FUD One-Two Punch Can't Shake Bull Market Foundation: With Fed Rate Cuts Countdown Underway, Has Crypto Market Reached Its Golden Bottom?

TechFlow Selected TechFlow Selected

FUD One-Two Punch Can't Shake Bull Market Foundation: With Fed Rate Cuts Countdown Underway, Has Crypto Market Reached Its Golden Bottom?

One callback triggers resonance among all variables.

Author: TRACER

Translation: Ethan, Odaily

Editor's Note: August began with intense volatility in the crypto market: Bitcoin weakened sharply, altcoins broadly corrected 20%-30%, and over $1.5 billion in positions were liquidated in a single day. Trump has been widely blamed for this turmoil. From new tariff policies and escalating geopolitical tensions to reversing macro data and the Fed holding steady, the market is once again shrouded in FUD. Meanwhile, rumors that "Trump secretly sold off crypto assets" have further intensified market panic, triggering a fresh chain reaction. In this article, the author analyzes macroeconomic data and capital flows to present a view contrary to mainstream sentiment: the short-term correction may be an opportunity for long-term positioning, and the true "second wave bull market" may already be brewing.

Note: The views expressed in this article are explicitly opinionated and not investment advice. Odaily reminds readers to rationally reference the analysis and make cautious decisions based on their own circumstances.

Original Content

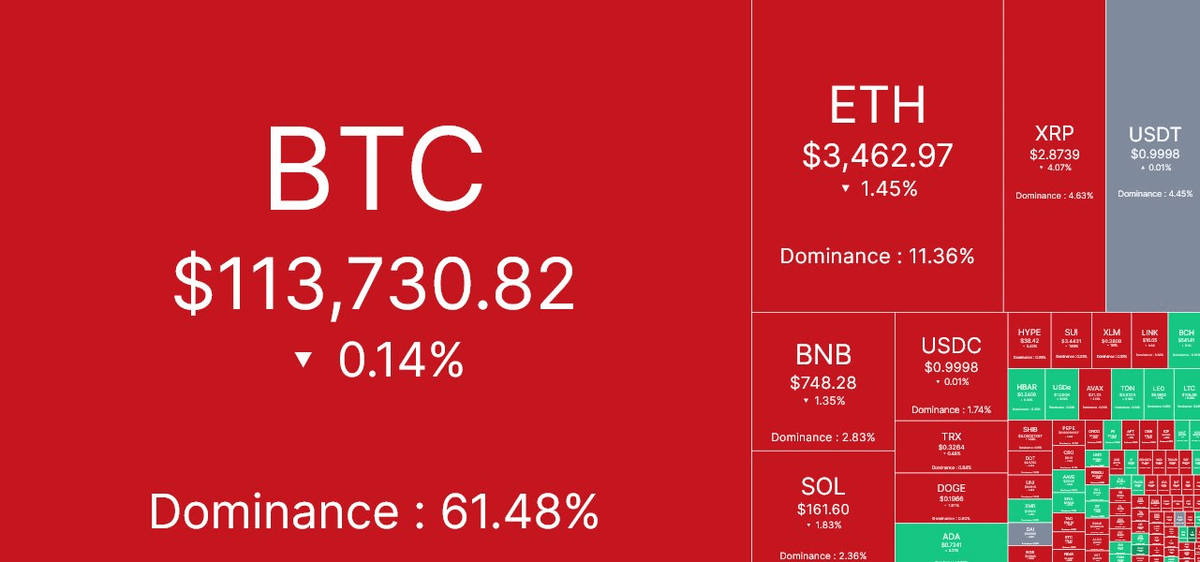

Market optimism has faded, adjustment has quietly arrived, Bitcoin pulled back 9% from its all-time high, and altcoins generally corrected 20%-30%.

In early August, the market suddenly faced strong selling pressure, with over $1.5 billion in liquidations in a single day. The core questions are: Is the trigger behind this downturn severe? And how should we respond?

The key catalyst for this correction lies in recent actions by U.S. President Trump:

-

New tariff policy proposals;

-

Escalating geopolitical uncertainty;

-

Conflicting macroeconomic data.

First, focus on the exhausting "new tariff proposal." Over 66 countries have been placed on a potential tariff list—same old playbook. Each time it feels like a rerun of an old script, even giving the impression of "market manipulation."

However, it's clear the U.S. government won't risk economic recession solely over these tariffs.

We've seen such market corrections triggered by similar moves many times before. Retail investors often treat such news as major bearish signals and overreact.

How many times have similar tariff threats been announced? And how many times has the market gone on to hit new highs afterward?

Therefore, there's no need to worry excessively—this is nothing new.

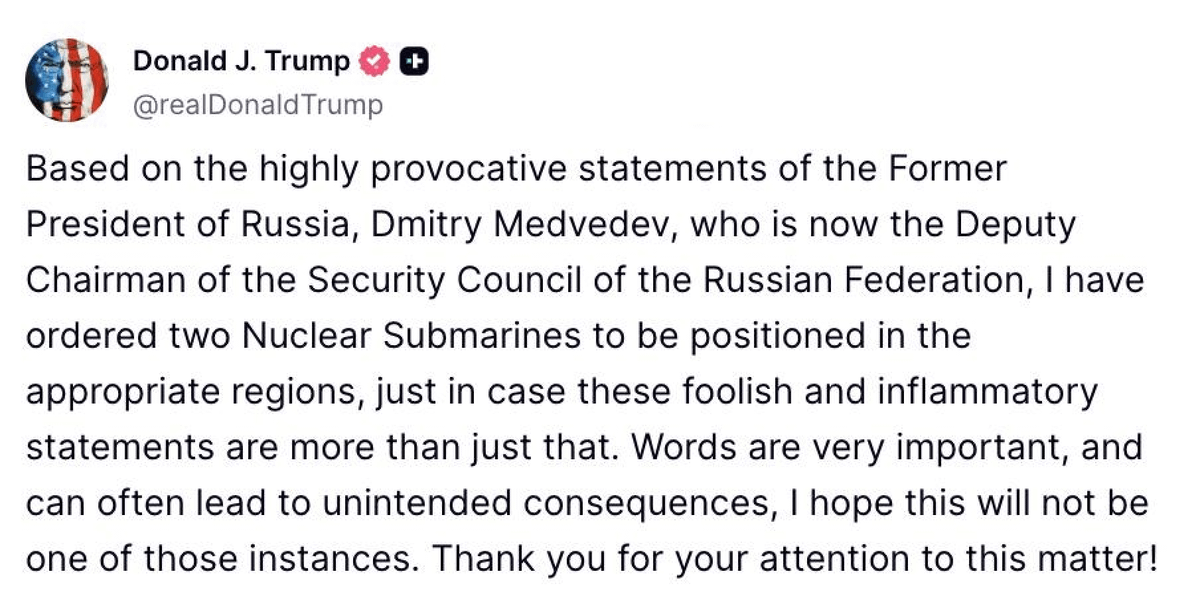

Besides tariffs, rising geopolitical risks recently have also increased anxiety. The trigger: the U.S. announced the deployment of two nuclear submarines near Russia. Is this concerning? Indeed.

But let’s think calmly: does anyone truly believe a nuclear war will break out in 2025? This is more likely a "pressure tactic" intended to push negotiations forward.

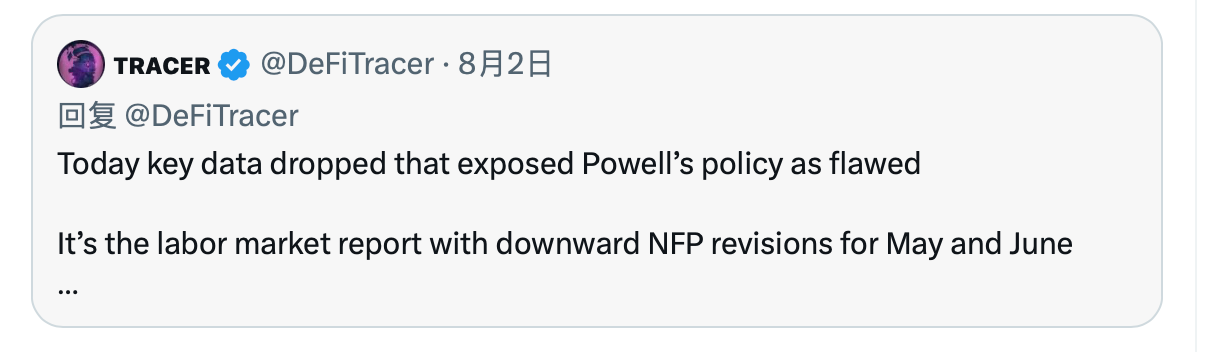

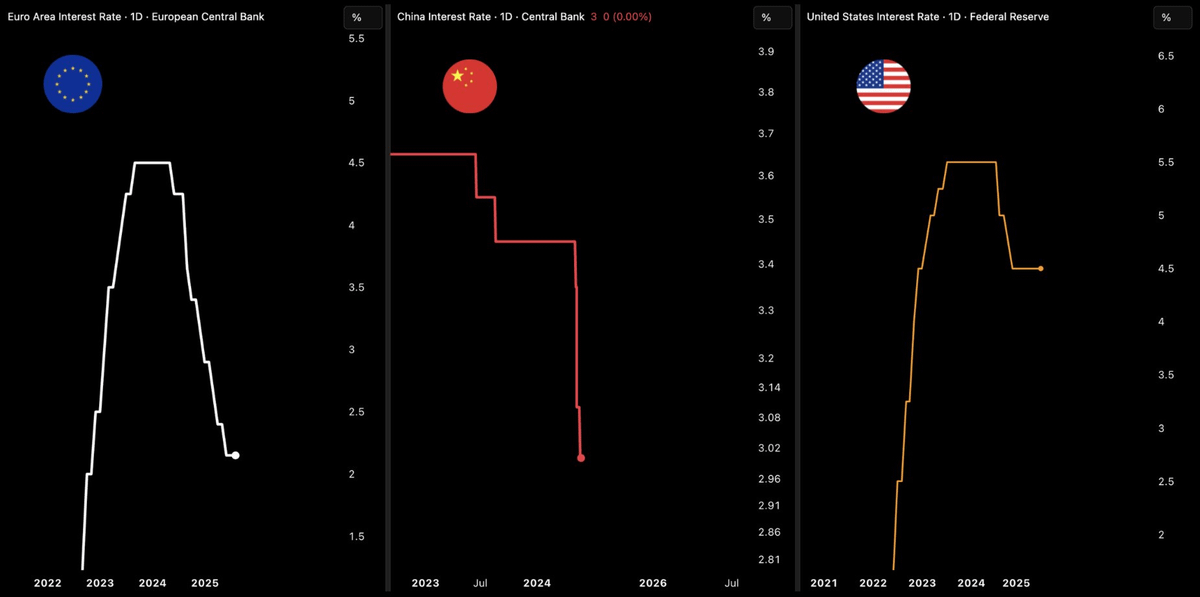

Yet what really troubles U.S. economic policymakers (like the Fed) is the messy macro data from the labor market.

The market's earlier bet on a "Fed policy pivot" (rate cuts) has failed to materialize.

More critically, non-farm payroll (NFP) data for May-June was revised down nearly tenfold, severely undermining confidence in the reliability of overall macro data.

Ultimately, multiple factors combined into a powerful one-two punch:

Interest rates remain high;

Signs of economic cooling are increasing.

These overlapping factors led to a significant shrinkage in institutional investor demand this week. Bitcoin spot ETFs recorded net outflows for the first time.

So, what is my outlook for the market?

My current view is based on the understanding that macro pressures continue to accumulate. At present, no major economy can generate enough credit growth to sustain GDP expansion.

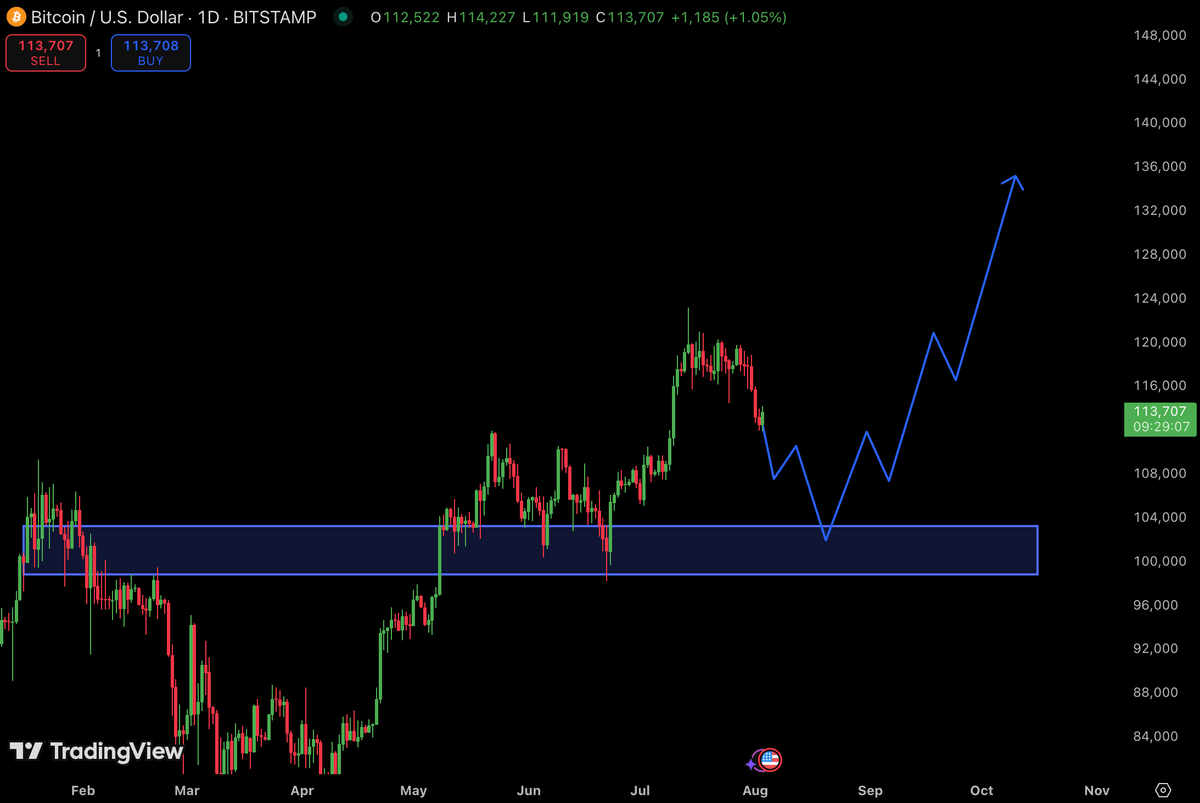

I’ve set key support levels at: Bitcoin $110,000, Ethereum $3,200.

I expect that by September, the Fed will have no choice but to begin rate cuts to re-stimulate the market:

-

Inflation data has dropped significantly;

-

The job market is under pressure;

-

It seems Powell intends to delay rate-cut decisions.

As that moment approaches, the market is likely to resume an upward trend.

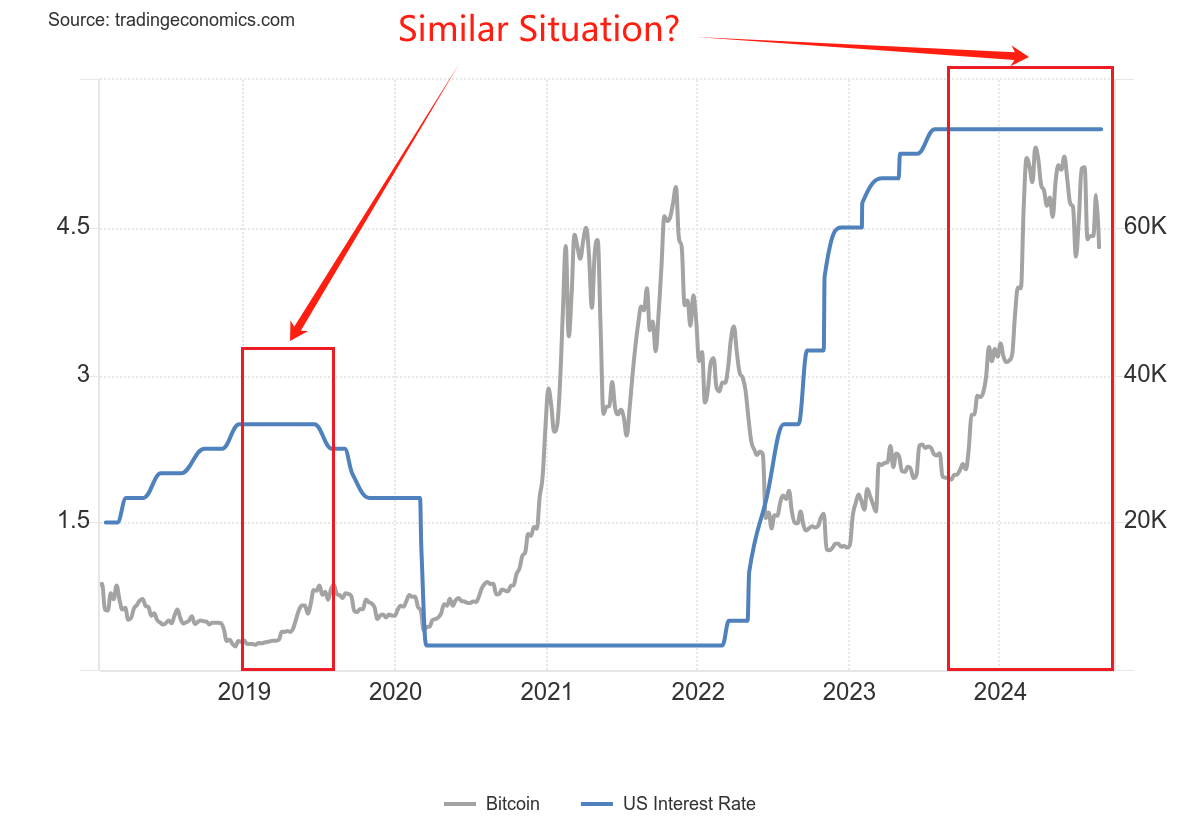

Historical patterns show that after every similar bout of FUD (fear, uncertainty, doubt), the market rebounds strongly.

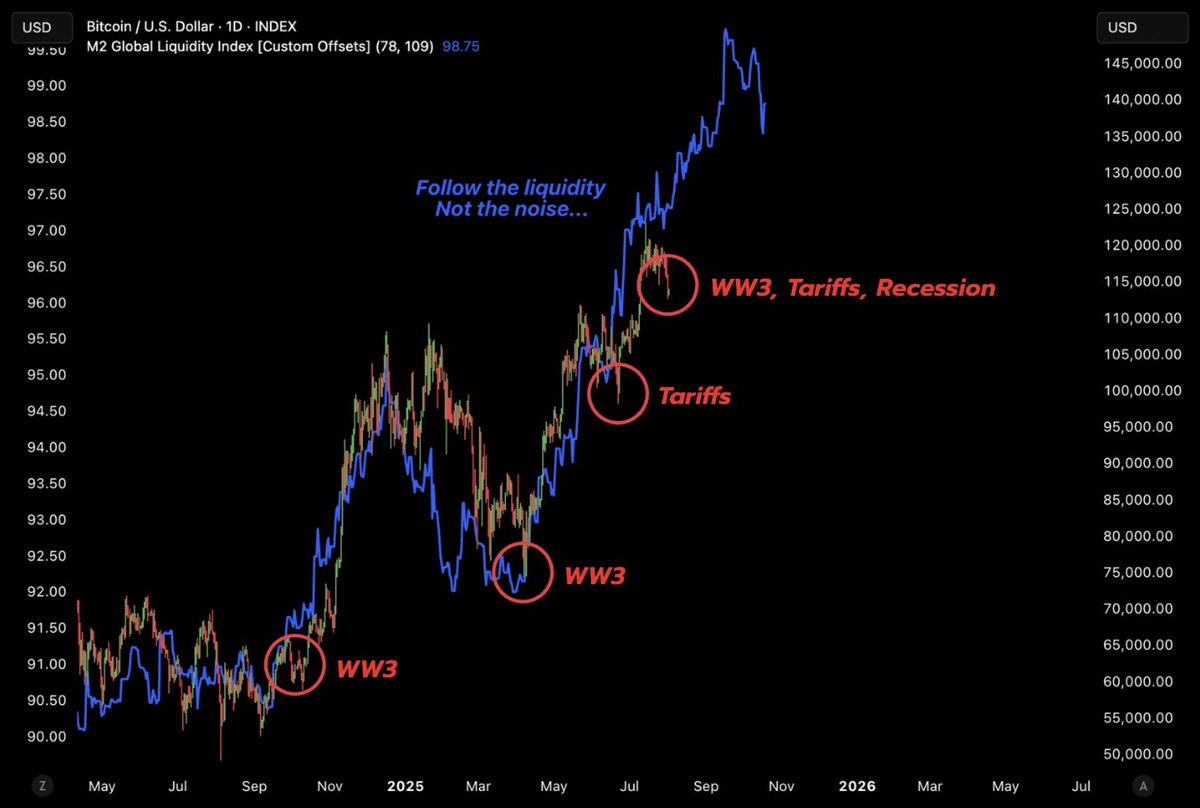

Referencing the chart linking M2 money supply to Bitcoin price, the conclusion is clear: market trends follow liquidity, and the global liquidity environment remains broadly loosening.

Thus, the current volatility is essentially a global market game fueled by叠加ed FUD.

Looking ahead to autumn, as the rate-cut cycle begins, I expect substantial capital inflows to return, launching the real "altcoin season."

That will be the critical window for actively locking in profits.

This is precisely my current strategy.

During this correction, I am continuously accumulating three types of assets: BTC, SOL, and ETH.

I’m particularly bullish on ETH’s technological potential and fundamentals, and I’ve noticed growing institutional interest. On August 3, a wallet linked to Shraplink added another $36 million worth of ETH—a telling example.

In summary, the strategy is clear: treat current volatility as an opportunity to build positions.

The market landscape is evolving, and such low-entry buying opportunities may not last long. Now is the ideal time to gradually establish positions, stock up on chips, and await the rally from October to December.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News