Tech giants are flocking to stablecoins—what exactly are they betting on?

TechFlow Selected TechFlow Selected

Tech giants are flocking to stablecoins—what exactly are they betting on?

Tech giants such as Amazon, Apple, Meta, PayPal, and Uber are all exploring this emerging field.

By Ben Weiss, Leo Schwartz

Translation: Luffy, Foresight News

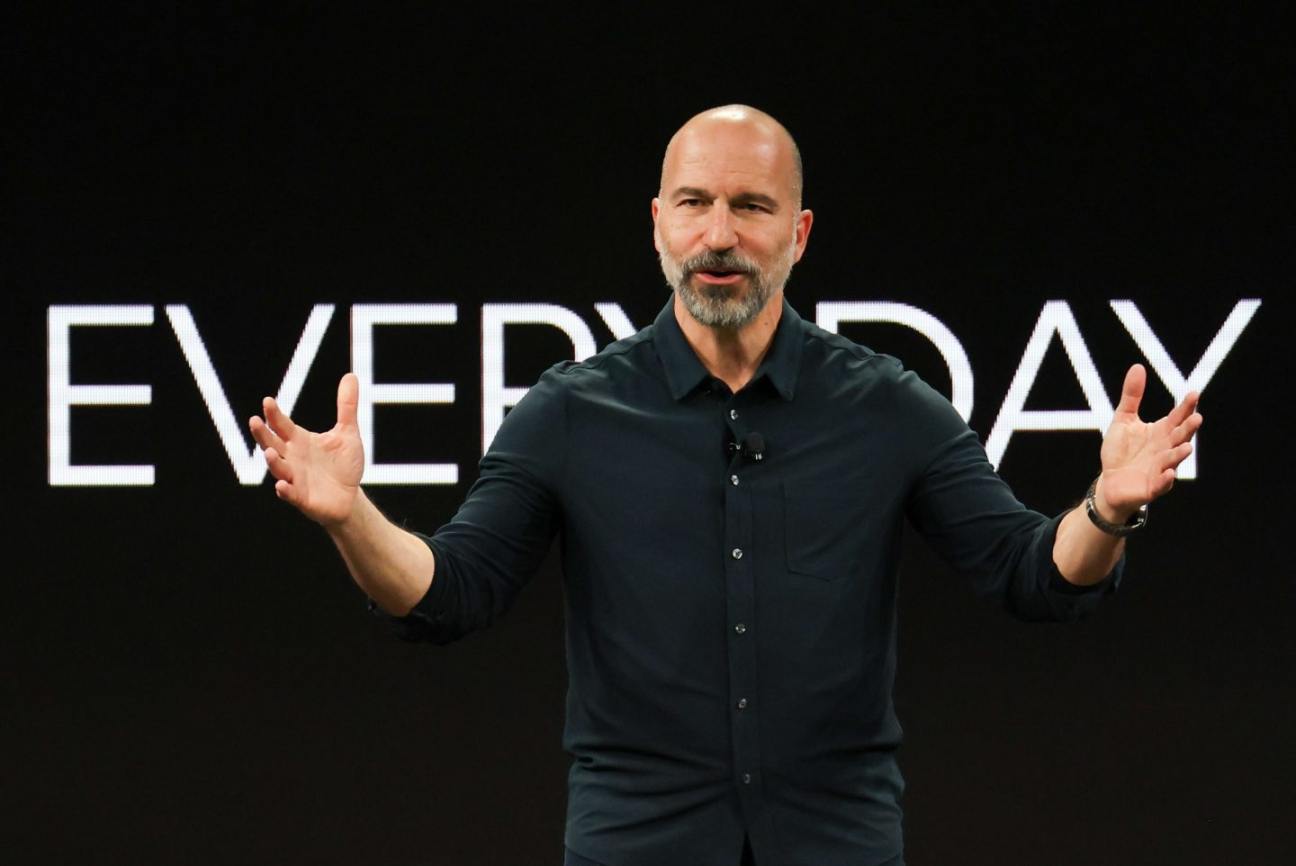

Dara Khosrowshahi, CEO of Uber

In June this year, Uber CEO Dara Khosrowshahi announced that the ride-hailing giant is considering stablecoins as a way to transfer money globally. A year ago, such a statement from a tech executive might have sounded absurd. But now, from Apple to Amazon—and not to mention major banks and brokerages—companies are rushing to embrace stablecoins, cryptocurrencies pegged to assets like the U.S. dollar. What has changed?

The most obvious shift is in the regulatory environment in Washington, D.C. The Senate has passed a bill currently under review by the House of Representatives that would clear the path for stablecoins to integrate into the financial system.

Crypto advocates also say the business case for stablecoins is growing stronger. Unlike more volatile cryptocurrencies such as Bitcoin and Ethereum, stablecoins offer the potential for more efficient payments, enabling digital dollars to be sent nearly instantly and at lower cost. This could fundamentally change how companies manage global finances, pay employees and contractors worldwide, and handle cross-border transactions.

However, because the technology is still in its early stages and the regulatory outlook remains uncertain, analysts interviewed by Fortune expressed skepticism about whether Silicon Valley tech giants will widely adopt stablecoins in the near term.

Cost of Doing Business

For a company like Amazon, moving money across borders is expensive. According to its 2024 annual report, international operations accounted for 22% of consolidated revenue last year—nearly $143 billion. These sales are denominated in local currencies, meaning the company must contend with foreign exchange risk and currency fluctuations, which could cost it billions of dollars.

Nick van Eck, CEO and co-founder of stablecoin startup Agora, points out that global treasury management is one area where stablecoins shine—allowing businesses to convert local currency into stablecoins and send them back to the U.S.

Agora enables companies to issue their own dollar-backed stablecoins. While Agora’s current clients are mostly crypto firms, van Eck told Fortune his ideal customer is a multinational like PepsiCo, which operates dozens of bank accounts and corporate entities globally and works with thousands of suppliers. “Stablecoins can dramatically improve their capital efficiency,” he said. “Now you can move $100 million from one country to another in a second, without waiting days.”

Agora isn’t the only startup hoping to profit from the Silicon Valley stablecoin boom. Over the past year, numerous stablecoin startups—including Mesh, Bastion, and BVNK—have raised tens of millions of dollars from venture capital firms. In October last year, payments company Stripe completed a landmark $1.1 billion acquisition of stablecoin startup Bridge.

Stripe serves half of the Fortune 100 and offers a range of payment products, including tools that help businesses automate customer billing, provide pre-built checkout systems, and facilitate global remittances. In their recent annual letter to investors, co-founders Patrick Collison and John Collison praised stablecoins, saying these assets will help large enterprises expand faster around the world and unlock additional benefits.

“Why Would I Pay With a Stablecoin?”

Colin Sebastian, an analyst covering Amazon at Baird, told Fortune that companies are constantly seeking financial tools or payment methods that help manage expenses or reduce friction. “Traditional credit card payments are quite expensive,” he said, “and cross-border transactions are even more so.”

Yet while Amazon and other multinationals may have economic incentives to experiment with stablecoins, convincing consumers to adopt the technology for everyday payments will be much trickier. “What actually drives consumer behavior change?” Sebastian asked. “Credit and debit cards are already extremely popular.”

Thomas Forte, an analyst at Maxim Group who follows consumer internet companies like Amazon and Apple, agrees with Sebastian. He believes Amazon’s most plausible use case for stablecoins is accepting customer payments via stablecoins to reduce transaction fees. “My question is: As a U.S. consumer, why would I pay with a stablecoin?” Forte asked.

Van Eck, co-founder of Agora, believes that until stablecoins gain broader adoption in the U.S., countries with higher currency volatility are most likely to embrace the technology, as consumers there have greater incentive to try more stable payment options. He recalled recently receiving funding from angel investors outside the U.S., where one transfer took 10 business days to settle and another took 22. “This is very common—not just for individuals, but for businesses operating across borders,” he told Fortune.

For example, in Argentina, where inflation has persisted for over 15 years, the local currency has plummeted against the U.S. dollar. So it’s no surprise that between June 2023 and July 2024, stablecoin transactions made up nearly 62% of the country’s crypto trading volume—well above the global average of about 45%, according to a 2024 Chainalysis report.

Nic Carter, founding partner at Castle Island Ventures, a crypto venture firm focused on stablecoin investments, said: “I’m more interested in businesses that solve real problems for enterprises—like helping a Nigerian business pay someone in the Philippines.”

Still, major U.S. tech companies remain enthusiastic about the technology and have begun taking steps into this emerging space. PayPal has already launched its own stablecoin. Online brokerage Robinhood and payments giant Mastercard have joined a consortium whose members can mint or issue the stablecoin USDG. Companies including Amazon, Apple, and Meta have also started exploring the use of stablecoins for payments.

Meta previously declined to comment on its stablecoin plans. Spokespeople for Apple and Amazon did not respond to requests for comment.

Baird analyst Sebastian said that with Congress nearing completion of stablecoin regulation, there’s little downside for big tech companies to experiment with this new technology. “A common trait among many large tech companies is that they’re very willing to try new things,” he said.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News