Ethereum: A Decade of Narrative Transformation

TechFlow Selected TechFlow Selected

Ethereum: A Decade of Narrative Transformation

What truly brings Ethereum to billions of users is not just what it can do, but what the real world chooses to do with it.

Authors: Ada, David, TechFlow

At 3:26 PM on July 30, 2015, the first block of Ethereum was successfully mined.

With that genesis moment known as "Frontier," an ambitious prophecy was born—the "World Computer." Vitalik and early developers believed they were not building an upgraded version of Bitcoin, but a global computing platform capable of running any decentralized application.

Ten years later, we stand at the tenth anniversary of Ethereum's mainnet launch.

When we examine Ethereum’s development trajectory, we find this "World Computer" has not run various decentralized applications as expected. Instead, it has evolved into a settlement layer dominated by financial applications.

DeFi protocols consume the vast majority of gas. Trillions of dollars in assets flow across this network, while once-promising decentralized social, gaming, and storage applications have either disappeared or migrated to other chains.

Is this shift in narrative a compromise or evolution?

Looking back from this juncture, Ethereum’s decade-long narrative transformation is not just a story about Ethereum—it is a story about how technological ideals find their footing in the real world.

The World Computer: The Golden Age of Idealism (2015–2017)

To understand the origins of Ethereum’s narrative, we must return to the winter of late 2013.

Then 19-year-old Vitalik Buterin, traveling in Israel, conceived a bold idea: What if blockchains could do more than transfer value—what if they could run arbitrarily complex programs?

The revolutionary aspect of this idea lay in its expansion of blockchain from a specialized value-transfer tool into a general-purpose computing platform.

Yet behind this initial vision lay deeper cultural motivations.

The early Ethereum community gathered a group of technologists who believed in “code is law.” They weren’t merely building a new technical platform—they were attempting to create a new social paradigm: a digital utopia operating entirely under code-defined rules, free from centralized authority.

The narrative then centered on "decentralization," on the concept of “World Computer” governed by code-is-law.

This was not only a technological ideal but also a political manifesto and philosophical stance. Early supporters believed smart contracts could reconstruct society’s operational rules, creating a fairer, more transparent, trustless world.

This techno-idealism was evident throughout Ethereum’s early design. A Turing-complete virtual machine, gas mechanism, account model—each technical choice reflected values prioritizing “maximal decentralization” and “maximal universality.”

On April 30, 2016—less than a year after Ethereum’s mainnet launch—the DAO (Decentralized Autonomous Organization) began its crowdfunding campaign.

This project perfectly embodied the early community’s idealism: a fund with no management, no board, fully controlled by code. Within just 28 days, the DAO raised 11.5 million ETH—14% of the total ETH supply at the time—worth over $150 million.

But ideals soon met harsh reality. On June 17, an attacker exploited a reentrancy vulnerability in the DAO’s smart contract, stealing 3.6 million ETH.

The subsequent debate split the entire community. One side argued that since code is law, gains from exploiting code vulnerabilities were “legitimate,” and any human intervention violated blockchain’s core principles. The other side believed that when outcomes clearly contradicted community consensus, correcting errors via hard fork was necessary.

In the end, Vitalik-led majority opted for a hard fork, returning stolen ETH to original holders. This decision caused Ethereum’s first major split. The minority adhering strictly to “Code is Law” continued maintaining the original chain—today’s Ethereum Classic (ETC).

This crisis revealed an internal contradiction within techno-idealism: full decentralization might lead to unacceptable consequences, while any human intervention risks betraying decentralization itself.

This tension has persisted throughout Ethereum’s history, foreshadowing future narrative shifts.

ICO Money Printer: Lost in the Bubble (2017–2020)

By the end of 2016, no one foresaw how the coming ICO frenzy would transform everything about Ethereum.

In summer 2017, the crypto world entered an unprecedented capital carnival. ICOs (Initial Coin Offerings)—raising funds by issuing tokens—ignited global speculation. In 2017 alone, over $6 billion was raised through ICOs; by mid-2018, that figure surged to $12 billion.

Ethereum became the primary engine powering these ICOs.

Write a contract, define funding rules, set token name and supply—tokens with no real-world commitments emerged en masse:

A grandiose whitepaper, a FOMO-inducing story, and a seemingly sound tokenomics model.

At this point, Ethereum faced an unexpected identity crisis—designed initially as a "World Computer," it suddenly found its most widespread use was issuing tokens.

This gap between vision and reality marked the first major rupture in Ethereum’s narrative.

Vitalik and early core developers envisioned a global computing platform for decentralized apps, but the market answered: we only need a simple ERC-20 standard to issue tokens.

This simplification occurred not just technically but cognitively. To investors, Ethereum ceased being a revolutionary computing paradigm and became a money printer.

More deeply, this “token issuance platform” label began shaping Ethereum’s own development direction. When 90% of ecosystem activity revolved around tokens, development priorities inevitably tilted accordingly. EIPs (Ethereum Improvement Proposals) focused far more on token standards than other use cases; developer tools centered on token creation and trading. The entire ecosystem fell into a state of “path dependency.”

If the DAO incident represented an internal philosophical debate among idealists, the ICO boom was the first head-on collision between idealism and market reality. It exposed a fundamental rift in Ethereum’s narrative: the vast chasm between technological vision and market demand.

Then came the 2018 bear market.

For Ethereum, this wasn’t just price collapse—it was narrative disintegration. As the ICO bubble burst and slogans like “blockchain revolution” lost credibility, Ethereum faced a fundamental question:

If not the World Computer, then what are you?

The answer slowly emerged during the long bear market. A new narrative took shape: Ethereum is first a financial settlement layer—and only potentially a general-purpose computing platform.

This shift was also reflected in the technical roadmap. Ethereum 2.0’s design began emphasizing needs of financial applications—faster finality, lower transaction costs, higher security. While official discourse still emphasized “universality,” practical optimizations now clearly targeted financial use cases.

The correctness of this choice would be tested in the next phase.

DeFi Triumph: Finance as Ethereum’s True Calling (2020–2021)

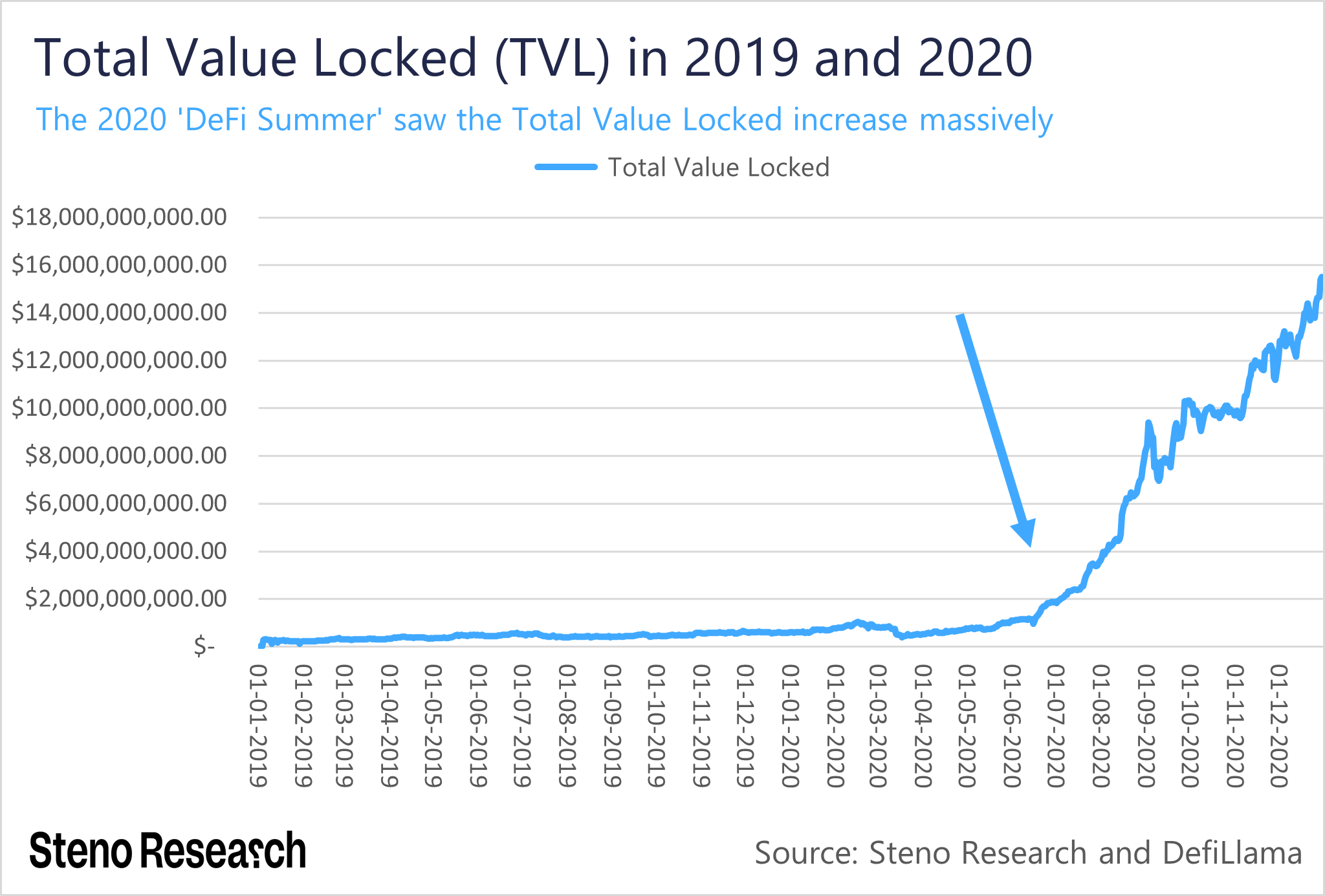

For Ethereum, the DeFi Summer of 2020 was not just an application-layer explosion—it was a complete transformation of identity.

If the 2017 ICO wave unexpectedly turned Ethereum into a token issuance platform, DeFi’s success made the ecosystem realize: finance may not be a compromise for Ethereum, but its natural destiny.

This realization evolved gradually.

Initially, DeFi was seen as one experiment among many—on par with gaming, social, and supply chain applications. But when Compound’s liquidity mining ignited market enthusiasm, when hundreds of billions flowed into DeFi protocols, and when gas fees hit record highs due to DeFi activity, an undeniable truth emerged: Ethereum had found its Product-Market Fit.

Previously, positioning Ethereum as a financial platform seemed like a “downgrade,” a betrayal of the grand “World Computer” vision. But DeFi revealed another possibility: finance itself is the most complex and valuable form of computation.

Every trade, every liquidation, every derivative represents intricate computation. From this perspective, becoming a “World Financial Computer” does not contradict becoming a “World Computer”—it’s simply a different articulation of the same vision.

DeFi’s explosion created a powerful positive feedback loop, reinforcing Ethereum’s narrative as financial infrastructure. Surging usage, developer concentration, and shifting influence—all amplified DeFi projects’ voices.

However, DeFi’s success brought a severe practical problem: Ethereum’s performance bottleneck.

When a simple token swap required tens or even hundreds of dollars in gas fees, Ethereum faced an existential crisis. This was no longer an abstract question of “how to become the World Computer,” but a concrete one: “how to keep DeFi running.”

This urgency fundamentally shifted Ethereum’s technical priorities. Previously, scalability was a long-term goal—researchers could afford to wait for the most elegant solution. But DeFi’s surge made scaling an immediate emergency. The Ethereum community had to accept a reality:

Perfect solutions can wait—but markets won’t.

Thus emerged a series of pragmatic choices. Layer 2 was no longer a distant concept but an urgent lifeline. Rollup technologies, though less decentralized, offered quick congestion relief and gained full support from core developers. Ethereum 2.0’s roadmap was revised to prioritize features most beneficial to DeFi.

This technical pivot was, in essence, a manifestation of narrative change. Once Ethereum accepted its role as financial infrastructure, all technical decisions revolved around this central identity.

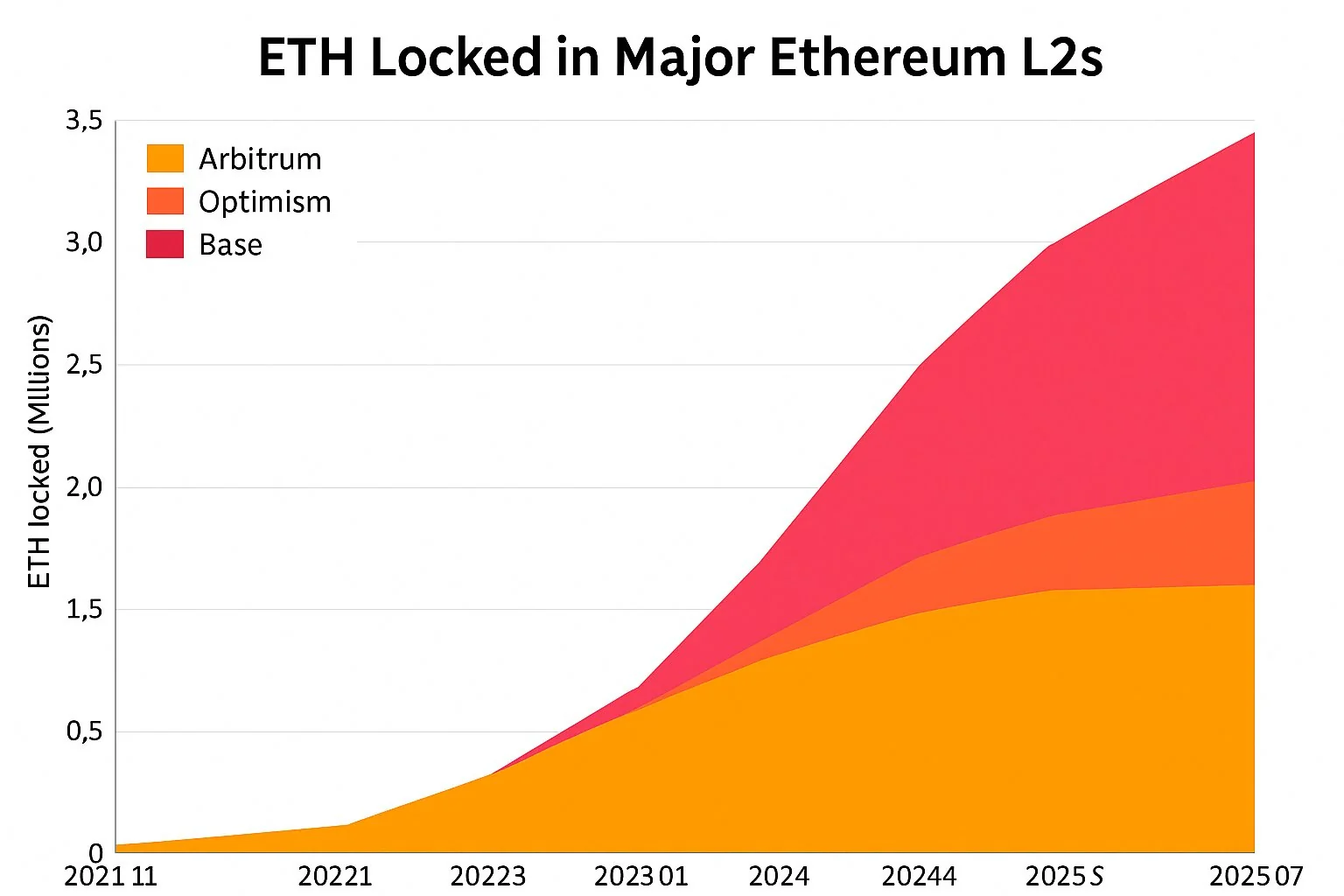

Rise of L2s: Sovereignty Ceded, Host Parasitized (2021–2023)

In 2021, Ethereum faced a brutal reality: DeFi’s success was killing Ethereum.

When simple transactions took minutes to confirm and high costs excluded ordinary users, Ethereum’s narrative encountered a new crisis. The “global financial settlement layer” sounds noble—but if only the wealthy can afford it, can this narrative hold?

A deeper contradiction emerged: Ethereum’s very success exposed structural flaws in its architecture. As a monolithic blockchain, Ethereum tried to handle everything on one layer—executing computations, validating transactions, storing data, achieving consensus. This “do-it-all” design was once an advantage, but at scale, it became a fatal weakness.

Facing this dilemma, the Ethereum community underwent a painful cognitive shift. A true World Computer should resemble the internet—a modular, layered system.

This transformation was most clearly articulated in a Vitalik article: “Ethereum’s future is modular.”

These words marked another pivotal turn in Ethereum’s narrative—from “one chain rules all” to “multi-layer collaborative ecosystem.” Ethereum began accepting a reality: no single blockchain can meet all needs; the future belongs to specialization.

As Arbitrum, Optimism, and other rollups began processing increasing volumes of transactions, a fundamental question arose. If most activity happens on Layer 2, what is Ethereum mainnet?

In 2022, tensions surfaced more visibly around data availability. When projects like Celestia proposed dedicated data availability layers, debates intensified over the balance between openness and control within Ethereum.

Ethereum has long championed openness and decentralization, but when such openness threatens its own position, community reactions grew complicated. Some began using the term “Ethereum Alignment” to attempt maintaining control while preserving openness.

More interestingly, this debate reshaped the definition of success.

Previously, success meant all activity occurring directly on Ethereum. Now, success was redefined: even if activity occurs elsewhere, as long as it ultimately relies on Ethereum’s security, it counts as a victory for the Ethereum ecosystem. This conceptual shift reflects a mindset evolution from “exclusive dominance” to “symbiosis.”

The Multi-Chain War and Defense of “Orthodoxy” (2023–2024)

In 2023, a subtle yet significant shift occurred in the blockchain world: new-generation public chains stopped trying to become “better Ethereums” and began telling completely different stories.

Solana stopped framing itself as a “faster smart contract platform” and instead positioned as “the Nasdaq of blockchains.” Aptos and Sui avoided discussing “decentralization,” focusing instead on “Web2-level user experience.”

For Ethereum, this shift brought both relief and challenge. Relief because it no longer needed to compete in an endless performance arms race. Challenge because when competitors opened new battlefronts, Ethereum’s traditional strengths risked irrelevance.

The deeper issue: when “decentralization” is no longer the sole value metric, how compelling is Ethereum’s celebrated core value?

This complexity in narrative competition became most apparent in Solana’s resurgence.

After FTX collapsed in 2022, many believed Solana was finished. Yet in 2023, it roared back with meme coins and low-cost transactions. This phenomenon revealed an uncomfortable truth for the Ethereum community—markets may not care about decentralization as much as assumed.

In response to rising new chains, Ethereum’s first reaction was to emphasize “orthodoxy.”

Ethereum advocates highlighted issues of centralization, security risks, and technical compromises in competing chains. But market response was surprisingly indifferent. When users could transact for pennies, they seemed unconcerned whether the network was “decentralized enough.”

When Ethereum attempted to justify its value in utilitarian terms, it lost its former moral high ground. “We’re more secure” lacked the inspirational power of “we’re building a decentralized future.” This narrative secularization, while potentially attracting mainstream users, may alienate core supporters.

Even more complex: new chains began redefining “decentralization” themselves.

They argued true decentralization means accessibility for ordinary people—not an elite network affordable only to the wealthy. When Solana users criticized Ethereum’s high gas fees, Ethereum fell into a moral trap of its own making.

By early 2024, an unsettling trend became clear: Ethereum’s narrative had grown increasingly defensive. Most discussions focused not on “what we will build,” but “why we are better than other chains.” This shift from offense to defense exposed Ethereum’s innovation stagnation.

This defensive posture manifested in multiple ways.

Technical roadmaps responded more to competitive pressure than intrinsic vision. Community discourse overflowed with criticism of other chains rather than self-reflection. Even Vitalik’s writings increasingly explained and defended, rather than proposing bold new ideas as in earlier days.

More seriously, this defensive mindset began stifling ecosystem innovation. Developers stopped asking “what’s possible,” and started asking “what’s safe.” Investors sought not breakthrough innovations but “killers of Ethereum killers.” The entire ecosystem陷入了 a state of involution—preoccupied with internal competition over external expansion.

The root cause lies in narrative exhaustion. When “World Computer” proved too grand, “DeFi settlement layer” too narrow, and “modular blockchain” too technical, Ethereum lacks a new narrative capable of sparking imagination.

Narrative Reconstruction and the Future (2024–)

In 2024, as the crypto market searched for new growth engines, RWA (Real World Assets) emerged as the new savior. For Ethereum, this isn’t just a new application scenario—it’s an opportunity for narrative reconstruction. Shifting from “transforming finance” to “connecting with reality,” Ethereum seeks to tell a more practical, mainstream-oriented story.

The appeal of Ethereum’s RWA narrative lies in its concreteness.

No longer abstract “decentralized finance,” but “turning your U.S. Treasuries into tradable tokens.” No longer just “permissionless innovation,” but “reducing friction costs in cross-border trade.” This shift from idealism to pragmatism reflects the Ethereum community’s evolving understanding of market needs.

More subtly, the RWA narrative changes the definition of success. Previously, success meant creating entirely new, native crypto economies. Now, success means serving existing financial systems.

Wall Street’s old money flocked to ETH ETFs; an Ethereum co-founder reverse-jumped into the U.S. stock market, acquiring shells of listed companies… Assets going mainstream, crypto equities convergence—Ethereum gradually returned to $4,000 in the new market cycle.

The game changed. So did the narrative.

Once, the community constantly searched for “the one” grand narrative to define Ethereum. Now, more people accept a reality: perhaps there is no single answer.

Instead of seeking one unified, all-encompassing story, multiple narratives now coexist. For DeFi users, Ethereum is financial infrastructure; for enterprises, it’s a tool for crypto transformation; for creators, it’s a copyright protection platform; for idealists, it remains the decentralized future.

Letting Ethereum serve broader needs and attract more diverse users.

Yet we don’t know whether this pluralism signifies maturity or symptom of loss. A healthy ecosystem should embrace diversity, but a platform lacking core vision may lose momentum.

Regardless, marginal returns on technological innovation are diminishing, and narrative innovation must continue.

When technology and narrative diverge, solving real problems matters more than inventing new terms. Improving user experience matters more than promising to change the world. This pragmatic attitude may lack excitement, but could prove more sustainable.

A cup of wine shared in spring breeze, ten years of lanterns in night rain.

From idealism to realism, revolution to reform, disruption to integration. Ethereum’s decade may not be a betrayal of初心, but the cost of growing up. After all, only when the old stories end can new ones begin.

Perhaps, what truly brings Ethereum to billions of users isn’t what it can do, but what the real world chooses to do with it.

From vision to reality, promise to delivery—this may be the ultimate direction of Ethereum’s narrative evolution. And the gains and losses, advances and retreats, persistence and compromises along the way will define not only Ethereum, but the entire future of the crypto industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News