My Eight Years with Ethereum

TechFlow Selected TechFlow Selected

My Eight Years with Ethereum

From a cellular perspective, I am no longer who I once was, but Ethereum remains Ethereum.

Author: Todd

First of all, happy 10th birthday to Ethereum!

It has been exactly eight years since I registered my first Ethereum wallet.

There's an old saying that every seven years, the human body undergoes a large-scale cellular renewal and replacement.

Indeed, from a cellular perspective, I am no longer the same person I once was.

But Ethereum remains Ethereum.

My earliest Ethereum wallet still exists, and even the small amount of leftover funds in it have grown tenfold right where they were left.

Back then, I was writing at home about Ethereum;

Now, it’s hard to imagine—I’m still sitting in the same spot, writing about Ethereum.

Let me start with myself.

As everyone knows, I'm a loyal supporter of Bitcoin, but I wouldn't call myself a BTC maxi (which roughly translates to an obsessive fan. I'm not that kind of fan). I also like Ethereum, BNB, and Solana, and enjoy studying them.

My first Ethereum wallet wasn’t MetaMask—it was an ancient one called MyEtherWallet. It was so primitive that each time I logged in, I had to upload a file called keystore, then enter a password to unlock it before I could use it.

The reason I wanted to register an Ethereum wallet was because I wanted to buy a CryptoKitty back then.

At the time, two cats could breed offspring, some cats had rare traits, and each cat reproduced at different speeds—leading to endless generations for people to speculate on.

My first use of MetaMask dates back to 2020, when I participated in trading AMPL, the pioneer algorithmic stablecoin. Its feature was that if the price rose above $1, it would mint new tokens for everyone; if it dropped below $1, it would burn tokens from everyone’s balance, thus regulating supply and demand to maintain stability.

These two wallets actually represent two different eras. In fact, I broadly divide Ethereum into four eras:

-

Era 0 (2015–2016): The Birth of Ethereum

-

Era 1 (2017–2019): The ICO Era

-

Era 2 (2020–2022): The DeFi Era

-

Era 3 (2023–2025): The LST Era

-

Era 4 (2025–Present): The Asset Era

Era 1: The ICO Era

From 2015 to 2016, Ethereum had only one trick: smart contracts. At the time, this was absolutely novel—other altcoins like Ripple or Litecoin didn’t have it.

Of course, people's understanding and development of smart contracts were very shallow. Until 2017, they were mostly used just for issuing tokens.

After all, I was still using such a user-unfriendly wallet as MyEtherWallet—how could Dapps possibly develop under these conditions?

But being able to issue tokens was enough. In the past, launching a token required modifying code (e.g., changing "Bitcoin" to "Litecoin"), finding miners for support, and constantly monitoring network stability—extremely troublesome.

At least 80% of people simply wanted a token to trade, without caring much about its underlying mechanics (nowadays, even narratives are becoming less important—I deeply regret not fully grasping this earlier).

Ethereum perfectly met this demand and thus became the absolute supernova of that era.

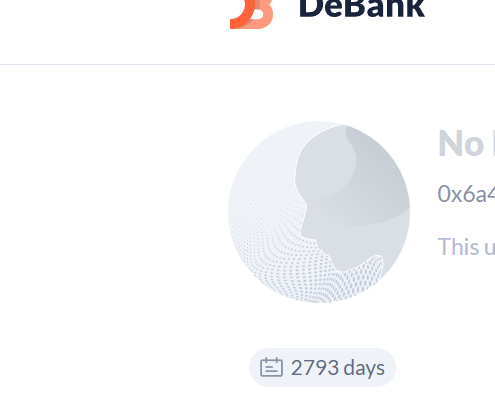

I clearly remember, when China issued its September 4 crypto ban, Ethereum was priced at 1400 RMB. Just half a year later, Ethereum reached 1400 USD!

This peak price was essentially driven by FOMO fueled through supply and demand.

Imagine you're joining 1–3 public ICOs daily in your group chats, each requiring ETH sent to a smart contract—and upon investment, you instantly gain 3x to 100x returns. How could you not accumulate some ETH?

Of course, the crash that followed was equally sudden.

I often share with friends the stories of SpaceChain and HeroChain breaking their offering prices. SpaceChain aimed to launch blockchain nodes into space, while HeroChain was a gambling chain allegedly launched by a Southeast Asian casino boss.

These two projects were considered top-tier during the ICO era, yet both broke their offering prices in early 2018, marking the beginning of a broader breakdown.

When people realized that projects previously funded via Ethereum were now dumping ETH, and that participating in ICOs with ETH led to consistent losses, they naturally began selling off ETH as well.

Thus, Ethereum crashed down to $80 in 2019—a true valley of despair.

I wasn’t immune either. I wasn’t one of those true E-vangelists who maintained faith during prolonged bear markets.

Maintaining a writing habit is indeed helpful as a tool for self-reflection. Looking back, in March 2018 when Ethereum was around $400, I published an article during its downturn questioning Ethereum’s value—“If all it does is enable ICOs, and ICOs have ended, what else can Ethereum do?”

In the comments section, there was indeed a wise voice. A user named LionStar sharply replied:

“2018 is just the beginning of Ethereum’s journey. People in the Ethereum community know full well that Ethereum currently lacks scalability and performance—everything is still early. Ethereum’s grand vision will only take its first step in 2018: PoS, sharding, plasma, Truebit, state channels, Swarm, zero-knowledge proofs, and many more technologies haven’t even been implemented yet. Reassess Ethereum’s progress five years from now. Also, most traders base their opinions solely on price—good when price goes up, bad when it drops. This mindset is not only terrifying but meaningless. Technology and development prospects determine real value, and price will eventually converge toward that real value.”

The dark irony is that except for PoS and zero-knowledge proofs, all the other mentioned technologies failed.

Yet this is precisely what makes Ethereum admirable—an open framework allowing various teams to experiment with diverse approaches: sharding, plasma, Truebit, state channels, Swarm, etc. Most originated from the community, with individuals sharing ideas and dedicating effort—an ultimate embodiment of internet and open-source software spirit.

Only through continuous, free experimentation did Ethereum become what it is today.

The entire Ethereum community actually follows two main threads:

One is technology, improving Ethereum’s own performance;

The second is applications, building apps around Ethereum.

Two separate blooms. After Ethereum fell into decline, unexpectedly, DeFi quietly began to unfold.

Era 2: The DeFi Era

It all started in 2020 when Compound announced subsidies for depositors and borrowers. People were amazed to discover that Ethereum could actually host meaningful applications—not just novelty games like CryptoKitties.

And this genuinely useful application turned out to be better than traditional ones: cheaper borrowing costs, higher deposit yields. At one point, “subsidies > interest paid” caused a reverse meter effect.

Today this seems normal, but back then it shocked everyone.

Remember, other popular coins at the time included things like distributed storage, solar-powered cannabis gaming chains—artificial creations. Ethereum, however, had something superior to traditional finance—that was truly cool, like the village’s first college graduate.

Also, ICOs weren’t entirely bubbles—they brought some lasting innovations. AAVE, which we use daily, evolved from EthLend, born in the ancient ICO era.

Thus, Ethereum rose from the ashes—the DeFi era officially began.

DeFi also altered supply and demand dynamics. Whether Uniswap or Sushiswap, both required large amounts of ETH as liquidity providers (LP), sharply increasing ETH demand.

Holding ETH, providing liquidity anywhere, enduring slight impermanent loss, could yield APRs exceeding 100% annually—who wouldn’t be tempted?

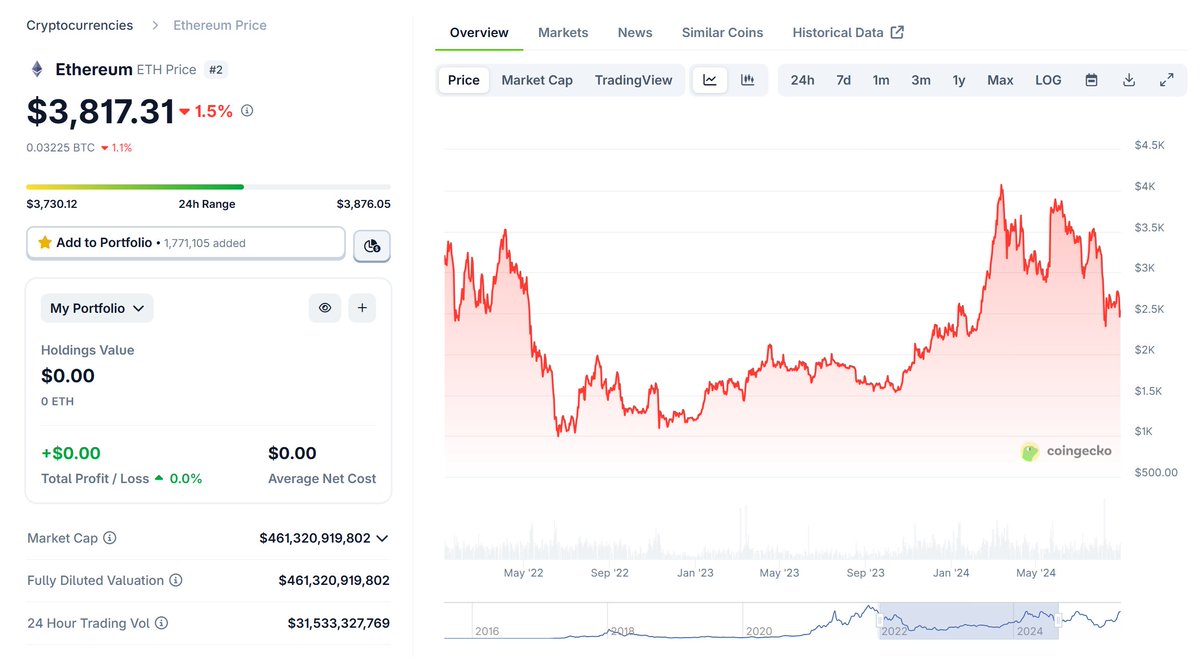

Driven by DeFi’s massive demand for ETH, Ethereum first climbed to 4100, then hit a historic high of 4800 in 2021. This reflected people’s (including mine) fantasy of Ethereum overtaking traditional finance.

However, unlike the ICO era, Ethereum in 2021 faced fierce competition. DeFi was born on Ethereum, but the gospel quickly spread to competing chains. Ethereum’s rivals offered cheaper fees and faster performance. During the ICO era, gas fee differences weren’t obvious, but in the DeFi era, calling Ethereum a “premium chain” was definitely the worst marketing, not praise.

Time flew to 2022. Luna—hard to call it DeFi, as it was a Ponzi scheme from the start—collapsed spectacularly, dragging down the market, taking FTX and 3AC with it, and abruptly ending the DeFi summer like a cold splash of water.

Similar to the ICO era, due to reversed supply-demand dynamics, people stopped participating in liquidity mining, and Ethereum entered a prolonged downtrend. Especially its declining exchange rate against BTC shattered many dreams.

When DeFi thrives, Ethereum thrives; when DeFi declines, Ethereum struggles too—especially when competing chains boast sub-dollar transaction fees.

Why has Ethereum heavily pushed its L2 strategy rather than L1 scaling in recent years?

If you’ve read this far, you probably already understand.

This was truly a moment of existential crisis! Ethereum had to immediately slow DeFi’s exodus—even at the cost of undermining its mainnet status. Thus, numerous L2s emerged at this critical juncture.

Some were pioneering (Arb, OP, ZK), some led by institutions (Base, Mantle, OPBNB), some mother-chains (Metis), some experimental (Taiko), and some app-driven (Uni).

Ethereum didn’t need a long-term rollout plan, but a fast, simple, even desperate immediate scaling solution. After evaluating options, L2 was the clear choice.

History proved L2 effective—it solidified EVM’s golden brand, preventing massive defection of DeFi developers due to fees.

Better to keep profits in-house. Though funds and users migrated away from ETH mainnet, at least:

(1) They didn’t go to competitors;

(2) They didn’t spawn new competitors.

Imagine if there were no L2 strategy—Coinbase would surely have launched its own chain. That’s human nature. But with L2, Base, Uni, and others nominally still recognize Ethereum as the “supreme sovereign.”

As long as EVM stands, Ethereum cannot lose.

Era 3: The LST Era

Next comes Ethereum’s third chapter—the one with the weakest market performance.

Following the ICO and DeFi eras, Ethereum entered the LST era.

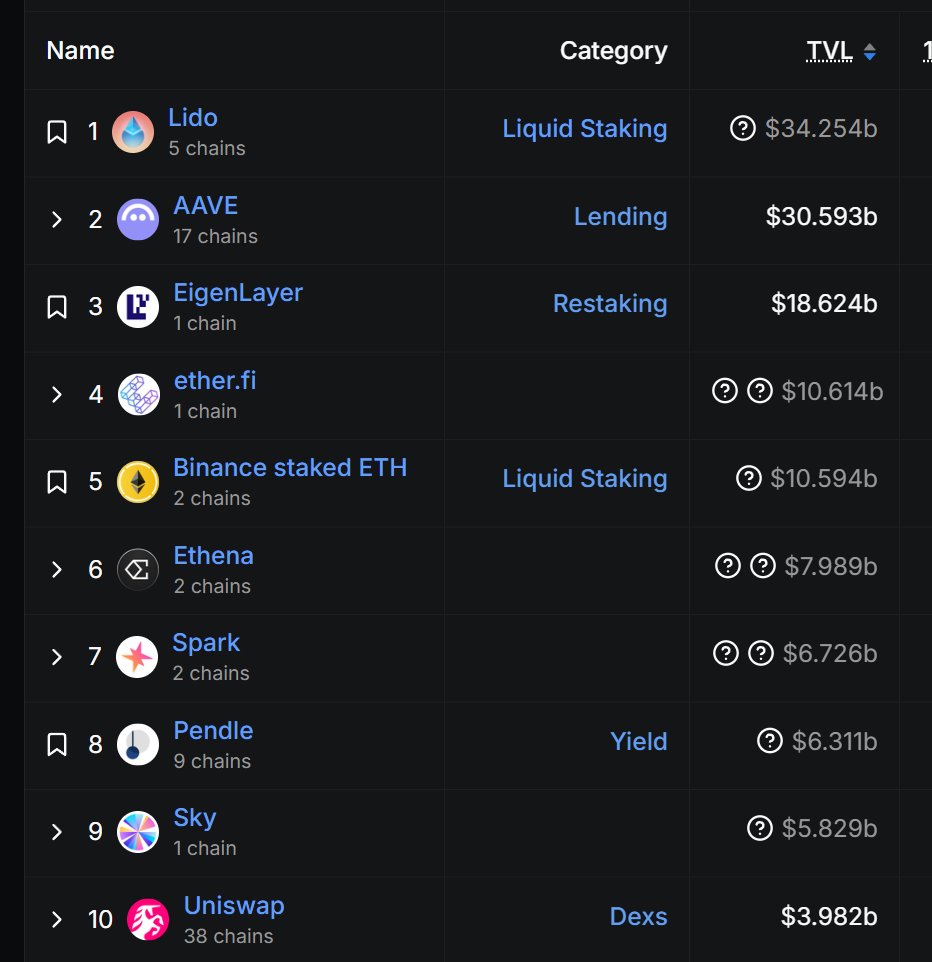

With the Shanghai upgrade, Ethereum’s transition to PoS succeeded completely. From a TVL standpoint, Lido rose, EtherFi rose, and countless ETH LSTs sprouted like mushrooms after rain.

Each new era carries strong imprints of the previous one. Check DeFillama—you’ll see that top-ranked DeFi protocols on Ethereum today are mostly LSTs or LST-related services.

Source: DeFillama

What are LST-related services?

For example, looping loans—EtherFi’s looping loan can easily achieve over 10% annual yield in ETH terms (DM me if interested to discuss). But “loans” require lending platforms, so a large portion of AAVE and Morpho’s TVL actually stems from looping loan demand. Though they’re DeFi, I refer to them as LST affiliates.

DeFi accelerated the birth of LSTs, and LSTs have now become DeFi’s biggest customers.

A side note: Our company Ebunker was also founded during this period, on September 15, 2022—the very day Ethereum successfully completed the PoS merge.

To date, over 400,000 ETH have run on our nodes in a non-custodial manner—a decision I remain deeply satisfied with.

Every true E-vangelist wants to contribute concretely to securing Ethereum (I do it by running nodes).

Back to the topic: If you pay attention, you’ll notice I’ve emphasized how “dramatic shifts in supply and demand affect Ethereum’s price.”

However, LST (including non-custodial staking) hasn’t improved supply-demand dynamics. Lido’s ETH yield has long stayed around 3%, EtherFi slightly higher at 3.5%—but that’s the limit.

Whether EigenLayer or other re-staking schemes, none have changed the fundamental nature of this base rate.

Yet, much like how people eagerly await U.S. interest rate cuts, this 3% benchmark rate strangely suppresses economic activity within this virtual nation.

Ethereum’s gas fees have decreased (thanks also to L1 improvements and L2 strategies), but on-chain economic activity remains depressed.

This mirrors the two previous historical instances of supply-demand imbalance.

Thus, LST didn’t bring a summer—it coincided with Ethereum’s continued decline.

Because a 3% yield doesn’t justify large investors buying ETH—only perhaps slowing their sell-offs. Still, we should thank LST: many whales deposited ETH into staking, preventing another gold pit crash like the $80 lows of 2019.

Era 4: The Asset Era

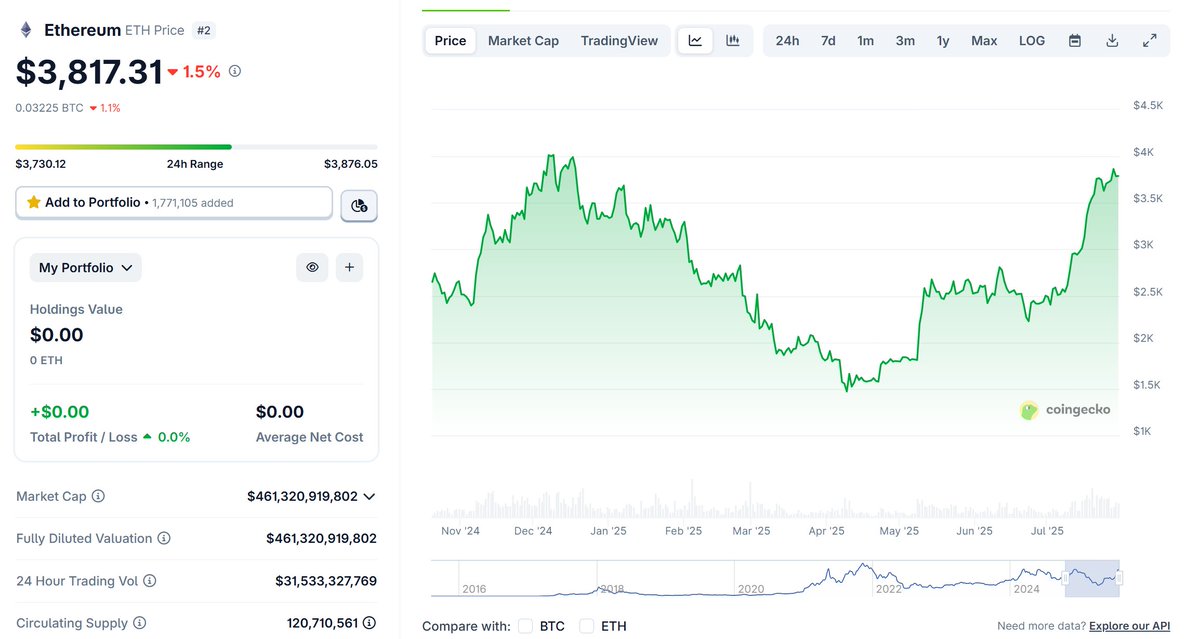

Luckily, following Bitcoin, Ethereum successfully launched spot ETFs in the U.S., giving Ethereum a brief hype. This actually marked the beginning of Ethereum’s fourth major chapter—the Asset Era.

The process of transitioning from alternative asset to mainstream asset is long. As ETH/BTC ratio gradually fell below 0.02, Ethereum faced its third major “doubt wave.”

Actually, everyone should thank that man—Saylor—for inventing the brilliant MicroStrategy playbook.

Companies first buy Bitcoin/Ethereum, then leverage these assets to issue stocks and debt, reinvesting proceeds into more Bitcoin/Ethereum, repeating the cycle—buying ever more Bitcoin/Ethereum.

MicroStrategy’s success with Bitcoin inspired the Ethereum community.

Sharplink, led by crypto-native capital like Consensys, and Bitmine, backed by traditional investor Cathie Wood, began vying for leadership in Ethereum’s version of the MicroStrategy model.

They, along with numerous imitators, successfully ignited this resonance between U.S. equities and crypto markets.

Yes, once again, Ethereum’s supply-demand relationship changed.

Institutions are aggressively buying ETH at market prices. And as before, the LST era laid foundational groundwork—massive staking locked up significant liquid ETH supply, naturally fueling this current FOMO-driven stock-coin correlation.

Of course, this also owes to Ethereum’s long-standing positive reputation among both crypto natives and traditional investors.

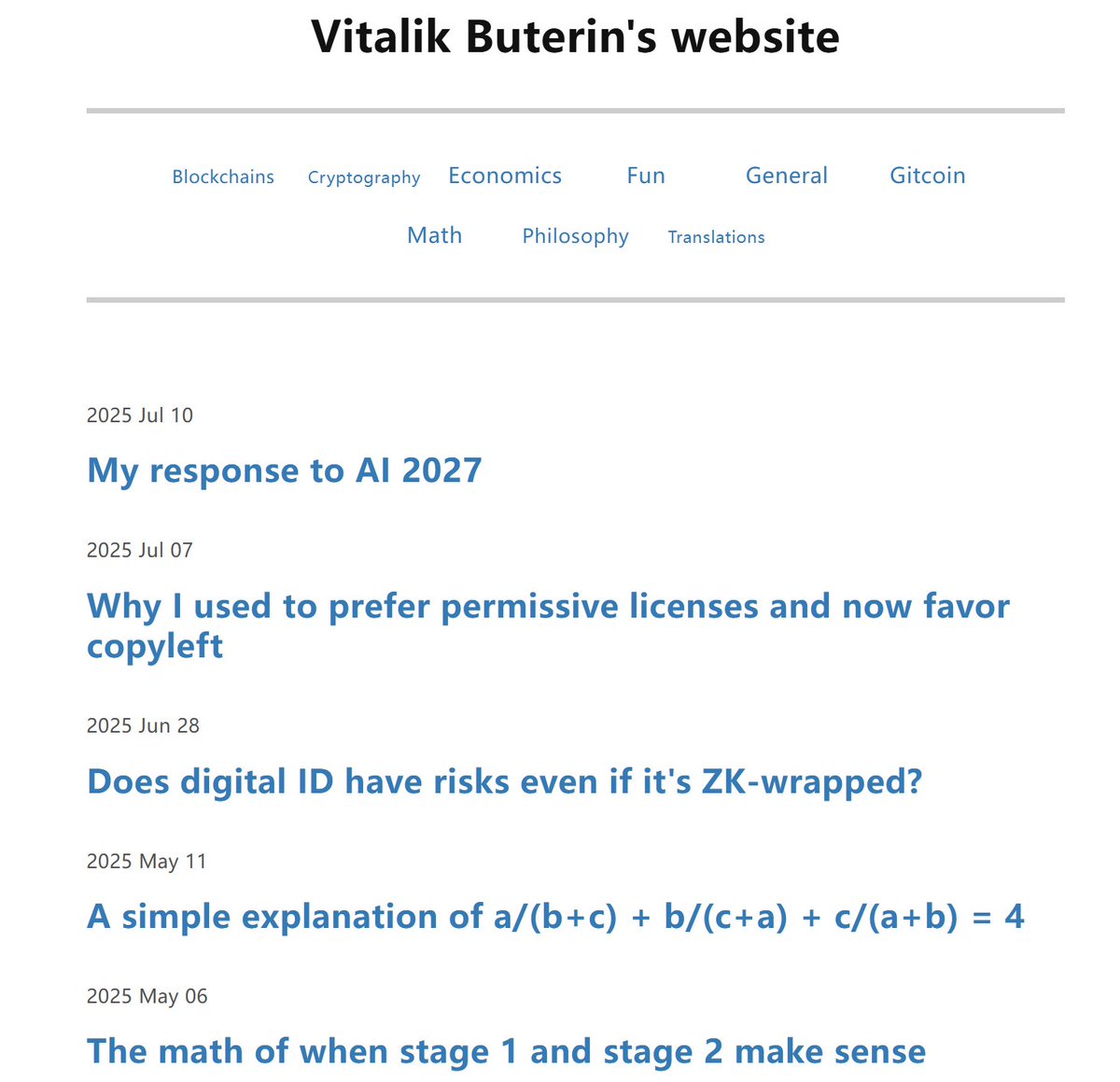

Vitalik Buterin never flaunted luxury cars or mansions, nor promoted scammy altcoins. Instead, he continuously thinks about how technology shapes Ethereum’s future—ZKVM, privacy, L1 simplification, and more.

He’s never even mentioned sbet or bitmine once on Twitter.

Ethereum being chosen by the market, entering this fourth era, is the result of goodwill and reputation built by Ethereum and Vitalik over many years.

I’d say Vitalik is a key reason I identify with Ethereum’s values.

Finally

As Binji said, the Ethereum network has operated steadily for 10 years—3,650 days and nights—without any interruptions or maintenance windows.

During this time:

-

Facebook went down for 14 hours;

-

AWS Kinesis froze for 17 hours;

-

Cloudflare shut down 19 data centers.

Indeed, Ethereum’s robustness is fascinating.

I hope—and believe—that ten years from now, I’ll still be analyzing everything about Ethereum on Twitter.

Happy 10th birthday, Ethereum!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News