Stablecoin Payments and Global Capital Flow Patterns

TechFlow Selected TechFlow Selected

Stablecoin Payments and Global Capital Flow Patterns

Payment involves much more than just "peer-to-peer transfers"; real enterprise-level scenarios are far more complex than simply "moving money from A to B".

Author: Wang

Stablecoins are the most representative practical tools in the digital currency space, demonstrating how blockchain can provide a new and efficient infrastructure for traditional financial payment systems. Over the past year, the total market cap of stablecoins has grown by more than 50%. Since Trump's re-election in November, their growth has accelerated sharply. Currently, the total market cap of stablecoins exceeds $250 billion, standing at the edge of an explosive phase. This scale already supports the efficient flow of trillions of dollars in global payment funds.

Industry insiders understand the value of stablecoins: they fully embody blockchain’s core capability of “instantly transferring funds and value,” making it possible to build commercial closed loops on-chain—payments. However, payments go far beyond just “peer-to-peer transfers.” Real enterprise-level scenarios are much more complex than simply “sending money from A to B.”

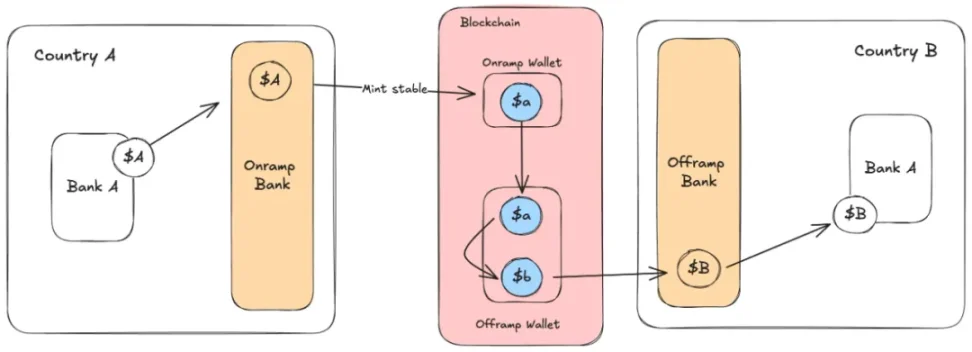

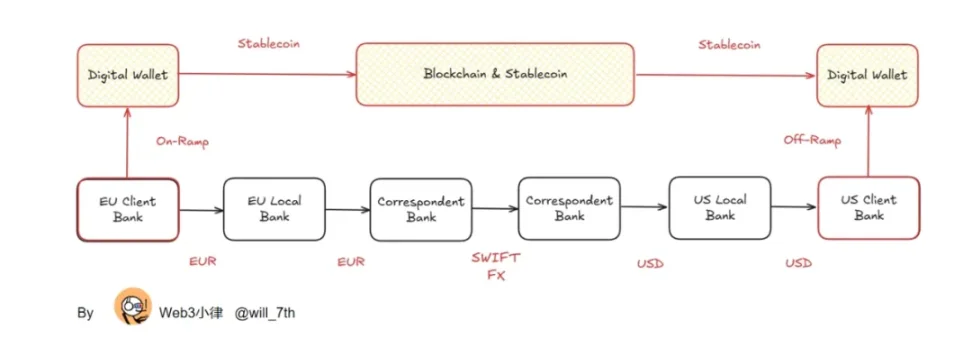

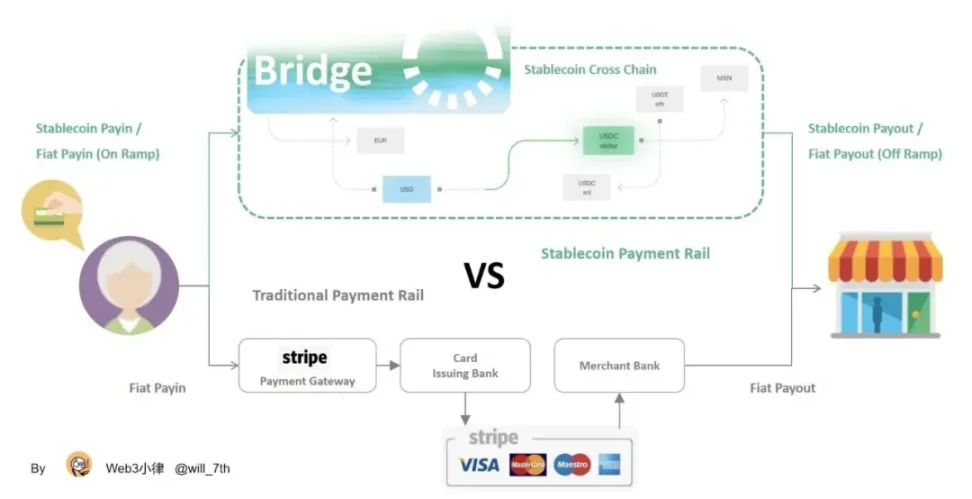

Currently, most enterprise-facing stablecoin applications adopt a “stablecoin sandwiched” architecture—a term first coined in 2021 by Ran Goldi, Senior Vice President of Payments and Networks at Fireblocks—where blockchain replaces the horizontal value/fund transfer of traditional payment channels, while both ends still rely on outdated financial payment systems.

This design brings significant improvements but also limits the full realization of blockchain advantages. This is why Airwallex CEO Jack criticized that he hasn’t seen stablecoin payments actually reduce costs or improve efficiency.

Therefore, building on Jesse’s article *Unpacking the Stablecoin Sandwich*, we will examine how stablecoins apply to global cross-border payments from the perspective of global fund transfers. This article will:

-

Break down the existing global cross-border payment system;

-

Analyze specific improvements brought by the stablecoin sandwiched architecture in fund management, B2B payments, and card network settlements;

-

Explore how to overcome challenges at both ends of the stablecoin sandwich, enabling blockchain value to run through the entire process.

1. Background of Stablecoin Payments

Among the many applications of stablecoins, B2B enterprise payments stand out most prominently. The latest Artemis report provides frontline data from payment companies: last year, monthly B2B enterprise payment volumes grew from $770 million to $3 billion. Fireblocks also reported that stablecoins account for nearly half of its platform transaction volume, with 49% of customers actively using stablecoins for payments.

Internal data from leading companies better reflect the size of niche markets. According to FXCIntelligence, BVNK (considered one of the largest players in this field) processes around $15 billion annually, about half of which comes from B2B enterprise payments—the largest segment within cross-border payments. Conduit’s annualized transaction volume reaches $10 billion, estimated to represent approximately 20% of the global B2B stablecoin cross-border payment market; Orbital reports an annualized scale of $12 billion.

Specifically, the use of global payments is becoming increasingly widespread because as legacy financial payment infrastructures become more apparent, the advantages of blockchain-based stablecoins are amplified. SWIFT and correspondent banking networks successfully facilitate over $100 trillion in global payments each year. Yet enterprises and banks still face major complexities and delays.

2. Various Models of Global Cross-Border Payments

2.1 Bank Infrastructure Based on SWIFT

First, let’s look at how current SWIFT-based global payments operate.

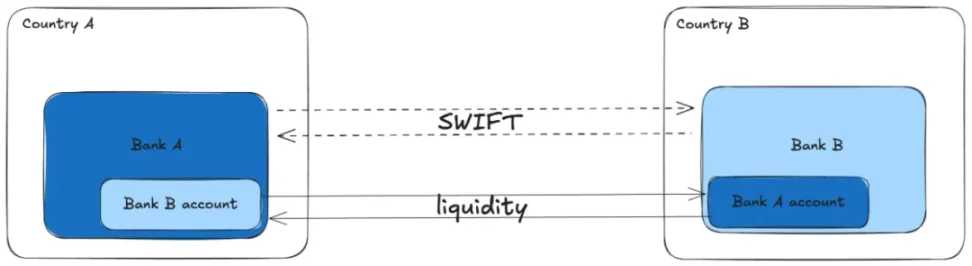

For transactions between banks in different countries, the entire process is split into two parts: “messaging/clearing” and “fund settlement.” SWIFT handles the transmission of transfer instructions between banks, while actual fund movement only occurs between banks that have pre-established accounts and can directly perform debit/credit transfers.

Jesse, Unpacking the Stablecoin Sandwich

Only when both banks are connected to the SWIFT system and are direct partners can final transfer—fund settlement—be completed. If there is no direct relationship, intermediary correspondent banks with appropriate interfaces and positions must be linked to complete the settlement.

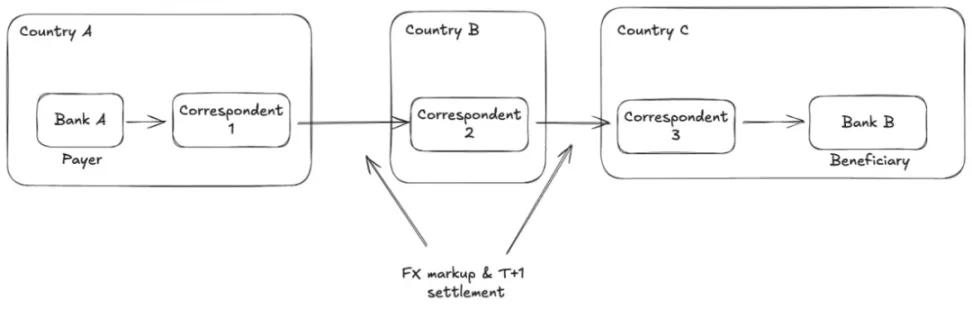

The diagram below shows a typical SWIFT network transaction: connecting two otherwise unrelated banks via a shared correspondent bank.

Jesse, Unpacking the Stablecoin Sandwich

As more intermediary banks are required, settlement times stretch to several days, fees rise, tracking becomes challenging, and other issues emerge. This also means that cross-border payments between neighboring countries with underdeveloped financial infrastructures often have to route through banks in the Global North, causing great inconvenience.

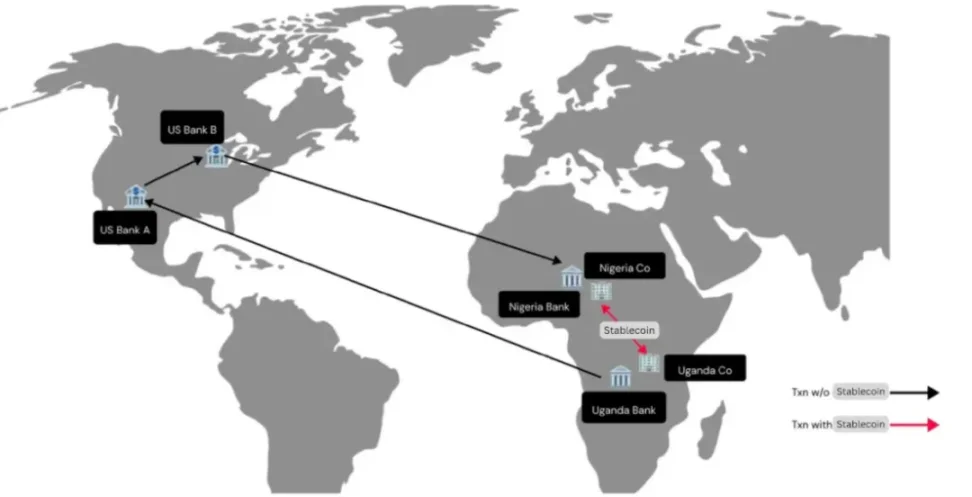

Stablecoins: Leapfrogging Africa's Financial System, Ayush Ghiya and Uchenna Edeoga

2.2 Cross-Border Liquidity Pool Model Based on PSPs

The process described above is exactly what businesses go through today when conducting international wire transfers: banks must be connected to SWIFT and possess clearing and settlement capabilities in the target payment corridor.

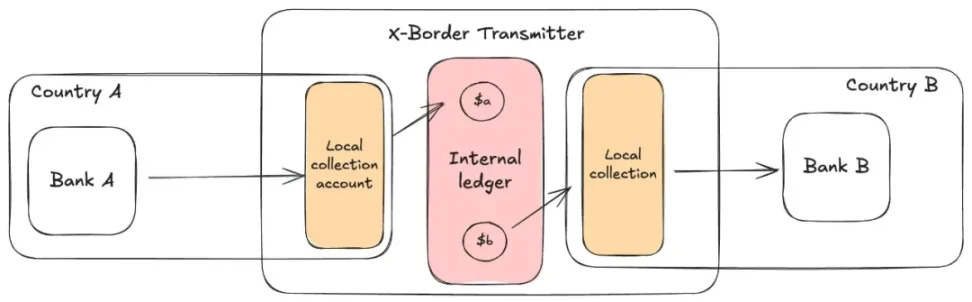

Thus, the service model of cross-border money transmitters (XBMT)—a.k.a. well-known cross-border payment companies—emerged. Their purpose is to enable enterprises to make global payments without going directly through SWIFT channels. This capability is also known as “global multi-currency accounts” or “local collection accounts.”

The essence is: a cross-border liquidity pool model.

The core of their service: providing enterprises with multi-currency liquidity pools so they can flexibly make payments across countries.

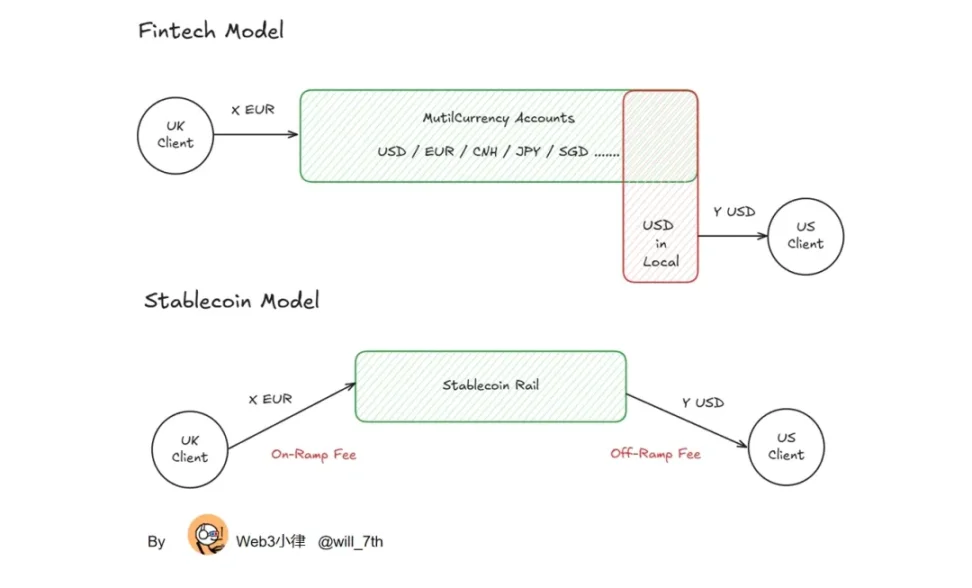

XBMTs manage compliance and banking relationships, while businesses or individuals receive a single multi-currency banking product, forming a “closed loop,” meaning no external operators or dependencies add cost or complexity. If viewed as a sandwich, the internal ledger is the meat, and local collection accounts in each region are the bread. Liquidity is managed internally across accounts:

Jesse, Unpacking the Stablecoin Sandwich

Today, XBMTs occupy an important position in the global B2B enterprise payment and corporate treasury management markets. Operating in closed-loop mode, they pre-position and orchestrate necessary liquidity, then distribute it to enterprise clients on demand. By controlling the end-to-end process, XBMTs impose strict quota and risk control rules on customers.

Despite their polished appearance, XBMTs still operate atop the SWIFT rails, relying on sophisticated liquidity management techniques to “simulate” instant settlement experiences. However, the speed and scale of such designs remain constrained by the available liquidity of the XBMT in specific countries and the inherent clearing timelines of their underlying settlement rails.

Considering bank account capabilities and liquidity management, Airwallex has already built relatively comprehensive “global multi-currency accounts” or “local collection accounts” in developed G10 countries, achieving near-zero-cost fund disbursement. Compared to the deposit and withdrawal costs required at both ends of the “stablecoin sandwich” model, this offers greater cost advantages.

Therefore, adoption of stablecoin payments requires clear scenario-specific advantages and cannot be generalized.

2.3 Stablecoin Model

If XBMTs are carefully designed “structured products” for B2B enterprise payment scenarios, then stablecoins represent a more fundamental leap: leveraging blockchain technology to reshape the way internet commerce operates.

The settlement cycle of stablecoins equals the block time of their issuing blockchain—an order-of-magnitude acceleration compared to SWIFT and correspondent bank transfers. Any system relying on traditional methods can be replaced by a shared, verifiable ledger that tracks stablecoin issuance and ownership.

More importantly, stablecoins are typically deployed on smart contract platforms, enabling innovative systems and workflows impossible under traditional banking rails. For example, if an XBMT wants to layer additional logic, it must integrate APIs with banks in each country individually. But on open, verifiable protocols (such as Ethereum’s ERC or Solana’s SPL standards), anyone can permissionlessly add functionality to stablecoins.

From a macro perspective, faster and more interactive financial payments can directly amplify global GDP: businesses receive payments faster, allowing capital to enter downstream processes sooner, reducing administrative costs and capital lockups caused by settlement delays. When settlement cycles shrink from “days” to “seconds” or “minutes,” the ripple effects will sweep across the entire economy. Meanwhile, the existence of verifiable standards enables financial innovation to occur globally and permissionlessly for the first time—a qualitative leap unattainable in traditional finance.

3. Applications of Stablecoins in Global Payments

Given the above advantages of stablecoins, we can now identify specific global payment use cases benefiting from them. We’ll explore how global treasury management, B2B enterprise payments, and card network settlements currently work, and discuss the application and benefits of stablecoins in these areas.

3.1 Corporate Treasury Management

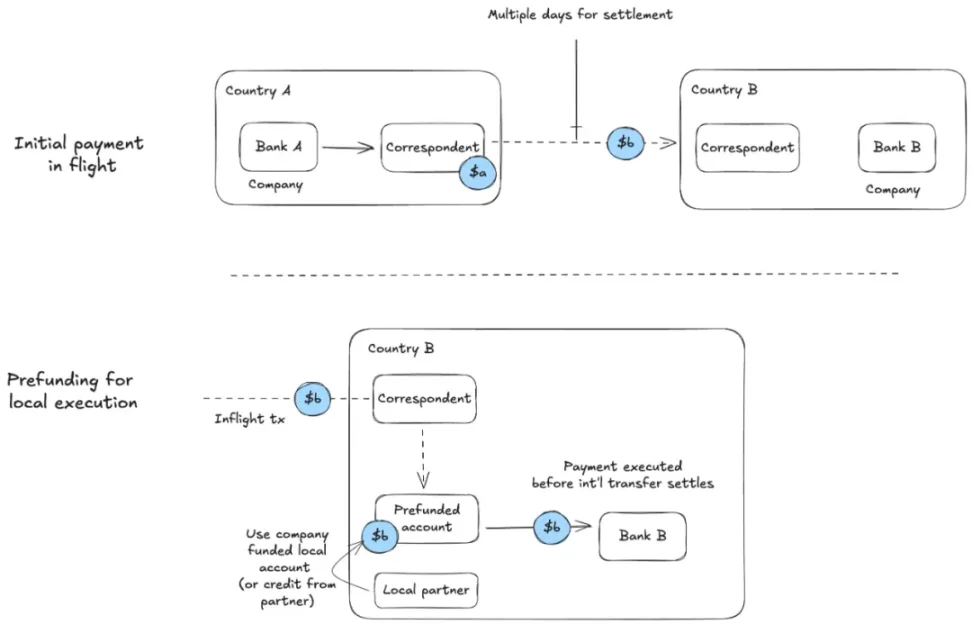

Take corporate treasury management as an example: suppose a company has an obligation to pay in currency b in Country B on a certain date. They must prepare a fund transfer from currency a in Country A before the payment deadline:

Jesse, Unpacking the Stablecoin Sandwich

This is the prepaid funding process, where the company’s finance team must consider the lead time needed to execute the payment on time.

The team must open a local bank account to ensure timely execution. Sometimes, to support this, companies may seek short-term loans from regional partners. The longer global settlements take, the greater the foreign exchange exposure and the higher the capital requirements for the finance department. For companies solely focused on executing global payments, managing derivatives to hedge currency risks and calculating short-term liquidity adds substantial operational overhead.

Stablecoins simplify this system by eliminating the need to manage delays in international settlement:

Jesse, Unpacking the Stablecoin Sandwich

We can see the role of the “stablecoin sandwich” structure: although initial on-ramps and off-ramps still touch the fiat system, the presence of stablecoins allows smooth fund flow between the two fiat “ramps.”

By using stablecoins, the entire process is broken down into local transfers within Country A and Country B respectively, while blockchain completes the global liquidity settlement between them. (Note: sufficient liquidity must exist on-chain to convert stablecoin A into stablecoin B for the exchange to succeed.)

3.2 B2B Enterprise Payments

The process for global B2B enterprise payments is similar to corporate treasury management, but B2B scenarios yield greater benefits because B2B payments are often more complex, and their success may impact other parts of business operations.

In such payments, banks in different countries are usually directly tied to the delivery of services or goods. This means all parties are more sensitive to payment progress tracking. For instance, in the previously mentioned “pre-funding” diagram, the cost of pre-funding may depend on the real-time status of an inbound payment.

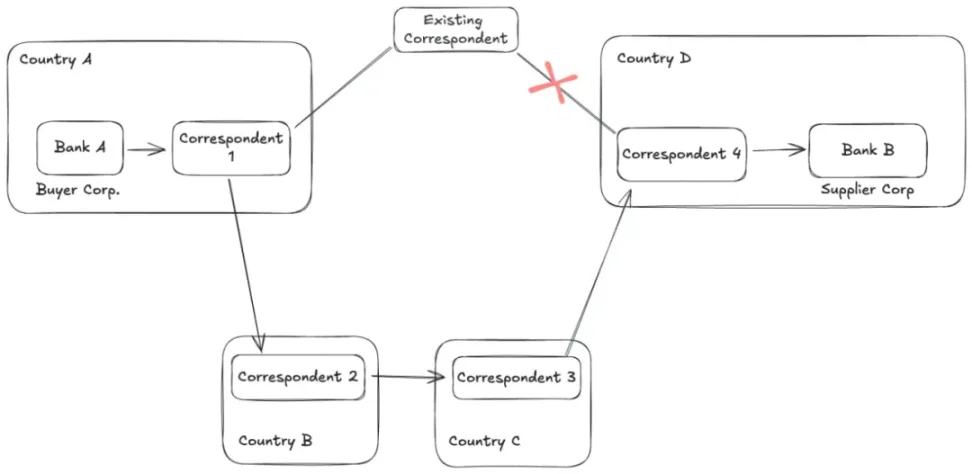

Additionally, if the required payment corridor is uncommon, companies often need multiple international relay paths to complete fund transfers—paths that frequently lack clear progress reporting mechanisms and are limited by banks’ non-24/7 operating hours, easily extending payment times.

Consider another example: a company in Country A needs to pay a company in Country B, but the two countries’ banks rarely conduct business together. If the bank in Country A lacks direct connections on any suitable channel to Country B, the payment must take an extra detour:

Jesse, Unpacking the Stablecoin Sandwich

When these B2B cross-border payment processes are executed via stablecoins in the middle of the chain, a series of additional benefits emerge at the enterprise level:

-

Both parties can clearly and in real time manage and monitor payment status.

-

Financing can be directly linked to time-sensitive raw materials or delivery milestones, allowing highly time-dependent businesses to avoid major risks or delays.

-

With reduced risk, capital costs decline and capital turnover accelerates; as stablecoin integration matures, this effect will bring significant productivity gains globally.

Similar to corporate treasury management, correspondent bank chains, pre-funding needs, and most foreign exchange exposures are largely eliminated. The entire process shrinks from three days to mere seconds, regardless of market closures, significantly reducing and simplifying working capital requirements.

3.3 Card Network Settlements

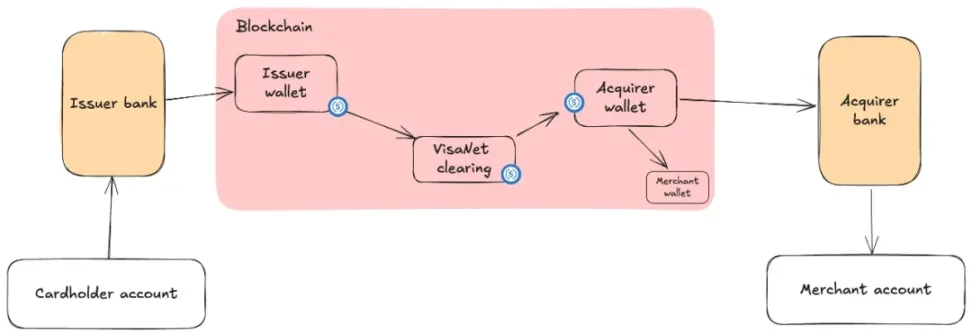

In card networks, the issuing institution sends payment on behalf of the cardholder to the merchant’s acquiring bank, which receives the payment and credits it to the merchant’s account. These banks do not settle debts directly; instead, they are all connected to VisaNet, where Visa performs net settlement between banks during weekday banking hours. Each bank must maintain a prepaid balance for timely wire transfers.

Visa began piloting stablecoin usage for settlement between acquiring and issuing banks as early as 2021. This approach replaces wire transfers with USDC on Ethereum and Solana. After authorizing card transactions for a specific date, Visa uses USDC to debit or credit the banks involved:

Jesse, Unpacking the Stablecoin Sandwich

Since this system operates within VisaNet, the net effect benefits network partners. It closely resembles the closed-loop system of XBMTs, but the vast scale of card networks benefits issuers/acquirers (who previously had to manage global payments).

The advantages of stablecoins are similar to those in treasury management, but these benefits accrue to banks within the network: they can lower capital requirements for timely international transfers, thus avoiding foreign exchange risk. Moreover, the openness, verifiability, and programmability of blockchain lay the foundation for credit and other financial primitives between banks inside VisaNet.

4. Conclusion

Through the above discussion, we’ve seen that the “stablecoin sandwich” indeed has utility in certain scenarios. However, most stablecoin applications today remain stuck within this sandwich structure, failing to break through further. Why is this?

In reality, very few enterprises truly use on-chain payments and stablecoins. As long as any step still touches the fiat rail, we’re forced to add bread slices at both ends of the “sandwich.” We’ve merely added some protein to an otherwise vegetarian sandwich, but it remains a sandwich.

The ultimate goal of stablecoin payments is to completely remove the bread at both ends. Once enterprises and consumers fully embrace stablecoins, entire financial and commercial cycles can be completed on blockchain, freeing us from the constraints of outdated traditional rails. When financial institutions and enterprises settle entirely in stablecoins, unprecedented business scale will be unleashed. With drastically reduced global friction in enterprise building, operations, and services, the growth curve of global GDP will align more closely with the true consumption speed of goods, services, and content on the internet.

Thus, PayFi’s essence is actually: Stablecoin Payments + On-Chain Finance. If we can fully escape the sandwich structure and build more on-chain financial services at both ends, the speed of global fund/value circulation will reach unprecedented heights.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News