The Story Behind SXT's V-shaped Reversal: When "Trust" Itself Becomes a Tradable Crypto Asset

TechFlow Selected TechFlow Selected

The Story Behind SXT's V-shaped Reversal: When "Trust" Itself Becomes a Tradable Crypto Asset

With support from Microsoft, NVIDIA, and Chainlink, SXT has built a complete commercial ecosystem.

Author: Oliver, Mars Finance

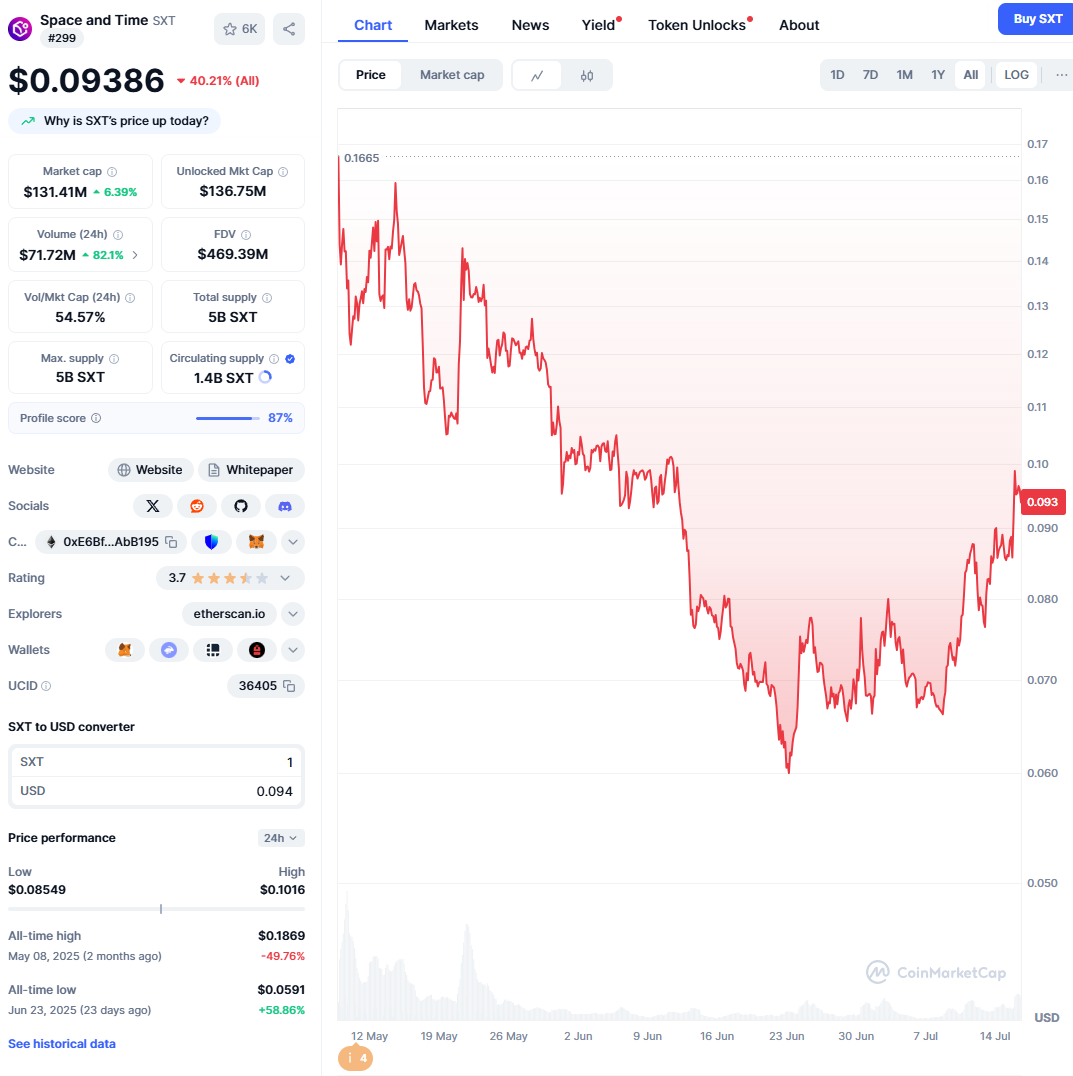

In the crypto world, sharp price surges are nothing unusual, but certain reversal patterns run like deep-sea undercurrents, signaling tectonic shifts in market sectors. Recently, while many mainstream assets remain in consolidation, a relatively obscure token to the general public—Space and Time (SXT)—has quietly traced a sharp "V-shaped reversal" on its price chart. This surge wasn't driven by community hype or viral meme propagation. The true catalysts are two titans representing traditional finance and technology: Grayscale and Microsoft.

This reversal is less about price correction and more about value re-evaluation. It marks a shift among the market's sharpest capital—from chasing application-layer "100x coin" mania toward deeper, more solid foundational layers. Grayscale’s move to establish a single-asset trust for SXT acts like a starting pistol, launching an ambitious experiment to forge "verifiable trust" into a core asset class suitable for institutional portfolios. SXT’s price chart is merely the first heartbeat of this experiment on the open market.

From "Data Warehouse" to "Trust Engine": A Silent Infrastructure Revolution

How can smart contracts trust the real world? Blockchain itself is a closed, deterministic system—analogous to a sterile lab—incapable of directly and securely accessing or processing vast amounts of external (off-chain) data. This inherent "data blindness" severely limits the imagination of decentralized applications (dApps), preventing them from thriving in fields like finance, gaming, and AI that require complex data interactions.

For years, oracles have served as "messengers," partially solving the data feed problem, but they mainly transmit information without guaranteeing the absolute trustworthiness of the underlying computation. It's like a messenger telling you "today's temperature is 30°C"—you can't be 100% sure whether the data came from a precise sensor or was made up on the spot.

Space and Time (SXT) aims to solve this final mile of trust. It builds not just a "decentralized data warehouse," but a "verifiable trust engine." Its core weapon is a patented technology called "Proof of SQL." The brilliance of this technology lies in seamlessly combining cutting-edge zero-knowledge proof (ZK-SNARKs) cryptography with SQL—the database language most familiar to millions of developers worldwide.

As SXT co-founder and CEO Nate Holiday put it: "Enterprises want to migrate their business logic and data on-chain, but are constrained by cost, storage, and compute limitations. What we do is connect large-scale off-chain data computation with on-chain smart contracts in a trustless way." In other words, SXT allows anyone to perform complex SQL queries on massive datasets off-chain, then generate a tiny, unfakeable cryptographic "receipt." On-chain smart contracts can verify this receipt at minimal cost and trust the result's correctness with mathematical certainty—without needing to understand the complexity of the computation or trust the server performing it.

This is a paradigm shift—moving the foundation of trust from probabilistic economic incentives to deterministic cryptography. It aligns perfectly with Ethereum founder Vitalik Buterin’s vision; he has repeatedly emphasized that ZK technology is the ultimate path to blockchain scalability and functionality, enabling networks to verify computations far beyond their native capacity without compromising security.

The Alliance of Giants

If groundbreaking technology forms SXT’s core, then its alliance with Microsoft, NVIDIA, and Chainlink serves as the invincible fleet propelling it to market. This coalition also explains why Grayscale dared to launch a single-asset trust—it's not a bet on an isolated technology, but an investment in a complete, vertically integrated commercial ecosystem.

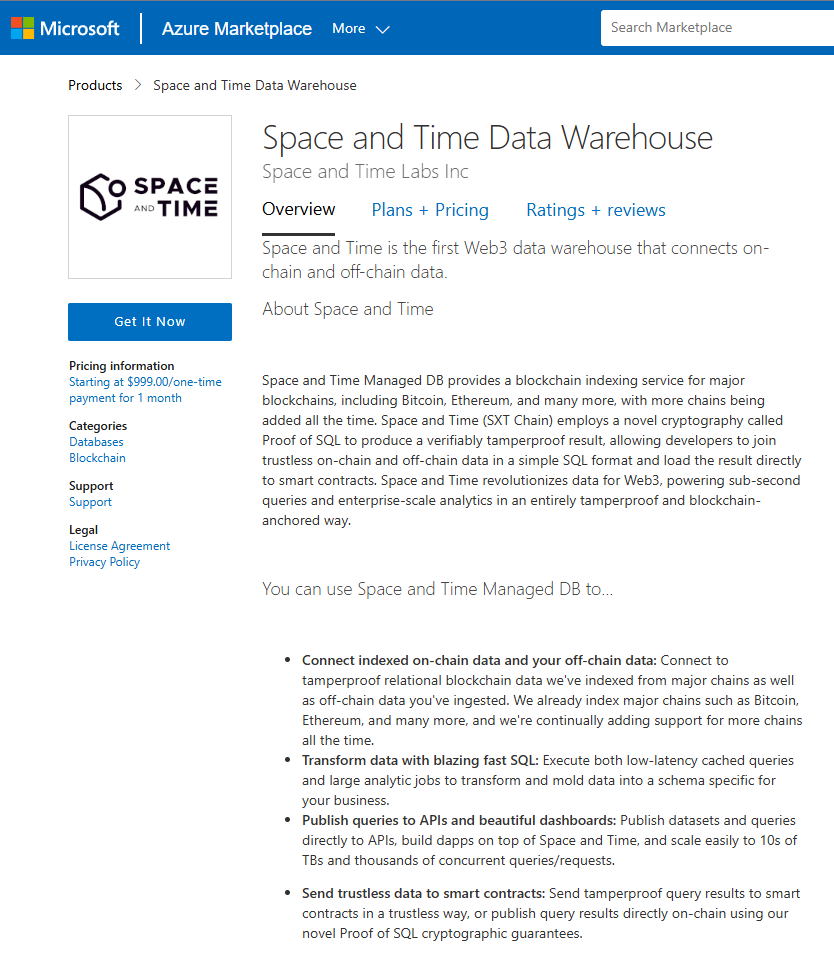

Microsoft acts as the "superhighway" to the vast enterprise market. Microsoft’s venture arm M12 not only led SXT’s strategic funding round, but the partnership runs deep into Microsoft’s strategic core. SXT’s services are already listed on the Azure cloud marketplace and have been natively integrated into Microsoft’s flagship enterprise analytics platform, Microsoft Fabric, becoming its first and only Web3-native data provider. Reports indicate this integration was purely strategic, with no fees exchanged. This clearly signals that Microsoft views SXT as a strategic extension of its enterprise data landscape—a "Trojan horse" injecting verifiable Web3 data seamlessly into its vast ecosystem.

If Microsoft provides market access, then AI hardware leader NVIDIA supplies the powerful "computing engine." Generating zero-knowledge proofs is computationally intensive. By joining the NVIDIA Inception program, SXT gains top-tier support from NVIDIA—dominant in the global GPU market—in hardware optimization and AI ecosystem integration. This relationship hints at SXT’s ultimate ambition: to occupy the pivotal role of "trusted data source" in the grand convergence of AI and crypto.

Finally, oracle leader Chainlink plays the role of "last-mile" deliverer. Through deep integration with Chainlink, SXT’s verifiable outputs can be securely and reliably delivered to smart contracts on any public blockchain. Thus, a complete commercial loop is formed—from底层 computing power (NVIDIA), to core logic (SXT), to enterprise distribution (Microsoft), and finally to on-chain applications (Chainlink).

When Infrastructure Gets "Tokenized"

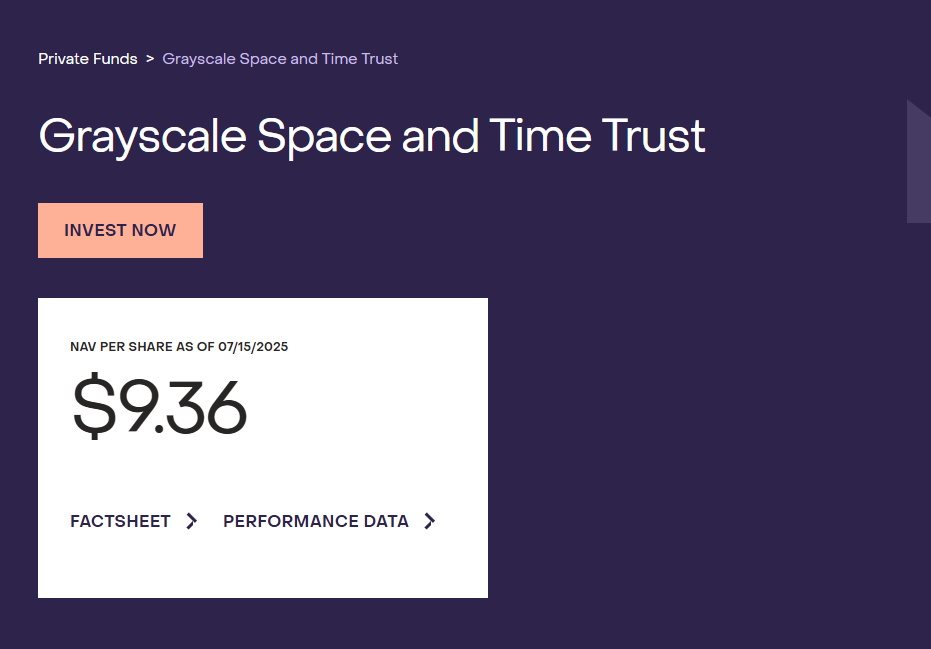

Now, let’s return to the original question: what does SXT’s "V-shaped reversal" truly signify? When Grayscale announced the creation of a single-asset trust for SXT—and that trust quickly attracted tens of millions in assets under management, second only to established blue-chips like XRP—the market finally decoded the signal.

This reversal represents a "Davis Double Play" in value discovery by capital markets. First, recognition of its technological value—"Proof of SQL" as a key solution to Web3’s core dilemma. Second, and more importantly, validation of its business model and strategic positioning. Markets no longer see SXT merely as a "data project," but as a quasi-enterprise-grade solution backed jointly by tech and financial giants.

Grayscale’s action is essentially an act of "infrastructure tokenization." Using its strong brand reputation and compliant channels, it packages the abstract technical concept of "verifiable computation" into a standardized financial product (a trust) accessible to qualified investors. This sends a clear message to Wall Street: investing in SXT is no longer about buying a high-risk startup token, but about allocating to an essential "digital commodity" in the future digital economy—verifiable trust.

Thus, SXT’s price movements begin to脱离 the logic of retail sentiment and short-term narratives, anchoring instead to a broader valuation model: what share of the vast future enterprise data services and AI computing markets can it capture? When a project’s valuation logic shifts from "To C" to "To B," from "application layer" to "infrastructure layer," its price stability and upside potential undergo a qualitative transformation. This is the true language behind that "V-shaped reversal" curve.

After the noise fades, we’ll realize that the next great wave of growth may not be powered by faster blockchains or flashier apps, but by invisible, intangible foundational architectures that provide the bedrock of trust for the entire digital world. Through the SXT trust, Grayscale hasn’t just opened a door to future investment for its clients—it has pointed the entire market in a direction: value will ultimately return to those solid foundations that create trust, empower applications, and bridge reality with the digital. And this wave of capitalization around "trust" has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News