ETH breaks through the 3,000 mark, BTC hits new highs—will altseason arrive this time?

TechFlow Selected TechFlow Selected

ETH breaks through the 3,000 mark, BTC hits new highs—will altseason arrive this time?

E boss has spoken: Bull market, launch!

Author: Azuma, Odaily Planet Daily

The cryptocurrency market appears to have entered an accelerating upward phase. After a significant surge the previous night, markets experienced an even more violent rally last evening.

According to OKX data, BTC briefly spiked to 117,548.2 USDT last night, currently trading at 115,408 USDT as of 8:30 this morning, marking a 24-hour gain of 3.75%. More astonishing was ETH, the bellwether altcoin, which surged past the 3,000 threshold amid multiple positive catalysts, reaching a high of 3,002.99 USDT before settling at 2,972.21 USDT by 8:30 AM—a 24-hour increase of 5.77%. Meanwhile, SOL, another leading altcoin, is now priced at 162.7 USDT with a 24-hour gain of 4%.

Driven by the overall bullish momentum—especially ETH’s breakout from its prolonged stagnation—the broader altcoin market has seen a strong recovery. As of 8:30 AM today, dozens of coins among the top 100 altcoins recorded double-digit gains: SUI at 3.42 USDT (+11.7%), ARB at 0.3915 USDT (+11.1%), PEPE at $0.00001218 (+11.2%), and PENGU at 0.0194 USDT surging 26.18%, among others.

CoinGecko data shows that the total crypto market cap has surpassed $3.669 trillion. Market sentiment indicators also reflect rising investor enthusiasm, with today’s Fear & Greed Index reaching 71, categorized as “Greed.”

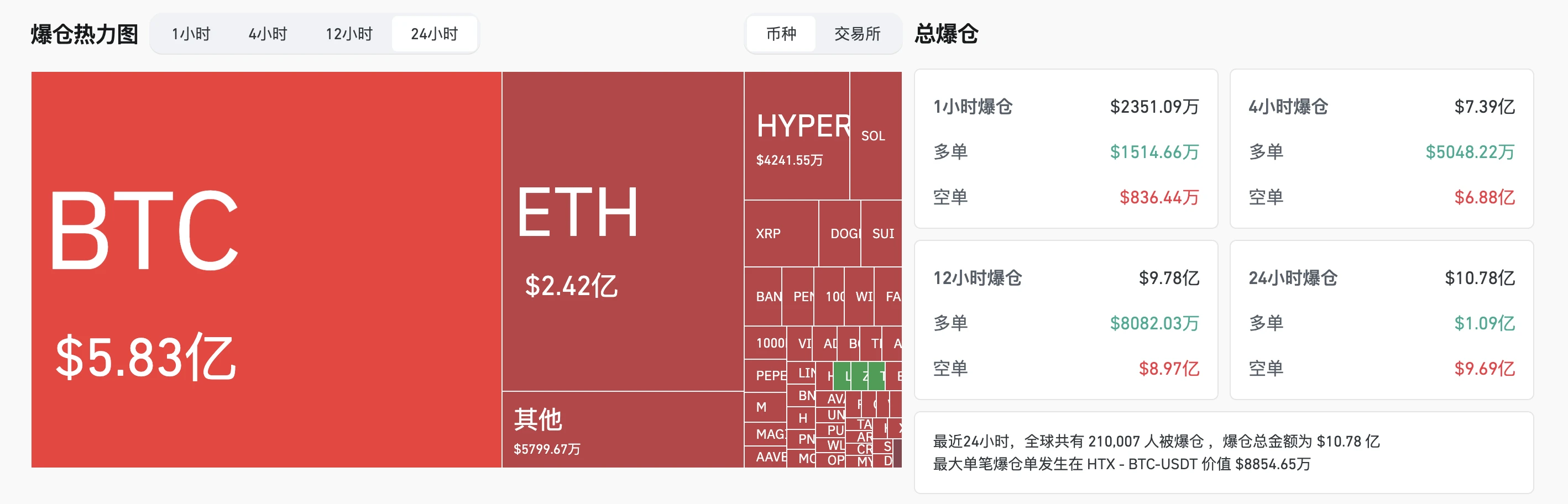

In derivatives trading, Coinglass reports $1.078 billion in liquidations across all platforms over the past 24 hours, with the vast majority being short liquidations totaling $969 million. By asset, BTC accounted for $583 million in liquidations and ETH for $242 million.

Reasons Behind the Rally: Tariff “Desensitization,” Institutional Accumulation, and Rate Cut Expectations

We previously analyzed some of the drivers behind this market upturn in yesterday’s article titled *“BTC Reaches New High at $112K, ETH Leads With 7% Gains—Is Altseason on the Horizon?”*

On one hand, the market has gradually recognized that the collective psychological impact of the recent tariff tensions has significantly diminished—much like the fable of “The Boy Who Cried Wolf,” repeated exposure reduces fear. The panic caused by trade wars on both crypto and global economies has waned considerably.

On the other hand, institutional buying pressure—including ETF inflows—has continued to grow. As of July 10, spot Bitcoin ETFs have recorded five consecutive days of net inflows. With SOL opening the door for altcoin ETFs, more such products may soon be approved. Moreover, beyond traditional BTC-focused firms like Strategy, an increasing number of public companies are now shifting their accumulation strategies toward ETH, SOL, and even speculative tokens like HYPE.

Besides these factors, comments from several Federal Reserve officials last night regarding potential rate cuts further boosted market sentiment.

-

Daly, President of the San Francisco Fed, stated: “I think there could be two rate cuts, though everyone’s expectations remain uncertain. We should consider implementing cuts in the fall.”

-

Waller, a Fed Governor and potential next Chair, said that despite strong June employment data, the Fed should still consider cutting rates at the July meeting: “I’ve made my view clear. Current policy rates are too high; we can discuss lowering the benchmark rate in July… When inflation cools, we don’t need to maintain such a restrictive stance—that’s sound central banking logic.”

ETH’s Strong Rebound: Can It Last?

ETH has clearly been the star performer in this rally. Since hitting lows in April this year, few expected the most pessimistically viewed asset at the time to outperform both BTC and SOL—yet ETH has already doubled from its trough.

We previously detailed the reasons behind ETH’s outperformance in our article *“Five Bullish Catalysts Emerge—Will ETH See Structural Reversal?”* In short, after a prolonged consolidation period, ETH may be entering a structural bull phase supported by five key factors: regulatory easing, institutional accumulation, foundation reforms, growing on-chain activity, and renewed market confidence—suggesting sustained upside potential in the long term.

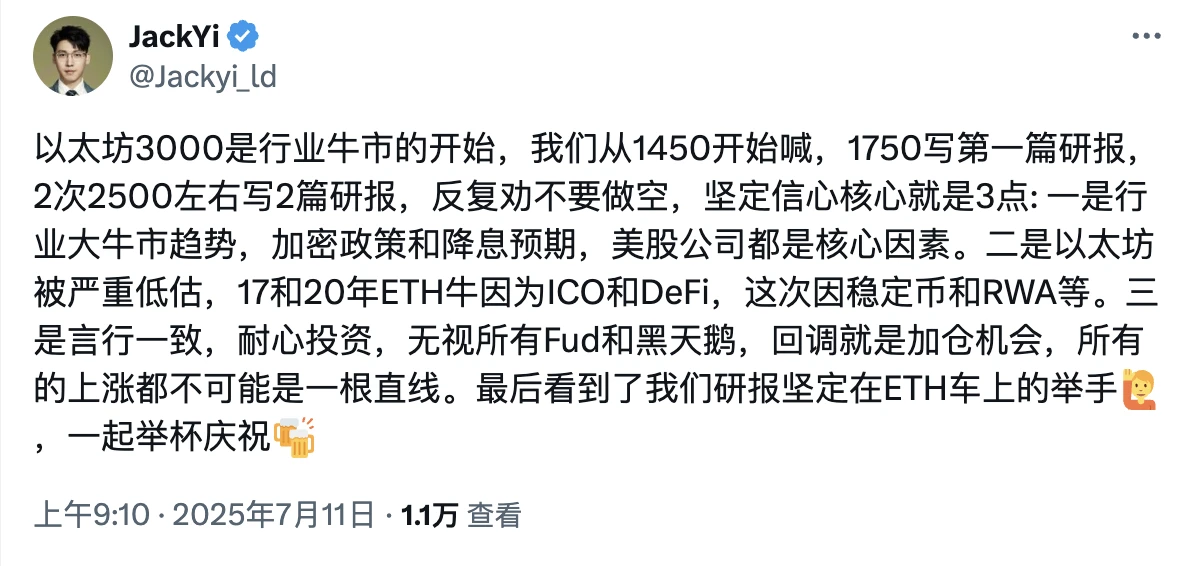

Jack Yi, founder of LD Capital—who once loudly advocated for ETH (now affectionately dubbed “Boss E” by ETH supporters)—posted on X this morning stating that ETH breaking $3,000 marks the beginning of a new bull market… “Ethereum is severely undervalued. Previous cycles were driven by ICOs and DeFi; this one will be powered by stablecoins and RWA.”

However, near-term price action and order book data suggest strong selling pressure around the $3,000 level. This implies ETH may require further consolidation below this zone to build momentum for a sustainable breakout. A model published by CoinDesk this morning also indicates strong resistance near $3,000, with support located around $2,750.

Additionally, the Ethereum Foundation—which had recently earned praise for operational improvements—sold another 1,210 ETH this morning at an average price of $2,889.50. Given the foundation’s historical track record of “topping out,” this move may weigh on market sentiment to some extent.

Will Altseason Finally Arrive?

ETH has long served as a barometer for the broader altcoin market. After months of ETH underperformance dragging down altcoins, its recent strength has reignited hopes for the legendary “altseason.”

On this topic, trader degentrading offered a contrarian take on X last night, suggesting that under the prevailing market narrative of “altcoins are scams,” rising short positions could ultimately fuel a massive short squeeze—becoming the very engine that drives altseason.

A historically unprecedented phenomenon is unfolding: the open interest (OI) of several altcoins now exceeds their market capitalization, indicating uncovered naked shorts. Since short covering requires buying actual spot assets, when OI surpasses market cap, there simply aren't enough tokens available to satisfy settlement demand.

The turning point lies here: as Bitcoin approaches new highs, we’re seeing—for the first time—massive capital flowing into ETH; institutions bidding for ETH via treasury vehicles; altcoin derivatives markets setting OI records; and a new generation of traders profiting from shorting altcoins based on the widespread belief that “they’re all scams.”

A short squeeze storm is brewing. Total market OI currently stands at approximately $172 billion (BTC: $83B, ETH: $40B), with altcoins alone accounting for $50B. When these massive short positions—established at historic lows—begin unwinding en masse, that will become the structural source of demand for altcoins. The game is about to begin.

Yet dissenting voices remain. Andrei Grachev, Managing Partner at DWF Labs, believes most altcoins will likely underperform Bitcoin going forward.

He argues that factors such as the passage of the “Big Beautiful Bill,” seasonal market strength in Q4, and potential rate cuts will push Bitcoin and crypto-related equities to new highs. While the altcoin market may rise partially in tandem, most mid-cap tokens are expected to lag behind BTC. Opportunities will come again—but not necessarily now.

It's been so long since the last true “altseason” that the term itself has become a joke. The market seems to have lost the courage to believe it could happen again.

This time—could it be different?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News