Lao Mo, I want to eat fish: Skillfully use Bitget Launchpool to make thousands of U monthly with one fish

TechFlow Selected TechFlow Selected

Lao Mo, I want to eat fish: Skillfully use Bitget Launchpool to make thousands of U monthly with one fish

If you're looking for a simple, stable, and effective investment method, Bitget Launchpool is a great choice.

Author: OneshotBug

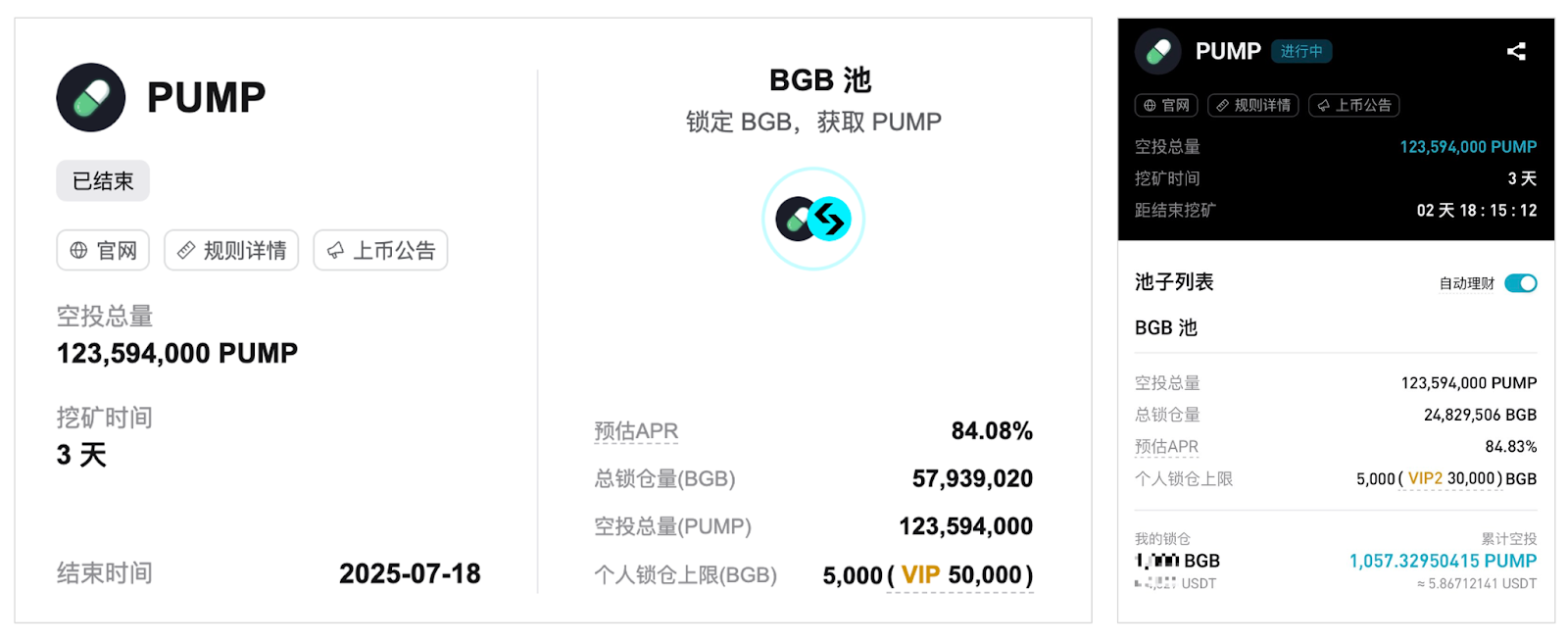

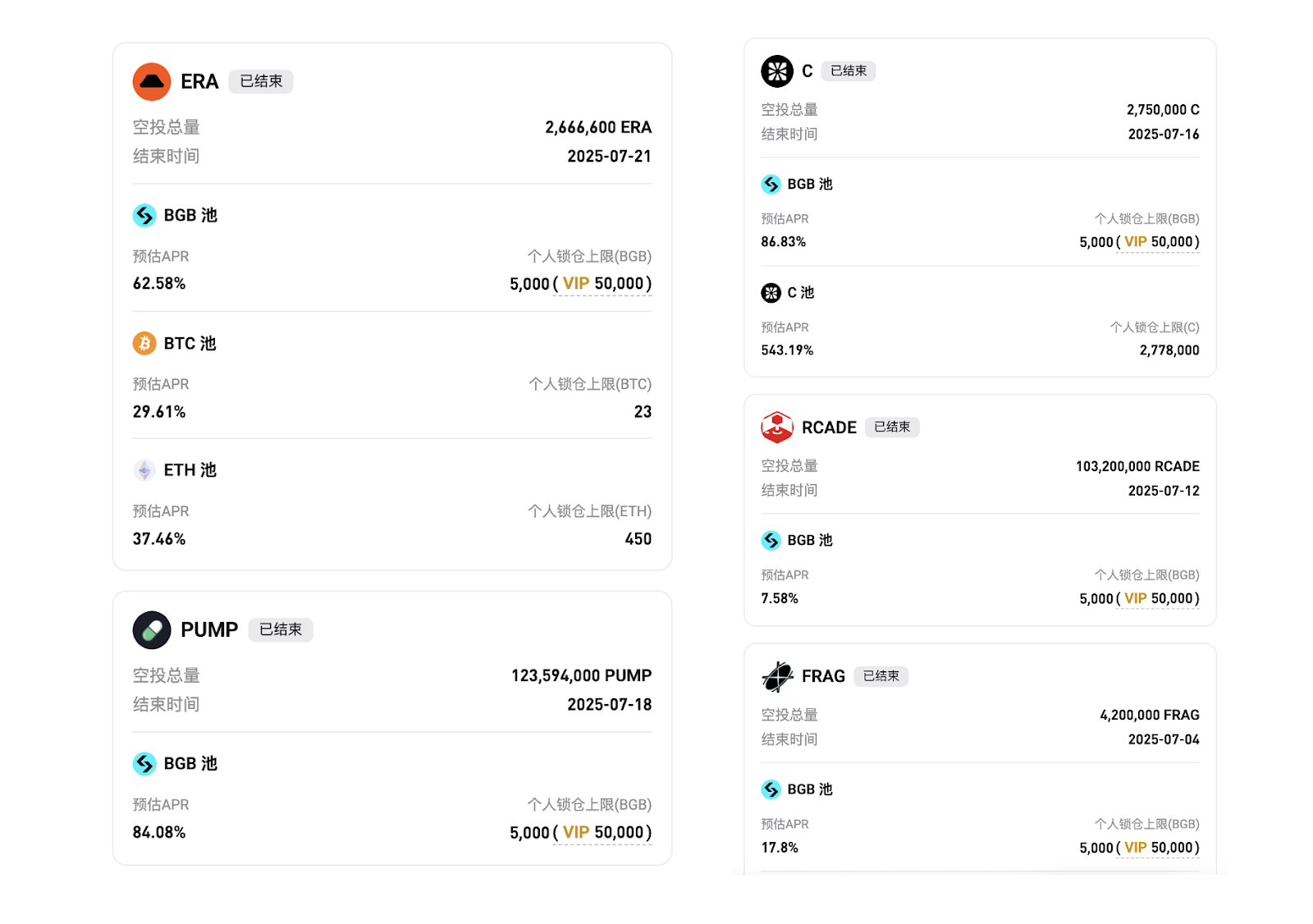

In the crypto market, although short-term high-return opportunities are tempting, for rational investors, stable returns and long-term appreciation are more worthy goals. Bitget Launchpool caught my attention after its return rates visibly increased following major project launches such as ENA, SONIC, and ELX. In July, it successively launched star projects like C, PUMP, and ERA—PUMP (Pump.fun) brought inherent buzz, while C (Chainbase) got listed on Binance.

After personally participating in all recent activities, I no longer view Bitget Launchpool as a short-term speculative tool, but rather as a long-term value-creation investment channel, achieving "multiple gains from one investment" through continuous capital rollover. If you're looking for a simple and stable investment method, Bitget Launchpool is an excellent choice. The latest GAIA project will soon open for staking and is confirmed to list on Binance Alpha, likely offering solid returns—an opportunity worth trying.

In this article, I'll share how to generate steady returns using the same funds across consecutive Launchpool events while effectively avoiding high market volatility risks.

Bitget Launchpool Activity Review: From Participation to Earnings

To better assess Bitget Launchpool's potential, I participated in all recent campaigns including C, PUMP, and ERA. Each project delivered expected returns, gradually verifying the platform’s actual effectiveness in delivering stable yields.

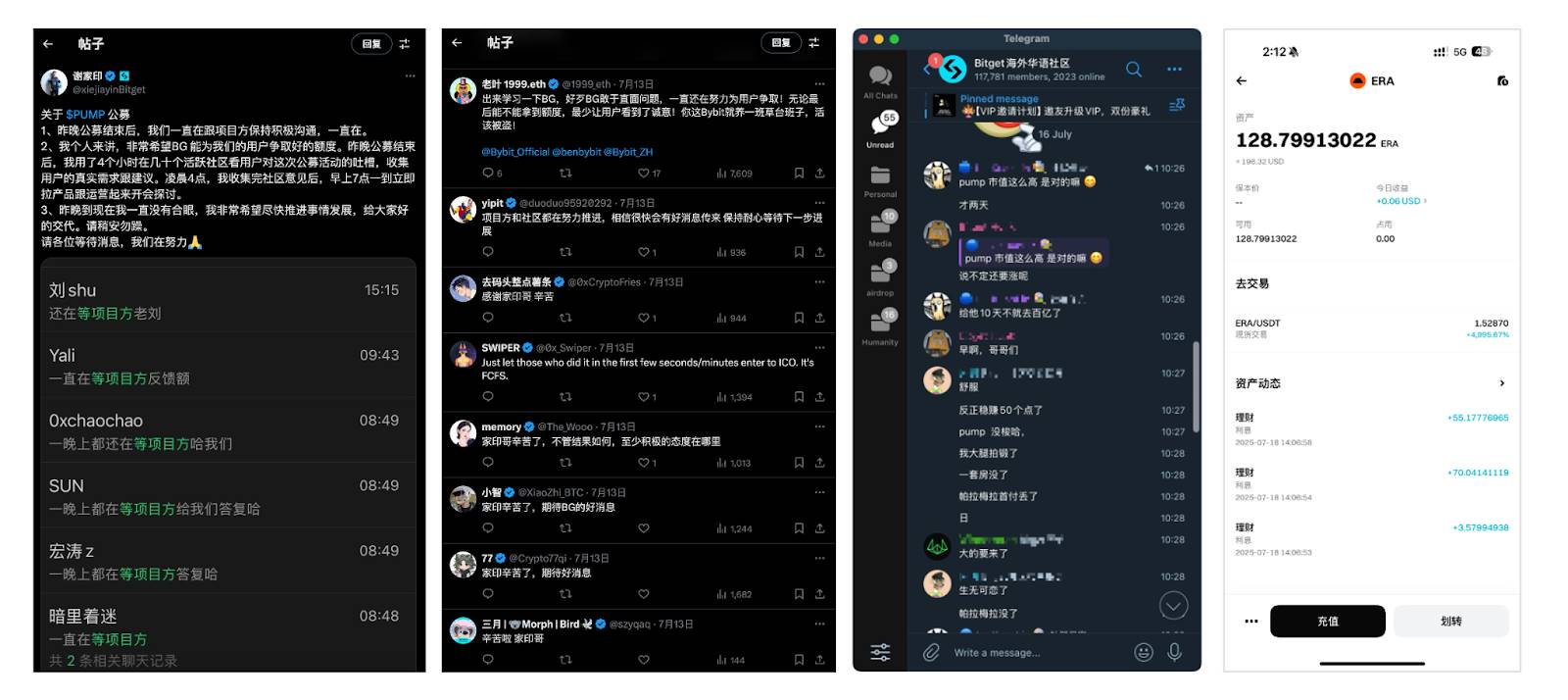

On returns: PUMP briefly achieved an APR as high as 1,273.32%, while ERA reached up to 4,958.73%. Based on shares from other users on Twitter and Telegram groups, most reported satisfactory results. For example, one investor earned 128 ERA (worth about 200U) within an hour during the ERA event, eventually exceeding 5,000U in total profit. Positive feedback quickly flooded the community, marking a strong reputation breakthrough.

Return estimate: Assuming you invested 10,000U at the beginning of July, converted into BGB to continuously join all events, your final earnings could reach approximately 1,460U, with an annualized yield over 175%. This return consists of:

-

Directional gain from BGB price appreciation: 1,220U

-

Hedged yield from Launchpool staking mining: 240U, where hedging strategies serve as a risk-free income source.

These examples fully demonstrate that Bitget Launchpool, through strong market performance and well-structured events, provides participants with consistent and stable returns. These outcomes not only meet expectations but also reflect the platform's robust resource allocation and sound yield framework.

What Makes Bitget Launchpool Unique?

Based on current projects, mechanics, returns, and public information, here are the key attractive aspects of BG’s Launchpool model:

1. Distribution Method: As fair and diverse allocation as possible

Many platforms often use a “first-come, first-served” model, which seems logical but in practice makes it hard for retail investors to secure allocations. Bitget Launchpool uses a more diverse allocation approach, primarily distributing shares based on staking amounts, allowing more users to obtain slots—receiving very positive community feedback.

2. Strong Returns: Satisfactory yields with frequent activity scheduling

Recent Bitget Launchpool projects have delivered impressive returns, a major factor attracting investors. During volatile markets, these events offer participants stable and substantial profits, holding significant positive implications for retail investors.

3. Platform Influence: Premium project listings and larger allocation shares

Judging by recent project quality and the share allocated to BG, Bitget—as the fourth-largest exchange with rapid growth—is gaining recognition from project teams. Besides C, PUMP, and ERA launched in July, previous projects included high-profile names like ENA, SONIC, and ELX; in the PUMP project, BG successfully secured the highest quota. This creates a virtuous cycle: the platform attracts quality projects, which then collaborate to provide users with greater earning opportunities. By joining these premium projects, users enjoy higher returns and develop stronger trust in the platform—benefiting projects, BG, and users alike.

Combined, these advantages not only set Bitget Launchpool apart in the market but also provide investors with a stable and efficient investment channel—an opportunity worth watching for both beginners and seasoned investors.

Rollover Strategy: Seamless Transition Between Events for Stable Earnings

In my current portfolio planning, Bitget Launchpool operates under a rollover logic. Simply put, I convert earnings from each round into BGB and reinvest them into the next campaign, ensuring continuous capital flow and maximizing returns.

Core Idea

After each Bitget Launchpool participation, instead of withdrawing token rewards, I convert them into BGB and continue staking in the next event. This avoids fund idle periods, keeps capital active, and enables compounding growth. With this strategy, every round’s earnings immediately generate further returns.

Specific Operational Process

The rollover process is very simple, similar to dollar-cost averaging in wealth management. After each event ends, I quickly liquidate the earned assets and convert them into BGB. Then, based on the content of the next event and BGB’s price trend, I decide how much BGB to stake. This process is efficient and continuous, requiring minimal monitoring—just checking the event page in advance. After each operation, I summarize the performance, analyze returns, and adjust my strategy according to market changes to better optimize the next investment round.

Strategic Advantages

The most significant advantage of the rollover strategy is eliminating funding idle periods. After many platform events end, capital faces extended waiting times—this is a loss for investors. Rollover enhances investment continuity: earnings are rapidly redeployed after each event, maximizing returns and effectively diversifying against market volatility. Even if some project tokens fluctuate in price, funds remain in a steadily growing state.

Theoretically, this strategy can also apply to other similar staking or yield-generating investments. However, currently, many platforms have low-frequency or non-continuous Launchpool events, making BG currently the only viable option.

Evolving Role of BGB: From Passive Holding to Active Management

In my current investment strategy, BGB has evolved from initial “hold-and-wait-for-appreciation” into an active instrument within my asset allocation.

Initially, my BGB strategy was straightforward: hold and wait for price increases. Especially after the market rally at the end of 2024, I grew confident in BGB’s appreciation potential, continued accumulating it, and treated it as a “passive asset.” But as Bitget Launchpool campaigns progressed—and since BGB is typically used as the main pool token—it became the core asset in my Launchpool rollover strategy.

Within Launchpool earnings, BGB’s own price growth constitutes a significant portion of overall returns, so expectations about BGB’s price are crucial. Considering last year’s market trends, high V/MC ratio, ongoing planned burns, and positive community feedback on Launchpool, I remain optimistic about its price outlook.

Risk Management and Sustainability: Rational Thinking Behind High Returns

While Bitget Launchpool offers highly attractive returns, as investors, we must recognize potential risks. No investment tool is risk-free. Understanding and managing these risks ensures sustainable gains and prevents unnecessary losses.

1. Potential Risks

First, market volatility is among the biggest risks. Crypto market fluctuations are inevitable—even profitable projects may experience price swings due to market sentiment or macroeconomic shifts. For LP pool tokens like BGB, price growth is a key component of returns, yet prices are influenced by broader market trends, which cannot be ignored. Therefore, as mentioned earlier, staying attentive to price movements is essential. Preparing for sudden volatility is a must for every investor.

Additionally, project-specific risks should not be overlooked. Although Bitget exercises caution when selecting projects, uncertainties still exist. Some emerging projects may face technical challenges, operational instability, or low market adoption, potentially undermining expected returns. Investors must remain vigilant and continually assess real project risks.

2. Mitigation Strategies: Diversification and Flexible Adjustment

To effectively manage these risks, diversification remains one of the most common and effective strategies. While I advocate reinvesting all project earnings into the next campaign, I don’t always commit the entire principal—instead, I make diversified arrangements, such as temporarily converting part of my BGB into USDT. I believe this reduces exposure to individual project risks and achieves more balanced returns.

Flexible portfolio adjustments are equally important. In case of significant market shifts, I adapt my investment based on actual conditions and the platform’s latest offerings. For instance, if a project’s return rate drops, I quickly shift funds to one with higher return potential. Through such agile responses, I strive to keep my investments in optimal condition.

Conclusion: Continuously Optimizing Investment Strategy

In this article, I’ve shared how to achieve stable long-term returns via Bitget Launchpool. Whether participating in high-yield projects or applying a rollover strategy to continuously deploy funds into new events, Bitget Launchpool demonstrates its unique strengths as a low-risk, high-return investment vehicle.

Going forward, I’ll keep monitoring two key factors: First, the stability of APR in Bitget Launchpool. While current returns are satisfying, as user participation grows, whether the platform can sustain these high yields remains to be seen. Second, the continuous introduction of quality projects. If Bitget can keep bringing in high-return projects like ENA, C, and PUMP, and maintain strong performance in upcoming ones like GAIA, its appeal and market position will further strengthen.

Above, by sharing my investment approach, I hope to offer readers valuable insights to help find their own path to stable returns in a complex market environment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News