Smart.fun: Trend Capture + Smart Shorting, a New Launchpad Approach Empowered by AI

TechFlow Selected TechFlow Selected

Smart.fun: Trend Capture + Smart Shorting, a New Launchpad Approach Empowered by AI

Fair, fun, and supports short selling.

By: TechFlow

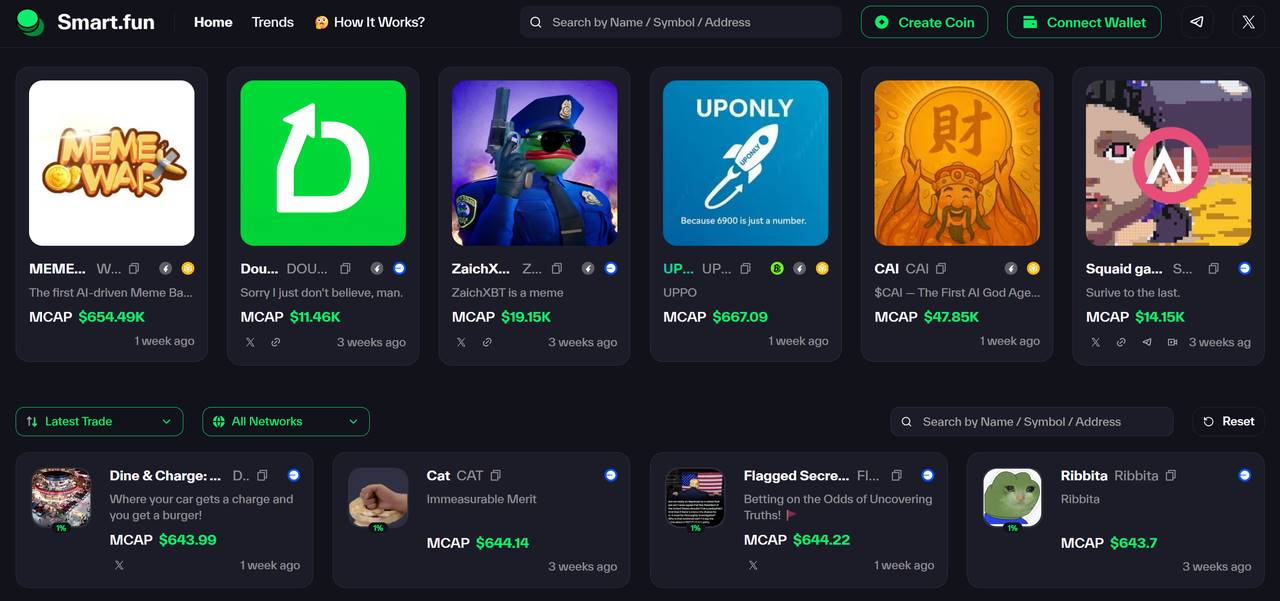

The Launchpad space is becoming increasingly competitive, yet Smart.fun, backed by Ora Protocol, has recently drawn significant attention due to a series of innovative features.

Launchpad has undeniably become a red ocean market:

Taking the highly competitive Solana ecosystem as an example, there are already over 40 homogeneous Launchpad platforms.

Yet new entrants continue flooding into the market, driven by one clear profit logic:

Launchpads generate direct revenue through platform fees. Whether via massive launches or high-frequency trading, Launchpads can reap substantial returns. According to DefiLlama data, Pump.fun reached a daily revenue peak of $7.07 million on January 23, 2025, and has accumulated over $700 million in total revenue since its launch in January 2024.

New projects on Launchpads still have opportunities to stand out: revenue comes from asset issuers and traders. If a new project offers lower barriers, superior issuance mechanisms, higher capital efficiency, stronger risk management, and more attractive ecosystem incentives, it can attract more users to issue and trade assets, thus becoming the next key player in the battle for "token issuance rights."

Then, within the ORA ecosystem—already known for breakout products in oracle, AI, and asset issuance—what unique competitive advantages allow Smart.fun to stand out amid the Launchpad chaos?

Fair, Fun, and Shortable

Fair, fun, and shortable

This tagline on Smart.fun’s official website appears to be the team's most direct answer to that question.

Currently, Smart.fun has launched its Trend section, leveraging AI to aggregate trending topics and enable rapid tokenization, along with zero creation fees, delivering a brand-new experience for token creation and trading.

Beyond fairness and fun, its unique shorting mechanism has become a major draw for many exploring Smart.fun.

AI-Driven Trend Detection, Content Generation, and One-Click Launch

As a Launchpad, asset issuance is its core function. Smart.fun uses AI as an engine to deliver real-time global trend detection and one-click launch of high-quality assets.

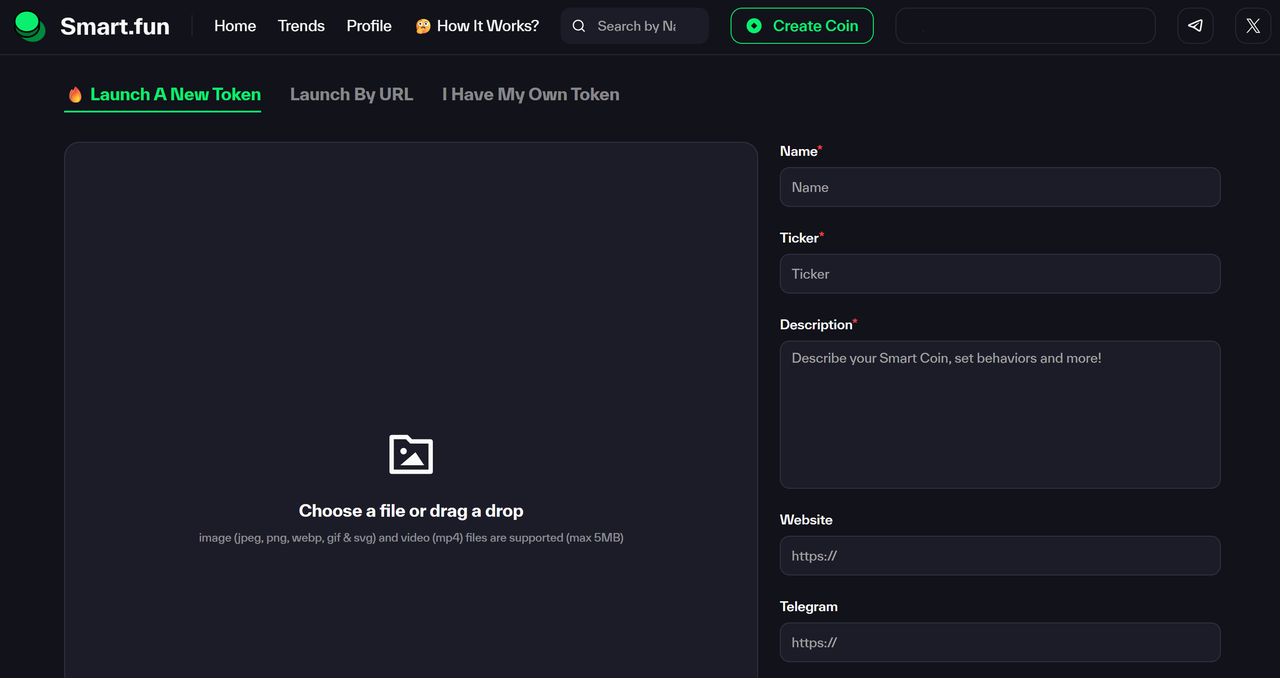

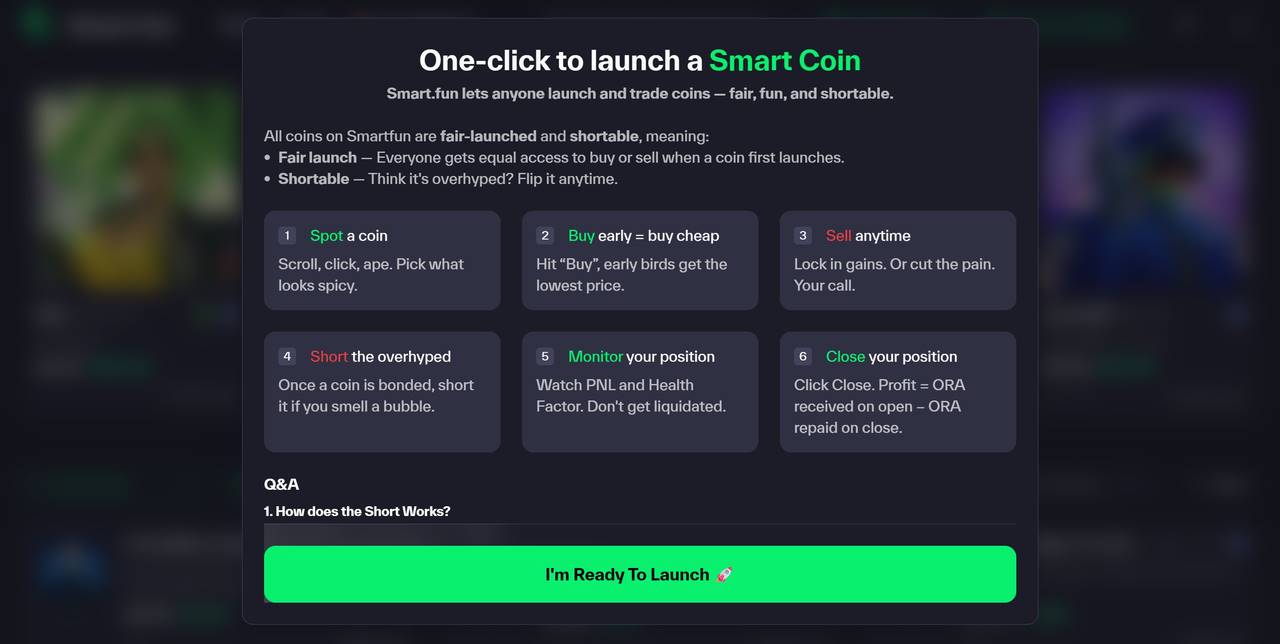

Basic One-Click Issuance: Zero-Barrier Launch for Your Ideas

On Smart.fun, anyone can easily issue an asset within a minute:

Users simply click the "Create Coin" button to upload materials—including images (jpeg, png, webp, gif, svg, etc.) and videos (mp4)—and fill in basic information such as token name and description, then publish with one click. Equal participation empowers everyone, truly bringing asset issuance into mainstream entertainment.

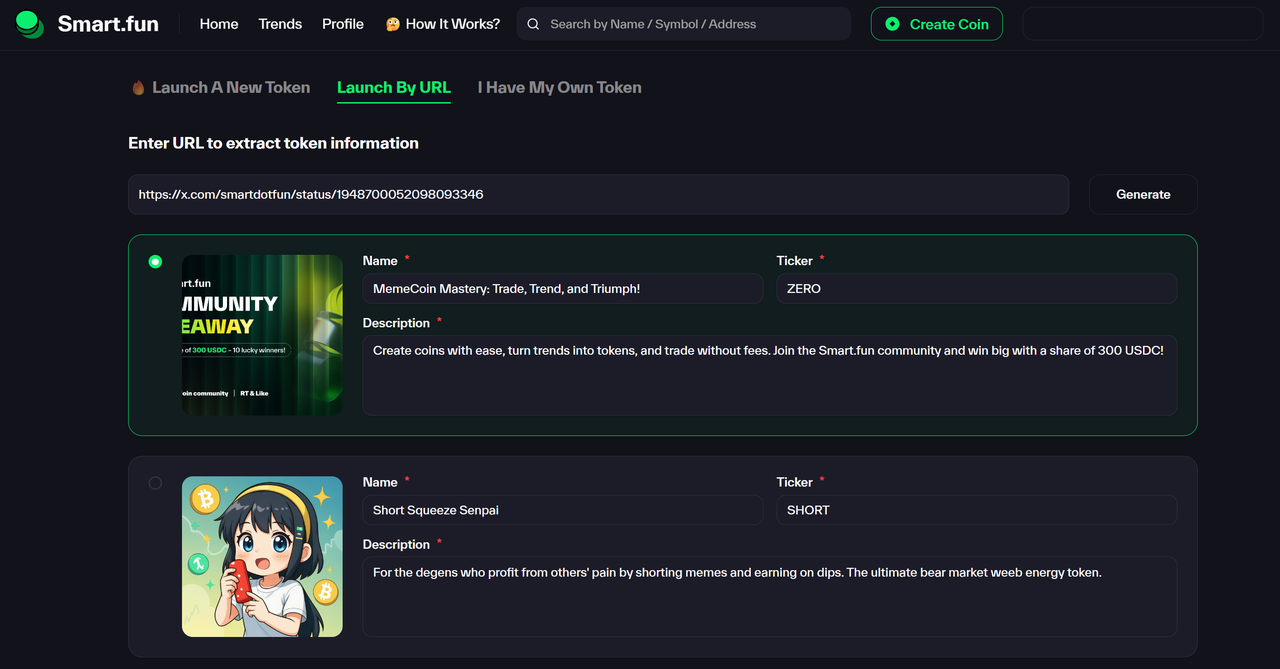

Smart Content Generation: AI Helps Your Meme Find the Perfect Angle

A breakout Meme requires precise marketing expression. While many are still pondering what token names or descriptions best capture an asset’s essence, Smart.fun leverages AI to handle content generation, eliminating guesswork.

In the "Launch By URL" mode, users only need to copy and paste any valuable trending news link. Smart.fun’s powerful AI will automatically analyze the content and generate multiple personalized asset proposals. Users can simply pick their preferred option or make minor adjustments before one-click publishing.

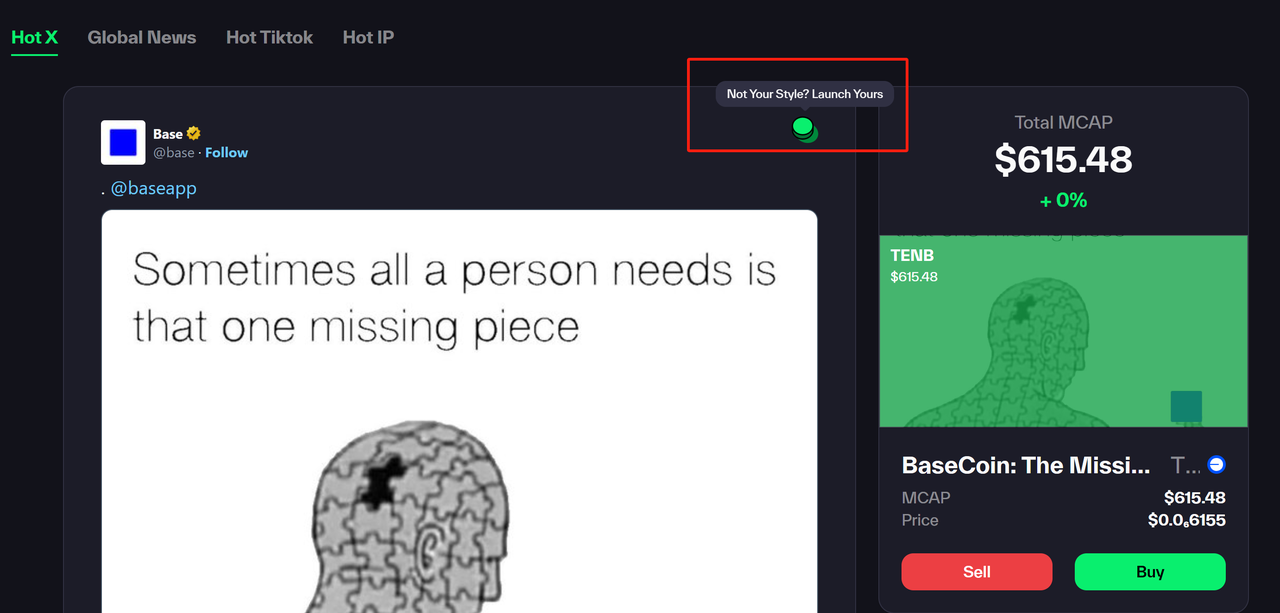

TrendFi Function: Real-Time Global Trend Detection for Faster Viral Spread

After lowering issuance barriers, in today’s attention economy, issuers need efficient tools for trend discovery. Smart.fun’s AI-powered TrendFi function acts like a “trend radar” scanning global multimedia platforms.

In the currently live Trends page, users can browse trending news through two sections—“Hot X” and “Global News”—buy or sell related Meme tokens with one click, and instantly launch new tokens based on these trends.

In the Hot X list, the left side shows trending posts from X, while the right displays related projects. If users believe a post could inspire a more engaging token, they can directly click the logo on the right to initiate creation.

On the Global News page, clicking the “Launch Coin” button below a news item triggers the AI to automatically generate multiple asset issuance proposals based on the content.

In the future, Smart.fun plans to rapidly integrate TikTok and IP trends, further helping users seize early-mover advantages in a fiercely competitive market.

0 Creation Fee, 0 Transaction Fee

To further encourage creation, Smart.fun currently charges no Creation Fee. During the internal market phase, users trading with $ORA tokens are exempt from transaction fees—significantly reducing issuance costs and operational barriers while catalyzing ecosystem growth.

The next viral Meme might stem from a user’s simple “one-click launch.”

$ORA Liquidity Incentives: Enabling Smooth “Graduation” for Assets

Lowering issuance barriers leads to an explosion of projects, but market fragmentation and scattered attention mean most die before public trading. Pump.fun’s less than 1% “graduation rate” clearly illustrates this.

Securing sufficient liquidity during initial stages is the first major hurdle for many projects.

Smart.fun cleverly addresses this pain point through a deeply integrated tokenomics model with the ORA ecosystem, using $ORA liquidity incentives to fuel sustainable project growth.

As the native token, $ORA is the core value carrier of the ORA ecosystem;

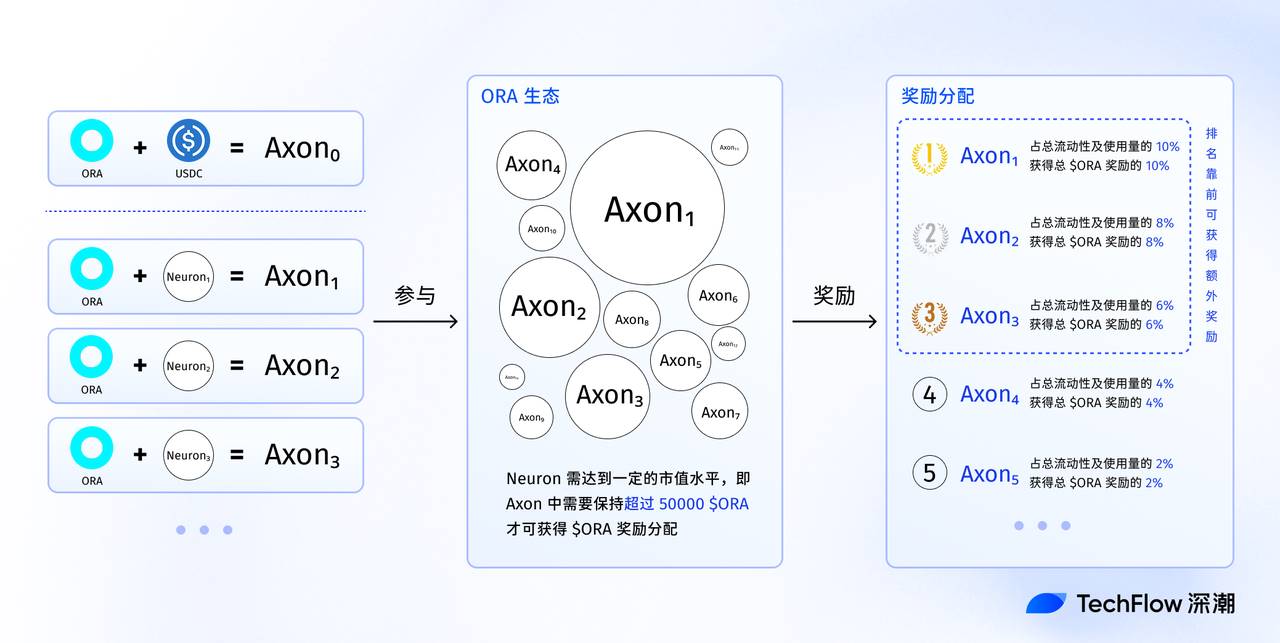

According to the ORA whitepaper, other tokenized assets issued within the ORA ecosystem are called Neurons. Since Smart.fun is built on ORA, all tokens issued via Smart.fun are Neurons.

A liquidity pool pairing $ORA and a Neuron token is called an Axon.

In ORA’s new tokenomics model, 11% of $ORA tokens are already issued and actively circulating, while the remaining 89% will be fully allocated to liquidity mining and gradually released.

Each $ORA + Neuron liquidity pool (i.e., Axon) receives $ORA rewards proportional to its share of total liquidity and usage—higher liquidity yields higher $ORA rewards. Users can add liquidity to Axons to mine additional $ORA rewards.

The threshold to claim $ORA rewards—and also the graduation threshold for Smart.fun—is 50,000 $ORA.

This strong liquidity binding mechanism creates a self-reinforcing liquidity snowball effect for Smart.fun:

$ORA rewards attract liquidity providers → higher liquidity increases $ORA rewards → higher rewards attract more liquidity → forming a positive cycle that continuously fuels token liquidity.

Once a project reaches the 50,000 $ORA threshold and graduates successfully, Smart.fun unlocks its Buy Back & Burn function: any market participant can repurchase and permanently burn Meme coins from the open market, reducing supply and enhancing scarcity and potential value of remaining tokens—providing long-term momentum for the project.

Borrowing and Shorting Mechanism: Efficient Risk Hedging and High-Yield Leverage

In Meme markets, extreme volatility is commonplace.

When prices crash, do you just watch your assets shrink helplessly?

Smart.fun breaks this limitation. Its borrowing and shorting feature turns the market into a “two-way sword,” enabling users to leverage downturns for high returns.

Currently, the shorting mechanism is available for projects that have transitioned from internal to public trading. The system uses $ORA as the value anchor. Specifically:

Users must first pledge $ORA as collateral to borrow target Meme coins. The loan-to-value ratio depends on the Health Factor. Currently, the platform’s borrowing ratio is approximately 50%. For example, pledging 100 $ORA allows borrowing Meme assets worth about 50 $ORA.

After acquiring borrowed Meme assets, users can leverage Smart.fun’s AI-driven trend detection to better gauge market movements. Based on their own analysis, they may choose to sell the borrowed Meme coins: typically, this sale constitutes opening a short position, indicating the holder expects the asset’s price to fall or rise minimally.

After selling, users monitor price fluctuations. When the price drops, they can repurchase the same quantity of Meme coins at a lower cost to repay the platform—the price difference being their profit.

Profit = ORA received at open - ORA repaid at close

We can clarify the logic with an example:

-

Tom borrows 1,000 Meme coins and sells them for 100 $ORA;

-

When the price drops 20%, Tom buys back 1,000 Meme coins for only 80 $ORA;

-

Tom earns 20 $ORA in profit.

Of course, in the high-volatility, high-risk Meme market, liquidation risks are elevated. Smart.fun uses the Health Factor (HF) as a risk control “safety gate”:

Health Factor (HF) = (Collateral Value / Debt Value) × 100%

HF measures the safety margin between collateral and debt. It must remain above 100% to maintain position safety. Once debt value reaches 90% of collateral value (HF < 100%), automatic liquidation is triggered, potentially resulting in partial or full loss of collateral.

Let’s illustrate liquidation with another example:

Tom pledges 100 $ORA to borrow 1,000 Meme coins valued at 50 $ORA (loan ratio 50%). If the Meme coin price keeps rising and its debt value approaches 90% of the collateral value, HF drops below 100%, putting the position at risk of liquidation.

Smart.fun breaks the single-direction “chasing rallies” investment pattern in Meme markets. The introduction of shorting not only deepens market dynamics—allowing profitable operations during downturns—but also signals Meme ecosystems’ potential evolution toward more mature DeFi models.

Ecosystem Synergy: Mutual Empowerment Between ORA and Smart.fun

Just as Pump.Fun’s success relied on Solana’s underlying technology and ecosystem support, Pump.Fun in turn became a traffic engine for Solana—a mutually reinforcing loop common in Web3.

As the next breakout candidate in the ORA ecosystem, Smart.fun aims to become the ORA-native version of Pump.Fun, continuing the same symbiotic relationship seen between Pump.Fun and Solana.

Backed by the ORA ecosystem, Smart.fun benefits from a suite of ecosystem advantages:

From an incentive perspective, higher liquidity yields more $ORA rewards, providing native liquidity support for projects on Smart.fun and helping more graduate into public markets.

Technically, ORA’s deep expertise in AI since 2021 provides a solid foundation for Smart.fun’s leap from “Fun” to “Smart.”

ORA has developed several well-known technical achievements and AI products: opML, a game theory-based, cost-efficient machine learning framework, significantly reduces on-chain AI operational costs; opp/ai, a hybrid model tailored for on-chain AI, enables private and efficient AI computation; OAO, a verifiable decentralized AI oracle, establishes trust for on-chain AI; IMO, an initial model offering solution for AI model tokenization, previously spawned hit products like OpenLM. These innovations directly empower Smart.fun’s AI capabilities in trend detection, content generation, and smart trading.

Beyond technology, ORA’s broader ecosystem—users, developers, community exposure—also feeds resources into Smart.fun, expanding its reach to wider audiences.

For ORA, the rich assets created by Smart.fun drive ecosystem demand and strengthen $ORA’s value:

As a Launchpad, Smart.fun diversifies asset types within the ORA ecosystem, injecting innovation and vitality through more projects, users, and capital.

Meanwhile, every token issued on Smart.fun aims to “graduate,” creating sustained demand for $ORA. As more assets launch via Smart.fun, $ORA demand grows, reinforcing its value foundation.

Thus: creators issue assets on Smart.fun; $ORA incentives attract liquidity providers; more projects graduate into public trading; combined with innovative shorting mechanics, the likelihood of breakout hits emerging from Smart.fun increases;

Hit projects bring new traffic; more users choose Smart.fun for issuance, generating greater $ORA demand and solidifying its value base;

A more valuable $ORA attracts even more liquidity providers seeking $ORA rewards, accelerating healthy project growth—creating a compounding cycle of ecosystem expansion.

The synergy between ORA and Smart.fun isn’t additive—it’s multiplicative. The powerful flywheel they co-create opens up far greater potential for exponential ecosystem growth.

Conclusion

After Pump.fun demonstrated the immense potential of the Launchpad business model, countless homogenous clones emerged, aiming to replicate the “low-barrier issuance + high-frequency fee extraction” formula. In today’s market—where leading projects keep improving and new ones flood in—securing a foothold in the Launchpad race is extremely difficult. Yet Smart.fun has forged a more imaginative evolutionary path:

-

AI empowerment elevates asset issuance from “chasing trends” to “creating trends,” enabling creators to precisely capture market sentiment;

-

Liquidity incentives solve the industry-wide “born-to-die” problem, offering sustainable development paths for quality projects;

-

The shorting mechanism breaks the Meme coin “long-only” paradigm, introducing more mature risk hedging tools to the market.

Of course, for Smart.fun to truly break out, it must further leverage ORA’s AI strengths, maximizing differentiation in lowering barriers, market monitoring, and content generation. Additionally, regarding liquidation risks under the borrowing and shorting mechanism, Smart.fun will need to refine its controls for finer risk management.

The crypto market’s pursuit of issuance efficiency and liquidity never stops. The Launchpad race is endless. As Smart.fun continues aggregating platform-level trend detection and enhances its DeFi trading functions, attracting more users and capital, it is positioning itself as an innovative variable in the evolving Launchpad landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News