Romantic Turkey, stablecoins under the pillow

TechFlow Selected TechFlow Selected

Romantic Turkey, stablecoins under the pillow

For now, Turkey's focus on cryptocurrency remains centered on hedging against fiat currency depreciation risks.

Author: Bright, Foresight News

On July 5, according to Financefeeds, Turkey's Capital Markets Board (CMB) has taken legal action to block 46 cryptocurrency-related websites, including the decentralized exchange PancakeSwap. The reason given by the CMB is straightforward: these platforms offer "unauthorized crypto asset services" to Turkish residents.

Turkey, once the world’s fourth-largest cryptocurrency market with nearly $200 billion in annual trading volume and where crypto trading was legalized, is once again tightening its grip on the crypto sector.

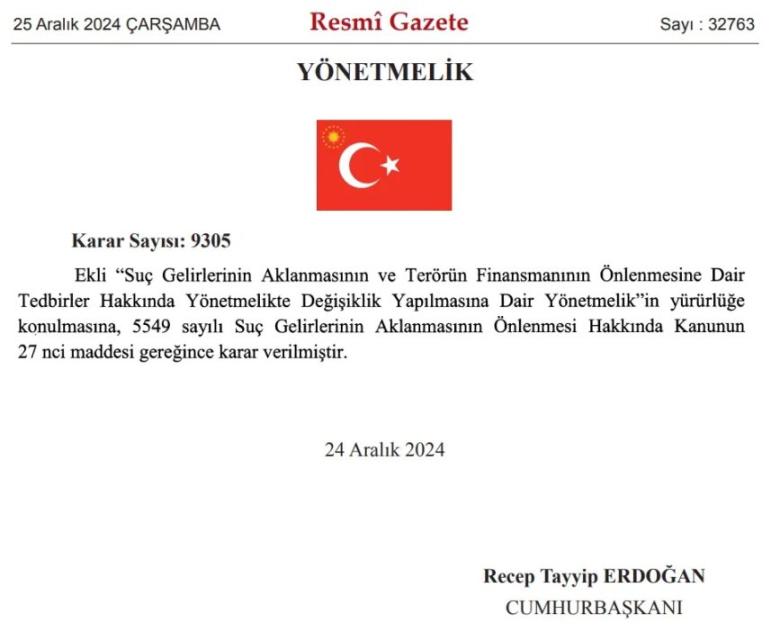

Since March 2025, the CMB has begun comprehensive oversight of crypto asset service providers operating in Turkey, establishing a new licensing and compliance framework. Additionally, Turkey’s anti-money laundering (AML) regulations for cryptocurrencies, announced in December 2024, officially took effect in February. Under these rules, users must submit full identity information when executing crypto transactions exceeding 15,000 Turkish lira (approximately $425). Moreover, wallet addresses not registered on platforms face strict controls, making it highly restrictive to use native crypto functionalities.

Testing the Waters Amid High Inflation

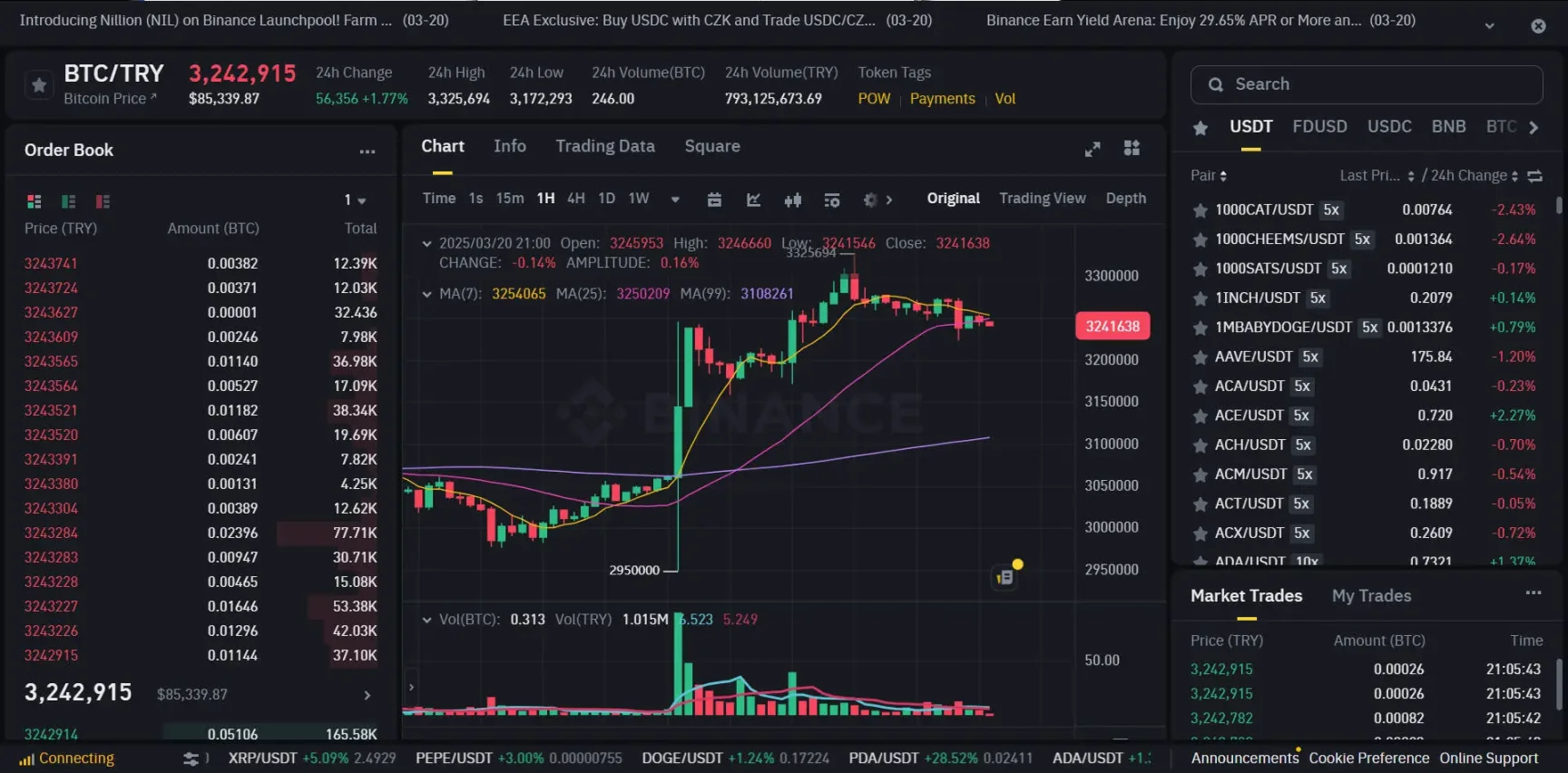

On March 19, 2025, Istanbul Mayor Ekrem Imamoglu, a political rival of President Erdogan, was arrested, triggering panic among local investors. The Turkish fiat currency, the lira (TRY), plunged about 10% around 4 p.m., hitting a record low of 41:1 (TRY:USD). Roughly an hour later, a fiat flight-to-crypto trend emerged, with BTC/TRY trading volume surging dramatically on Binance.

In fact, under what has been dubbed "Erdoganomics"—a policy of low interest rates to stimulate investment and deliberate currency depreciation to boost exports—the Turkish lira has lost over 80% of its value in five years. Soaring inflation and capital outflows have repeatedly battered the Turkish economy. As The Economist put it: "He (Erdogan) is trying to treat cancer with stimulants."

Faced with this reality, Turkish citizens have long had their own coping mechanisms—most notably, "gold under the mattress." According to estimates from the Central Bank of Turkey in Q3 2024, Turkish households hold physical gold worth over $311 billion, far exceeding the central bank’s gold reserves of $86.5 billion. From January to April 2025, Turkey recorded a current account deficit of $20.3 billion, up from $14.5 billion a year earlier, with $6.27 billion of that deficit attributable to gold trade. Once imported, much of this gold disappears into private homes and exits circulation.

Starting in 2022, alongside gold, Turkish investors rapidly turned to cryptocurrencies as a more stable and convenient store of value. Although Bitcoin entered a bear market in 2022 due to factors like the Fed’s rate hikes and the FTX collapse—losing 64% for the year—Turkish investors remained highly active. Dogecoin (DOGE) became one of the most popular trading assets in Turkey; between October and November 2022, its trading volume even surpassed the combined volumes of BTC and ETH, reaching $380 million. Despite early government warnings against crypto, locals increasingly view digital assets as tools to hedge against inflation.

Later, Turkish authorities themselves began embracing broader crypto adoption, aiming to reduce dependence on external economies and SWIFT, and seeking greater autonomy and stability in their financial system.

Aligning with EU Compliance—but Falling Behind

Turkey’s move toward crypto legalization stems from a complex mix of factors. On one hand, the rapid growth of the global crypto market and evolving regulatory trends have forced Turkey to confront the legitimacy and regulation of this emerging financial tool. On the other hand, Turkey hopes to enhance financial inclusion, especially in underserved regions, where crypto debit cards and similar tools allow users to bypass traditional banking systems for easier access to financial services.

On December 25, 2024, the Turkish government issued a notice outlining key provisions of its new AML regulations, focusing on transaction thresholds, handling high-risk transactions, and restrictions on unregistered wallets—all aimed at improving transparency and security in crypto trading.

This regulation coincided with the enforcement of Europe’s Markets in Crypto-Assets Regulation (MiCA) on December 30, 2024. MiCA is considered the world’s first comprehensive regulatory framework covering crypto assets, detailing rules on issuance, authorization and operation of service providers, reserve and redemption management, and AML compliance. It also incorporates the Travel Rule from the Funds Transfer Regulation (TFR), requiring crypto asset service providers (CASP) to include sender and recipient information in every transfer to enhance traceability.

Turkey has essentially copied MiCA in full. However, as the U.S. emerges as a leader in crypto compliance and progressively removes restrictions on the industry, Turkey’s regulatory progress now appears clearly behind the curve.

At least regarding stablecoin applications, Turkey has shown no signs of loosening its stance. Since 2021, while recognizing the tradability of cryptocurrencies, the Turkish government has continued to ban their use as payment methods. This means investors can trade freely but cannot directly use crypto for daily consumption. As a result, the trillion-dollar stablecoin payments market remains untapped.

Nevertheless, despite imposing restrictions on certain trading activities, Turkey maintains an open approach to crypto taxation. The government does not tax capital gains from crypto assets and levies only a 0.03% transaction tax—making it highly favorable for traders.

All in all, like Argentina and other countries suffering rapid fiat depreciation, Turkey’s focus in crypto remains centered on hedging against currency devaluation. Turkish citizens primarily seek to convert their rapidly depreciating lira into dollar-pegged stablecoins on blockchain networks. After all, the Central Bank of Turkey’s foreign exchange reserves have already turned negative. Compared to the high fees and low security of traditional black markets, high-liquidity on-chain stablecoins have become the preferred store of value. Just as Turks traditionally kept "gold under the mattress," now "stablecoins under the pillow" are gaining popularity. The extensive dedicated ecosystem Tron has built in Turkey—from payments to exchanges—is strong evidence of the country’s vast market demand.

Yet, when it comes to innovative applications such as cross-border stablecoin payments or tokenized stocks, Turkey is currently far from becoming a hub of innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News