Buying the BTC dip with Bitget's GetAgent, my friend said I'm trading like an investment bank

TechFlow Selected TechFlow Selected

Buying the BTC dip with Bitget's GetAgent, my friend said I'm trading like an investment bank

Bitget's AI trading assistant, GetAgent, effectively streamlines the cryptocurrency trading decision-making process by integrating multi-dimensional information and natural language interaction. It provides users of all levels with end-to-end support from information acquisition to trade execution, demonstrating tangible revenue value and significant tool democratization in testing.

Preface: Research Background and Review Motivation

The information density and strategic complexity of the crypto market are increasing daily. Even users familiar with K-lines, fundamentals, and on-chain data often feel overwhelmed by information overload.

This is why I’ve remained highly interested in the integration of AI and crypto trading. In recent years, more platforms have started incorporating AI features, but most remain at the level of basic functionality or simple information aggregation. Bitget’s launch of GetAgent, promoted as the "world's first all-in-one cryptocurrency trading assistant," aims to help users access information, analyze strategies, and execute trades. During my testing, I unexpectedly caught a wave of BTC price increase.

This article evaluates GetAgent in real-world trading scenarios, focusing on two key questions: “Can it simplify the decision-making process?” and “Can it generate higher returns?” The findings are shared for readers’ reference and discussion.

1. Product Positioning and Core Function Overview

GetAgent is an AI-powered trading assistant embedded within the Bitget App. Positioned as an “AI personal investment advisor,” it uses natural language interaction to handle tasks such as information processing, strategy generation, portfolio diagnostics, and simplified trade recommendations. Its standout feature is the combination of conversational interface with over 50 professional-grade MCP tools.

Based on testing, the applicable use cases are broad, including market analysis, holding suggestions, and even automated trading:

- Market Analysis and Trend Interpretation: You can directly ask, “How is BTC performing today?” and receive a comprehensive interpretation combining K-line indicators, on-chain data, and market sentiment;

- Strategy Recommendations and Risk Alerts: For example, when asking, “Should I add to my ETH position now?”, GetAgent provides range references and take-profit/stop-loss advice based on technical signals and personalized risk preferences;

- Smart Money Tracking and Trend Forecasting: It simulates early warning systems for emerging trends by tracking on-chain capital flows, whale transfers, and frequency of mentions by KOLs on social media;

- Holding Analysis and Rebalancing Suggestions: Based on your account’s asset composition, concentration levels, and correlations, it offers rebalancing recommendations;

- Conversational Learning AI: Answers foundational questions like “What is AMM?” or “Who benefits from dollar-cost averaging?”;

- Automated Trading: Enables direct trade execution via chat commands such as “Buy 1 ETH” or “Add 100 BGB to position,” allowing order placement through natural language instructions.

From a functional logic standpoint, GetAgent attempts to close the loop from information input to execution recommendation, acting as a true “AI personal investment advisor.”

2. User Experience: Interaction Flow from Input to Output

The most immediate impression is that, as an “AI personal investment advisor,” you can interact with GetAgent using natural language just like ChatGPT—no need to switch interfaces or manually check charts. The overall experience is quite smooth.

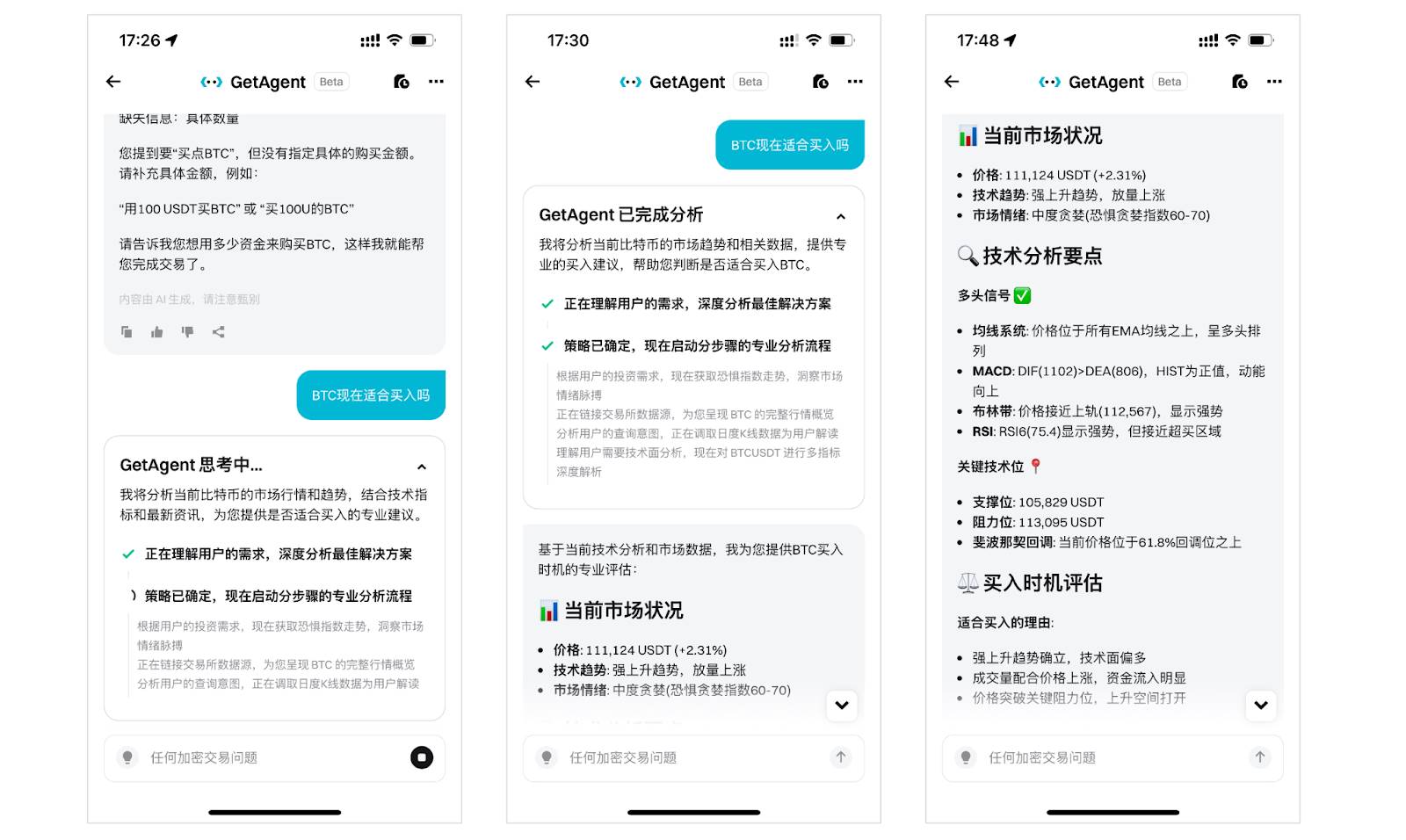

For instance, during testing, I asked: “Is now a good time to buy BTC?” GetAgent entered a thinking state, and its reasoning process could be viewed in the UI:

- "Understanding user intent, deeply analyzing optimal solutions"

- "Strategy determined, initiating step-by-step professional analysis," which breaks down into sub-steps such as:

- Analyzing user investment needs and retrieving fear & greed index trends to gauge market sentiment

- Connecting to exchange data sources to present a full overview of BTC’s market performance

- Analyzing query intent and retrieving daily K-line data for interpretation

- Recognizing need for technical analysis, conducting multi-indicator deep dive on BTCUSDT

Unlike the often-mocked thought processes seen in models like DeepSeek, this appears to be a deliberately structured analytical workflow designed by developers to serve vertical-domain expertise, following a logical and coherent analysis path.

Ultimately, GetAgent delivered a detailed report including:

- Price movements and volume changes over the past month;

- Status of key indicators such as RSI/MACD/Bollinger Bands;

- Whether BTC has seen inflows amid shifting market narratives;

- Current technical support and resistance levels;

- External sentiment references (e.g., community mood and frequency of mentions by influencers);

The output format is highly structured and can be used directly as a decision-making reference.

In terms of user experience, the greatest success lies in translating complex quantitative and fundamental analyses into plain language. This lowers the learning curve for beginners while enhancing decision efficiency for experienced traders.

However, when requesting analysis on specific assets like above, GetAgent typically takes around 30 seconds—or longer—to respond. On a mobile app, this feels somewhat slow and represents a key area for optimization.

3. Testing Three Key Features: GetAgent’s Practical Capabilities

Market Interpretation

We begin with basic market analysis. I posed similar questions about BTC, ETH, and PEPE: “Is the current level suitable for buying?” The system returned information covering price ranges, support/resistance levels, status of major technical indicators, and shifts in sentiment metrics. Data completeness here was strong, especially due to the integration of technical, on-chain, and sentiment dimensions.

Compared to traditional methods—where I would need multiple platforms to gather this information—GetAgent condenses everything into a single textual summary, saving significant switching time.

Smart Money Tracking

This is one of the standout features I focused on. When I asked, “Are there any notable large-player moves in PEPE recently?” GetAgent provided data on large on-chain addresses, DEX inflow/outflow trends, and mention volumes from trending KOLs. Upon asking, “What are whales buying lately?”, it listed several tokens along with reference data (24-hour gains, current trading volume, and market cap). When I inquired about “Cathie Wood’s recent activity,” it offered insights into her investment moves, rationale, implications, and market impact.

While the depth may seem modest to seasoned traders, the overall analysis approaches the quality of professional research teams. For retail investors, especially newcomers, it’s highly accessible and easy to understand, effectively bridging the information gap with institutional players at minimal cost.

Holding Diagnosis

This was a surprisingly useful feature. GetAgent analyzed my portfolio structure and pointed out risks such as excessive ETH concentration, lack of hedging assets, and missed opportunities to deploy stablecoins strategically. It also recommended establishing a “market-cap balancing mechanism” to reduce altcoin exposure.

This third-party perspective, distinct from self-assessment, holds significant value in trading decision support. Particularly valuable is the system’s ability to provide clear reasoning and traceable logic rather than issuing mechanical directives. This “explainability” greatly enhances trust in the recommendations themselves.

4. Can It Deliver “Excess Returns”?

This is the question every reader cares about. During testing, I followed several small-sized strategies suggested by GetAgent, strictly adhering to its entry and scaling points. Unexpectedly, I caught a sustained upward movement in BTC, with both entry and add-on positions perfectly timed—earning an 8% gain in spot within a day. Unfortunately, I didn’t follow its suggestion to open a futures position, missing out on additional leveraged gains!

In my view, GetAgent is a valuable decision-optimization tool that helps you make better decisions and earn returns. Its advantages include:

- Saving time on information search and integration;

- Providing structured entry recommendations;

- Highlighting potential risks that might otherwise be overlooked;

- Improving the data foundation behind your decisions;

- Executing trades on your behalf based on your final judgment.

Of course, it doesn't precisely predict tops and bottoms. You still need to judge, decide, and take responsibility for risk. My attitude toward it is similar to how I view autonomous driving: AI should not and cannot replace a trader’s subjective judgment.

5. How Has It Changed Decision-Making Behaviors?

Prior to using GetAgent, I relied on cross-verifying three types of data: technical indicators, on-chain trends, and community sentiment—requiring me to switch between at least three platforms and manually annotate and summarize findings. Since integrating GetAgent into my routine, I’ve found the process of information synthesis and rapid judgment significantly more efficient.

Streamlined Decision Process, Enhanced Efficiency

From posing a vague question like “Is BGB suitable for short-term entry?” to receiving a recommended range, stop-loss reference, and support/resistance zones took less than 20 seconds. More importantly, I no longer had to pull up charts or verify MACD/EMA values myself—the system provided a credible analytical pathway upfront.

This shifted my daily decision flow from “gather → summarize → judge → act” to simply “filter → judge → act.”

Shift in Analytical Perspective

Previously, I heavily relied on visual patterns and technical shapes such as “triangle breakouts” or “golden crosses.” Now, I pay more attention to “systemic cross-verification”: Is there divergence between sentiment indicators and capital inflows? Is narrative momentum for a given token declining?

This marks a transition from “indicator-based thinking” to a “systems perspective.” GetAgent helps clarify logic rather than merely presenting numbers.

Expanded Information Dimensions

GetAgent also has a subtle yet profound effect: it exposes you to critical data points you may have never considered before—such as changes in active on-chain addresses, social mention frequency across meme sectors, or trend behaviors of whale wallets transferring into exchanges.

The structured presentation of such data was once exclusive to institutions but is now instantly accessible via conversation. Over time, this broadens the dimensions I consider when trading, naturally improving my ability to avoid pitfalls.

6. Usage Recommendations for Different Trader Types

AI tools aren’t suitable for everyone, nor do they perform optimally at every stage. Based on my testing, I evaluated GetAgent’s fit across several typical user profiles.

New Users: A Friendly Onboarding Guide

For users unfamiliar with charts or on-chain mechanics, GetAgent’s core value lies in being beginner-friendly. It can help plan dollar-cost averaging strategies, explain basic concepts, and illustrate sources of volatility and risk through concrete examples.

This is far more reliable than new users blindly studying TA or chasing KOL opinions. For those entering the market, it serves as an excellent “AI coach”-style tool.

Active Traders

For frequent traders who already have their own strategy frameworks, GetAgent acts as a decision aid and blind-spot alert system. It won’t replace your existing system but can validate whether observed trends align with your views or warn you when details are overlooked.

Especially during periods of rapid meme coin rotation, GetAgent accelerates judgment speed and reduces noise from information overload.

Aggressive Investors

For high-frequency, trend-chasing, alpha-hunting aggressive investors, GetAgent offers potential value in two directions:

- Early Trend Detection: By analyzing narrative热度, social sentiment indices, and whale buying rhythms, it may provide signals ahead of sharp rallies;

- Risk Checklist Function: It flags risks such as low liquidity, extremely small market caps, or tokens frequently sold by institutions, serving as a cautionary alert.

AI’s rationality acts like a sword sheath—providing restraint and prudence for aggressive investors.

7. What Is GetAgent Really Worth?

As a product still in testing, GetAgent is far from perfect and cannot fully replace manual trading. However, I believe it has made a clear breakthrough in enhancing the crypto trading user experience.

Current Stage: Learning Tool + Decision Support

In terms of functional completeness, GetAgent is already a comfortable-to-use tool, particularly suitable for:

- Newcomers navigating the learning curve;

- Intermediate users with established strategies but limited bandwidth;

- Experienced traders seeking to quickly identify key information and reduce judgment blind spots.

Mid-Term Potential: A Milestone in Tool Democratization

GetAgent’s greatest potential lies in closing the information gap between individual and institutional traders. With broad data coverage and a relatively robust information model, it may not generate true alpha strategies, but it enables users to quickly filter out irrelevant noise and focus on actionable insights.

In a way, it delivers “quant-grade data services” directly into the hands of ordinary users—via a chat interface.

Long-Term Vision: The Default Entry Point for Trading Platforms

If GetAgent continues to optimize modules such as input understanding, strategy modeling, and execution integration, I believe it could become the default interaction gateway for future trading platforms. Just as you use Google to search for news or Siri to control devices, tomorrow’s trading app may start with “Ask the AI.”

8. Summary and Conclusion

After several days of testing, I believe GetAgent can genuinely serve as an excellent “AI personal investment advisor” for the crypto market. It helps you focus information, alerts you to risks, offers directional guidance, lets you make the final call, and then executes your trades with one click.

For traders passionate about self-learning and upgrading their cognitive frameworks, this is a tool well worth continuous attention. I will continue using it for trade preparation, portfolio rebalancing, and trend validation—and look forward to further improvements in data depth, response speed, and execution interfaces.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News