Solana's Launchpad Chaos: Why Can New Platforms Take Bonk's Lunch?

TechFlow Selected TechFlow Selected

Solana's Launchpad Chaos: Why Can New Platforms Take Bonk's Lunch?

Where does the "traffic" that attracts real money actually come from?

Author: Squid | drift

Translation: Saoirse, Foresight News

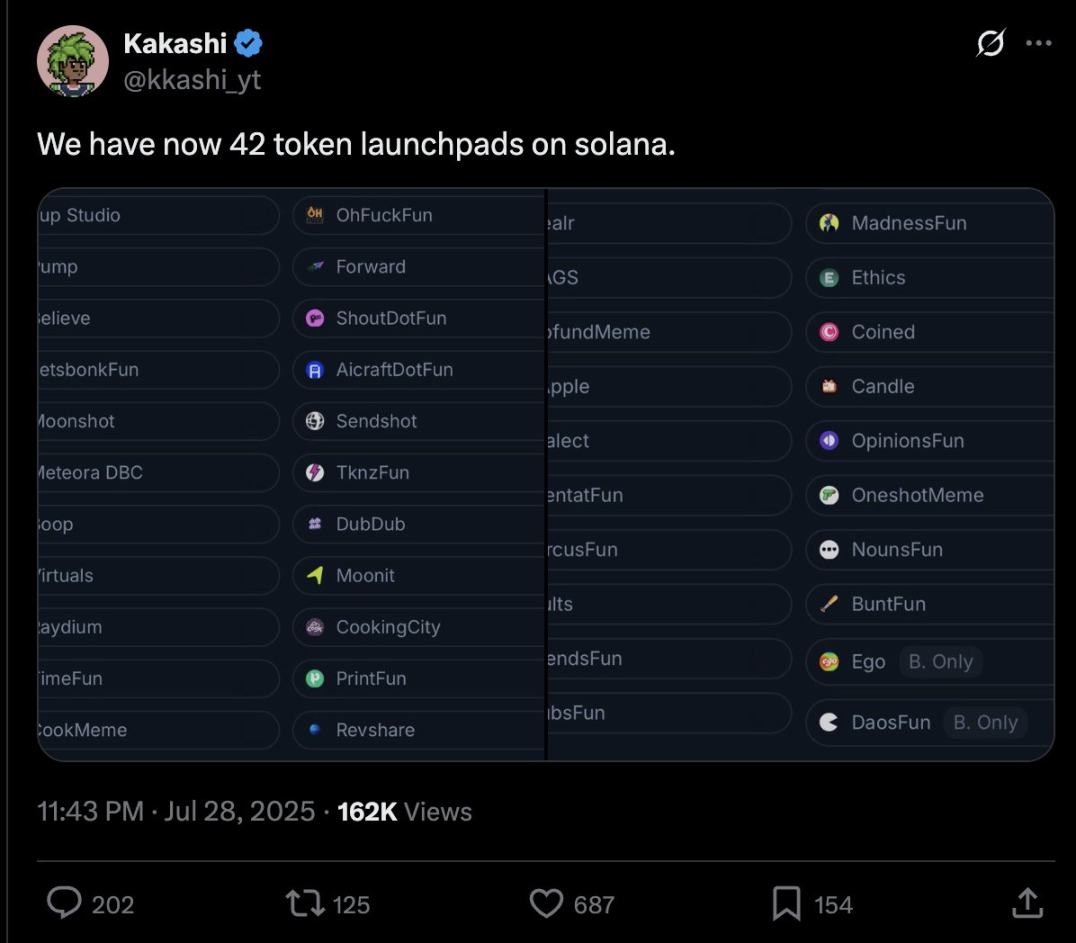

There are already dozens of homogeneous Launchpads on Solana, with new ones emerging every day.

This article aims to provide a simple framework to help clarify industry chaos and provoke thought. We start with a core question:

Why do users choose a new Launchpad instead of Pump.Fun (or today's Bonk)?

Users can be divided into bidders and deployers. Although these two groups are highly correlated, since capital is scarce, bidders are the primary group we focus on first.

To analyze why buyers choose a new platform over a leading one, the answer is simple: they believe the new platform offers more profit opportunities. However, many of these factors are beyond platform control, so this article focuses on two key drivers that platforms can control:

-

Assets: Can the platform create assets with significant differentiated value?

-

Flows: Does the platform have a differentiated deployer process?

Let’s dive deeper.

Assets

People buy tokens for two main reasons: speculation (believing the token will rise in value) and utility (the token has practical uses).

-

Speculation: There are many drivers of speculation, mainly memes (e.g., Meme coins) and fundamentals (such as value derived from reserves or cash flow).

However, Launchpads cannot differentiate themselves at the speculative level. Memes are spontaneous and market-dependent, while fundamental aspects like returns are ultimately determined by the project team or product.

-

Utility: Utility is more flexible—essentially answering "besides speculation, why would someone buy this token?" (Of course, utility is closely tied to speculation because utility can drive it). Examples include token-gated access, fee discounts, and governance rights.

Launchpads can gain an advantage in utility by providing differentiated supporting infrastructure and tools that allow deployers to plug in from day one. These support mechanisms vary, but competition may center on platforms with more vertical-specific focus. It's important to note that supporting infrastructure must not only give tokens unique utility but also create 'valuable utility'—giving users a compelling reason to buy.

Social Token Case Study: Ego vs Time.Fun

Both attempt to tokenize social influence, allowing each creator to issue only one Twitter-linked "soulbound token."

-

Ego’s tokens belong to creators but lack direct use cases. This "flexibility" gives creators little incentive to build utility, ultimately making their tokens no different in essence from those on Pump platforms.

-

Time.Fun, by contrast, builds utility directly into its tokens, enabling creators to quickly generate value and earn revenue via tokens, thus achieving sustained user engagement.

(Disclosure: I respect the Ego team; I chose this example because I believe they will keep improving.)

Moreover, "providing utility" does not equal "creating value." For instance, many tweet-based tokenization platforms integrate tweets into supporting infrastructure, creating a "value-based curated social feed." While this counts as utility, if no one uses this social feed, its value is zero. Such platforms often struggle to create real value.

It's worth noting that creating value is difficult and requires careful evaluation of whether supporting infrastructure or design truly adds value. Also, differentiation is relative. Features currently popular in the industry—like "token buyback tools" and "project economics tied to token flywheels"—may offer short-term value but quickly become standardized tech. Once differentiation fades, they cease to be attractive.

In summary, when evaluating new platforms from the 'assets' perspective, consider: Where is the token’s differentiation? Does this differentiation add real value to the token?

Fields I’m currently watching include: incentivized distributed training, next-gen prediction markets (with some interesting mechanisms), niche real-world assets (with novel designs), and Initial Coin Models (ICM—an early-stage area with high potential).

Flows

We now turn to another differentiating factor: exclusive deployer "flows." Similar to venture capital’s "deal flow," the core question is whether the platform can attract the hottest projects to launch.

From a limited partner (LP) perspective, one key criterion for evaluating a VC firm is whether it has access to high-quality, exclusive deal flow. The same logic applies to Launchpads. Both share similar return structures (top projects contribute most volume/income), and both fundamentally revolve around "getting value creators to choose you over homogenous competitors."

For example, a contrarian view holds that Believe’s early success stemmed not from mechanism design (in fact, I don’t endorse this design), but from founder Pasternak’s ability to attract Web2 entrepreneurs who otherwise wouldn’t issue tokens—this is the power of flow.

Large platforms naturally have flow advantages: user base, ecosystem integration, and distribution channels. But user attention is scarce; new platforms must rely on tangible differentiation to attract flow.

The following are common factors driving flow differentiation:

-

Founder Influence: The crypto space is small and relationship-driven. Do platform founders have sufficient social capital to attract deployers? Can they rally social support for tokens post-launch? (e.g., Pasternak)

-

Momentum: Does the platform have successful launch examples? For instance, Bonk’s Launchpad gained traction after successful token launches, encouraging more people to issue and bid on tokens there—creating a "social flywheel effect." Early platforms should curate quality projects and offer deep support, as just a few failed launches can destroy a platform—after all, flywheel effects work both ways.

-

Specialization: A platform focused on a specific niche can enhance project visibility through a dedicated community. This is especially true in areas like AI agents and virtual assets (even if tokens are homogenous), and even more so when targeting non-crypto-native users.

-

Capital Formation Capability: For more commercially oriented projects, fundraising ability during launch can determine ultimate success. Does the platform’s issuance mechanism and reach support higher levels of capital formation?

-

Utility: As discussed earlier, asset utility can directly attract flow.

In summary, when evaluating new platforms from the 'flow' perspective, ask: Why do deployers choose this platform? What are their current reasons? Is this differentiation sticky and scalable?

Market Outlook

Below is my analysis of the trajectory of major Launchpads in the market (non-Solana platforms are labeled with their respective chains):

-

BonkFun: Industry leader with strong meme advantage. Its dominant position is more solid than imagined and unlikely to be challenged unless a platform with entirely new incentive mechanisms emerges.

-

Raydium, Jup, Orca (launching soon): No asset differentiation, technology is standardized, but brand and capital strength help maintain flow. Competition centers on business development—who can secure more partnerships and better support top tokens.

-

Pump.fun: Lacks differentiation until launching more streaming features; currently losing flow. Unlikely to regain peak status in the short term unless launching incentives or new products. Aggressive acquisitions or funding moves could change this.

-

Block: Gains asset differentiation through partnership with WLFI.

-

Zora: (deployed on Base) Became a top player by leveraging Base ecosystem flow, but due to asset homogeneity, its market share may decline as more platforms enter (though support from the Base camp might reverse this trend).

-

Doppler: Positioned as a "Launchpad for Launchpads," enjoys high industry recognition and promising prospects.

-

MetaDAO: Offers differentiated asset creation, but needs to prove the value of its governance mechanism.

-

Vertigo: No asset differentiation (anti-snipe tech is now standardized), but still has chances to attract deployers.

-

Believe: (deployed on BNB Smart Chain) Core strength lies in flow, but currently experiencing deployer attrition and unclear market sentiment. I still have hopes for this project; its health should be assessed through upcoming launches.

-

heaven: (deployed on BNB Smart Chain) Well-designed, but the core challenge is attracting high-quality deployers; its investors may provide assistance.

-

The Metagame (deployed on BNB Smart Chain), Trends: Details remain unknown, but the team consists of seasoned crypto natives (which is crucial), giving them strong potential to break through in the social space.

Conclusion

-

Vertical specialization presents important opportunities, but must create real value.

-

Early positioning is easier to reward than betting on "defensive" plays or market growth.

-

Novelty deserves attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News