From a "crypto-stock" perspective on the future trends of cryptocurrency

TechFlow Selected TechFlow Selected

From a "crypto-stock" perspective on the future trends of cryptocurrency

This round of market upswing is characterized by the parallel drivers of institutionalization and fundamentals, differing from previous retail-speculation-dominated rallies. The overall capital structure is more stable compared to the last bull market, and investors' medium- to long-term allocation willingness toward mainstream assets has significantly increased.

1. Why has the "coin stock" concept suddenly gained popularity?

1.1 Deteriorating overall crypto market liquidity

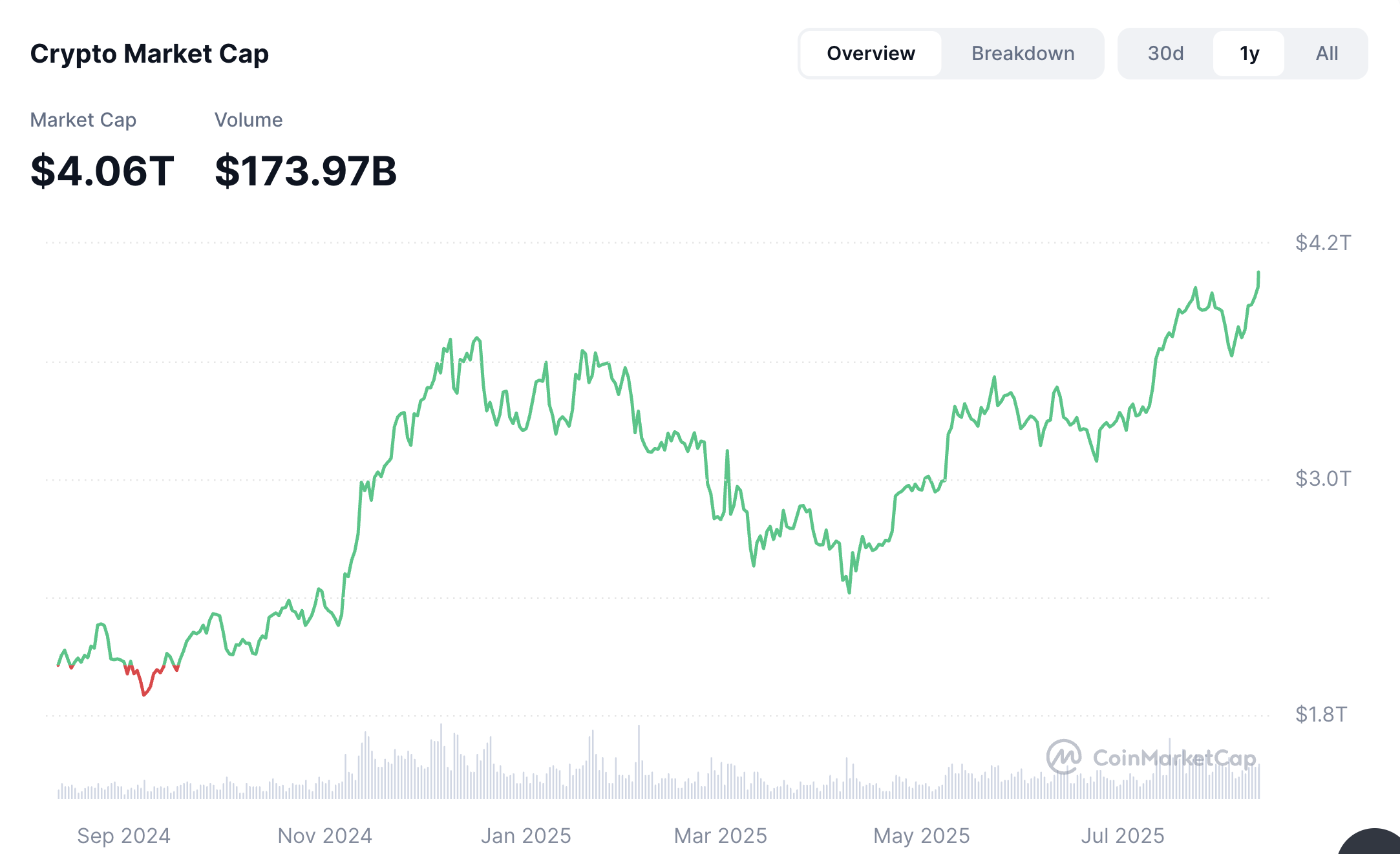

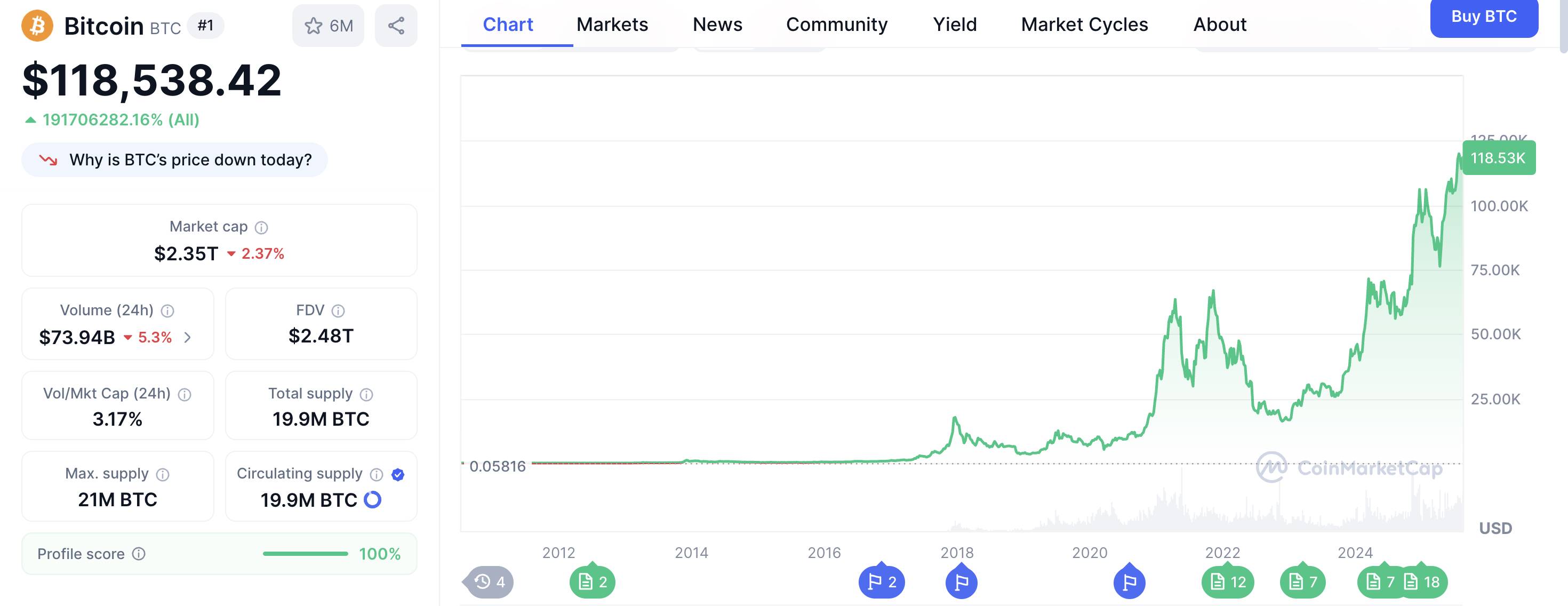

According to CoinMarketCap data, from November to December 2024, the cryptocurrency market entered a significant upward cycle. The total market capitalization rose from $2.26 trillion to $3.72 trillion, with average daily trading volume maintaining at around $250 billion. Market activity significantly increased, exhibiting typical "bull market" characteristics.

However, starting in late January 2025, due to a combination of factors, market sentiment began to shift:

1. Macro factors: U.S. tariff policies created uncertainty, suppressing risk appetite;

2. Fund diversion: Celebrity tokens such as "Trump Coin," "Melania Meme," and Argentina's presidential-themed token "Libra" attracted substantial funds and trading attention in the short term;

3. Liquidity drain and risk events: Subsequently, these tokens experienced sharp price volatility or even collapsed (e.g., Libra), causing some capital to flee and weakening market confidence in emerging projects.

Under this backdrop, on-chain activity and market sentiment gradually cooled down, pushing the crypto market into an adjustment phase, with both total market cap and trading volume declining.

By May 2025, market sentiment reached a turning point. On one hand, U.S. inflation data came in below expectations for two consecutive months, increasing market pricing for a potential Fed rate cut within the year; on the other hand, negative impacts from earlier tariff policy concerns gradually faded, with partial recovery in trade and macro expectations, leading to renewed risk appetite. Additionally, multiple compliant channels—including ETFs, retirement plans, and regulated custodial platforms—progressively opened access to mainstream crypto asset allocation, driving inflows of incremental capital. During this period, "coin stock"-like assets (such as ETH and certain tokens with on-chain cash flows) became key targets for fund deployment, with average daily trading volume notably rebounding.

By August 2025, the total cryptocurrency market capitalization surpassed $4.0 trillion, reaching a record high. This rally was characterized by institutionalization and fundamental drivers acting in parallel, differing from previous retail-driven speculative rallies. The funding structure was more stable than in the last bull run, and long-term institutional appetite for major assets significantly strengthened.

VC funding slows, forcing crypto projects to seek alternative paths, highlighting limitations of traditional financing methods

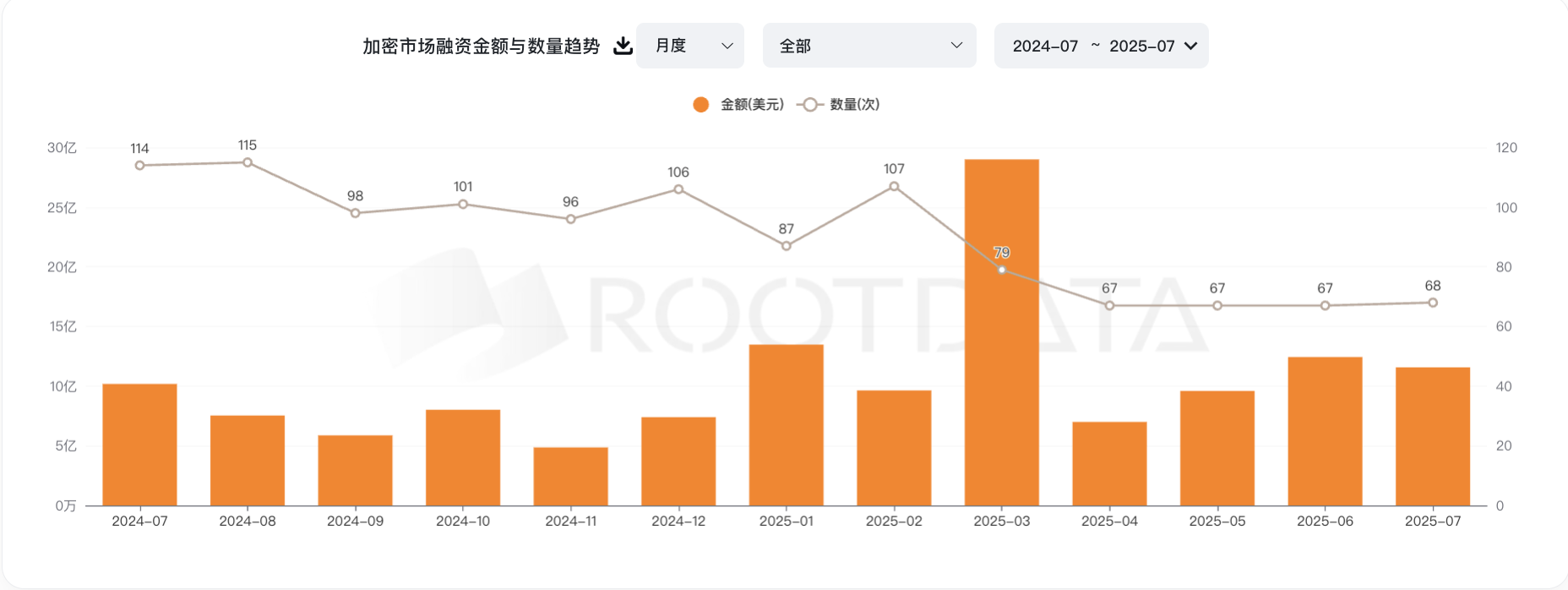

From July 2024 to July 2025, fundraising activity in the crypto market clearly cooled. According to RootData, the number of project financings declined steadily from 114 deals in July 2024 to a low of 67 in April 2025, indicating shrinking VC willingness to invest in new projects.

Against this backdrop of slowing fundraising, some projects adopted a strategy of launching tokens first and gradually releasing tokens later—known as the "VC coin" model—to quickly raise capital. A typical example is listing on Binance Alpha and attracting users via airdrops to rapidly gain access to large exchanges. However, this model revealed clear drawbacks in the current market environment. Projects like PRAI and XTER, despite being backed by well-known institutions, saw their token prices fall below investor cost bases shortly after launch. The root cause lies in high fully diluted valuations (FDV) combined with low circulating supply, artificially inflating initial prices. As unlock schedules released more tokens, insufficient liquidity pressured prices downward.

This phenomenon not only weakened VC confidence in crypto projects but also negatively impacted retail investors. For institutions, projects showed paper losses immediately upon listing; for retail, "VC coins" became synonymous with "dump upon unlock," reducing willingness to participate—a vicious cycle. Chart data shows that from February to April 2025, the number of financings dropped sharply from 107 to 67, coinciding precisely with a concentrated outbreak of "VC coin" break-even failures during this period.

In summary, slowing VC investment and frequent "VC coin" break-evens are different manifestations of the same structural market issue. On one hand, weak macro conditions and poor market sentiment make institutional capital more cautious; on the other, high-valuation, low-circulation, and short-term profit-taking token issuance models lose appeal when markets cool. If future fundraising and token issuance mechanisms fail to innovate, "VC coin" price performance will remain poor, continuing to constrain market confidence recovery.

Therefore, facing tightening financing conditions and token price volatility, many VCs seeking more stable and sustainable returns have begun, in regions with relatively relaxed regulatory oversight, to adopt methods such as "backdoor listings" to establish companies that directly purchase and hold cryptocurrencies as asset reserves. This approach avoids price volatility risks associated with traditional token issuance and offers institutions a compliant, long-term investment channel. This is the background and origin of the emergence of "coin stock companies."

1.2 "Compliance"

The re-election of U.S. President Donald Trump in 2024 marked the beginning of a new era for U.S. crypto asset regulation. In early 2025, newly appointed SEC Chair Paul S. Atkins swiftly introduced a series of crypto-friendly policies, clearly distinguishing most crypto assets from securities and advancing the creation of a dedicated regulatory framework for digital assets. This shift greatly boosted market confidence and accelerated the industry’s compliance process.

Under this context, in July 2025, Congress passed and President Trump signed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), the first federal legislation in the U.S. specifically targeting payment stablecoins, establishing a clear regulatory system for stablecoin issuance and operations. Key provisions include:

• Reserve assets must strictly maintain a 1:1 ratio; stablecoin issuers must hold USD or highly liquid U.S. Treasuries to ensure redeemability and stability.

• Enhanced transparency and audit requirements: issuers must regularly disclose financial status to regulators and undergo independent audits to verify reserve authenticity and adequacy.

• Clear anti-money laundering and sanctions compliance responsibilities: stablecoin issuers must implement robust AML and KYC systems to prevent use in illicit financial flows.

Additionally, the U.S. Treasury recognized Bitcoin (BTC) as a national strategic reserve asset, allowing federal agencies to include BTC in foreign exchange reserves. This not only affirms Bitcoin’s status as “digital gold” but also provides authoritative endorsement for the entire digital asset market.

The clearer and more lenient regulatory environment has encouraged more traditional financial institutions to actively enter the crypto space, willing to hold and trade digital currencies through compliant channels, avoiding the high risks previously caused by regulatory uncertainty. This policy direction is moving crypto assets from the fringe “gray zone” toward mainstream financial assets, making them an important component of institutional portfolios.

1.3 Circle’s IPO and Coinbase’s inclusion in the S&P 500 lead more financial institutions to properly recognize the investment attributes of cryptocurrencies

Driven by this compliant environment, in June 2025, Circle successfully completed its initial public offering (IPO), raising over $1.1 billion. Its share price surged 168% on the first day, briefly approaching a $20 billion market cap—one of the largest public offerings in the digital asset sector in recent years. This reflects strong market recognition of compliant stablecoin issuers and investor confidence in the long-term value of crypto assets as a new asset class. Circle’s successful listing broke through barriers for the crypto industry to enter traditional capital markets, serving as a key milestone toward integration with the mainstream financial system and validating the feasibility of compliant pathways and sustainable business models.

Meanwhile, in May 2025, Coinbase officially became the first native crypto company to join the S&P 500 Index. This historic breakthrough not only granted broad legitimacy to the entire crypto industry but also greatly enhanced institutional investor acceptance. With Coinbase included in a major index, more pension funds, insurance companies, and asset managers began incorporating crypto assets into standard portfolios, improving diversification and stability of capital structures.

This not only generated significant scale effects but also prompted more crypto firms to strengthen compliance, governance, and transparency to meet strict institutional requirements, driving the industry’s standardization.

From a capital flow perspective, Circle and Coinbase’s success triggered a new wave of institutional inflows. Data shows that in Q2 2025, institutional allocations to compliant crypto assets grew over 40% year-on-year. Demand for holding digital assets via listed companies or regulated entities clearly rose, effectively reducing traditional investors’ concerns about price volatility and regulatory risk.

Moreover, compliant holding models help institutions avoid common price volatility risks in token issuance, enabling stable asset appreciation and enhancing overall market liquidity and resilience.

Overall, the success of Circle and Coinbase not only brought capital market recognition to the crypto industry but, more importantly, set benchmarks for compliant development, inspiring broad imagination and firm confidence in the future of digital assets.

2. Financing routes for "coin stocks"

I. PIPE (Private Investment in Public Equity)

Operating logic

○ Listed company issues shares or convertible bonds at a discount to select institutional investors to quickly raise funds for purchasing large amounts of cryptocurrency

○ Rapid injection of PIPE funds enables the company to build positions quickly and signal "institutional entry," boosting stock price

○ Investing institutions enjoy discounted prices and preferential rights, while retail investors follow at higher levels

Advantages

○ Fast and flexible fundraising

○ Institutional backing enhances market confidence; narrative marketing drives stock price growth

○ Simple structure, suitable for rapid promotion

II. SPAC (Special Purpose Acquisition Company)

Operating logic

○ Establish a shell public company, raise funds, then acquire a crypto project, bypassing traditional IPO processes for faster listing

○ Use SPAC combined with tools like PIPE and convertible bonds to raise capital for buying crypto, building a "crypto-denominated" balance sheet

○ Leverage listed status to attract institutional buyers such as ETFs and hedge funds, enhancing liquidity

Advantages

○ Fast listing (4–6 months), diverse funding options

○ Founding team retains greater control and equity

○ Stocks more readily accepted by mainstream trading platforms, enhancing legitimacy and investor confidence

III. ATM (At-The-Market Offering)

Operating logic

○ Company sells shares periodically and incrementally at prevailing market prices to raise cash for purchasing crypto

○ No fixed price or timing; shares can be issued anytime

○ Provides flexible cash flow support, enabling quick position increases or capital replenishment

Advantages

○ High flexibility, low fundraising threshold

○ Not dependent on specific institutions, responds dynamically to market changes

○ Supports continuous construction of a crypto-denominated balance sheet

IV. Convertible Bonds

Operating logic

○ Companies issue bonds with conversion rights into equity

○ Investors earn fixed bond interest and can convert to equity for gains if stock price rises

○ Companies raise capital at lower cost to buy crypto while delaying equity dilution

○ When stock price reaches conversion level, bonds convert to shares, releasing selling pressure

Advantages

○ Low financing cost, reduces immediate dilution

○ Attracts institutional investors due to debt security plus equity upside

○ Enables companies to rapidly expand crypto holdings

2.1 Drivers behind the surge in coin stock companies

The rapid increase in coin stock companies is primarily driven by the following factors:

• Stabilizing regulation and improved compliance frameworks: Crypto assets are gaining policy recognition and legal clarity, encouraging institutions to enter the market via compliant channels, making the coin stock model a mainstream choice.

• Tightening market funding channels: Traditional token issuance and VC fundraising are cooling, prompting projects to seek more stable, compliant ways to access capital; backdoor listings and direct reserve accumulation become alternatives.

• Changing investor demand: Institutions and high-net-worth individuals prefer holding crypto assets through listed companies to avoid regulatory and volatility risks of direct ownership.

• Demonstration effect of successful cases: Success stories of pioneers like MicroStrategy, Circle, and Coinbase inspire more enterprises to adopt the coin stock model, accelerating industry growth.

In summary, coin stock companies, as bridges between traditional capital markets and the crypto ecosystem, are becoming a key industry trend thanks to advantages in compliance, efficient fundraising, and diversified asset allocation.

3. Coin Stock Case Studies

3.1 The most successful case—MSTR

I. Background and strategic decision

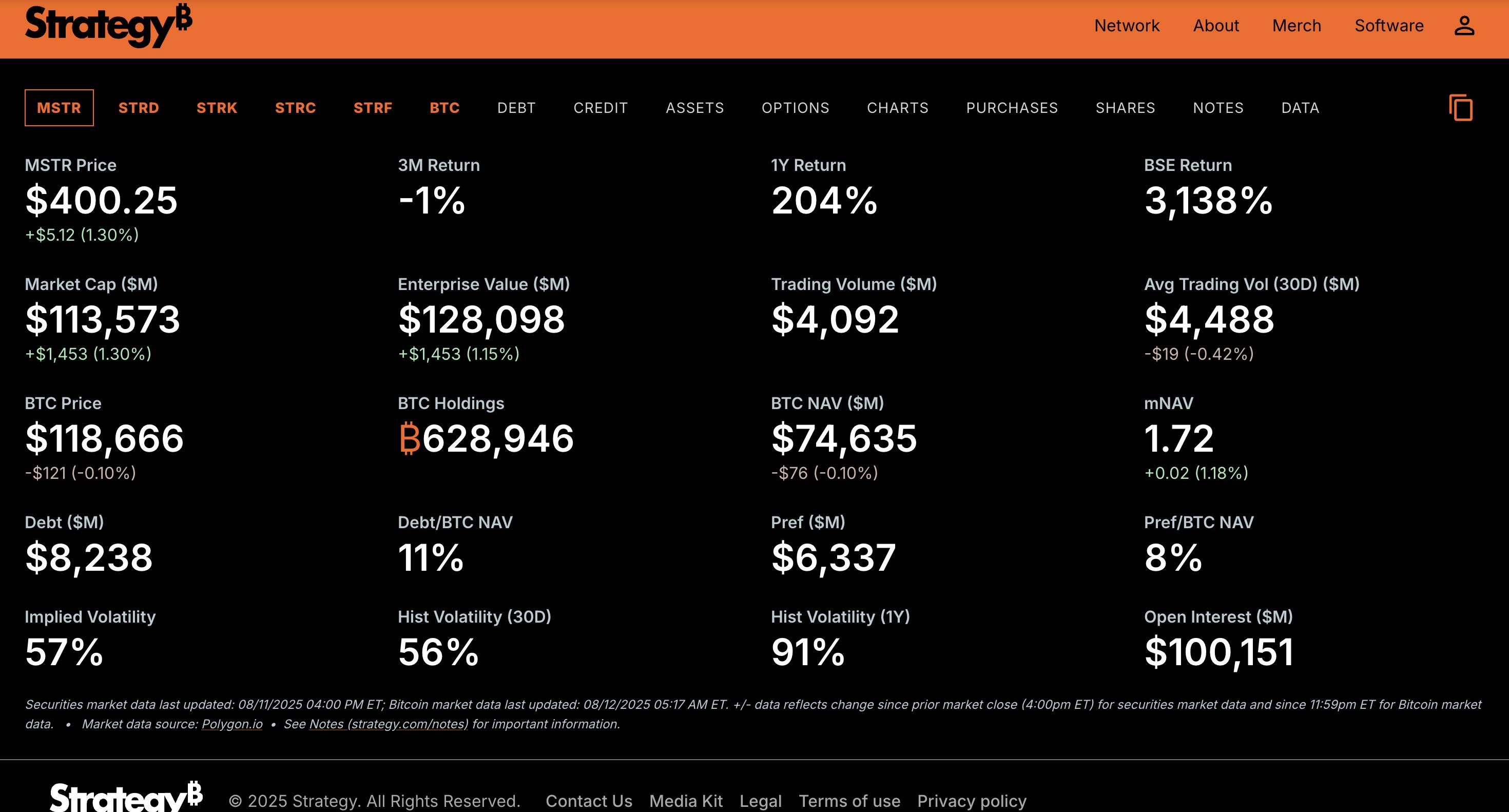

In 2020, the pandemic triggered a global liquidity crisis, and monetary easing policies heightened inflation risks. Michael Saylor believed Bitcoin was the best fiat-alternative store of value, so he led MicroStrategy (MSTR) to redirect corporate funds and financing capacity toward large-scale Bitcoin purchases. Unlike traditional ETFs/ETPs that merely track price, MSTR holds Bitcoin directly—bearing price volatility while capturing upside gains.

II. Funding sources and Bitcoin acquisition journey

MSTR’s four main financing methods for Bitcoin purchases:

1. Internal funds

The initial investments were made using idle cash on hand.

○ In August 2020, MicroStrategy invested $250 million to buy 21,400 BTC

○ In September, it invested $175 million to buy 16,796 BTC

○ In December, it invested $50 million to buy 2,574 BTC

○ Occasionally used internal funds to buy BTC between 2022 and 2024

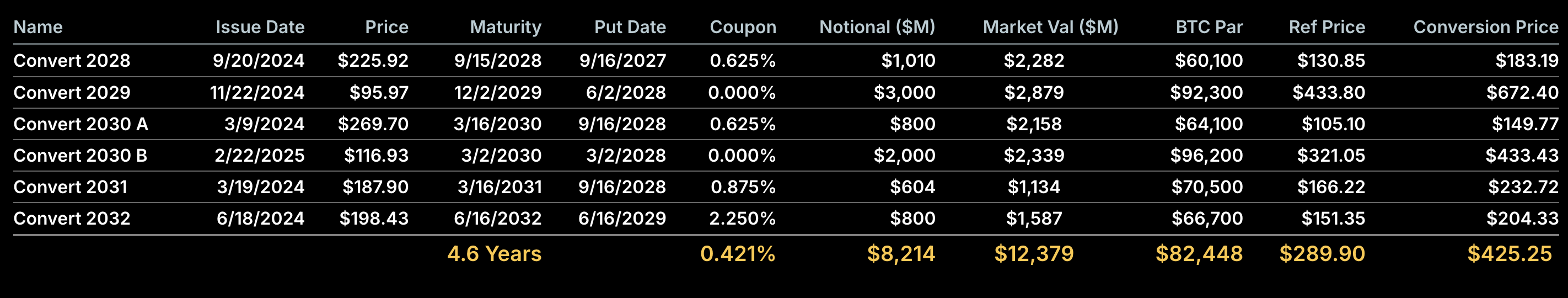

2. Convertible preferred bonds (low or zero interest, betting on MSTR stock price rise)

Convertible preferred bonds are financial instruments allowing investors to convert bonds into company stock under certain conditions.

These bonds typically carry low or zero interest rates, with conversion prices set above current stock prices. Investors accept them because they offer downside protection (principal and interest repayment at maturity) and upside potential if the stock price rises.

MicroStrategy’s convertible bonds mostly had rates between 0% and 0.75%, showing investor confidence in MSTR’s stock appreciation, hoping to profit from bond-to-stock conversion.

3. Secured senior bonds (collateralized, fixed income, already repaid early)

Besides convertible preferred bonds, MicroStrategy once issued $489 million in secured senior bonds maturing in 2028 with a 6.125% interest rate.

Secured senior bonds are collateralized, carrying lower risk than convertible preferred bonds, but offer only fixed interest returns. MicroStrategy has already chosen to repay this batch of secured senior bonds ahead of schedule.

4. At-the-market stock issuance (ATM) (flexible, no debt burden, but dilutes equity)

MicroStrategy signed public market sale agreements with agents including Jefferies, Cowen and Company LLC, and BTIG LLC. Under these agreements, it can irregularly issue and sell Class A common stock through these agents.

ATM issuance is highly flexible, allowing MicroStrategy to time new share sales based on secondary market conditions. While stock issuance dilutes existing shareholders, changes in correlation with Bitcoin price and rising BTC per-share metrics create complex market reactions, resulting in high MSTR stock volatility.

As of August 2025, MSTR has cumulatively purchased 628,946 BTC through the above four methods, worth approximately $74.635 billion at current market prices.

III. Stock performance and downside resilience (core advantage)

1. Amplified upside

○ Between 2024 and 2025, as BTC rose ~166% ($45,000–$120,000), MSTR stock surged over 471% ($70–$400)

○ Reason: The market values MSTR not just on BTC price but also pays a premium for its financing ability and expected future purchases

2. Strong downside resistance

○ During BTC’s 28% correction (Jan 22, 2025: $106,000 → Apr 9, 2025: $76,000), MSTR stock fell only 15% ($353 → $300), mainly because:

▪ Some shareholders hold for equity exposure and don’t sell immediately due to short-term BTC moves.

▪ Market expects MSTR to buy more during dips, creating a “buy-the-dip” support floor.

3. Historical advantage

○ As the first major company to use listed corporate funds to buy BTC at scale, MSTR has built a first-mover brand in media visibility and investor awareness. ETFs/ETPs may have lower fees, but lack this dual engine of “operational expectation + asset appreciation.”

3.2 Core buyers driving the current Ethereum rally—BMNR, SBET

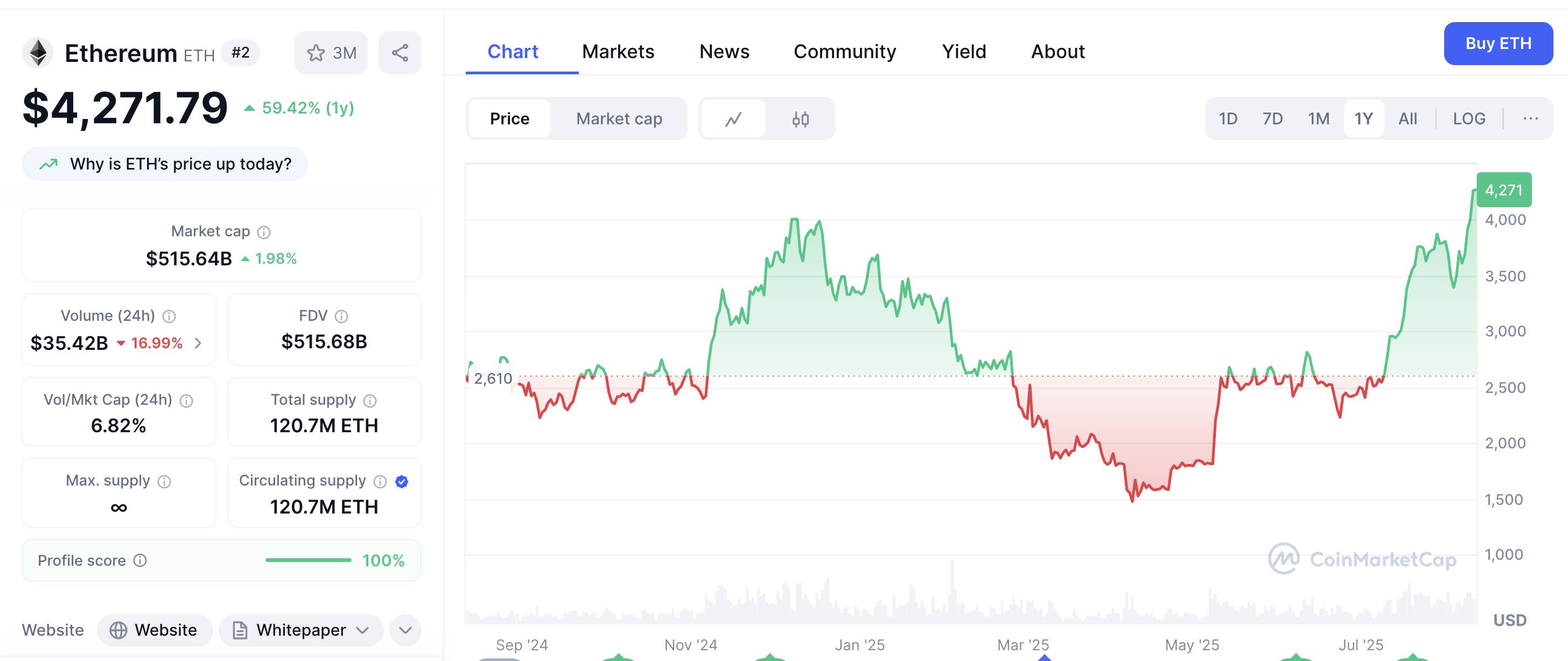

In this cycle, the strongest-performing top-tier asset is undoubtedly Ethereum. As of August 11, ETH price surged from a low of $1,472 in April to $4,271—an almost 190% gain. Unlike past cycles driven by retail sentiment, this rally is led by concentrated institutional accumulation from Wall Street and similar players.

First, since May, U.S.-listed spot Ethereum ETFs have seen sustained net inflows, with growing scale.

Second, a group of public companies have started adding Ethereum to strategic treasury reserves, using equity financing to buy ETH and leveraging crypto appreciation to boost market cap—creating a virtuous cycle of “stock price → financing power → holdings.” These “coin stocks” not only directly capture on-chain value but also benefit from broader investor reach and compliance advantages in public markets, becoming a core narrative in the latest wave of crypto capital stories.

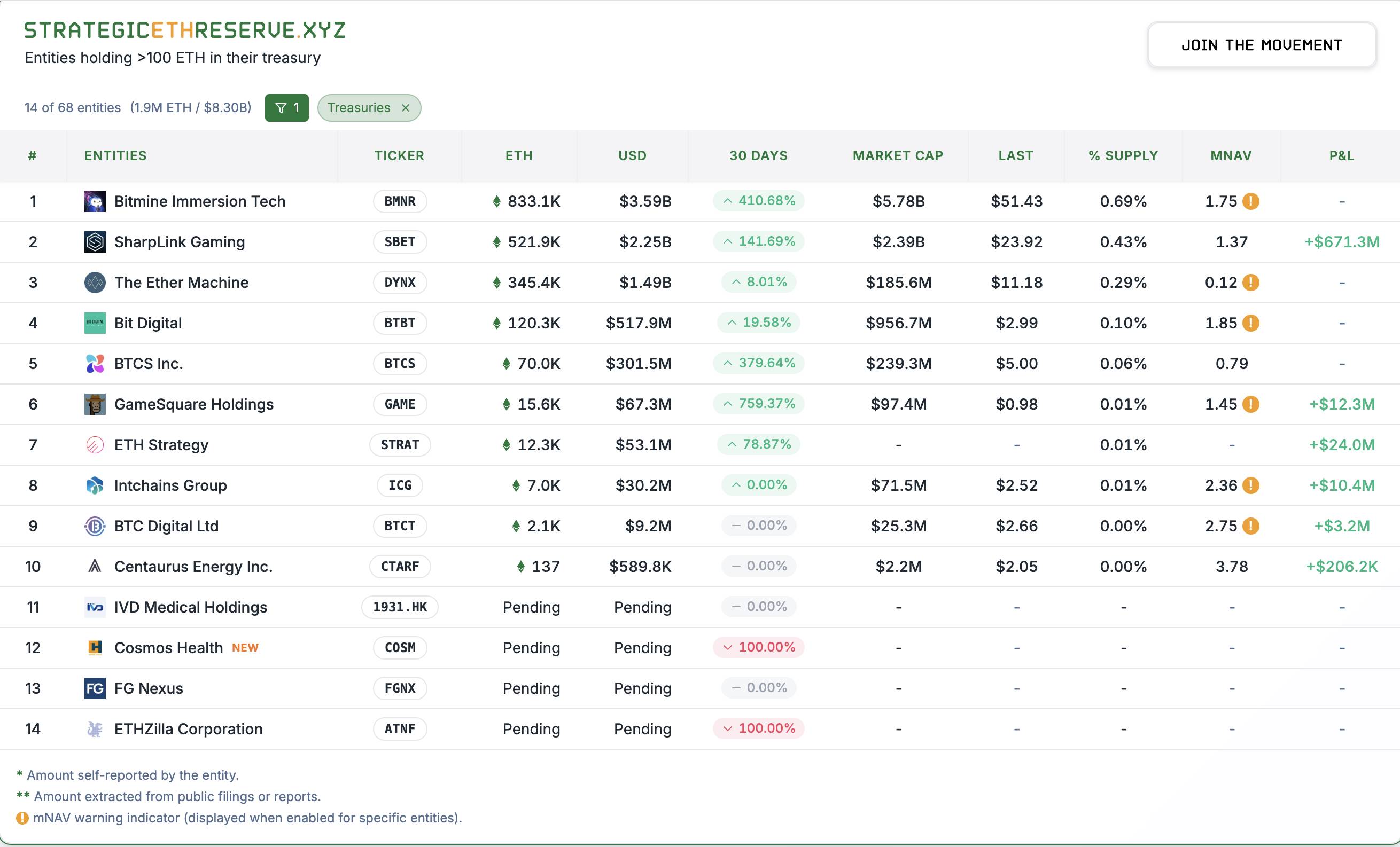

According to data from Strategic ETH Reserve, over 10 publicly listed companies have disclosed Ethereum treasury strategies, collectively purchasing over 1.928 million ETH. At current ETH prices, total holdings exceed $8.2 billion, representing 1.6% of Ethereum’s circulating supply. Two particularly noteworthy ones are Bitmine (BMNR) and SharpLink (SBET).

BMNR:

1. Former name and rebranding

Originally named Sandy Springs Holdings, Inc., the company changed its name and ticker to BMNR in March 2022 to reflect its focus on immersion-cooling-based mining hosting and mining operations.

2. Main businesses

– Hosting services: Providing proprietary immersion-cooling-based data center hosting, power supply, racks, thermal management, and security services for third-party miners;

– Proprietary mining: Using hosted mining rigs for self-operated Bitcoin mining;

– Equipment sales and software: Selling mining equipment and providing infrastructure management and custom firmware software.

3. Key figure: TOM Lee

Known as the “Wall Street oracle,” he has earned widespread attention for his accurate market forecasts and deep insights into tech stocks and assets like Bitcoin. As founder of research firm Fundstrat, he is a prominent traditional market analyst and a staunch supporter of digital assets like Bitcoin and Ethereum.

Lee was appointed Chairman of mining firm Bitmine and participated in the company’s $250 million Ethereum treasury strategy, drawing significant market attention. In recent interviews, Tom Lee boldly predicted ETH could reach $10,000 in this market cycle.

4. Funding history and methods

Click image to view full spreadsheet

PIPE private placement

○ June 30, 2025: BMNR successfully completed a PIPE private placement, issuing 55.6M shares (~$4.50/share), raising ~$250 million, officially disclosed for launching its ETH treasury strategy

Launch of ATM ("At The Market") offering program

○ Early July 2025: Company announced launch of an ATM stock issuance program, initially targeting up to $2 billion in fundraising, issuing shares gradually at market prices via Cantor Fitzgerald and ThinkEquity as sales agents.

ATM limit expanded to $4.5 billion

○ July 24, 2025: BMNR filed supplementary documents with the SEC, increasing the ATM issuance cap from $2 billion to $4.5 billion.

Institutional participation: ARK Invest

○ July 22, 2025: BMNR announced ARK Invest joined its existing ATM program, acquiring company shares via block trades totaling $182 million. The announcement stated 100% of ARK’s net proceeds would continue to be used to buy ETH. PR NewswireStock Titan

ETH reserve progress

○ August 4, 2025: Company disclosed it held over 833,137 ETH, worth ~$2.9 billion, making it one of the largest publicly traded corporate holders.

5. Investors

6. Current ETH holdings and stock performance

Based on latest official disclosures, BMNR currently holds 1.15 million ETH, valued at $5.29 billion at current prices, with a market cap of $6.444 billion.

BMNR stock hit a relative low of $30 on August 1 but doubled to $62 within two weeks.

SBET:

1. Company background and reason for transformation

• SharpLink was formerly MER Telemanagement Solutions, founded in 1995, focused on traditional telecom. It pivoted to sports betting in 2019 but suffered major revenue declines in 2024 and faced delisting risks.

• In May 2025, it announced a $425 million PIPE financing to transform, using Ethereum (ETH) as its primary treasury reserve asset.

2. Timeline and actions of ETH treasury strategy

• On May 20, SharpLink conducted a share issuance, raising $4.5 million at $2.94/share. Officially, funds were to restore compliance with Nasdaq’s minimum shareholder equity requirements. Consensys was the sole investor, signaling its long-term positioning in ETH reserve companies.

• On May 27, SharpLink Gaming announced its Ethereum treasury strategy, aiming to raise $425 million to accumulate ETH.

• Subsequently, SBET conducted multiple ATM offerings, raising about $1 billion to buy ETH.

• On July 24, SharpLink held a shareholder meeting to approve additional share issuance to raise $5 billion for ETH purchases.

3. Key figure: Joseph Lubin

Co-founder of Ethereum, leader in the blockchain industry, and founder & CEO of blockchain development firm ConsenSys. Lubin graduated from Princeton with degrees in Electrical Engineering and Computer Science, previously worked at Goldman Sachs, and possesses deep technical and financial expertise. He has long championed decentralized applications and blockchain infrastructure development, making him one of the foundational figures in the Ethereum ecosystem.

Currently serving as CEO of SharpLink Gaming, he leads SBET in raising funds via share issuance to buy and stake ETH, and proposes a vision to tokenize company shares on-chain, aiming to enhance integration between capital markets and the blockchain world.

4. Funding history and methods

SharpLink’s initial $425 million raise was done via PIPE (private placement), followed by multiple ATM offerings to sell shares in the market. According to Lubin’s latest interview, the company may consider issuing convertible bonds in the future.

5. Investors

In the PIPE round, Consensys Software Inc. served as the lead investor. Participating institutions also included several well-known crypto VCs and infrastructure firms:

• ParaFi Capital

• Electric Capital

• Pantera Capital

• Arrington Capital

• Galaxy Digital

• Ondo

• White Star Capital

• GSR

• Hivemind Capital

• Hypersphere

• Primitive Ventures

• Republic Digital

6. Current ETH holdings and stock performance

Based on latest official disclosures, SBET currently holds 600,000 ETH, worth $2.76 billion at current prices, with a market cap of $3.13 billion.

After a sell-off triggered by "ATM dilution," SBET stock rebounded from a low of $17 on August 1 to $24, up over 40%.

3.3 Small-cap company reserves

ENA—StablecoinX

1. Listed background and transformation

○ StablecoinX originated from Nasdaq-listed SPAC TLGY Acquisition Corp. (TLGYF), which raised $230 million via IPO, originally planning to merge with Verde Bioresins, but the deal failed.

○ In June 2024, the Carnegie Park Capital team took over, shifting focus to the Ethena ecosystem.

2. Core team

○ Jin-Goon Kim (Chairman of TLGYF), expert in finance and listed company transformations

○ Young Cho (CEO of StablecoinX), experienced in crypto and SPAC mergers

○ Edward Chen (Founder of CPC), seasoned SPAC investment strategist

3. PIPE funding structure

○ Total size ~$360 million, primarily for strategic accumulation of ENA tokens.

○ $260 million in cash used to buy 1.23 billion ENA tokens at ~$0.21/ENA (locked).

○ ~$100 million in discounted ENA tokens (including $60 million from Ethena Foundation).

○ Lead investors: Dragonfly, Ribbit Capital, Blockchain.com, Pantera, Haun Ventures, Polychain, Galaxy Digital, etc.

4. Lock-up and unlock schedule

○ 48-month lock-up period for ENA tokens.

○ 25% unlocked after 12 months post-closing, remaining 75% unlocked monthly over 36 months.

5. Equity and governance structure

○ PIPE investors receive Class A non-voting shares, priced at $10/share.

○ Ethena Foundation holds voting Class B shares, holding majority control post-closing.

6. de-SPAC transaction structure

○ TLGYF merges with its subsidiary SPAC Merger Sub, which then merges with operating entity StablecoinX Assets Inc., forming the listed entity StablecoinX Inc.

7. Valuation and market metrics

○ PIPE issue price $10, with floating share count adjusted based on ENA token price.

○ Expected issuance of 101 million shares, total post-closing shares ~104 million.

○ Fully diluted market cap ~$1.43 billion, roughly matching value of 1.7 billion ENA tokens held (mNAV ~1x).

○ Valuation discounted compared to MicroStrategy (1.5x), BitMine Immersion (1.9x).

8. ENA price performance

Since July 22, subsidiaries of the Ethena Foundation have initiated a buyback program via third-party market makers, repurchasing 83 million ENA tokens in the open market.

Since then, ENA token price has risen from a late-June low of $0.25 to $0.78, a 212% gain.

4. ATA Creativity Global (Nasdaq: AACG)

1. Transaction structure and funding scale

○ Signing date: August 2, 2025

○ Investor: Baby BTC Strategic Capital (Babylon Foundation as primary LP)

○ Investment method:

▪ New share subscription: $30 million

▪ Warrants: $70 million

▪ Total investment: $100 million

○ Outcome: Baby Capital obtains control of ATA and appoints 3 directors to the board

2. Strategic goals and differentiation

○ Different from MSTR (hoarding BTC) and SBET (focusing on ETH ecosystem)

○ Core competencies:

i. Activating the BTC ecosystem

• Deep collaboration with Babylon project

• Introducing Bitcoin staking (BTC staking) to DeFi

ii. Large-scale acquisition of Baby tokens

• Baby token market cap ~$100 million

• ATA plans to reinvest equivalent capital, amounting to a 100% re-investment of market cap, expected to significantly boost token value

3. Babylon project background

○ Bitcoin Layer 2 network focused on trustless BTC staking

○ Founders: David Tse (Stanford professor), Fisher Yu (former senior engineer at Dolby Labs)

○ Funding: $96 million total (Paradigm, Polychain, OKX Ventures, Binance Labs, etc.)

○ Mainnet: Launched August 2024

○ Total value staked: >$5 billion as of July 2025

○ Baby token listed on Binance, OKX, Bybit, KuCoin, and other major exchanges

4. Future plans for the listed company

○ Treasury strategy:

▪ Majority of funds into Baby tokens

▪ Minority into BTC

○ Funding sources:

▪ PIPE (private placement)

▪ ATM (at-the-market offering)

▪ Convertible bonds

○ Acquisition strategy: Continuous market purchases of Baby tokens & BTC

○ Expected outcomes:

▪ Drive asset value growth

▪ Boost market capitalization

▪ Build a positive feedback loop between asset appreciation and market cap growth

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News