Bitget Daily Morning Report: Market Seeks Safety Amid Fed Independence Controversy, Meta Plans to Cut Spending on Metaverse Team

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Market Seeks Safety Amid Fed Independence Controversy, Meta Plans to Cut Spending on Metaverse Team

Strategy increased its BTC holdings by 13,627 BTC last week.

Author: Bitget

Today's Outlook

1. U.S. SEC Chair: It remains to be seen whether the U.S. will seize or confiscate Venezuela's held Bitcoin.

2. Thailand’s Prime Minister orders tighter regulation on gold trading and digital assets to crack down on "gray funds".

3. According to The Block, Republican Senator Cynthia Lummis and Democratic Senator Ron Wyden introduced a bill clarifying that software developers who do not control user funds should not be classified as money transmitters—amid growing momentum toward a broader cryptocurrency legislative framework.

4. Standard Chartered plans to launch a crypto prime brokerage service, expanding its digital asset footprint.

Macro & Highlights

1. Besent warns: Market volatility triggered by the Fed investigation could lead Powell to refuse stepping down.

2. Former Fed Chair Yellen: Investigation into Powell undermines the Federal Reserve's independence.

3. Hasset, Director of the White House National Economic Council: Doesn't know if former President Trump approved the Fed probe. Still interested in Fed positions. Describes Fed Chair Powell as a good man.

4. QCP Capital: Controversy over Fed independence triggers market risk-off sentiment, causing BTC to rise then retreat.

Market Trends

1. Over the past 24 hours, total liquidations across the crypto market reached $231 million, with long positions accounting for $143 million. BTC liquidations amounted to ~$72 million, ETH to ~$46 million.

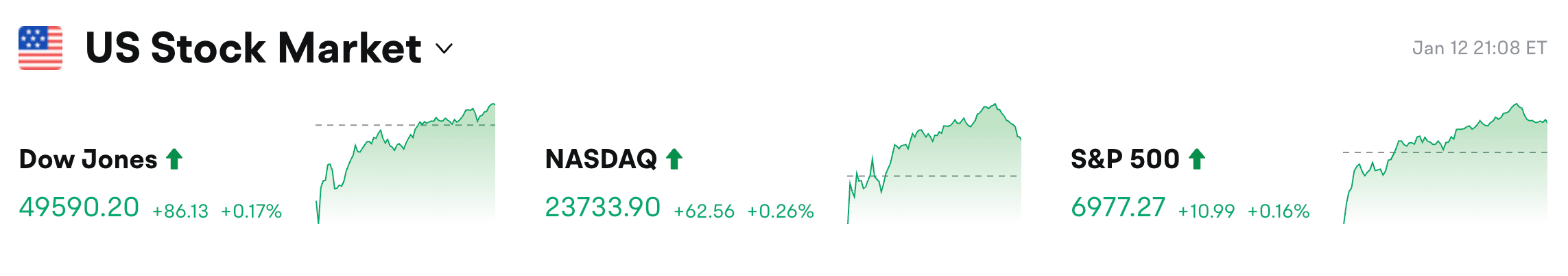

2. U.S. equities: Dow +0.17%, Nasdaq +0.26%, S&P 500 +0.16%. Additionally, CRCL (Circle) +3.1%; MSTR (Strategy) +3.11%; NVDA (NVIDIA) +0.04%.

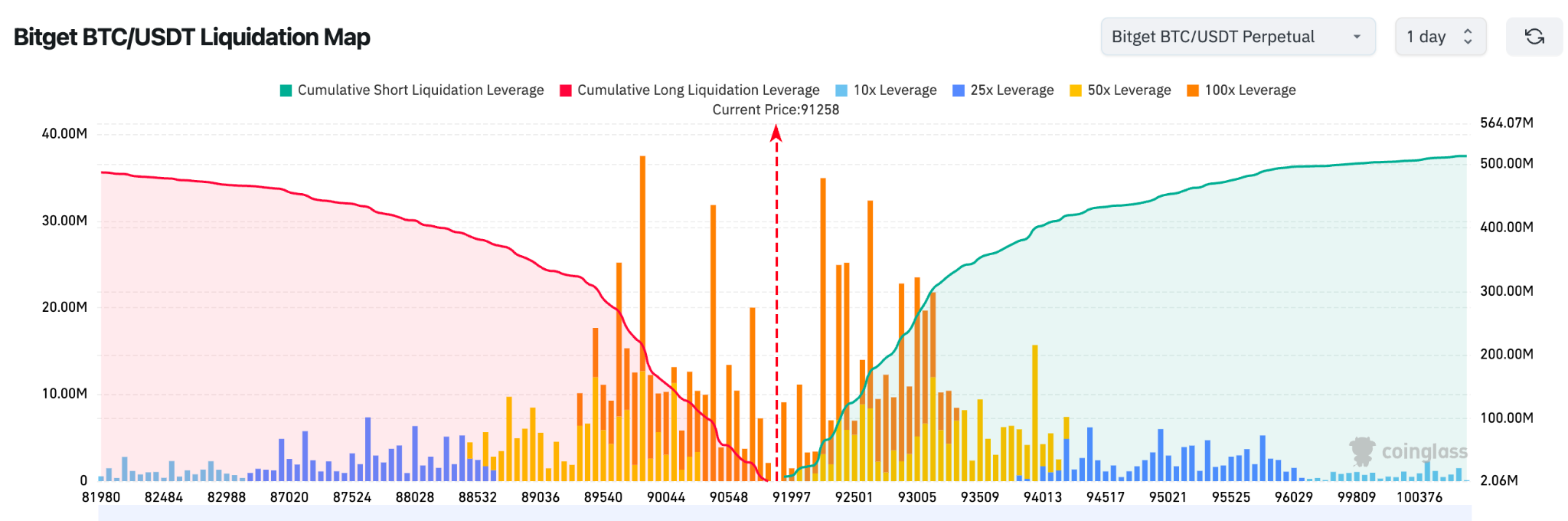

3. Bitget BTC/USDT liquidation map shows current BTC price around 91,258. Long liquidations are concentrated below in the 89,000–90,500 range, mostly at high leverage (50x–100x). A drop into this zone may trigger cascading liquidations and amplify downward pressure. On the upside, short liquidations are accumulating in the 92,000–94,000 range. A sustained breakout above this area could prompt short covering, accelerating upward momentum.

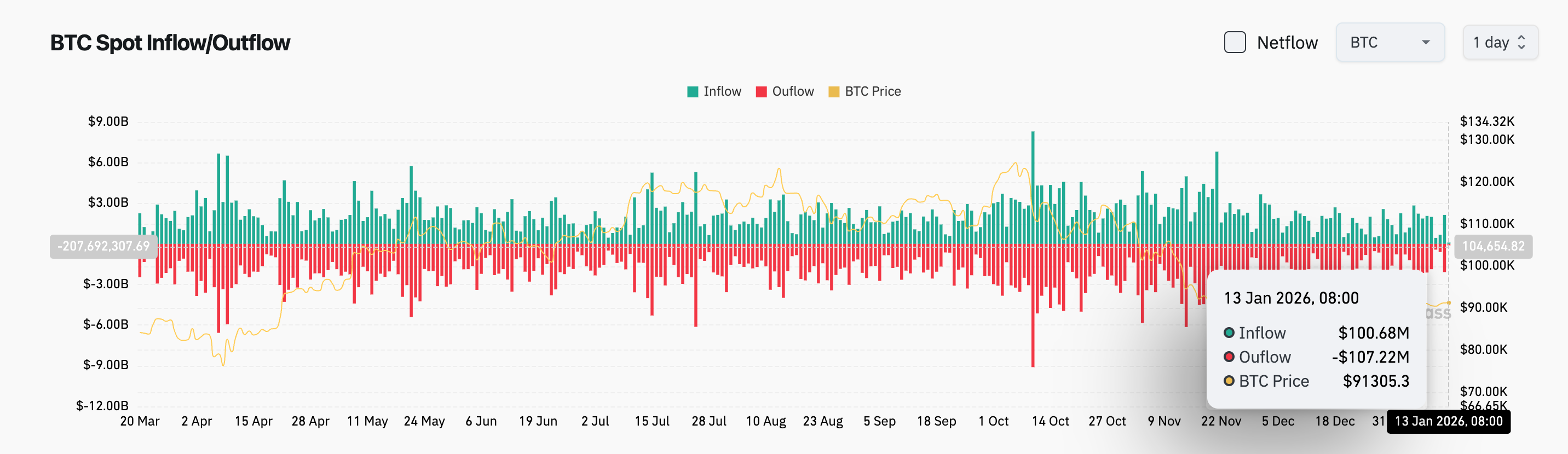

4. In the past 24 hours, BTC spot inflows totaled approximately $100.68 million, outflows $107.22 million—nearly flat net flow.

News Updates

1. Solana privacy app SHDW suspected of locking user funds.

2. Fortune reports: Former New York City Mayor Eric Adams announces a cryptocurrency initiative called “NYC Token” aimed at raising funds to combat antisemitism and anti-American sentiment, and to educate children about blockchain technology. However, specific details remain vague.

3. Meta plans to reduce investment in its metaverse team, redirecting savings toward VR headset development.

4. Apple selects Google's Gemini to power AI-enhanced Siri launching this year. Alphabet's market cap surpassed $4 trillion following the news.

5. BitGo has filed for a U.S. IPO, aiming to raise up to $201 million.

Project Updates

1. U.S. SEC delays decision on PENGU and T. Rowe Price's crypto ETF applications.

2. pump.fun transfers another 148 million USDC and USDT earned from public $PUMP sales to Kraken.

3. WLFI official address sends 500 million WLFI tokens (~$83.12 million) to Jump Trading. Previously reported: $TRUMP worth $271 million is set to unlock this week.

4. FTX/Alameda has unstaked over 190,000 SOL (~$27.98 million).

5. Bitmine stakes over 150,000 ETH (~$479 million). Earlier report: Bitmine acquired an additional 24,266 ETH, bringing total holdings above 4.16 million ETH.

6. Strategy's unrealized gains reach $10.55 billion; BitMine records $3.225 billion in unrealized losses. Last week, Strategy added 13,627 BTC (~$1.25 billion), bringing total BTC holdings to 687,400.

7. Italy’s central bank, in a paper titled “If Ethereum Goes to Zero? How Market Risk Becomes Infrastructure Risk,” notes that if ETH drops to zero, validators may exit, block production could slow, network security weaken, and services relying on Ethereum settlement—including stablecoins and tokenized assets—could be disrupted.

8. WLFI launches “World Liberty Markets,” a lending market powered by Dolomite.

9. BlackRock transfers over 3,100 BTC and 7,200 ETH to Coinbase.

10. Bitcoin Core adds its sixth core code maintainer in three years: TheCharlatan.

Disclaimer: This report is AI-generated with human verification for information accuracy. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News