Quick look at Binance's H1 market report: Bitcoin shows high beta characteristics, stablecoin mainstream adoption accelerates

TechFlow Selected TechFlow Selected

Quick look at Binance's H1 market report: Bitcoin shows high beta characteristics, stablecoin mainstream adoption accelerates

Focus in the second half of the year on the Fed's policy shift, progress in U.S. crypto legislation, TradFi and crypto merger waves, stablecoin payment penetration, and RWA.

Author: Binance Research

Translation: Chopper, Foresight News

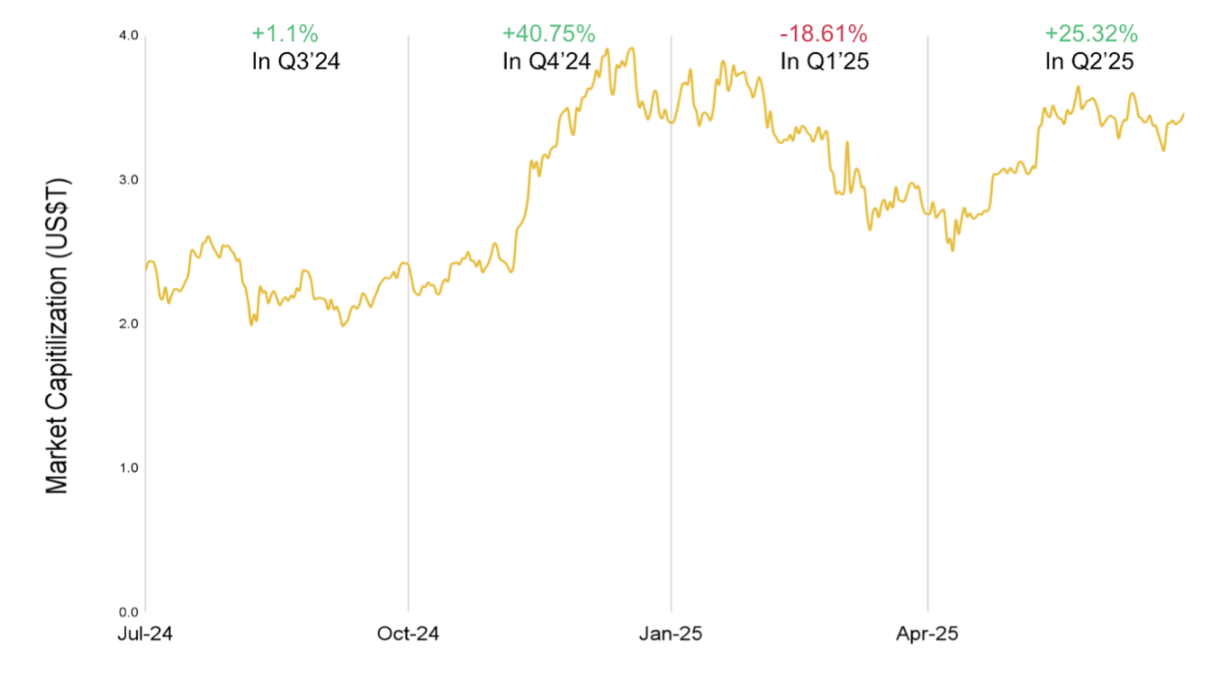

In the first half of 2025, the crypto market exhibited a volatile "first down, then up" pattern: total market cap dropped 18.61% in Q1, rebounded 25.32% in Q2, and ultimately achieved a slight year-on-year increase of 1.99% for the first half.

Crypto market cap is up 1.99% year-to-date

This dynamic stems from multiple factors:

-

Loose monetary expectations following the Fed's rate cuts in the second half of 2024 and post-U.S. election regulatory optimism drove the market to peak at $3 trillion;

-

Early 2025 inflation stickiness, weak economic data, and the Trump administration’s implementation of broad tariffs in April dampened market sentiment;

-

Recent tariff pauses and improved clarity on stablecoin and DeFi regulations have fueled market recovery.

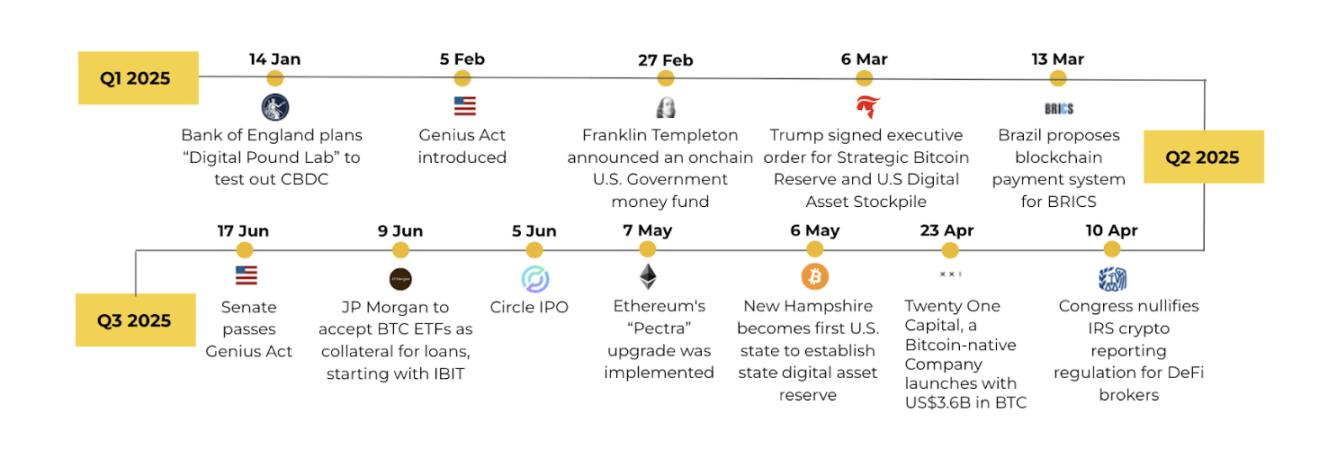

Key events timeline in H1 2025

The core narratives of the crypto market in the first half centered on Bitcoin investment vehicles, stablecoins, AI agents, and tokenized real-world assets (RWA). Looking ahead, global monetary policy, trade tariff dynamics, institutional adoption, crypto-AI convergence, and a new wave of crypto IPOs following Circle will be key focal points.

1. Macroeconomic Background and Market Performance

Global Economic "Great Divergence"

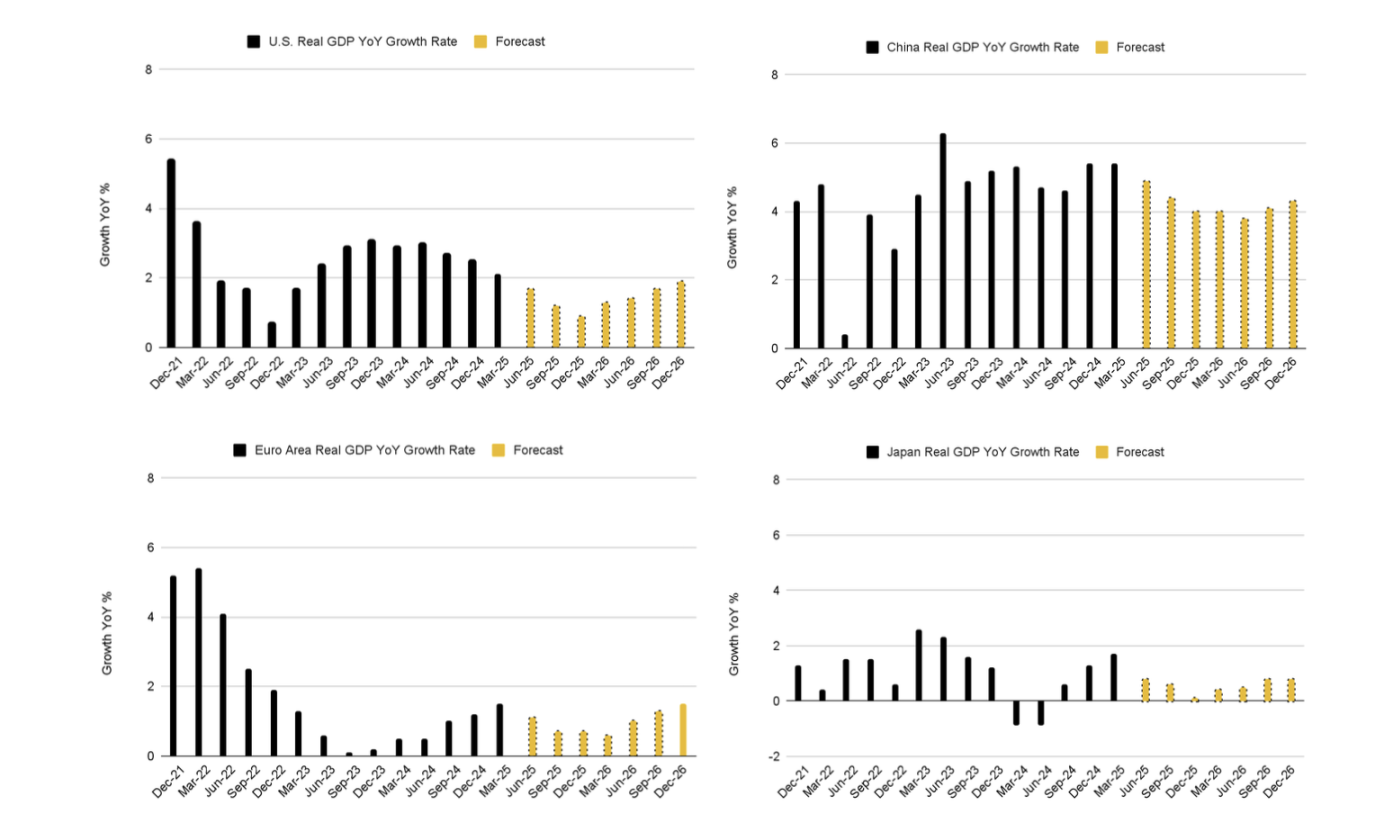

Economic divergence: The U.S. economy gradually slowed, with unemployment stable at 4.1% but labor market cooling; China's Q1 GDP grew 5.4% year-on-year, exceeding expectations due to stimulus policies; the Eurozone and Japan saw steady economic recovery.

Quarterly GDP performance and market forecasts for G4 nations

Liquidity easing: Combined money supply from the U.S., China, Europe, and Japan increased by $5.5 trillion—the largest semiannual rise in four years—boosting risk asset sentiment.

Geopolitical shocks: A brief U.S.-China trade war caused tariffs to spike to 145%, increasing market volatility.

Bitcoin's "High Beta" Characteristic

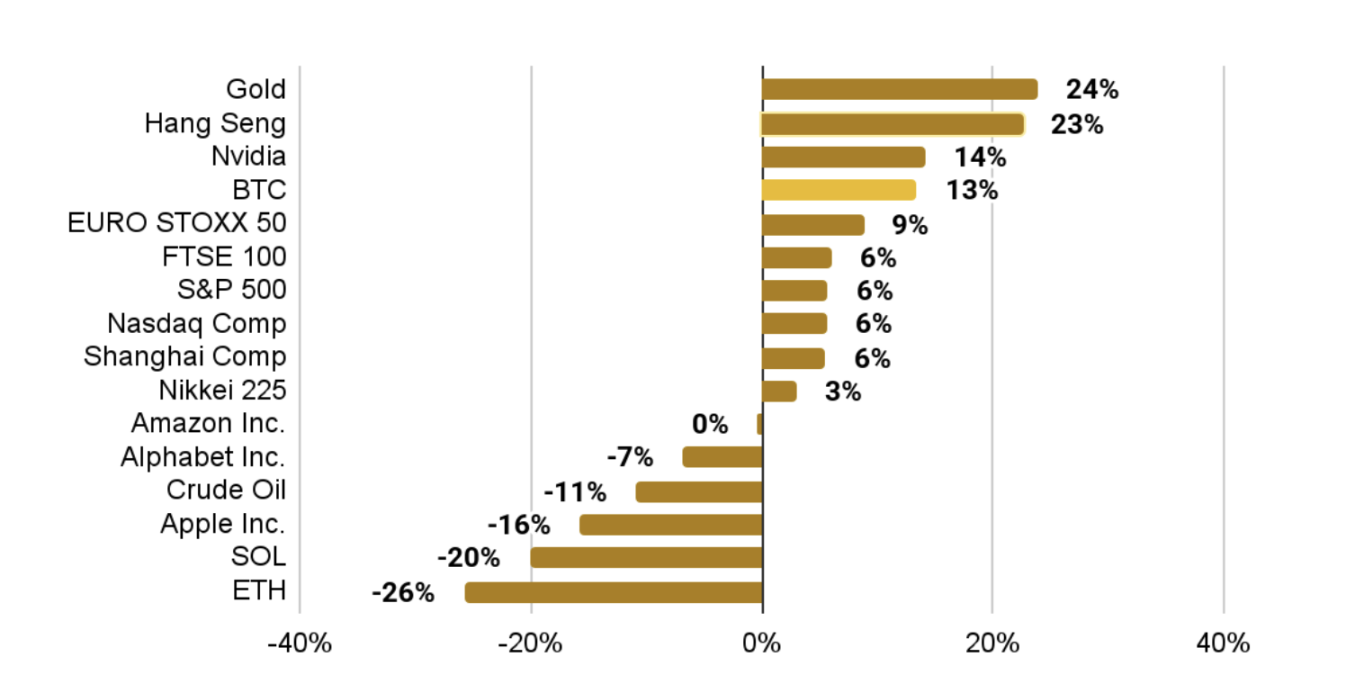

Bitcoin delivered a year-to-date return of 13%, outperforming most traditional equity indices, maintaining a market cap above $2 trillion. Its price cycle is seen as a leading indicator for the global manufacturing cycle (leading by 8–12 months), suggesting potential opportunities in the second half of 2025.

Year-to-date returns of select major global assets

2. Core Asset Performance: Bitcoin and Public Blockchain Ecosystems

Maturation of the Bitcoin Ecosystem

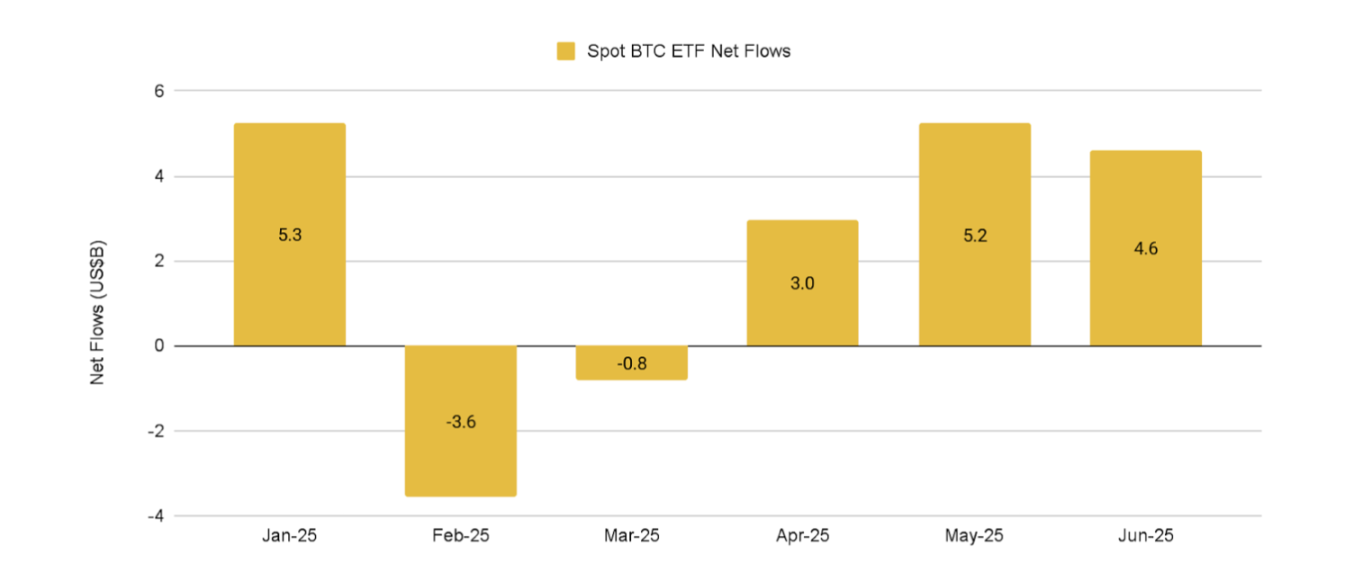

Accelerated institutional adoption: Spot ETFs recorded net inflows exceeding $13.7 billion, led by BlackRock’s IBIT; over 140 public companies hold 848,000 BTC, a growth of more than 160% compared to last year.

Spot Bitcoin ETFs have attracted over $13.7 billion in net inflows year-to-date

Ecosystem innovation and divergence: Layer 2 solutions (e.g., Stacks, BitVM) advanced scalability, with BTCFi total value locked (TVL) reaching $6.5 billion, up 550% year-on-year; however, speculation around native Bitcoin assets such as Ordinals and Runes cooled, with daily trading volume dropping to an 18-month low.

Market dominance: Bitcoin's dominance peaked at 65.1%, a four-year high, underscoring its status as the core asset.

Dynamics of Major Public Blockchains

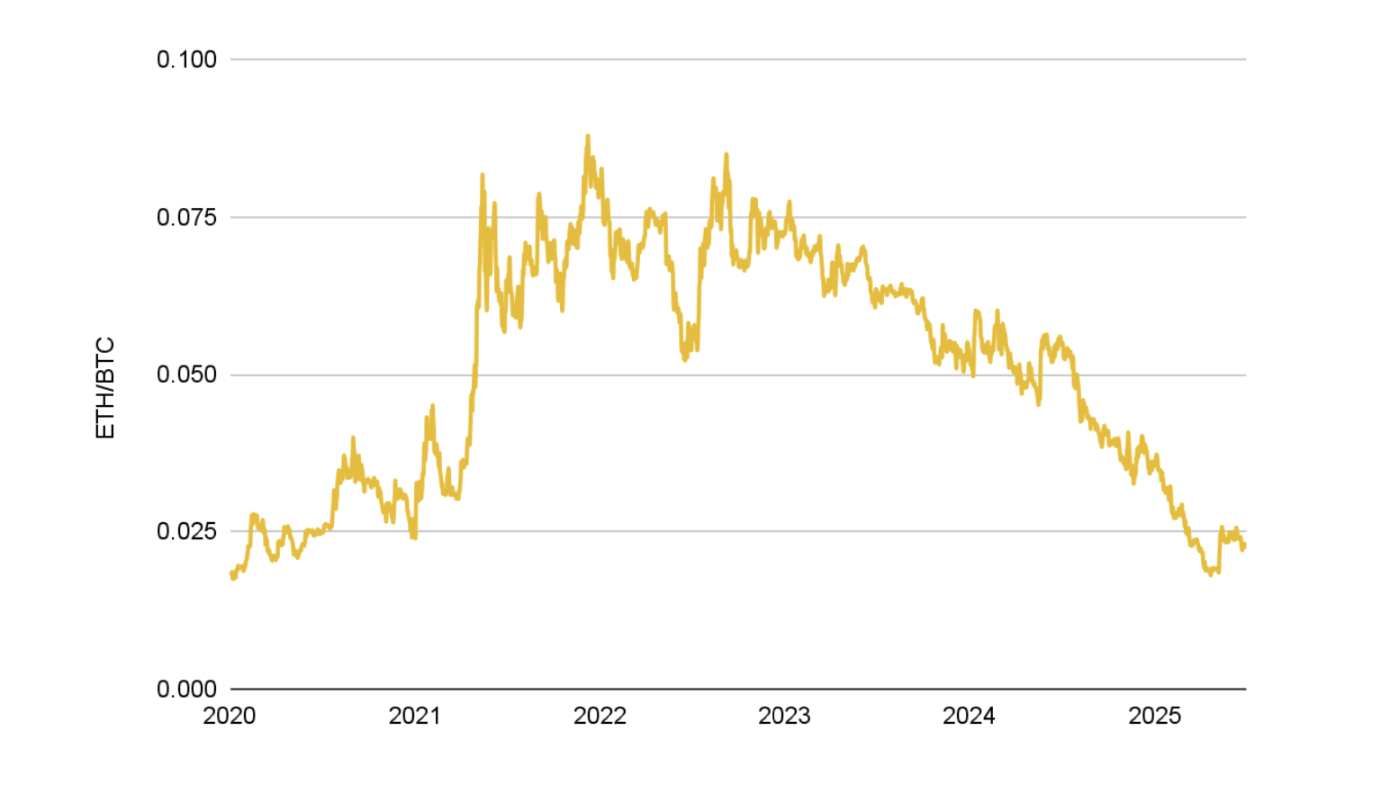

Ethereum: ETH price declined 26%, yet ecosystem resilience was evident. The Pectra upgrade enhanced staking efficiency (maximum balance per validator node increased from 32 ETH to 2048 ETH), with staked amount reaching 35.4 million ETH (29.3% of circulating supply); Layer 2s (Base, Arbitrum, etc.) processed over 90% of transactions, becoming primary scaling solutions.

ETH/BTC exchange rate fell to 0.023, a multi-year low, data as of June 30, 2025

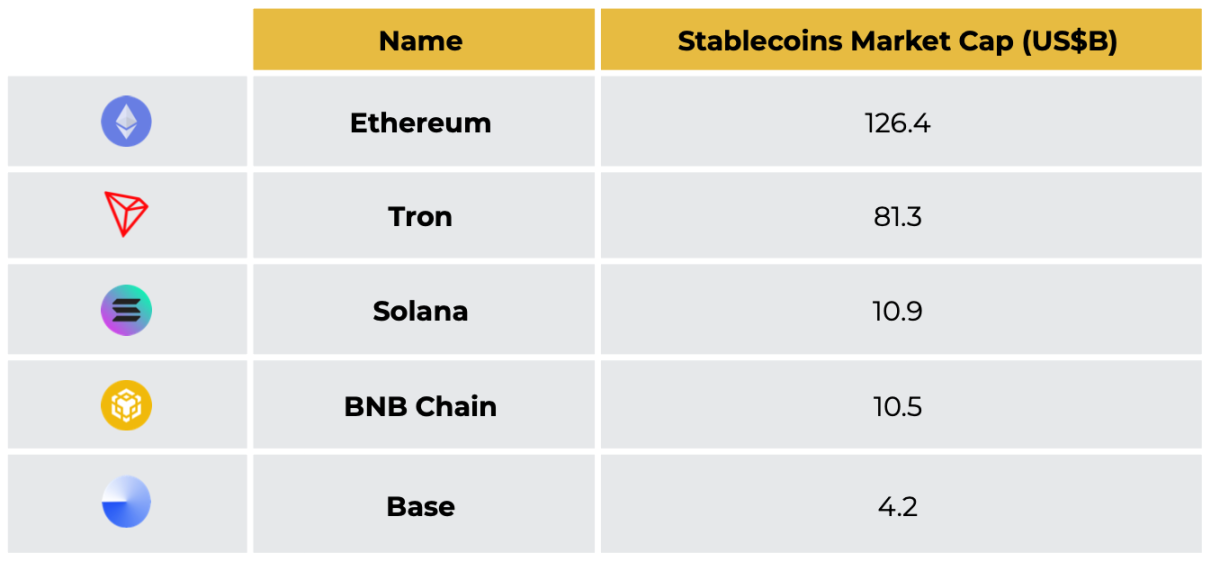

Solana: Maintained high throughput (average 99 million daily transactions), with stablecoin market cap reaching $10.9 billion, surpassing BNB Chain; institutional interest rose, with several asset managers applying for spot SOL ETFs, expected to be approved mid-year.

Stablecoin market cap across major blockchains, data as of June 30, 2025

BNB Chain: DEX trading volume hit a record high, with PancakeSwap contributing over 90%; upgrades such as Pascal and Lorentz reduced block time to 0.8 seconds, expanding the ecosystem into Memecoins, RWA, and AI domains, achieving 4.4 million daily active addresses.

3. DeFi and Stablecoins: From Speculation to Utility

DeFi Enters Maturity Phase

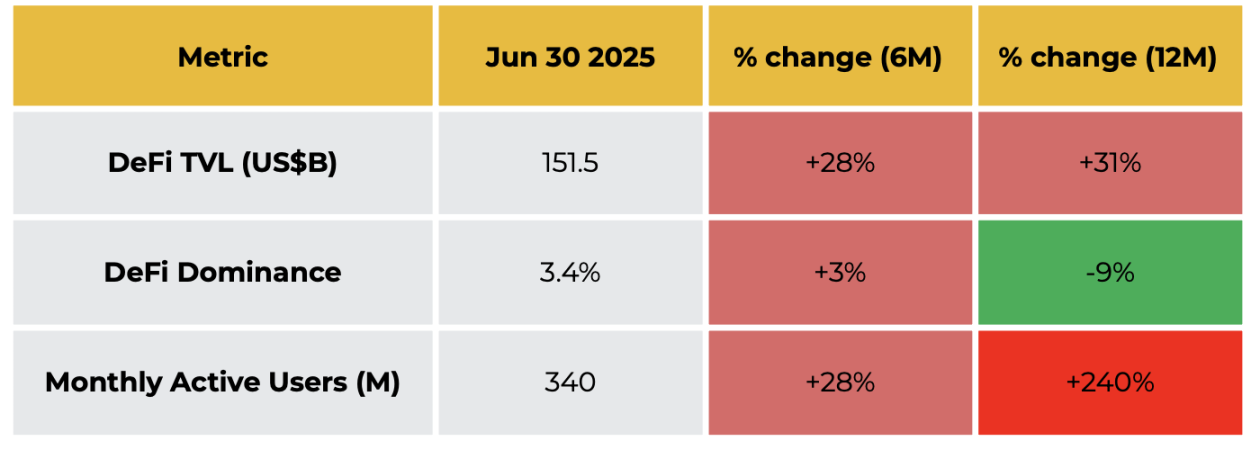

Core data: TVL stabilized at $151.5 billion, monthly active users reached 340 million (+240% YoY), DEX spot trading volume share rose to 29%, hitting a record high.

Six-month and one-year changes in major DeFi indices

Key trends:

-

RWA boom: On-chain real-world assets reached $24.4 billion in value, with private credit accounting for 58%, serving as a key bridge between TradFi and DeFi.

-

Prediction market breakthrough: Polymarket partnered with social platform X, recording over $1.1 billion in trading volume in June, with 400,000 monthly active users, emerging as an information analytics tool.

-

Liquidity stratification: Ethereum leads in institutional-grade assets (re-staking, RWA), Solana focuses on retail trading, while BNB Chain attracts traffic through Memecoins and zero gas fee campaigns.

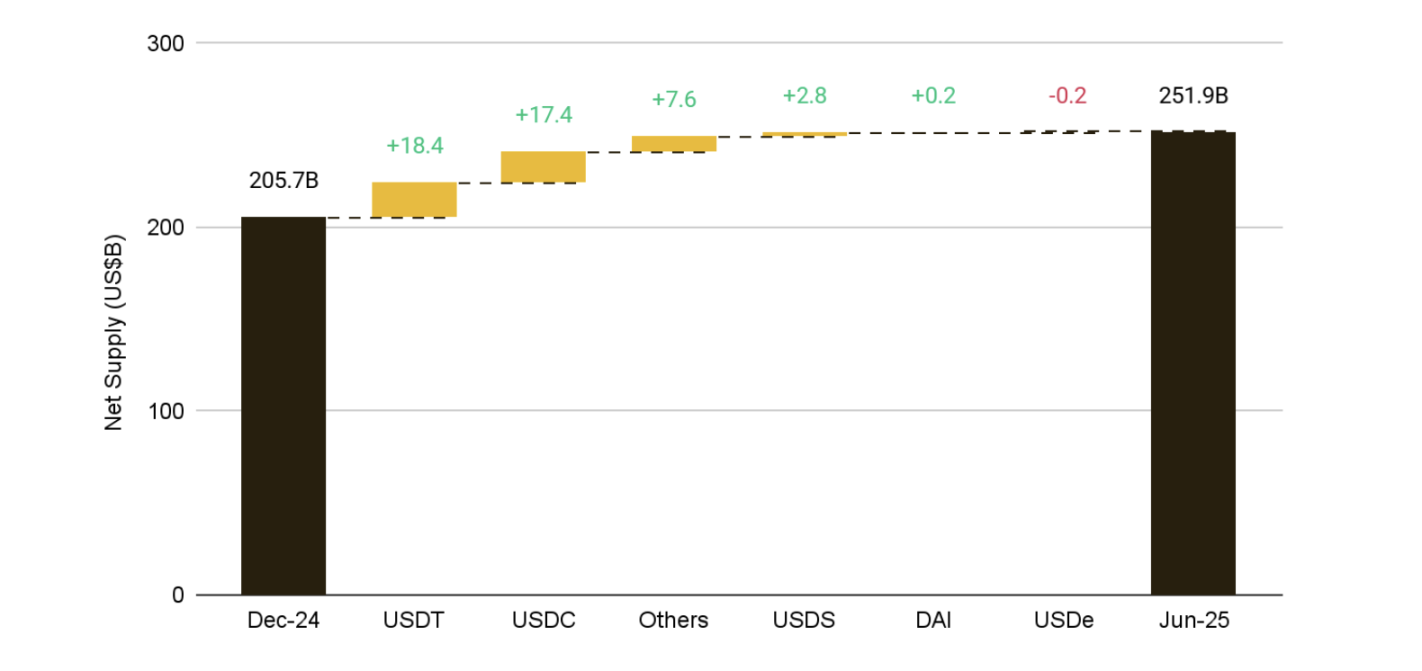

Acceleration of Stablecoin Mainstreaming

Market landscape: Total market cap surpassed $250 billion, with USDT (153–156 billion) and USDC ($61.5 billion) forming a duopoly, collectively holding 92.1% market share.

Stablecoin total supply grew over 22% this year, setting a new record

Key developments:

-

Institutional adoption: Circle went public on the NYSE via IPO, raising over $600 million; JPMorgan, Société Générale, and others launched bank-issued stablecoins; Walmart and Amazon explored proprietary stablecoins to reduce payment costs.

-

Regulatory clarity: The U.S. GENIUS Act passed, and EU's MiCA was fully implemented, providing compliance frameworks for stablecoins and promoting their role in cross-border payments and settlement infrastructure.

4. Institutional Adoption

TradFi integration: 60% of Fortune 500 companies are now involved in blockchain; JPMorgan launched deposit token JPMD on Base; Apollo Global Management tokenized its $785 billion credit fund onto Solana.

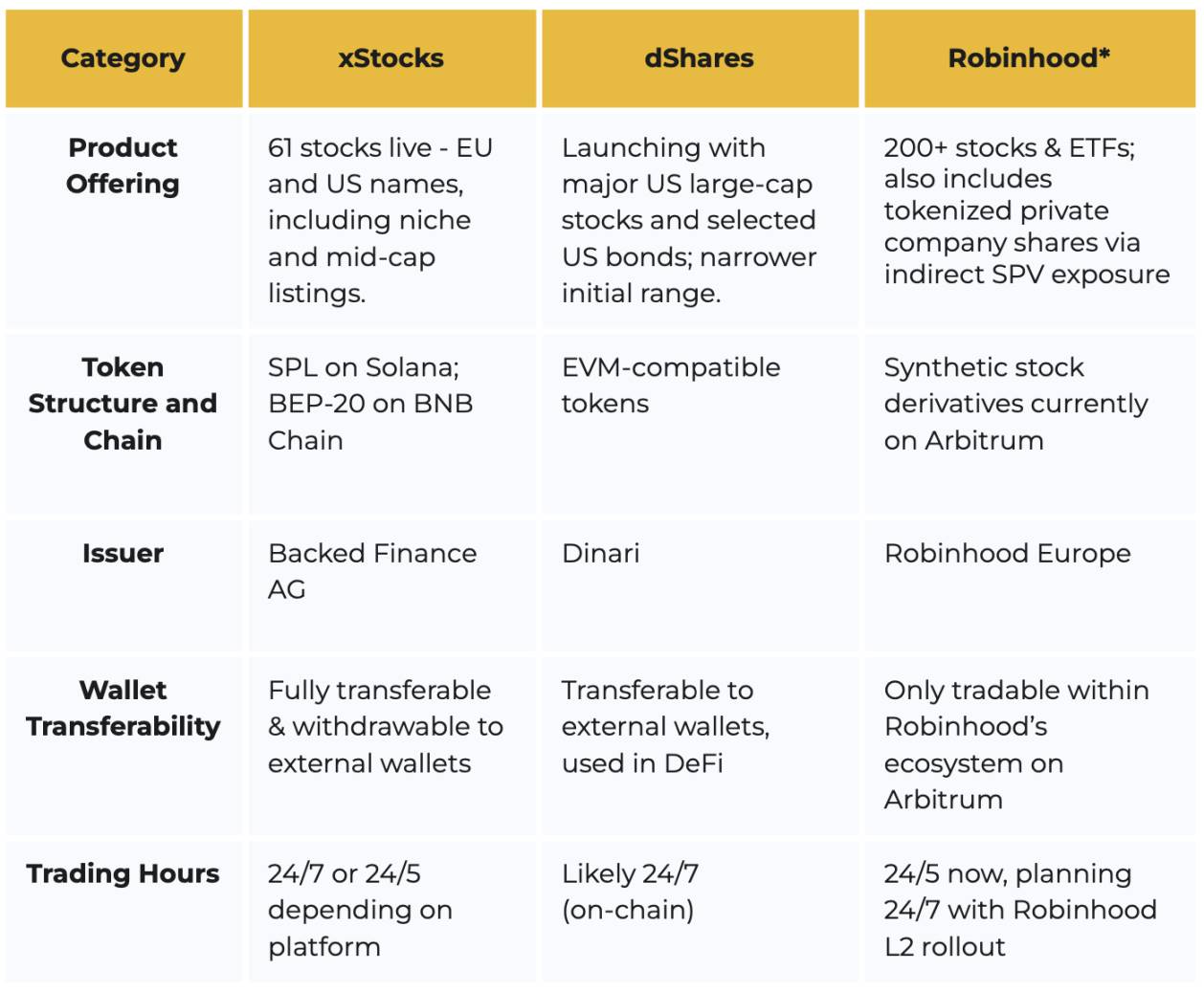

Asset tokenization: Traditional assets like stocks and bonds are accelerating on-chain migration; Backed Finance’s xStocks and Dinari’s dShares enable 24/7 trading, while Robinhood launched synthetic stock derivatives in the EU.

Comparative analysis of xStocks, dShares, and Robinhood's tokenized stock offerings

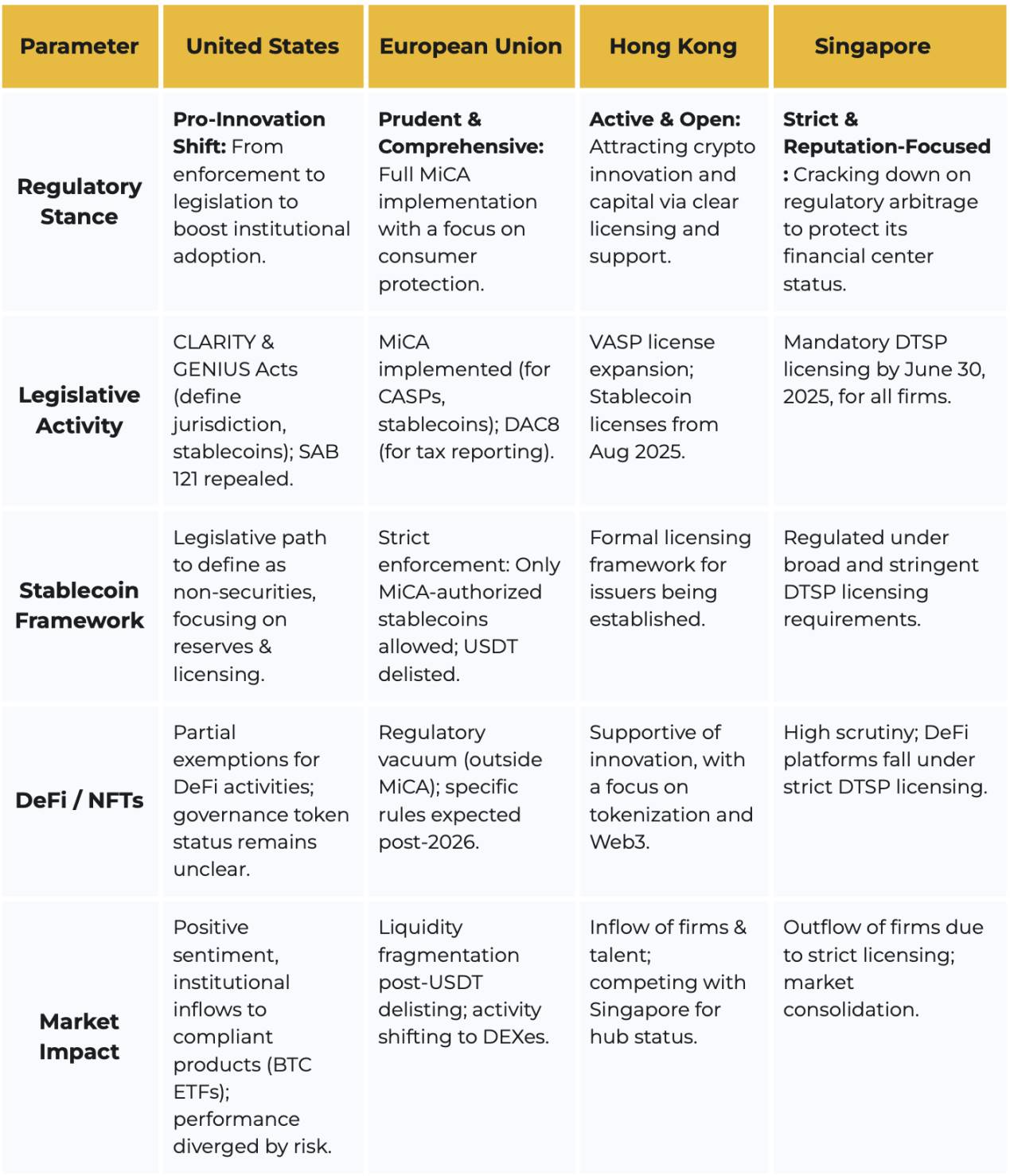

5. Regulatory Landscape

Major cryptocurrency regulatory policies in H1 2025

-

United States: Shifted from "enforcement-based regulation" to "legislative leadership"; the CLARITY Act and GENIUS Act clarified digital asset classifications and stablecoin rules, facilitating compliant institutional entry.

-

European Union: Full implementation of MiCA led to delisting of non-compliant USDT from some exchanges, increasing market share for compliant stablecoins like USDC.

-

Asia: Hong Kong attracted innovation through open licensing and tax incentives; Singapore cracked down on regulatory arbitrage, prompting corporate relocations.

Outlook for the Second Half

Fed policy shifts, advancement of U.S. crypto legislation, TradFi-crypto merger waves, deeper penetration of stablecoin payments, and RWA expansion will shape the trajectory of the crypto market in the second half of 2025.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News