The War of Blockchain Giants: Who Will Control the Flow of Value and Become the New Oligarchs of the Web3 Industry?

TechFlow Selected TechFlow Selected

The War of Blockchain Giants: Who Will Control the Flow of Value and Become the New Oligarchs of the Web3 Industry?

This article analyzes the differences between Jupiter and Hyperliquid in terms of merger and acquisition strategies and market expansion approaches.

Author: Saurabh Deshpande, Decentralised.co

Compiled by: AididiaoJP, Foresight News

In November 2023, Blackstone acquired a pet care app called Rover. Rover started as a way to find dog walkers or cat sitters. The pet care industry typically consists of tens of thousands of small, mostly local, offline service providers. Rover aggregated this supply into a searchable marketplace, added reviews and payments, making it the default platform for pet care services. By the time Blackstone took it private in 2024, Rover had become the hub for demand in this space. Pet owners think of Rover first, and service providers have no choice but to list on the platform.

ZipRecruiter did something similar in the job search space. It collects job postings from employers, job boards, and applicant tracking systems and distributes them across multiple channels. ZipRecruiter posts jobs to social networks like Facebook. For employers, ZipRecruiter becomes a one-stop distribution channel; for job seekers, it's a unified gateway to the market. ZipRecruiter doesn't own the companies or the jobs, but it owns the relationship with both sides. Once that relationship is established, it can charge for visibility and job matching. This is the introductory lesson in aggregation economics.

Aswath Damodaran calls this model "owning the shelf": taking messy, fragmented supply, controlling how it's displayed, and charging for access. Ben Thompson calls it "aggregation theory": building a direct relationship with end users, having suppliers compete to serve them, and extracting value from each transaction. The core characteristics are consistent across different domains: Google with web pages, Airbnb with listings, Amazon with goods.

The Amazon Flywheel is the classic illustration of this concept. During the downturn after the dot-com bubble burst, Jeff Bezos and his team borrowed Jim Collins's "flywheel" concept and drew a cycle that every MBA can now recite from memory: more selection leads to a better customer experience, attracting more traffic, which in turn attracts more sellers, lowering the unit cost structure, enabling lower prices, and ultimately leading to more selection. Turning the flywheel once has little effect, but after a thousand turns, the machine starts to roar. Bezos's motto during this period was: "Your margin is my opportunity." The core lies in self-reinforcement: more users, more suppliers, lower costs, ultimately achieving higher profits.

Once this model works, it's perfect. Costs grow much slower than revenue, and the product improves as users increase. But it only holds under two conditions: the aggregated content has value, and the supply side cannot easily exit. Both are essential; otherwise, the moat becomes shallow. Take eBay as an example. In the early 2000s, it aggregated millions of unique niche sellers and buyers. This aggregation was once highly valuable, but when sellers realized they could build their own stores on Shopify or switch to Amazon, they left. The flywheel doesn't stop overnight, but if suppliers are no longer controlled, it begins to wobble and eventually becomes ordinary.

Damodaran explains the power of platforms and aggregators in a concrete way. He mentions "controlling the shelf," not literally a supermarket shelf, but the space customers first encounter when demand arises. Controlling this space means deciding what to display, how to display it, and the cost of entry. You don't need to own the goods themselves, just the relationship with the buyers; others must go through you to reach buyers. When analyzing Instacart, Uber, Airbnb, or Zomato, Damodaran repeatedly emphasizes: the aggregator's task is to consolidate messy, fragmented markets into a single pane of glass and make that pane the only window worth looking at. Once you achieve that, you can charge for the "right to view."

Ben Thompson believes an aggregator is a business that establishes a direct relationship with end users at internet scale, provides a standardized, reliable experience, and has suppliers compete to serve them. At internet scale, you're not the biggest store in town; you're the store that covers all towns simultaneously.

The marginal cost of serving the next customer is almost zero, but the marginal value of owning them is enormous. Because each customer reinforces your brand, data, and network effects. Since the aggregator controls demand, suppliers become replaceable. This doesn't mean quality is undifferentiated, but that suppliers cannot take customer relationships with them when they leave. Hotels on Expedia, drivers on Uber, sellers on Amazon—they all need the aggregator more than the aggregator needs them.

Damodaran's research reminds us that the flywheel doesn't spin equally well in all markets. For example, Uber aggregates local driver liquidity, but drivers can open three apps simultaneously and choose the first order they receive. This creates leaks in the moat. Airbnb hosts offer unique listings with limited alternative channels, so their take rates are more durable.

In low-margin areas, the shelf might have value, but there's limited room for take rates, and suppliers can easily push back. This is why Instacart had to move into advertising and white-label logistics to grow.

The economic structure of supply is as important as the number of users focused on the platform. If the platform contains readily available goods, you're just a convenience store with a better view; but if the content is scarce, differentiated, and hard to replace, people will keep coming, even if you charge higher fees. Think of high-end listings on Airbnb.

Why Aggregators Fail

When conditions are missing, the aggregator is no longer a flywheel, just a carousel with high operating costs.

Quibi is a classic case of failing to control the shelf. The platform had expensive Hollywood content and a beautiful app but lacked a direct channel to users. Potential users were already gathered on YouTube, Instagram, and TikTok. These platforms controlled attention, while Quibi locked content in a standalone app, away from users, forcing it to attract users through ads and promotions.

Great aggregators start with zero marginal cost user reach methods, such as built-in distribution, pre-installation, or daily habits. Quibi had none and eventually ran out of time and money before building these.

Facebook's Instant Articles faced a similar problem. The idea was to aggregate content from publishers, load it faster within Facebook, and monetize the traffic. But publishers could easily distribute content to their open web, apps, or other social platforms. Instant Articles never became the default reading platform, just an option in the news feed.

Both examples violate the same rule: the business failed to own user relationships in a way that creates default behavior, and suppliers are not significantly harmed by leaving.

The checklist for a great aggregator is simple:

-

Directly connect and own user relationships;

-

Suppliers are either unique or replaceable enough that you won't be held hostage by a single supplier;

-

The marginal cost of adding supply is close to zero or low enough that the business model optimizes with scale.

If these conditions aren't met, you're just another easily replaceable middleman.

How Liquidity Becomes a Moat

In the crypto industry, projects can build moats in different ways. Some build trust through licenses and regulation (like USDC), some rely on technology (like Starkware's proof system or Solana's parallel execution), and others depend on community and network effects (like Farcaster's user graph). But the hardest to shake is liquidity.

"Correct execution" is crucial. But if incentives are strong enough, liquidity can shift rapidly. In 2020, Sushiswap drained over $1 billion from Uniswap in days through liquidity mining rewards. The lesson is simple: liquidity only solidifies when leaving is more painful than staying.

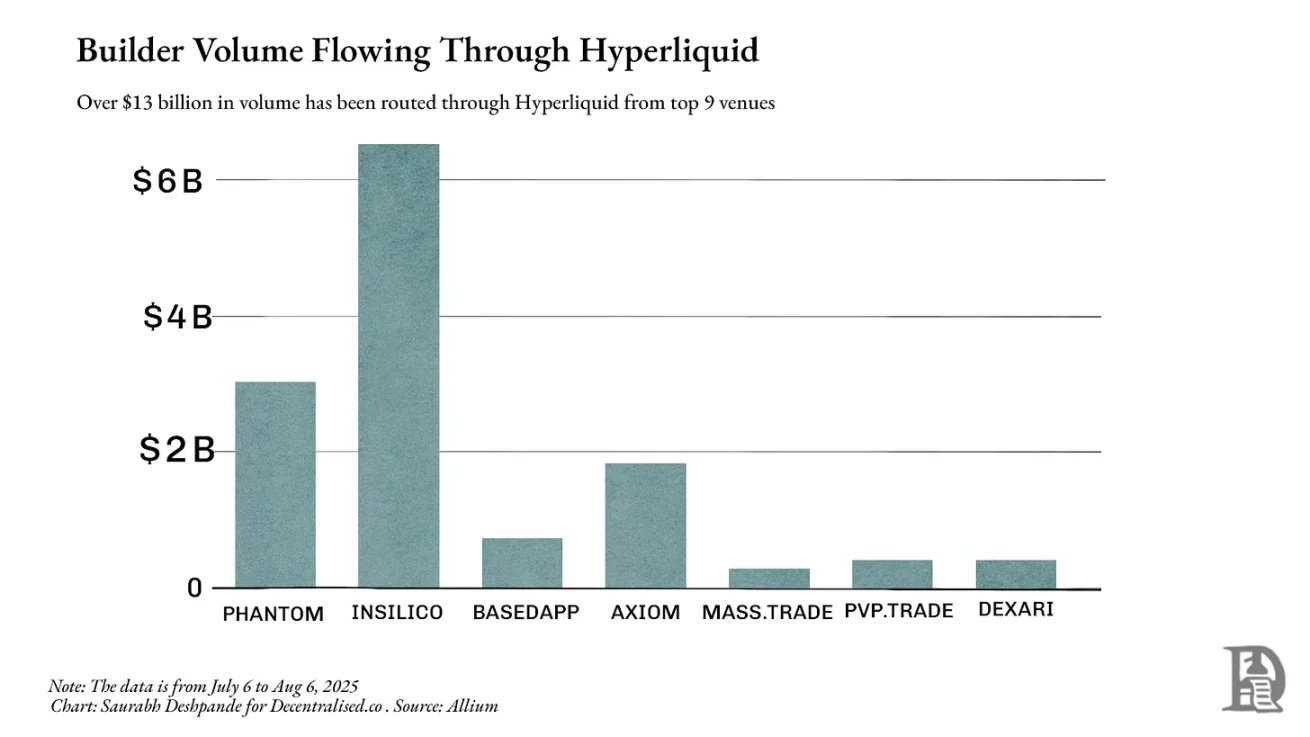

Hyperliquid understands this well. It not only built the deepest order book for a perpetual exchange but also allows other apps and wallets to directly access its liquidity. For example, Phantom can connect to Hyperliquid's order flow, providing users with narrow spreads without building its own market. In this model, the aggregator needs the supply side more. When traders and apps default to routing through you, you're no longer an ordinary aggregator; you're the core channel they cannot avoid.

Beyond its own platform, Hyperliquid processed over $13 billion in volume through other builders last month. Phantom routed $3 billion through it, earning over $1.5 million. This demonstrates Hyperliquid's current strong network effects.

Liquidity allows you to convert assets without impacting price. In finance and DeFi, deep liquidity makes trading cheaper, lending safer, and derivatives possible. Without liquidity, even the most perfect protocol becomes a ghost town. Once successfully established, liquidity tends to persist. Traders and apps flow to deep pools, further increasing liquidity, narrowing spreads, and attracting more trading.

This is why protocols like Aave endure. Aave has large lending pools for multiple assets, becoming the first choice for borrowers and lenders seeking scale and safety. As of August 6, Aave's cross-chain total value locked exceeds $24 billion. Over the past 12 months, borrowers paid $640 million in fees, with platform revenue around $110 million.

Similarly, Jupiter, a Solana-based aggregator, evolved from a routing tool to the default entry point for trading on that network. On Ethereum, Uniswap has concentrated most spot liquidity, so aggregators like 1inch can only offer marginal improvements. On Solana, liquidity is scattered across platforms like Orca, Raydium, and Serum. Jupiter consolidates it into a single routing layer, always providing the best price. Its trading volume once accounted for nearly half of Solana's total compute usage; any delay or disruption immediately affected the network's execution quality.

Viewing liquidity as the object being aggregated makes Jupiter's product decisions easier to understand. Acquisitions, mobile apps, and expansion into new trading and lending products all aim to capture more order flow, keep liquidity routed through Jupiter, and solidify its position.

Jupiter is worth watching because it's a clear case in DeFi of evolving from a niche tool to a liquidity platform. Starting with finding the best spot price, it gradually became the default route for Solana's liquidity, then expanded into products that attract entirely new liquidity. Observing how it moves through these stages and reinforces them provides a living case study of aggregation dynamics.

The Layers of Aggregation

Three questions form a quick checklist for identifying potential aggregators:

-

What is the key differentiator of existing businesses? Can it be digitized? In DeFi, the differentiator is liquidity. Deep pools offer narrower spreads and safer loans. Liquidity is already digitized, easy to read and compare.

-

If the differentiator is digitized, does competition shift to user experience? When liquidity can be accessed arbitrarily, competition revolves around execution quality: faster settlement, better routing, fewer failed transactions. Products like BasedApp and Lootbase emerged from this. The former packages DeFi primitives into a smooth mobile experience; the latter brings Hyperliquid's deep perpetual liquidity to mobile.

-

If you win on user experience, can you build a virtuous cycle? Traders come for better prices, attracting more liquidity, which in turn provides better prices. When liquidity is embedded in habits and integrations, it becomes sticky.

Become the default gateway to the market. If suppliers cannot afford your absence, you can charge for shelf space or, in DeFi, decide where order flow goes.

Note: The boundaries between different layers are often blurred. The classification is not precise but provides a mental model for the layers of aggregation.

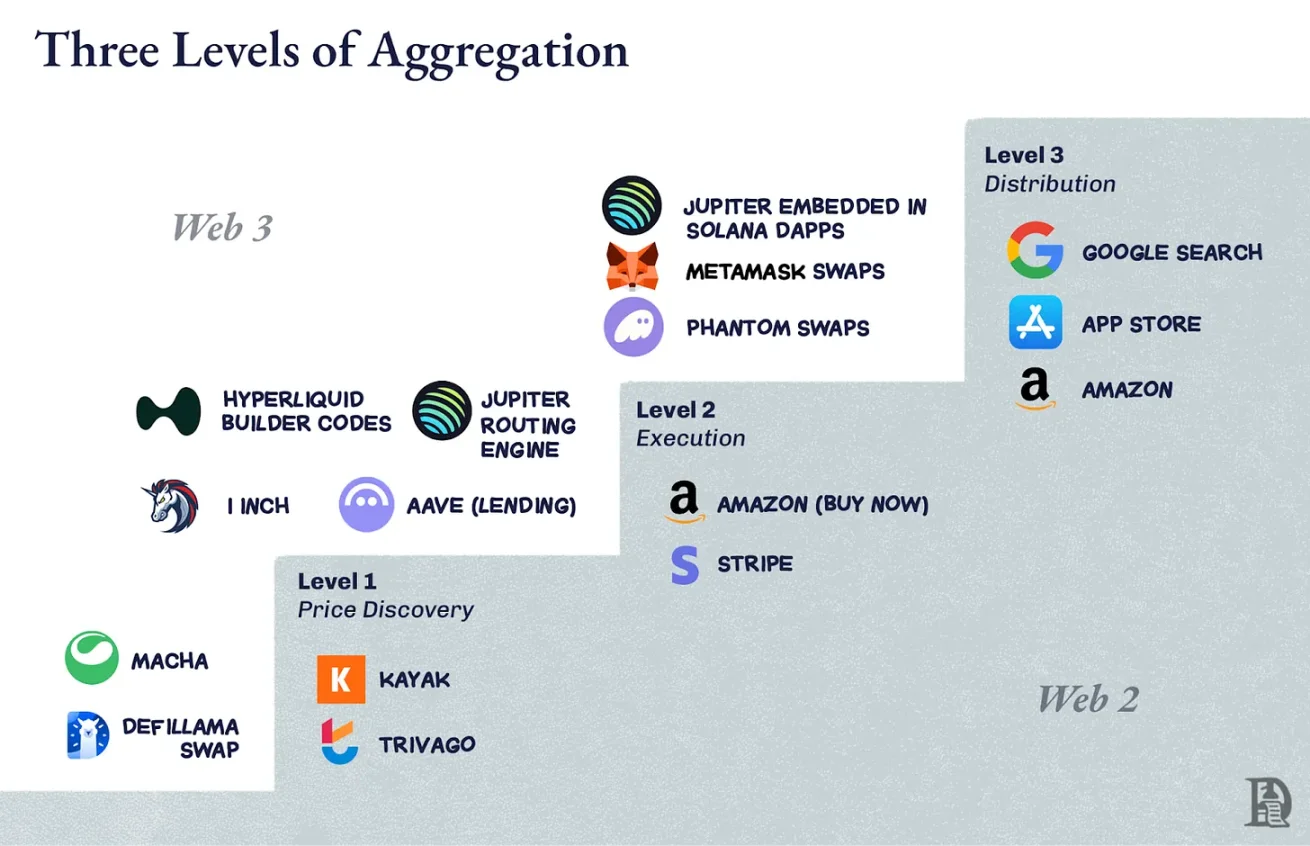

Layer 1: Price Discovery

This is the most basic work: telling people where the best deal is. Kayak for flights, Trivago for hotels. In crypto, early DEX aggregators like 1inch or Matcha belong here. They check available pools, show the best rates, and provide a jump-in point. Price discovery is useful but fragile; DeFiLlama's swap function is similar.

If the underlying market is already concentrated (like Ethereum spot trading on Uniswap), routing improvements are minimal, users can go directly to the venue, and your help is non-essential.

Layer 2: Execution

Here, you no longer direct users elsewhere; you act on their behalf. Amazon's "1-Click Buy" belongs here. In DeFi, Aave's lending function sits at this layer. When borrowing, liquidity already exists in its contracts. Execution adds stickiness because the outcome is directly tied to you: fast settlement, good experience with no failed transactions.

Layer 3: Distribution Control

You become the gateway. Google Search for the web, app stores for mobile apps. In crypto, the swap tab built into a wallet can become the starting and ending point for ordinary users.

On Solana, Jupiter has reached this layer. It started as a price discovery tool, entered the execution layer through smart order routing, and then embedded into frontends like Phantom and Drift. Much of Solana's trading is effectively Jupiter trading, even if users never type "jup.ag." This is distribution control; suppliers cannot bypass you to reach users.

Climbing the Layers in DeFi

The challenge in DeFi is that liquidity can shift rapidly. Incentives can drain pools overnight. Therefore, climbing from Layer 1 to Layer 3 is not just about becoming the top aggregator but also about creating enough reason for liquidity and order flow to keep routing through you.

On Ethereum, 1inch largely stays at Layer 2 because Uniswap has already done the aggregation work through concentrated liquidity. Routing is still valuable for edge cases, but improvements are limited, and many traders choose to skip it. Additionally, aggregators like CowSwap and KyberSwap also hold significant shares. Aave is at Layer 2 because it controls execution in its niche, but it's infrastructure, not a starting point.

Jupiter's advantage on Solana is its ability to climb all three layers sequentially. Liquidity is fragmented, making Layer 1 valuable; its routing engine is better than manual swaps, naturally transitioning to Layer 2; through direct integration with wallets and dApps, it reaches Layer 3, fully controlling the distribution of Solana's liquidity. At one point, nearly half of Solana's compute usage came from Jupiter trades because both the trader demand side and the liquidity pool supply side relied on Jupiter.

After reaching Layer 3, the question becomes, "What else can we run through this distribution?" Amazon started with books and ended with everything; Google started with search and ended up controlling maps, email, and cloud computing. For Jupiter, distribution is order flow. The obvious next step is adding products like perpetuals, lending, and portfolio tracking, leveraging the same liquidity relationships.

The bigger move is Jupnet. Solana hasn't yet matched the throughput and execution characteristics of venues like Hyperliquid, which are designed for financial-grade latency and determinism. These characteristics are crucial for scaling the full financial stack to real-world scale. The simpler option is launching products on chains that already have these characteristics, but Jupiter chose the harder path, building Jupnet as an application-controlled, low-latency execution layer running in parallel with Solana.

Jupnet aims to be shared infrastructure within the Solana ecosystem, supporting latency-sensitive transactions like perpetuals, request-for-quote systems, and batch auctions, ultimately settling natively on Solana. If successful, it will provide the speed and determinism expected from vertically integrated venues while keeping users and assets retained. This is an attempt to bridge the gap between general-purpose blockchain throughput and the microsecond latency demands of global finance, without splitting liquidity across chains.

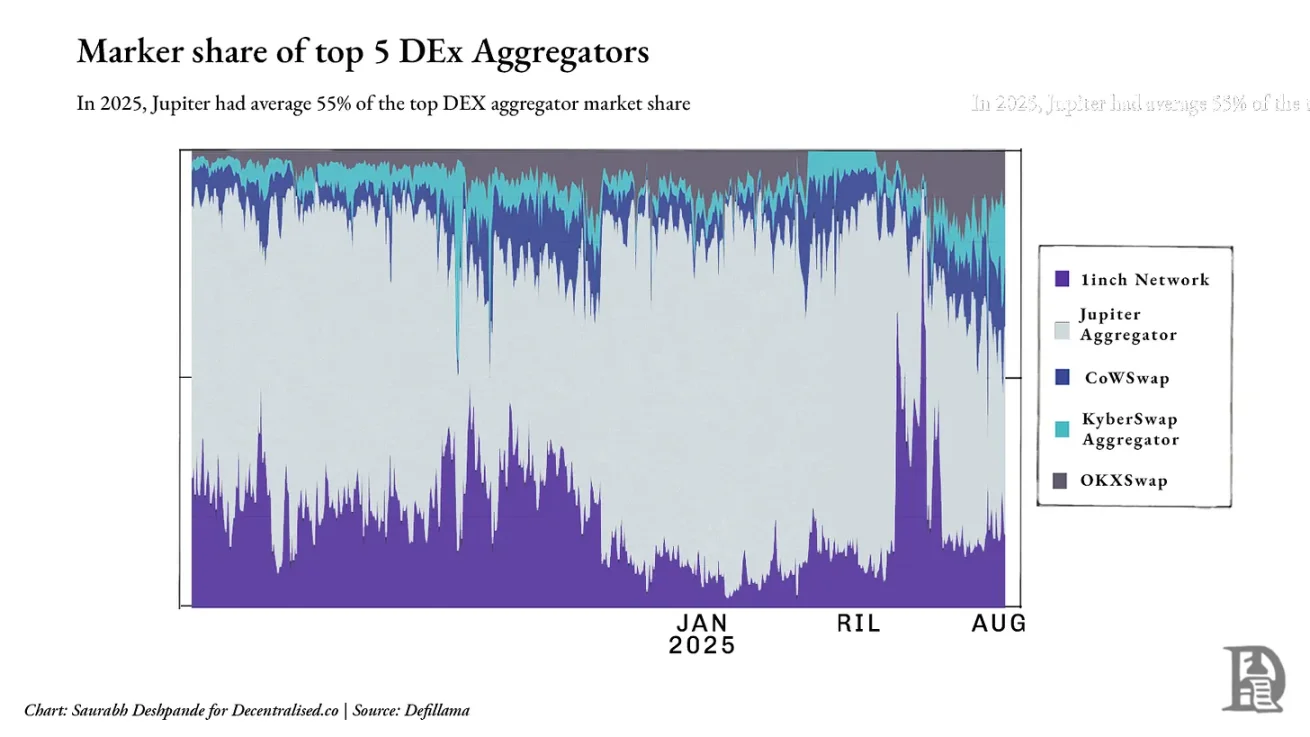

But note: Although Jupiter dominates within Solana, it faces fierce competition at the industry level. In the cross-chain space, 1inch, CoWSwap, and OKX Swap remain important. As of 2025, Jupiter averages about 55% share among the top five DEX aggregators, but this share fluctuates with on-chain activity and integrations. The chart below shows how fragmented the aggregation layer is outside Solana.

Clearly, Jupiter has become the aggregator within the Solana ecosystem. The flywheel is spinning: more traders bring more liquidity, more liquidity optimizes execution, better execution attracts more traders. At this point, you're not just a liquidity aggregator; you're the shelf, the habit, and the gateway to the market. So, when liquidity alone is no longer enough, how do you keep growing? Jupiter's answer is acquiring projects that already control new user flows.

M&A as a Growth Engine

Previously, I wrote about two major themes in scaling businesses: the nature of compounding innovation, and how businesses accelerate this process through M&A. The former is about building new products, features, or capabilities based on existing strengths; the latter is about identifying when "buying" is faster than "building" to establish an advantage.

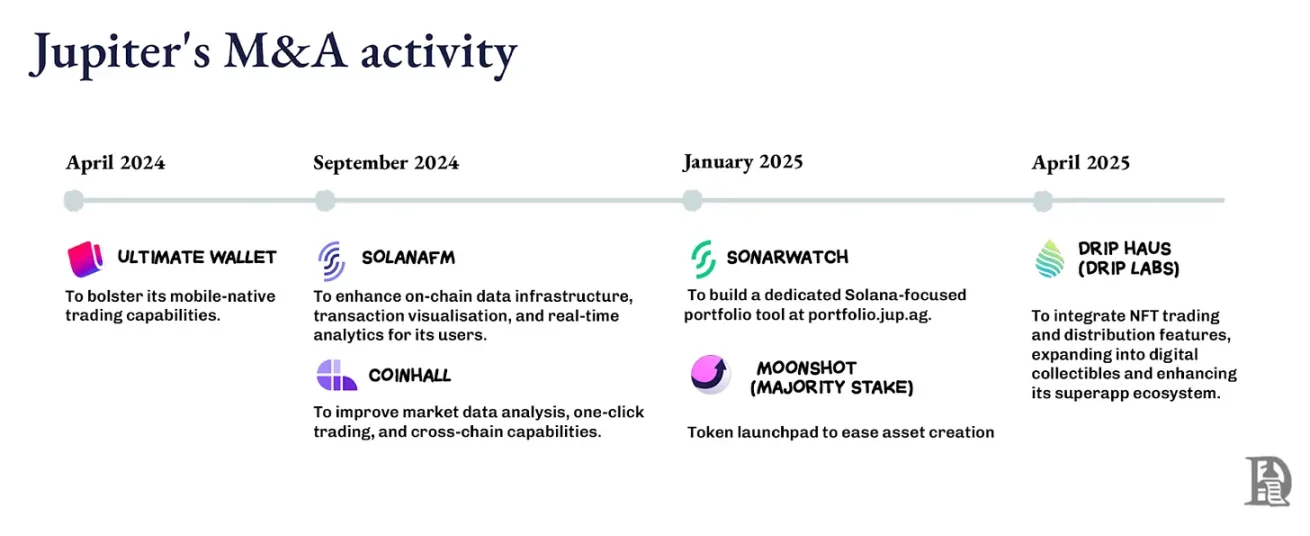

Jupiter's evolution combines both. Its M&A strategy is rooted in finding founder teams with real traction and integrating them into a distribution network that amplifies their impact. The company looks for expert teams in verticals to expand coverage without derailing the core roadmap.

This isn't just buying feature stacks; it's acquiring teams that already dominate a segment of Jupiter's target market. When these teams plug into Jupiter's distribution wallet interfaces, APIs, and routing, their products grow faster, and the generated traffic feeds back into Jupiter's core.

Moonshot brought a token launchpad, turning new token creation into direct swap and trading activity within Jupiter's ecosystem; DRiP added a community-driven NFT minting and distribution platform, attracting audiences far from the trading interface and converting them into on-chain behavior; the Portfolio acquisition provided active traders with position management tools. Jupiter could have built these features internally at lower cost, but its goal is to acquire founders, not just features.

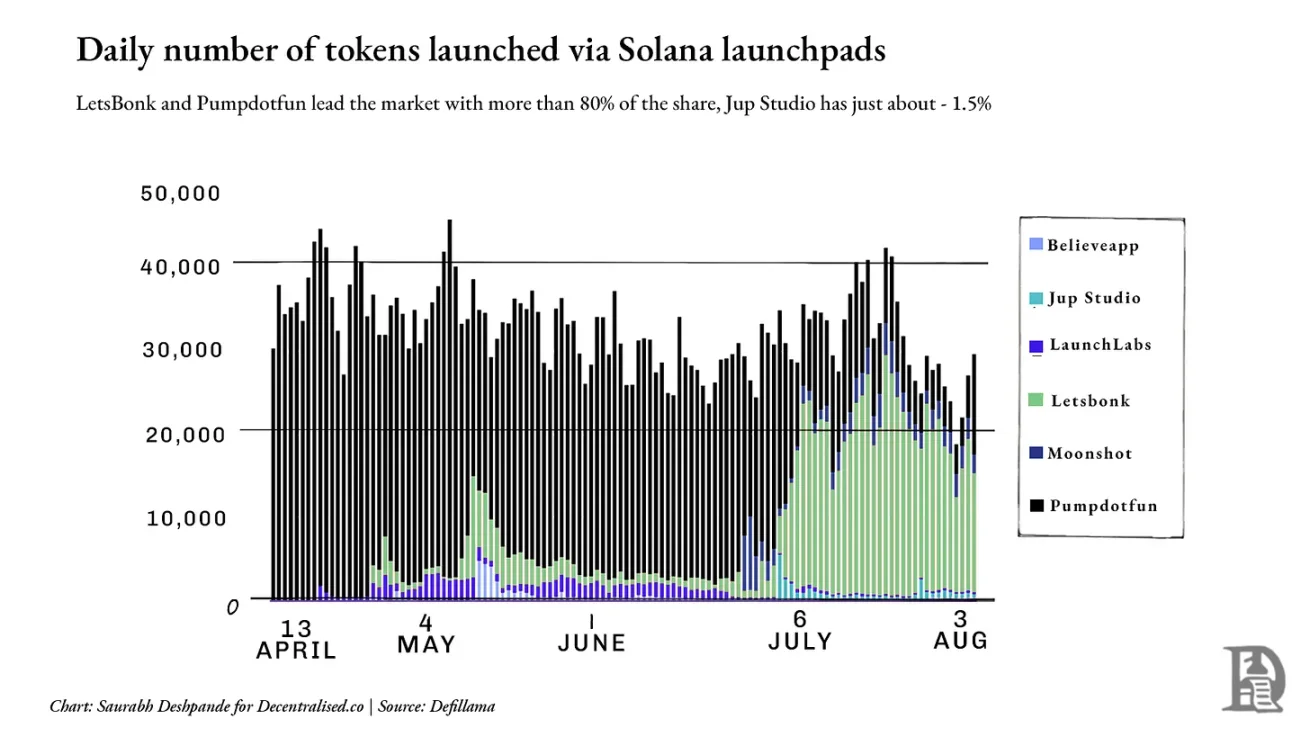

But growth in some metrics hasn't materialized yet. Take the launchpad space: market leaders Pumpdotfun and LetsBonk control over 80% of daily token launches, while Jup Studio and Moonshot combined account for less than 10%. The chart below shows the incumbents' dominance. In this case, the default landscape might already be solidified, and Jupiter may need a completely different approach to break through.

The Force Multiplier: Founder-Led M&A

To widen the shelf, you need to bring in operators who already control a segment of your target market. Jupiter's screening criteria: does the team bring a new type of liquidity or user that reinforces the flywheel? This logic echoes Amazon's early flywheel: each added category or supplier expands "selection," optimizes customer experience, drives more traffic, which in turn attracts more suppliers.

For Jupiter, each acquisition is like adding a new shelf to the store, widening choice and deepening engagement for traders and liquidity providers.

Acquiring creative founders allows Jupiter to enter unfamiliar territories (like DRiP's NFT culture or mass retail token launches) without diluting core competencies. These founders already understand the segment, have communities that trust them, and can move fast. Plugging into Jupiter's distribution channels amplifies their reach overnight, while Jupiter gains new user flows and liquidity.

The acquisition cases illustrate this: Moonshot is a minting and trading platform for mainstream behavior, and its launched tokens can seamlessly flow into swaps, money markets, and perpetuals within Jupiter's ecosystem; DRiP is a creator-first collectible distribution channel, attracting communities that otherwise wouldn't touch the trading interface.

Moonshot added over 250,000 users in three days during the TRUMP token launch, processing over $1.5 billion in volume; DRiP attracted over 2 million collectors, minted over 200 million collectibles, and saw over 6 million secondary sales.

Integration follows a clear pattern: founders retain primary control over product direction; products launch already connected to Jupiter's interfaces and backend, instantly benefiting from its user base, while Jupiter gains new traffic; each acquisition adds a unique liquidity primitive (like launches, culture, leverage), not duplicating existing features. Core competencies remain unchanged; all paths still lead back to Jupiter.

In DeFi, code can be forked overnight, but market share is hard to replicate. Founder-led M&A lets Jupiter add market share without losing its core path, making its flywheel harder to copy. As application-controlled execution and low-latency infrastructure mature, Jupiter may target teams for risk engines, matching layers, and professional venues, integrating them into Jupnet.

Aggregator vs. Supplier

Looking at the big picture, two dominant models are emerging in DeFi: Jupiter and Hyperliquid. Both are strong, but their strategies are截然不同.

Hyperliquid aims to control liquidity, not directly own end-user relationships. It offers liquidity as a service. If you can build a better user experience, you're welcome to use Hyperliquid's order book and execution engine. Builder Codes are based on this idea—others can own the frontend experience while Hyperliquid silently powers the backend. This is a supplier-first model.

Jupiter focuses on distribution. It wants to own the interface, the shelf, and the market gateway, aggregating fragmented liquidity by becoming the default interface and directing it where needed. This means controlling user relationships, not just the execution rails. From perpetuals to portfolios, Jupiter tries to make all financial interfaces start and end within its rails.

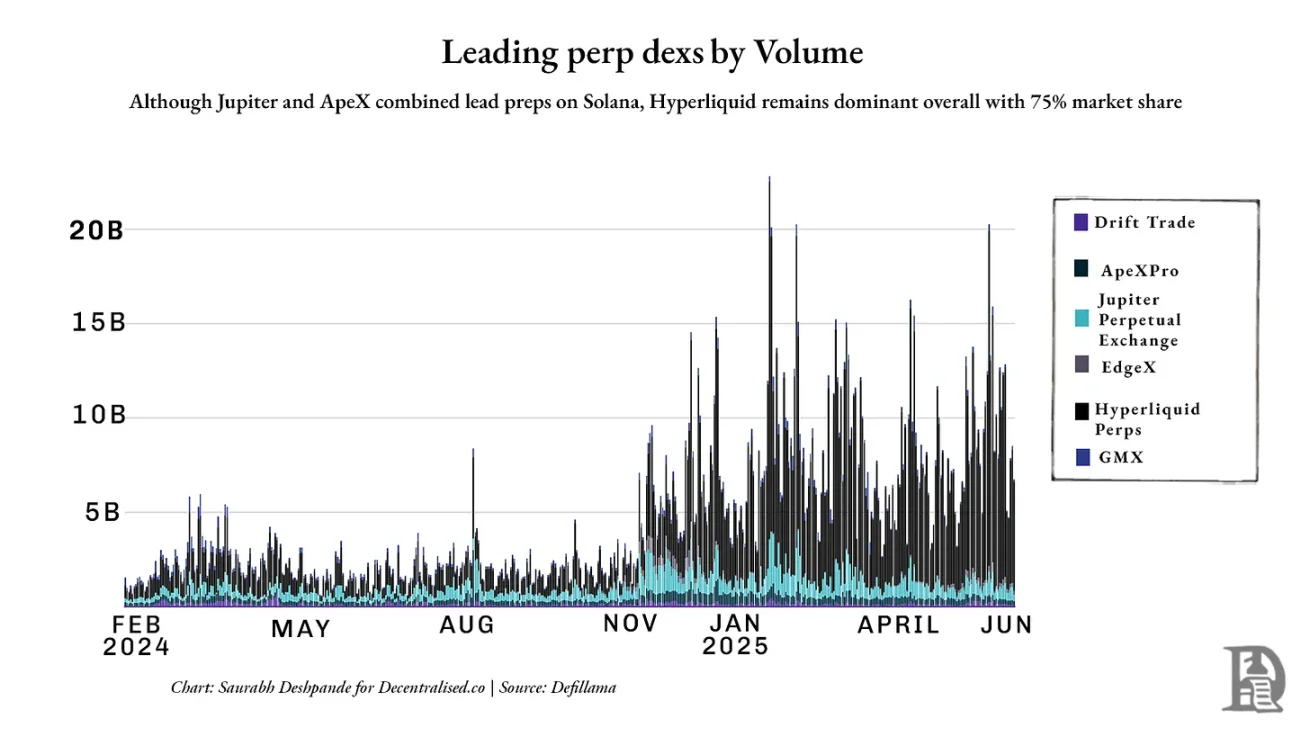

But perpetuals perhaps most expose the current limitations of this strategy. Jupiter has made progress on Solana, but Hyperliquid still dominates the perpetual DEX market with about 75% share. The chart below shows Hyperliquid's lead in raw trading volume:

Both models bet on scale but start from opposite ends. Jupiter believes liquidity follows user interfaces; Hyperliquid believes liquidity is the interface. Jupiter builds gateways; Hyperliquid builds destinations.

In practice, we see divergence: if you need a broad interface and user aggregation, choose Jupiter; if you need depth, determinism, and composability, choose Hyperliquid. One turns liquidity into a dependency network; the other becomes the foundation everyone builds on.

The winner isn't just the one who arrives first, but the one others cannot do without.

This is what makes DeFi exciting right now. For the first time, we're witnessing a philosophical showdown: one side believes distribution is the moat; the other firmly believes liquidity is.

Applications as the New Platforms

When Ethereum Layer 2s first appeared, people hoped they would become new platforms: neutral grounds where applications could compose, compete, and scale. But it turned out L2s haven't become platforms as imagined; most remain at the infrastructure level: providing the technical foundation of speed, security, and scalability, but not controlling user relationships.

A platform is the interface where user journeys begin, where demand aggregates, habits form, and distribution lives. Few L2s cross this line; most are pipes, not shelves, rarely building meaningful distribution, and even fewer becoming users' default gateway.

Instead, applications like Jupiter and Hyperliquid are increasingly showing platform-like traits. They own user relationships, embed into daily habits, and strengthen their position through acquisitions or integrating other apps. In fact, they're starting to resemble Web2.

Google moved beyond search, acquiring YouTube, turning its search advantage into video dominance; Facebook expanded its control over attention by acquiring Instagram and WhatsApp. They targeted adjacent areas where they were absent but users already gathered, and crucially, acquired the core players in those areas. Once acquired, these apps could immediately plug into Google's and Facebook's existing distribution flywheels, resulting in ownership of multi-channel user attention.

Jupiter is running a similar playbook. Launchpads, NFT minting tools, portfolio managers, and now Jupnet—all serve the same purpose: expanding coverage, capturing more user behavior, routing more liquidity to itself. Its strategy is to become the shelf, the default choice, the starting point for financial interactions.

But aggregation isn't a guaranteed win. History is full of failed platform acquisitions and aggregation attempts, either because they didn't own user relationships or misunderstood how habits form.

Take Microsoft's acquisition of Nokia. It was a bet on controlling mobile distribution, but users had already moved to iOS and Android ecosystems. Microsoft owned hardware and software, but its mobile devices and OS were either too similar to existing products or insufficient to make users switch. It didn't control the application layer, didn't win developer loyalty, and didn't provide a reason to change behavior. Without control over supply or clear differentiation, the shelf remained empty.

These cases reflect a core truth: acquisitions alone don't create flywheels. If you're not the starting point, the habit, or the interface, users won't follow, no matter how many features you bundle.

This makes the current moment in DeFi particularly interesting. Jupiter acquires frontends, distribution channels, and liquidity primitives, trying to become the default gateway to Solana's financial stack; Hyperliquid goes the opposite way: building depth over breadth, letting others compose around it.

In a sense, we're witnessing a real platform war playing out between applications, not between public chains as many expected. This raises bigger questions: if L2s don't control distribution, and the applications on them do, where will value flow? What will happen to fat protocols?

We end with unanswered questions because there's no conclusion yet. In the future, we'll bring sharper perspectives, new data points, and more stories and analogies to clarify where all this is heading.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News