Strong ETF demand drives crypto surge over the weekend, led by Ethereum

TechFlow Selected TechFlow Selected

Strong ETF demand drives crypto surge over the weekend, led by Ethereum

This year, spot Ethereum ETFs listed in the U.S. have attracted over $6.7 billion in capital inflows.

By Long Yue, Wall Street Insights

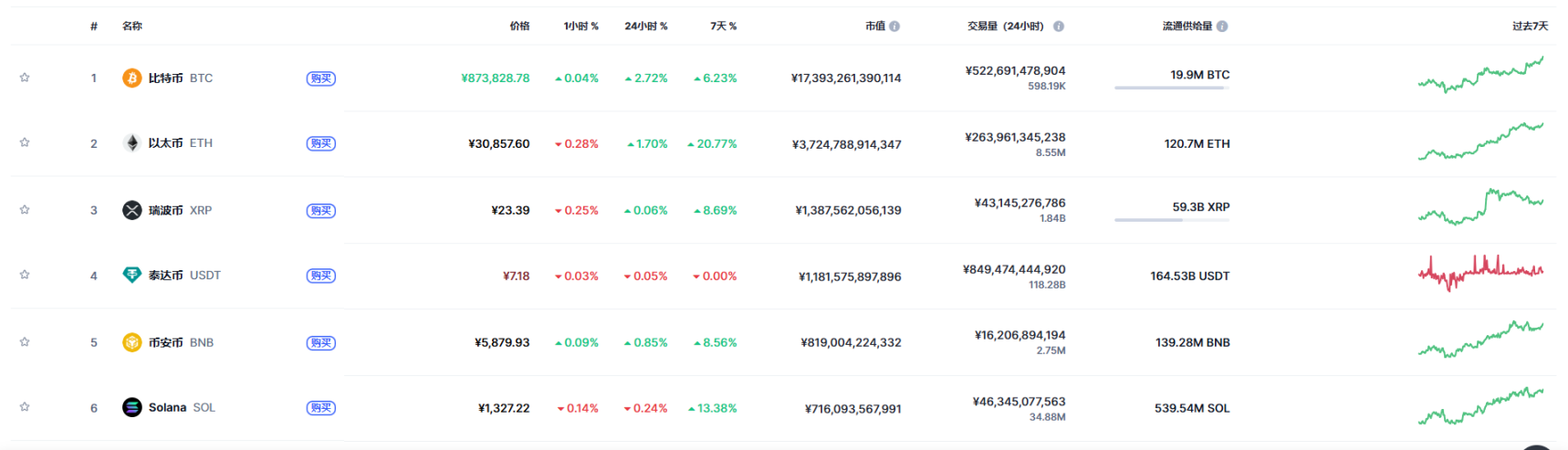

Ether, the second-largest cryptocurrency by market value, outperformed other major digital assets over the past weekend.

During Monday's Asian trading session, its price surged 2.9%, breaking above $4,300 to reach its highest level since December 2021. Over the past seven days, Ether has gained more than 20%. Meanwhile, Bitcoin also rose above $121,000 today, nearing its all-time high.

Driving this rally is growing interest from large investors. Data shows that nine spot Ether ETFs listed in the United States have attracted over $6.7 billion in net inflows year-to-date. Additionally, so-called "digital asset treasury firms"—public companies shifting focus toward accumulating cryptocurrencies—have further fueled Ether's rise. According to data compiled by strategicethreserve.xyz, these firms have accumulated approximately $13 billion worth of Ether to date.

Sean McNulty, Head of Derivatives Trading for Asia-Pacific at digital asset prime broker FalconX Ltd., said the shift of capital from Bitcoin to Ether represents a "massive positive sentiment shift driven by strong spot ETF inflows, growing corporate treasury adoption, and broader tailwinds from stablecoins."

Options markets also reflect bullish sentiment, with Ether's overall put/call ratio at 0.39. According to Deribit data, the largest concentration of call options expiring on December 26 is at the $6,000 strike price.

Interestingly, Eric Trump, son of U.S. President Donald Trump, praised Ether's surge on X. As Bloomberg reported last Friday, large investors are discussing plans around World Liberty Financial, a Trump-family-backed venture aiming to create a publicly traded company holding its WLFI token.

ETF Flows Reverse

Shifting fund flows are the most direct indicator of changing market sentiment. As Wall Street Insights noted, U.S. spot Ether ETFs have recorded consistent net inflows since May, recently outpacing Bitcoin in capital attraction. Data shows that during six consecutive trading days in late July, net inflows into Ether ETFs approached $2.4 billion, far exceeding Bitcoin ETFs' $827 million over the same period.

This trend is mirrored in price performance and derivatives markets. Over recent weeks, Ether has consistently outperformed Bitcoin, with their price ratio strongly rebounding from multi-year lows since 2019. Meanwhile, the annualized premium of Ether futures on the Chicago Mercantile Exchange (CME) over spot has exceeded 10%, surpassing Bitcoin's level, prompting some traders to shift positions from Bitcoin to Ether.

From Bitcoin to Ether: A Shift in Market Leadership?

Following the trend of multiple companies adopting Bitcoin as a treasury reserve asset, a similar pattern is now unfolding with Ether. Goldman Sachs' crypto team pointed out that, just as an increasing number of firms have added Bitcoin to their treasuries, several U.S. public companies have recently begun building Ether reserves. It is estimated these firms purchased over $1.5 billion worth of ETH in the past month alone.

Meanwhile, Ether has significantly outperformed Bitcoin over recent weeks, with their price ratio rebounding sharply from earlier 2019 lows. The annualized premium of CME Ether futures over spot has surpassed 10%, exceeding Bitcoin's level and encouraging a rotation of positions from Bitcoin into Ether.

Swiss blockchain research firm Swissblock expects this trend to continue, stating, "As the market enters a new cycle, ETH is replacing BTC as the dominant force."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News