Cold Reflections Amid the Stablecoin Wave: Why Is the BIS Sounding the Alarm?

TechFlow Selected TechFlow Selected

Cold Reflections Amid the Stablecoin Wave: Why Is the BIS Sounding the Alarm?

BIS explicitly pointed out that stablecoins are not genuine currencies, and behind their seemingly thriving ecosystem lurks systemic risks that could shake the entire financial system.

Author: AiYing Research

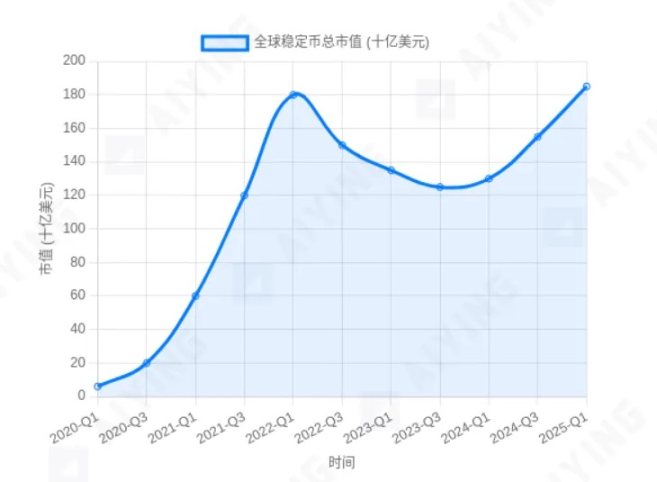

In the wave of digital assets, stablecoins have undoubtedly emerged as one of the most remarkable innovations in recent years. Promising parity with fiat currencies like the U.S. dollar, they have created a "safe haven" of value within the volatile world of crypto, increasingly serving as critical infrastructure for decentralized finance (DeFi) and global payments. Their market capitalization has skyrocketed from zero to hundreds of billions of dollars, seemingly heralding the rise of a new form of money.

Figure 1: Global Stablecoin Market Cap Growth Trend (illustrative). Its explosive growth contrasts sharply with regulators' cautious stance.

Yet, just as markets celebrate, the Bank for International Settlements (BIS)—often dubbed “the central bank’s central bank”—issued a stern warning in its May 2025 Economic Report. The BIS clearly stated that stablecoins are not real money; beneath their seemingly thriving ecosystem lie systemic risks capable of shaking the entire financial system. This assessment acts like a bucket of cold water, forcing us to re-examine the true nature of stablecoins.

The Aiying Research team aims to provide an in-depth analysis of this BIS report, focusing on its proposed “Three Gates” theory—any credible monetary system must pass three tests: Singleness, Elasticity, and Integrity. We will analyze specific cases to illustrate stablecoins’ struggles at these three gates, supplement the BIS framework with real-world considerations, and ultimately explore where digital money is headed.

First Gate: The Challenge of Singleness—Can Stablecoins Stay ‘Stable’ Forever?

"Singleness" is the cornerstone of modern financial systems. It means that one unit of currency should always be exactly equal in value to another, anywhere and anytime. Simply put, “one dollar is always one dollar.” This uniform stability is fundamental for money to function effectively as a unit of account, medium of exchange, and store of value.

The core argument from the BIS is that stablecoins' pegging mechanisms are inherently flawed and cannot guarantee a true 1:1 redemption against fiat currencies like the U.S. dollar. Their trust does not stem from sovereign credit but relies instead on private issuers’ commercial credibility, the quality and transparency of reserve assets—making them perpetually vulnerable to "de-pegging."

The BIS cites the historical "Free Banking Era" (approximately 1837–1863 in the United States) as a cautionary tale. At that time, the U.S. lacked a central bank, and chartered private banks across states could issue their own banknotes. Although theoretically redeemable in gold or silver, in practice, the value of these notes varied significantly based on the issuing bank's reputation and solvency. A $1 bill from a remote rural bank might be worth only 90 cents—or less—in New York City. This chaotic situation drastically increased transaction costs and hindered economic development. According to the BIS, today’s stablecoins are a digital reincarnation of this disorder—each stablecoin issuer functions like an independent “private bank,” and whether its “digital dollars” can actually be redeemed remains an open question.

We needn’t look back too far for evidence. The recent collapse of algorithmic stablecoin UST (TerraUSD), which lost all value within days and wiped out hundreds of billions in market cap, vividly demonstrated how fragile such “stability” becomes once trust collapses. Even asset-backed stablecoins face ongoing scrutiny regarding the composition, auditing, and liquidity of their reserves. Thus, even at the first gate—Singleness—stablecoins already falter.

Second Gate: The Cost of Elasticity—The 'Beautiful Trap' of 100% Reserves

If “singleness” concerns the *quality* of money, then “elasticity” concerns its *quantity*. Monetary elasticity refers to the financial system’s ability to dynamically create and contract credit in response to real economic needs. This capacity is the key engine enabling modern market economies to self-regulate and grow sustainably. During booms, credit expands to fuel investment; during downturns, it contracts to manage risk.

The BIS points out that stablecoins—especially those claiming to hold 100% high-quality liquid assets (like cash and short-term Treasuries) as reserves—operate under a “narrow banking” model. In this model, user funds are fully locked into safe reserve assets and are not used for lending. While this sounds secure, it comes at the complete cost of monetary elasticity.

Consider the following comparison:

-

Traditional banking system (elastic):

Suppose you deposit 1,000 yuan into a commercial bank. Under fractional reserve banking, the bank may keep only 100 yuan as reserves and lend out the remaining 900 yuan to an entrepreneur. That entrepreneur pays suppliers with the 900 yuan, who then redeposit it into the banking system. This cycle continues, allowing the initial 1,000 yuan deposit to generate additional credit through the banking multiplier effect, supporting real economic activity.

-

Stablecoin system (inelastic):

Suppose you use 1,000 USD to purchase 1,000 units of a stablecoin. The issuer commits to holding that full amount in cash or U.S. Treasuries as reserves. This money is now “locked up” and cannot be lent out. If an entrepreneur needs financing, the stablecoin system itself cannot meet that demand. It can only passively wait for more real-world dollars to flow in, unable to endogenously create credit based on economic needs. The entire system resembles a “stagnant pond,” lacking the ability to self-adjust or support economic growth.

This lack of elasticity not only limits stablecoins’ own potential but also poses a latent threat to the existing financial system. If large amounts of capital flow out of traditional banks and into stablecoins, it directly reduces banks’ available lending funds, shrinking credit creation capacity (similar to balance sheet contraction). This could trigger credit tightening, raise financing costs, and ultimately harm small and medium enterprises and innovation—the very sectors most reliant on accessible credit. For further insight, refer to a recent article by Aiying titled Questioning Profitability Behind the 'Stability' Halo: Lessons from Hong Kong Virtual Banks' Universal Losses and Implications for Stablecoin Business Models.

That said, as stablecoins scale, we may eventually see the emergence of “stablecoin banks” that lend, thereby reintroducing credit creation back into the financial system in a new form.

Third Gate: The Deficit of Integrity—The Eternal Tug-of-War Between Anonymity and Regulation

Monetary “integrity” serves as the financial system’s “safety net.” It demands that payment systems be secure, efficient, and capable of preventing illegal activities such as money laundering, terrorist financing, and tax evasion. This requires a robust legal framework, clear accountability, and strong regulatory enforcement to ensure compliance.

The BIS argues that the underlying technology of stablecoins—particularly those built on public blockchains—poses a serious challenge to financial integrity. The core issues are anonymity and decentralization, which render traditional financial oversight ineffective.

Imagine a concrete scenario: millions of dollars in stablecoins move via a public blockchain from one anonymous address to another in minutes, with minimal fees. While the transaction record is publicly visible on-chain, linking these randomly generated addresses to real-world identities is extremely difficult. This opens the door to illicit cross-border fund flows, rendering core regulatory requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) practically meaningless.

In contrast, traditional international wire transfers (e.g., via SWIFT), while sometimes slow and costly, operate within a tightly regulated network. Sending banks, receiving banks, and intermediary agents must all comply with national laws, verify counterparties’ identities, and report suspicious transactions to authorities. This system may be cumbersome, but it provides foundational safeguards for financial integrity.

The technical features of stablecoins fundamentally undermine this intermediary-based regulatory model. This is precisely why global regulators remain highly vigilant and insist on bringing stablecoins under comprehensive regulatory frameworks. No monetary system—no matter how technologically advanced—can gain lasting trust from society or governments if it fails to prevent financial crime.

Aiying Viewpoint Supplement: Blaming the integrity issue solely on technology may be overly pessimistic. As on-chain analytics tools (such as Chainalysis and Elliptic) mature and global regulatory regimes (like the EU’s Markets in Crypto-Assets Regulation, MiCA) take shape, the ability to track and enforce compliance on stablecoin transactions is rapidly improving. In the future, fully compliant, transparently reserved, and regularly audited “regulation-friendly” stablecoins may well become mainstream. Thus, the integrity challenge could be significantly mitigated through the convergence of technology and regulation, rather than being seen as an insurmountable barrier.

Supplement and Reflection: What Else Should We See Beyond the BIS Framework?

The BIS’s “Three Gates” theory offers a grand and profound analytical lens. However, this section is not intended to critique or deny the practical value of stablecoins. Rather, consistent with Aiying Research’s role as a sober observer amid industry hype, our aim is to envision future possibilities with risk mitigation as a priority. We offer clients and industry professionals a broader, constructive, and supplementary perspective—refining and extending the BIS arguments, and exploring real-world issues that the report did not deeply cover but are equally crucial.

1. Technological Vulnerabilities of Stablecoins

Beyond the three economic challenges, stablecoins are also not immune to technological risks. Their operation heavily depends on two critical infrastructures: the internet and the underlying blockchain network. This means that in the event of large-scale internet outages, submarine cable failures, widespread power blackouts, or targeted cyberattacks, the entire stablecoin system could stall or even collapse. This absolute dependence on external infrastructure represents a significant weakness compared to traditional financial systems. For instance, during the recent nationwide internet shutdown in Iran amid conflict—where some areas even experienced power outages—such extreme scenarios may not yet be adequately factored into risk models.

An even longer-term threat comes from disruptive technologies. For example, the maturation of quantum computing could fatally compromise most current public-key encryption algorithms. If the cryptographic security protecting private keys on blockchains is broken, the entire foundation of digital asset security would crumble. While this may seem distant today, for any monetary system aspiring to carry global value flows, it is a fundamental security concern that must be taken seriously.

2. Real-World Impact and the ‘Ceiling’ for Stablecoins

The rise of stablecoins is not merely about creating a new asset class—it’s also about direct competition with traditional banks for the most critical resource: deposits. This trend of financial disintermediation, if left unchecked, could erode the central role of commercial banks and weaken their ability to serve the real economy.

Another widely circulated narrative deserves deeper scrutiny: “Stablecoin issuers support their value by purchasing U.S. Treasury bonds.” This process is not as straightforward as it sounds and faces a critical bottleneck: bank reserves. Let’s examine the capital flow using the diagram below:

Figure 2: Capital Flow and Constraints in Stablecoin Purchases of U.S. Treasuries (Illustrative)

Flow explanation:

-

Users deposit USD into a bank and transfer it to a stablecoin issuer (e.g., Tether or Circle).

-

The stablecoin issuer receives the USD deposit in its partner commercial bank.

-

When the issuer decides to buy U.S. Treasuries, it instructs its bank to make the payment. Especially during large-scale operations, this payment clears through the Federal Reserve’s settlement system (Fedwire), reducing the reserve balance of the issuer’s bank at the Fed.

-

Conversely, the bank of the party selling the Treasuries (e.g., a primary dealer) sees its reserve balance increase.

The key point here is that commercial banks’ reserves at the Federal Reserve are not infinite. Banks must maintain sufficient reserves for daily settlements, customer withdrawals, and regulatory compliance (e.g., the Supplementary Leverage Ratio, SLR). If stablecoin growth continues unchecked, massive Treasury purchases could excessively drain bank system reserves, leading to liquidity and regulatory pressures. Eventually, banks may restrict or refuse services to stablecoin issuers. Therefore, the upper limit of stablecoin demand for U.S. Treasuries is constrained by the availability of bank reserves and regulatory policies—it cannot grow indefinitely.

In contrast, traditional money market funds (MMFs) reinvest funds into the banking system via the repo market. When MMFs buy Treasuries, they effectively deposit funds back into commercial banks (B), increasing both bank liabilities (MMF deposits) and reserves. These deposits can then be used for credit creation (e.g., loans), directly restoring the banking system’s deposit base. See the diagram below:

Figure 3: Capital Flow and Constraints in MMF Purchases of U.S. Treasuries (Illustrative)

Between 'Crackdown' and 'Co-optation'—The Future Path of Stablecoins

Considering both the BIS’s cautious warnings and real market demands, the future of stablecoins appears to stand at a crossroads. They face both global regulatory “crackdowns” and the possibility of being “co-opted” into the mainstream financial system.

Summary of Core Contradictions

The future of stablecoins boils down to a tension between their “wild innovation energy” and the modern financial system’s core demands for “stability, safety, and control.” The former brings efficiency and financial inclusion; the latter ensures global financial stability. Finding equilibrium between these forces is the shared challenge for regulators and market participants alike.

BIS’s Solution: Unified Ledger and Tokenization

Facing this dilemma, the BIS does not reject innovation outright. Instead, it proposes a bold alternative: a “Unified Ledger” centered on tokenized central bank reserves, commercial bank money, and government bonds.

“Tokenised platforms with central bank reserves, commercial bank money and government bonds at the centre can lay the groundwork for the next-generation monetary and financial system.” — BIS Annual Economic Report 2025, Key Takeaways

Aiying Research believes this is essentially a “co-optation” strategy. It seeks to harness the benefits of tokenization—such as programmability and atomic settlement—but anchors them firmly within a central bank-led trust framework. In this vision, innovation occurs within regulated boundaries, allowing society to enjoy technological gains without compromising financial stability. Under this model, stablecoins would at best play a “strictly limited, auxiliary role.”

Market Evolution and Divergent Paths

Despite the BIS’s clear blueprint, market evolution is often more complex and diverse. The future of stablecoins is likely to diverge along multiple paths:

-

Compliance Path:

Some stablecoin issuers will actively embrace regulation, ensuring full transparency of reserves, undergoing regular third-party audits, and integrating advanced AML/KYC tools. These “compliant stablecoins” could be integrated into the existing financial architecture, becoming regulated digital payment instruments or settlement vehicles for tokenized assets.

-

Offshore / Niche Market Path:

Other stablecoins may opt to operate in jurisdictions with lighter regulation, continuing to serve niche markets such as DeFi and high-risk cross-border transactions. However, their scale and influence will be strictly capped, preventing them from becoming mainstream.

The “Three Gates” dilemma facing stablecoins not only exposes their structural flaws but also acts as a mirror, reflecting inefficiencies, high costs, and lack of inclusivity in the current global financial system. The BIS report sounds an alarm, reminding us that financial stability must not be sacrificed for blind technological advancement. Yet, real market demand also suggests that the path to the next generation of finance is unlikely to be black-and-white. True progress may lie in thoughtfully combining top-down institutional design with bottom-up market innovation—finding a middle ground between “crackdown” and “co-optation”—to build a future financial system that is more efficient, secure, and inclusive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News