Huobi Growth Academy | Cryptocurrency Market Macro Research Report: "Crypto-Stock Strategy" Ignites Market Momentum, Ushering in a New Industry Cycle

TechFlow Selected TechFlow Selected

Huobi Growth Academy | Cryptocurrency Market Macro Research Report: "Crypto-Stock Strategy" Ignites Market Momentum, Ushering in a New Industry Cycle

The crypto-stock strategy is just the prologue; deeper capital integration and the evolution of governance models have only just begun.

1. Global Macro Variables Reshaping Asset Pricing Paths: Inflation, the Dollar, and a New Round of Capital Competition

In the second half of 2025, global financial markets entered a new era dominated by macro variables. Over the past decade, asset pricing was traditionally supported by three pillars: loose liquidity, global cooperation, and technological dividends. However, in this cycle, these conditions are undergoing systemic reversals, leading to a deep restructuring of capital market pricing logic. As a frontline reflection of global liquidity and risk appetite, crypto assets are now being driven by new variables in terms of price trends, capital structure, and asset weighting. The three most critical factors are the stickiness of structural inflation, the structural weakening of dollar credibility, and institutional fragmentation in global capital flows.

First, inflation is no longer a short-term volatility issue that can be quickly suppressed but has begun to exhibit stronger "sticky" characteristics. In advanced economies represented by the United States, core inflation remains persistently above 3%, far exceeding the Federal Reserve's 2% target midpoint. The root cause lies not simply in monetary expansion but in entrenched and self-reinforcing structural cost-push factors. Although energy prices have fallen back into a relatively stable range, surging capital expenditures driven by artificial intelligence and automation, rising upstream rare metal prices during the green energy transition, and increased labor costs due to manufacturing reshoring have all become endogenous sources of inflation. Moreover, at the end of July, the Trump team reaffirmed plans to fully reinstate high tariffs on bulk industrial and technology products from China, Mexico, Vietnam, and other countries starting August 1. This decision not only signals the continuation of geopolitical rivalry but also indicates that the U.S. government views inflation as an acceptable "strategic cost." Under this backdrop, American firms will face continuously rising raw material and intermediate product costs, triggering a second wave of consumer price increases—forming a "policy-driven cost inflation" regime. This is not traditional overheating-type inflation but rather policy-embedded inflation, whose persistence and impact on asset pricing will be significantly stronger than in 2022.

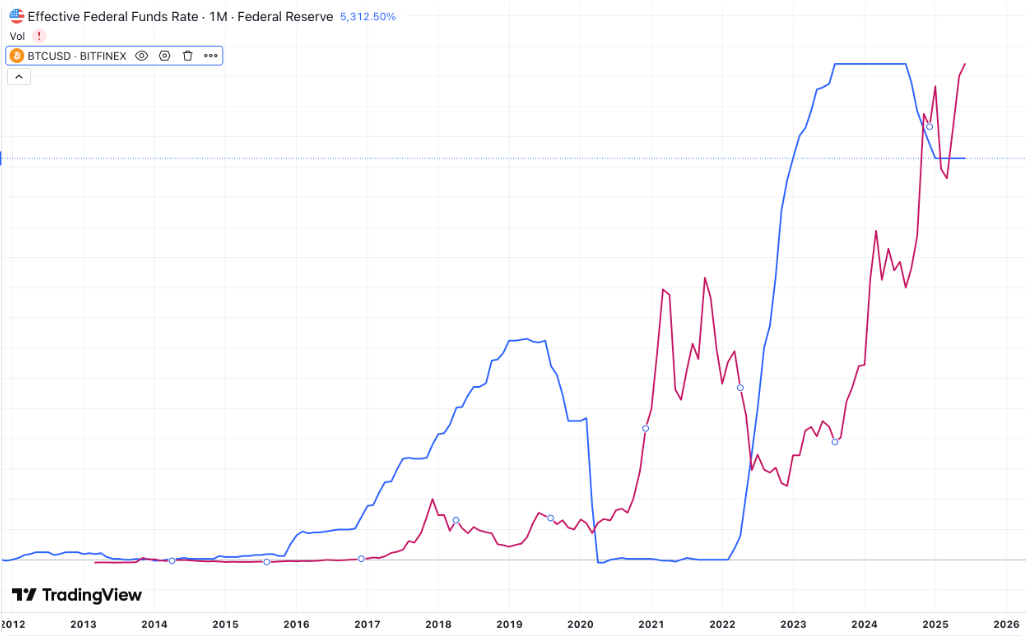

Second, with inflation still elevated, the Federal Reserve’s interest rate policy cannot loosen quickly. Markets now expect the federal funds rate to remain above 5% at least until mid-2026. This creates a "suppressive pricing" effect on traditional stock and bond markets: yield curves invert, long-duration instruments suffer severe losses, while equities face continuously rising discount rates in valuation models. In contrast, crypto assets—especially Bitcoin and Ethereum—are priced more through a combined model of "expected growth–scarcity–consensus anchor," which is not directly constrained by conventional interest rate tools. Instead, they attract greater capital attention during high-rate environments due to their scarcity and decentralization features, exhibiting "counter-cyclical" pricing behavior. This characteristic is gradually transforming Bitcoin from a "high-volatility speculative instrument" into an "emerging alternative value reserve asset."

More profoundly, the U.S. dollar’s anchoring role globally is facing structural erosion. U.S. fiscal deficits continue to expand, with the federal deficit surpassing $2.1 trillion in Q2 2025—an 18% year-on-year increase, setting a new historical record for the period. At the same time, America’s position as the world’s settlement hub is encountering decentralized challenges. Countries such as Saudi Arabia, the UAE, and India are aggressively advancing bilateral local currency settlement mechanisms, including RMB-AED and INR-Dinar cross-border payment systems, replacing parts of dollar-based settlements. Behind this trend is not only the cyclical damage caused by dollar policies to non-U.S. economies but also active attempts by these nations to decouple from a "single currency anchor." In this context, digital assets emerge as neutral, programmable, and de-sovereign alternatives for value transfer. For example, stablecoins like USDC and DAI are rapidly expanding in OTC trades and B2B cross-border payments across Asia and Africa, serving as digital extensions of an “underground dollar system” for emerging markets. Meanwhile, Bitcoin functions as a tool for capital flight and a safe haven against domestic currency depreciation. In Argentina, Nigeria, and Turkey, residents’ BTC purchase premiums have exceeded 15%, reflecting real demand for capital preservation.

Notably, as de-dollarization accelerates, the internal credit system of the dollar itself is showing signs of fatigue. In June 2025, both Moody’s and Fitch downgraded the outlook on the U.S. long-term sovereign credit rating to “negative,” citing “structurally irreversible long-term fiscal deficits” and “political polarization undermining budget execution.” These systemic warnings from rating agencies amplified volatility in the Treasury market, prompting safe-haven capital to seek diversified reserve forms. ETF purchases of gold and Bitcoin rose sharply during the same period, indicating institutional investors’ renewed preference for reallocating into non-sovereign assets. This behavior reflects not just liquidity needs but also a broader “valuation escape”—as valuations of U.S. stocks and bonds become increasingly stretched, global capital seeks alternative anchors to rebalance portfolio “systemic security.”

Finally, institutional differences in global capital flows are reshaping the boundaries of asset markets. Within traditional finance, tightening regulation, valuation bottlenecks, and rising compliance costs are limiting institutional capital expansion. In contrast, particularly due to ETF approvals and relaxed audit regimes, crypto assets are entering a phase of “regulatory legitimacy.” In the first half of 2025, several asset management firms received SEC approval to launch thematic ETFs covering SOL, ETH, and AI-sector crypto assets, allowing capital to flow indirectly onto blockchains and reshaping inter-asset capital allocation. This phenomenon underscores how institutional architecture is increasingly shaping capital behavior pathways.

Thus, we observe a clearer trend: changes in traditional macro variables—including institutionalized inflation, dulled dollar credibility, prolonged high interest rates, and policy-driven capital divergence—are collectively ushering in a new pricing era. In this era, value anchors, credit boundaries, and risk assessment mechanisms are being redefined. Crypto assets, especially Bitcoin and Ethereum, are transitioning from a phase of liquidity bubbles toward institutional value absorption, becoming direct beneficiaries of marginal restructuring within the macro-monetary system. This provides the foundation for understanding the “core logic” behind asset price movements in the coming years. For investors, updating cognitive frameworks is far more crucial than short-term market predictions; future asset allocation will reflect not merely risk appetite but also depth of understanding regarding institutional signals, monetary structures, and the global value system.

2. From MicroStrategy to Corporate Earnings: The Institutional Logic and Expansion Trend of Coin-Stock Strategies

In the 2025 cycle, one of the most structurally transformative forces in the crypto market stems from the rise of the “coin-stock strategy.” From MicroStrategy’s early experiment of holding Bitcoin as corporate treasury reserves to increasing numbers of public companies voluntarily disclosing their crypto asset holdings, this model has evolved beyond isolated financial decisions into an institutionally embedded strategic behavior. The coin-stock strategy not only bridges capital markets and on-chain assets but also spawns new paradigms in corporate reporting, equity pricing, financing structures, and even valuation logic. Its diffusion and capital effects have profoundly reshaped the funding architecture and pricing models of crypto assets.

Historically, MicroStrategy’s Bitcoin strategy was seen as a “high-stakes gamble” amid extreme volatility, especially between 2022 and 2023 when crypto prices plummeted, drawing significant skepticism about its stock performance. However, starting in 2024, as Bitcoin broke previous all-time highs, MicroStrategy successfully restructured its financing and valuation logic through a “coin-stock linkage” mechanism. This hinges on a triple flywheel dynamic: First, the “stock-coin resonance” mechanism—BTC holdings appreciate on the balance sheet, boosting reported crypto net asset value, thereby lifting share prices, which in turn lowers subsequent financing costs (via stock issuance or bonds). Second, the “equity-debt synergy” mechanism—raising diversified capital via convertible bonds and preferred shares while leveraging BTC’s market premium to reduce overall funding costs. Third, the “coin-debt arbitrage” mechanism—combining traditional fiat liabilities with crypto appreciation logic to enable cross-cycle capital transfers over time. After successful validation at MicroStrategy, this framework has been widely replicated and structurally adapted across capital markets.

By 2025, the coin-stock strategy has moved beyond experimental adoption by individual firms and become a financially strategic and accounting-advantaged structure spreading across broader public companies. According to incomplete statistics, by the end of July, over 35 listed companies globally had explicitly added Bitcoin to their balance sheets, with 13 also allocating ETH, and five making trial allocations to major altcoins such as SOL, AVAX, and FET. A shared feature of these structural allocations is building closed-loop financing through capital markets while enhancing book value and shareholder expectations via crypto holdings—creating a positive feedback loop that boosts valuations and equity expansion capacity.

The driving force behind this expansion is first institutional change. The July 2025 implementation of the GENIUS Act and CLARITY Act provided clear compliance pathways for public companies to hold crypto assets. Notably, the CLARITY Act’s certification mechanism for “mature blockchain systems” classified core cryptocurrencies like Bitcoin and Ethereum as commodities, removing them from SEC securities oversight. This grants legal legitimacy for companies to include these assets in financial statements—not as “financial derivatives” under risk categories, but as “digital commodities” recorded as long-term assets or cash equivalents, eligible in certain cases for depreciation or impairment accounting, thus reducing accounting volatility. This shift allows crypto assets to join gold and foreign exchange reserves within mainstream financial reporting.

Second, from a capital structure perspective, the coin-stock strategy offers unprecedented financing flexibility. Amid persistently high interest rates set by the Fed, traditional corporate financing remains expensive, especially for small and medium-sized growth firms seeking leveraged expansion. Companies holding crypto assets benefit from valuation premiums driven by stock appreciation, achieving higher price-to-sales and price-to-book ratios (PS and PB) in capital markets. They can also use crypto holdings as collateral for on-chain lending, derivative hedging, and cross-chain asset securitization—enabling a dual-track financing system: on-chain assets provide flexibility and yield, while off-chain capital markets offer scale and stability. This structure is particularly advantageous for Web3-native and fintech firms, granting them capital structure freedom far exceeding traditional routes under compliant frameworks.

Additionally, the coin-stock strategy has shifted investor behavior patterns. With widespread crypto holdings on corporate balance sheets, markets are re-pricing valuation models for these firms. Traditionally based on profitability, cash flow forecasts, and market share, valuations now increasingly correlate with cryptocurrency prices when large crypto positions appear on balance sheets. For instance, stocks like MicroStrategy, Coinbase, and Hut8 significantly outperformed sector averages during Bitcoin rallies, demonstrating strong “crypto exposure” premiums. Simultaneously, more hedge funds and structured products treat these “high-coin-weight” stocks as ETF substitutes or proxy vehicles for crypto exposure, increasing their allocation within traditional portfolios. Structurally, this accelerates the financialization of crypto assets, enabling Bitcoin and Ethereum to gain indirect circulation channels and derivative pricing roles within capital markets.

Furthermore, from a regulatory strategy standpoint, the spread of the coin-stock approach is viewed as an extension of U.S. efforts to maintain “dollar话语权” in the global financial order. Amid rising global CBDC pilots, expanding RMB cross-border settlement, and the European Central Bank testing digital euros, the U.S. government has refrained from launching a federal CBDC. Instead, it promotes a decentralized dollar network through stablecoin policies and the development of a “regulatable crypto market.” This strategy requires a compliant, high-frequency gateway with substantial inflow capacity. Publicly traded companies, acting as bridges between on-chain assets and traditional finance, fulfill this role perfectly. Thus, the coin-stock strategy can be interpreted as an institutional pillar supporting the U.S. financial strategy of using non-sovereign digital currencies to sustain dollar circulation. From this angle, corporate crypto allocation is not merely an accounting decision but a participation pathway within national-level financial restructuring.

A deeper implication lies in the global diffusion of capital structure innovation. As more U.S.-listed firms adopt the coin-stock model, enterprises in Asia-Pacific, Europe, and emerging markets are following suit, seeking regulatory space within regional frameworks. Singapore, the UAE, and Switzerland are actively revising securities laws, accounting standards, and tax regulations to open institutional channels for local firms to hold crypto assets—sparking a global race among capital markets to embrace digital assets. It is foreseeable that the institutionalization, standardization, and globalization of the coin-stock strategy will become a key evolution in corporate finance over the next three years, serving as a vital bridge between crypto and traditional finance.

In summary, from MicroStrategy’s singular breakthrough to strategic adoption across multiple listed firms and onward to formal institutional evolution, the coin-stock strategy has become a critical conduit linking on-chain value and traditional capital markets. It represents not only an update in asset allocation logic but also a reconstruction of corporate financing structures and a result of two-way博弈 between institutions and capital. Through this process, crypto assets have gained broader market acceptance and institutional safety margins, completing a structural leap from speculative instruments to strategic assets. For the entire crypto industry, the rise of the coin-stock strategy marks the beginning of a new cycle—one where crypto assets are no longer confined to on-chain experiments but have entered the core of global balance sheets.

3. Compliance Trends and Financial Structural Transformation: Accelerating the Institutionalization of Crypto Assets

In 2025, the global crypto market stands at a historic juncture of accelerated institutionalization. Over the past decade, the industry’s central axis has shifted from “innovation outpacing regulation” to “compliance frameworks driving growth.” In this cycle, regulators have evolved from mere “enforcers” into “institutional designers” and “market guides,” reflecting a renewed recognition of the structural influence of crypto assets within national governance. With the approval of Bitcoin ETFs, enactment of stablecoin legislation, initiation of accounting reforms, and transformation of risk and value assessment mechanisms in capital markets, compliance is no longer an external pressure on the industry but an endogenous driver of financial structural change. Crypto assets are progressively integrating into the institutional fabric of mainstream finance, completing a leap from “gray-zone financial innovation” to “compliant financial components.”

The core of this institutionalization trend is first evident in the clarification and gradual liberalization of regulatory frameworks. From late 2024 to mid-2025, the U.S. passed the CLARITY Act, GENIUS Act, and FIT for the 21st Century Act, providing unprecedented clarity on commodity classification, token issuance exemptions, stablecoin custody requirements, KYC/AML details, and applicable accounting boundaries. Most impactful is the “commodity classification” regime, which treats foundational public chain assets like Bitcoin and Ethereum as tradable commodities, explicitly exempting them from securities regulation. This designation not only lays the legal groundwork for ETFs and spot markets but also creates a clear compliance path for institutions—including funds, banks, and corporations—to incorporate crypto assets. Establishing this “legal label” is the first step in institutionalization and serves as a foundation for subsequent tax treatment, custody standards, and financial product design.

Meanwhile, major global financial centers are competing to implement localized institutional reforms, shifting from “regulatory havens” to “regulatory leaders.” Singapore’s MAS and Hong Kong’s HKMA have introduced multi-tier licensing systems, bringing exchanges, custodians, brokers, market makers, and asset managers into differentiated regulatory frameworks, clearly defining entry thresholds for institutions. Abu Dhabi, Switzerland, and the UK are piloting on-chain securities, digital bonds, and composable financial products at the capital market level, evolving crypto assets beyond mere asset classes into foundational elements of financial infrastructure. These “policy testbeds” preserve innovation vitality while advancing the digital transformation of global financial governance, offering traditional finance new paths for institutional upgrades and collaborative development.

Driven by institutional progress, the internal logic of financial structures is undergoing profound shifts. First is asset class restructuring: the share of crypto assets in large asset managers’ portfolios continues to grow—from less than 0.3% of global institutional allocations in 2022 to over 1.2% in 2025, projected to exceed 3% by 2026. Though seemingly modest, this marginal flow within multi-trillion-dollar asset pools is sufficient to reshape the liquidity and stability landscape of the entire crypto market. Firms like BlackRock, Fidelity, and Blackstone have not only launched BTC and ETH ETFs but also integrated crypto into core investment baskets through proprietary funds, FOFs, and structured notes, establishing their roles as both risk hedging tools and growth engines.

Second is the standardization and diversification of financial products. Previously limited to spot and perpetual contracts, crypto trading is now spawning a variety of instruments embedded within traditional financial structures due to regulatory momentum. Examples include volatility-protected crypto ETFs, bond-like products tied to stablecoin yields, ESG indices driven by on-chain data, and on-chain securitized funds with real-time settlement capabilities. These innovations enhance risk management for crypto assets and lower institutional entry barriers through standardized packaging, enabling traditional capital to effectively participate in on-chain markets via compliant channels.

The third layer of financial transformation involves clearing and custody models. Starting in 2025, the U.S. SEC and CFTC jointly recognized three “compliant on-chain custodians,” formally establishing a bridge between on-chain asset ownership, custody responsibilities, and legal accounting entities. Compared to earlier models relying on centralized exchange wallets or cold storage, these compliant on-chain custodians use verifiable on-chain technology to ensure tiered asset ownership, segregated transaction permissions, and embedded risk controls—offering institutional investors risk management capabilities comparable to traditional trust banks. This foundational shift in custody infrastructure is a critical component of institutionalization, determining whether on-chain finance can truly support complex operations such as cross-border settlement, collateralized lending, and contract fulfillment.

More importantly, the institutionalization of crypto assets is not merely a case of regulation adapting to markets but also a sovereign effort to integrate digital assets into macro-financial governance. With stablecoin daily trading volumes exceeding $3 trillion and beginning to serve real payment and clearing functions in some emerging markets, central banks’ attitudes toward crypto assets have grown increasingly nuanced. On one hand, central banks push forward CBDC development to strengthen domestic monetary sovereignty; on the other, they adopt an “open management” approach toward certain compliant stablecoins (e.g., USDC, PYUSD), applying “neutral custody + strict KYC” rules that effectively allow them to perform international settlement and clearing functions within regulated boundaries. This shift means stablecoins are no longer adversaries to central banks but potential institutional containers within the reconstruction of the international monetary system.

This structural evolution ultimately manifests in the “institutional boundary” of crypto assets. The 2025 market no longer operates under a discontinuous logic of “crypto circle → chain circle → outside,” but is forming three continuous layers: “on-chain assets → compliant assets → financial assets.” Each layer is connected through channels and mapping mechanisms, meaning every type of asset can enter mainstream finance via specific institutional pathways. Bitcoin transitions from native on-chain asset to ETF underlying; Ethereum evolves from smart contract platform asset to universal computing financial protocol token; even governance tokens from certain DeFi protocols enter FOF fund pools as hedging instruments after structured packaging. This flexible evolution of institutional boundaries makes the definition of “financial asset” genuinely trans-chain, trans-national, and trans-systemic for the first time.

From a broader perspective, the essence of crypto institutionalization is the global financial system’s adaptive response and evolution amid the digital wave. Unlike the 20th century’s “Bretton Woods system” or “petrodollar system,” 21st-century finance is reconstructing the foundations of resource flows and capital pricing in a more distributed, modular, and transparent manner. As a pivotal variable in this evolution, crypto assets are no longer outliers but digitally manageable, auditable, and taxable resources. This institutional journey is not defined by sudden policy shifts but by a systemic evolution shaped through coordinated interaction among regulators, markets, enterprises, and technology.

Therefore, it is foreseeable that the institutionalization of crypto assets will deepen further. Over the next three years, three coexisting models will emerge across major economies: one led by the U.S.—a “market-open + prudent regulation” model centered on ETFs, stablecoins, and DAO governance; another represented by China, Japan, and South Korea—a “restricted access + policy guidance” model emphasizing central bank control and permissioned mechanisms; and a third exemplified by Singapore, the UAE, and Switzerland—the “financial intermediary试验区” model, serving as institutional intermediaries between global capital and on-chain assets. The future of crypto assets will no longer be defined by technology resisting institutions but by institutions reorganizing and absorbing technology.

4. Final Thoughts: From Ten Years of Bitcoin to Coin-Stock Linkage, Welcoming a New Crypto Paradigm

July 2025 marks Ethereum’s tenth anniversary, symbolizing the maturation of the crypto market from early experimentation to institutional legitimacy. The broad rollout of coin-stock strategies signifies the deep integration of traditional finance and crypto assets.

This cycle is not merely another market upswing but a structural and logical reconstruction—from macro monetary systems to corporate treasuries, from crypto infrastructure to financial governance models—marking the first true entry of crypto assets into institutional asset allocation.

We believe that over the next 2–3 years, the crypto market will evolve into a ternary structure: “on-chain native yield + compliant financial interfaces + stablecoin-driven demand.” The coin-stock strategy is only the beginning; deeper capital integration and governance model evolution have just started.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News