The Truth Crypto KOLs Won't Tell You: Four Illusions of New Project Launches and Data Disproof

TechFlow Selected TechFlow Selected

The Truth Crypto KOLs Won't Tell You: Four Illusions of New Project Launches and Data Disproof

Focusing on product development, reasonably pricing tokens to avoid overvaluation, communicating transparently, and abandoning vanity metrics are key to a successful TGE.

Author: rosie, Crypto KOL

Translation: Felix, PANews

Crypto Twitter (CT) loves to tell you how to launch a token: first grow 100K followers, boost engagement through tasks, raise funds from top-tier VCs, keep only 2% of supply circulating at launch, and maximize hype during the Token Generation Event (TGE) week.

The problem? It's all nonsense.

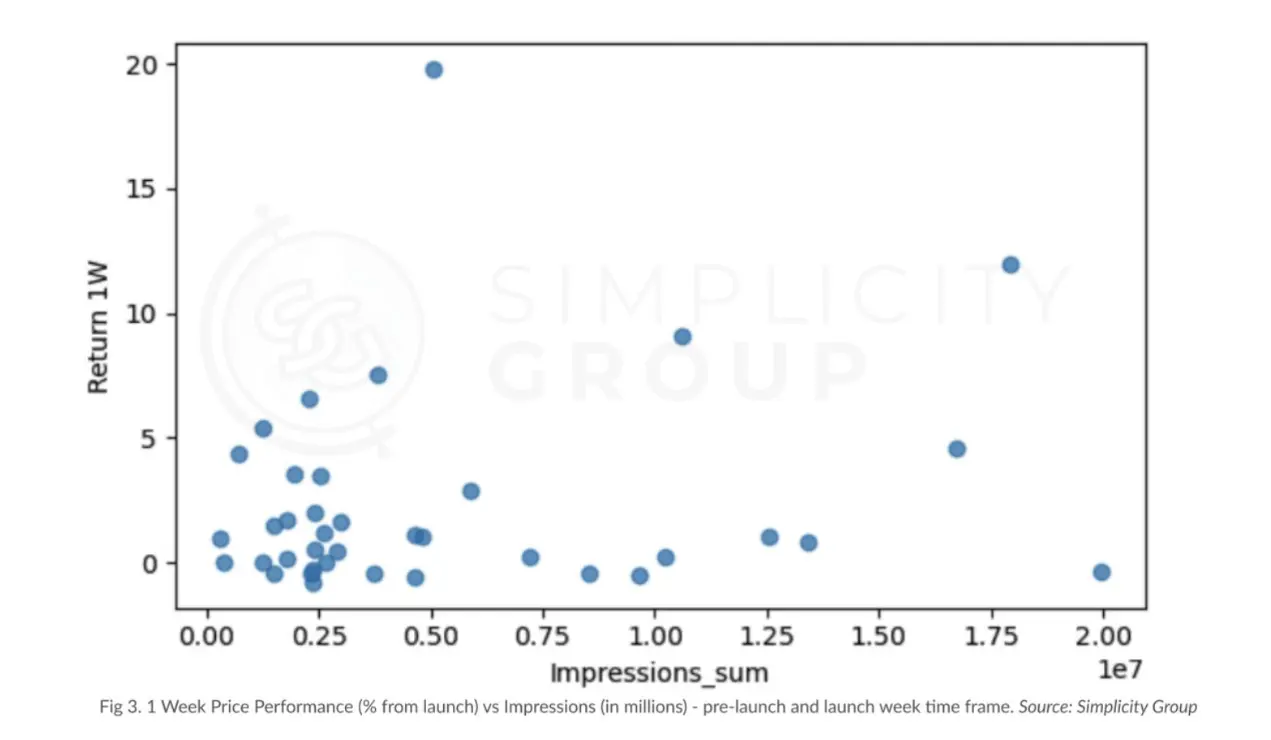

A recent research report by Simplicity Group analyzed 50,000 data points across 40 major token launches in 2025, revealing that the conventional wisdom promoted on CT simply doesn't work in real-world token launches.

The Lie About Engagement

Everyone (including the author) is obsessed with Twitter metrics—likes, retweets, replies, impressions—all vanity metrics. Projects spend thousands on engagement farming, task platforms, and buying followers.

Correlation with price performance within one week: nearly zero.

Simplicity Group’s regression analysis shows an R² correlation coefficient of just 0.038 between engagement metrics and price performance. In short: engagement explains almost nothing about a token’s success.

Likes, comments, and retweets are actually slightly negatively correlated with price performance. This means higher-engagement projects sometimes perform worse. GoPlus, SonicSVM, and RedStone constantly post content, yet their user engagement does not scale proportionally with actual user base growth.

The only metric showing even marginal positive correlation is surprising: retweets in the week before launch. With a p-value of 0.094, it barely passes statistical significance, and even then, the correlation is weak.

So when you're spending money on bots, orchestrating complex task campaigns, you're essentially burning cash for meaningless activity.

The Myth of Low Circulating Supply

CT is obsessed with “low circulation, high FDV” projects. The idea: launch with minimal circulating supply to create artificial scarcity, then watch the price skyrocket.

Turns out, this is wrong too.

The percentage of initial circulating supply relative to total supply shows no correlation whatsoever with price performance. The study finds no statistically significant relationship at all.

What actually matters? The dollar value of the initial market cap.

R² = 0.273, adjusted R² = 0.234—the relationship is clear: for every one-unit increase in initial market cap (IMC), weekly return decreases by approximately 1.37 units.

In short: for every 2.7x increase in initial market cap, first-month price performance drops by about 1.56%. The link is so strong it’s almost causal.

Lesson: It’s not about the percentage of tokens unlocked—it’s about the total dollar value entering the market.

The Illusion of VC Backing

"Wow, they raised $100M from a16z—they’re going to moon!"

Narrator: They didn’t moon.

Correlation between funding amount and one-week return: 0.1186, p-value = 0.46. Correlation with one-month return: 0.2, p-value = 0.22.

Neither is statistically significant. There is effectively no relationship between how much a project raises and how its token performs.

Why? Because more funding usually means higher valuations, which translates into greater sell-off pressure. Extra capital doesn’t magically translate into better tokens.

Yet CT treats funding announcements as buy signals. It’s like judging a restaurant based on how much rent the owner pays.

Perfect example: Projects that raised massive sums in the study did not necessarily outperform those with limited funding. A $100M raise doesn’t guarantee better tokenomics or a stronger community than a $10M raise.

The Timing Hype Fallacy

Conventional wisdom says: save your biggest news for launch week, maximize FOMO, capture everyone’s attention right when the token goes live.

Data shows the opposite is true.

After launch, user engagement drops. Users move on to the next airdrop opportunity, and your carefully crafted content gets ignored.

The projects that sustain strong performance built awareness *before* launch week—not during. They understand that pre-launch attention brings real buyers; launch-week attention brings only passersby. Engagement peaks *before* TGE, when they announced the launch, not after—when everyone has already moved on to the next thing.

What Actually Works

If Twitter engagement, low circulation, VC backing, and hype timing don’t matter, what does?

Real Product Utility

Projects whose products naturally generate content (e.g., Bubblemaps with on-chain analytics or Kaito with narrative tracking) outperform meme-heavy accounts. Bubblemaps and Kaito enjoy sustained, organic engagement because their products inherently create alpha-rich content.

Trading Retention

Tokens that maintain trading volume after initial hype show significantly better price performance. Spearman rank correlation = -0.356 (p = 0.014)—tokens with larger volume drop-offs tend to perform worse. One month post-launch, the top quartile in trading volume retention shows significantly higher median and mean price returns.

Reasonable Initial Market Cap

The strongest predictor of success. Correlation coefficient: -1.56, statistically significant. Launch at a reasonable valuation, and you have room to grow. Launch with a $1B+ market cap, and you're fighting gravity.

Genuine Communication

Consistent tone aligned with product substance. Powerloom’s $5.2M raise paired with an overly flippant tone backfired—POWER crashed 77% in its first week and is down 95% since launch. In contrast, Walrus tweeted with authentic humor and saw its token rise 357% one month after TGE. Hyperlane stuck to factual updates and surged 533% in its first week.

Why CT Gets It Wrong?

This disconnect isn’t malicious—it’s structural.

CT rewards engagement, not accuracy. Posts titled “10 Ways to 100x Your Token Launch” get more retweets than “Here’s What the Data Actually Shows.”

KOLs grow followers by pleasing projects, not challenging them. Telling users their engagement farming is pointless doesn’t win likes.

Besides, most CT KOLs have never actually launched a token. They’re commenting on a game they’ve never played. Meanwhile, real product builders like Story Protocol consistently deliver strong results—regardless of Twitter follower count.

The Real Meta

Here’s what successful projects actually do (backed by data):

-

Focus on building products people want to use

-

Price tokens reasonably at launch

-

Communicate authentically with their audience

-

Measure what truly matters—not likes

How revolutionary.

Take Quai Network as an example—they focused on technical deep dives and educational posts about their unique blockchain consensus model. During TGE, average views were around 24K. QUAI rose 150% in its first week. Not because they had millions of followers, but because they genuinely sparked interest in their innovation.

In contrast, projects burning money on task platforms and engagement marketing see their tokens crash because no one truly understands or cares about what they’ve built.

Ironic, isn’t it? While everyone chases the Twitter algorithm, the real winners are quietly building useful things and launching wisely.

Case in point: Zora failed to disclose tokenomics details early, leading to a 50% crash one week after TGE. Meanwhile, projects using transparent approaches and focusing on product-driven content consistently outperform.

CT isn’t lying on purpose. But when incentives reward hot takes over hard data, useful information drowns in noise.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News