Crypto Venture Capital 2025: Emerging Trends Behind the Funding Crunch

TechFlow Selected TechFlow Selected

Crypto Venture Capital 2025: Emerging Trends Behind the Funding Crunch

Cryptocurrency is leading venture capital into a new era of public-private integration and higher liquidity.

Author: Mason Nystrom

Translation: TechFlow

Providing founders with some insights into the current state of crypto fundraising, along with my personal predictions on the future of crypto VC.

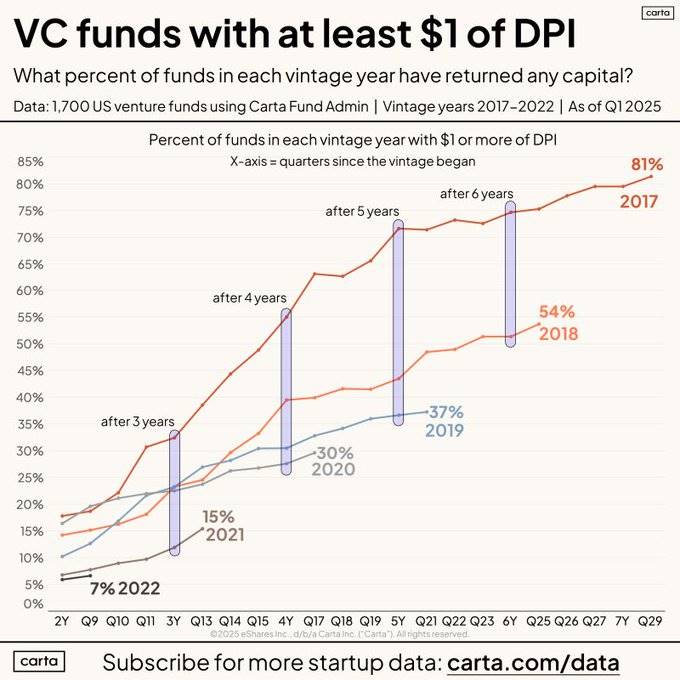

First things first: the fundraising environment is tough, due to upstream DPI and LP funding challenges. Across the VC landscape, funds are returning less capital to LPs over the same period compared to previous years.

This in turn leads to reduced net capital for both existing and newly formed VCs, ultimately resulting in a more difficult fundraising environment for founders.

What does this mean for crypto startups?

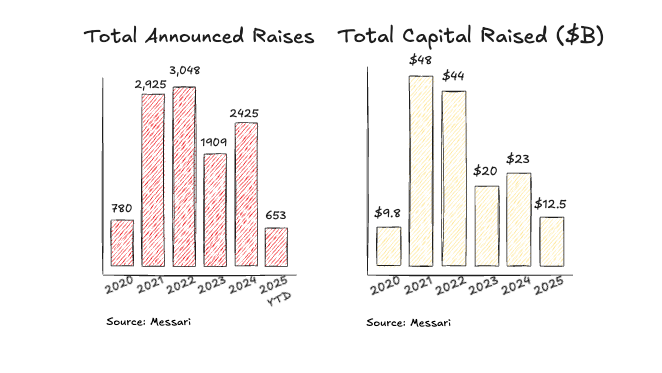

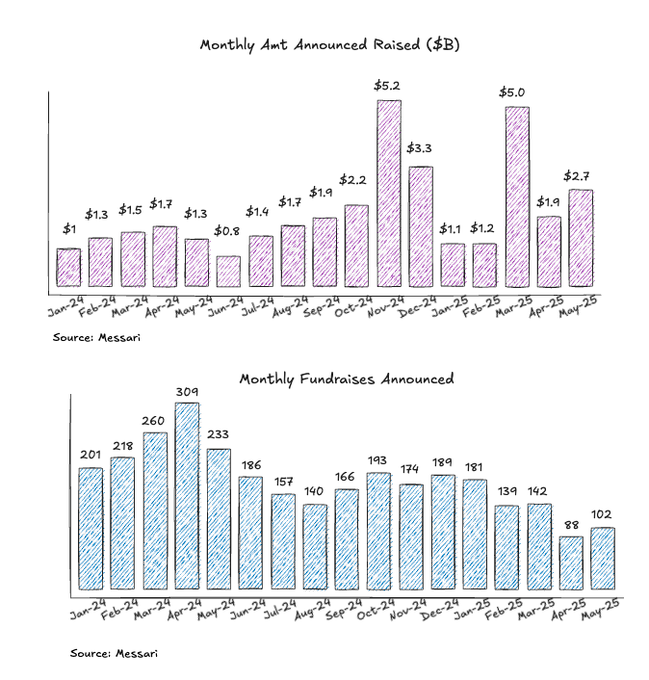

Deal activity slowed in 2025, but capital deployment remained on par with the pace seen in 2024.

- The decline in deal count may be linked to many VCs approaching the end of their fund cycles, with less capital left to deploy.

- Some large deals were still completed by major funds, keeping capital deployment levels consistent with the past two years.

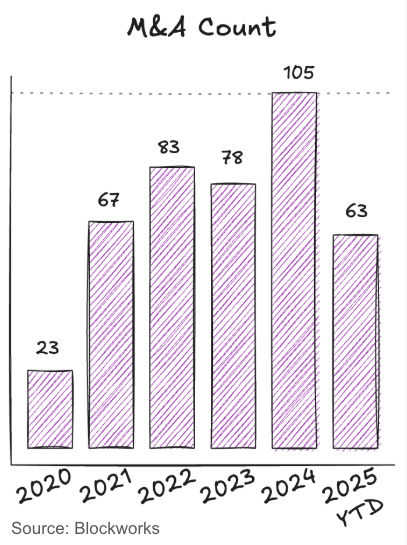

M&A activity in crypto has continued to improve over the past two years, signaling positive developments in liquidity and exit opportunities. Recent major acquisitions involving NinjaTrader, Privy, Bridge, Deribit, and HiddenRoaad suggest favorable conditions for further consolidation and underwriting of crypto equity venture investments.

Deal volume has remained relatively stable over the past year, with several larger, later-stage transactions closed (or announced) in Q4 2024 and Q1 2025.

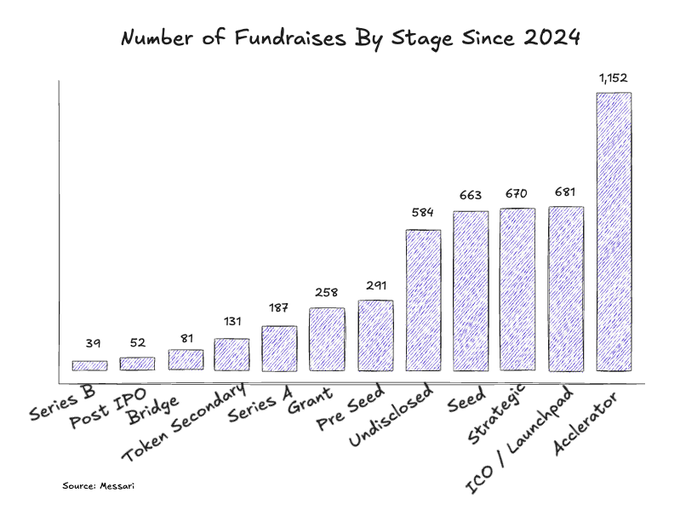

This is primarily because a greater share of deals occur at the earlier Pre-seed, Seed, and accelerator stages—where capital tends to remain more accessible.

Accelerators and Launchpads Lead Deal Volume Across Stages

Since 2024, we've seen a surge in accelerators and launchpad platforms, possibly reflecting a tighter capital environment and founders opting to launch tokens earlier.

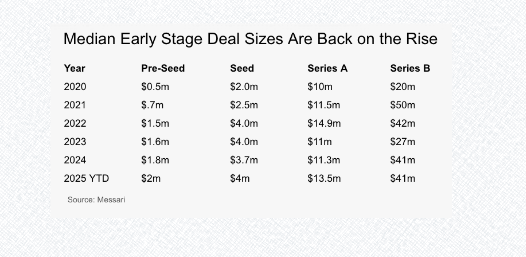

Median Deal Size Rebounds in Early-Stage Rounds

Pre-seed round sizes continue to grow year-over-year, indicating sufficient capital availability at the earliest stages. Median sizes for Seed, Series A, and Series B rounds have approached or rebounded to 2022 levels.

Predictions for the Future of Crypto VC

1: Tokens Will Become the Primary Investment Vehicle

A shift from dual token-and-equity structures toward a unified model centered on single-asset appreciation. One asset. One value-growth narrative.

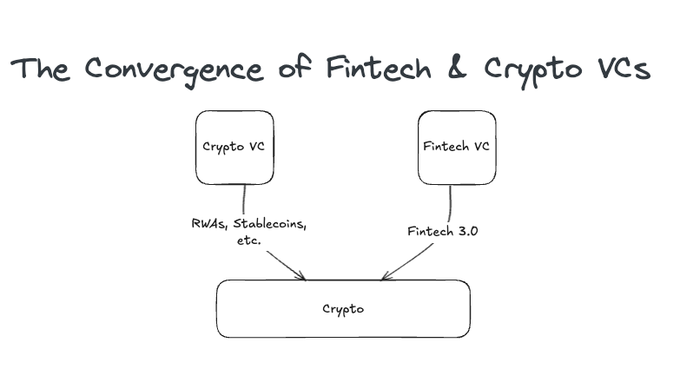

2: Convergence of Fintech and Crypto VC

Every fintech investor is transitioning into a crypto investor, as they seek exposure to next-generation payment networks, new banking models, and tokenization platforms—all built on crypto rails.

The competition in crypto VC is coming. Many crypto-native VCs that haven't invested in stablecoins or payments will struggle to compete against seasoned fintech VCs.

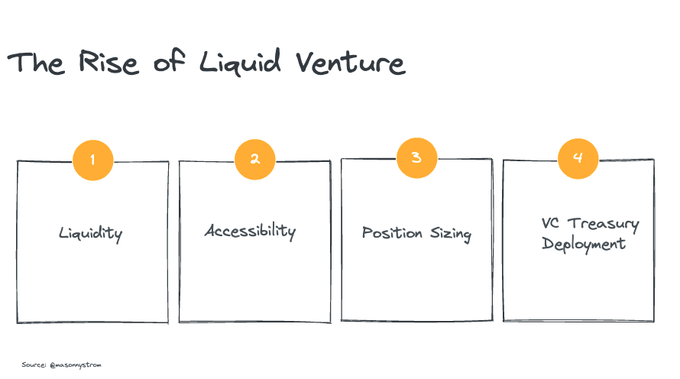

3: Rise of Liquidity Venture Capital

"Liquidity Venture Capital" — venture opportunities within liquid token markets.

Liquidity — public assets/tokens enable faster exits.

Accessibility — gaining access in private venture is hard, but in liquidity VC, investors don’t always need to win deals; they can directly buy assets. OTC options are also available.

Position sizing — as companies issue tokens earlier, small funds can still build meaningful positions, while large funds can similarly deploy into larger-cap liquid assets.

Capital allocation — many top-performing VCs have historically held portions of their risk capital in tokens like BTC and ETH, generating outsized returns. I believe it will become increasingly common for VCs to call capital earlier during bear market cycles.

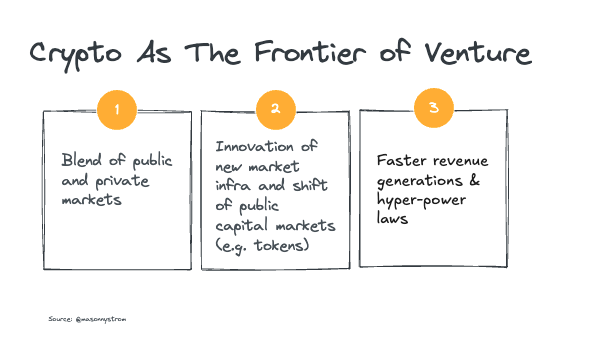

Crypto Will Continue Leading the Frontier of Venture Capital

The convergence of public and private capital markets is the direction of venture evolution. As companies delay IPOs, more traditional VCs are investing via post-IPO vehicles or secondary markets. Crypto is at the forefront of this shift.

Crypto continues to innovate in forming new capital markets. And as more assets move on-chain, an increasing number of companies will adopt an on-chain-first approach to capital formation.

Finally, returns in crypto tend to be more power-law distributed than traditional venture. Top crypto assets are racing to become foundational layers for sovereign digital currencies and new financial economies. This decentralization will deepen, but crypto’s hyper-power-law dynamics and volatility will continue driving capital into crypto venture seeking asymmetric returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News