RWA milestone: Figure, the first RWA stock token, to launch上市

TechFlow Selected TechFlow Selected

RWA milestone: Figure, the first RWA stock token, to launch上市

Stablecoin + RWA + top-tier funding lineup.

Author: kkk

On August 5, the U.S. crypto capital market welcomed a special "newcomer"—Figure Technology Solutions (FTS). This fintech company, founded by Mike Cagney, co-founder and former CEO of SoFi, has filed an S-1 form with the U.S. Securities and Exchange Commission (SEC), officially launching its IPO process. Unlike traditional financial institutions that follow conventional models, Figure was built from the ground up on blockchain technology, redefining financial paradigms for mortgage and crypto-backed lending.

Mike Cagney once led SoFi to create a sensation in the internet finance space. Now, he aims to use blockchain to disrupt the core business models upon which legacy banks depend. He stated, “The funding validates our vision of redefining capital markets using blockchain technology, and we’re already realizing tangible benefits by adopting blockchain across our lending and capital markets operations.”

Starting with Mortgages: The Largest Non-Bank HELOC Provider in the U.S.

In the mortgage market, Figure directly targets traditional banks’ weaknesses with speed and transparency. In the past, applying for a HELOC loan could take weeks or even months, but on Figure’s platform, users can complete a fully online application and get approved in as little as five minutes, with funds disbursed within five days.

To date, Figure has helped over 200,000 households unlock $16 billion in home equity, rising to become one of the largest non-bank HELOC providers in the United States. More notably, this achievement isn’t due to loosened underwriting standards, but rather stems from Figure’s proprietary Provenance blockchain—a public, PoS blockchain built on Cosmos SDK that supports instant finality, irreversible confirmations, and ensures secure, transparent loan settlements.

Provenance not only creates standardized, tamper-proof on-chain records for every loan but also seamlessly integrates with Figure Connect—a native private capital market platform on-chain. Through it, lenders and investors can match, price, and settle transactions on-chain, reducing processes that traditionally took months down to just days, effectively redefining the efficiency of private credit circulation.

Crypto-Backed Lending: Achieving Both HODLing and Liquidity

If HELOC established Figure’s foothold in traditional mortgage markets, then crypto-backed lending is how it makes its move in the digital asset arena.

Under this service, customers can use Bitcoin (BTC) or Ethereum (ETH) as collateral to borrow cash at up to 75% LTV (loan-to-value), with interest rates as low as 8.91% (at 50% LTV), all without requiring a credit score.

All collateral assets are stored in decentralized, isolated multi-party computation (MPC) custody wallets. Customers can directly view the on-chain addresses to ensure their funds are never misappropriated. This means users can confidently continue holding their BTC or ETH while borrowing against them, using the cash for debt repayment, home purchases, renovations—or even to buy more crypto.

This design is especially popular during bull markets—investors can unlock liquidity without selling assets, preserving upside potential; during bear markets, it allows access to emergency funds, avoiding forced liquidations.

Engaging Deeply with Crypto: Dual Engine of RWA and Stablecoins

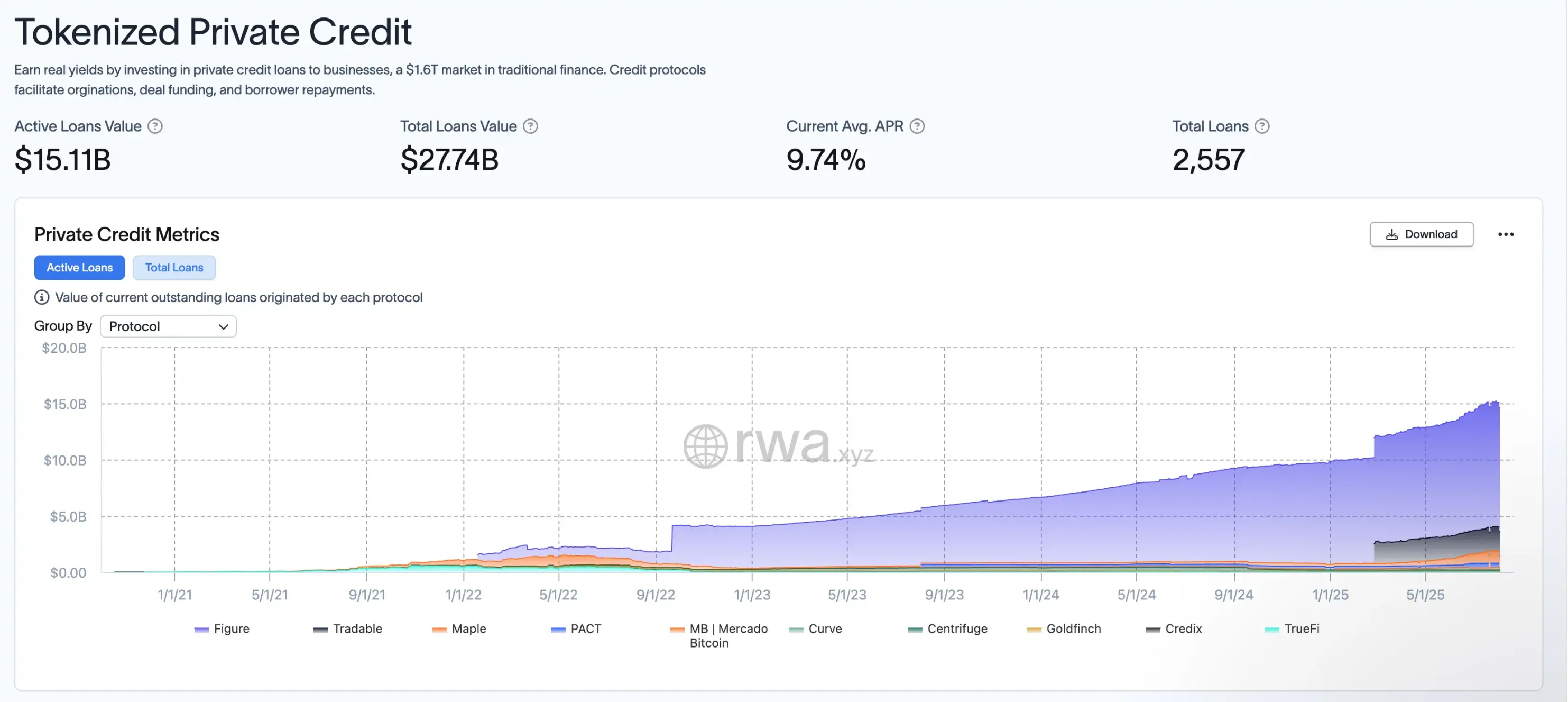

Figure’s ambitions extend far beyond mortgages and crypto loans. Leveraging the underlying Provenance blockchain technology, Figure has originated $13 billion in loans within the tokenized private credit market, which totals $27.74 billion. Of these, $11 billion in loans remain active, achieving an impressive utilization rate of over 84%. According to rwa.xyz, Figure ranks first in the private credit category. Whether mortgage assets or private credit, Figure digitizes and programmatically transforms them, enabling standardized issuance and trading on-chain. These on-chain assets are inherently compatible with decentralized finance (DeFi) protocols, allowing capital previously locked in traditional finance to circulate, be pledged, and reused globally—blurring the lines between TradFi and DeFi entirely.

Meanwhile, YLDS, the stablecoin launched by Figure Markets, has become the first interest-bearing stablecoin approved by the SEC. Pegged 1:1 to the U.S. dollar, it accrues interest based on SOFR minus 50 basis points, offering an annual yield of approximately 3.79%. YLDS is not only fully compliant but also delivers stable returns, supporting diverse use cases such as payments, cross-border settlements, and collateralized financing. This “RWA + stablecoin” combination enables Figure to capture growth in both real-world and digital asset markets, positioning it at the gateway to the next multi-trillion-dollar market.

Capital Strategy and IPO Preparation

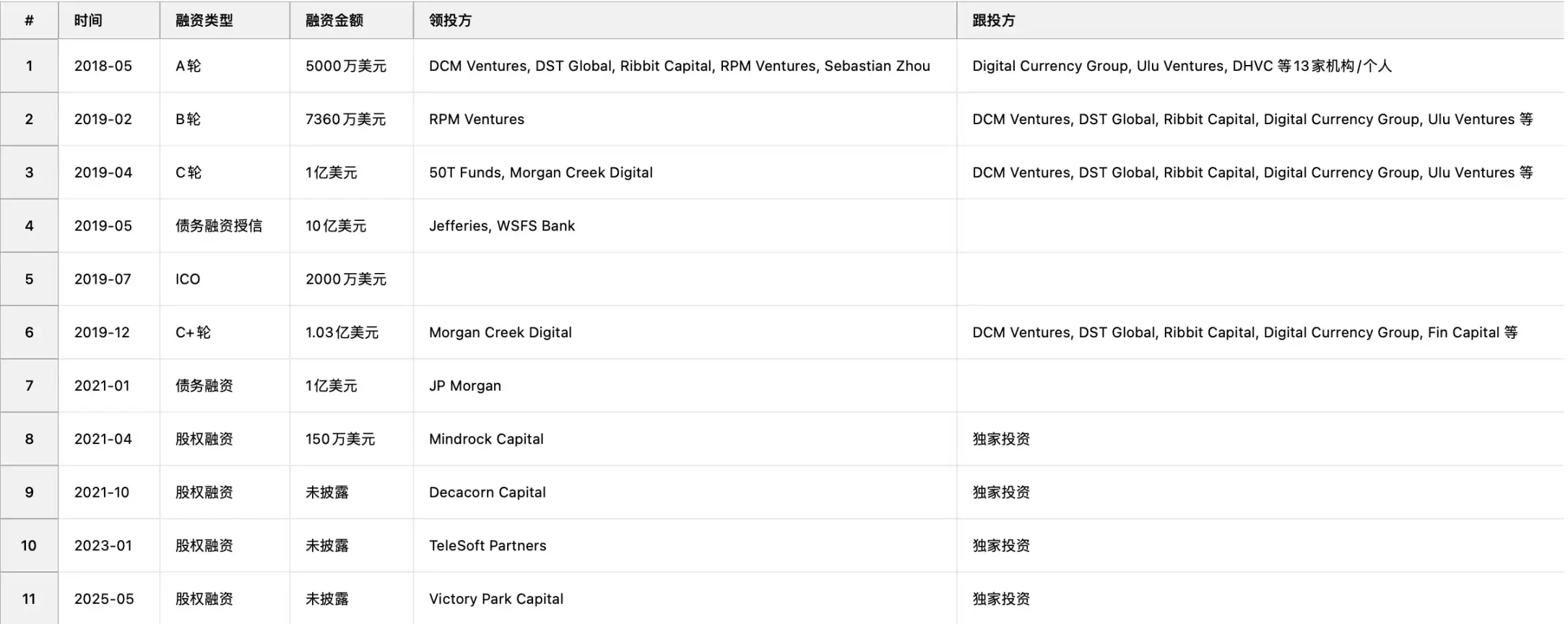

In just a few years, Figure has completed multiple funding rounds backed by prominent investors including DCM Ventures, DST Global, Ribbit Capital, and Morgan Creek Digital, along with billions of dollars in debt facilities from Jefferies and JPMorgan Chase. Market reports indicate that Goldman Sachs and JPMorgan Chase have joined the IPO underwriting syndicate.

Prior to this, Figure restructured internally, bringing its lending entity, Figure Lending LLC, under the Figure Technology Solutions brand, and assembling an executive team with extensive experience in regulation and corporate governance—to pave the way for a successful public listing.

Conclusion

The year 2025 may be remembered as the dawn of the crypto-equity era. From the sudden emergence of various “microstrategy-style altcoin plays,” to CRCL’s astonishing 10x surge within a month post-IPO, to top crypto firms like Kraken preparing to enter the fray, the convergence of capital markets and on-chain markets is entering uncharted territory.

Now, everyone is waiting for the true RWA whale—the entity capable of moving trillions in real-world assets onto the blockchain and reshaping market dynamics the way Bitcoin and Ethereum once did. Figure is racing full speed toward that position, and its next step might just become part of history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News