All liquidity goes to Hyperliquid

TechFlow Selected TechFlow Selected

All liquidity goes to Hyperliquid

Hyperliquid reaches the Solana ecosystem via Phantom, while Phantom abandons Jupiter to step beyond the Solana ecosystem.

GMX is busy dealing with the hack, Hyperliquid is busy expanding.

This time, Hyperliquid has taken a bold step into the Solana ecosystem. Unlike simple multi-chain deployment, this move involves providing liquidity through the Phantom wallet—surprisingly chosen over Drift and Jupiter.

Rather than merely supporting the Solana chain or enabling Phantom wallet logins, Hyperliquid's approach differs from predecessors like dYdX and GMX. It resembles a decentralized version of Binance—aiming to become the ultimate source and destination of liquidity for all protocols and dApps, establishing itself as a true on-chain cornerstone through supercharged liquidity.

The Third Way

To understand Hyperliquid, one must look beyond Hyperliquid alone.

Contrasted with spot DEXs like Uniswap, perpetual contract products from a spot perspective are seen as leveraged gambling—extremely difficult to sustain liquidity. Note: the core challenge for spot DEXs lies in liquidity generation, which is why AMMs and bonding curves are so critical.

Uniswap can boost asset participation across chains and grow protocol TVL even within a single chain. But perpetual DEXs—whether dYdX, GMX, or Hyperliquid—must actively "attract" liquidity to centralize it, a natural advantage held by centralized exchanges (CEXs) like Binance.

Centralization inherently favors liquidity concentration.

In comparison with peers like dYdX and GMX: from GMX’s perspective, Perp DEXs combine dYdX’s off-chain order book matching with on-chain settlement and tokenized liquidity—the essence behind GMX’s explosive revenue in 2022, sustained via LP Token → GMX Token “incentives” to retain liquidity.

Hyperliquid follows a similar path but executes more precisely. Its closed HyperCore handles spot and derivatives trading—this is the primary basis for claims of centralization—while HyperEVM manages the “blockchain” layer. The operational ambiguity leaves Hyperliquid in a long-term superposition of decentralization and centralization, where its superior liquidity and matching efficiency reside.

For full Hyperliquid architecture, see: Hyperliquid: 9% of Binance, 78% Centralized

Decentralization naturally strengthens brand effect.

Hyperliquid evolves through dynamic interplay with Binance—striving for maximum liquidity while balancing centralized efficiency with decentralized experience. It integrates dYdX’s improved order book matching, GMX’s liquidity token “bribery” mechanisms, and mirrors BNB’s role linking BNB Chain and Binance—the same way $HYPE connects HyperCore and HyperEVM.

In the end, Hyperliquid reconciles previously uncoupled contradictions. Systems engineering once again works its magic, stacking existing technical elements into today’s optimal product-market fit—and even improves upon Binance’s original blueprint.

- Multi-chain deployment / centralized liquidity

- Bridging / chain abstraction / aggregators / intents

- Decentralized UI / centralized UX

To become market infrastructure, one must capture as many entry points as possible. Phantom serves perfectly as a traffic conduit for the Solana ecosystem. But rather than buying market share with subsidies, revenue sharing proves smarter than token incentives.

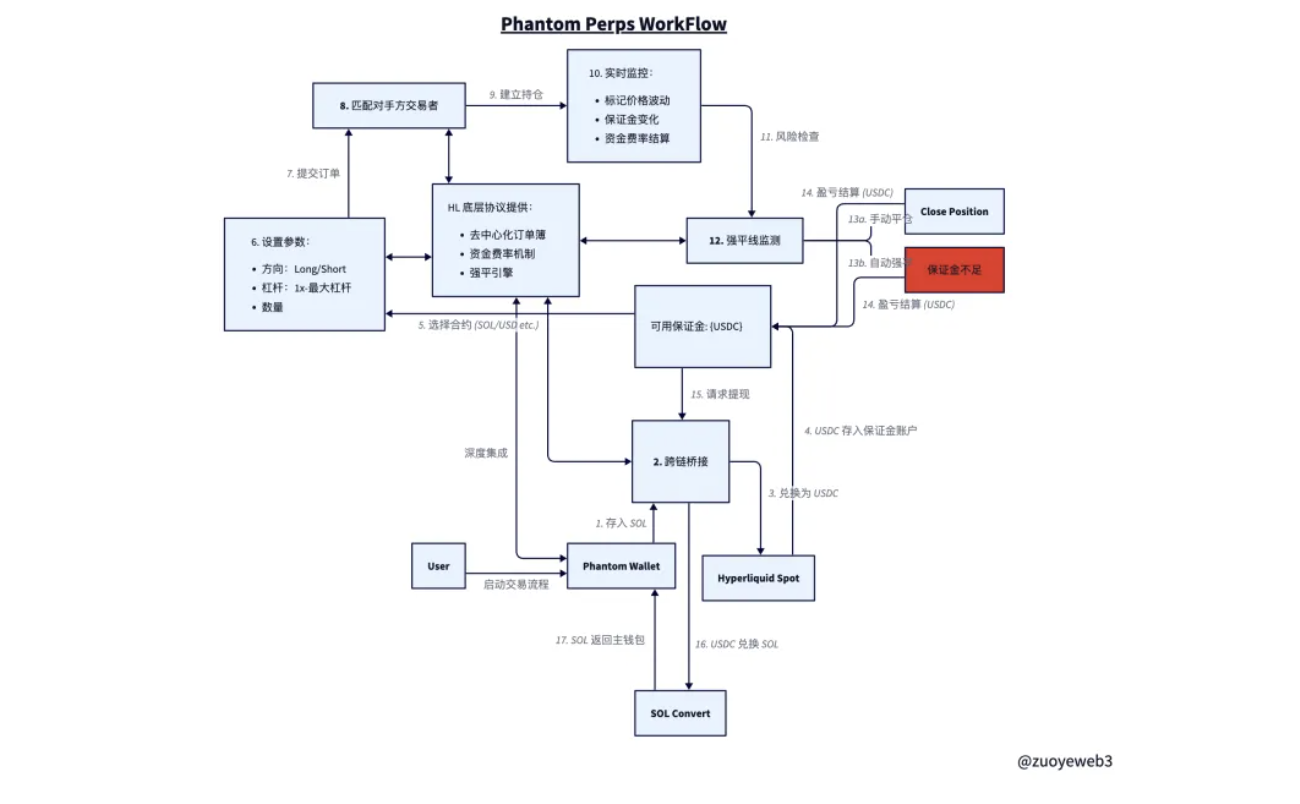

In the Phantom Perps design, instead of simply logging into dYdX or Drift, Hyperliquid is embedded directly within Phantom’s interface. The prerequisite: SOL on Solana must first bridge into Hyperliquid’s spot account and be converted to USDC, then transferred to Hyperliquid’s futures account as margin.

This bridging may be supported by Unit Protocol’s Hyperunit, though not confirmed—additional information welcome, and security assessment remains crucial.

Afterward, during trading and liquidation, roles shift between Phantom and Hyperliquid. Phantom’s interface only displays information—actual operations are fully controlled by Hyperliquid. This marks the biggest difference from dYdX and Drift: user funds truly enter the Hyperliquid system.

Upon closing a position, profits or losses are denominated in USDC, but gradually unwrapped back into SOL. Specifically, USDC must first move from Hyperliquid’s futures account to spot, then be exchanged for SOL, bridged back to Solana, and finally appear in Phantom as SOL.

The benefit? Greater capital flexibility.

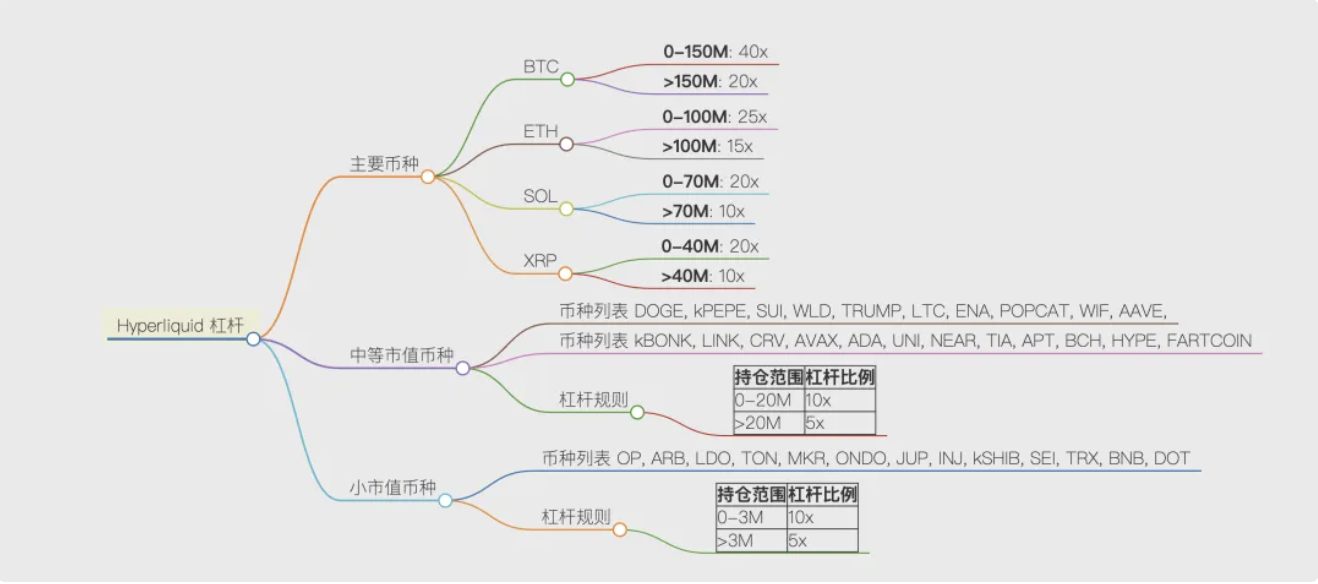

Once users’ SOL enters Hyperliquid, they can trade any asset supported by Hyperliquid, with leverage up to 40x depending on size. However, after repeated attacks, Hyperliquid has adopted a risk-aware stance: lesser-known assets or larger positions receive lower leverage.

The downside? Reduced system security.

Asset bridging in and out will face stress during extreme market volatility.

During trading, users must trust Hyperliquid at the same level as CEXs like Binance—trusting that the exchange won’t steal funds and will execute trades per instructions.

This isn't just a simple collaboration—Hyperliquid aims to turn Phantom into an ally for penetrating and dominating Solana, clearly a direct offensive against native Solana DEXs. CEXs like Binance and local DEXs across chains must now rethink how to respond to Hyperliquid.

BNB’s performance surpasses all exchange tokens, reflecting Binance’s grip on liquidity. So does Hyperliquid—from spot to Perps, Ethereum to Solana. This is an all-or-nothing charge.

New Revenue Streams

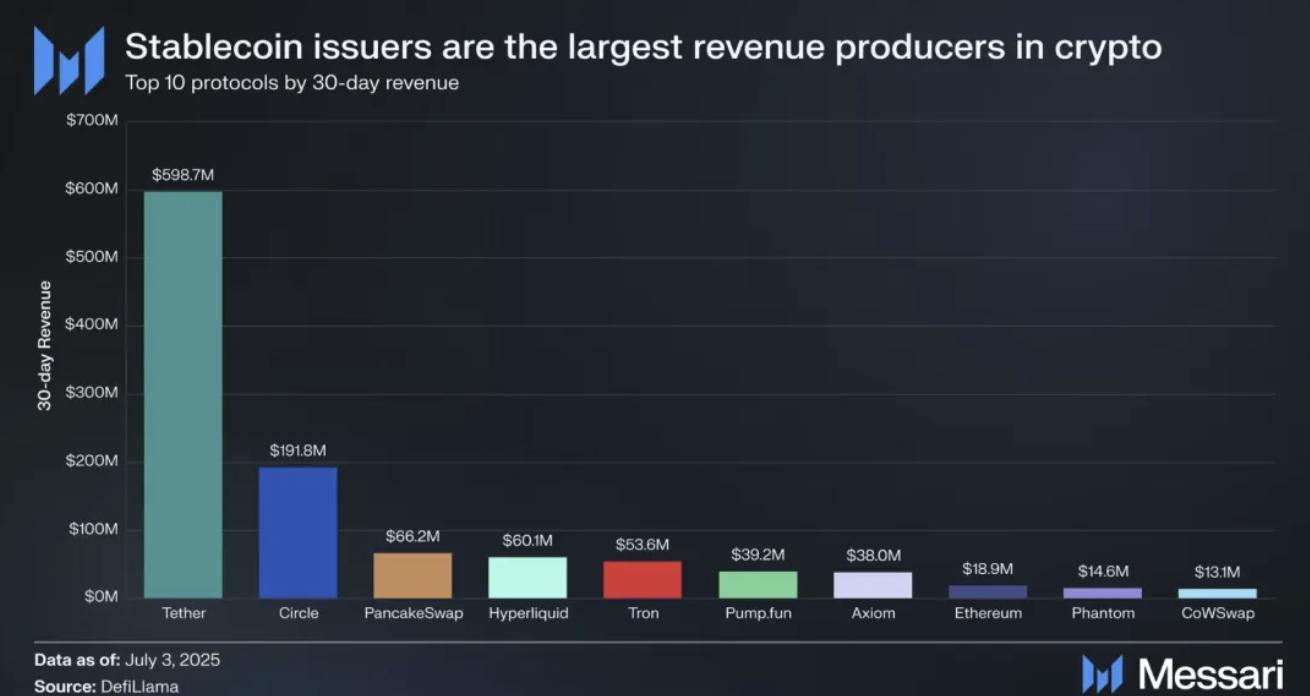

Hyperliquid isn’t cheap—in fact, it’s highly profitable.

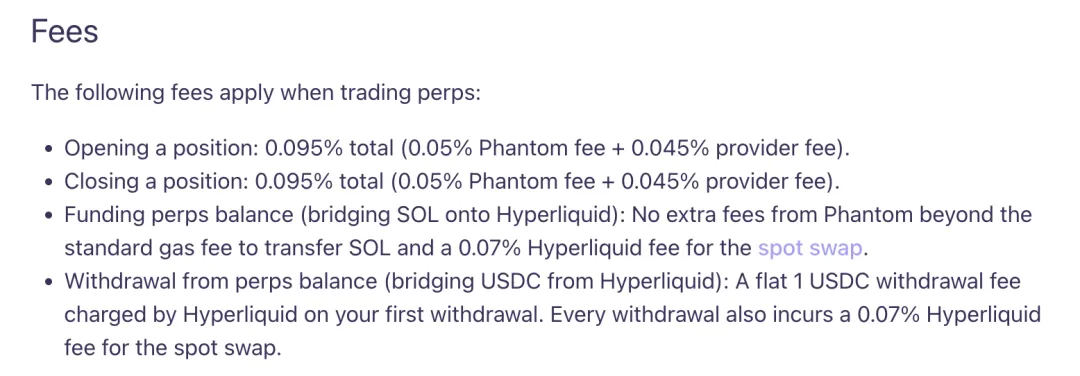

Unlike dYdX or Binance, Hyperliquid never competed on low fees. Coincidentally, neither does Phantom—it’s a profit powerhouse, earning from SOL staking to trading, across single and multiple chains, with strong business diversification.

MetaMask is now a distant myth in the wallet space—Phantom is reality.

But it’s still not enough to define the future. Backpack wants to compete head-on within Solana, and OKX Wallet looms as a formidable rival. If CEX-DEX convergence defines this cycle, then combinations like Binance + PancakeSwap, OKX Spot + OKX Wallet, or Backpack Wallet + Backpack Exchange each have their own strategies.

Stablecoins will persist. The longevity of Memes and on-chain issuance/trading tools remains uncertain. Public chains and DEXs must rediscover growth vectors. Hyperliquid already hosts public chains, DEXs, stablecoins, and Meme markets—but lacks a wallet tool, or more precisely, access to retail and mass markets.

This seems counterintuitive, but whales dominate Hyperliquid. While their capital volume is large, without sufficient retail users, it’s hard to sustain stablecoins, Memes, or higher-frequency, everyday-use products like RWA.

Retail users drive marginal innovation and mass-market reach. Only with massive data can intelligence “emerge,” and randomness spark endless evolutionary possibilities.

Luckily, Phantom has ample retail users—at least topping Solana.

Beyond that, this partnership is mutually profitable. Thoughtful fee anchors are placed at every touchpoint and gateway. Both Phantom and Hyperliquid charge fees—will competitors respond with faster speeds and lower fees? Will HL+Phantom become the new dragon?

Conclusion

HL chooses to onboard new users through wallets; Phantom seeks to transcend its image as just a Solana wallet and enter mainstream markets.

CEXs compete on token equity, DEXs aggressively acquire users. It’s clear: crypto traffic has hit a bottleneck. Pure product categories can no longer sustain business growth. Increasingly frequent competition, cooperation, acquisitions, and attacks will define the landscape.

Every cycle is an arena for exchanges and public chains. This time, will it be Hyperliquid vs Binance, Solana vs Ethereum?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News