Beginner-friendly guide: How to use NAV to evaluate the value of your crypto stocks?

TechFlow Selected TechFlow Selected

Beginner-friendly guide: How to use NAV to evaluate the value of your crypto stocks?

NAV and other metrics are not a panacea, but rather powerful tools in the toolbox.

Author: TechFlow

Undoubtedly, this crypto bull market first took off in the U.S. stock market.

When the "crypto treasury reserve strategy" becomes a trend among U.S. stocks and crypto-linked equities emerge, how should we evaluate the quality of a stock? Should we focus on which company holds a larger amount of crypto assets, or on which one has the financial capacity to keep buying more?

If you've been closely following recent analyses of crypto-linked U.S. stocks, you've likely seen one term repeatedly: NAV, or Net Asset Value.

Some analysts use NAV to determine whether a crypto stock is overvalued or undervalued; others compare a new crypto-reserve company’s share price with that of MicroStrategy using NAV. But the real wealth-generating insight lies here:

A publicly listed U.S. company pursuing a crypto reserve strategy—holding $1 worth of cryptocurrency—is often valued at more than $1.

These companies can continue acquiring more crypto assets or repurchasing their own shares, causing their market capitalization to frequently far exceed their NAV (Net Asset Value).

However, for ordinary retail investors, most projects in the crypto space are rarely evaluated using rigorous metrics, let alone applying such methods to assess traditional stock valuations.

Therefore, we aim to provide an introductory guide to the NAV indicator, helping those interested in crypto-equity dynamics better understand the operational logic and evaluation methods behind these stocks.

NAV: What Is Your Stock Actually Worth?

Before diving into crypto-linked U.S. stocks, it's essential to clarify a fundamental concept.

NAV is not a metric designed specifically for the crypto market—it's one of the most common methods in traditional financial analysis used to measure a company’s value. At its core, NAV answers a simple question:

"What is the true per-share value of a company?"

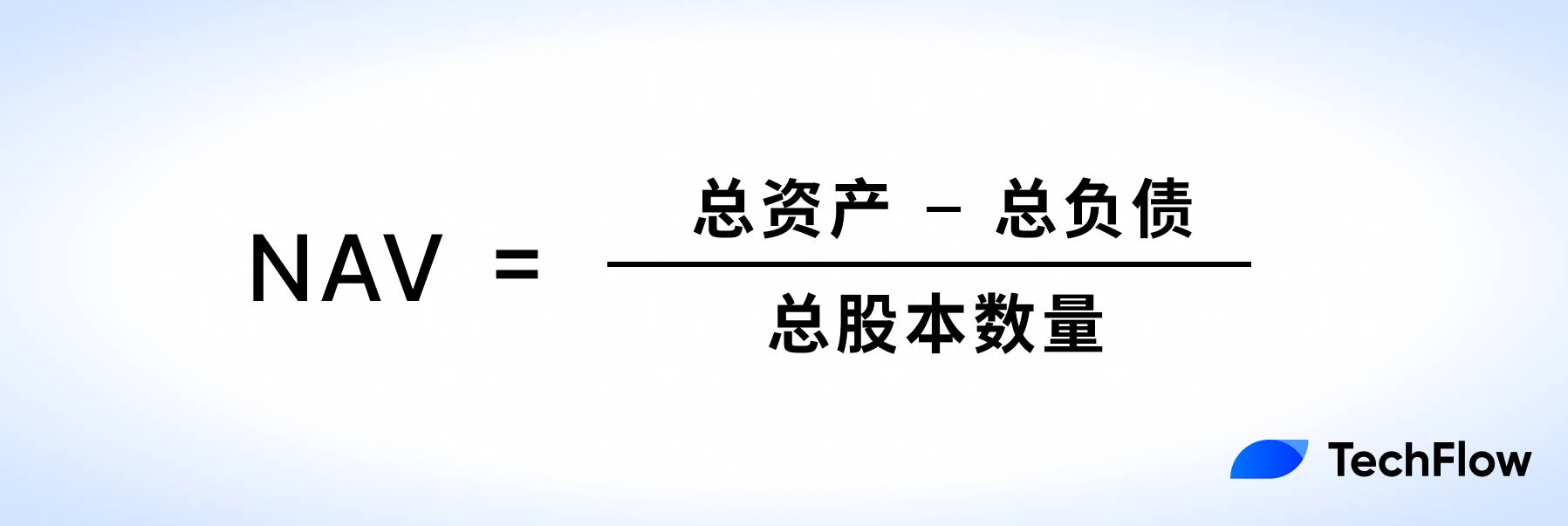

The calculation of NAV is straightforward: it represents the value each shareholder would receive if the company liquidated all assets and settled all liabilities.

To better grasp the logic behind NAV, consider a traditional example. Suppose a real estate company has the following financials:

Assets: 10 buildings totaling $1 billion in value; Liabilities: $200 million in loans; Total Shares Outstanding: 100 million shares.

The company’s net asset value per share would be $80. This means that, upon liquidation and debt repayment, each shareholder would theoretically receive $80 per share.

NAV is a widely used financial metric, especially suitable for asset-driven companies such as real estate firms and investment funds. These companies typically have transparent and easily valued assets, making NAV an effective reflection of their intrinsic stock value.

In traditional markets, investors usually compare NAV with the current market price of a stock to judge whether it is overvalued or undervalued:

-

If Stock Price > NAV: The stock may be trading at a premium, indicating investor confidence in future growth potential;

-

If Stock Price < NAV: The stock may be undervalued, reflecting weak market confidence or uncertainty about asset valuation.

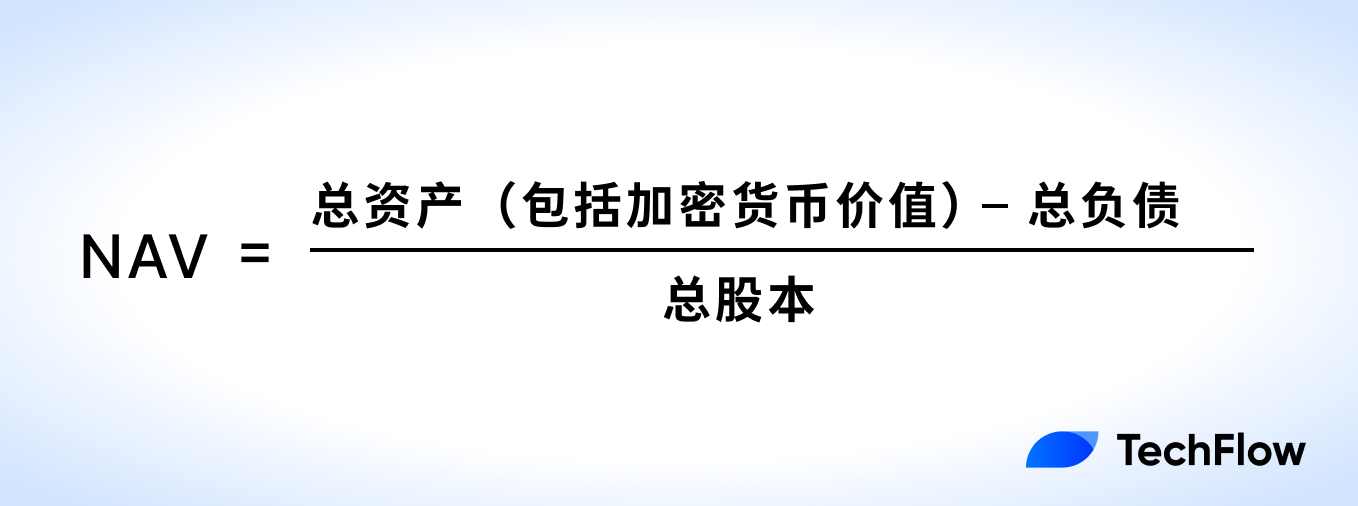

When NAV is applied to crypto-linked U.S. stocks, its meaning undergoes subtle changes.

In the context of crypto equities, the primary role of NAV can be summarized as:

Measuring the impact of a public company's crypto holdings on its stock value.

This means NAV is no longer just the traditional formula of "assets minus liabilities," but must specifically account for the value of the company's cryptocurrency holdings. Fluctuations in crypto prices directly affect the company’s NAV and indirectly influence its stock price.

For companies like MicroStrategy, NAV calculations heavily emphasize the value of their Bitcoin holdings, as this asset constitutes the majority of their total assets.

Thus, the standard calculation is slightly extended:

When crypto assets are included in NAV calculations, several critical shifts occur:

-

NAV volatility increases significantly: Due to the high volatility of cryptocurrency prices, NAV becomes much less stable compared to traditional assets like real estate or fund holdings.

-

NAV is "amplified" by crypto assets: Crypto assets often command a market premium, meaning investors are willing to pay more than book value for related stocks. For instance, a company holding $100 million in Bitcoin might see its market cap reach $200 million, reflecting investor expectations of future Bitcoin appreciation.

When the market is bullish on Bitcoin’s future price, investors may assign a premium to the company’s NAV. Conversely, during periods of low market sentiment, the relevance of NAV may diminish.

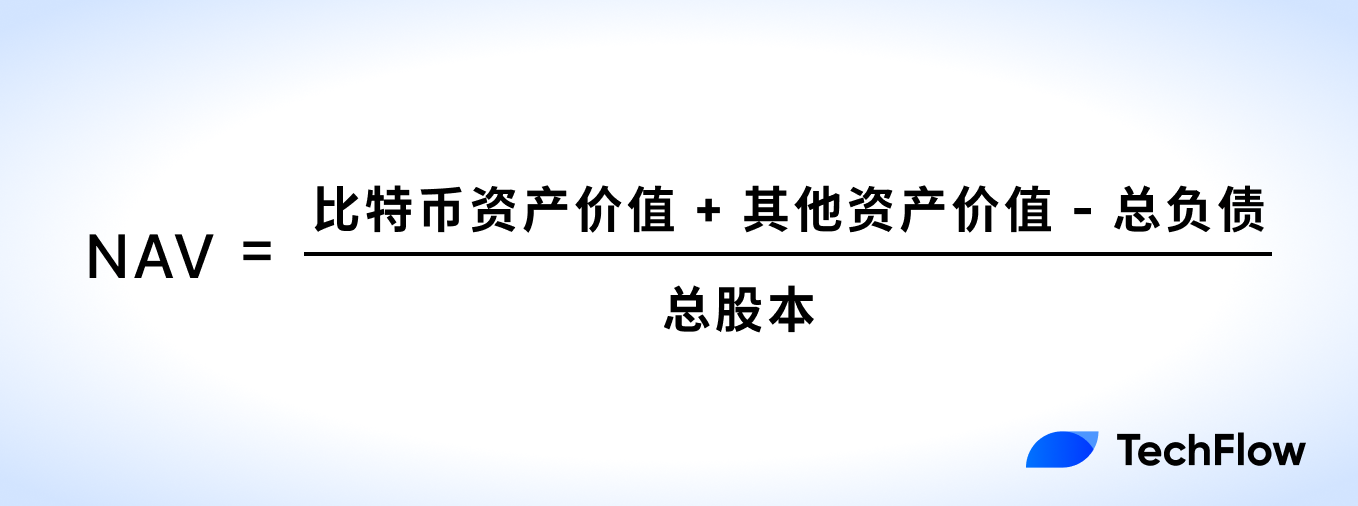

If NAV still seems unclear, let’s use MicroStrategy as an example.

As of publication date (July 22), public data shows MicroStrategy holds 607,770 BTC, priced at $117,903 each, giving a total Bitcoin asset value of approximately $72 billion. Other assets are valued at around $100 million, while liabilities stand at $8.2 billion.

With roughly 260 million shares outstanding, the calculated NAV is approximately $248 per share. That is, under a BTC reserve strategy, each share of MicroStrategy should be worth $248.

Yet, in the previous U.S. trading session, MicroStrategy’s actual stock price was $426.

This reflects a market premium—when investors believe Bitcoin will rise further, they incorporate this expectation into the stock price, pushing it well above NAV.

This premium illustrates how NAV fails to fully capture market optimism toward crypto assets.

mNAV: The Sentiment Thermometer for Crypto Stocks

Beyond NAV, you’ll often hear analysts and KOLs mention another similar metric: mNAV.

If NAV is the basic tool for determining what a share is truly worth, mNAV is a more advanced, market-responsive metric tailored to crypto market dynamics.

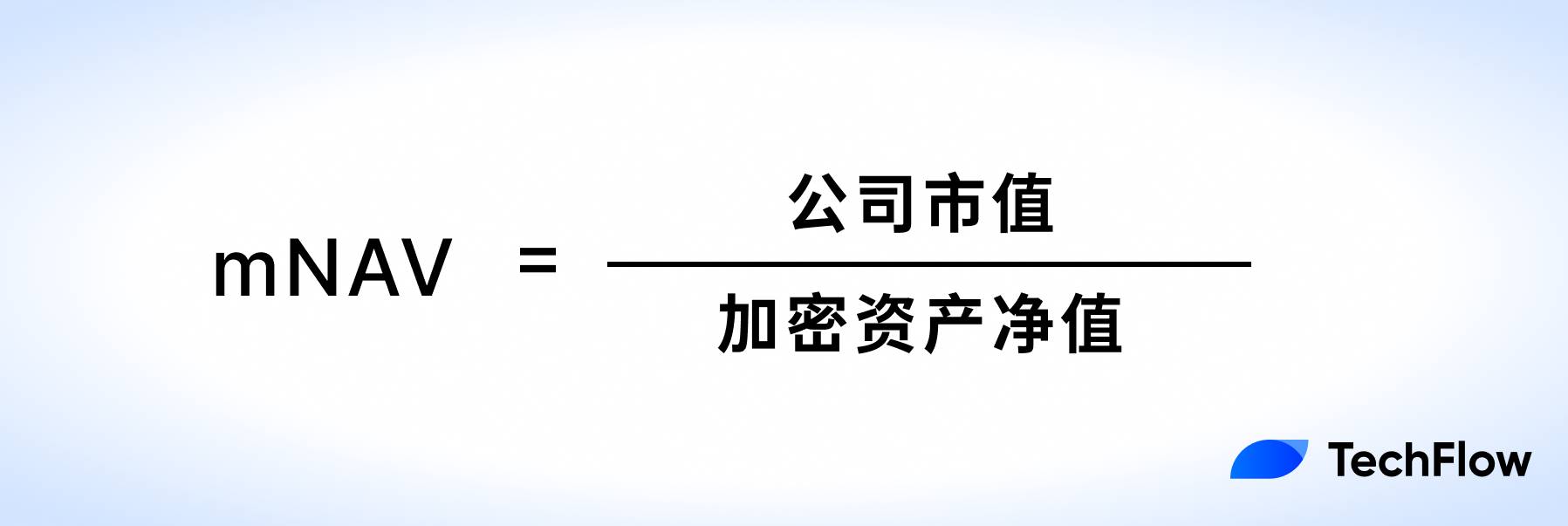

As previously noted, NAV focuses on reflecting a company’s current net asset position—mostly crypto assets—without factoring in market expectations. In contrast, mNAV is more market-oriented, measuring the relationship between a company’s market cap and the net value of its crypto assets. Its formula is:

Here, “net crypto asset value” refers to the value of a company’s crypto holdings minus associated liabilities.

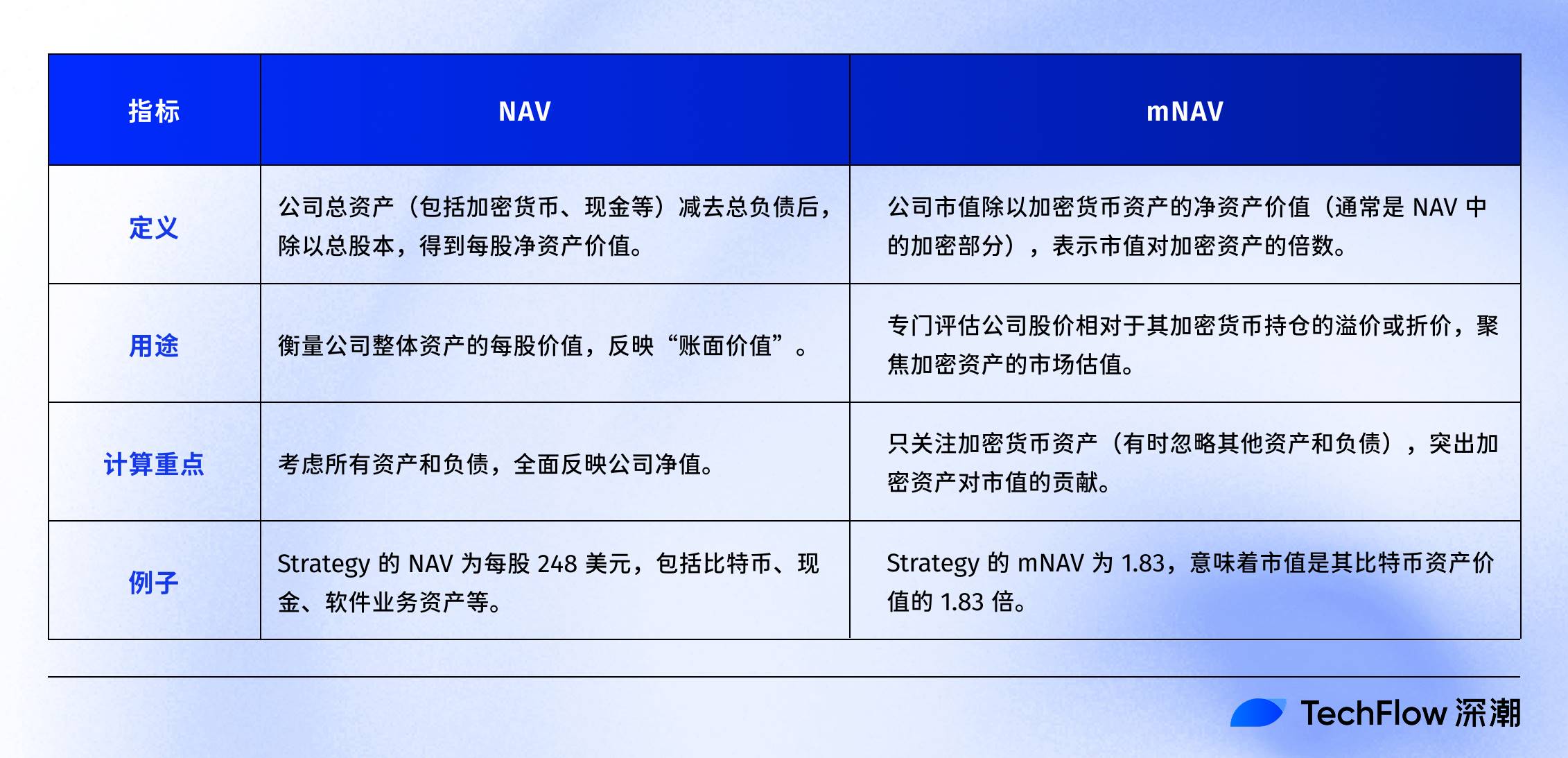

We can clearly compare the two metrics using a table:

Using earlier figures, MicroStrategy’s total market cap is approximately $120 billion, while the net value of its BTC holdings (crypto assets + other assets – liabilities) is around $63.5 billion. Thus, its mNAV is approximately 1.83.

In other words, MicroStrategy’s market cap is 1.83 times the value of its Bitcoin holdings.

Therefore, when a company holds significant crypto assets, mNAV better reveals market expectations, showing whether investors are assigning a premium or discount to those assets. In the example above, MicroStrategy’s stock trades at a 1.83x premium over its crypto net assets.

For short-term investors focused on market sentiment, mNAV serves as a more sensitive reference:

When Bitcoin prices rise, investors may become more optimistic about the future performance of crypto-driven companies. This optimism is reflected in mNAV, causing the stock price to trade above its book value (NAV).

An mNAV greater than 1 indicates a market premium on the company’s crypto assets; an mNAV below 1 suggests weak market confidence.

Premiums, Reflexivity Flywheels, and Death Spirals

As mentioned, MicroStrategy currently has an mNAV of around 1.83.

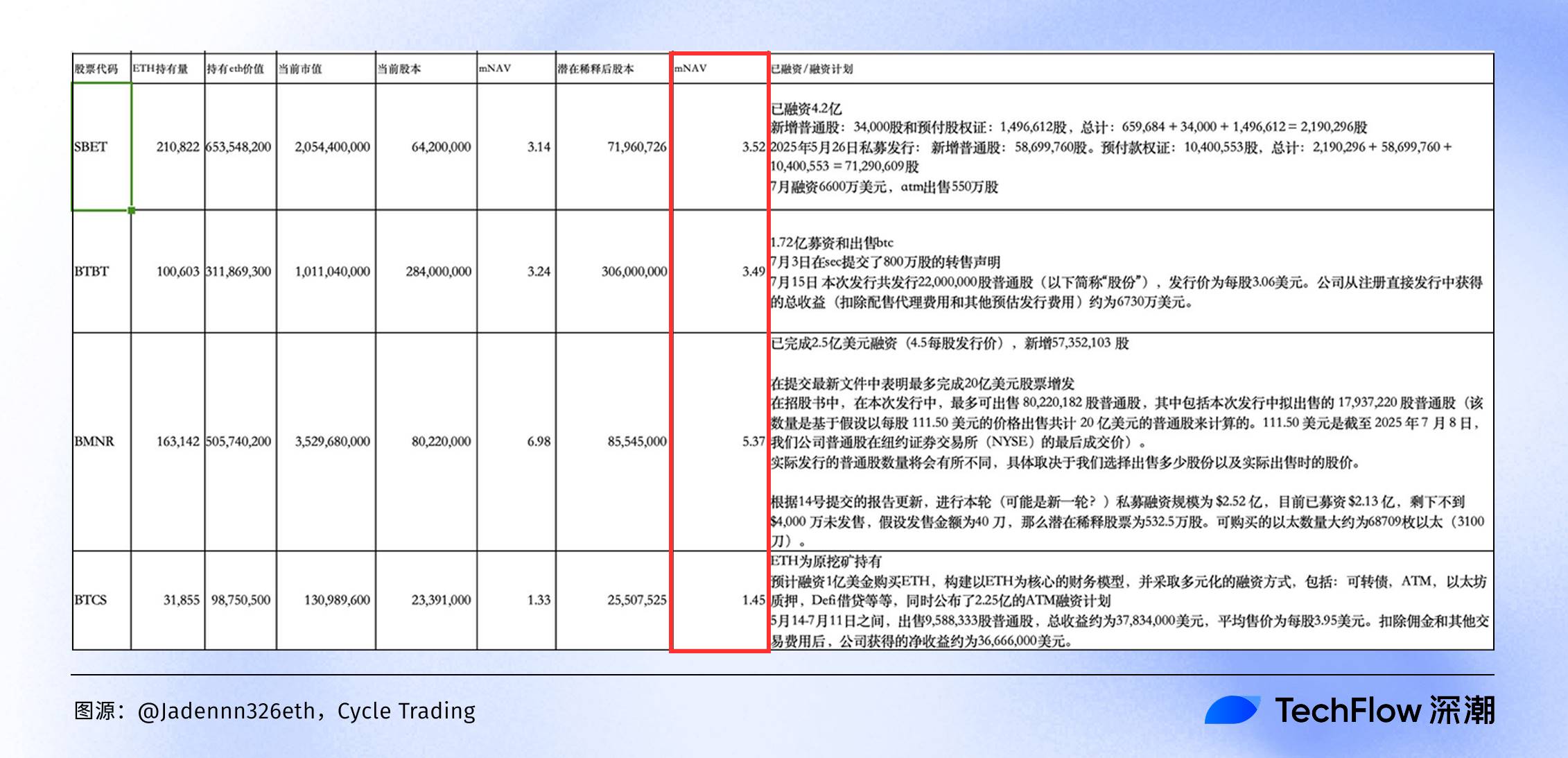

As ETH increasingly becomes part of corporate treasury reserves, understanding the mNAV of these companies offers valuable insights into whether their corresponding U.S. stocks are over- or undervalued.

Jadennn326eth, an analyst from Cycle Trading, has compiled a detailed table clearly presenting the balance sheets and mNAV values of major ETH reserve companies (data as of last week).

(Image source: @Jadennn326eth, Cycle Trading)

From this comparison chart of ETH reserve companies’ mNAV, we can immediately identify the "wealth map" of 2025’s crypto-equity convergence:

BMNR leads with an mNAV of 6.98x, meaning its market cap vastly exceeds its ETH holdings—a sign that could signal overvaluation and potential bubbles. If ETH corrects, its stock would likely suffer first. BTCS, with an mNAV of only 1.53x, appears relatively less overvalued.

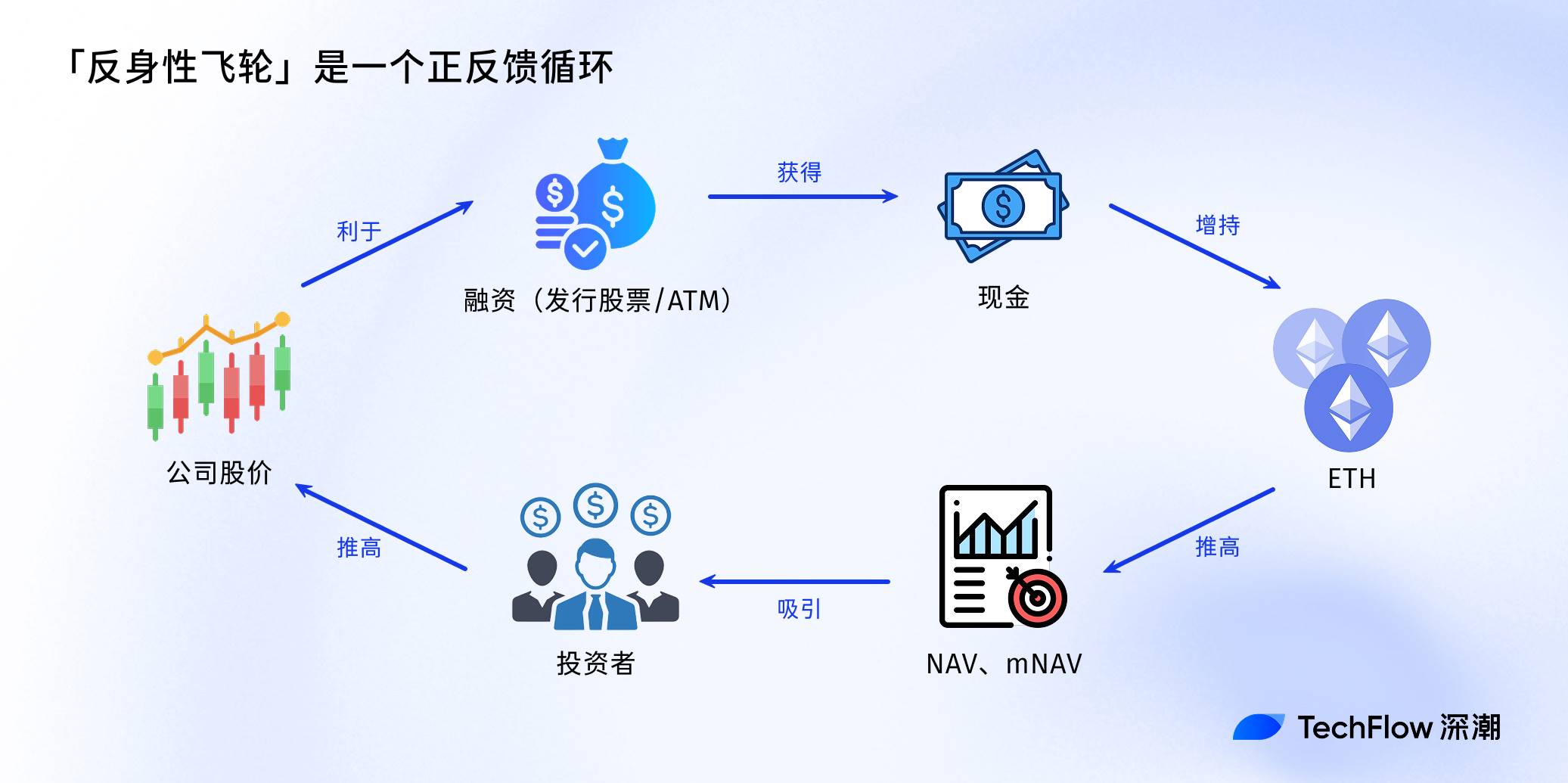

Looking at these numbers naturally brings us to the concept of the "Reflexivity Flywheel."

This idea originates from financier George Soros’s theory of reflexivity and has become the "secret engine" behind soaring stock prices of these companies during the 2025 bull market.

In simple terms, the reflexivity flywheel is a positive feedback loop: A company raises capital through stock issuance or ATM (At-The-Market) offerings, uses the cash to aggressively buy ETH; increased ETH holdings boost NAV and mNAV, attracting more investor interest and driving up the stock price; a higher market cap enables easier future fundraising, allowing further ETH accumulation—and so on, creating a self-reinforcing, snowballing effect.

But if ETH prices decline, regulators tighten oversight (e.g., SEC scrutiny of crypto reserve models), or financing costs spike, this upward flywheel can reverse into a death spiral: stock prices collapse, mNAV plummets, and ultimately, retail investors bear the losses.

Finally, by now you should understand:

Metrics like NAV are not magic bullets, but powerful tools in your toolkit.

When chasing crypto-linked equities, combining macro trends in Bitcoin/Ethereum with assessments of company leverage and growth rates allows rational decision-making—helping you navigate this new cycle, full of both opportunity and danger, to find your own edge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News