Strategy Entangled in Legal Troubles Again: Why Accounting Standards Cause Major Issues?

TechFlow Selected TechFlow Selected

Strategy Entangled in Legal Troubles Again: Why Accounting Standards Cause Major Issues?

Seeking legal liability from Strategy Company and certain of its senior executives for alleged securities fraud related to Bitcoin investment profit figures and accounting standards, and claiming compensation for investment losses incurred as a result.

Author: FinTax

1. Incident Overview

In early July 2025, the law firm Pomerantz filed a class-action lawsuit in the U.S. District Court for the Eastern District of Virginia on behalf of all individuals and entities that purchased or otherwise acquired securities of Strategy (formerly MicroStrategy, Nasdaq: MSTR) between April 30, 2024, and April 4, 2025. The complaint, brought under Section 10(b) and Section 20(a) of the Securities Exchange Act of 1934 and SEC Rule 10b-5, seeks to hold Strategy and certain of its senior executives legally accountable for alleged securities fraud related to misrepresentations concerning Bitcoin investment profits and accounting standards, and to recover resulting investment losses. As digital assets become an increasingly important component of corporate strategic asset allocation, this litigation may serve as a significant signal for regulators and market participants to reevaluate accounting and disclosure standards for crypto assets.

2. Strategy's Bitcoin Strategy

The well-known Strategy was originally a software company focused on enterprise-level business intelligence (BI), cloud-based services, and data analytics, long providing large corporate clients with data visualization, reporting, and decision support tools. Although its traditional software business enjoyed some recognition within the industry, growth had slowed, with relatively stable revenue and profit performance.

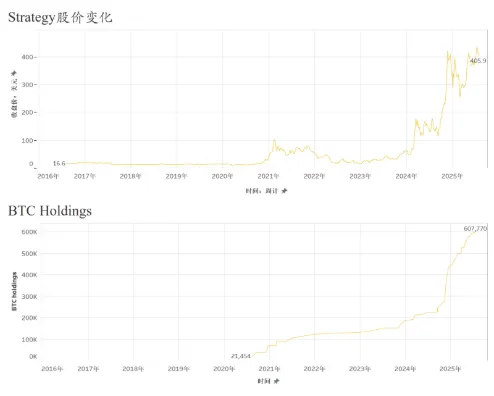

Starting in 2020, under the leadership of founder Michael Saylor, the company formally established a Bitcoin-centric asset allocation strategy, positioning Bitcoin as its primary reserve asset alternative to cash. This transformation marked Strategy’s shift toward deploying substantial capital into the Bitcoin market, continuously increasing its holdings through multiple financing rounds. The company not only used its own funds to purchase Bitcoin but also raised low-cost capital via convertible bonds, senior notes, and loans collateralized by Bitcoin, thereby amplifying its investment scale. Since then, Strategy has evolved into a leveraged Bitcoin financial firm rather than merely an enterprise software company.

The core of its Bitcoin strategy lies in long-term holding; Strategy has explicitly stated it will not actively sell its holdings, instead relying on Bitcoin’s long-term appreciation potential to increase total corporate assets and market capitalization. Since 2024, the company has continued buying during periods of significant Bitcoin price recovery, accelerating purchases especially after prices surpassed $60,000. In Q1 2024 alone, the company added over 12,000 Bitcoins, bringing its cumulative holdings to more than 200,000 by early 2025—further reinforcing its identity as a "Bitcoin-native" corporation and tightly linking its stock price to Bitcoin’s market movements, making it a notable alternative crypto asset vehicle in capital markets.

3. Key Allegations

The central allegations in the complaint are that Strategy and its executives issued false and/or misleading statements or failed to adequately disclose material information, primarily including: (1) exaggerating the expected profitability of its Bitcoin investment strategy and funding operations; (2) failing to sufficiently disclose risks associated with Bitcoin price volatility, particularly the potential for significant losses due to changes in fair value under the updated accounting standard (ASU 2023-08); therefore, (3) the company’s public statements were materially misleading at all relevant times.

Analytically, the core issues center on two aspects: first, false or misleading statements regarding the profitability of its Bitcoin investment strategy; second, failure to timely disclose the material impact of the new accounting standard and downplaying related risks.

On one hand, the lawsuit alleges that the company made false and misleading statements about the profitability of its Bitcoin investment strategy, violating federal securities laws. As a publicly traded company, Strategy has a duty to accurately reflect the actual financial contribution of its Bitcoin investments in its financial reports and public disclosures. However, it is accused of overstating the positive financial effects of Bitcoin in various external communications, obscuring the fact that its gains largely stem from unrealized paper profits driven by rising cryptocurrency prices rather than sustained earnings power from core operations. At the same time, the company may have used adjusted non-GAAP metrics or optimistic language to paint a favorable earnings outlook, masking the real financial pressures caused by crypto price volatility. Such conduct, if constituting material misrepresentation, could violate Section 10(b) of the Securities Exchange Act of 1934 and SEC Rule 10b-5.

On the other hand, Strategy is also accused of failing to timely and fully disclose financial data in accordance with the revised ASU 2023-08 accounting standard. In late 2023, the Financial Accounting Standards Board (FASB) formally adopted a new accounting treatment for digital assets, requiring companies to measure Bitcoin and other cryptocurrencies at fair value starting in fiscal years beginning after December 15, 2024 (i.e., the 2025 fiscal year), with changes in fair value reflected directly in the income statement. Early adoption is permitted.

The plaintiffs argue that combining both false statements and inadequate disclosure, Strategy failed to meet its legal obligations as a public company regarding information transparency during critical periods, thereby misleading investors and causing actual financial losses.

4. Key Provisions of ASU 2023-08 and Related Challenges

ASU 2023-08, issued by FASB in December 2023, marks a major shift in how digital assets are accounted for under U.S. GAAP. The standard applies to specific fungible digital assets and requires companies to measure them at fair value each reporting period, with changes in value recognized in current net income and separately disclosed in financial statements. It becomes effective for fiscal years beginning after December 15, 2024, and allows early adoption. The rule introduces more detailed disclosure requirements—including types, quantities, fair values, restrictions, and period-over-period changes of digital assets—enhancing financial statement transparency and consistency. In short, while ASU 2023-08 improves the quality of accounting information, it also places higher demands on corporate compliance capabilities and risk management practices.

Previously, FinTax conducted a dedicated analysis of ASU 2023-08. For crypto-focused enterprises, adopting ASU 2023-08 may lead to several impacts: increased financial statement transparency, simplified accounting processes, altered tax and capital structures, and heightened regulatory scrutiny of non-GAAP metrics. Prior to adopting ASU 2023-08, Strategy—which has Bitcoin investment at the core of its strategy—did not use fair value accounting but instead applied a cost-depreciation model, treating its large Bitcoin holdings as intangible assets. Under this model, Strategy only recognized impairment when prices declined and did not record upward revaluations unless the assets were sold. It was not until April 7, 2025, that the company disclosed in an SEC filing a $5.91 billion unrealized loss resulting from adopting the new standard, later explaining in its May quarterly earnings press release and conference call that the loss stemmed from valuation adjustments amid falling Bitcoin prices. As the plaintiffs contend, this delayed disclosure impaired investors’ ability during the class period to assess the company’s true financial condition and risk exposure, constituting a material omission.

5. Conclusion

Overall, the class-action lawsuit facing Strategy highlights the dual pressures public companies face in the rapidly evolving landscape of digital assets—particularly in terms of information disclosure and regulatory compliance.

On one hand, as companies integrate Bitcoin and other digital assets into their financial structures, their profitability, asset volatility, and financing models become highly dependent on market conditions. Any public statements that fail to fully reflect these real risks may easily trigger legal liability for omissions or misleading disclosures.

On the other hand, with the implementation of FASB’s new accounting standard adopted in late 2023, companies must now report digital assets at fair value in their financial statements and proactively assess the systemic implications of such changes on asset valuations, profit fluctuations, and disclosure obligations. Failure to timely and accurately explain the nature and scope of this accounting change may constitute a material misrepresentation of investor expectations.

Therefore, this case goes beyond individual liability—it may become a landmark example of how public companies navigate disclosure responsibilities and balance strategic messaging against compliance boundaries in the context of crypto accounting reform.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News