The Right Valuation Model for Public Blockchains: Understanding Whether Solana Is Overvalued

TechFlow Selected TechFlow Selected

The Right Valuation Model for Public Blockchains: Understanding Whether Solana Is Overvalued

For token prices, the most important factor remains GDP growth in crypto nations. Since the metaverse is still in its primitive stage, we haven't even seen the first phase of this growth yet.

Author: RealNatashaChe

Translation: Xiaohe Aifengxiang

Many people try to value Layer 1 blockchain tokens like stocks, which is absurd. Instead of pricing Ethereum, Solana, and others like *companies*, we should price them like *nations*. Most people approach the valuation of public chain tokens in the wrong way:

First Wrong Valuation Approach: Earnings Multiples

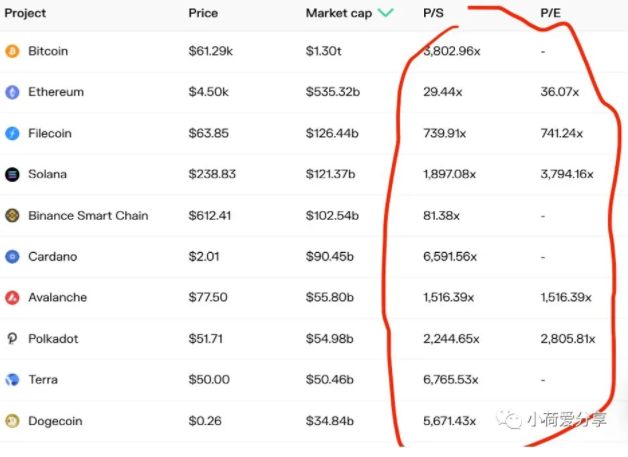

Some apply equity investing frameworks to blockchains and calculate price-to-earnings or price-to-sales ratios for ETH, SOL, AVAX, etc. Unsurprisingly, these ratios appear shockingly high—so high that they would give any value investor a heart attack.

Here’s the problem: earnings represent the full value of a company, but they do not reflect the value of a public blockchain. If Ethereum halved average gas fees tomorrow, all else being equal, its P/E ratio would double. Does this mean Ethereum is twice as overvalued? No—quite the opposite; it would actually be a boost to platform growth. Since token holders—the owners—are also users of the blockchain, the chain's value comes from how much economic activity it supports, not how much of that activity is captured by the platform as “profit.”

If you view public blockchains as sovereign economic ecosystems—akin to nations—the absurdity of valuation multiples becomes immediately apparent. If the U.S. doubled all tax rates, the government’s “P/E ratio” would halve. But would that benefit the U.S. economy? Hardly. Structurally, some countries have governments that take up a larger share of total economic output than others. All else equal, China (larger government) would show a lower P/E than the U.S. (smaller government)—but does that tell us anything meaningful about the value of these two economies? Clearly not!

Second Wrong Valuation Approach: Discounted Cash Flow (DCF)

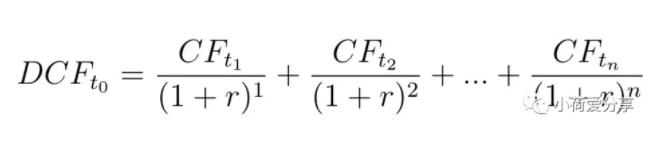

DCF is another common stock valuation framework—and even more absurd when applied here. Using discounted cash flows to assess the value of L1 tokens is a waste of time. It attempts to determine the current ETH/USD exchange rate using Ethereum’s future income. But future income must be converted via future exchange rates—which depend on current exchange rates. This is entirely circular.

L1 tokens such as ETH and SOL are both currencies and yield-bearing assets. Treating them like stocks ignores their function as units of account and mediums of exchange within their respective economies. The latter—exchange rates—is far more complex to value.

Stock DCF Model:

Because a company’s future cash flows and its stock price are denominated in the same currency (e.g., USD). But Solana’s and Ethereum’s future cash flows are denominated in SOL and ETH—not USD. Therefore, you need to assume future exchange rates at each period to derive a USD-denominated DCF.

Solana DCF Model:

This is entirely useless because the USD/SOL exchange rate is exactly what you’re trying to calculate in the first place. Rather than applying corporate valuation models, L1 tokens should be valued as currencies of crypto-native nations.

L1 tokens are a new asset class—they resemble stocks, bonds, and currencies all at once. But the larger the blockchain platform, the more it resembles a sovereign economy, and its native token becomes a true currency. The most reliable bet in crypto is blockchain nations powered economically by proof-of-stake (PoS).

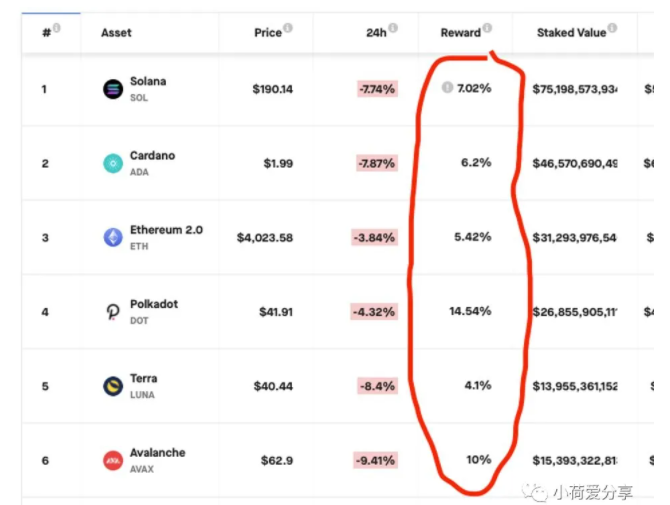

Currently, there are over 100 crypto projects using proof-of-stake (PoS) as their consensus mechanism. Their combined market cap is $400 billion (excluding ETH 2.0), accounting for 15% of the total crypto market. Around 40 of these are public smart contract platforms—so-called Layer 1 chains—where decentralized applications run. Despite fierce competition and many L1s likely to fail, it’s clear that multiple PoS-based L1 chains and their scaling layers will coexist and become the infrastructure of the metaverse.

Beyond security, technology, and functionality, most people fail to grasp the profound economic implications of PoS. If L1 chains are new sovereign economic ecosystems—new nation-states (the difference being you can be dual, triple, or quadruple citizens without giving up your old passport)—then proof-of-stake is the foundational engine enabling healthy circulation of energy and value across the system.

How does value circulation work, and why is PoS so important?

Smart contract platforms as sovereign economies—a growing L1 platform—is a powerful financial liquidity black hole. If you want to enter the Ethereum nation, you need to buy ETH. If you want to enter the Solana nation, you buy SOL.

Through a flywheel effect, financial dynamics and real-world adoption drive their national economies. Native token price rises → attracts liquidity to the platform → funds more applications building more use cases on its land → attracts more real users and greater network effects → increases demand for the native token → token price rises. In a sense, this isn’t new. When a country’s economy grows rapidly, its domestic currency’s exchange rate tends to appreciate. This happened with the U.S. dollar over the past 200 years and with China’s RMB over the past 20. But this flywheel itself is unstable. Token prices—i.e., exchange rates—don’t rise forever. If the flywheel can spin upward when prices rise, it can just as easily spin downward when prices move the other way. In the “real world,” this is called the business cycle—economies experience booms and busts.

Since people dislike recessions, mechanisms were invented to increase or decrease money supply based on economic conditions to balance downturns and booms—we call this “monetary policy.” To stimulate the national economy, expand the money supply. As long as you don’t go too far, it usually works. Just as the Fed printed dollars to rescue the U.S. economy during COVID, new L1 chains like Solana and Avalanche issue more SOL and AVAX to grow their economies. (So many people deeply resent the “printing press” and symbolic inflation—it’s an overreaction. These tools have negative side effects, but if you have a proven effective tool and choose not to use it, you’re a fool.)

Beyond programmability, the key difference between blockchain nations and the Federal Reserve is this: the Fed must rely on TradFi (banks and shadow banks) to transmit its monetary policy into the economy. But TradFi is a broken pipe—clogged where it should flow, leaking where it should contain. Eventually, ugly imbalances emerge throughout the system, surprising you later. In contrast, proof-of-stake offers blockchain economies a fairer, more efficient, and sustainable mechanism for monetary policy transmission. As the foundational economic engine of blockchain nations, PoS has a simple core idea: the blockchain rewards people for validating transactions, and to ensure validators are honest, it requires them to lock up resources—in the form of the chain’s native token—staking.

While designed as a security mechanism, PoS has profound economic implications.

1. It provides citizens with continuous incentives to hold the native token. Under proof-of-work, only miners receive rewards for processing transactions. Other holders mainly speculate on price appreciation. This is why PoW chains like Bitcoin must perpetually promote rising prices and cultivate a religious HODLing culture to maintain interest. (It’s also why BTC prices are always volatile and unsuitable as a unit of account.) In contrast, PoS provides tangible economic incentives beyond price gains. Even with just 1 SOL, you can earn consistent returns through delegated staking. Liquid staking services like Lido and Marinade Finance make it even easier—you no longer face lock-up periods and can freely enter and exit. This increases user stickiness, improves price stability for everything priced in the L1 token, and reduces transaction costs.

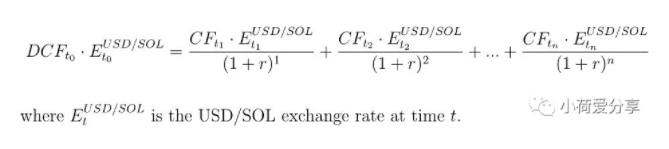

2. Efficient distribution of platform economic output. In the traditional world, any market economy’s GDP is distributed in two forms: labor income and capital income. Over recent decades, labor’s share of income has declined across all developed nations. This is the combined result of globalization, automation, and tax policies. It leads to worsening wealth inequality, since labor is the primary income source for the masses, while only a few own capital.

Technological advances like AI and robotics replacing labor will intensify this trend in coming years. Eventually, many people won’t be able to survive on labor income alone. The world is already rich—but it needs new ways to distribute that wealth. One solution is enabling more people to earn more through capital income. The staking mechanism in blockchain nations helps achieve this in a programmable way.

Part of L1 staking rewards come from transaction fees collected by the platform. Blockchain nations take a cut from every economic activity occurring on their land, directly as staking rewards or indirectly by burning transaction fees to support the token price. This allows everyone participating (via stake) in the platform to share in its economic output as non-labor income—this is capital income for the masses. While traditional governments take years to implement any form of universal basic income, blockchains are already doing it—through staking. Staking participation rates on L1s like Solana and Fantom exceed 60%—meaning most citizens in these economies earn capital income.

3. Enhances monetary policy transmission. Another portion of L1 staking yields comes from new token emissions—i.e., the platform “prints” money and puts it directly into users’ pockets. This is far more powerful than the Fed’s monetary policy, which must trickle down through a high-friction banking system that benefits some far more than others.

4. Provides foundational components for new financial systems. Primary L1 staking APYs range from 4% to 15%, making them more attractive than bank savings rates and more stable than DeFi yield farming. Thus, PoS lays the foundation for other financial products.

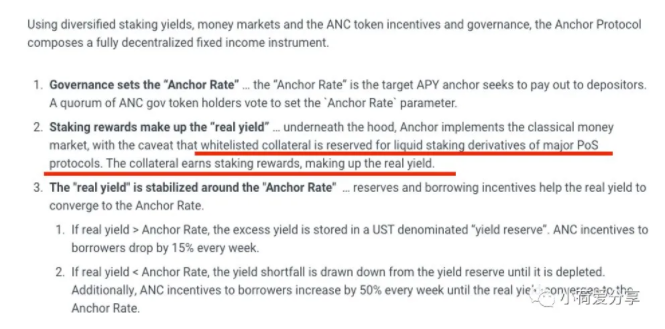

DeFi products like Anchor already use L1 staking in the backend to offer ~20% stablecoin savings yields.

Other products offer "self-repaying" loans or reduce liquidation risks by staking borrowers’ collateral in PoS chains.

This is just the beginning of a new financial system, where L1 staking yields serve as the benchmark interest rate for all other financial products in their ecosystem.

Summary:

1/ Smart contract platforms are new sovereign economies

2/ Proof-of-stake powers the economy of crypto nations

3/ PoS supports price stability, delivers capital income to the masses, enables strong monetary policy, and forms the bedrock of new financial systems

Therefore, when evaluating L1 tokens, currency exchange rate models are more useful than stock dividend models. Unfortunately, when you attempt to evaluate exchange rates, it opens a can of worms—with a million different factors influencing relative currency prices, hundreds of frameworks and assumptions, enough material to fill an entire library of books.

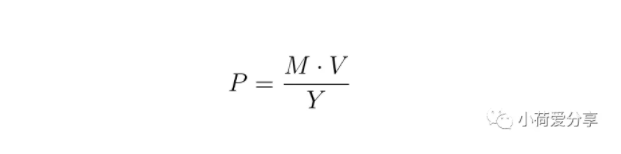

But there is one simple and elegant framework—perhaps the closest thing to “fundamental analysis”—called the quantitative model of money. It states: Money Supply (M) · Velocity of Money (V) = Price Level (P) · Real GDP (Y). Rearranging the equation, you can express the price level as:

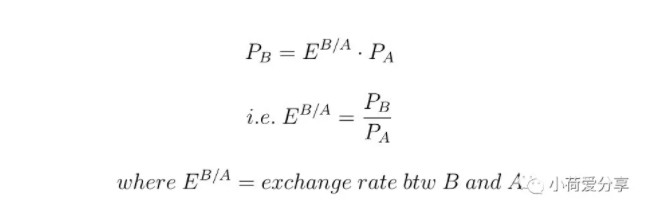

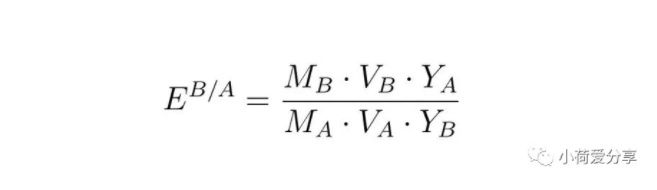

How does this relate to exchange rates? Assuming outputs of any two economies are interchangeable—so price differences get arbitraged away (not strictly true in many cases, but directionally sufficient for our purpose)—the relationship between price levels in Country A and Country B is:

Simple example: a burger sells for €1 in Germany and $1.50 in the U.S., so USD/EUR = 1.5. Substituting this back into the earlier domestic price level equation gives:

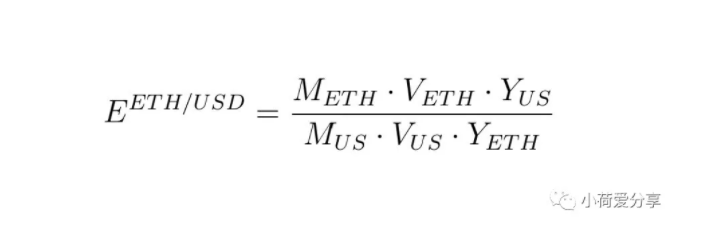

If still unclear, let Country A = USA, Country B = Ethereum, yielding:

This means ETH appreciates against the dollar when:

1/ Ethereum’s GDP (Y_ETH) grows faster than U.S. GDP (Y_US)

2/ U.S. money supply (M_US) grows faster than Ethereum’s money supply (M_ETH)

3/ Velocity of USD (V_US) increases faster than velocity of ETH (V_ETH)

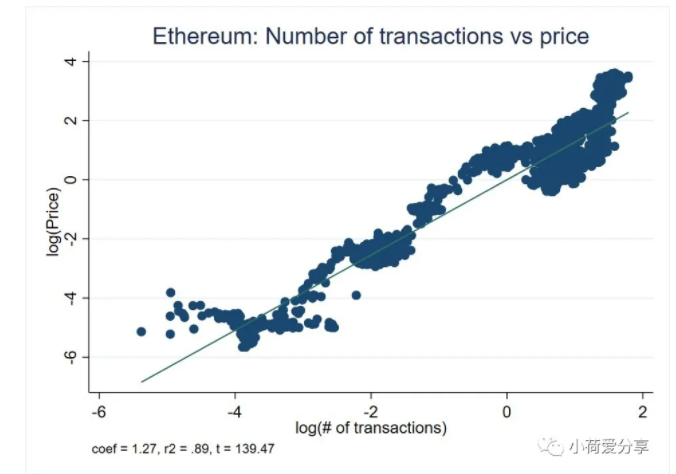

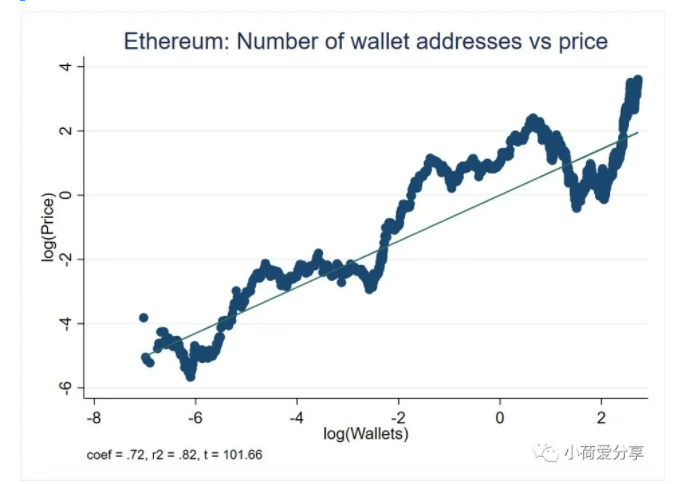

Taking this equation at face value, the ETH price growth rate in USD should have a 1:1 relationship with the growth rate of U.S. money supply. Evidence lies in ETH price movements since the Fed’s massive balance sheet expansion last year. But that’s not even the most interesting part. The equally fascinating insight is that ETH price growth should also have a 1:1 relationship with Ethereum’s GDP growth rate (i.e., total economic output of the Ethereum economy). Of course, no statistics bureau publishes “GDP” for the Ethereum nation. But GDP growth can be indirectly inferred from growth in transactions, wallets, TVL, etc. Almost every transaction involves additional economic output; wallet growth can be seen as increasing the nation’s “working population”; TVL growth reflects expansion of the financial sector. None are perfect measures, but crucially, they are positively correlated with additional economic output generated on the platform. Real data confirms the relationships between these variables and the token/USD exchange rate.

Transaction volume growth correlates nearly linearly with ETH price growth: historically, a 10% increase in transaction volume corresponds to an average 13% price increase.

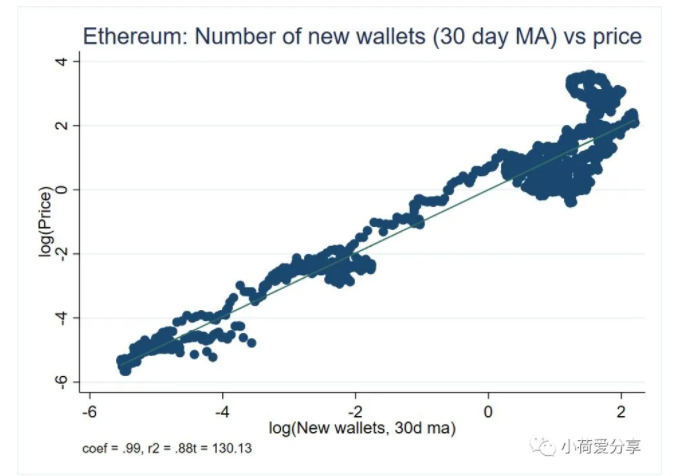

Similarly, a 10% increase in total wallets leads to an average 7% price increase.

The next chart is even more striking: acceleration in wallet growth (i.e., growth rate of new wallets) correlates almost 1:1 with ETH price growth.

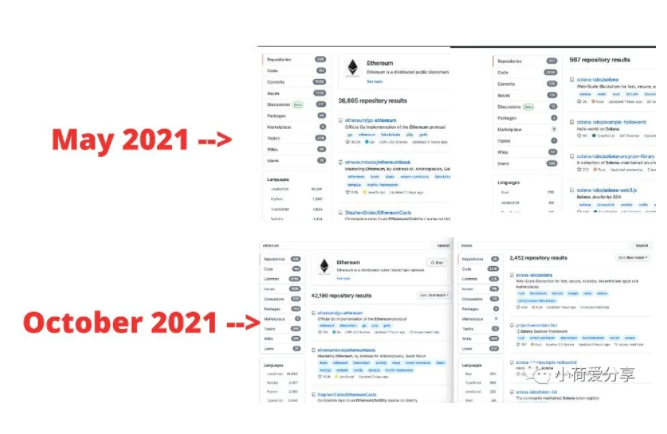

That’s not all. Software development in the virtual world is like construction in the real economy—an early indicator of GDP growth. Developer activity on Layer 1 platforms may be a stronger leading signal of upcoming economic expansion than transactions or wallets. Back in May, searching “ethereum” and “solana” on GitHub returned 65 times more repos for the former. By October, that ratio had shrunk to 17x, closely tracking Solana’s rapid growth.

All this is not to say a platform’s own cash flows are irrelevant. They matter greatly for L1 token stability.

Governments didn’t become monopolists in currency issuance by accident. History has seen many private currencies, but none lasted long—they were always outcompeted by government-backed money. Among the many issues with private money, lack of a “value anchor” is the most severe. Governments can protect their currency’s value through taxation—the most stable, almost guaranteed revenue stream. Even though fiat money is “unbacked,” governments can raise resources via taxes and use them to buy/sell their currency to maintain its value. This instills confidence in currency holders. For non-government money, this is extremely difficult!

Because transaction fees are embedded in every economic activity on the platform and used for token burning or staking rewards, blockchain sovereign economies are achieving fiscal backing similar to government currencies. As previously discussed, while these cash flows don’t determine token prices, they help maintain exchange rate stability in the long run. But for token prices, the most important factor remains GDP growth of the crypto nation. Since the metaverse is still in its infancy, we haven’t even seen the first stage of this growth yet.

TechFlow is a deep-content platform focused on alternative asset investment. Follow our official account for more in-depth content, or add WeChat TechFlow01 to join the TechFlow community and participate in discussions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News