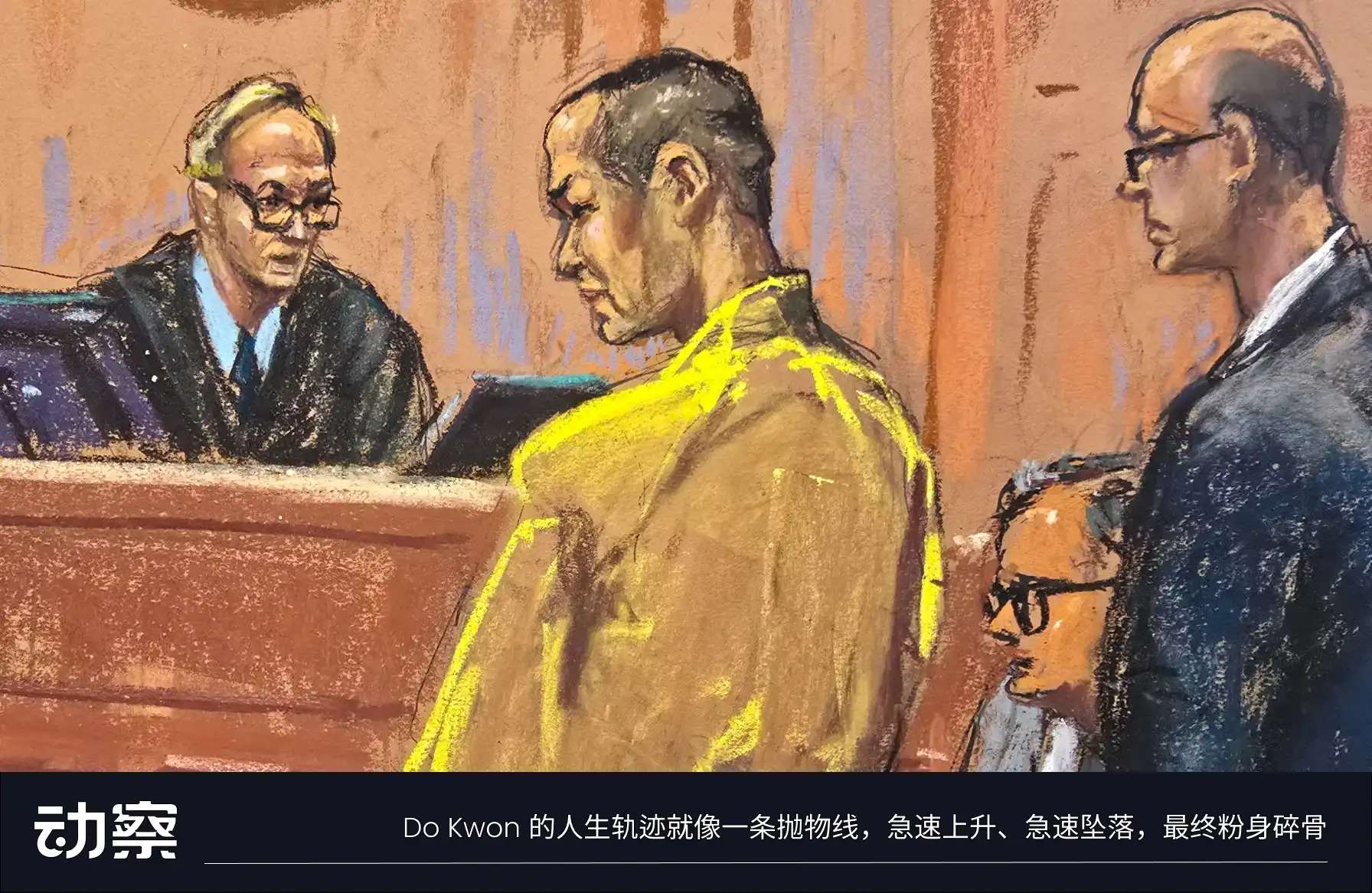

Kwon appeared in Manhattan federal court on Thursday wearing an olive-green long-sleeved shirt and black sweatpants. His attorney, Andrew Chesley, entered a not guilty plea on his behalf. U.S. Magistrate Judge Robert Lehrburger ordered Kwon to remain in custody, as his lawyers said they would not immediately seek bail. After the hearing, Kwon was handed a 79-page indictment and escorted out of the courthouse by U.S. marshals. He is expected to appear in court again on January 8.

In fact, as early as June last year, Kwon reached a $4.55 billion settlement with the U.S. Securities and Exchange Commission (SEC) in a civil case related to the TerraUSD and Luna collapse. As part of that agreement, he agreed to pay an $80 million penalty and was barred from participating in any cryptocurrency transactions. However, this did not prevent him from facing criminal charges.

According to Thursday's indictment, Manhattan prosecutors accused Kwon of misleading investors during the 2021 promotion of TerraUSD, a cryptocurrency known as a "stablecoin," designed to maintain a value of $1 at all times.

The indictment alleges that when TerraUSD fell below $1 in May 2021, Kwon publicly claimed that an algorithm called the "Terra Protocol" restored its value. In reality, he secretly arranged for a high-frequency trading firm to purchase millions of dollars' worth of tokens to artificially prop up the price.

Prosecutors say Kwon’s false statements attracted large numbers of retail and institutional investors to buy Terraform products, which in turn drove up the price of Luna, a highly volatile cryptocurrency closely linked to TerraUSD. At its peak in spring 2022, Luna had a market capitalization of $50 billion.

"This growth was largely fueled by Kwon’s brazen fraud concerning Terraform and its technology," the indictment states.

However, when TerraUSD’s value sharply declined again in May 2022, an unnamed trading firm warned that “this time it would not be easy” to stabilize the price.

Ultimately, both TerraUSD and Luna collapsed that month, triggering a sharp decline in other cryptocurrencies like Bitcoin and causing widespread turmoil across the entire crypto market.

While prosecutors did not name the trading firm, the U.S. Securities and Exchange Commission (SEC) identified Jump Trading in its civil case as having helped stabilize TerraUSD’s price in May 2021. Jump Trading has not yet responded to requests for comment.

Detention in Montenegro

In the SEC’s lawsuit against Terraform, a Manhattan federal jury ruled last April that Kwon and Terraform were liable for defrauding cryptocurrency investors.

Terraform’s lawyers argued in closing arguments that the company and Kwon had always accurately disclosed their products and how they worked—even if those products ultimately failed.

But Kwon did not attend that trial because he had been detained in Montenegro since March 2023 on charges of document forgery. He was handed over to U.S. authorities on Tuesday at the airport in Podgorica, the capital of Montenegro.

Terraform declared bankruptcy last January.

Kwon is one of several prominent figures in the cryptocurrency industry who have faced federal charges following the 2022 digital currency market crash—a crisis that led to the collapse of multiple companies and had far-reaching consequences for the entire sector.

For example, Sam Bankman-Fried, founder of the FTX exchange, was convicted last March of stealing $8 billion in customer funds and sentenced to 25 years in prison. He is currently appealing the verdict. Sam Bankman-Fried

Additionally, Alex Mashinsky, founder and former CEO of cryptocurrency lending platform Celsius Network, pleaded guilty last month to two counts of fraud.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News