For ETH to break through the $10,000 mark, Ethereum needs a new growth narrative

TechFlow Selected TechFlow Selected

For ETH to break through the $10,000 mark, Ethereum needs a new growth narrative

The feedback loop between Ethereum's utility and ETH value capture will be restored.

Author: David Hoffman

Translation: TechFlow

Ethereum is winning, but ETH investors aren't

You may have noticed that my stance on ETH has recently become more tempered. The decline in ETH's relative valuation has eroded investor confidence—an essential ingredient as ETH aspires to become internet money.

For years, the reasons behind ETH’s underperformance have been a subject of debate. Many of the issues plaguing ETH’s relative valuation were beyond its control—contributors include Gary Gensler, Michael Saylor, and others. (Gensler has now stepped down, and an ETH asset management firm has finally launched; some external problems resolve themselves.)

Today, I want to focus on challenges firmly within the Ethereum community’s control, because many of the reasons Ethereum has lagged behind the market for over three years are decisions made by the community itself. We should concentrate our efforts here to re-energize potential ETH buyers.

The ETH value capture problem

Many of Ethereum’s current challenges can be distilled into one core theme: a broken value-capture supply chain between Ethereum’s utility and the value of ETH.

"I'm surprised... the usage of stablecoins on Ethereum, Solana, Tron... doesn't seem to create much value for the Layer 1 token holders these stablecoins rely on."

— Joe Weisenthal on The Chopping Block

In this episode, the CB crew continued discussing this Ethereum-specific issue, noting that while SOL and TRX hit new all-time highs, Ethereum’s economic model—especially its Layer 2 model—appears particularly flawed by comparison.

Regarding stablecoins, concerns about the relationship between stablecoin supply and value capture for their underlying Layer 1 tokens emerged during the 2018–2019 bear market. In 2020, Nic Carter wrote about this on Bankless—Crypto-Fiat: Mutualism or Parasitism?

In short, stablecoin buyers and holders on Ethereum’s Layer 1 generate no value for ETH beyond spending roughly $0.50 in gas fees to acquire them. If they do so on Layer 2, even with billions of dollars worth of stablecoins purchased, ETH’s value capture drops below $0.01.

Ethereum's narrative momentum

Nonetheless, Ethereum’s adoption metrics are undeniably bullish.

The recent launch of Robinhood Chain deploying tokenized stocks on Ethereum validates Ethereum’s Layer 2 roadmap and its status as a credible neutral settlement layer for Wall Street assets. With Robinhood Chain, the OG promise—that blockchain technology would upgrade Wall Street’s outdated financial system through tokenization and trading—is finally happening.

This announcement is just one of many bullish signals for the network:

-

The Ethereum ecosystem maintains 50% dominance in stablecoin supply; excluding the opaque Tron ecosystem, this rises to 75%.

-

CRCL’s high-profile IPO specifically validates Ethereum, as Ethereum holds 66% of all USDC.

-

Coinbase, the most trusted and respected brand in crypto, is building an Ethereum Layer 2.

-

Ethereum boasts 100% uptime, prioritizes true decentralization, and meets Wall Street’s needs without counterparty risk, enhancing its brand image against competitors.

-

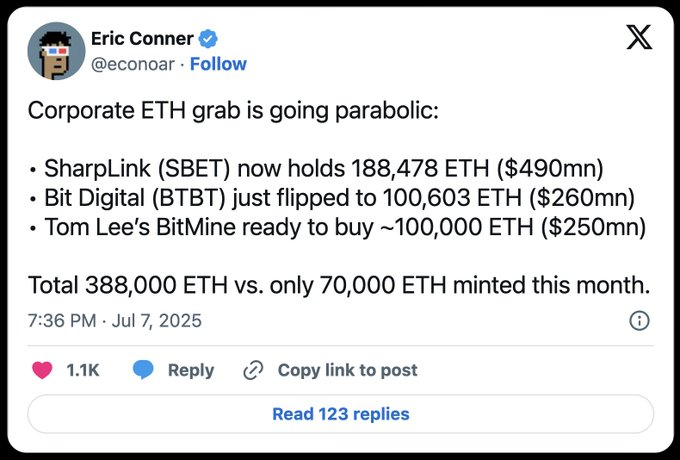

The economic influence of ETH-focused asset management firms continues to grow:

If you're looking to advocate bullish arguments for ETH and Ethereum, it's becoming increasingly easy to do so.

All the work Ethereum developers have done to preserve decentralization and credible neutrality is paying off, reflected in incredible adoption metrics at the world’s center of capital gravity—Wall Street.

Expanding ETH's narrative

Many see the above adoption and success stories as an opportunity.

Tom Lee’s Bitmine asset management strategy leverages Ethereum’s narrative strength. The strategy is simple: put ETH on the balance sheet, then sell ETH to Wall Street. Ethereum already has plenty of compelling narratives; ETH simply needs someone energetic enough to excite Wall Street.

We’re about to see just how deeply undervalued ETH has been over the past four years. Is ETH’s poor price performance due to market irrationality? Or does its decline reflect deeper, structural issues?

Tribalism and social scalability

Digging deeper into the above reveals two sides of ETH.

On one hand, a network adopting a Layer 2 model breaks a link in ETH’s value-capture supply chain. On the other hand, you see an incredible success story that seems just one small push away from sending ETH to $10,000.

Here’s how I view this duality:

If you add narrative firepower on top of an unresolved value-capture supply chain, you get tribalism—loved by insiders, rejected by outsiders:

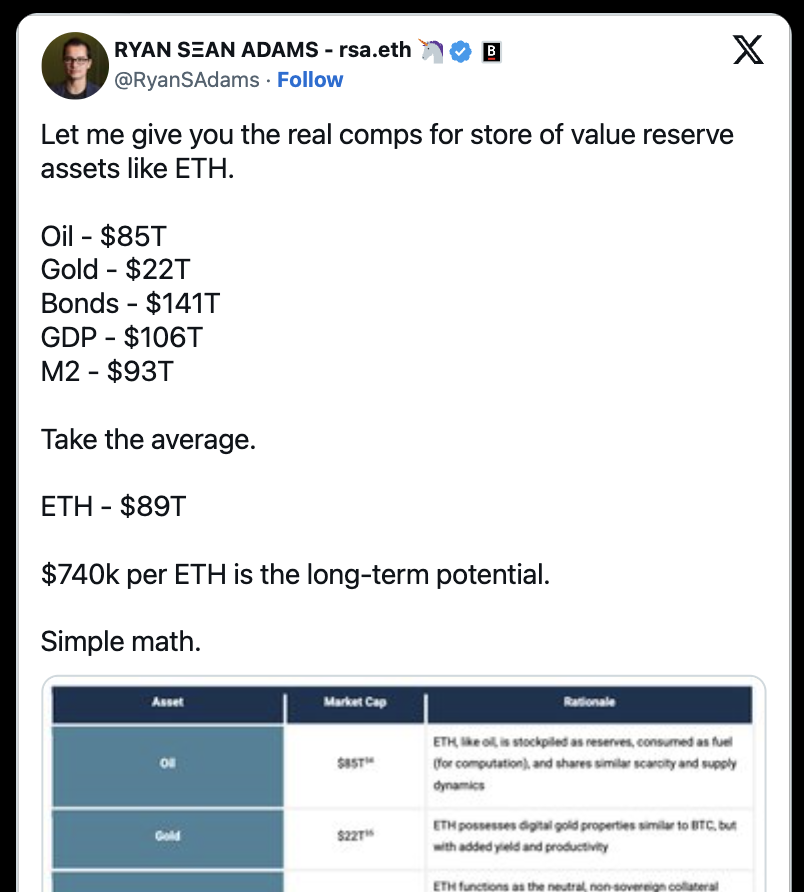

Now, most inside Ethereum get excited seeing Ryan’s $740,000 per ETH price target, while those outside might look at the same thing and call it delusional (just read QT).

But let’s imagine an alternate scenario where ETH’s superior value-capture supply chain becomes central to its narrative, as it was in 2021. In this world, all Ethereum Layer 2s are Based + Native Rollups, and Ethereum’s block time decreases to around 2 seconds (a long-term goal for Ethereum).

In this world:

-

Rollups achieve synchronous composability, eliminating the need for bridges. Faster Layer 1 block times allow market makers to offer tighter spreads, increasing on-chain trading volume. Price execution improves significantly.

-

Ethereum’s powerful MEV infrastructure could finally be used to deliver optimal execution for traders (e.g., on Memecoins), rather than the ~20% slippage they often face elsewhere.

-

Liquidity flows back to Layer 1, and Native+Based Rollups seamlessly access Layer 1 liquidity, further boosting volume.

-

Based+Native Rollups consume 10 to 100x more gas than current L2s while providing shared liquidity and composability, meaning all activity on rollups actually burns significant amounts of ETH.

-

Tokenized assets on rollups become accessible across the Ethereum ecosystem. Ethereum’s position as the leading platform for issuing and trading tokenized assets strengthens further.

What I’ve described above is a future where the feedback loop between Ethereum’s utility and ETH’s value capture is restored.

Breaking the tribal narrative

In 2024, Bitcoin transformed from an asset primarily promoted by its tribal community into one recognized by the world’s most powerful governments as a “special snowflake.” Only Bitcoin has strategic reserves. No other asset has that.

Bitcoin’s fundamentals—the 21 million cap—compel non-tribal investors to hold at least some Bitcoin.

Ethereum needs to do the same.

While Tom Lee and other ETH asset managers are spreading the gospel of ETH to Wall Street, it would be far more effective if they stood on a coherent value-capture story and leveraged it.

The Ethereum community must quickly repair the feedback loop between Ethereum’s utility and ETH’s value. We understand the necessary inputs. We know the stakeholders—many are already working toward this vision, while others may need convincing from the rest of the community. We believe we can achieve this.

What’s at stake? A more compelling growth story for Ethereum—one we can sell to the world. A story capable of finally delivering on the tribe’s ultimate hope for ETH: breaking the $10,000 price barrier.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News