Big Tech Support + Dual-Driven Consumer Scenarios: The Battle for Korean Won Stablecoins, Kaia Takes the Lead

TechFlow Selected TechFlow Selected

Big Tech Support + Dual-Driven Consumer Scenarios: The Battle for Korean Won Stablecoins, Kaia Takes the Lead

A deep analysis of key players and potential trends in Korean won stablecoins, exploring the future landscape of Korean won stablecoins together.

Author: TechFlow

With the implementation of the GENIUS Act, the U.S. effort to reinforce dollar hegemony through stablecoins has officially entered a phase of "rule-based" development. As dollar-backed stablecoins attract global attention, a multipolar competition around stablecoins is unfolding worldwide, vying for monetary influence in the emerging economic landscape.

In the Western world, dollar stablecoins lead the market, while euro and pound-pegged stablecoins are gaining momentum. In the East, beyond the widely watched Hong Kong dollar stablecoin, South Korea—a hotbed of crypto innovation—is witnessing unprecedented opportunities for its own native stablecoin:

On one hand, strong support from the new administration: Lee Jae-myung, elected in June as South Korea's 21st president, pledged to build a stablecoin system pegged to the Korean won as a strategic tool to prevent capital outflows and strengthen domestic financial sovereignty.

On the other hand, widespread mobilization across Korea’s crypto ecosystem: Major entities including Samsung SDS, LG CNS, and eight leading Korean banks have announced plans to issue won-denominated stablecoins. Notably, the representative Layer 1 project Kaia has partnered with super apps Kakao Pay and LINE NEXT to jointly launch a Korean won stablecoin.

Following these announcements, Kakao Pay’s stock surged nearly 30%, and Kaia’s native token $KAIA rose over 20% within 24 hours—clear market validation of Kaia as the frontrunner in the Korean won stablecoin race.

With clear policy backing now in place, will Korean won stablecoins rise to prominence?

And amid fierce global competition, why is Kaia—the project championing “Stablecoin Summer”—seen as essential infrastructure for taking the Korean won stablecoin global?

This article aims to deeply analyze key players and emerging trends in the Korean won stablecoin space, exploring its future trajectory.

New President, New Era: South Korea’s Crypto Frontier Heats Up in Won Stablecoin Race

The Korean market is calling for a won-denominated stablecoin.

Faced with structural challenges such as slowing economic growth, won depreciation, low interest rates, weak real estate and equity markets, and limited upward mobility for youth due to class rigidity, Koreans are eager for transformative financial disruption.

As President Lee Jae-myung stated, stablecoins represent an effective measure to prevent Korean wealth from flowing overseas via dollar-denominated digital assets.

Data shows that in Q1 2025 alone, Korean crypto exchanges transferred approximately 56.8 trillion KRW in digital assets abroad, with stablecoins accounting for about 47.3%. This highlights Korean investors’ demand for the efficient capital mobility offered by stablecoins, but also raises systemic concerns over monetary sovereignty, compliance, and foreign exchange outflows.

Notably, despite capital outflows, the won has strengthened against the dollar—appreciating about 6.5% in 2025. This contrast suggests that Korean investors aren’t necessarily favoring dollar stablecoins, but rather lack viable won-denominated alternatives in a dollar-dominated crypto market. A Korean won stablecoin thus becomes a critical vehicle for reclaiming financial sovereignty.

When it comes to stablecoins, South Korea enjoys unmatched national readiness.

Korea’s reputation as the Eastern capital of crypto is well earned.

According to the Bank of Korea’s Annual Payment and Settlement Report, as of April 2025, 25 million people—nearly half of Korea’s 51 million population—have opened accounts on virtual asset exchanges to invest in cryptocurrencies.

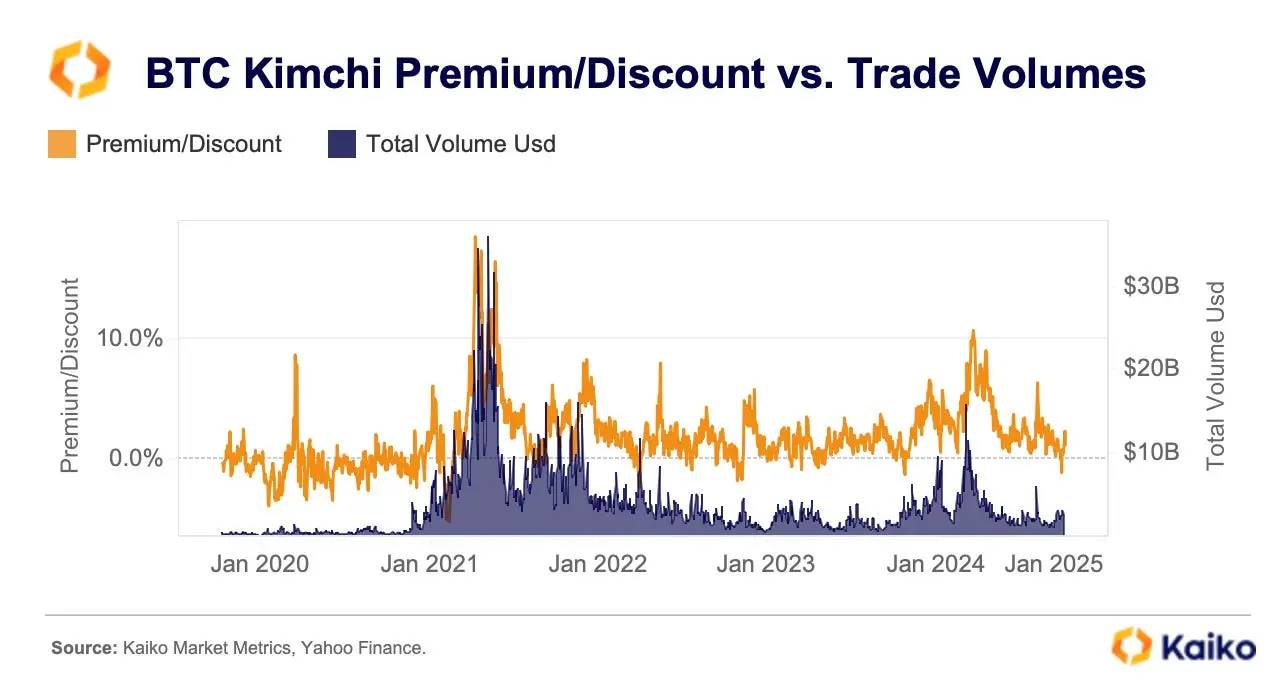

Beyond sheer user numbers, trading activity is robust: Korea’s top five domestic crypto exchanges collectively manage $73 billion in assets, with daily trading volume exceeding $10.7 billion in December—surpassing both major Korean securities exchanges. Many are also familiar with Korea’s unique “kimchi premium,” where crypto prices on local exchanges run 3%–10% higher than global averages, reflecting intense local investor enthusiasm and arbitrage demand under capital controls.

This mutual pull between the won and stablecoins makes supporting stablecoins not just a populist move for President Lee Jae-myung, but a strategic blueprint to revive Korea’s “Miracle on the Han River.”

A crypto-friendly leader, Lee places stablecoins at the core of his broader digital asset agenda.

During his campaign, he championed the Korean won stablecoin, pledging to create a won-pegged stablecoin system to curb capital flight and strengthen domestic financial sovereignty.

After taking office, on June 10, Korea’s ruling Democratic Party, under President Lee, formally introduced the draft Digital Asset Basic Act, which would allow qualified domestic enterprises to issue stablecoins. Regulatory authority over issuers would shift from the Bank of Korea (BOK) to the Financial Services Commission (FSC), and the minimum capital requirement for stablecoin issuers would drop from 5 billion KRW to 500 million KRW. This positions Korea to become Asia’s first major economy to formally permit non-bank stablecoin issuance, significantly lowering barriers and fueling domestic competition.

Facing this unprecedented opportunity in won stablecoins, major Korean corporations and banks are preparing to enter the arena:

Due to the potential impact of stablecoins on monetary policy and settlement systems, the Bank of Korea has responded swiftly. According to Korean media outlet The Economic Review, eight major banks—including KB Kookmin Bank, Shinhan Bank, Woori Bank, NH Bank, IBK Industrial Bank, Suhyup Bank, Citibank Korea, and Standard Chartered Korea—are planning to form a joint venture to issue won stablecoins.

Meanwhile, major conglomerates are moving fast: Samsung SDS, the IT solutions and systems integration subsidiary of Samsung Group, offers Nexledger—an enterprise-grade private blockchain platform capable of issuing or custodizing stablecoins. Similarly, LG CNS, the IT arm of LG Group, possesses core capabilities in minting, clearing, auditing, and custody of on-chain assets, positioning it to benefit significantly through technological leadership in the won stablecoin race.

Since announcing its full commitment to deploying the won stablecoin, Kaia—possessing the deepest crypto roots—has emerged as the top contender many believe can drive mass adoption and global expansion of the Korean won stablecoin.

Among such formidable competitors, how does Kaia stand out?

Dual Engine of Capital and Use Cases: Kaia’s Unique Edge in Asia’s Premier Web3 Ecosystem

As stablecoin competition intensifies, the key ingredients for success are becoming increasingly clear:

-

Compliance: A necessary prerequisite for sustainable growth in a stable and trusted environment

-

Technology: The foundational layer enabling mass adoption of won stablecoins

-

Distribution: Critical for rapidly building circulation networks and real-world use case deployment

On compliance, as Korea’s leading public blockchain, Kaia faces no hurdles.

Since regulatory intervention began in 2017, Korea’s crypto landscape has evolved through multiple phases. Kaia has consistently embraced regulation, fully complying with Korean rules on crypto taxation, anti-money laundering, and DeFi oversight. As government monitoring of stablecoins becomes clearer, Kaia continues to operate legally and deliver financial services.

As Kaia Foundation President Seo Sang-min noted: “Kaia understands Korean regulations and institutional stances better than overseas teams, giving us a regulatory edge—which is highly advantageous for the won stablecoin.”

In Japan’s closely linked market, Kaia has already become a formal member of the Blockchain Association of Japan—the first Layer 1 project to achieve this status.

With multiple stablecoin initiatives underway, Kaia is actively advancing global compliance measures to remove barriers for the global rollout of the Korean won stablecoin.

Technologically, Kaia stands out with high performance, low barriers, and seamless social-integrated user experiences.

Kaia’s vision is to provide infrastructure for consumer DApps in payments, gaming, and social—domains defined by high-frequency usage that demand robust technical foundations.

Formed by the merger of Klaytn and Finschia chains, Kaia inherits strong technical synergies. As an Ethereum-compatible L1, Kaia’s Istanbul BFT consensus—optimized from Klaytn’s IBFT—enables rapid finality and supports multi-node participation.

According to official documentation, Kaia can process up to 4,000 transactions per second, with a 1-second block time and instant transaction finality—once a block is produced, it’s irreversible, eliminating traditional rollback risks and delivering fast, secure, and efficient transactions.

Leveraging integration with two social giants—LINE and KakaoTalk—Kaia has developed unique expertise in seamlessly onboarding Web2 users to Web3:

First, Kaia supports account abstraction and gas fee sponsorship, greatly simplifying user experience.

Second, by integrating with LINE and KakaoTalk identities and payment channels, Kaia enables Web2 users to effortlessly explore its ecosystem—no additional registration required.

Having covered compliance and technology, let’s now focus on distribution.

It’s possible for a technically and compliantly strong stablecoin project to fail—but a stablecoin without distribution advantages will certainly fail, because the ultimate purpose of issuance is circulation.

When it comes to distribution—driving real-world circulation and embedding into rich consumer scenarios—Kaia holds unmatched advantages in user reach, resource integration, and practical applications.

Circulation requires users.

Merged from Klaytn and Finschia, Kaia leverages two dominant messaging platforms: KakaoTalk, used by nearly 95% of South Koreans, and LINE, serving over 200 million users across Japan, Korea, Taiwan, and Thailand. This combined user base of over 250 million provides Kaia with unparalleled distribution power to bring the won stablecoin to hundreds of millions across Asia.

Circulation also demands real-world use cases.

First, years of ecosystem development have enabled Kaia to build a vast and diverse matrix, leveraging KakaoTalk and LINE to educate and convert 250 million users.

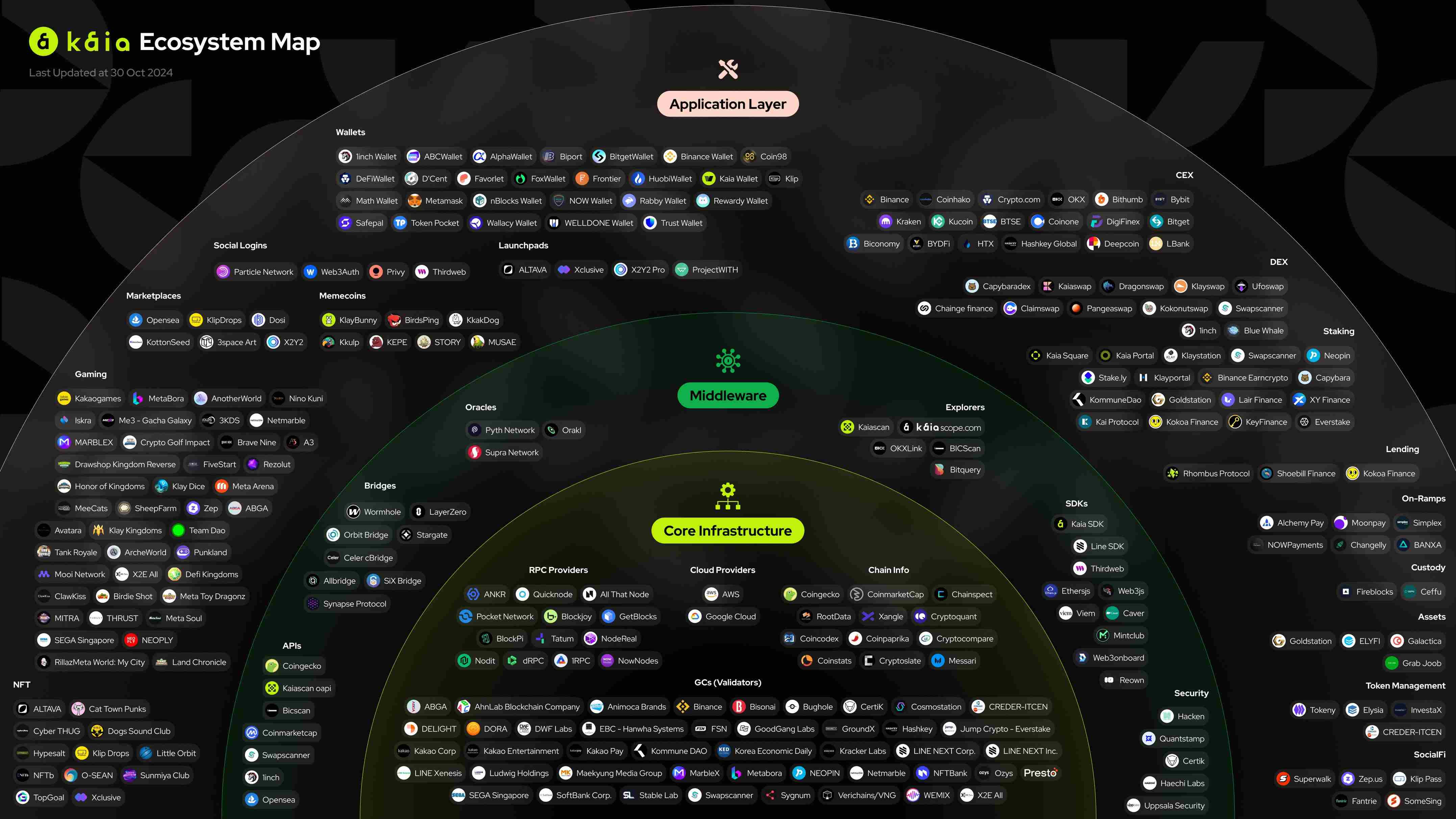

Kaia is now one of Asia’s largest Web3 ecosystems, hosting thousands of projects across DeFi, gaming, RWA, social, and NFT sectors—providing abundant real-world use cases for the won stablecoin.

A standout example is Kaia Mini DApps—small games built within LINE’s messaging platform. Within less than a year, they’ve attracted over 65 million users and surpassed 30 million monthly transactions. Users can discover, download, and explore various Kaia dApps via the DApp Portal, enjoy reward programs, and conduct asset transactions seamlessly.

Since the DApp Portal launched, more than 100 million new wallets have been created on Kaia, with active on-chain users growing over 280% to nearly 9.5 million. Backed by Kaia’s developer incentive programs, Mini DApp developers, users, and transaction volumes continue to grow rapidly.

Second, thanks to powerful backing and exceptional resource integration, Kaia is seen as Korea’s only platform currently capable of driving real-world adoption of the won stablecoin.

Kaia enjoys explicit support from two tech titans—KakaoTalk and LINE—each backed by top-tier capital from Japan, Korea, and the West.

KakaoTalk belongs to Kakao, a Korean internet giant with businesses spanning social, payments, and entertainment. In February 2023, Kakao acquired a 9.05% stake in SM Entertainment, becoming its second-largest shareholder.

LINE’s parent company NAVER is Korea’s largest IT firm. Recently, Guo Dongxin, vice chairman of semiconductor firm Hankook Semiconductor, invested 31 billion KRW personally into LINE Next, securing an 8.5% stake.

Notably, NAVER originated from Korean conglomerate NHN, which operates Korea’s top search engine NAVER and gaming portal Hangame. KakaoTalk founder Kim Beom-su was not only the founder of Hangame—the country’s largest gaming platform—but also served as CEO of NHN before competing with NAVER for dominance in Korea’s internet space.

Kaia’s supporters also include Crescendo Equity Partners, a Korean PEF sponsored by PayPal co-founder Peter Thiel, with LPs including the National Pension Service of Korea, Korea Teachers’ Credit Union, Korea Development Bank, and Korea Growth Finance.

Despite complex rivalries among these giants, their collective bet on Kaia reflects strong institutional confidence and signals further resource convergence.

In practice, Kaia has already demonstrated massive potential in penetrating consumer use cases: KakaoTalk integrates KakaoPay, allowing direct money transfers, while LINE Pay has become one of the most popular cross-border payment methods in Japan, Thailand, and Taiwan.

By integrating with LINE and KakaoTalk’s identity and payment systems, Kaia instantly gains access to their extensive real-world payment networks. Backed by influential capital, Kaia is expanding its won stablecoin into tourism, fan economies, crypto cards, and crypto ATMs—creating natural advantages for real-world adoption.

In April 2025, the Kaia Foundation announced a new funding round led by renowned VCs 1kx and Blockchain Capital, with participation from Galaxy Digital, The Spartan Group, IDG Capital, Mirana Ventures, SNZ Holding, Comma3 Ventures, Caladan, Lingfeng Capital, Waterdrip Capital, and MEXC Ventures.

This funding aims to accelerate Kaia’s business strategy, ecosystem collaboration, integration with traditional financial institutions like Visa, and marketing and content support—deepening its international expansion, compliance framework, and ecosystem partnerships. By leveraging institutional networks, Kaia strengthens its consumer adoption logic and global footprint.

With distinct advantages in distribution, technology, and compliance, Kaia has emerged as the frontrunner in the Korean won stablecoin race. And as it champions “Stablecoin Summer,” recent moves reveal Kaia’s forward-looking strategy and clear roadmap for the stablecoin sector.

The First Shot: Native USDT Deployment Marks the Start of Kaia’s Stablecoin Strategy

The native deployment of Tether’s USDT on the Kaia blockchain marks a pivotal milestone—and the first chapter—in Kaia’s stablecoin strategy.

In May 2025, Tether launched native USDT on Kaia. Unlike bridged USDT, Kaia’s USDT is deployed directly via native contracts on the Kaia network, managed and issued by Tether itself, ensuring 1:1 USD reserves and real-time parity. This enhances transaction speed, security, and accessibility, allowing Kaia users to make payments and cross-border transfers directly within chat interfaces.

Around USDT, Kaia has rapidly built diverse use cases through an expanding partner network:

Multiple partners—including Tether, Dapp Portal, Bybit, Bitfinex, Bitget, Gate, MEXC, Flipster, Holdstation, Bitkub, Coins.ph, Crypto.com, D’CENT, TokenPocket, and Bitget Wallet—now support USDT-KAIA. This provides users with diverse on/off ramps and expands Kaia’s stablecoin services to broader audiences and richer applications.

Beyond functionality, Kaia’s native USDT excels in real-world consumer adoption:

On July 30, the Kaia DLT Foundation announced a partnership with blockchain fintech firm DaWinKS, enabling Kaia-issued USDT to be used at DaWinKS’ digital ATMs (DTMs) located across major Korean tourist sites.

This means travelers to Korea can now withdraw KRW directly from their Kaia-based USDT at DTMs—no need to pre-exchange currency at home. Whether buying skincare, K-pop merchandise, coffee, or medical aesthetics, users can instantly convert USDT to cash.

Alternatively, users can obtain a prepaid card that bridges virtual and real-world spending. The card supports 85 fiat currencies from 15 countries, and users can convert leftover funds back to USD before departure. Exchange rates are calculated using real-time daily data.

DaWinKS has already installed DTMs at seven landmark locations: N Seoul Tower, Homeplus (Hapjeong and Centum City branches), Lotte Mart (Gwangbok branch), LIFEWORK Myeongdong flagship store, Myeongdong Money Club, and Namdaemun Exchange Café. Expansion to major Lotte Mart stores nationwide is planned for broader coverage.

In short, Kaia functions like an Asian PayPal, with native USDT—and soon the won stablecoin—mirroring PayPal’s PYUSD, rapidly capturing consumer markets through expansive commercial integration.

Does this sound compelling?

In reality, native USDT on Kaia is widely seen as the opening act of “Stablecoin Summer”—a strategic precursor that sets a crucial precedent for the upcoming launch, circulation, and real-world adoption of the Korean won stablecoin.

With deeper exploration of the won stablecoin alongside super apps Kakao Pay and LINE NEXT, the true “Stablecoin Summer” is about to begin.

Multipronged Moves: Kaia Rapidly Advances Toward “Stablecoin Summer”

Built around USDT as a cornerstone, Kaia has more plans ahead:

On one front, gas abstraction is expected to launch in August 2025 and will be gradually integrated as a native feature into dApps and wallets across the ecosystem. This allows users to pay transaction fees in various supported tokens, forming key infrastructure for seamless global stablecoin payments.

Combined with native stablecoins, gas abstraction turns Kaia into a zero-barrier Web3 gateway, letting users effortlessly engage with Web3 through social interactions, payments, and mini-games. In just two months since launch, Kaia’s USDT transaction volume has exceeded $2 billion. With gas abstraction coming online, Kaia USDT could see another surge.

On the other front, Kaia will continue enhancing USDT’s accessibility and utility within its ecosystem, including securing more exchange and wallet integrations, enabling seamless USDT transactions in LINE Mini DApps, and promoting USDT as a payment method across Kaia’s consumer-facing apps.

These announced steps have sparked broad speculation about Kaia’s stablecoin future:

Under current Korean policy, only payment-focused stablecoins are allowed; interest-bearing models are prohibited. Yet Kaia, known for its compliance-first approach, recently partnered with derivatives exchange Flipster to launch a promotion celebrating native USDT’s arrival—offering zero withdrawal fees and up to 127% APR rewards on Kaia network withdrawals. Could this signal Kaia pioneering a future of “compliant interest-bearing stablecoins” in Korea?

Additionally, Kaia is placing strong emphasis on USDT applications in DeFi and RWA—particularly innovative perpetual futures built on USDT and deeper integration of USDT with real-world assets.

Kaia has long pursued RWA development. Its blockchain hosts tokenized gold, ships, and real estate. Previously, the Kaia Foundation partnered with an Indonesian shipping company to tokenize vessels, streamlining purchases and improving fundraising efficiency. Future plans include listing fiat-backed stablecoins and bonds on-chain, expanding asset options for developers.

As traditional institutions flood in and RWA momentum builds, could stablecoin + RWA yield products become Kaia’s next DeFi hotspot?

Of course, the most anticipated element of Kaia’s stablecoin strategy remains the won stablecoin.

Recent reports indicate that Kaia Foundation President Seo Sang-min and Line Next CSO Kim Woosuk told Maeil Business Newspaper:

“We’re discussing stablecoins with domestic financial firms. Talks are still early, but through strong collaboration with Kakao and Line, we’ll develop stablecoin infrastructure tailored to Korean users’ familiar environments.”

Regarding competition among Korean giants—especially banks—Seo offered a unique perspective:

“Bank-issued stablecoins may be trustworthy, but they lack creativity. A model where private firms develop the tech and banks handle AML could be ideal.”

Indeed, Kaia’s won stablecoin initiative is still in its infancy. But its ambition—to drive issuance, inject real-world asset-pegged liquidity into the ecosystem, and accelerate the adoption of domestic Web3 applications—is clearly evident, and preparations are already underway.

According to Korean media Naver News, Kaia will team up with Tether, KakaoPay, and LINE NEXT to launch the first “Korean Stablecoin Hackathon” on August 1. The event focuses on two tracks: the KRW Stablecoin Ideathon and Kaia-USDT Application Development, aiming to advance compliant stablecoins and Web3 fintech in Korea.

Participants will have the chance to deploy Mini dApps on LINE Messenger—used by 196 million people—and pitch to VCs Simsan Ventures and Kaia Wave. Total prize pool: $72,500.

As the top contender in the won stablecoin race, Kaia’s advantages are clear: Through partnerships with super apps like Kakao Pay and LINE NEXT, it has built an integrated “on-chain + social + payment” framework, delivering strong user bases, powerful distribution, and rich consumer use cases. Since launching in August 2024 through the merger of Klaytn and Finschia, Kaia has shown strong growth—a trend poised to continue through diversified ecosystem development. All this lays a solid foundation for the global expansion of the Korean won stablecoin.

While challenges remain—including evolving government regulations, fierce competition from entities like the banking consortium, and timely execution of its roadmap—Kaia has already stepped onto the global stage. As “Stablecoin Summer” unfolds, Kaia is emerging as a pivotal force in elevating the Korean won onto the world stage.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News