Tom Lee: Are crypto company stock prices rising due to higher cryptocurrency prices or reserve strategies?

TechFlow Selected TechFlow Selected

Tom Lee: Are crypto company stock prices rising due to higher cryptocurrency prices or reserve strategies?

$MSTR created a template for the cryptocurrency treasury strategy.

Author: Thomas (Tom) Lee (not drummer) FSInsight.com

Translation: TechFlow

Understanding DAT* (Digital Asset Treasury) and BTC/ETH Treasury Strategies

*Post published with permission from @saylor (MicroStrategy CEO)

Case Study: $MSTR created the template for the cryptocurrency treasury strategy.

-

Since implementing the $BTC strategy in 2020, Strategy's stock price has surged from $13 to $455.

Question:

How much of the stock price increase is due to Bitcoin's price rise, and how much is due to the treasury reserve strategy?

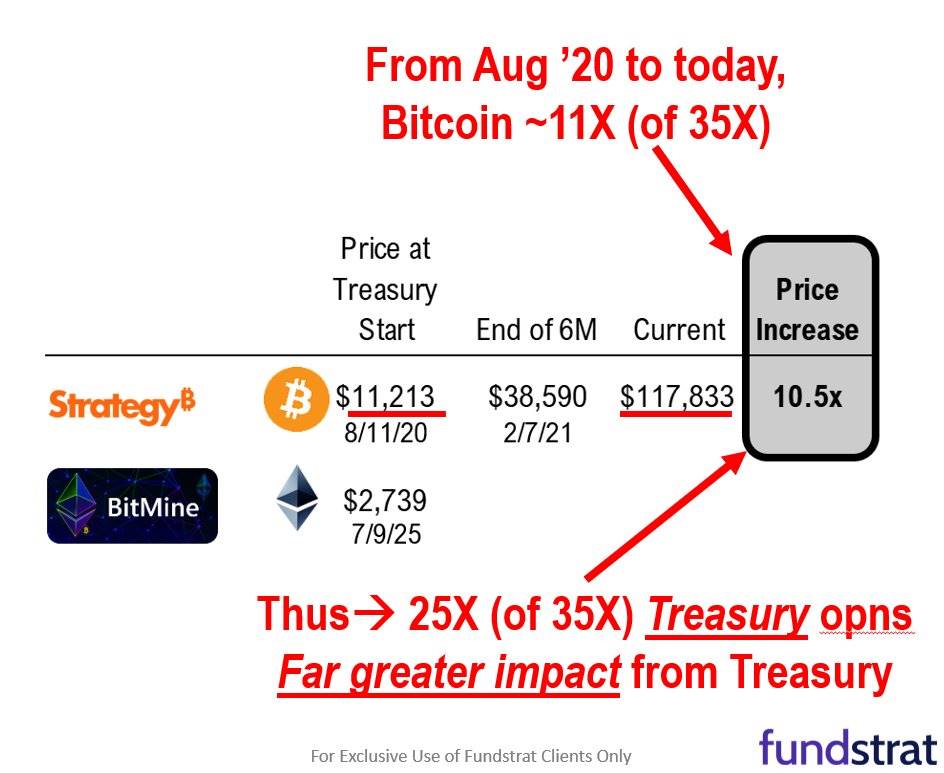

Behind the 35-fold rise in $MSTR's stock price:

-

11-fold came from Bitcoin ($BTC) rising from $11,000 to $118,000

-

25-fold came from the treasury strategy

-

That is, an increased number of Bitcoins held per share

The impact of the treasury strategy far exceeds that of token price appreciation.

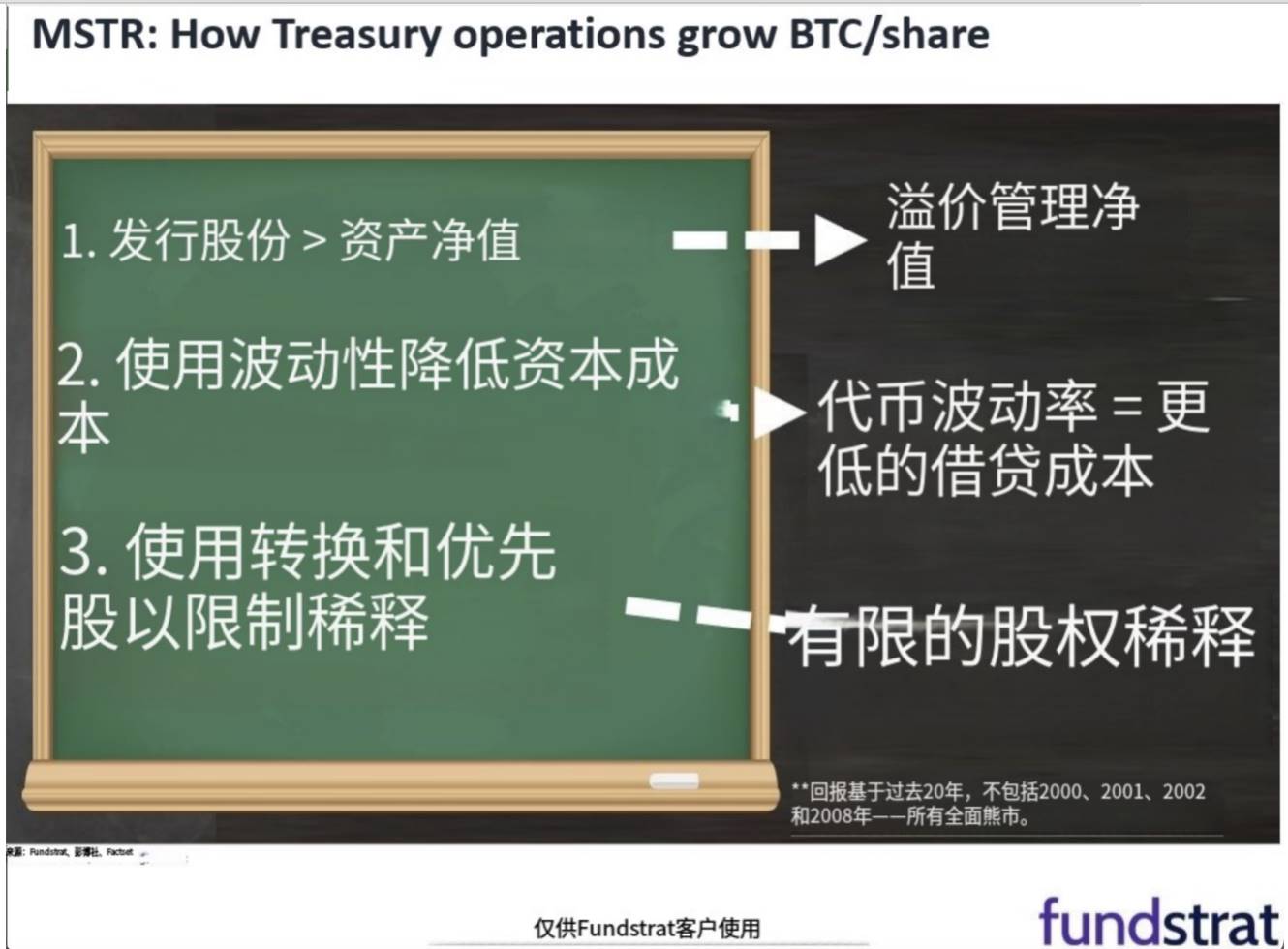

$MSTR’s DAT (Digital Asset Treasury) strategy increases the number of tokens held per share through:

-

Issuing shares > P/NAV (price to net asset value) = higher tokens per share

-

Token price volatility reduces borrowing costs = higher ROI (return on investment)

-

Using convertible bonds/preferred shares = limits equity dilution

By the way:

-

$ETH is more volatile than $BTC

-

Therefore, this volatility has a greater impact on ETH DAT than on BTC DAT.

@grok produced the following table (excerpt)

TechFlow note: The table shows some of MicroStrategy (MSTR)'s financing activities since it began including Bitcoin in its treasury in 2020. These include internal cash, Convertible Senior Notes, Senior Secured Notes, Secured Loans, and ATM Equity Program, nearly all of which were used to purchase Bitcoin.

Bitmine announced its ETH treasury strategy on June 30, 2025, and completed the transaction on July 9, 2025.

The $MSTR example shows that purchasing tokens can:

-

Increase the number of tokens held per share

$BMNR seven days after completing the initial transaction:

-

Acquired $1 billion worth of ETH

-

$MSTR acquired $250 million worth of tokens during the same period

That's all.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News