Hotcoin Research | The Era of Stock Trading on the Blockchain: Analysis and Outlook on the Stock Tokenization Trend

TechFlow Selected TechFlow Selected

Hotcoin Research | The Era of Stock Trading on the Blockchain: Analysis and Outlook on the Stock Tokenization Trend

This article will provide a detailed analysis of the fundamental principles, advantages, representative platforms of stock tokenization, its impact on the crypto market and traditional financial landscape, and explore potential future development paths for stock tokenization.

Author: Hotcoin Research

1. Introduction

As crypto-asset ETFs and the on-chain integration of real-world assets (RWA) continue to evolve, the boundaries between cryptocurrency and traditional finance are gradually dissolving. Recently, tokenized stocks have become a hot topic in financial markets. On June 30, Bybit and Kraken simultaneously launched "xStocks," a product offered by Swiss-regulated asset tokenization platform Backed Finance, covering approximately 60 stock and ETF tokens. Kraken's Co-CEO Arjun Sethi stated that “the market size for tokenized stocks will ultimately far exceed that of stablecoins.” On the same day, U.S. brokerage giant Robinhood announced it would launch tokenized stock trading services for EU users on the Arbitrum network, supporting over 200 U.S. equities and ETFs—including NVIDIA, Apple, and Microsoft—with uninterrupted 24-hour trading on weekdays. The market responded positively, sending Robinhood’s parent company stock surging 8%—a new all-time high since its IPO. Additionally, Dinari obtained the first broker-dealer license in the U.S. for stock token trading, positioning itself as the first compliant stock token platform within the United States. Coinbase, America’s largest crypto exchange, also revealed it has applied to regulators for approval to offer on-chain stock trading services.

This wave of concentrated developments clearly signals that stock tokenization is moving from concept to reality and inching toward the mainstream of finance. Could stock tokenization be the next catalyst driving trillions of dollars in traditional markets onto blockchains? Are tokenized stocks a disruptive innovation enabling financial democratization—or merely another short-lived speculative frenzy in the crypto space? This article explores the fundamental mechanics, benefits, key platforms, and implications of stock tokenization for both crypto and traditional finance. It also examines potential future trajectories, helping readers fully understand the real value and challenges of this financial innovation and better navigate the opportunities and risks behind this emerging trend.

2. Mechanisms and Advantages of Stock Tokenization

1. Definition and Implementation of Stock Tokenization

Stock tokenization refers to converting traditional securities like stocks into digital tokens on a blockchain. Instead of holding physical share certificates, investors hold digital tokens linked to specific stocks, which grant them equivalent rights such as price appreciation and dividend receipts.

Currently, there are two primary approaches to stock tokenization:

-

1:1 Real Stock Backing Model: A regulated custodian holds the underlying shares, issuing one token on-chain for every one physical share owned. These stock tokens are backed by real assets, similar to reserve-backed stablecoins. For example, Switzerland-based Backed issues bAAPL, bTSLA, and other U.S. stock tokens, with corresponding shares held by regulated banks and regular proof-of-reserves disclosures. Similarly, Swarm's stock tokens are backed by assets held in custody and verified by trustees, with monthly public reporting ensuring full 1:1 backing.

-

Synthetic Tokens / Derivatives Model: No actual shares are held. Instead, price feeds from oracles and derivative structures replicate stock prices on-chain. For instance, Helix, a decentralized exchange on the Injective ecosystem, offers iAssets—synthetic assets that bring stocks, commodities, and forex onto the blockchain purely through smart contracts. These synthetic stock tokens lack physical share backing and function more like perpetual or CFDs (contracts for difference), tracking prices entirely via on-chain mechanisms.

2. Advantages of Stock Tokenization

Compared to traditional securities markets, on-chain stock token trading brings transformative improvements:

-

Breaking Time and Geographic Barriers: Stock tokens enable 7×24 trading, allowing free buying and selling even during weekends or traditional market closures. Global investors can participate seamlessly with just a smartphone or computer, bypassing geographic restrictions, time zones, and complex cross-border procedures. For example, Robinhood’s U.S. stock tokens allow European users to trade American equities anytime, just like cryptocurrencies, without opening a U.S. brokerage account or dealing with time zone differences.

-

Improved Settlement Efficiency and Lower Costs: Blockchain’s peer-to-peer transactions eliminate central clearinghouses, reduce intermediaries and manual reviews, and enable near-instant settlement with faster fund availability. This significantly lowers transaction fees and friction costs. Industry experts widely believe stock tokenization can drastically cut trading costs and accelerate settlement times.

-

Enhanced Accessibility and Liquidity: Tokenization allows high-value blue-chip stocks to be divided into smaller units, enabling fractional ownership and micro-investing. These tokens can be freely transferred and traded across platforms, expanding liquidity beyond single exchanges. For emerging-market investors previously excluded from U.S. markets, stock tokens lower entry barriers and remittance costs, allowing broader access to global capital market growth.

-

New Use Cases Through DeFi Integration: Tokenized stocks can be used like any cryptocurrency—transferred, held, spent, or used as collateral for lending—all executed instantly, globally, and without intermediaries from a user’s crypto wallet. Previously unimaginable scenarios—such as using an Apple stock token as collateral to borrow stablecoins, or providing Tesla stock token liquidity in a DeFi pool to earn trading fees—are now possible. These innovations unlock dormant equity value and enhance financial system efficiency.

Stock tokenization combines the openness of blockchain technology with the intrinsic value of traditional securities—breaking down geographic and temporal barriers while increasing asset transfer speed and composability within the financial "Lego" ecosystem. According to RWA.xyz data, the stock tokenization market has seen significant growth since early 2025. As of July 3, the market cap exceeded $340 million, with projections suggesting it could reach several trillion dollars in the future.

Source: https://app.rwa.xyz/stocks

3. Key Platforms in Stock Tokenization

The idea of stock tokenization is rapidly transitioning from theory to practice, with numerous platforms emerging. Below is an overview of representative stock tokenization platforms and projects:

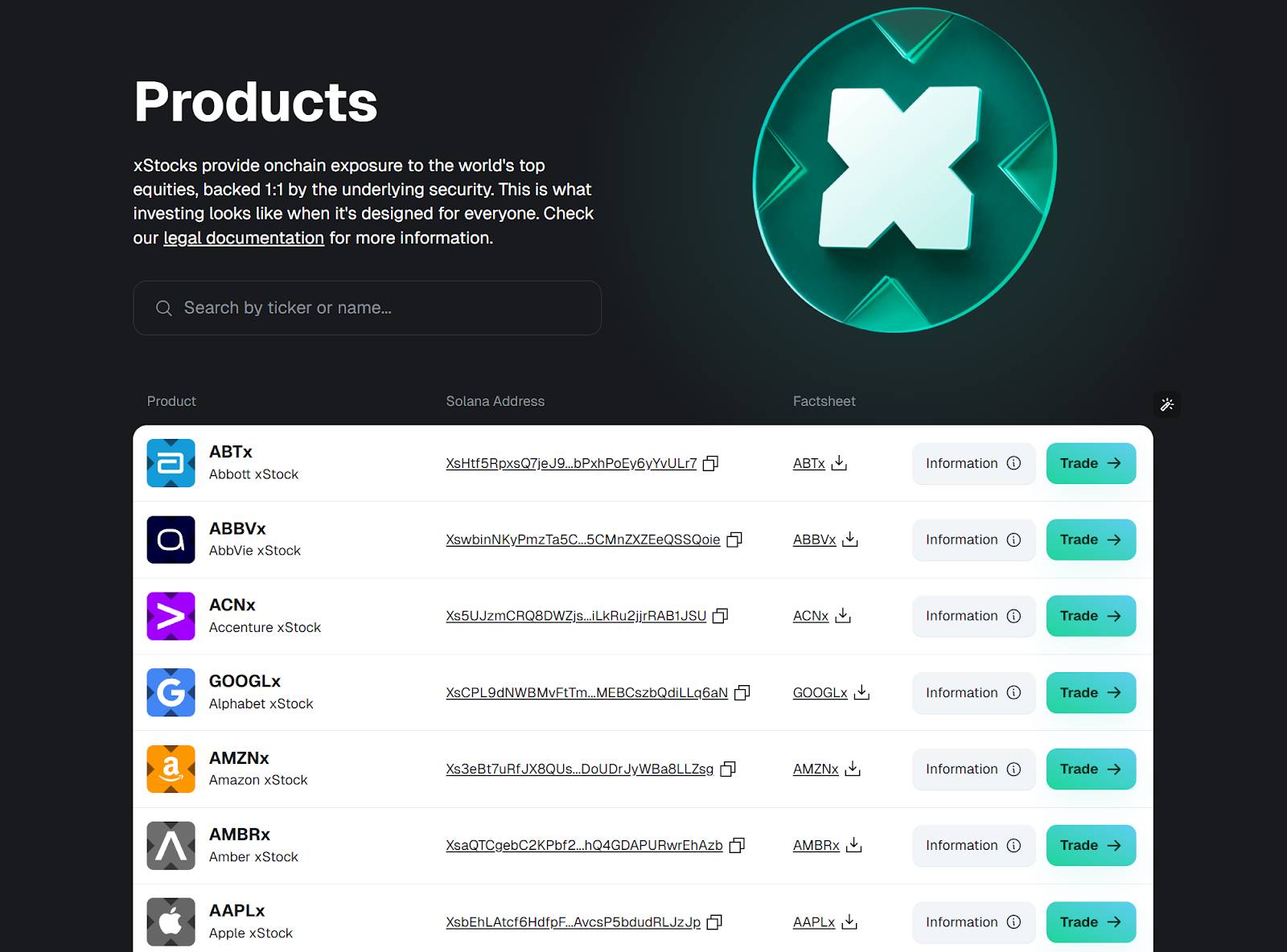

1. xStocks

On June 30, Swiss asset token issuer Backed partnered with Kraken, Bybit, Raydium, Jupiter, and Kamino to launch xStocks—a tokenized stock trading service offering 61 U.S. stocks and ETFs including Apple, Amazon, Tesla, and NVIDIA, available to non-U.S. users. As one of the few regulated token issuers, Backed operates under Switzerland’s DLT regulatory framework, providing compliance-reviewed tokenized stock products to exchanges and DeFi protocols, accelerating global adoption. Backed uses a strict 1:1 physical collateral model: each token minted on-chain corresponds to one real stock purchased in secondary markets, with assets held by licensed Swiss custodial banks and regular proof-of-reserves reports ensuring transparency.

Source: https://xstocks.com/products

2. Bybit

In 2023, Bybit introduced CFD (Contract for Difference) trading in stocks and commodities for select users—though these were off-chain contracts. On June 16, Bybit officially launched its standalone TradFi multi-asset trading platform based on MT5, enabling users to trade precious metals, oil, indices, stock CFDs, and forex directly within Bybit without installing MT5 separately. TradFi supports up to 5x leverage, with all trades settled in USDT—no currency conversion or traditional brokerage accounts required. On June 30, Bybit announced its partnership with Backed’s xStocks, enabling direct trading of 1:1 real-stock-backed on-chain tokens. Bybit plans to roll out trading pairs for multiple stock tokens including Coinbase (COINX), NVIDIA (NVDAX), Circle (CRCLX), Apple (AAPLX), Robinhood (HOODx), Meta (METAX), Google (GOOGLX), Amazon (AMZNX), Tesla (TSLAX), and McDonald’s (MCDX).

3. Robinhood

On June 30, traditional brokerage giant Robinhood announced at its Cannes launch event a tokenized U.S. stock and ETF trading service for European users, allowing them to buy and sell over 200 U.S.-listed stocks and ETFs using their crypto accounts. Robinhood promises “zero commission fees, dividend payouts, and 24/5 continuous trading.” These stock tokens are issued on Arbitrum, an Ethereum Layer 2 network. Through partnerships with custodial brokers, each token is backed by one real stock, with synchronized on- and off-chain settlement and rights updates. Token holders receive equal rights to dividends and stock splits. Robinhood also unveiled plans to develop its own Layer 2 blockchain—“Robinhood Chain”—built on Arbitrum technology, optimized for tokenized assets with support for 7×24 trading, self-custody, and cross-chain bridging. Robinhood envisions a “free tokenization of everything,” aiming to build a global on-chain network for real-world assets over the next decade.

4. Dinari

In June 2025, Dinari became the first stock token platform in the U.S. to register as a Broker-Dealer. Its stock tokens, called dShares, are issued on Arbitrum One. Each time Dinari purchases a stock on an exchange, it mints an equivalent amount of dShares, maintaining strict 1:1 collateralization. Registered with U.S. securities regulators as a transfer agent, Dinari directly manages and holds the underlying stocks, ensuring a one-to-one correspondence between tokens and shares. To meet compliance requirements, Dinari enforces rigorous KYC/AML checks: currently only U.S. and Canadian users may register, requiring government-issued ID (driver’s license, passport) and address verification before trading. The platform already offers nearly 100 U.S. stock tokens including Apple, Amazon, Microsoft, NVIDIA, and Coinbase. In addition to price gains, dShare holders receive dividends: Dinari converts cash dividends into USD+, a stablecoin, and distributes them on-chain. Fees are fixed: $10 per trade on Ethereum mainnet, $0.20 on L2s like Arbitrum. Dinari has stated it will not issue a platform token to avoid confusion with securities. Operating a B2B2C model, Dinari focuses on integrating its compliant trading API into other platforms rather than mass consumer outreach.

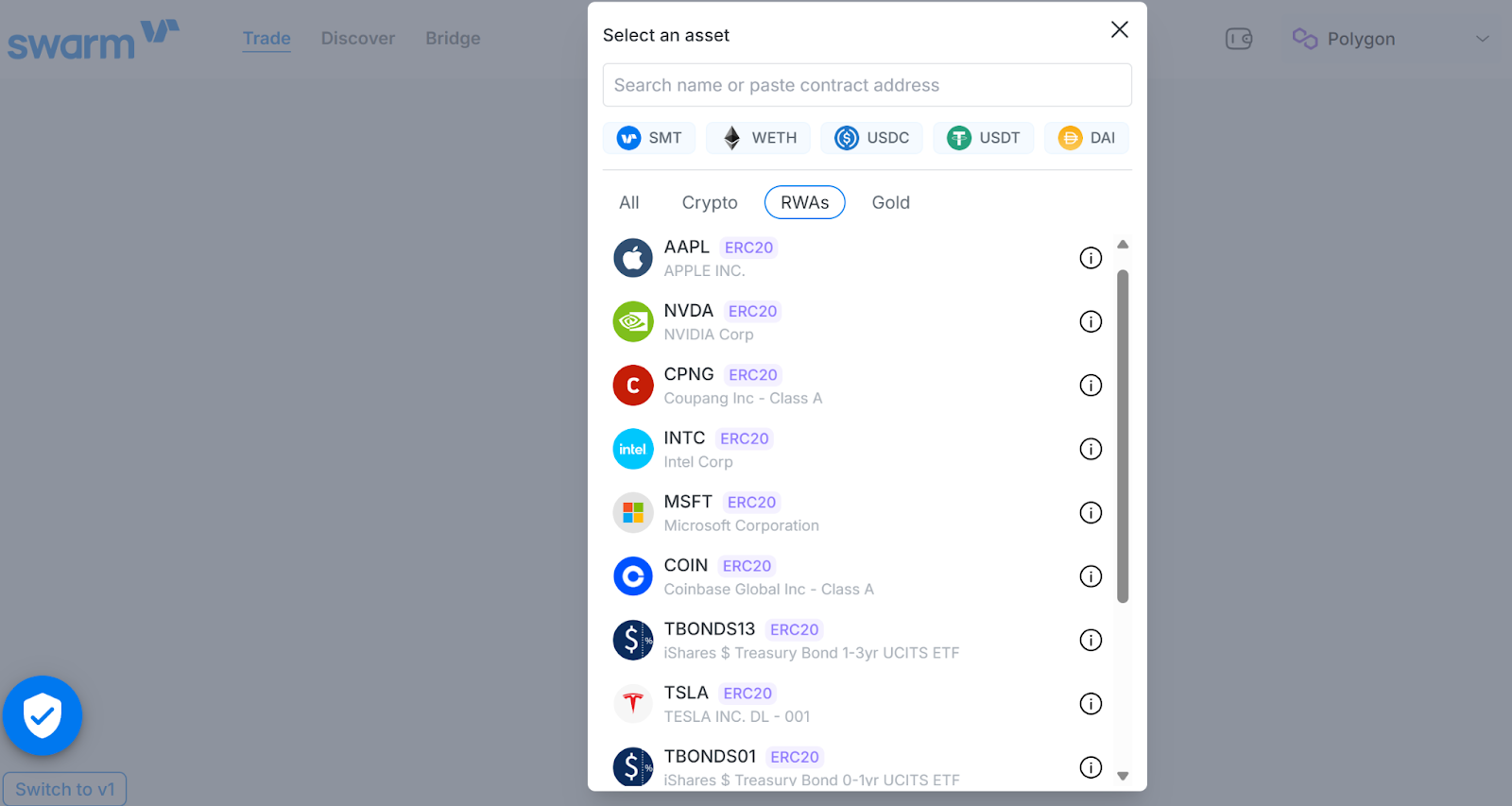

5. Swarm

Swarm is a compliant DeFi infrastructure project offering token issuance, liquidity, and trading. Since 2023, it has rolled out stock and gold token trading services. Users can trade 12 U.S. stock tokens—including AAPL, NVDA, MSFT, COIN, TSLA—and physical gold tokens via Swarm’s built-in decentralized trading app dOTC, using stablecoins like USDC. Supported on Ethereum, Polygon, Base, and others, Swarm enables users to find optimal liquidity across chains, charging a 0.25% trading fee. Stock tokens are issued by Swarm’s subsidiary SwarmX GmbH and fully backed by real shares held in regulated custody. Trustees verify holdings, and reserve details are disclosed monthly. As a decentralized protocol, Swarm does not enforce mandatory KYC, leaving compliance to users—which enhances global accessibility.

Source: https://swarm.com/

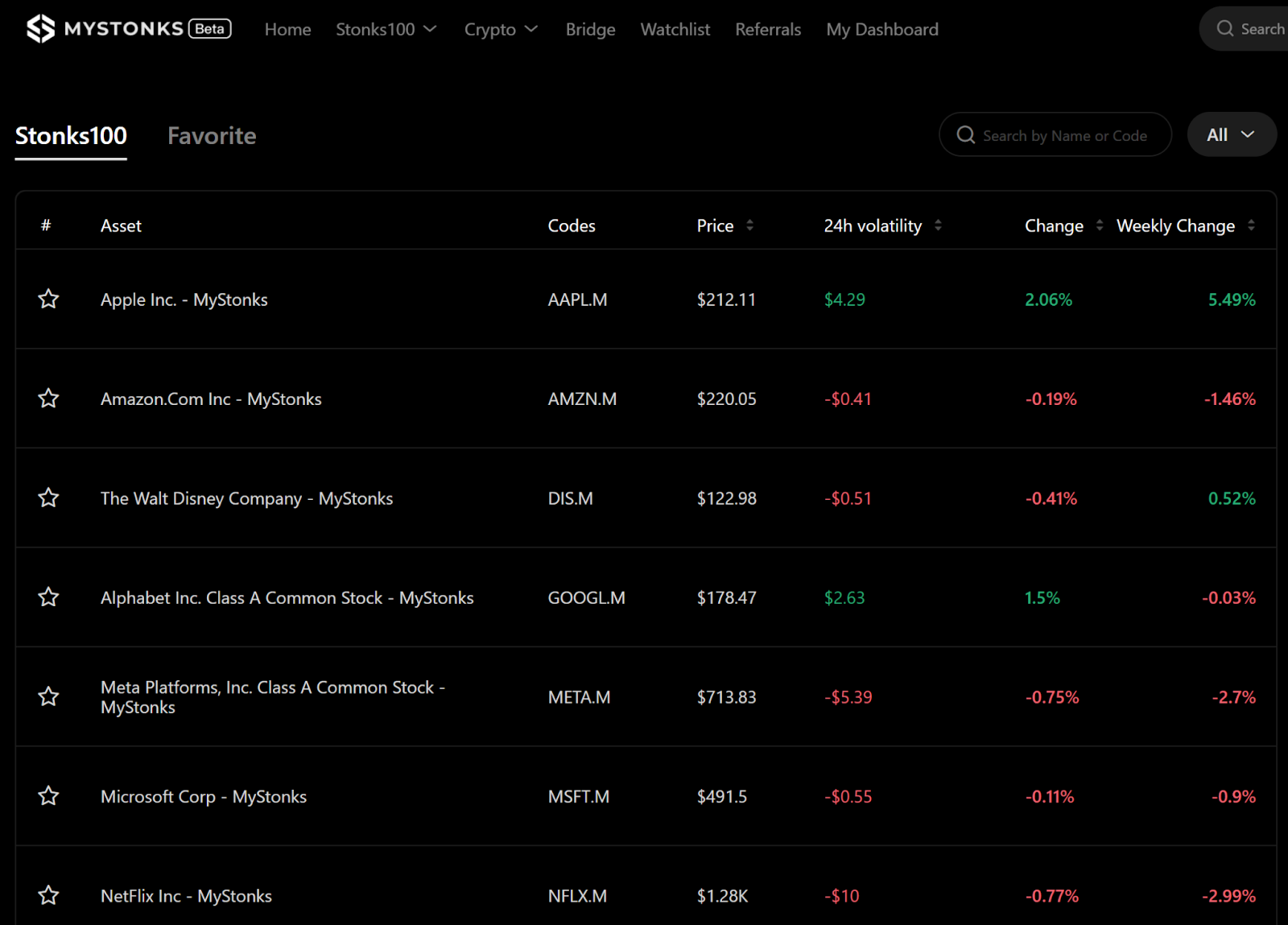

6. MyStonks

MyStonks is a decentralized protocol on the Base chain launching a “Stonks 100” section offering 95 U.S. stocks and 5 U.S.-listed crypto/stock ETFs—including Apple, Amazon, Disney, Google, Meta, Microsoft, and NVIDIA. MyStonks employs an on-chain/off-chain linkage mechanism: each on-chain trade triggers a 1:1 purchase or sale of real stocks off-chain, with Fidelity Investments serving as custodian. When users buy a stock token, MyStonks mints a corresponding token on Base and sends it to their wallet; upon sale, the token is burned and stablecoins returned. Price feeds are provided by Chainlink oracles, with a 0.3% trading fee charged by the platform.

Source: https://mystonks.org/

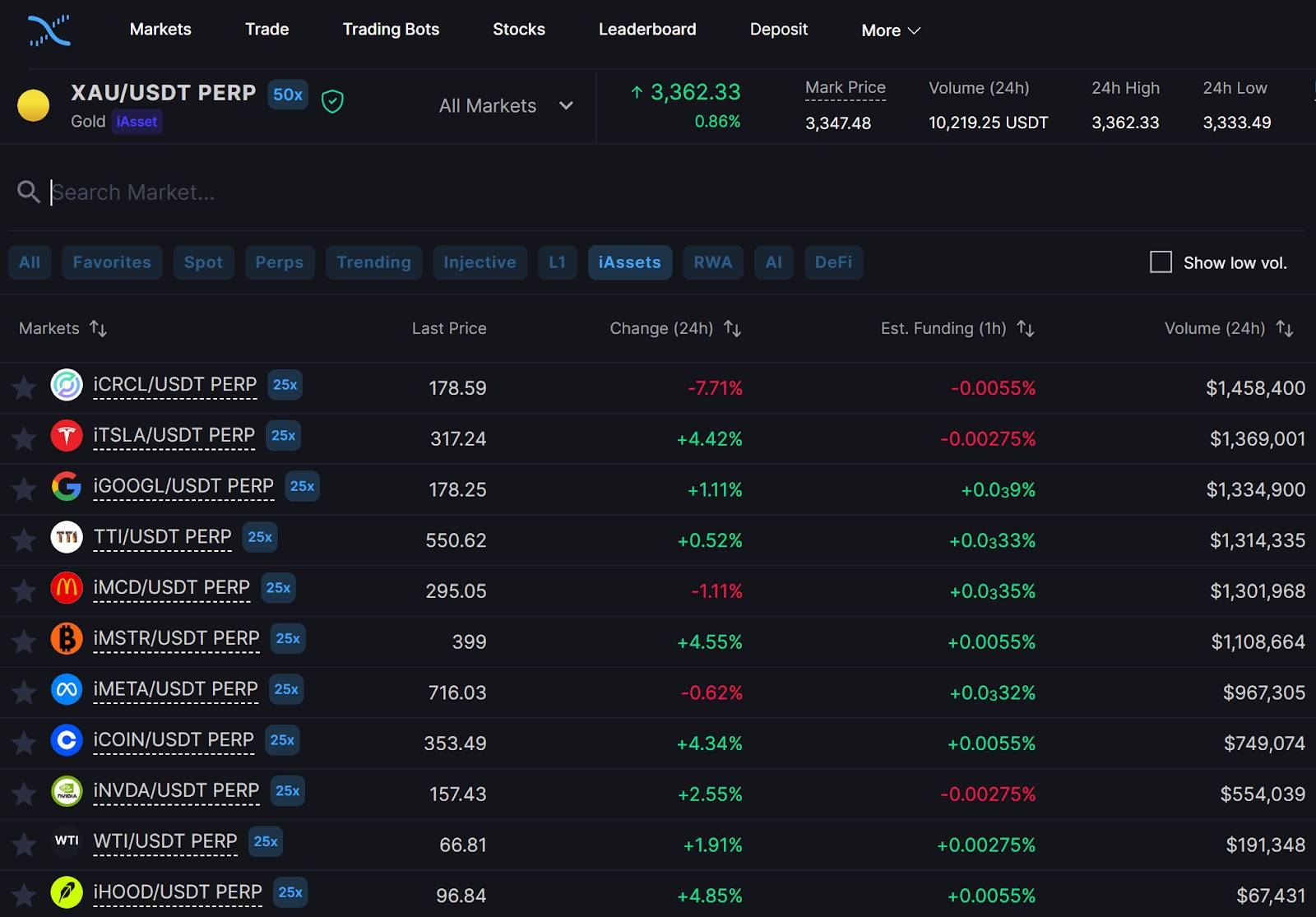

7. Helix

Helix is a decentralized exchange built on the Injective blockchain, natively supporting cross-chain spot and perpetual futures trading. Recently, Helix launched a synthetic asset market for 13 U.S. stocks, including Meta (FB), Tesla (TSLA), NVIDIA (NVDA), MicroStrategy (MSTR), and Coinbase (COIN). These synthetic stocks, known as iAssets, are on-chain derivatives: they do not require holding or custody of the underlying stock but instead track price movements via smart contracts and oracle price feeds. Without real asset backing, iAssets trade similarly to crypto perpetuals: users post USDT or other stablecoins as margin, trade with up to 25x leverage, enjoy 7×24 trading, and settle positions in USDT rather than physical delivery. Helix offers competitive fees (0.005% maker, 0.05% taker) and incentive programs like trading points and rebates to attract high-frequency traders. Helix represents a “pure on-chain” path to stock tokenization—one that caters to crypto-native users seeking volatility and leverage, making iAssets better suited for short-term speculation and hedging than long-term investment.

Source: https://helixapp.com/

8. Coinbase and Other Platforms

Coinbase has publicly listed “stock tokenization” as a strategic priority and submitted an application to the U.S. SEC in June to launch on-chain stock trading. According to Coinbase’s Chief Legal Officer Paul Grewal, if approved, Coinbase plans to let users trade public company stocks directly on blockchain, competing head-on with traditional brokers like Robinhood and Charles Schwab. Beyond Coinbase, Ondo Finance announced in February the launch of “Ondo Global Markets,” an RWA tokenization marketplace where users can trade 1:1 asset-backed stock, bond, and ETF tokens—all issued on its dedicated Ondo Chain (initially excluding U.S. users). Robert Leshner, founder of Compound, launched Superstate, planning to introduce the “Opening Bell” platform allowing compliant public companies to issue and trade shares directly on the Solana blockchain. The first pilot will involve Canadian-listed firm SOL Strategies, enabling cross-border equity circulation on-chain. More players are expected to enter this “on-chain Wall Street” race, further expanding the stock tokenization landscape.

4. Impacts and Challenges of Stock Tokenization

1. Impacts of Stock Tokenization

The rise of stock tokenization will profoundly affect both crypto and traditional finance:

-

For the Crypto Sector: This marks a shift from crypto exchanges being mere digital currency marketplaces to becoming one-stop financial platforms encompassing traditional assets. Companies like Robinhood, Coinbase, and Kraken are expanding their offerings, blurring the lines between crypto exchanges and internet brokers. Investors can now allocate both Bitcoin and Apple stock on the same platform, with both assets existing and trading as tokens. This opens vast new revenue streams for crypto platforms and allows them to compete for users traditionally served by legacy brokers. A new phase of competition among crypto and traditional financial platforms is likely to unfold across user acquisition, liquidity, and technology.

-

For Traditional Financial Institutions: This trend presents both challenge and opportunity. On one hand, blockchain-based direct trading threatens existing exchange and intermediary models, pushing traditional institutions to adopt new technologies to stay competitive. On the other, the tokenization of real-world assets offers Wall Street new innovation pathways. Major institutions are already experimenting—JPMorgan developed a blockchain-based digital securities settlement network in 2020; in 2023, Credit Suisse and Citigroup participated in a pilot settling European bonds on Ethereum. With stock tokenization accelerating, traditional investment banks and exchanges may fast-track their own on-chain platforms to avoid losing ground to tech-first entrants.

-

For Investors and the Market Overall: The benefits are clear: lower barriers for global investors to access international securities, greater portfolio diversification, improved market efficiency, and reduced pain points like T+2 settlement delays and cross-border remittance costs.

2. Risks and Challenges Facing Stock Tokenization

Despite its promise, stock tokenization faces significant hurdles:

-

Regulatory Uncertainty: This remains the biggest risk. While a few platforms like Dinari have navigated compliance, most countries lack clear legal definitions and unified regulatory standards for stock tokens. Early attempts by Binance and FTX to offer U.S. stock tokens were shut down due to regulatory pressure. Until robust frameworks emerge, many platforms operate in gray areas, exposing themselves to compliance risks. KYC/AML policies are double-edged: fully anonymous trading won’t satisfy regulators, but overly strict identity checks deter privacy-conscious crypto users. Balancing accessibility with compliance remains a long-term challenge.

-

Liquidity and Demand Constraints: As of now, the total on-chain real-world asset (RWA) market is about $23 billion, with stock tokens accounting for only ~$313 million. Thus, stock tokenization remains in its infancy—far from the “disruptive” scale often predicted. The chart below shows key metrics (market cap ~$313M, monthly volume ~$71M), underscoring how small this segment is relative to global equity markets.

-

Platform Immaturity: Many stock tokenization platforms lack transparency or proper licensing, deterring serious investment. Meanwhile, traditional stock markets are already mature and efficient. For investors seeking U.S. equities, conventional channels (offshore brokerage accounts,沪港通, etc.) are not prohibitively expensive or difficult. In some cases, compliant on-chain platforms are actually more cumbersome. Crucially, crypto-native users who favor high volatility and returns may find stocks too tame—compared to meme coins or DeFi tokens that can swing dozens of percent in a day, blue-chips like Apple and Microsoft seem “too calm” to deliver the thrill of crypto trading.

Hence, for stock tokenization to truly take off, it must discover new product-market fits—offering differentiated services and unique on-chain financial applications. Examples include integrating stock tokens into DeFi yield strategies, using them as collateral for borrowing, or pairing them with other tokens in liquidity pools. Only then can on-chain stock trading evolve from a gimmick into a genuine bridge connecting global capital markets with Web3.

5. Conclusion

From stablecoins to stock tokens, the on-chain migration of real-world assets is steadily reshaping the crypto industry. With regulations gradually easing and technology maturing, stock tokenization shows immense potential to unlock trillions in traditional assets. As a Kraken executive put it, “We’re not launching a novelty—we’re unlocking a foundational transformation.” Stock tokenization embodies the vision of financial democratization: enabling individuals everywhere to fairly participate in wealth creation, unbounded by geography or financial gatekeeping. Yet realizing this vision remains a long and winding road. Regulatory clarity, market liquidity, and user education require collective effort across the industry. But one thing is certain—the tide is turning. When major players like Robinhood and Coinbase go all-in, the era of on-chain securities may have already begun.

Looking ahead a decade, cautious optimism is warranted: stock tokenization may not replace traditional markets, but it could coexist alongside them, forming a hybrid “on-chain + off-chain” ecosystem. Traditional exchanges and institutions will embrace blockchain to boost efficiency and cut costs, while crypto-native platforms innovate with more diverse and engaging investment products. These forces, competing and converging, will drive financial evolution and deliver more innovative, efficient investment experiences for global investors.

The current wave of stock tokenization is the opening movement in the convergence of Wall Street and the crypto world. Before long, we may witness the emergence of a true “always-on, borderless, disintermediated” global capital market taking shape on-chain. The age of on-chain stock trading is coming our way.

About Us

Hotcoin Research, the core research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We have built a three-pillar service framework—“trend analysis + value discovery + real-time monitoring”—delivering deep dives into crypto industry trends, multidimensional evaluations of promising projects, and round-the-clock market tracking. Through weekly dual broadcasts of our flagship programs “Top Token Picks” strategy livestream and “Blockchain Today” daily news digest, we provide precise market interpretations and actionable strategies for investors at all levels. Leveraging advanced data analytics models and an extensive industry network, we empower novice investors to build cognitive frameworks and help institutional clients capture alpha, jointly seizing value growth opportunities in the Web3 era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News