From printing money to building chains: Circle's "central bank dream"

TechFlow Selected TechFlow Selected

From printing money to building chains: Circle's "central bank dream"

If Arc successfully launches and attracts sufficient users and liquidity, Circle will establish itself as a leader in the stablecoin infrastructure space.

Author: David, TechFlow

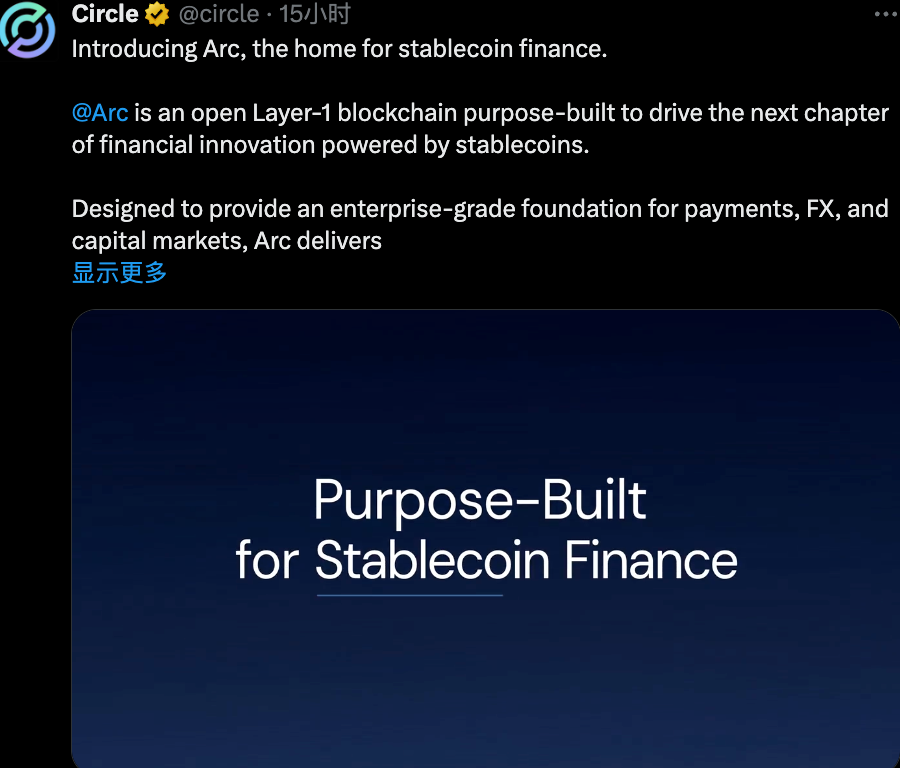

On August 12, the same day it released its first earnings report since going public, Circle dropped a bombshell: Arc, a Layer 1 blockchain purpose-built for stablecoin finance.

If you only read the headlines, you might think this is just another standard public chain story.

But when viewed within the context of Circle’s seven-year trajectory, it becomes clear:

This isn't just a blockchain—it's a territorial declaration of a “digital central bank.”

Traditionally, central banks have three core functions: issuing currency, managing payment and clearing systems, and setting monetary policy.

Circle is systematically replicating this in digital form—first securing the “minting right” via USDC, then building the clearing system with Arc, and next potentially shaping policy for digital currencies.

This is not merely about one company; it's about the reconfiguration of monetary power in the digital age.

Circle’s Evolution into a Digital Central Bank

In September 2018, when Circle and Coinbase jointly launched USDC, the stablecoin market was dominated by Tether.

Circle chose what seemed at the time a “clumsy” path: extreme regulatory compliance.

First, it proactively tackled the toughest regulatory hurdles, becoming one of the earliest companies to obtain a New York State BitLicense. Known as the “hardest crypto license to get,” its arduous application process deterred many firms.

Second, it didn’t go it alone. It partnered with Coinbase to form the Centre Consortium—sharing regulatory risks while gaining instant access to Coinbase’s massive user base, allowing USDC to launch on the shoulders of giants.

Third, it maximized reserve transparency: publishing monthly attestation reports from accounting firms, ensuring reserves were 100% backed by cash and short-term U.S. Treasuries, avoiding commercial paper or high-risk assets. This “straight-A student” strategy wasn’t popular early on—during the wild growth era from 2018 to 2020, USDC was criticized as “too centralized” and grew slowly.

The turning point came in 2020.

The DeFi summer explosion drove soaring demand for stablecoins. More importantly, institutional players like hedge funds, market makers, and payment firms began entering the space, finally making USDC’s compliance advantage shine.

From $1 billion in circulation to $42 billion, and now reaching $65 billion, USDC’s growth curve has been nearly vertical.

But being just a “printing press” wasn’t enough.

In March 2023, Silicon Valley Bank collapsed. With $3.3 billion of Circle’s reserves held there, USDC briefly depegged to $0.87, triggering widespread panic.

The outcome of this “stress test” was that the U.S. government, aiming to prevent systemic risk, ultimately guaranteed full deposits for all SVB customers.

Though not a bailout specifically for Circle, the incident made Circle realize that being merely an issuer wasn’t sufficient. To truly control its fate, it needed to own more infrastructure.

What further intensified this need was the dissolution of the Centre Consortium, exposing Circle’s “contract worker” dilemma.

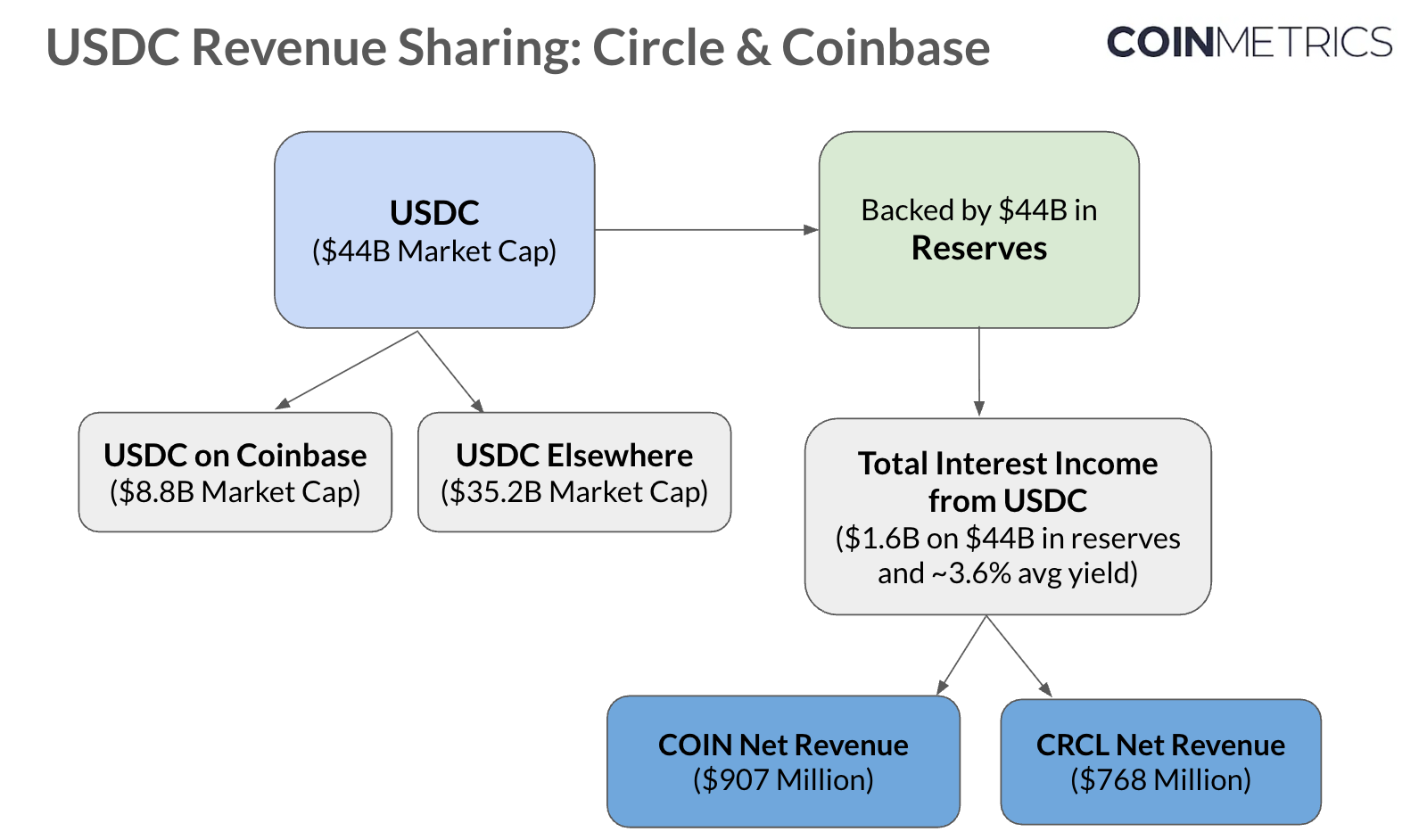

In August 2023, Circle and Coinbase announced the dissolution of the Centre Consortium, with Circle taking full control of USDC. On the surface, this granted Circle independence—but at a heavy cost: Coinbase secured a 50% share of USDC reserve income.

What does this mean? In 2024, Coinbase earned $910 million from USDC, a 33% year-on-year increase. Meanwhile, Circle paid over $1 billion in distribution costs that year, most of which went to Coinbase.

In other words, Circle built USDC into a giant, yet had to hand half the profits to Coinbase. It’s akin to a central bank printing money but having to give half the seigniorage to commercial banks.

Besides, Tron’s rise revealed a new profit model to Circle.

In 2024, Tron processed $5.46 trillion in USDT transactions, averaging over 2 million transfers per day, earning substantial transaction fees just by providing transfer infrastructure—a business model upstream and more stable than stablecoin issuance.

Especially amid expectations of Fed rate cuts, traditional stablecoin interest income will shrink, while infrastructure transaction fees remain relatively stable.

This served as a wake-up call to Circle: whoever controls the infrastructure can keep collecting taxes.

Thus, Circle began transforming into an infrastructure builder, expanding across multiple fronts:

-

Circle Mint allows enterprise clients to directly mint and redeem USDC;

-

CCTP (Cross-Chain Transfer Protocol) enables native USDC transfers across blockchains;

-

Circle APIs provide enterprises with a complete suite of stablecoin integration solutions.

By 2024, Circle’s revenue reached $1.68 billion, with its income structure shifting—beyond traditional reserve interest, increasing contributions came from API usage fees, cross-chain service fees, and enterprise service fees.

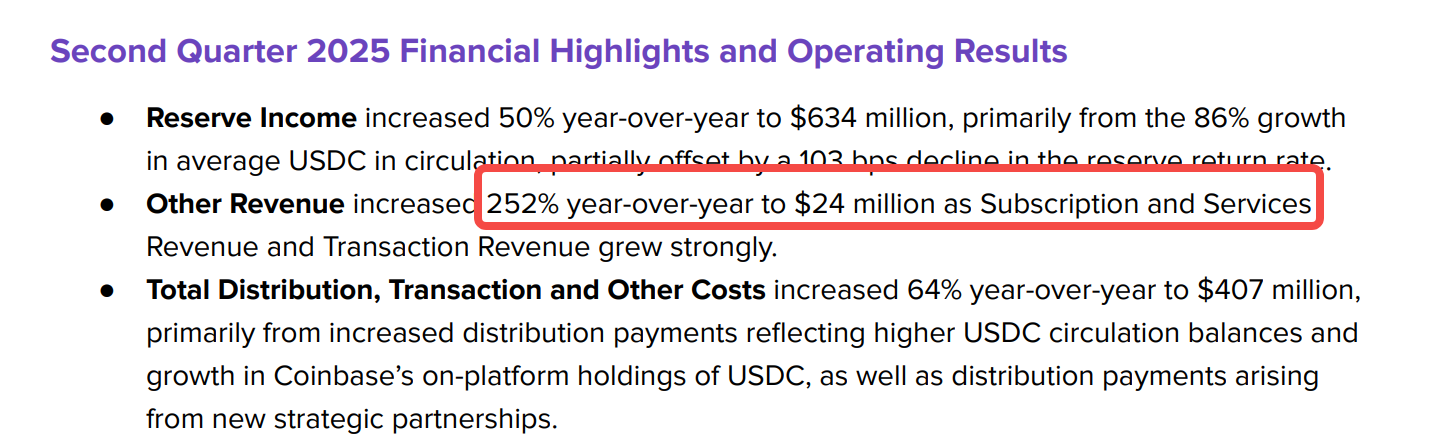

This shift is confirmed in Circle’s recently released earnings report:

Data shows that Circle’s subscription and service revenue reached $24 million in Q2 this year, still only about 3.6% of total revenue (the bulk remains interest from USDC reserves), but up 252% year-on-year.

Moving from a single-interest “printing” business to a diversified “rent-collecting” model gives Circle greater control over its business.

The debut of Arc marks the climax of this transformation.

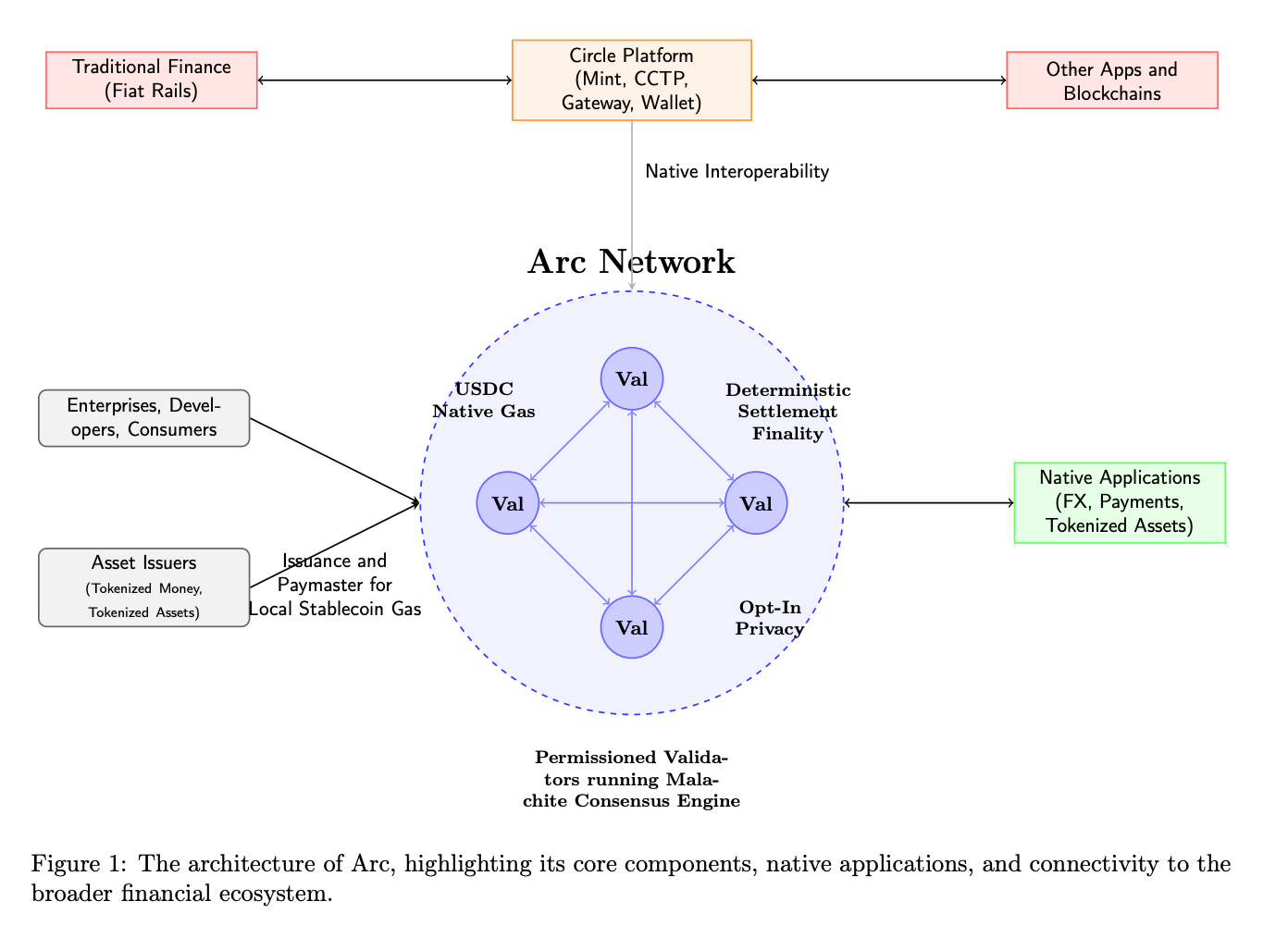

It’s a blockchain custom-built for stablecoins (USDC):

USDC serves as native gas, eliminating the need to hold ETH or other volatile tokens; an institutional-grade quote request system supports 7×24 on-chain settlement; transaction confirmation under 1 second, with privacy options for balances and transactions to meet compliance needs.

These features are essentially technological assertions of monetary sovereignty. Arc is open to all developers, but the rules are set by Circle.

From Centre to Arc, Circle has completed a triple leap:

First leap: securing the right to mint (USDC);

Second leap: building financial pipelines (APIs, CCTP);

Third leap: establishing sovereign territory (Arc)

This path almost digitally replays the historical evolution of central banks:

From private banks issuing banknotes, to monopolizing currency issuance, to controlling the entire financial system—except Circle is moving much faster.

And Circle is not the only one chasing this “digital central bank dream.”

Different Paths, Same Ambition

In the 2025 stablecoin landscape, major players all share a “central bank dream,” but their paths differ.

Circle has chosen the hardest but potentially most valuable path: USDC → Arc blockchain → full financial ecosystem.

Circle is not content with being just a stablecoin issuer; it aims to control the entire value chain—from currency issuance to clearing systems, from payment rails to financial applications.

Arc’s design is infused with “central bank thinking”:

First, monetary policy tools: using USDC as native gas gives Circle control similar to a “benchmark interest rate”; second, clearing monopoly: the built-in institutional RFQ foreign exchange engine forces on-chain FX settlements through its mechanism; third, rule-making authority: Circle retains control over protocol upgrades, deciding which features launch and which behaviors are permitted.

The hardest part is ecosystem migration—how to convince users and developers to leave Ethereum?

Circle’s answer is not migration, but supplementation. Arc doesn’t aim to replace USDC on Ethereum, but to serve use cases unmet by existing chains—such as enterprise payments requiring privacy, FX trading needing instant settlement, or dApps needing predictable costs.

This is a high-stakes gamble. If successful, Circle could become the digital equivalent of the “Federal Reserve”; if it fails, billions in investment may be lost.

PayPal’s approach is pragmatic and flexible.

PYUSD debuted on Ethereum in 2023, expanded to Solana in 2024, launched on Stellar in 2025, and recently added Arbitrum.

Instead of building a dedicated chain, PayPal spreads PYUSD across multiple viable ecosystems, treating each chain as a distribution channel.

In the early stages of stablecoins, distribution channels matter more than infrastructure. When ready-made options exist, why build your own?

Secure user mindshare and use cases first, worry about infrastructure later—especially when PayPal already has a 20-million-merchant network.

Tether acts as the de facto “shadow central bank” of the crypto world.

It rarely interferes with USDT usage—once issued, it circulates freely, a matter for the market. Especially in regions and use cases with unclear regulations and difficult KYC, USDT becomes the only option.

Circle founder Paolo Ardoino once said in an interview: USDT primarily serves emerging markets (like Latin America, Africa, Southeast Asia), helping local users bypass inefficient financial infrastructure, making it more of an international stablecoin.

With 3–5 times more trading pairs than USDC on most exchanges, Tether has achieved powerful liquidity network effects.

Most interesting is Tether’s attitude toward new chains. It doesn’t build them itself but supports others who do—such as backing Plasma and Stable, blockchains dedicated to stablecoins. It’s a low-cost bet to maintain presence across ecosystems, waiting to see which one emerges.

In 2024, Tether’s profits exceeded $10 billion, surpassing many traditional banks. Instead of using these profits to build its own chain, Tether continues buying U.S. Treasuries and Bitcoin.

Tether bets that as long as it maintains sufficient reserves and avoids systemic risk, inertia will preserve USDT’s dominance in stablecoin circulation.

These three models represent different visions of the future of stablecoins.

PayPal believes in users first. With 20 million merchants, technical architecture is secondary. This is internet thinking.

Tether believes in liquidity first. As long as USDT remains the base currency for trading, nothing else matters. This is exchange thinking.

Circle believes in infrastructure first. Control the rails, and you control the future. This is central bank thinking.

The rationale may lie in a congressional testimony by Circle CEO Jeremy Allaire: "The dollar stands at a crossroads—currency competition today is technological competition."

Circle isn’t just eyeing the stablecoin market; it’s aiming for the standard-setting power of digital dollars. If Arc succeeds, it could become the “Federal Reserve System” of digital dollars. That vision justifies the risk.

2026: The Critical Window

The window of opportunity is narrowing. Regulation advances, competition intensifies. When Circle announced Arc would launch its mainnet in 2026, the crypto community’s immediate reaction was:

Too slow.

In an industry that worships “rapid iteration,” taking nearly a year to move from testnet to mainnet seems like a missed opportunity.

But understanding Circle’s position reveals this timing may actually be sound.

On June 17, the U.S. Senate passed the GENIUS Act—the first federal-level stablecoin regulatory framework.

For Circle, this is the long-awaited “legitimization.” As the most compliant stablecoin issuer, Circle already meets nearly all requirements of the GENIUS Act.

2026 is precisely when these rules take effect and the market adapts. Circle doesn’t want to be the first mover, nor arrive too late.

Enterprise clients value certainty above all—and Arc delivers exactly that: clear regulatory standing, predictable technical performance, and stable business models.

If Arc launches successfully and attracts sufficient users and liquidity, Circle will cement its leadership in stablecoin infrastructure. This could usher in a new era—privately operated “central banks” becoming reality.

If Arc underperforms or is overtaken by rivals, Circle may need to reconsider its strategy. Perhaps, after all, a stablecoin issuer can only remain an issuer, never dominate infrastructure.

Yet regardless of the outcome, Circle’s attempt pushes the entire industry to confront a fundamental question: In the digital age, who should control money?

The answer may begin to emerge by 2026.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News