TechFlow: Breaking Down the Logic of Crypto Funding—No Product Is the Best Product

TechFlow Selected TechFlow Selected

TechFlow: Breaking Down the Logic of Crypto Funding—No Product Is the Best Product

The game hasn't spun out of control—it's simply being played "perfectly."

Author: rosie

Translation: TechFlow

Have you noticed that projects effortlessly raising millions in crypto often rely solely on a slick website?

This isn't luck, nor is it entirely fraud (well, sometimes it might be). It's actually the result of game theory.

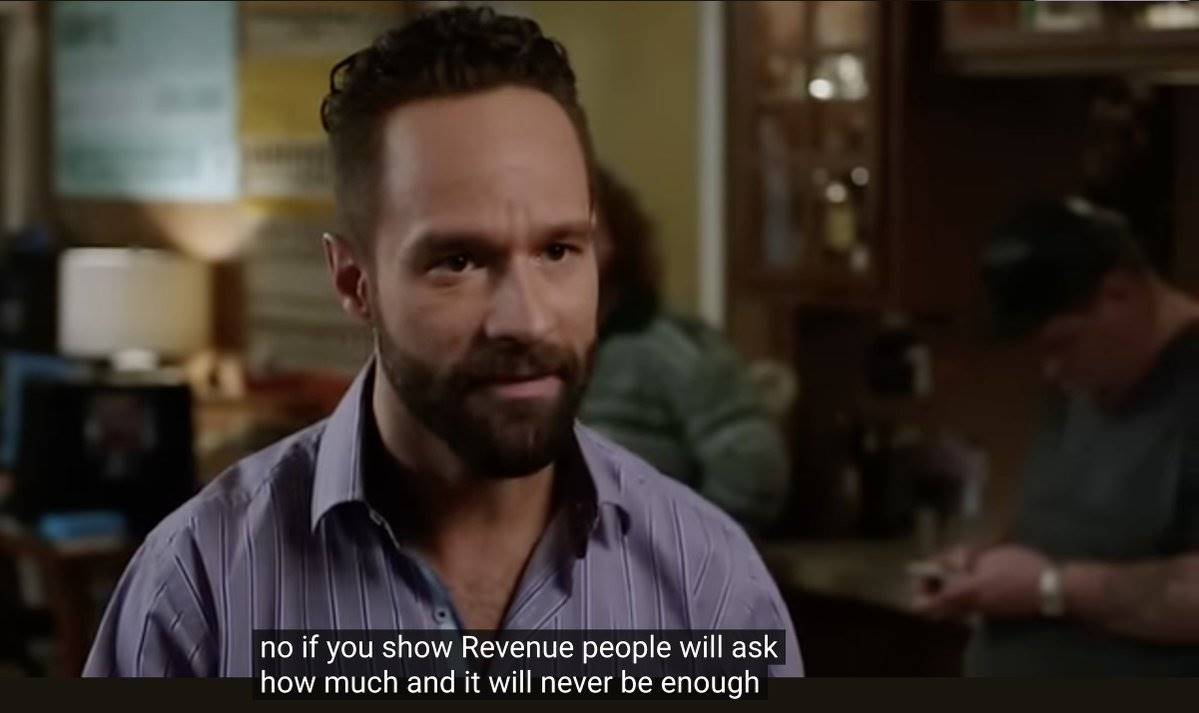

Remember that classic scene from "Silicon Valley"? Companies with no revenue were valued higher than those actually making money. A venture capitalist explains:

"If you show revenue, people ask 'How much?'—and the answer is never satisfying. But if you have no revenue, people can imagine infinite revenue."

Crypto takes this logic to the extreme: the less real your product, the more money you can raise. This isn't a bug—it's crypto’s most profitable “feature.”

Reality Caps Valuation

When you have an actual working product, you're forced to confront something uncomfortable: facts.

Facts mean:

-

Actual user numbers (usually disappointing)

-

Real technical limitations (always disappointing)

-

Quantifiable metrics that can’t be faked (potentially devastating)

But what if it's just a whitepaper project? Then its potential value is limited only by your imagination and your audience’s gullibility.

This creates a bizarre phenomenon: actually building something tangible is punished by the market.

Perfect Information Game

The core of game theory is this: people act based on what they know and what serves their self-interest.

In crypto fundraising, we have:

-

Founders (who know everything)

-

Venture capitalists (who know some things)

-

Retail investors (who know almost nothing)

If you’re a founder without a product, your winning strategy is clear:

-

Keep everything vague but exciting

-

Talk about potential, not reality

-

Create FOMO (fear of missing out) by any means necessary

The vaguer you are, the harder it is to challenge you; the fewer features you ship, the fewer ways you can fail.

Why Doesn’t Anyone Demand Better Standards?

In game theory, there's a famous scenario called the prisoner’s dilemma, which shows why individuals make choices that harm everyone collectively.

Crypto investing works similarly:

-

If everyone demanded real products before investing, the market would be healthier.

-

But anyone who waits risks missing early gains. The earliest investors often profit the most—even if the project ultimately fails.

So for each individual investor, the smartest move is to jump in early based on promises ("ape in"). But this leads to a collectively stupid outcome: rewarding bullshit over substance.

Selling Dreams vs. Facing Reality

A project supported only by Medium posts can claim it will revolutionize everything and capture trillions in value.

But a real project with actual code must answer tough questions:

-

How many users do you actually have?

-

What can the technology really do—and not do?

-

Why haven’t competitors already overtaken you?

This creates what I call the "bullshit premium"—the extra valuation granted to projects completely unburdened by reality.

Hype as Coordination Mechanism

When no one can tell which projects are good, everyone looks for the same signals:

-

Which influencers or celebrities are talking about it?

-

Which exchanges have listed its token?

-

How fast is the token price rising?

Projects without real products can dedicate all resources to generating these signals instead of building anything real.

The less budget spent on developers, the more available for marketing. And in crypto, marketing always beats development.

Real-World Examples: “All-Star” Projects With No Product

Crypto is full of billion-dollar whitepaper projects whose fates perfectly validate the above theory:

-

Berachain: Built one of crypto’s most fanatical communities and achieved a multi-billion dollar valuation—all before launching mainnet. This proves that in crypto, the less real a product is, the more easily people project their dreams onto it.

-

Aptos: Raised $350 million for a blockchain claiming 162,000 transactions per second (TPS), but delivered just 4 TPS at launch. The less evidence required for technical claims, the more funding they attract.

-

Worldcoin: Proposed the idea of “trading your biometric data for tokens,” which somehow sounded compelling to VCs—and attracted billions in investment.

These cases share one thing: the more abstract or technically complex the promise, the more money raised—and the more catastrophic the eventual collapse.

Why This Won’t Stop

The logical solution would be for investors to demand functional products.

But game theory tells us this won’t happen, because:

-

FOMO is real: Early investors earn the most, creating pressure to invest before validation.

-

Claims can’t be verified: Most investors lack the technical ability to assess whether a project can deliver.

-

Fund managers don’t care: Their performance is judged quarterly, not by long-term success.

-

Incentives are misaligned: Choices beneficial to individuals are harmful to the market as a whole.

This is why projects with no product consistently raise more than those actually building useful things.

The game isn’t broken—it’s being played perfectly.

This article is for informational and commentary purposes only and does not constitute financial advice. I'm just having fun watching it all unfold :)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News