China's Robinhood: Is cryptocurrency trading a big opportunity for Futu?

TechFlow Selected TechFlow Selected

China's Robinhood: Is cryptocurrency trading a big opportunity for Futu?

Analysts believe that as the regulatory environment in Hong Kong and other regions gradually becomes clearer, Futu is well-positioned to capture a significant share of the rapidly growing cryptocurrency trading market.

Author: Bao Yilong, Wall Street Insights

Morgan Stanley upgraded its rating on Futu Holdings, stating that its cryptocurrency business has the potential to become a key growth engine for years to come.

According to TradingFlow News, on July 9, Morgan Stanley released a research report projecting that Futu will achieve an average annual profit growth of 27% from 2025 to 2027, driven by strong potential in its crypto businesses in Hong Kong, Singapore, and the U.S. markets.

The analysts believe that as regulatory environments in regions like Hong Kong become clearer, Futu is well-positioned to capture significant market share in the rapidly growing crypto trading space, thanks to its strong brand trust, one-stop investment platform, and comprehensive licensing advantages. While risks remain—such as high volatility in crypto markets and regulatory uncertainty—Futu’s brand credibility and full suite of licenses are expected to help it stand out amid competition.

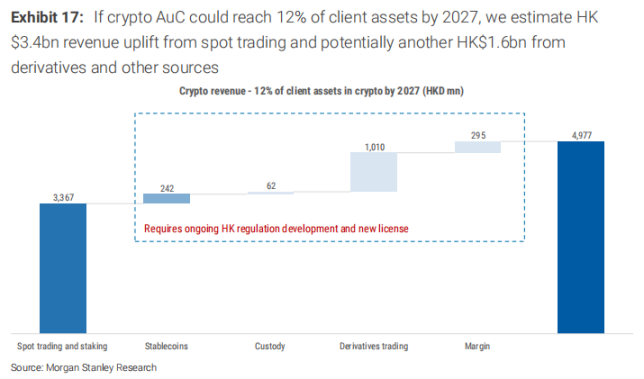

In a base-case scenario, if crypto assets grow to represent 12% of total client assets by 2027, spot trading alone could generate HK$3.4 billion in incremental revenue—equivalent to an 18% increase over previous 2027 revenue estimates. Additional income from stablecoins, derivatives, and margin financing could add another HK$1.6 billion.

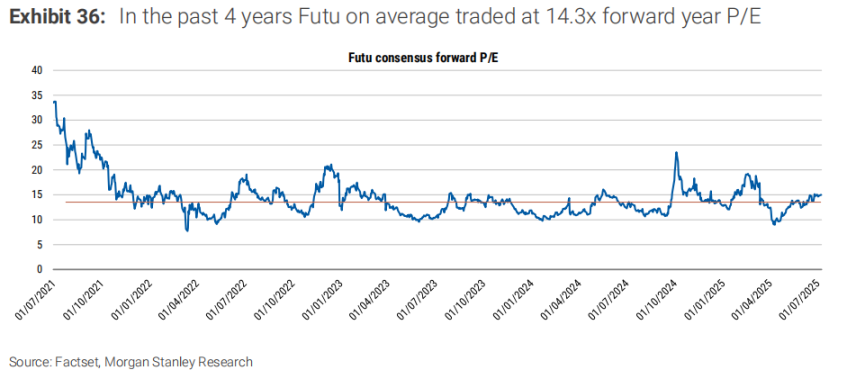

Morgan Stanley noted that Futu's current forward P/E ratio stands at around 15x, slightly above its four-year average of 14.3x. However, analysts believe the stock remains undervalued and expect its 2026 forward P/E to reach 20x. As a result, they raised their price target from $140 to $160 per share. In comparison, U.S. retail broker Robinhood trades at a 2026 forward P/E of 63x, highlighting Futu’s relative valuation appeal.

Rise of the Cryptocurrency Market: A Strategic Opportunity for Futu

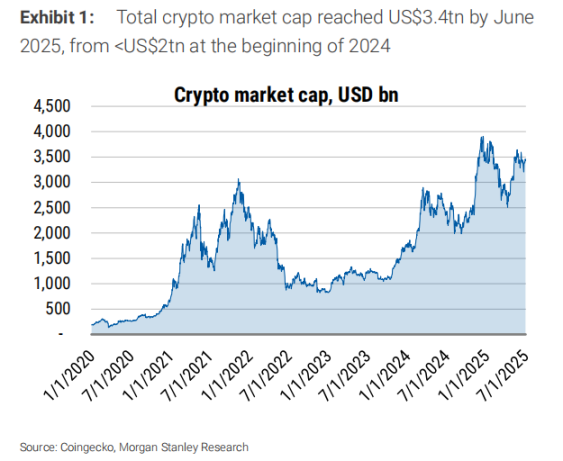

The report highlights the significant expansion of the global cryptocurrency market, which grew from less than $2 trillion in market capitalization at the beginning of 2024 to $3.9 trillion by year-end, now stabilizing around $3.4 trillion.

This scale is now comparable to major equity markets such as Japan ($6.5 trillion), Hong Kong ($4.1 trillion), and the UK ($4.6 trillion).

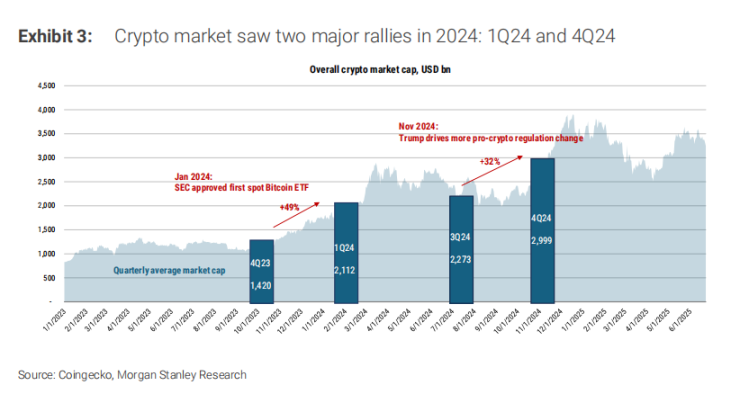

Regulatory developments have been a key driver of this growth. The U.S. Securities and Exchange Commission’s (SEC) January 2024 approval of spot Bitcoin ETFs triggered nearly a 50% market rise in the first quarter. In Q4 2024, expectations of a more crypto-friendly regulatory stance under a potential Trump administration led to another 32% surge.

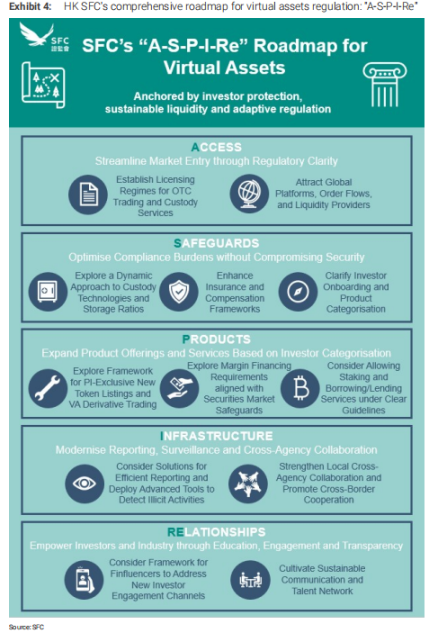

In February 2025, Hong Kong’s Securities and Futures Commission (SFC) unveiled a comprehensive regulatory roadmap titled "A-S-P-I-Re," encompassing 12 key initiatives covering crypto brokerage, virtual asset trading platforms (VATPs), and stablecoins.

This regulatory framework paves the way for traditional financial institutions to enter the crypto market. Futu obtained its Hong Kong brokerage license in the second half of 2024 and received its VATP license in January 2025, positioning itself among the first regulated financial firms to enter this space.

Analysts believe this opens up substantial market share opportunities for Futu, particularly in Hong Kong and Singapore, where it already accounts for over 60% of its client assets. The company is expected to gradually introduce additional services such as derivatives, margin trading, and OTC transactions, further expanding its addressable market within institutional clients.

Futu’s Core Competitive Advantages: Brand and Platform

Futu has built a robust customer base and strong brand trust in Hong Kong and Singapore. As of the end of 2024, it had 2.4 million active accounts and managed client assets totaling HK$743 billion, rising to HK$829 billion in Q1 2025.

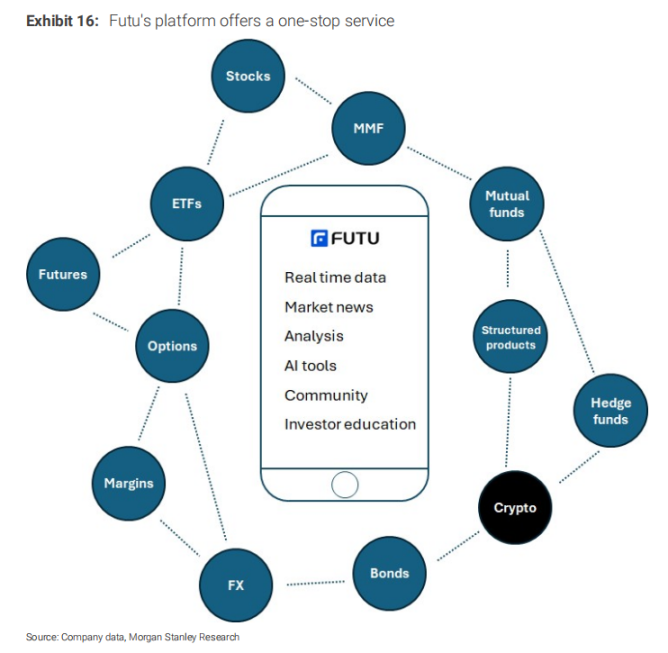

The report emphasizes that Futu’s full range of licenses—including brokerage, exchange, and banking-related permits—combined with its industry-leading user experience, enable it to attract crypto investors through investor education and competitive pricing.

Futu’s one-stop platform integrates trading across multiple asset classes including stocks, ETFs, options, and cryptocurrencies, significantly lowering the barrier to entry for novice investors. For example, Hong Kong users can directly trade Bitcoin using Hong Kong or U.S. dollars, with a minimum transaction amount of just about $30.

This convenience and trust form a durable moat for Futu, especially when competing against local brokers and global crypto exchanges. Morgan Stanley estimates that if crypto assets account for 12% of Futu’s total client assets, spot trading could contribute HK$3.4 billion in incremental revenue by 2027—an 18% uplift from prior revenue forecasts.

Additionally, the high velocity of crypto trading is a key growth driver. Measured by trading volume relative to average market cap, Bitcoin and Ethereum globally exhibit trading velocities of 410% and 780%, respectively—far exceeding the 130–160% seen in Hong Kong and U.S. equity markets.

If permitted under Hong Kong regulation, revenue from stablecoin issuance, derivatives trading, and margin financing could add another HK$1.6 billion. For instance, earnings from stablecoin reserve investments (assuming a 2.5% yield) could generate HK$240 million while also hedging against cyclical risks in equity markets.

Futu currently charges relatively low fees for crypto trading—8 basis points in Hong Kong and 49 bps in the U.S.—but the report expects these rates to gradually converge toward the industry average of 20–30 bps, further enhancing revenue potential.

Risk Factors: Competitive Pressures and Short-Term Uncertainties

Despite the positive outlook, Futu’s crypto strategy faces two main risks.

First is the inherent high volatility of cryptocurrency markets, which may lead to temporary declines in market capitalization and trading volumes, disrupting linear revenue growth.

For example, the 2022 collapses of FTX and UST caused sharp drops in global crypto market value and trading activity. Since launching its crypto services in August 2024, Futu’s trading volume has also fluctuated in line with broader market trends.

Second is intensifying competition. Pressure from fintech firms, payment companies, and experienced crypto players—including global exchanges—could affect customer retention and fee levels.

The presence of three potential stablecoin issuers from diverse backgrounds in Hong Kong’s Monetary Authority sandbox illustrates the diversity and intensity of competition.

Morgan Stanley has revised upward its earnings forecasts for Futu for 2025–2027, raising its 2027 net profit estimate by 11.5% to HK$11.233 billion. This revision reflects the revenue potential from crypto spot trading (approximately HK$1.6 billion already factored into the base case) and continued strength in Hong Kong’s equities market.

The report projects a 27% CAGR in Futu’s profits from 2025 to 2027, with client assets growing 4–6% annually. It raises the price target from $140 to $160 per share, based on a discounted cash flow model with a 60% weight on the base case and 30% on a bull case.

At the current share price of $130.53, Futu trades at approximately 15x forward P/E—below its growth rate, suggesting room for upside. In contrast, U.S. retail broker Robinhood trades at a 2026 forward P/E of 63x, underscoring the attractiveness of Futu’s valuation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News