Launchpads Pile Up on Solana: Innovation or Saturation?

TechFlow Selected TechFlow Selected

Launchpads Pile Up on Solana: Innovation or Saturation?

Token issuance platforms on Solana are heating up.

Author: samoyedscribes

Translation: TechFlow

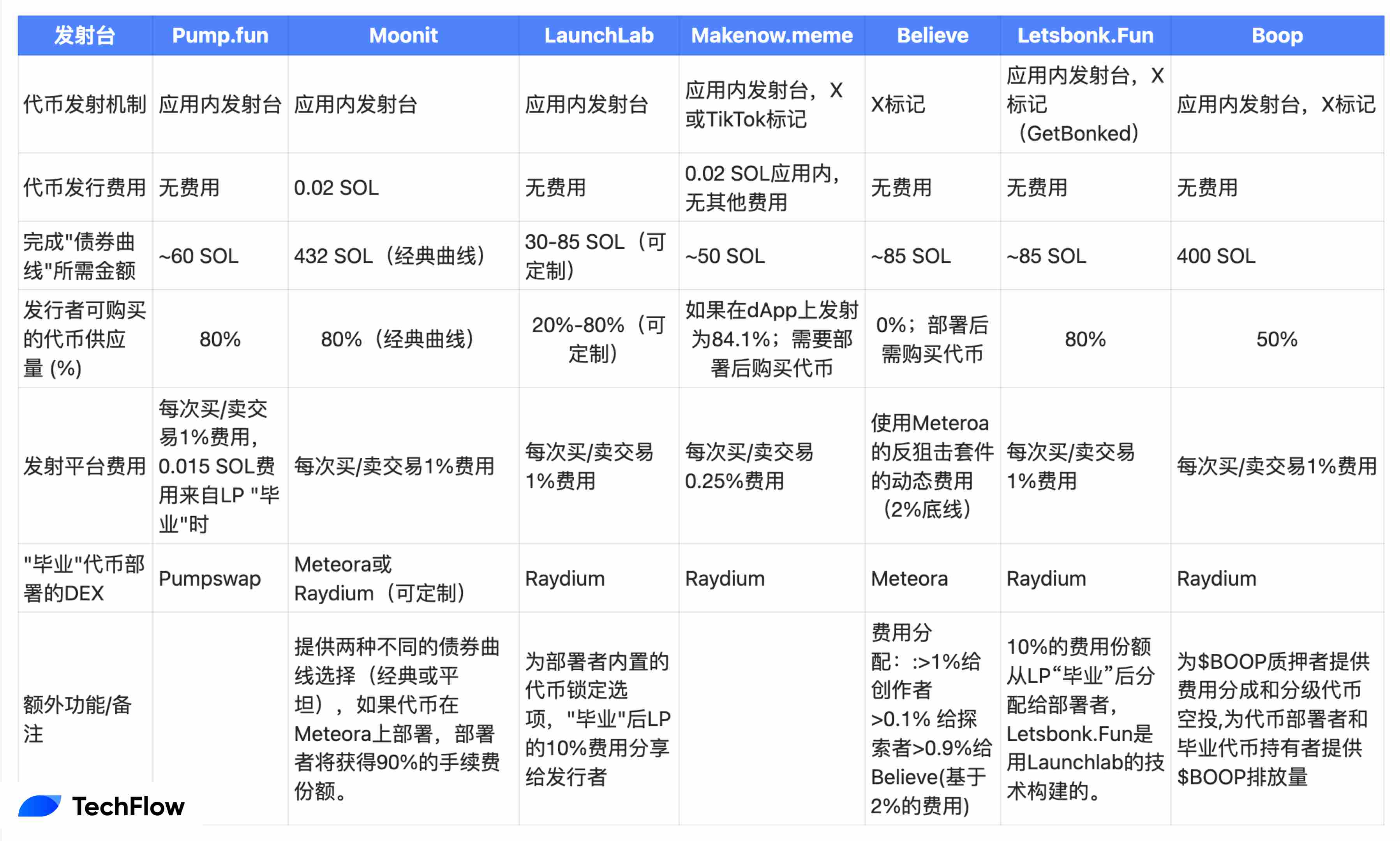

Comparison of token launch platforms on Solana, translated by TechFlow (original image from @samoyedccribes and SIGNUM CAPITAL)

A Brief History of Token Launch Platforms

Token launchpads have become a mature sector within the crypto ecosystem, offering projects a structured path to raise funds and bootstrap liquidity. Before the rapid rise of Pump.fun, this space was dominated by protocols better suited for Initial DEX Offerings (IDOs). Protocols like CoinList, PinkSale Finance, and Fjord Foundry were go-to choices for projects looking to launch on blockchains such as Ethereum and Binance Smart Chain (BSC). These launchpads typically served more established protocols with dedicated builders and often operated in a more selective environment, where investors usually needed to be whitelisted to participate in specific fundraising events. These entry barriers made them less accessible to smaller protocols and more informal projects like meme coins or experimental tokens.

Why Was Pump.fun So Influential?

Pump.fun's emergence has been hailed by some as the kingmaker for Solana, playing a pivotal role in advancing the chain’s dominance. Launched on Solana, Pump.fun leveraged the blockchain’s low cost and high-speed transactions to revolutionize token issuance. Unlike its predecessors, Pump.fun introduced a standardized mechanism that burns liquidity pool (LP) tokens at launch, ensuring liquidity cannot be pulled—this feature provided retail participants with added trust, although the platform wasn't entirely immune to manipulation by certain insiders.

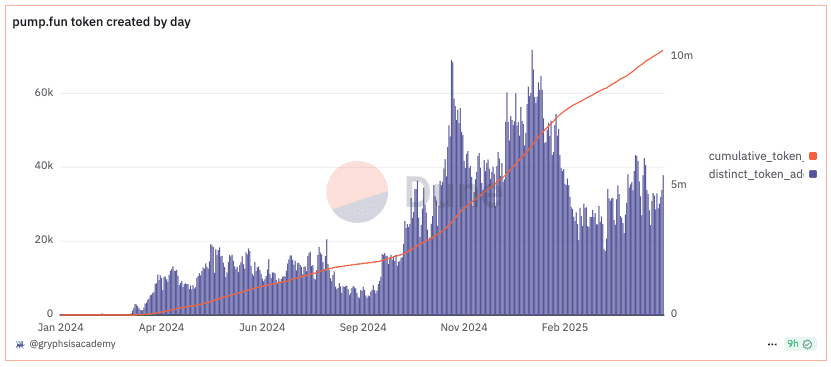

Number of tokens created on Pump.fun since inception

Where Pump.fun truly made an impact was through its decentralized approach. It allowed anyone—not just established protocols—to fairly raise funds and launch liquidity. To date, over 10 million tokens have been launched on Pump.fun. This accessibility turned Pump.fun into the breeding ground for Solana’s meme coin frenzy, leading Solana to be dubbed the premier "on-chain casino." Other chains have attempted to claim this title, but none have succeeded. Pump.fun’s model was pioneering, enabling new token issuance to scale at an unprecedented level.

But is this net positive or negative for the crypto space? On one hand, Pump.fun lowered barriers to entry and fostered creativity and experimentation. On the other hand, it opened the floodgates to low-quality projects and widespread liquidity draining events. Some argue this harms the long-term health of the ecosystem. Only time will tell, as markets tend to self-correct eventually.

Makenow.meme — The Earliest Iteration

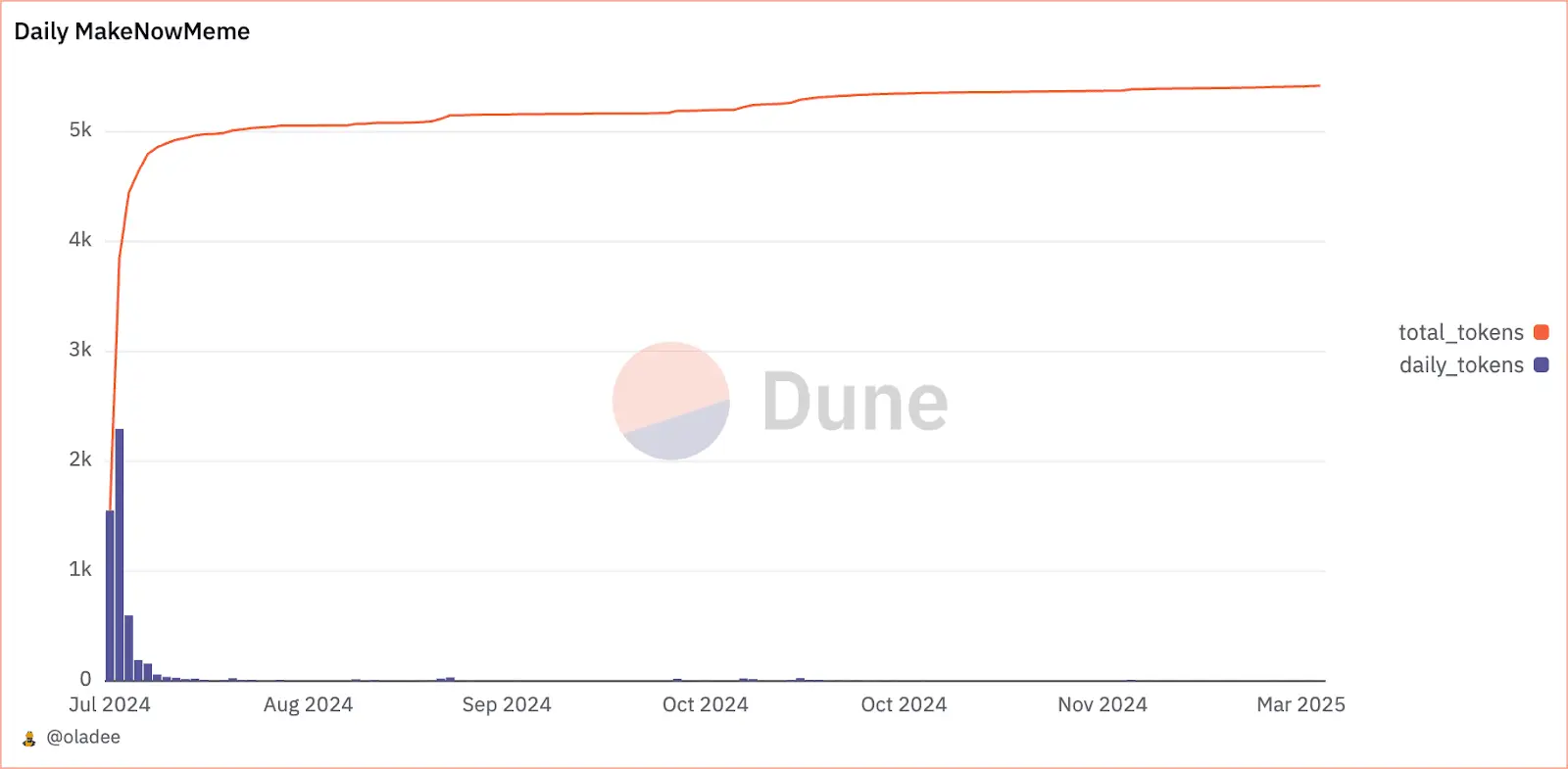

Number of tokens created since Makenow.meme's inception

Following Pump.fun’s success, Makenow.meme emerged as an early competitor aiming to take the concept further by integrating directly with platforms like X. The idea was to let users create tokens simply by tagging Makenow.meme’s X account, making token issuance a seamless and user-friendly experience. In theory, this appeared to be a promising decentralized application for the masses, merging social media with crypto innovation. However, despite its potential advantages, Makenow.meme struggled to find product-market fit (PMF). Platform adoption remained weak, leading to a sharp decline in user activity shortly after launch. Despite its novelty, it lacked the execution and incentives needed to drive mainstream adoption.

The Resurgence of Pump.fun Competitors

Pump.fun’s dominance didn’t last long. A turning point came when Pump.fun decided to migrate its “graduated” tokens—those reaching a certain market cap threshold—from Raydium to its own decentralized exchange (DEX), Pumpswap. This move triggered a wave of competition: Raydium responded by launching its own token launchpad, LaunchLab. Additionally, Believe rolled out a product similar to Makenow.meme, allowing users to issue tokens on X, while Bonk also launched its own launchpad built on Raydium’s LaunchLab tech stack. More recently, Boop entered the market under the leadership of Dingaling, founder of PancakeSwap, LooksRare, and others.

Boop, the Most Promising Rookie

Boop stands out due to its innovative approach and "fun" Ponzi economics. It introduced a fee-sharing mechanism, addressing a major pain point of Pump.fun: the lack of incentives for token creators and early adopters. Boop also adopted aggressive user onboarding strategies to attract users. Notably, some core DeFi users received $BOOP airdrops—but with a catch. They had to launch tokens, promote them, and encourage others to buy in order to claim their airdropped tokens. Moreover, Boop offers fee sharing, airdrops, and other incentives to token deployers, $BOOP holders, and recent “graduate” token holders. Though still in early stages, Boop’s dynamic incentive structure and willingness to rethink launchpad possibilities may cultivate a loyal and engaged user base over time.

Final Thoughts

Thanks to @jeff_w1098 for contributions on X

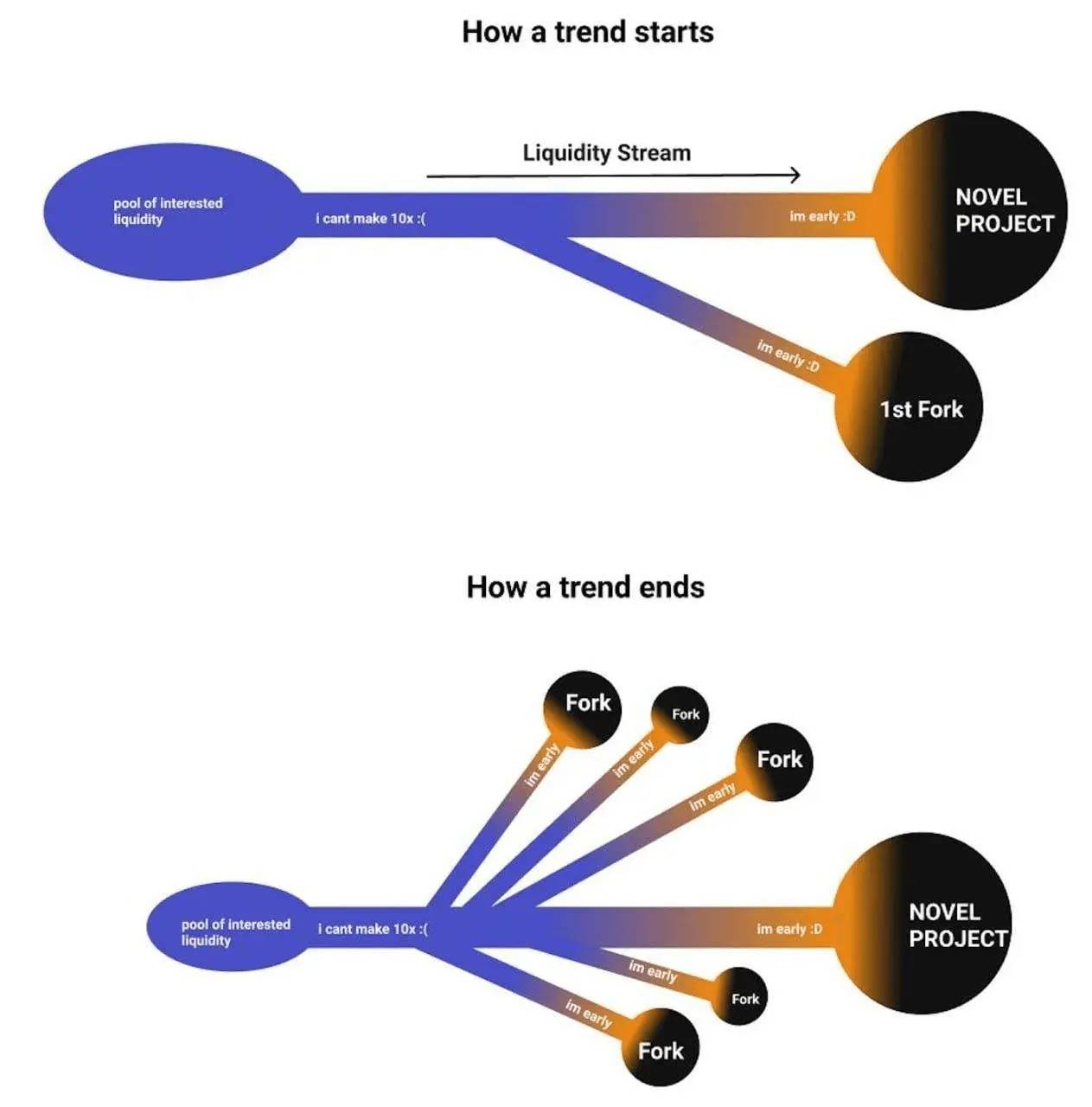

There’s no doubt the token launchpad landscape on Solana is becoming increasingly saturated. The ability for protocols to fork is a fundamental feature of blockchains and isn’t inherently negative. However, the proliferation of nearly identical products may stifle innovation, as they offer little differentiation, resulting in a crowded market where user attention and liquidity are fragmented.

In contrast, the crypto space should encourage projects like Boop, which, under Dingaling’s leadership, iterate on existing product designs. By introducing novel incentive structures and rethinking user onboarding, Boop demonstrates there’s still room for innovation in this space. As the market evolves, the key to success will lie in balancing accessibility with sustainability, ensuring token launchpads not only empower creators but also foster a healthier, more resilient crypto ecosystem.

*Disclosure: The information provided in this article is for general informational purposes only and does not constitute professional or investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News