The Economist: If stablecoins are truly useful, they will also be truly disruptive

TechFlow Selected TechFlow Selected

The Economist: If stablecoins are truly useful, they will also be truly disruptive

The view that cryptocurrencies have not yet produced any noteworthy innovations is long outdated.

By The Economist

Translated by Centreless

One thing is clear: the view that cryptocurrencies have yet to produce any noteworthy innovation is now outdated.

To conservative figures on Wall Street, cryptocurrency "use cases" are often discussed with derision. Veterans have seen it all before. Digital assets come and go, frequently generating great excitement among investors chasing memecoins and NFTs. Beyond speculation and financial crime, their other applications have repeatedly proven flawed or inadequate.

Yet this latest wave of enthusiasm is different.

On July 18, President Donald Trump signed the Stablecoin Bill (GENIUS Act), providing long-sought regulatory clarity for stablecoins—cryptographic tokens backed by traditional assets, usually dollars. The industry is booming; Wall Street players are now rushing to get involved. "Tokenization" is also rising: trading volume of on-chain assets—including stocks, money market funds, and even private equity and debt—is growing rapidly.

As with any revolution, revolutionaries are ecstatic while conservatives are anxious.

Vlad Tenev, CEO of digital asset broker Robinhood, says the new technology could "lay the foundation for crypto to become a pillar of the global financial system." Christine Lagarde, president of the European Central Bank, sees things differently. She worries the rise of stablecoins amounts to "the privatization of money."

Both sides recognize the scale of change at hand. Mainstream finance may now face a transformation more disruptive than early crypto speculation. Bitcoin and other cryptocurrencies promised to be digital gold, whereas tokens are merely wrappers—or representations—of other assets. That might not sound impressive, but some of modern finance’s most transformative innovations have indeed changed how assets are packaged, subdivided, and restructured—exchange-traded funds (ETFs), Eurodollars, and securitized debt being prime examples.

Stablecoins currently in circulation are worth $263 billion, up about 60% from a year ago. Standard Chartered expects the market to reach $2 trillion in three years.

Last month, JPMorgan Chase, America’s largest bank, announced plans to launch a stablecoin-like product called JPMorgan Deposit Token (JPMD), despite CEO Jamie Dimon’s long-standing skepticism toward cryptocurrencies.

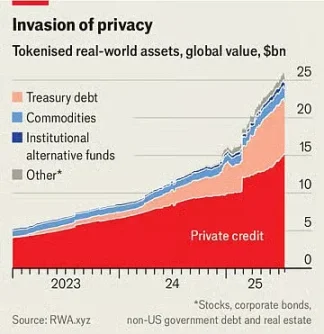

The market value of tokenized assets stands at just $25 billion, but has more than doubled over the past year. On June 30, Robinhood launched over 200 new tokens for European investors, allowing them to trade U.S. stocks and ETFs outside regular trading hours.

Stablecoins make transactions cheap, fast, and convenient because ownership is instantly recorded on a digital ledger, eliminating intermediaries that operate traditional payment channels. This is especially valuable for cross-border payments, which are currently expensive and slow.

Though stablecoins account for less than 1% of global financial transactions today, the GENIUS Act will give them a boost. The bill confirms stablecoins are not securities and requires them to be fully backed by safe, liquid assets.

Retail giants including Amazon and Walmart are reportedly considering launching their own stablecoins. For consumers, these could function like gift cards, offering balances to spend at retailers, potentially at lower prices. This would threaten companies like Mastercard and Visa, which earn profit margins of about 2% on sales they facilitate in the U.S.

Tokenized assets are digital replicas of another asset—be it a fund, company stock, or basket of commodities. Like stablecoins, they can make financial transactions faster and easier, particularly those involving less liquid assets. Some products are mere gimmicks. Why tokenize stocks? It might enable 24-hour trading, since exchanges where stocks are listed wouldn’t need to be open—but the benefits are questionable. Moreover, for many retail investors, marginal trading costs are already low or zero.

Efforts in Tokenization

Yet many products are not so flashy.

Take money market funds investing in Treasury bills. Their tokenized versions can double as payment instruments. These tokens, backed by safe assets like stablecoins, can be seamlessly exchanged on blockchains. They also offer better returns than bank interest rates. The average U.S. savings account yields under 0.6%, while many money market funds pay up to 4%. BlackRock’s largest tokenized money market fund is now worth over $2 billion.

"I expect the day will come when tokenized funds are as familiar to investors as ETFs," wrote Larry Fink, the firm’s CEO, in a recent letter to investors.

This would disrupt existing financial institutions.

Banks may be venturing into new digital packaging, but partly because they recognize tokens pose a threat. The combination of stablecoins and tokenized money market funds could ultimately reduce the appeal of bank deposits.

The American Bankers Association notes that if banks lose about 10% of their $19 trillion in retail deposits—their cheapest funding source—their average funding cost would rise from 2.03% to 2.27%. While total deposits, including commercial accounts, would not shrink, bank profit margins would be squeezed.

These new assets could also disrupt the broader financial system.

For example, holders of Robinhood’s new stock tokens do not actually own the underlying shares. Technically, they hold derivatives tracking the asset’s value—including dividends paid by the company—not the shares themselves. As such, they lack voting rights typically granted by share ownership. If the token issuer goes bankrupt, holders would be left in limbo, competing with other creditors for claims to the underlying assets. A similar situation occurred earlier this month with Linqto, a fintech startup that filed for bankruptcy. It had issued shares of private companies through special-purpose vehicles. Buyers are now uncertain whether they own the assets they thought they did.

This represents one of tokenization’s greatest opportunities—and regulators’ biggest challenges. Pairing illiquid private assets with easily tradable tokens opens a closed market to millions of retail investors with trillions of dollars to deploy. They could buy shares in the most exciting private companies, which were previously out of reach.

This raises questions.

Regulators like the U.S. Securities and Exchange Commission (SEC) exert far greater influence over public companies than private ones—that’s why the former are considered suitable for retail investment. Tokens representing private shares would turn formerly private equity into assets as easy to trade as ETFs. But unlike ETF issuers, who commit to trading underlying assets to provide intraday liquidity, token providers do not. At sufficient scale, tokens would effectively turn private companies into public ones—without requiring the usual disclosure obligations.

Even crypto-friendly regulators want to draw lines.

Hester Peirce, an SEC commissioner known as “Crypto Mom” for her favorable stance on digital currencies, emphasized in a statement on July 9 that tokens should not be used to circumvent securities laws. "Tokenized securities are still securities," she wrote. Therefore, companies issuing securities must comply with disclosure rules, regardless of whether they use new crypto packaging. While this makes sense in theory, the flood of new assets with novel structures means regulators will be perpetually playing catch-up in practice.

Thus, a paradox emerges.

If stablecoins prove truly useful, they will also be genuinely disruptive. The more appealing tokenized assets become to brokers, clients, investors, merchants, and other financial firms, the more they will transform finance—a transformation both exhilarating and worrisome. Regardless of how this balance plays out, one thing is clear: the view that cryptocurrencies have yet to produce any noteworthy innovation is now outdated.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News