Behind the Frenzy of Crypto Reserve Companies: Breaking ETF Limitations and Attracting Institutional Investors

TechFlow Selected TechFlow Selected

Behind the Frenzy of Crypto Reserve Companies: Breaking ETF Limitations and Attracting Institutional Investors

A crypto asset management company, Wall Street's gateway to DeFi, and Hyperliquid's blue ocean opportunity.

Author: Jesse

Translation: TechFlow

Earlier this month I wrote an article about crypto asset management companies. If you're unfamiliar with the topic, I suggest reading it first, as this piece builds on many of the same concepts.

The trend of crypto asset management firms represents a shift in how capital flows on-chain (or how value created on-chain reaches investors).

The more these firms invest in other altcoins (just last week we added TAO and Litecoin), the more bubbly the market seems. However, public company participation in ecosystems or other on-chain applications may bring some value—at least for some of the highest-quality assets in crypto.

This article covers the following points:

-

Crypto asset management companies are more flexible and market-driven than ETFs, giving them an edge

-

Asset management firms represent the final form of institutional crypto, aligning investor returns with technological adoption

-

In many cases, treasury reserve models alone are insufficient; teams must balance the ability to finance asset development with the capacity to extract value via DeFi or other infrastructure

-

Hyperliquid is particularly well-suited for this trend, potentially offering a more attractive ecosystem than Ethereum or Solana

Asset Management Companies vs ETFs

Asset management companies are clearly ideal when investors have no alternatives, but do they still make sense when other options exist—such as ETFs?

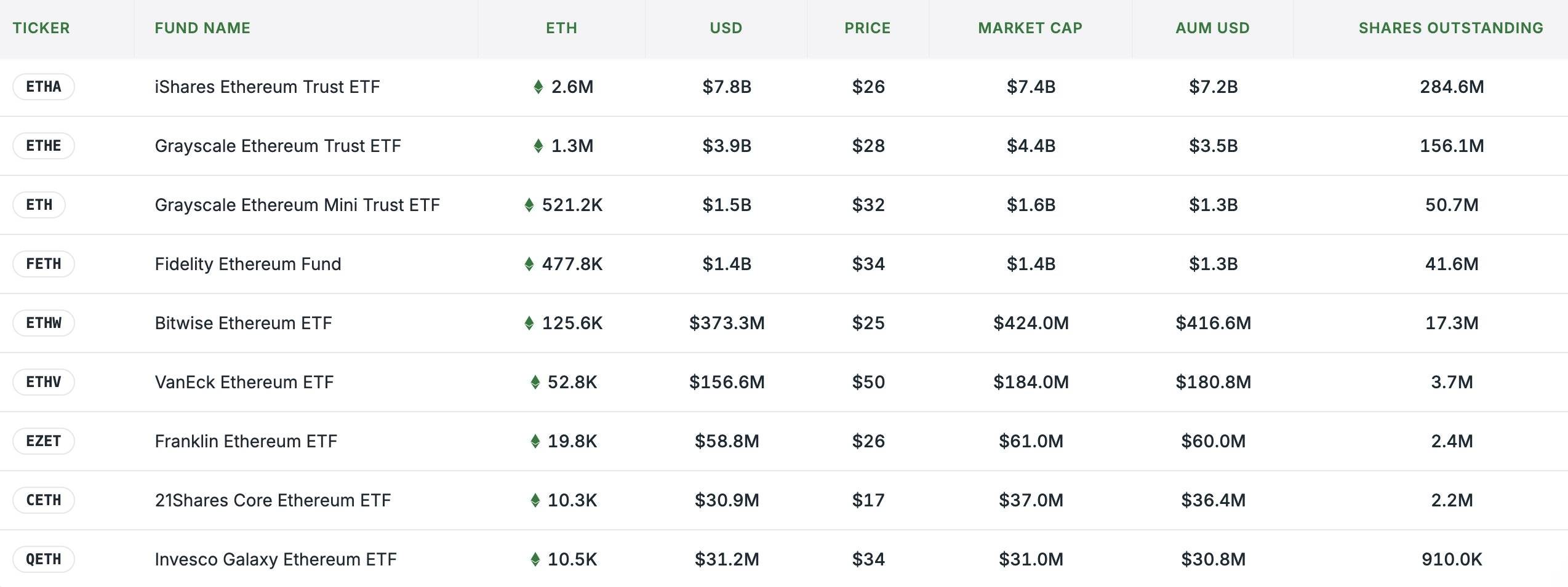

The listing of ETFs doesn't mean the end for asset management companies. ETFs, like any investment product, must be sold—the more popular and accessible the underlying asset, the more competitive the product. Thus, ETF competition ultimately relies heavily on trust or relationships rather than actual managerial advantages. For many investors, simple exposure to a familiar brand may be preferred. Recently, demand for Ethereum ETFs has been strong, with total holdings approaching 5 million ETH:

That said, for specific crypto assets, asset management companies may outperform ETFs:

-

They can reach a broader range of investor types; many investors may not be allowed to buy ETFs, or may prefer fixed income, equities, convertible bonds, etc. Asset management firms can structure deals tailored to these investors.

-

Asset managers can maximize the productivity of core assets to create shareholder value—that is, unlike waiting for ETH staking ETF approval, they can freely stake ETH directly.

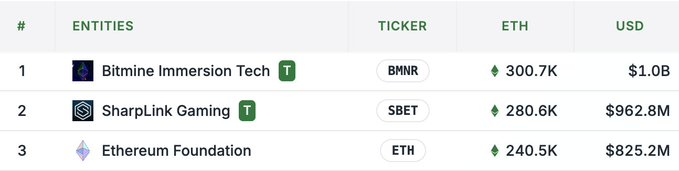

This is why, despite multiple ETH ETFs, @BitMNR ($BMNR) and @SharpLinkGaming ($SBET) have accumulated more ETH than many ETFs (both sit between Bitwise and Fidelity in scale mentioned above). They now hold more ETH than the Ethereum Foundation:

The second point is crucial for every fund manager, as the best firms are deeply integrated into DeFi. Currently, leaders appear to be Sharplink in the Ethereum space and @defidevcorp ($DFDV) in Solana. DFDV’s name clearly signals its focus, while Sharplink markets Ethereum directly as “DeFi on Nasdaq.”

Ecosystem Asset Managers: The New Form of Institutional Crypto

Companies that invest in and use a chain's native assets or DeFi infrastructure are approaching the final form of institutional crypto adoption.

Previously, institutional entry into crypto followed two paths: investment (e.g., Grayscale products or funds) and technical application/adoption (e.g., enterprise blockchains or L2 payment partnerships). Now, entities holding blockchain tokens are beginning to actively use those tokens.

Companies running crypto asset management businesses also serve as the ultimate regulatory arbitrage between traditional finance and crypto finance. Previously, regulated counterparties needing pooled capital could leverage asset management firms as operational tools for DeFi yields or other needs (in a way, DeFi-using asset managers can replace the role of investment banks).

We’ve seen asset-specific or region-specific asset management firms:

However, we haven’t yet seen them expand beyond operating infrastructure or staking base assets for yield. I wouldn’t be surprised if a company becomes the first to successfully scale RWA integration with DeFi, or if they’re used as vehicles to cross-connect previously siloed capital pools via DeFi.

The Special Case of HYPE

For mature assets, the above discussion on ETFs versus fund companies should reflect trends we observe in the market. The pattern generally looks like this:

-

ETF launches and/or asset management firm fundraising → Each new firm needs differentiation → They move on-chain to pursue yield → Token access ceases to be a differentiator; asset utility and DeFi profitability become key factors

This pushes firms toward investing in tokens that offer higher-quality, sustainable yields. For assets where most economic value occurs on-chain—like ETH and SOL—companies can build strategies around value capture. (Conversely, it’s hard to see how an asset firm lacking yield opportunities could survive long-term.)

This is highly favorable for HYPE as an asset for management firms, as the token is tightly linked to value generated from product usage. Fees collected from traders on Hyperliquid accumulate and are used to periodically repurchase HYPE tokens from the market. Beyond the many subtler mechanisms within HYPE’s value proposition, this is the most direct one for investors.

For equity holders in asset management firms, this provides a strong rationale for holding an asset that generates a dividend stream from crypto trading activity (and in a tax-efficient manner).

But another key reason HYPE presents a compelling case for asset management firms is that, beyond adopting core DEXs, the development of such firms is still immature.

Institutional presence in HYPE is minimal compared to other assets, and core DeFi protocols in the ecosystem are only just launching and gaining attention.

For today’s asset management firms, the first point is most critical. The prior discussion on ETFs especially strengthens HYPE’s case. Yet a Hyperliquid ETF seems unlikely to become the primary institutional route for investing in HYPE—especially given the early traction of HYPE-focused firms like @HyperionDeFi, @HYLQstrategy, and @SonnetBio. Additionally, ETFs would need to fund liquidity, much of which is already flowing to these asset management firms. This may be one of the largest divergences between institutional market entry and actual market demand.

The opportunity becomes even more attractive if a firm can act as a steward of the ecosystem—not just offering asset exposure to traditional investors. The Hyperliquid ecosystem is still in early development, presenting an open opportunity for a firm to become a key player in DeFi protocol and infrastructure design/operations.

We’re already seeing this in the market: @kinetiq_xyz launched its LST by splitting it into iHYPE—specifically procured for institutional HYPE exposure by asset management company partners.

Beyond product design or development, such a firm could also invest in early-stage protocols within the ecosystem. This serves as a great complement for fundraising companies—they can sell exposure to base assets, fund ecosystem infrastructure operations, and deliver venture-like returns to investors.

This contrasts with $SBET and DeFi protocols: while they hold more ETH than the Ethereum Foundation, the underlying DeFi they use may already be rigid or DAO-governed. For example, Lido’s staking has scaled for institutional users. New asset managers are unlikely to become design partners for a new Lido. ETH staking remains profitable, but offers lower agency compared to co-building the next Lido—a path closer to the reality of hyper-liquid asset management.

In any case, the further a company is from the underlying DeFi protocols it uses, the fewer value-capture opportunities it has. This also explains why DFDV is pursuing a franchise model—owning the foundational infrastructure of other regional firms to build brands and raise capital for SOL purchases.

Conclusion

Most token-based asset management firms won’t command premiums during bear markets, and those competing over shared assets will need deeper ecosystem integration to prove unique value.

From this perspective, power laws may favor firms focused on specific assets. Those unable to fully capture non-native crypto demand will need to pivot to other assets or on-chain activities. Failure to do so may result in widely varying failure modes depending on the firm and asset—perhaps a topic worthy of a separate article.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News