The Product-Market Fit Myth: Why VCs Are Actually Betting on Founder-Investor Fit?

TechFlow Selected TechFlow Selected

The Product-Market Fit Myth: Why VCs Are Actually Betting on Founder-Investor Fit?

Research shows that 95% of surveyed VCs consider the founder or founding team to be the most important factor in their investment decisions.

Author: rosie

Translation: Luffy, Foresight News

Venture capital (VC) operates on a simple premise: identify companies with product-market fit, fund them to scale, and then reap returns as they grow.

The problem is that most VCs are actually unable to assess product-market fit. They aren't the target customers, they don't understand the use cases, and they rarely have time to dive deep into user behavior and retention metrics.

So they resort to a proxy: Do I like this founder? Do they remind me of other successful founders? Can I imagine working alongside them for the next seven years?

Studies show that 95% of surveyed VCs rank the founder or founding team as the most important factor in their investment decisions—not market size, product appeal, or competitive advantage, but the founder.

What's called "product-market fit" is often just "founder-investor fit" with some revenue numbers attached.

The Problem of Selection Bias

The reality of most venture capital meetings:

Investors spend 80% of their time evaluating founders—their background, communication style, strategic thinking, and cultural alignment with the company. Only 20% of the time is dedicated to the actual product and market dynamics.

From a risk management perspective, this makes sense. Investors know they’ll be working closely with founders through critical moments, market shifts, and strategic pivots. A great founder can succeed even with an average product, while an average founder can ruin an excellent one.

But this creates systemic bias: favoring founders who are good at communicating with investors over those who are good at communicating with customers.

The result? Companies raise money but struggle to retain users. Products look compelling in pitch decks but fail in real-world usage. The so-called "product-market fit" exists only in boardrooms.

What Fuels the "Pivot Epidemic"

If you’ve ever wondered why so many well-funded startups repeatedly pivot, "founder-investor fit" explains it perfectly.

Data shows nearly 67% of startups stall at some point during the VC funding process, and fewer than half manage to secure follow-on funding. Yet interestingly, those that do raise subsequent rounds typically pivot multiple times along the way.

When a company raises significant capital based on founder quality rather than genuine product appeal, the pressure shifts from serving customers to maintaining investor confidence.

Pivoting allows founders to keep telling a growth story without admitting the original product isn’t working. Since investors bet on the founder, not a specific product, they often support pivots that sound strategically sound.

This leads companies to prioritize fundraising over customer satisfaction. They become experts at identifying new markets, crafting compelling narratives, and sustaining investor enthusiasm—but not at building something people genuinely want to use consistently.

Metrics Theater

Most early-stage companies lack true product-market fit metrics. Instead, they have metrics designed to signal product-market fit to investors.

Swapping monthly active users for daily ones, total revenue for cohort retention rates, partnership announcements for organic growth, and testimonials from friendly clients for spontaneous user behavior.

These aren't necessarily fake metrics, but they serve investor narratives rather than business sustainability.

Real product-market fit shows up in user behavior: people use your product unprompted, get frustrated when it breaks, recommend it proactively, and willingly pay more over time.

Investor-friendly metrics appear in pitch decks: exponential growth charts, impressive brand partnerships, TAM calculations, and competitive positioning analysis.

When founders optimize for the second kind—because it gets them funded—a disconnect emerges. The first kind determines whether the business is truly viable.

Why Investors Can’t Tell the Difference

Most VCs pattern-match against past successful companies they’ve seen, rather than assessing whether current market conditions align with those historical patterns.

They look for founders who remind them of past winners, metrics that resemble those of previous successes, and stories that sound like prior winning pitches.

This works when markets are stable and customer behavior is predictable. But it fails when technology, user expectations, or competitive dynamics shift.

An investor who funded SaaS companies in 2010 knew what successful SaaS metrics looked like back then. But they may not understand what a sustainable SaaS business looks like in 2025, where customer acquisition costs are tenfold higher and switching costs far lower.

As a result, they invest in founders who can convincingly argue their metrics will mirror 2010 SaaS benchmarks—not those who deeply understand today’s market realities.

No amount of funding can buy you real product-market fit

The Cascade Effect of Social Proof

Once a company secures funding from a respected VC, other investors assume due diligence on product-market fit has already been done.

This creates a cascade of validation, where investor pedigree replaces product quality. "We're backed by a top-tier VC" becomes the primary signal of product-market fit—regardless of actual user engagement.

Customers, employees, and partners start believing in the product—not because they’ve used and loved it, but because smart investors have endorsed it.

This social proof can temporarily substitute for real product-market fit, creating companies that look successful on the surface but are struggling with fundamental product issues underneath.

Why This Matters for Founders

Understanding that fundraising is mostly about founder-investor fit—not product-market fit—changes how you build a company.

If you build solely to attract investors, you’ll create something fundable but not necessarily sustainable. If you build solely for customers, you might create something sustainable but struggle to raise the capital needed to scale.

The most successful founders know how to achieve real product-market fit while also being able to articulate it in ways investors can understand and get excited about.

This often means translating customer insights into investor language: showing how user behavior drives revenue metrics, how product decisions create competitive advantages, and how market understanding shapes strategic positioning.

Systemic Consequences

Substituting founder-investor fit for product-market fit leads to predictable market inefficiencies:

Strong products with poor access to funding receive less capital than their potential warrants, allowing better-funded competitors to capture market share through capital, not product quality.

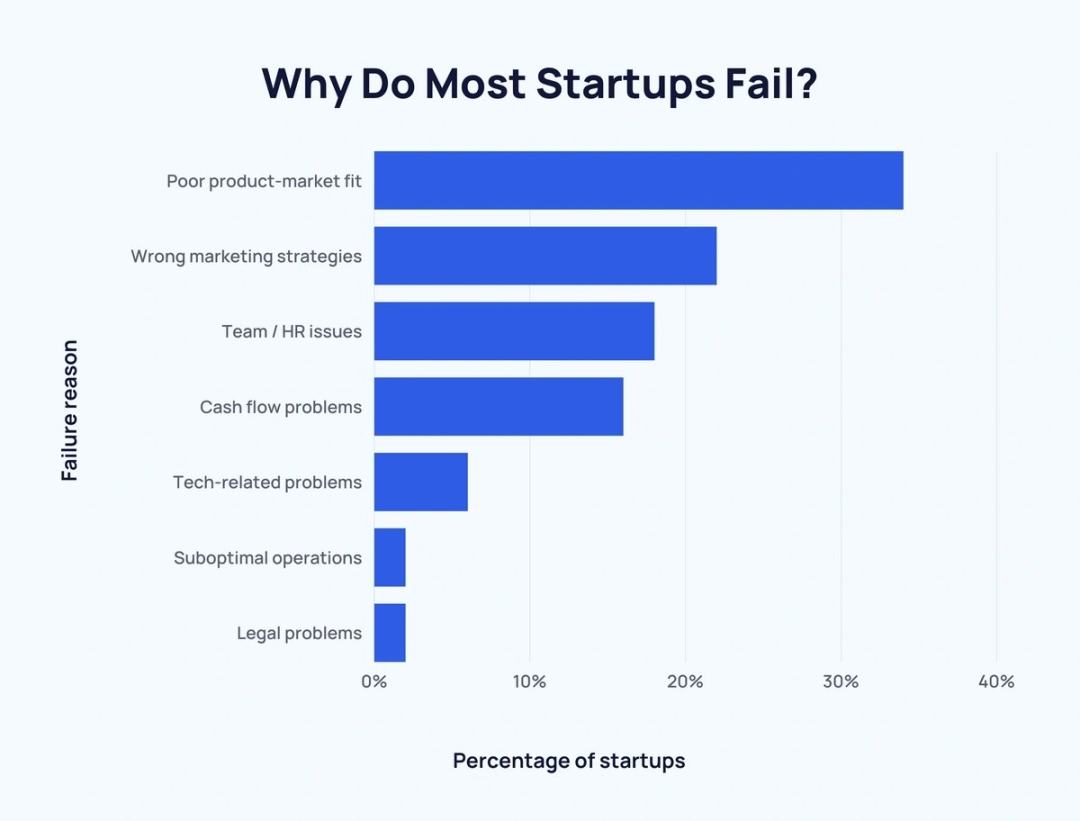

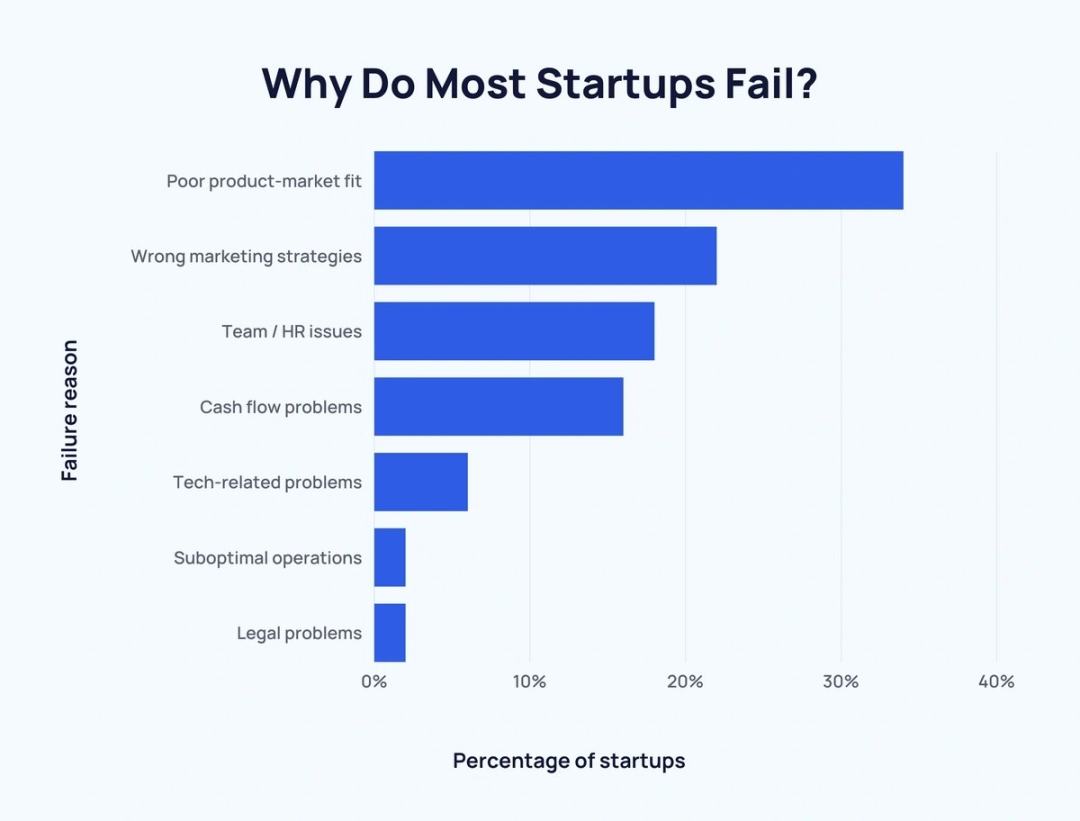

Skilled fundraisers with mediocre products receive excessive capital relative to fundamentals, leading to unsustainable valuations and inevitable disappointment. Research shows 50% of VC-backed startups fail within five years, and only 1% become unicorns.

True product-market fit becomes harder to identify, as signals are drowned out by fundraising performances and cascading social proof.

Innovation clusters around investor preferences rather than customer needs, resulting in market saturation in some areas and underdeveloped opportunities in others.

What This Means for the Ecosystem

Recognizing this pattern doesn’t mean founder quality is irrelevant or that all VC decisions are arbitrary. Great founders do build better companies over time.

But it does mean that the "product-market fit" commonly cited in venture capital is often a lagging indicator of founder-investor compatibility, not a leading indicator of business success.

The most sustainably advantaged companies are usually those that achieve real product-market fit before optimizing for founder-investor fit.

They understand their customers so deeply that they can build products independent of investor opinions. Then, they translate that understanding into frameworks investors can evaluate and support.

The worst outcome is when founders mistake investor enthusiasm for customer validation, or when investors mistake their trust in a founder for evidence of market opportunity.

Both matter—but confusing them leads to well-funded companies that fail to create lasting value.

Next time you hear a company has amazing product-market fit, ask: Are they referring to customers who can’t live without the product, or investors who can’t stop praising the founder? That distinction determines whether you’re seeing a sustainable business or a sophisticated fundraising performance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News