$PUMP rises against the trend, what happened in the Meme launchpad over the past two weeks?

TechFlow Selected TechFlow Selected

$PUMP rises against the trend, what happened in the Meme launchpad over the past two weeks?

How far has the Meme Launchpad battle progressed?

By: Cookie

The "Meme launchpad battle" between Pump.fun and Letsbonk.fun has now lasted a month since early July. During this time, we've witnessed Pump.fun complete one of the largest ICOs in cryptocurrency history, as well as observed Letsbonk.fun aggressively challenging Pump.fun's market share and successfully gaining dominance. Meanwhile, some "new players" have entered the arena—though they haven't caused major waves in the short term, they still deserve our attention and understanding.

Let’s start with this data chart from Jupiter.

Although Letsbonk.fun continues to lead in market share over the past 7 days, the current hotspots within its ecosystem and that of Pump.fun are moving in completely different directions.

Pump.fun: Is PVE market returning?

On July 24, after completing a live interview with threadguy, Pump.fun and its founder @a1lon9 entered nearly two weeks of silence. At the time, many viewed the livestream as a "public relations disaster," as it significantly impacted the token price—$PUMP dropped nearly 15% during the broadcast and around 20% for the day, briefly falling below a $3 billion market cap.

Since the end of that stream, Pump.fun hasn’t notably narrowed the market share gap with Letsbonk.fun. However, starting from July 30, public sentiment toward Pump.fun has seen a significant turnaround.

The reason? The community tokens within Pump.fun's ecosystem have performed remarkably well during a period of broader market instability.

The image above, posted by Pump.fun’s official Twitter on July 23, features Meme coins widely regarded as “officially curated.” Among them, $TROLL stands out—since July 25, it has surged up to 9x, surpassing a $100 million market cap. In the same period, $Tokabu rose approximately 5x, briefly exceeding $35 million in market cap. $USDUC increased 2x, peaking near $40 million. $CHILLHOUSE and $neet achieved gains similar to $USDUC, briefly approaching $30 million and $18 million in market cap, respectively.

All newer entries since July 25 have been on an upward trajectory, while only "streamer coins" and larger-market-cap, long-established tokens like $FWOG and $michi (over 300 days old) failed to participate in this rally.

Are there any clear catalysts for these "new coins"? Not really—the silence from Pump.fun and alon only ended two days ago. If anything, narratively speaking, these new projects maintained strong content output and community activity even during Pump.fun’s lowest point, aligning well with Pump.fun’s vision of sustainable, long-term Meme coin development.

We only learned about Pump.fun’s official countermove two days ago—the $PUMP buyback dashboard.

“Over the past 6 days, we’ve repurchased approximately $PUMP worth 8,740 SOL, equivalent to 102% of our revenue during this period.”

In the early hours today, Pump.fun updated its profile banner once again, promoting its “officially curated” Meme coins:

Interestingly, following the July 24 livestream, nearly all Meme coins purchased by Pump.fun’s founder were initially in loss. Now, all his holdings have turned profitable—with substantial gains:

For the Meme coin market to recover, the first step is to “put clothes back on”—that is, restore confidence among investors. People need to believe that Meme coins aren’t just about schemes; strong narratives, quality content, vibrant communities, and consistent operations can ultimately elevate a Meme coin. While we must continue monitoring the performance of these tokens on Pump.fun, it’s fair to say that if this trend holds, it’s a positive beginning.

Looking ahead, Pump.fun still has many moves left—such as potential airdrops and future livestreams. This is just the first step on a long journey. With major exchanges like Binance and OKX largely ceasing listings of new Solana Meme coins, Pump.fun must explore more possibilities.

The revolution isn’t over yet—comrades must keep striving.

Letsbonk.fun: A home for new coins hitting a short-term bottleneck

Over the past 7 days, Letsbonk.fun’s market share remains above 50%, holding its top position. The recent resurgence in Pump.fun’s momentum was mainly driven by strong performances from “second-tier new coins,” without generating much buzz around truly “new” launches.

In contrast, recent “hot plays” like $Ani emerged on Letsbonk.fun. The path to success that Pump.fun once pioneered is now being occupied by Letsbonk.fun.

However, recently, the larger-cap tokens on Letsbonk.fun have entered correction phases. $USELESS pulled back from a high of $400 million to around $200 million in market cap. $Memecoin dropped from nearly $60 million to around $11 million. $Bluechip fell from $17 million to $1.5 million. $Ani declined from a peak of $86 million to approximately $30 million.

$$BONK and $$GP also dropped 36% and 63% from their highs, respectively.

Despite underperforming assets, Letsbonk.fun has not stopped its buybacks or support for its ecosystem’s Meme coins. Rather than framing this as an ongoing war between Letsbonk.fun and Pump.fun, it’s more accurate to say both platforms are independently striving forward. Only when overall market confidence in Meme coins recovers will both have brighter futures.

Peace and love—looking forward to what comes next from Letsbonk.fun.

Bags and Moonit: Old platforms, new tactics

Bags originally started as a social trading app and launched its token launchpad feature on May 22. Moonit is Helio’s platform, launched at the end of April this year.

Recently, Bags gained attention through its “donation narrative.” $CANCER donates 100% of its transaction fee revenue to Susan G. Komen, one of the world’s most renowned and influential breast cancer charities. It has already donated $35,000 to the organization and transferred approximately 2.2% of its $CANCER tokens.

Since tokens launched on Bags can directly assign creator fee earnings to a specific Twitter account, another notable token, $WINRAR, assigned its earnings directly to the official WinRAR Twitter account—the popular compression software used by millions. This attracted a reply from WinRAR’s official account.

However, both tokens quickly faded and are now essentially down after their initial spikes. As for Bags’ flagship token, judging by attention and market cap, it’s hard to identify a clear leader on the platform at the moment.

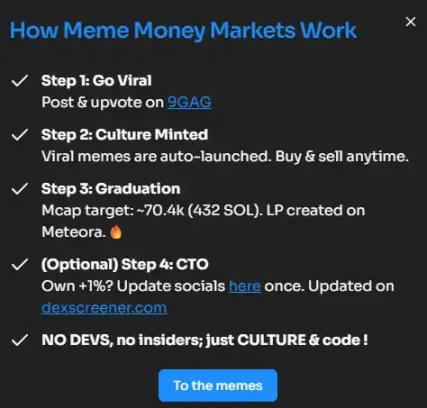

Moonit’s approach is far more ambitious. They’ve launched an AI protocol co-developed by 9GAG, Memeland, Helio Pay, MoonPay, and Dexscreener, capable of automatically tokenizing internet culture and viral memes.

In simple terms, the protocol uses AI to detect trending memes on 9GAG and automatically mints tokens—essentially “automatically launching officially curated hot picks from 9GAG.” The key advantage here is integration with 9GAG. If other platforms could similarly integrate TikTok, Instagram, or Twitter, they could replicate this model.

However, several challenges remain before this model proves viable. First, “technology does not equal liquidity.” There are countless developers across the chain, and if a meme goes viral, everyone will rush to mint it. Whether such tokens gain consensus will still depend heavily on the platform’s liquidity.

Second is sustainability. It would be compelling if 9GAG’s community could be effectively brought onto the token. But as seen in the diagram’s Step 4 involving the CTO, relying on executive involvement suggests weak community foundations—undermining the very advantage this model aims to create.

So far, Moonit’s new feature hasn’t produced a breakout leader either.

With more and more platforms emerging, the core problems remain unchanged.

Conclusion

The Meme launchpad battle will undoubtedly continue in the foreseeable future. Pump.fun’s massive success over the past year has made everyone want a piece of the action. Yet all platforms face the same critical challenge—how to rekindle market interest and trust in Meme coins?

When CEXs seem uninterested in listing new Meme coins, can on-chain infrastructure and liquidity evolve enough to make Meme coins great again?

Rather than calling this a “war,” it’s more accurate to view it as a shared test facing all Meme launchpads. After all, the case of inscriptions serves as a cautionary tale—inscription tools kept improving, but the hype never returned.

Hopefully, in the end, the entire Meme coin market—and all crypto enthusiasts who still love Meme coins—will benefit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News