The Overt Strategy of Tokenized U.S. Stocks: Attracting Global Liquidity through "Regulatory Advantages"

TechFlow Selected TechFlow Selected

The Overt Strategy of Tokenized U.S. Stocks: Attracting Global Liquidity through "Regulatory Advantages"

Tokenizing U.S. stocks isn't about "moving to the blockchain," but about "embedding into the core."

By: Daii

The buzz around dollar-pegged stablecoins hasn't even died down, and now tokenized U.S. equities are quietly gaining momentum.

While you're still amazed that you can buy Apple stock on-chain, the American financial system has already silently embedded itself into your wallet.

Tokenized U.S. stocks may appear to be just another tech trend—available 24/7, low barrier to entry, divisible, composable—but what you actually gain goes far beyond convenience. You've gained access to an entire "financial operating system" refined over years by SEC oversight and Wall Street practice: regulatory logic, compliance standards, and disclosure mechanisms—all encoded behind these on-chain tokens.

Stablecoins export U.S. dollar credibility; tokenized equities export the U.S. regulatory framework itself.

You no longer need a U.S. identity or a Nasdaq brokerage account—just a wallet address and some USDC—and you can buy AAPLx or TSLAx at 3 a.m. But while enjoying this "global liquidity dividend," it also means global capital is increasingly operating within rules set by the United States.

This isn't a conspiracy. It's an open strategy.

On the surface, tokenized U.S. equities represent technological innovation; in reality, they are institutional export. On the surface, they open markets; in truth, they use "regulatory compliance" as a banner and "trustworthy transparency" as bait to globally siphon attention, asset flows, and control over financial sovereignty.

This is an expansion without war—an act of global credit conquest under the name of compliance.

1. Tokenized Assets: Turning U.S. Stocks into Global "Programmable Assets"

What is equity tokenization? Simply put, it involves using special purpose vehicles (SPVs) or custodians to package the economic rights, dividend entitlements, and even partial governance rights of U.S. stocks into blockchain-based tokens issued on-chain.

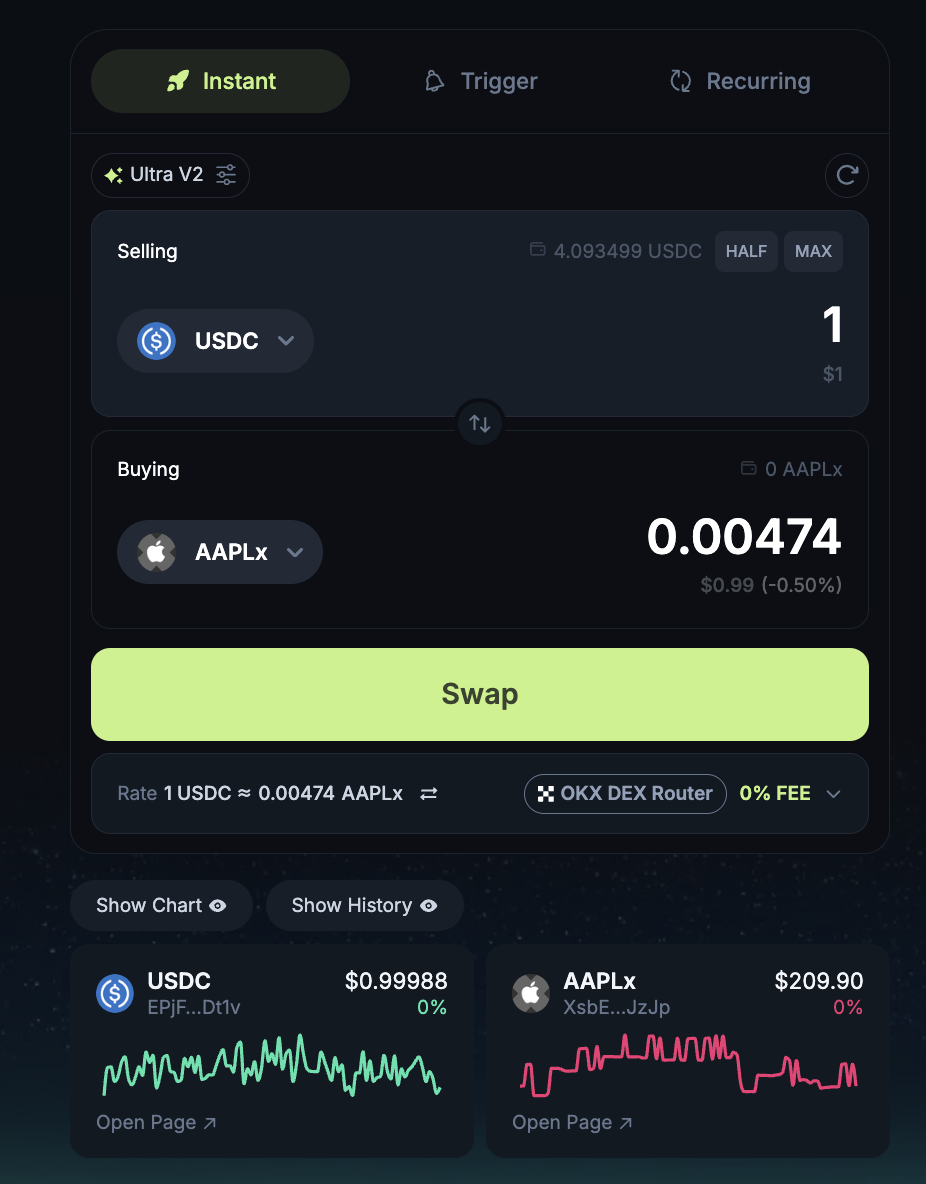

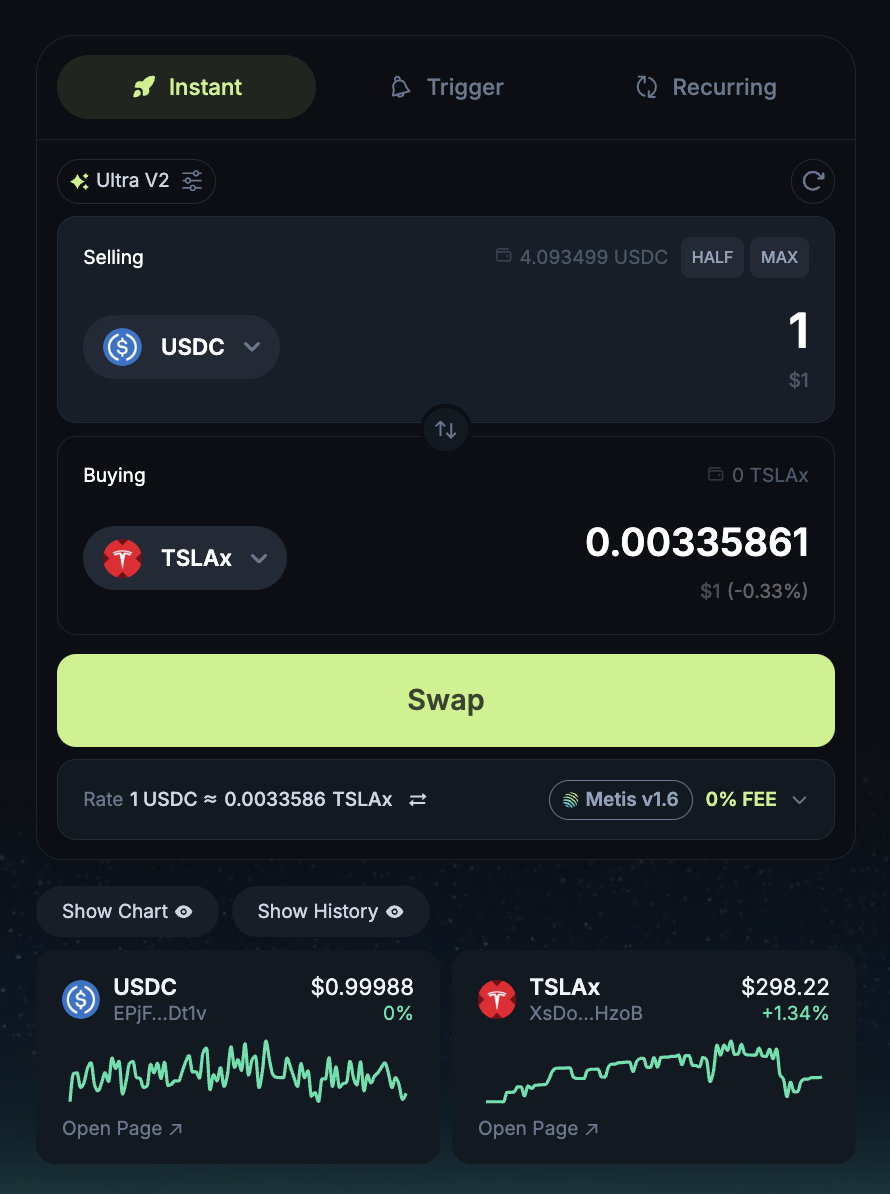

For example, you can now use 1 USDC on Jupiter to buy 0.0047 units of APPLx. APPLx is the tokenized representation of Apple Inc. stock on the Solana blockchain, backed by real-world Apple shares held for you via an SPV custodian.

The creation process of such a tokenized stock like APPLx is actually a hybrid mechanism combining cross-border compliance with technical mapping, integrating traditional finance, digital asset custody, and blockchain issuance. The full workflow is as follows:

-

Real-World Share Acquisition: Backed Finance AG—a Swiss-based digital asset service provider registered with FINMA—uses partner brokers like Interactive Brokers LLC or other U.S.-licensed broker-dealers to purchase actual Apple (AAPL) common shares on the Nasdaq market.

-

Custody and SPV Structuring: The purchased AAPL shares are not held directly by Backed but are fully deposited with a regulated third-party financial institution (typically SIX Digital Exchange Custody or equivalent), and owned by a dedicated Special Purpose Vehicle (SPV). This SPV is usually incorporated in Liechtenstein or Zug, Switzerland, operates independently, and exists solely to "hold shares and map rights," ensuring legal clarity and asset isolation.

-

Legal Disclosure: Backed Finance publishes detailed legal disclosure documents (e.g., ISIN mappings, token terms, prospectuses under Liechtenstein’s TVTG/Blockchain Act) for each token, confirming that token holders have economic rights to the underlying assets, though not direct voting rights. These disclosures are publicly archived on Backed’s website or compliance platforms (like DACS or the Swiss Prospectus Register) for regulatory review and investor access.

-

Token Minting on Solana: Based on the amount of custodied assets, Backed mints APPLx tokens 1:1 on the Solana blockchain, where each token represents one real Apple share. These tokens follow smart contract standards (such as SPL Token) and are initially distributed via Backed’s multi-signature on-chain wallet. Users receive APPLx in DeFi wallets like Phantom—no Nasdaq account or U.S. tax forms (e.g., W-8BEN) required.

-

On-Chain Circulation & Redemption: APPLx can be traded, split, staked, or used as liquidity (LP) on Solana-based platforms like Jupiter Aggregator, Meteora, or Marinade Finance. If users wish to redeem for actual shares (typically limited to qualified investors), they must submit KYC documentation and go through Backed’s redemption process, after which the SPV instructs its broker to transfer real shares.

This structure—“real stock → SPV custody → legal mapping → on-chain token”—emphasizes authenticity, compliance, and traceability. While token holders aren’t traditional “shareholders,” they obtain economic benefits through trust structures and contractual agreements, effectively anchoring traditional market value into the blockchain world.

What does this mean?

Even though you’re only buying a blockchain token, the underlying governance logic is firmly defined by the U.S. legal system.

In other words, on-chain tokens become a “coded” expression of traditional U.S. equity governance rules.

2. Why U.S. Equities?

You might ask: if tokenization is a global technological innovation, why aren’t European, Hong Kong, or Chinese A-shares leading the way?

No one prevents other countries’ stocks from being tokenized, and blockchain is supposed to be decentralized. The sole reason U.S. equities lead in tokenization is simple: they are highly desirable. People want to buy them.

And why are U.S. equities so attractive?

Just two words: “transparency.”

Transparency is the rarest resource in modern finance. The reason U.S. equities command “high premiums + strong consensus” globally isn’t sentiment—it’s a deeply transparent regulatory regime.

Of course, this transparency wasn’t born naturally—it’s enforced by a comprehensive legal framework.

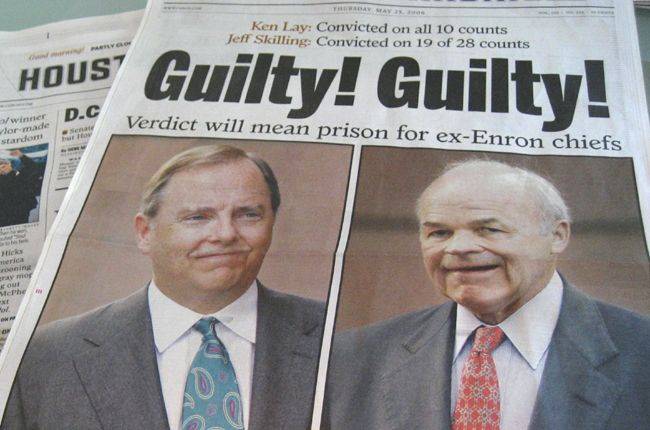

Take the U.S. Sarbanes-Oxley Act (SOX) of 2002, enacted after the Enron scandal. This “ironclad” law mandates:

-

The CEO and CFO of public companies must personally sign off on annual financial reports,

-

If financial fraud is uncovered, executives face criminal liability—even prison time.

Such rules dramatically raise corporate governance accountability. Compared to certain Asian markets characterized by “high valuations + fake financials + zero consequences,” the credibility of U.S. financial reporting becomes its strongest selling point.

Similarly, the U.S. Securities and Exchange Commission (SEC) requires all listed companies to file a Form 10-Q quarterly and a Form 10-K annually, disclosing core data including revenue, costs, shareholder structure, and risk factors.

Let’s briefly explain 10-Q and 10-K reports. These names sound like code numbers because they literally are—they come from the numbering system established in U.S. securities regulations.

📘 What is a 10-K?

The “10” in “10-K” refers to its category in the SEC’s form numbering system (Form 10 series), while “K” designates the annual report. First introduced in the rules under the Securities Exchange Act of 1934, the SEC requires public companies to file a “Form 10-K” annually, disclosing their full business operations, financial condition, and compliance status for the prior fiscal year.

Thus, “10-K” essentially means “Form 10 – Category K,” and has become the formal designation for U.S. annual reports.

📗 What is a 10-Q?

Similarly, “10-Q” is the form number used for quarterly reports (“Q” stands for “Quarterly”). Public U.S. companies file three 10-Qs per year, covering Q1, Q2, and Q3 (Q4 is included in the annual 10-K).

Though slightly less detailed than the 10-K, the 10-Q still follows strict SEC-prescribed formats and disclosure requirements, enabling investors to make timely assessments of short-term performance changes.

Thus, the naming convention of 10-K and 10-Q reflects the rigor and standardization of U.S. securities regulation. Every filing is publicly accessible via the SEC’s EDGAR database (https://www.sec.gov/edgar.shtml), forming one of the foundational pillars of the “world’s highest transparency” in U.S. markets.

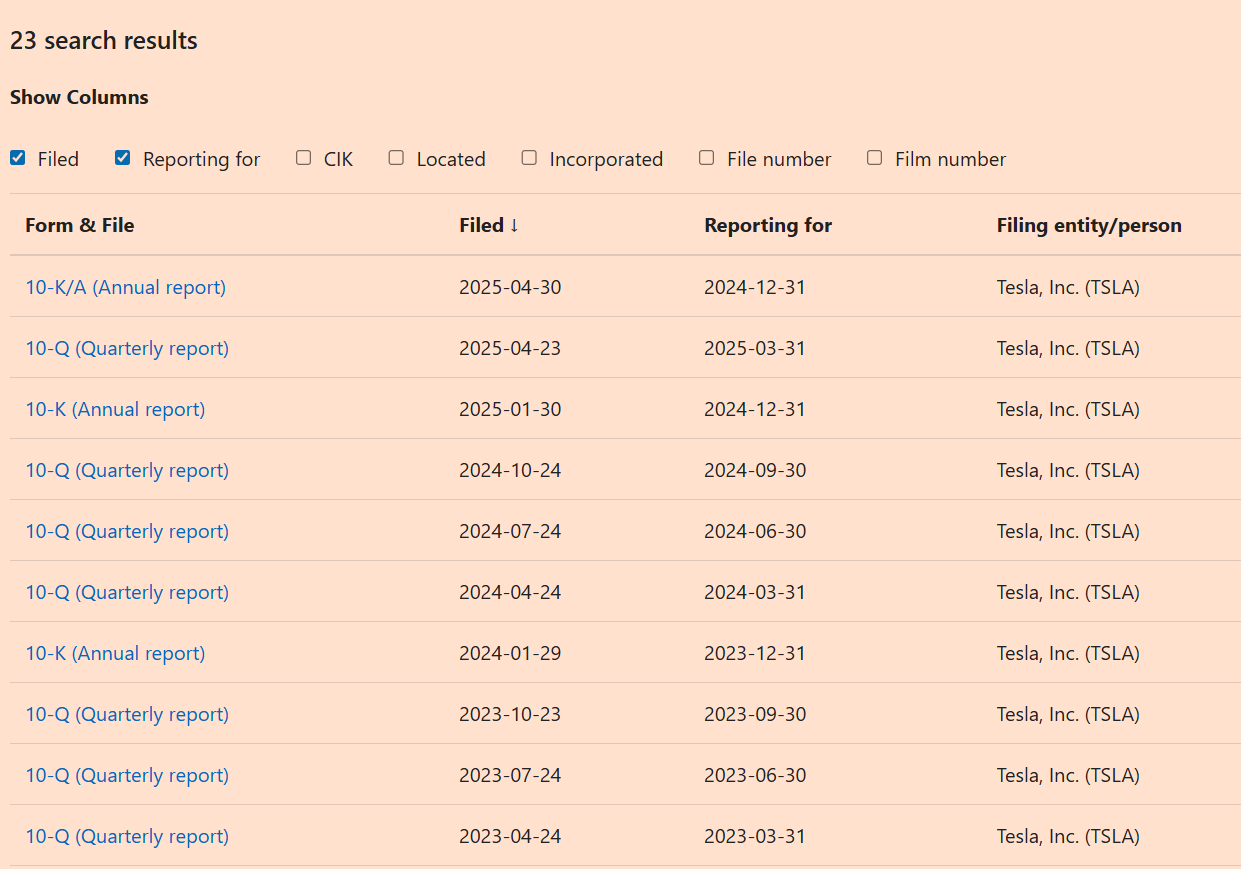

For instance, you can view Tesla’s latest 10-K and 10-Q filings through this link:

This level of public disclosure builds the kind of foundational trust that the crypto world desperately seeks.

Now, through tokenization, this “institutional transparency” of U.S. equities is being packaged as a “code template” and imported into the blockchain world—allowing global users, regardless of nationality, to benefit from U.S.-style regulatory safeguards.

3. The Value Engine of Tokenized U.S. Equities = Regulatory Arbitrage + Liquidity Dividend

If the global circulation of dollar stablecoins is akin to the Federal Reserve exporting “anchored trust,” then the rise of tokenized U.S. equities resembles a self-fulfilling prophecy driven by market demand and reinforced by regulatory credibility.

The regulatory dividend lies in providing asset “trustworthiness”; the crypto-driven liquidity dividend enhances global “accessibility.” Together, they create a powerful synergy—compliance enables trust, technology fuels reach—and together, they are reshaping the fundamental logic of global asset allocation.

3.1 Liquidity Dividend: Breaking Time and Space, 24/7 Market Access

In traditional markets, trading hours are a natural constraint. U.S. markets trade Monday to Friday, 9:30–16:00 Eastern Time—often late night in Asia. Most retail investors in Asia face hurdles due to time zones, account requirements, and cross-border regulations when trying to invest in popular names like Tesla, Nvidia, or Microsoft.

Tokenization changes everything.

On Solana’s decentralized exchange Jupiter, users can now trade TSLAx, AAPLx, and other tokenized U.S. stocks anytime using USDC—without time, geographic, or identity restrictions. These tokens operate via AMM (automated market maker) models, running 24/7, requiring no opening bell, counterparty matching, or account verification.

On-chain, “U.S. markets never close” is no longer a slogan—it’s reality.

2. Fragmented Ownership: Lowering Barriers, Expanding Participation

Traditional stocks trade in whole-share units, creating high barriers for expensive stocks. At end-2024, Amazon (AMZN) cost over $150 per share, and Berkshire Hathaway Class A exceeded $500,000. For most small investors, these are out of reach.

Tokenization makes these assets programmable and divisible.

Tokens like TSLAx and AAPLx can be traded in increments as small as 0.0001 units. With just $1 in USDC, a user can own “0.001 shares of Tesla.” Combined with the global reach of stablecoins, this hyper-fragmentation opens investment access to billions who previously couldn’t participate in U.S. markets.

This isn’t just convenience—it’s democratization of access. Asset ownership no longer depends on intermediaries or account qualifications, only on whether you have a blockchain wallet.

3.3 DeFi Integration: From “Investment” to “Callable Asset”

The significance of tokenized equities goes beyond “buying stocks on-chain”—it unlocks real-world assets within DeFi’s imagination.

On-chain, these stock tokens aren’t just passive holdings—they become “callable asset components” that can circulate, combine, and nest within various smart contracts, gradually integrating into DeFi’s financial Lego ecosystem.

Currently, tokens like AAPLx and TSLAx already have preliminary liquidity on Solana, tradable 24/7 on DEXs like Raydium. You can even provide liquidity for TSLAx and earn fees.

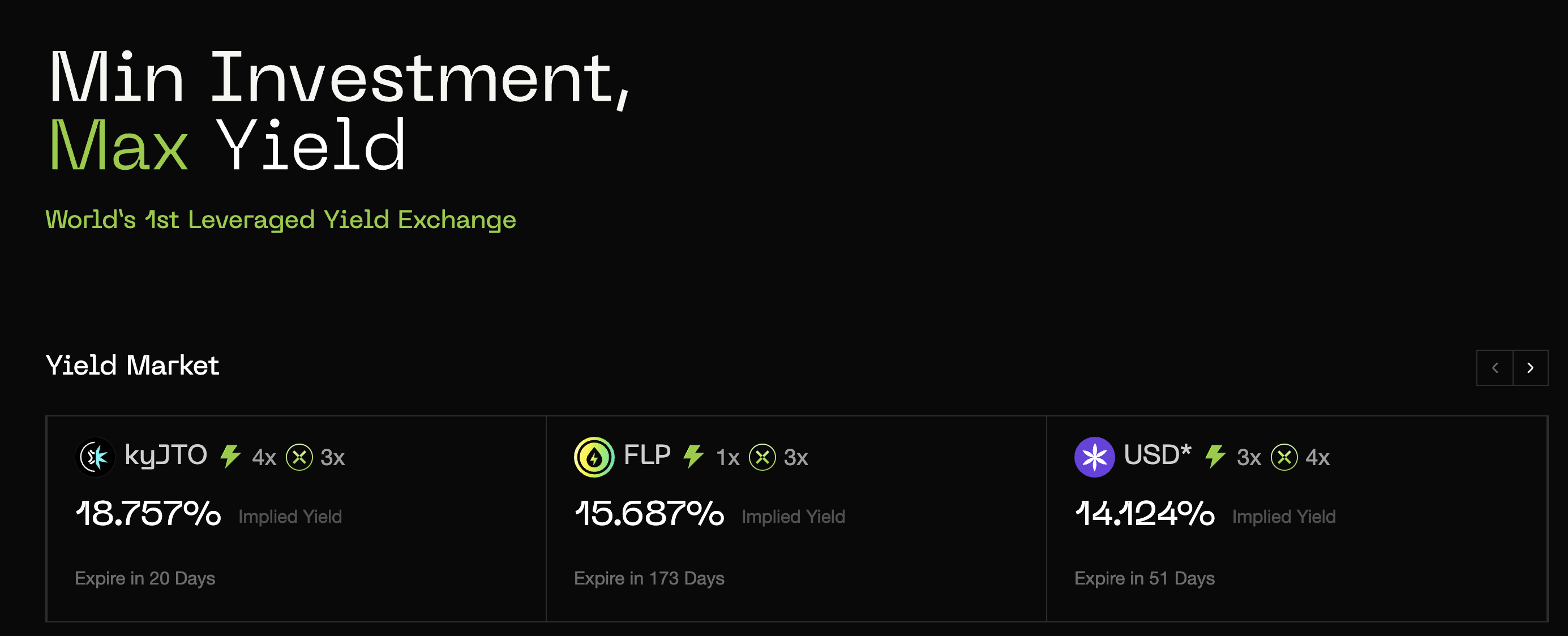

Although these tokens aren’t yet integrated into lending protocols like Kamino or yield protocols, industry expectations are clear: once liquidity, custody, and legal frameworks stabilize, they could be used as collateral, staked, or even split into PT (Principal Token) + YT (Yield Token) structures—creating secondary markets for real-world cash flows.

For example, in the future on Rate-X, users might tokenize Tesla’s dividend income and sell it as a YT, unlocking immediate liquidity—all executed automatically via smart contracts, without shareholder approvals or paper contracts.

This is the greatest appeal of combining tokenization with DeFi: it’s not merely putting stocks on-chain, but transforming them into modular, composable, and programmable financial building blocks—enabling structural innovations impossible in traditional finance.

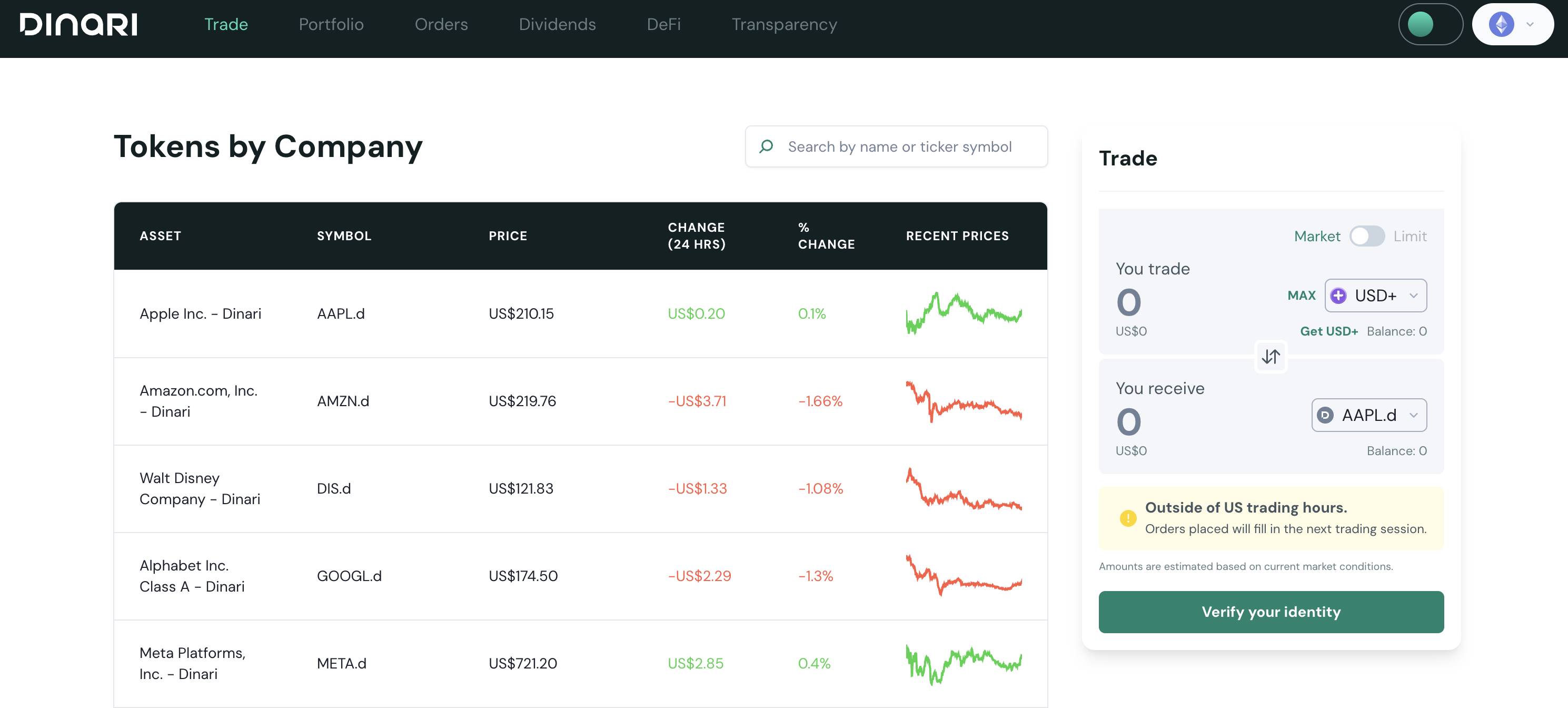

All of this is still early, but the direction is clear. As platforms like Dinari and Backed Finance advance compliance and custody transparency, we are witnessing a real-world experiment in how traditional assets integrate into open financial systems.

3.4 Grassroots Access to Private Markets: Circumventing IPO Gatekeepers

Retail investors are getting unprecedented access to private equity. Robinhood EU recently launched tokenized shares in the EU, offering not just Apple and Google, but also OpenAI and SpaceX—allowing users to gain economic exposure to these pre-IPO unicorns with just tens of dollars in USDC.

Though legally controversial (OpenAI has publicly stated it did not authorize this), the trend is unmistakable: private equity is no longer exclusive to VCs and family offices—it’s becoming an “on-chain accessible asset class.”

This implies that the “pre-IPO market” on-chain could emerge earlier, more transparently, and with better price discovery than the official IPO.

3.5 Summary

The true value of tokenized U.S. equities isn’t about “putting stocks on-chain,” but rather:

-

The U.S. securities regulatory system provides a credible “trust template”;

-

Blockchain offers a “global interface” that allows infinite replication, fragmentation, and composability.

Regulatory dividends ensure people believe these are real, redeemable assets; liquidity dividends transform them into sleepless, composable, income-generating “new financial Legos.”

This is why the world is embracing tokenized U.S. equities. This isn’t a tech revolution—it’s an institutional evolution in how “value trust” scales.

All the above highlights the promise of equity tokenization. But don’t forget—this new path, however shiny, is not without traps.

4. Don’t Overlook Centralization Risks

You might think tokenized U.S. equities are something entirely new. But in fact, this game was quietly played out three years ago during the chaos of the crypto boom.

In April 2021, FTX launched FTX-CM Equity, a tokenized U.S. equity product. It promised 24/7 on-chain trading and even claimed users could “redeem for real shares at any time.”

But when FTX collapsed in November 2022, it turned out these seemingly legitimate, redeemable tokens had no proper custody documentation at all. Investors’ “on-chain U.S. stocks” became unconvertible digital shells overnight. In one night, countless users lost their on-chain assets.

Ironically, FTX’s marketing copy proudly proclaimed “compliant custody” and “transparent settlement.” It was like happily buying a luxury villa, only to discover your name isn’t on the deed.

The FTX case isn’t isolated. Today’s rising star xStocks faces a similar crisis of confidence.

At the end of 2024, amid surging demand for tokenized equities, exchanges like Kraken and Bybit adopted xStocks’ infrastructure to launch tokenized versions of Apple (AAPL) and Tesla (TSLA) shares.

But xStocks’ past raises red flags. In June 2024, media exposed that early team members were linked to the notorious DAOstack project, which faced community backlash over opaque token distribution and a founder “soft rug pull.”

I’m not saying xStocks will inevitably repeat FTX’s fate—but the key question remains: why should you trust it?

Centralized entities inherently carry trust vulnerabilities.

History shows that centralized institutions without regulatory constraints struggle to resist the temptation to misbehave. Exchanges like Nasdaq and NYSE are trusted not because they’re noble, but because the SEC enforces nearly draconian oversight, quarterly audits, and regular public reserve verifications—leaving these platforms “no chance to cheat.”

However, the nature of equity tokenization means it can never be fully decentralized—on-chain tokens must represent real-world stocks or rights. Thus, critical functions like custody, clearing, and redemption will always depend on centralized institutions.

Since centralization can’t be avoided, the solution is to build a trust system that is transparent, strictly regulated, and auditable—ensuring custodians can’t arbitrarily cheat or disappear. This is exactly the path Dinari is attempting.

In June this year, San Francisco-based Dinari became the first U.S. equity tokenization platform in history to obtain a Broker-Dealer license. Holding this license means Dinari must comply strictly with SEC rules (including Rule 15c3-3 for asset custody and segregation) and undergo annual third-party financial audits and reserve verifications.

Dinari CEO Gabriel Otte stated clearly that the company’s upcoming tokenized equity services will operate through a model of “regulated intermediaries + blockchain real-time settlement,” with full transparency in custody and audit reporting. Additionally, Dinari will integrate via API with traditional financial platforms like Coinbase, Robinhood, and Cash App, rapidly spreading its SEC-compliant model through white-label partnerships.

Almost simultaneously, crypto giant Coinbase has actively pushed for similar services and formally submitted a compliance application to the SEC for its stock tokenization offering. Coinbase’s Chief Legal Officer Paul Grewal publicly stated, “The future of tokenization must be driven by regulation, not technology. Only then will on-chain U.S. stocks truly earn investor trust.”

The actions of Dinari and Coinbase send a clear message: the real competition in equity tokenization isn’t about who has better blockchain tech, but who has more transparent and stricter regulatory compliance.

After all, centralization risk cannot ultimately be solved by blockchain—it takes a regulatory regime strong enough to inspire awe to be the final answer.

Conclusion: Tokenized U.S. Equities Are Not “Moved On-Chain,” But “Planted in Mind”

In this era where capital and code converge, regulation and protocol are quietly merging. Tokenized U.S. equities are not merely an evolution of asset form, but a march of trust architecture.

This campaign needs no fleet, no force—only code as vessel, institutions as sails—engraving “verifiable transparency,” “executable rules,” and “inheritable trust” into the blockchain world.

What we’re seeing isn’t a simple “move to chain,” but a silent institutional expansion—the logic of American finance planting digital estates across the borderless land of DeFi, under the banners of governance and compliance.

Here, SEC form numbers become consensus instructions in smart contracts; KYC procedures embed into wallet signature permissions. Trust once reserved for Wall Street now takes root in every decentralized wallet.

This is the true face of tokenized U.S. equities:

It’s not turning stocks into code, but transforming institutions into consensus, minting trust into liquidity, and compressing financial governance into portable modules of civilization.

When control over assets shifts from brokers to code arbitration, and when the boundary of trust is no longer national borders but the depth of compliance standards—

We can finally say:

Tokenized U.S. equities are not the end, but the prologue to a restructuring of global finance—a silent expansion of “code-based civilization.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News