The Rediscovery of RWA—New Life for Traditional Assets on the Blockchain

TechFlow Selected TechFlow Selected

The Rediscovery of RWA—New Life for Traditional Assets on the Blockchain

RWA has been regarded as the core interface for driving the integration of Web3 and Web2 finance, and a key赛道 for mainstream adoption of on-chain finance.

Author: kleinlabs X Aquarius

Introduction

Since 2024, Real-World Assets (RWA) have been re-emerging as one of the core narratives in the crypto market. From stablecoins to U.S. Treasuries, and further into equities and non-standardized assets, the process of bringing real-world assets on-chain is transitioning from a validation phase to an expansion phase. The driving force behind this shift is not only technological maturity but also a clearer global regulatory landscape and traditional finance actively embracing blockchain infrastructure. This wave of RWA growth is no accident—it results from the convergence of multiple factors:

-

Macroeconomic backdrop: High global interest rates have prompted institutional capital to reassess on-chain yield instruments;

-

Policy evolution: Major regulators in the U.S. and Europe are gradually establishing frameworks for "regulated tokenized assets," expanding compliance space for projects;

-

Technological advancement: Infrastructure such as on-chain settlement, KYC modules, institutional wallets, and permission management systems is maturing;

-

DeFi integration: RWA is no longer just “wrapping” off-chain assets, but has become an integral part of the on-chain financial system, featuring liquidity, composability, and programmability.

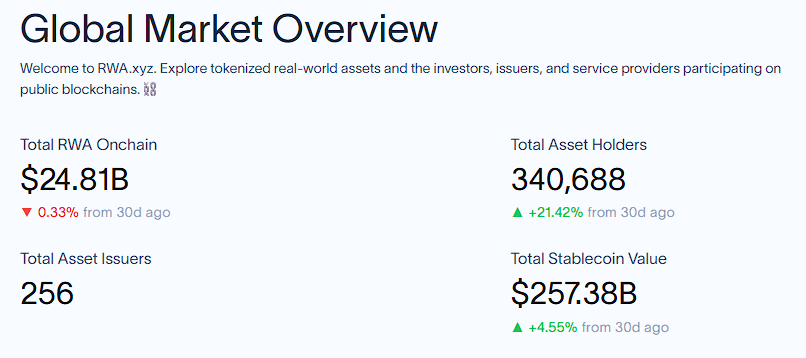

Data shows that by August 2025, the total value of global RWA assets on-chain (excluding stablecoins) has exceeded $25 billion, while the market cap of stablecoins has surpassed $250 billion. RWA is now seen as the key interface bridging Web3 and Web2 finance, and a critical pathway toward mainstream adoption of on-chain finance.

1. Tokenization of Real Assets: Motivations and Implementation Pathways

1.1 Why RWA? Why Put Real Assets On-Chain?

Traditional finance relies on centralized registries and multi-layer intermediaries—this structure inherently suffers from structural inefficiencies that constrain asset liquidity and financial inclusion:

-

Limited liquidity: Real assets like real estate, private equity, and long-term bonds face high transaction thresholds (e.g., minimum investments in millions), long holding periods (years or even decades), and limited transfer channels. As a result, vast amounts of capital remain “locked,” unable to be efficiently allocated.

-

Complex settlement and custody processes: Asset issuance, trading, and clearing depend on multiple intermediaries such as brokers, clearing houses, and custodian banks. These processes are complex and time-consuming (e.g., cross-border bond settlements take 3–5 days), increasing fees and operational risks.

-

Lack of data transparency: Asset valuations rely on fragmented offline data (e.g., property appraisals, corporate financial statements), while transaction records are scattered across different institutions’ systems, making real-time synchronization and cross-validation difficult. This leads to delayed pricing and inefficient portfolio management.

-

High participation barriers: High-quality assets (e.g., private equity, fine art) are typically accessible only to institutions or high-net-worth individuals. Ordinary investors are excluded due to capital requirements or compliance restrictions, exacerbating financial inequality.

Blockchain, as a decentralized distributed ledger system, restructures asset recording and trading logic by removing intermediaries, addressing fundamental pain points in traditional finance. Its core advantages and the value proposition of asset tokenization are as follows:

Foundational Support from Blockchain Technology

-

Decentralized resilience: Ownership records are jointly maintained by network nodes without reliance on any single centralized entity, reducing single points of failure such as data tampering or system collapse, thus enhancing overall fault tolerance.

-

Immutability and traceability: Once confirmed, on-chain transactions are permanently recorded and can be traced backward via timestamps, providing an immutable “digital certificate” for ownership transfers, reducing fraud and disputes.

Specific Value Created by Tokenization

-

Liquidity innovation: Through fractional ownership, high-value assets can be split into small-denomination tokens (e.g., a $10 million property divided into 1,000 tokens worth $10,000 each). Combined with 24/7 decentralized markets and automated market makers (AMMs), investment thresholds are significantly lowered and trading flexibility enhanced.

-

Process automation and disintermediation: Smart contracts automatically execute processes such as asset issuance, dividend distribution, and maturity redemption, replacing manual operations by traditional intermediaries. Oracles connect to off-chain data (e.g., property valuations, company revenues), enabling automated triggers for complex scenarios like insurance claims, significantly lowering operational costs.

-

Compliance and audit enhancement: On-chain KYC/AML rules can automatically verify investor eligibility; all transaction data is recorded in real time, facilitating efficient audits by regulators and auditors. Studies estimate this could reduce compliance costs by 30%–50%.

-

Atomic settlement and risk elimination: Smart contracts enable atomic settlement—simultaneous exchange of asset and funds—completely eliminating counterparty risk from asynchronous delivery ("delivery vs. payment") in traditional transactions, shortening settlement times from T+3 to seconds.

-

Global circulation and DeFi integration: Tokenized assets transcend geographical boundaries and can seamlessly flow across global blockchain networks. They can also serve as collateral in DeFi protocols for lending, liquidity mining, etc., enabling “one asset, multiple uses” and unlocking higher capital efficiency.

-

Overall, RWA represents a Pareto improvement for traditional finance—an efficiency upgrade driven by technology.

Validated Success Path: Lessons from Stablecoins

As the “gateway” for real-world assets going on-chain, stablecoins have already proven the feasibility of connecting off-chain value with on-chain ecosystems:

-

Prototype model: Stablecoins like USDT and USDC achieve a 1:1 peg to off-chain USD reserves, standardizing the mapping of fiat assets to blockchain tokens—the initial practice of “real assets on-chain.”

-

Market validation: By August 2025, stablecoin market cap had exceeded $256.8 billion, dominating the RWA market and demonstrating the scalability potential of off-chain assets on-chain.

-

Insightful implications: The successful operation of stablecoins validates the security, transparency, and efficiency of the “off-chain asset – on-chain token” mapping, providing technical standards and compliance templates for more complex RWA tokenizations (e.g., real estate, bonds).

Through blockchain technology, real-world assets overcome the limitations of traditional finance, upgrading from “static holding” to “dynamic circulation” and from “exclusive access for a few” to “accessibility for all.”

1.2 How to RWA? Implementation Pathways and Operational Structure

The essence of RWA is transforming valuable real-world assets into programmable digital tokens on-chain through blockchain technology, achieving a closed loop of “off-chain value → on-chain liquidity.” Its core implementation consists of four key stages:

a) Off-chain asset identification and custody:

- Verification of off-chain assets: Third-party institutions (law firms, accounting firms, valuation agencies) must verify the legality, ownership, and value of the asset. For example, real estate requires title verification; rental income rights require confirmation of lease contracts; gold must be stored in LBMA-certified vaults and regularly audited. For accounts receivable, the core enterprise must confirm debt authenticity, with evidence stored on-chain via blockchain.

· Classification and practices of custody models:

Centralized custody

a. Advantages: Strong compliance, suitable for financial assets (e.g., government bonds, corporate bonds). For instance, MakerDAO’s bonds are held by banks, with on-chain contracts recording collateral status and updating data quarterly.

Risk: Custodians may misappropriate assets. In 2024, a Singapore real estate project failed to update chain records after a title change, rendering its NFT an “ownerless asset,” highlighting information lag issues in centralized custody.

Decentralized custody

Technical implementation: DAO governance and smart contracts automate revenue distribution. For example, the DeFi protocol Goldfinch brings loan assets on-chain, with smart contracts managing repayments and default handling.

Challenges: Lack of legal support; code vulnerabilities may lead to asset loss. Some projects attempt zero-knowledge proofs (ZKP) to verify ownership consistency, but large-scale deployment remains elusive.

Mixed custody

Balanced approach: Off-chain assets are held by trusted third parties, while on-chain data is validated by nodes. For example, in Huamin Data's RWA consortium chain, institutional nodes (banks, trust companies) manage asset custody, regulatory nodes (30%) set compliance standards, and industrial nodes (e.g., ports) provide logistics data.

Example: The carbon credit tokenization project Toucan Protocol is managed by environmental organizations, with transactions and retirements recorded on-chain to ensure transparency.

b) Legal structure setup:

Using legal structures such as SPVs (Special Purpose Vehicles) or trust agreements ensures that on-chain token holders possess legitimate ownership or revenue rights, establishing enforceable legal bridges with off-chain judicial systems to guarantee “tokens = rights certificates.”

Different regions exhibit significant differences in legal design due to varying regulatory frameworks:

-

United States: Centered on “SPV isolation + securities compliance.” A common approach involves registering an LLC (Limited Liability Company) in Delaware as an SPV to hold underlying assets (e.g., U.S. Treasuries, equity), allowing token holders to indirectly enjoy asset benefits through equity shares. Additionally, SEC regulatory frameworks must be followed based on asset type—if tokens represent bonds or equity, they must comply with Reg D (for accredited investors) or Reg S (non-U.S. investors) exemptions; if involving revenue splits, a “tokenized note” structure should clarify creditor-debtor relationships to avoid being classified as unregistered securities.

-

Europe: Leverages the MiCA (Markets in Crypto-Assets Regulation) framework, using “trusts or EU-approved SPVs” as foundations. For example, registering a SICAV (Société d'Investissement à Capital Variable) in Luxembourg as an SPV to hold assets and issue “Asset-Referenced Tokens (ART),” where the link between tokens and underlying assets is governed by both smart contract terms and legal agreements. MiCA explicitly requires issuers to disclose custody details, profit distribution rules, and undergo regular audits by EU regulators, ensuring legal binding between on-chain tokens and off-chain rights is enforceable across the EU.

c) Tokenization issuance:

Minting the above off-chain assets into tokens (typically ERC-20), serving as vehicles for on-chain circulation and composition

-

1:1 full mapping: Each token corresponds to full rights of an equivalent amount of underlying asset. For example, in Paxos Gold (PAXG), one token equals one troy ounce of physical gold, which holders can redeem at any time, with token value fully synchronized to gold prices; Treasury token $OUSG maps 1:1 to short-term U.S. Treasury ETF shares, including full principal and interest rights.

-

Partial rights mapping: Tokens represent specific rights of the underlying asset (e.g., cash flows, dividend rights), excluding full ownership. For example, in real estate tokenization, a project might issue “rental income tokens,” granting proportional rental income without property ownership or disposal rights. In corporate bond tokenization, “interest-only tokens” can be issued, representing only interest payments while principal remains with original holders. This model suits fractionalization of high-value assets, lowering investment barriers.

d) On-chain integration and circulation:

Tokens enter the DeFi ecosystem, usable for collateralized lending, market making, re-staking, structured product design, etc., with compliant user participation supported by permission management and on-chain KYC systems.

On-chain KYC systems are core tools for compliant circulation, operating on the principle of “identity verification on-chain + dynamic permission control”:

-

Core functionality: Smart contracts integrate with third-party identity verification providers (e.g., Civic, KYC-Chain). Users submit identity documents (passport, address proof, asset proof), and upon verification, receive an “on-chain KYC credential” (a hash of the verification result, not the raw data itself).

-

Permission control: Smart contracts restrict trading permissions based on KYC credentials—for example, only allowing “accredited investors” (assets over $1 million) to participate in private credit token trading; for U.S. Treasury tokens, restricting non-U.S. investors (under Reg S) from redemption during certain time windows.

-

Privacy protection: Zero-knowledge proof (ZK-proof) technology allows proving “user meets qualifications” to smart contracts without revealing specific personal information, balancing compliance and privacy needs. For example, a user’s KYC credential may only show “passed EU AML verification,” without disclosing name or address.

Through this closed-loop design across four stages, RWA achieves transformation from “real-world assets” to “programmable on-chain assets,” preserving the value foundation of traditional assets while endowing them with blockchain-enabled efficiency and composability.

2. Category Classification: Mainstream RWA Asset Types and the Rise of U.S. Treasury Narrative

Off-chain assets (Real World Assets, RWA) are migrating into the blockchain world at an unprecedented pace, extending beyond core categories of traditional finance into broader areas of the real economy. From standardized financial instruments like national debt, corporate bonds, and stocks, to physical assets like real estate, gold, and crude oil, to non-standardized rights like private equity, intellectual property, and supply chain receivables—virtually any real-world asset capable of generating value or possessing ownership characteristics is being explored for tokenization and integration into blockchain networks.

2.1 Seven Mainstream RWA Asset Categories

Currently, the RWA (Real World Assets) ecosystem features seven major asset classes: stablecoins, tokenized U.S. Treasuries, tokenized global bonds, tokenized private credit, tokenized commodities, institutional alternative funds, and tokenized stocks. As of August 2025, the total on-chain RWA asset size reached $25.22B, with stablecoins and U.S. Treasuries remaining dominant—stablecoins alone account for $256.82B, and tokenized government bonds stand at $6.80B. (Source: RWA.xyz | Analytics on Tokenized Real-World Assets)

2.1.1 Stablecoins

-

Although stablecoins are not typical “off-chain assets,” their anchoring mechanism primarily relies on off-chain fiat or bond reserves, giving them the largest share within broad RWA definitions.

-

Representative assets: USDT, USDC, FDUSD, PYUSD, EURC

-

Motivation for on-chain migration: Payment composability, on-chain financial infrastructure, and alternatives to fiat settlement

-

Future directions: Local currency stablecoins (e.g., KRW, JPY) are accelerating development to serve domestic crypto ecosystems and reduce dollar dependence; traditional banks are piloting deposit tokenization for on-chain money to improve transaction efficiency and adaptability; multiple countries are advancing CBDC pilot programs (e.g., Hong Kong’s “Digital Dollar”) to accumulate technical and policy experience.

2.1.2 U.S. Treasuries

-

U.S. Treasuries have become the most mainstream on-chain asset, accounting for over 60% of market value, introducing a low-risk yield curve to DeFi

-

Representative protocols: Ondo, Backed, OpenEden, Matrixdock, Swarm

-

Motivations for on-chain migration:

-

Demand side: Amid declining crypto-native yields, there is growing demand for stable, composable “risk-free rate benchmarks”

-

Technology push: Infrastructure such as on-chain wrapping, KYC whitelists, and cross-chain bridges is maturing

-

Compliance structure: Legal structures like SPVs, tokenized notes, and BVI funds enable asset transparency and regulatory compatibility

-

-

Typical product structures:

-

$OUSG (Ondo): Tracks short-term U.S. Treasury ETF, pays daily interest

-

2.1.3 Global Bonds

-

Besides U.S. Treasuries, government and corporate bonds from Europe, Asia, and other regions are beginning to be tokenized

-

Representative protocols: Backed, Obligate, Swarm

-

Motivations for on-chain migration: Expand geographic and currency coverage; support non-dollar stablecoin issuance (e.g., EURC); form global interest rate curves

-

Challenges: Complex cross-border legal structures and inconsistent KYC standards

2.1.4 Private Credit

-

Connecting on-chain capital with real yield-generating off-chain assets such as SME loans, microloans, real estate financing, and working capital loans

-

Representative protocols: Maple, Centrifuge, Goldfinch, Credix, Clearpool

-

Motivations for on-chain migration: Create real yield sources for on-chain capital; enhance credit transparency and composability

-

Typical structures:

-

SPVs manage underlying assets, DeFi provides capital liquidity, and investors enjoy on-chain interest rates

-

Chainlink Proof of Reserve / Attestation enhances data credibility

-

-

Key tension: Transparency vs. privacy protection, yield vs. risk control quality

2.1.5 Commodities

-

Tokenization of physical assets such as gold, carbon credits, and energy

-

Representative protocols: Tether Gold (XAUT), Pax Gold (PAXG), Toucan, KlimaDAO

-

Motivations for on-chain migration: Provide commodity exposure to on-chain investors; combine physical custody with on-chain trading

-

Hot areas: Green finance, carbon markets, sustainability applications

2.1.6 Institutional Funds

-

On-chain issuance of shares in private equity, hedge funds, ETFs, and other closed-end funds

-

Representative protocols: Securitize, ADDX, RedSwan, InvestX

-

Motivations for on-chain migration: Increase share liquidity, lower entry barriers, expand global base of qualified investors

-

Development constraints: High compliance barriers, limited to Reg D / Reg S investors

2.1.7 Stocks

-

Token-based or synthetic forms mirroring off-chain stock assets

-

Representative protocols: Backed (xStock), Securitize, Robinhood, Synthetix

-

Motivations for on-chain migration: Enable on-chain trading strategies, cross-chain arbitrage, and fractional share investing

-

Current stage: Mostly early experimentation, compliance pathways still under exploration

Among various RWA assets, bonds stand out as a benchmark due to their high standardization. Whether U.S. Treasuries, corporate bonds, or personal debt, bonds rely on clear contractual frameworks and payout mechanisms, offering an efficient path for large-scale on-chain migration. In contrast, physical real-world assets come in diverse forms with complex ownership verification processes. The standardized nature of bonds makes their on-chain mapping more deterministic and seamless. Additionally, bond yields are relatively predictable, enabling more efficient interaction between on-chain capital and off-chain returns than other asset classes, quickly establishing a precise “on-chain – off-chain” value loop that aligns perfectly with RWA’s core goals of digitization and efficiency.

2.2 U.S. Treasury RWA Lays the Foundation for Industry Development

The rapid rise of U.S. Treasury RWA as the “entry point” for on-chain assetization stems not only from its strong financial attributes but also from how it addresses current gaps and urgent demands in the crypto market on both supply and demand sides. Key factors include:

Supply side: Structural safety and clear compliance pathways

-

U.S. Treasuries are theoretically default-free and globally recognized as the most trustworthy foundational asset

-

The ETF and bill markets have mature secondary markets with high liquidity

-

Compared to equity or credit, the legal structure for tokenizing U.S. Treasuries is more stable and transparent (e.g., BVI fund + token wrapper)

Demand side: Alternative to dwindling crypto-native yields

-

Since the liquidity peak in 2021, many DeFi yield models have collapsed, pushing the market into a “yield drought” period

-

Investors are turning to composable real-yield assets on-chain, with U.S. Treasury tokens being the most natural choice

-

Demand for an “on-chain interest rate anchor” is rising, especially with the emergence of interest rate protocols like LayerZero, EigenLayer, and Pendle

Technology side: Standardized asset wrapping structures are maturing

-

Typical structures:

-

Tokenized Note: Linked to underlying ETF, daily interest settlement

-

Real-time redeemable Stablecoin: Instant redemption with composability

-

-

Supporting tools like oracles, audits, Proof of Reserve, and token-ETF NAV tracking are well-developed

Compliance side: Relatively easier to pass regulatory scrutiny

-

Most U.S. Treasury protocols use Reg D / Reg S paths, limiting access to accredited investors

-

Funding structures are clear, with relatively manageable tax and regulatory risks

-

Suitable for institutional participation, promoting convergence between TradFi and DeFi

3. RWA Progress and Market Landscape

Real-World Assets (RWA) are gradually moving from narrative phase to structural growth, with participants, asset types, technical architectures, and regulatory paths entering a period of substantive evolution. This section systematically reviews the current state and evolving landscape of the on-chain RWA market, analyzing developments across four dimensions: asset trends, participant ecosystem, regional regulation, and institutional adoption.

3.1 Market Developments and Key Trends

Current trends indicate strong momentum in RWA growth. Globally, the market continues to expand rapidly—by mid-2025, the total value of on-chain RWA assets had surpassed $23.3 billion, a nearly 380% increase from early 2024, making it the second-fastest growing sector in crypto. Institutions are increasingly entering the space: Wall Street firms are accelerating efforts, Tether launched an RWA tokenization platform, Visa is exploring asset tokenization, and BlackRock issued tokenized funds, driving the market toward standardization and scale. Different RWA asset types are advancing along their respective paths: U.S. Treasury assets continue to lead growth due to stability and mature systems; private credit is actively expanding amid high yields while optimizing risk controls; commodity tokenization is broadening its scope; and equity tokenization is striving to overcome regulatory hurdles.

U.S. Treasury Market (T-Bills): Dominant Growth Engine Driven by Structural Interest Rates

-

By August 2025, the market cap of on-chain U.S. Treasury assets exceeded $68 billion, a year-on-year increase of over 200%. This category has become the largest RWA sub-sector after stablecoins.

-

Mainstream platforms like Ondo, Superstate, Backed, and Franklin Templeton have achieved distributed mapping of U.S. Treasury ETFs/money market funds on-chain.

-

For institutions, Treasury RWA provides infrastructure for on-chain risk-free yields; for DeFi protocols, they serve as yield sources for stablecoins and DAO treasuries, forming a “on-chain central bank” model.

-

Treasury products demonstrate high maturity in compliance, clearing, and legal structures, making them currently the most scalable RWA type.

Private Credit: High Returns Come with High Risks

-

Protocols like Maple, Centrifuge, and Goldfinch are expanding on-chain credit into SME loans, revenue-sharing, and consumer finance.

-

They offer high yields (8–18%) but face significant risk control challenges, relying on off-chain due diligence and asset custody. Projects like TrueFi and Clearpool are transitioning toward institutional services.

-

In 2024, Goldfinch and Centrifuge expanded new credit pilots in Africa and Asia, improving financial inclusion.

Commodity Tokenization: On-Chain Mapping of Gold & Energy Assets

-

Representative projects include Paxos Gold (PAXG), Tether Gold (XAUT), Meld, and 1GCX, which map precious metal reserves into on-chain tokens.

-

Gold is the top choice for commodity tokenization due to its clear reserve logic and stable value, often used as collateral for stablecoins.

-

Energy commodities (e.g., carbon credits, physical oil) face higher regulatory barriers and remain in experimental stages.

Equity Tokenization: Early Breakthroughs Still Constrained by Regulation

-

Current on-chain equity token market cap is around $362 million, about 1.4% of total RWA, dominated by Exodus Movement (EXOD) at 83%.

-

Platforms like Securitize, Plume, Backed, and Swarm are conducting compliant equity mapping for U.S. stocks, European listed companies, and startups.

-

The biggest challenge lies in secondary market trading compliance and KYC management, with some projects adopting permissioned chains or restricted address whitelists as solutions.

Looking ahead, RWA is poised to become a multi-trillion-dollar market. Citibank believes almost any valuable asset can be tokenized, with private asset tokenization potentially reaching $4 trillion by 2030. BlackRock forecasts that the RWA tokenization market could reach $16 trillion by 2030 (including private chain assets), representing 1% to 10% of global asset management. Technologically, advances such as optimized smart contracts, cross-chain solutions, IoT for real-time asset data collection, AI-enhanced valuation models, and zero-knowledge proofs for privacy will further support RWA development. Use cases will continue to expand into emerging areas like carbon assets, data assets, and intellectual property. On the policy front, harmonized global regulatory standards would greatly accelerate RWA’s global circulation and growth. RWA is set to become the core bridge linking traditional economies and Web3, profoundly reshaping global asset allocation.

3.2 Ecosystem Structure and Participant Landscape

3.2.1 Distribution of On-Chain Protocol Participants

|

Public Chain Ecosystem |

Main Projects |

Characteristics |

|

Ethereum |

Ondo, Superstate, Franklin, Plume |

Concentrated institutional presence, complete compliance pathways, most mature stablecoin and fund ecosystem |

|

Stellar |

Franklin Templeton FOBXX |

Transparent institutional custody, efficient payment and issuance |

|

Solana |

Maple, Zeebu, Clearpool |

Low transaction cost suitable for high-frequency credit operations, though security and infrastructure remain immature |

|

Polygon |

Centrifuge, Goldfinch |

Supports off-chain asset mapping and DAO credit governance, low cost, high scalability |

|

Avalanche / Cosmos |

Backed, WisdomTree |

Exploring cross-chain interoperability and fund governance compliance, mostly experimental deployments

|

Trend observation: Ethereum remains the primary hub for RWA assets, especially suitable for high-compliance assets like funds and bonds; credit-focused RWA is beginning to migrate toward lower-cost, high-throughput chains.

|

Region |

Regulatory Stance |

Representative Policies |

Key Impact |

|

United States |

Strict regulation, divergent paths |

SEC / CFTC compliance review + Reg D/S/CF framework |

Large institutions prefer Reg D model, e.g., Securitize with BlackRock |

|

European Union |

Open, unified |

MiCA regulation implemented (2024) |

Clearly distinguishes e-money tokens from asset-referenced tokens, favorable for compliant institutional operations |

|

Singapore |

Highly friendly |

MAS sandbox + RMO license |

Supports RWA product pilots and multi-currency clearing; Circle and Zoniqx have already entered |

|

Hong Kong |

Gradually opening up |

SFC VASP mechanism + virtual asset ETF policy |

Supports compliant tokenized funds going live, promoting local TradFi–Web3 integration |

|

Dubai (VARA) |

Most proactive |

Multi-tier licensing framework + project sandbox |

Becoming a Middle East RWA experiment hub, attracting deployments from Plume, Matrixdock, etc. |

Certain Asian regions (Singapore, Hong Kong, Dubai) are leading in RWA regulatory design and innovation, gradually becoming centers for capital and project aggregation.

3.2.3 Institutional Participation Analysis

Institutional involvement in RWA is shifting from “observational trials” to “substantive deployment.” Based on market tracking, key institutional players currently include:

|

Type |

Institution Name |

Participation Pathway |

|

Asset Managers |

BlackRock, Franklin Templeton, WisdomTree |

Issuing on-chain funds and money market products; launching stable-yield tools via Ethereum/Stellar |

|

Brokers / Issuance Platforms |

Securitize, Tokeny, Zoniqx |

Supporting compliant issuance of stocks/bonds/funds; integrating traditional securities accounts with on-chain holdings |

|

Crypto-Native Protocols |

Ondo, Maple, Goldfinch, Centrifuge |

Building native RWA structures, serving DAOs, treasuries, and DeFi ecosystems |

|

Trading Platforms / Synthetic Protocols |

Backed, Swarm, Superstate |

Providing secondary liquidity for tokenized assets, exploring LP权益 combinations and compliant trading mechanisms |

Institutional roles are becoming increasingly diversified—from “issuers” to “clearing service providers,” “custody platforms,” and “secondary market matchmakers”—positioning RWA as a bridge connecting Web3 and TradFi directly.

4. Case Studies of Representative Projects

This section analyzes representative RWA projects across U.S. Treasuries, private credit, commodities, and equities, dissecting their token models, investor structures, product mechanisms, and return logic:

4.1 U.S. Treasury Track: Ondo Finance

Ondo Finance is a platform focused on tokenizing traditional financial assets, particularly U.S. Treasuries, aiming to bring low-risk yield assets into the crypto market and provide investors with stable, composable returns. It builds a compliant bridge between traditional finance and decentralized finance (DeFi), enabling U.S. Treasuries to be traded and used on-chain in tokenized form.

• Token Model: Issues ERC-20 tokens pegged 1:1 to off-chain U.S. Treasury ETFs (e.g., $OUSG for short-term U.S. Treasury ETF), with daily automatic interest settlement.

• Investor Structure: Primarily institutions (family offices, asset managers) and accredited investors accessing via Reg D/S compliance paths; some retail users can participate indirectly through DeFi protocols.

Product Mechanism: Implements an “on-chain fund” architecture where an SPV (Special Purpose Vehicle) holds U.S. Treasury assets, and smart contracts manage subscriptions, redemptions, and interest distributions, supporting on-chain staking and lending (e.g., integration with Aave, Compound).

• Return Logic:

• Underlying Asset Yield: The base return for tokens like $OUSG comes from interest income of the underlying U.S. Treasury assets. After deducting platform management fees (e.g., 0.15%–0.3%), the net interest is distributed to token holders.

• DeFi Ecosystem Yield: When tokens like $OUSG are used in DeFi, additional returns are generated—for example, using $OUSG as collateral to borrow other assets, then deploying those assets into liquidity mining or other DeFi applications; or participating in liquidity pools to earn trading fees.

4.2 Private Credit Track: Maple Finance

Maple Finance is a multi-chain DeFi platform focused on institutional-grade on-chain lending and RWA investment, operating on Ethereum, Solana, and Base. Its core clients include hedge funds, DAOs, and crypto trading firms. By simplifying complex traditional financial processes, it offers low-collateral loans, tokenized U.S. Treasuries, and trade receivables pools. As of June 2025, its assets under management (AUM) surpassed $2.4 billion, making it a representative private credit platform amid growing institutional adoption.

-

Token Model:

-

Core token: SYRUP (ERC-20 standard), total supply of 118 million, with approximately 111 million in circulation—nearly fully circulating, minimizing potential sell pressure.

-

Core functions:

-

Staking mechanism: SYRUP holders can stake tokens to become “risk sharers,” who absorb losses first in case of loan defaults and receive platform rewards (e.g., fee sharing) otherwise.

-

Value capture: The platform charges 0.5%–2% fees per loan, with 20% used to repurchase SYRUP and distribute to stakers, creating token value support.

-

-

-

Investor Structure: Institutional funders (hedge funds, crypto VCs) provide large capital pools; DeFi treasuries (e.g., Alameda Research initially participated) add liquidity; borrowers must pass off-chain due diligence (KYC, credit rating).

-

Product Mechanism: Uses a “decentralized credit pool” model where smart contracts match borrowing needs (e.g., SME working capital, crypto miner loans) with funding supply, automatically executing repayments and default liquidations (via Chainlink oracles verifying off-chain repayment data).

-

Return Logic:

-

Base Yield: Lenders earn interest by providing liquidity, with returns tied to product risk (e.g., High Yield offers higher returns due to higher-risk assets compared to Blue Chip).

-

Platform Share: Stakers earn a portion of platform fees (20% of fees used to repurchase SYRUP and distribute), while assuming responsibility for compensating default losses.

-

Ecosystem Synergy: Institutional borrowers gain fast, low-cost liquidity to support crypto trading and arbitrage activities, indirectly boosting platform lending demand and forming a closed loop of “borrowing → lending → yield distribution.”

-

4.3 Commodity Track: Paxos Gold ($PAXG)

Paxos Gold is a gold tokenization product issued by regulated fintech firm Paxos, aiming to enable on-chain circulation and efficient management of physical gold via blockchain. Its core value lies in combining gold’s store-of-value properties with blockchain’s programmability, allowing investors to participate in gold investment without bearing storage and transportation costs, while enabling 24/7 global trading and DeFi integration.

-

Token Model:

-

Core token: $PAXG (ERC-20 standard), strictly adhering to a 1:1 peg—one token corresponds to one troy ounce of LBMA-certified physical gold, securely stored by global custodians like Brink’s.

-

Issuance and redemption mechanism: When users purchase $PAXG, Paxos simultaneously acquires an equivalent amount of physical gold; upon redemption, tokens are burned and corresponding gold is released, ensuring perfect alignment between on-chain tokens and off-chain reserves, eliminating over-issuance risks.

-

-

Investor Structure: Retail investors (purchasing via exchanges or wallets), institutions (asset managers seeking gold exposure), and DeFi protocols (using $PAXG as collateral to back stablecoin issuance).

-

Product Mechanism: Smart contracts link to custodian gold reserve proofs (verified via Chainlink PoR oracles), support physical gold redemption (subject to minimum thresholds and fees), and allow free trading on DEXs (e.g., Uniswap).

-

Return Logic: Long-term value appreciation of gold (inflation hedge) plus liquidity gains from on-chain trading/staking (e.g., using $PAXG as collateral to mint $DAI, then deploying into DeFi yield farming); Paxos earns fees from redemptions, custody, and trading services, covering storage, auditing, and tech maintenance costs, forming a sustainable operational loop.

4.4 Equity Track: xStocks (Backed Finance U.S. Stock Tokenization Platform)

xStocks is a U.S. stock tokenization platform launched by Swiss fintech firm Backed Finance, converting U.S. stocks like Tesla (TSLAx) into tradable on-chain tokens via the Solana blockchain. Its core goal is to break traditional stock market time zone and liquidity barriers while integrating DeFi to make stock assets programmable. As of July 2025, its tokens are listed on exchanges including Bybit, Kraken, and Raydium, becoming a representative case of “24/7 trading + on-chain reuse” in equity tokenization.

-

Token Model:

-

Core token: Issued on Solana using SPL standard (e.g., $TSLAx for Tesla stock), 1:1 pegged to off-chain shares, with each token backed by one real share held by Backed in partnership with compliant institutions (e.g., Alpaca Securities in the U.S., InCore Bank in Switzerland).

-

Pricing mechanism: Chainlink oracles synchronize U.S. stock prices in real time. During traditional market downtime (e.g., weekends, holidays), prices are derived from the last close price and on-chain supply-demand dynamics, exhibiting “prediction market” characteristics.

-

-

Investor Structure: No strict accredited investor restrictions (subject to exchange KYC), serving individual investors (via Bybit, Kraken, or Solana wallets) and small asset managers seeking fractional U.S. stock exposure.

-

Product Mechanism:

-

Issuance and custody: Backed pre-purchases target stocks, held by compliant brokers and banks, and mints corresponding tokens 1:1 on Solana; upon redemption, tokens are burned and off-chain shares released, with reserve transparency ensured via periodic Proof of Reserve verification.

-

Dividend handling: No shareholder voting rights or AGM access, but dividends are delivered via “token airdrops”—after the underlying stock pays dividends, Backed distributes additional tokens proportionally to token holders, indirectly passing economic benefits.

-

On-chain circulation: Supports 24/7 trading (breaking traditional market hours), available on centralized exchanges (Bybit, Kraken) and decentralized platforms (Raydium, Jupiter), with cross-chain potential (planned bridge integration in future).

-

-

Return Logic: Appreciation and dividends from underlying stocks plus liquidity premium from on-chain trading (fractional shares, 24/7 market); Backed earns fees from token issuance, custody, and trading, covering compliance and technical costs.

4.5 RWA Infrastructure Track: Plume Network

Plume Network is a full-stack blockchain platform dedicated to Real-World Assets (RWA), designed to bridge traditional finance and crypto by efficiently bringing real-world assets on-chain and integrating them with DeFi, solving key challenges in compliance, liquidity, and user experience during the asset tokenization process.

-

Token Model:

-

Core token: $PLUME (ERC-20 standard), total supply of 10 billion, with 59% allocated to community incentives and ecosystem development. Functions include paying on-chain fees, governance voting, staking for revenue sharing, and serving as a settlement medium for asset trades within the ecosystem.

-

Incentive design: Users configuring RWA assets on the platform (e.g., real estate tokens, credit certificates) earn base returns (10%-20% annualized) plus additional $PLUME rewards, with reward ratios tied to holding duration and staking amount, enhancing ecosystem stickiness.

-

-

Investor Structure: Institutional side includes top-tier capital like Brevan Howard Digital and Haun Ventures investing and piloting asset tokenization; retail and crypto-native users participate via Passport wallet for trading and yield farming, primarily individual investors seeking “traditional assets + crypto yields,” emphasizing compliance and cross-chain opportunities.

-

Product Mechanism:

-

Asset classification management: Covers collectibles (e.g., sneakers, Pokémon cards, watches, wine, art), alternative assets (private credit, real estate, green energy projects), and financial instruments (stocks, corporate bonds), catering to users with different risk profiles and investment needs.

-

Toolkit support system:

-

Arc: Tokenization issuance system enabling flexible on-chain representation of assets as NFTs, tokens, or composite assets, optimizing issuance structure and enhancing liquidity.

-

Nexus: RWA-specific oracle ensuring accurate synchronization between on-chain data and off-chain asset information, providing reliable data for trading and yield calculations.

-

Passport: Aggregated asset management tool—a smart wallet integrating multiple token standards and DeFi composability, allowing users to easily engage in RWA operations and DeFi apps like yield farming.

-

SkyLink: Cross-chain bridge that mirrors YieldTokens, enabling permissionless access to institutional-grade RWA yields, breaking chain silos and expanding asset circulation.

-

Compliance assurance: Leverages regional partners to flexibly switch licenses and meet local regulations, offering end-to-end compliance solutions from development to operations, safeguarding the security and legality of asset tokenization. For example, its support for ERC-3643 standard uses the built-in decentralized identity system ONCHAINID to ensure only qualified users can hold tokens, maintaining regulatory compliance.

-

-

Return Logic:

-

User Returns: Users participating in different asset projects earn intrinsic asset yields (e.g., stable returns from green energy projects); by staking $PLUME, they share platform trading fees and can capture capital gains from price fluctuations. For example, in collectibles, users can engage in flipping, collateralized lending, and synthetic asset trading to capture profit opportunities.

-

Platform Revenue: Plume generates income from asset issuance fees,

-

-

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News