Visa's Understanding of the Next Phase for Stablecoins

TechFlow Selected TechFlow Selected

Visa's Understanding of the Next Phase for Stablecoins

As one of the dominant rulers of direct value and capital flows in the traditional fiat world, Visa must have already seen everything and made corresponding preparations.

By: Web3 Lawyer

Recently, the U.S. Senate passed the "Guidance and Establishment of National Innovation for Stablecoins Act" (also known as the "GENIUS Act"), marking another critical milestone toward regulatory clarity in the United States. On June 23, Jack Forestell, Visa’s Chief Strategy and Product Officer, published an article titled *The potential genius of GENIUS*, outlining Visa’s perspective on the future of stablecoins—aligning closely with views previously expressed by Visa CEO Ryan McInerney in a CNBC interview.

Visa's insights are highly significant. As one of the dominant players in traditional fiat value transfer, Visa exemplifies the adage “the duck knows first when the spring river warms.” They have likely already seen what is coming and prepared accordingly. Therefore, we extract Visa’s viewpoints here, combined with our own reflections, to explore the next phase of stablecoins.

1. A "Potential" Pivotal Moment in Payment History

Jack Forestell, Visa:

For Visa, the GENIUS Act should be seen as a "potential" pivotal moment in payment history.

The term "potential" is used because while stablecoins represent an opportunity to usher in the next age of digital programmable money, there remains substantial work to achieve true scalability.

As Visa CEO Ryan McInerney noted: "Our world hasn’t changed dramatically just because of this stablecoin legislation. Visa has been preparing for stablecoins for years and is ready for their arrival."

Expanding new payment technologies is no easy task—it requires building broad trust among buyers, sellers, payers, and recipients. This trust accumulates over time and is rooted in a complex, interwoven set of functions that collectively deliver security, reliability, fraud protection, dispute resolution, ease of use, and continuous innovation.

For stablecoins to become part of the world’s next-generation digital payment infrastructure, they must succeed across three layers:

1. Technology Layer

There must be a robust, scalable, flexible, and open technological backbone capable of securely executing large-scale transactions at high speed—with zero tolerance for failure, leakage, or breaches.

Advancements in blockchain technology have provided promising solutions to this challenge.

2. Reserve Layer

-

Trust in the value and stability of the medium of exchange must be established.

-

Regulated, reserve-backed stablecoins offer a solution to this issue.

3. Interface Layer

There must be a ubiquitous interface layer that participants actively want to engage with:

-

This layer must provide trust, rules, standards, security, and value for all parties involved in every transaction

-

It must scale to serve billions of end users

-

It must offer users a simple and convenient mechanism to convert value tokens into their preferred fiat currency (i.e., users must be able to spend received value tokens wherever and whenever they choose)

The stablecoin infrastructure itself cannot solve the challenges of this final layer. Without addressing it, stablecoins will fail to achieve mass adoption and remain far from becoming mainstream means of value exchange.

If not widely adopted, stablecoins may still serve narrow payment use cases, closed-loop systems, or function behind the scenes as infrastructure for wholesale money markets and capital markets—but they won’t scale into mainstream payments.

Web3 Lawyer’s Reflections:

We can treat the blockchain—proven over more than a decade—as the settlement layer, and compliant stablecoins as the reserve layer, forming a foundational stablecoin infrastructure. Additionally, global on/off-ramp networks and financial institutions providing fiat channels are equally crucial.

With this foundation, seamless conversion between fiat and stablecoins becomes possible, supporting real-world stablecoin payment scenarios and solving the “last-mile” problem—making stablecoins truly omnipresent.

Several strategic moves illustrate this approach:

Visa strategically invested in BVNK, a stablecoin infrastructure provider; BVNK later integrated with major online/offline acquirers like Worldpay and cross-border SME payment solutions such as LianLian Pay. Combined with Visa’s own capabilities like Visa Direct and Account/Card products, this enables last-mile delivery. See: *10,000-Word Report on Web3 Payments: The Web3 Transformation of Cross-Border Consumer Payments.*

Circle issues its USDC stablecoin, co-founded with Coinbase, and built the Circle Payment Network—a key stablecoin infrastructure network enabling last-mile reach. See: *Circle Releases Whitepaper on ‘Stablecoin Payment Network’.*

Stripe acquired Bridge and Privy to enhance its stablecoin infrastructure capabilities, then leveraged its B2B2C strategy to empower platforms like Shopify, achieving last-mile distribution. See: *Stripe Acquires Bridge, Stripe Acquires Privy.*

Ripple evolved from the XRP Ledger to RippleNet (a financial institution network), then launched the RLUSD stablecoin. See: *Ripple, XRP, RippleNet.*

PayPal launched its PYUSD stablecoin, connecting ecosystems like PayPal and Venmo—super-applications that consolidate user bases and serve 400 million users—enabling everyone to pay exactly how they want.

At the launch of PYUSD, PayPal outlined its evolutionary framework:

When PayPal was founded, its mission wasn't just facilitating payments—it was introducing and popularizing a new technology: digital payments. Today, that form of digital payment is everywhere.

While PayPal’s PYUSD stablecoin hasn’t generated massive buzz, its prior success offers valuable guidance and fresh insights for launching stablecoin-based payments. Specifically, PayPal divides the path to mass adoption into three stages:

-

Awareness: The GENIUS Act serves as a perfect catalyst for awareness;

-

Utility: Clearly, we are currently in this stage;

-

Ubiquity: Requires more real-world stablecoin payment use cases—not just a race to obtain stablecoin licenses.

Similarly, Visa’s CEO emphasized the capabilities needed to truly enable new payment methods—complementing PayPal’s evolution model:

Scaling new payment technologies is challenging. We need:

-

Trust (backed by thousands of financial institutions on Visa’s network)

-

Usability (front-end payment products like Visa Card)

-

Scalability (Visa’s network of tens of millions of consumers and merchants)

The final stage of adopting any new payment technology is ubiquity—where the technology seamlessly integrates into daily life. At this point, people use it effortlessly and unconsciously—just as we now access the internet without thinking about which telecom carrier or protocol underpins it.

To users, this may no longer be about blockchain—or even about stablecoins.

2. Visa Will Help Solve This Problem

Jack Forestell, Visa:

Visa has built the largest, most secure, trusted, and recognized Layer 3 payment system in the world. We’ve invested billions of dollars continuously improving it, enhancing compatibility with underlying transaction mediums, and enabling各方to easily and flexibly integrate into the Visa ecosystem.

By integrating Visa’s infrastructure, services, and connectivity, Visa delivers seamless, secure digital payment experiences to billions of buyers and sellers worldwide—with unmatched scale, reliability, and security. We call this powerful combination the “Visa as a Service” stack.

From the smallest sellers to the largest banks and enterprises, when the world needs to scale payment solutions, they turn to the Visa stack. Crypto-native partners are no exception. For years, Visa has collaborated with leading crypto and stablecoin platforms, providing them access to our stack and enabling hyper-scaling of payments.

Since 2020, Visa has facilitated nearly $95 billion in cryptocurrency purchases and over $25 billion in cryptocurrency spending—more than $100 billion in total fund flows.

Global consumers and businesses view 4.8 billion Visa credentials and nearly 14 billion Visa digital tokens as the best way to pay—and the best way for anyone, anywhere, to get paid. Visa’s tech stack delivers superior payment experiences, and we continue investing relentlessly to make it the most advanced, secure, and convenient payment method available.

-

Thanks to Visa’s capabilities, users no longer need to ask themselves before shopping:

-

Will this merchant accept my payment?

-

Do I need a special wallet to pay?

-

Do I have the right type of currency in my wallet? Am I on the correct blockchain?

-

What is the gas fee for this transaction?

-

Can I maintain privacy? After buying something, can others see all my transaction records and addresses without my consent?

-

Will I earn rewards?

-

How can I use my credit line?

-

If I encounter an issue, who do I contact?

-

Is it secure?

The vast majority of consumers and businesses will continue using fiat payments and enjoy the convenience offered by Visa credentials. The same applies to stablecoin-powered solutions connected to the Visa stack.

Web3 Lawyer’s Reflections:

The core message Visa wants to convey is clear: even if you possess stablecoin infrastructure capabilities, that alone isn’t enough. What matters is leveraging Visa’s ecosystem and capabilities to achieve scale—this is the essence.

(Visa CEO on GENIUS ACT: We've been embracing stablecoins)

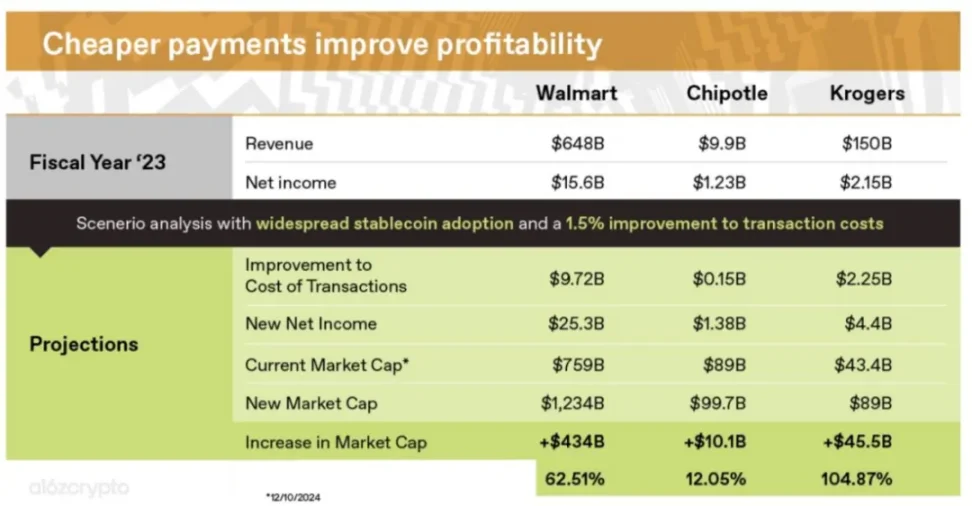

However, companies like Walmart and Amazon have reportedly considered issuing their own stablecoins. If these large-scale enterprises can bypass Visa/Mastercard settlement networks, they could eliminate massive intermediary fees—significantly boosting profitability.

This is a challenge Visa cannot ignore.

As previously discussed in *10,000-Word Report on Web3 Payments: How Stablecoins Will Play Out in 2025*:

Transaction fees in today’s payment systems directly erode most companies’ profits. Reducing these fees opens up enormous profit potential. The first shoe has dropped: Stripe announced it will charge only 1.5% for stablecoin payments—30% lower than its credit card processing fees.

For simplicity, assume businesses currently pay a blended 1.6% in payment processing costs, with negligible currency conversion expenses.

Walmart generates $648 billion in annual revenue and pays around $10 billion in credit card fees, with $15.5 billion in profit. Eliminating payment fees could increase Walmart’s valuation by over 60%—all else being equal—simply through cheaper payment solutions.

Chipotle, a fast-growing fast-casual restaurant chain, earns $9.8 billion annually with $1.2 billion in profit, paying $148 million in credit card fees. Just reducing these fees could boost Chipotle’s profitability by 12%—an extraordinary gain unattainable elsewhere on its balance sheet.

National grocer Kroger operates on razor-thin margins, meaning it stands to benefit the most. Surprisingly, Kroger’s net income may be nearly equal to its payment processing costs. Like many grocers, its profit margin is below 2%, less than typical credit card processing fees. With stablecoin payments, Kroger’s profits could potentially double.

(How stablecoins will eat payments, and what happens next, a16z)

3. What Problems Do Stablecoins Actually Solve?

Jack Forestell is often asked: “What problems do stablecoins actually solve?”

His response: First, stablecoins have already achieved product-market fit within the crypto trading market. Beyond that, they represent meaningful opportunities in certain use cases—especially in emerging markets:

-

Users in countries with weak currencies, high inflation, or foreign exchange restrictions who want to hold U.S. dollars but lack easy access to them.

-

Certain cross-border fund transfer use cases, such as C2C remittances or B2B business payments.

Tether’s CEO stated: Less than 40% of Tether’s market cap is tied to crypto trading activity. In other words, over 60% of USDT’s growth comes from grassroots usage in emerging markets. The next driver of USDT’s market cap may come from commodity trade.

Visa sees these use cases as unsolved processes—offering pathways for business growth. To address them, Visa plans to collaborate with native stablecoin platforms, crypto-native partners, and financial institution partners—leveraging the full power of the Visa stack.

In developed markets like the U.S., it remains unclear whether consumers and businesses will adopt stablecoin payments, given the abundance of existing alternatives—such as direct bank account transfers using “digital dollars.”

The GENIUS Act brings tangible regulatory clarity to stablecoins, opening doors for broader applications. Visa is already actively developing various stablecoin solutions, including:

-

Deploying Visa credentials and digital tokens to connect stablecoin and crypto platforms and their users to fiat currencies and our global network

-

Providing local stablecoin settlement

-

Enabling cross-border fund transfer solutions via stablecoin infrastructure

-

Offering customers programmable money solutions

-

And more in development

Of course, making stablecoins truly “genius” will take time—and we’re only just beginning.

Web3 Lawyer’s Reflections:

Visa’s CEO made a crucial point: There is a widespread misconception about where stablecoins are used. Because most stablecoins are USD-denominated, people assume the U.S. is the primary market. But the real product-market fit for stablecoins lies outside the U.S.—in what we call the Global South (Africa, Asia, Latin America). Across roughly 30–50 countries, stablecoin adoption can drastically improve financial efficiency.

Tether’s CEO confirmed this during a Bankless interview:

The U.S. is one of the most efficient markets for fund flows, with financial channel efficiency reaching about 90%. Introducing stablecoins might raise that to 95%—a very limited upside. In contrast, in much of the rest of the world, stablecoins can boost financial efficiency by 30%–40%. For these regions, the impact of stablecoins is far greater.

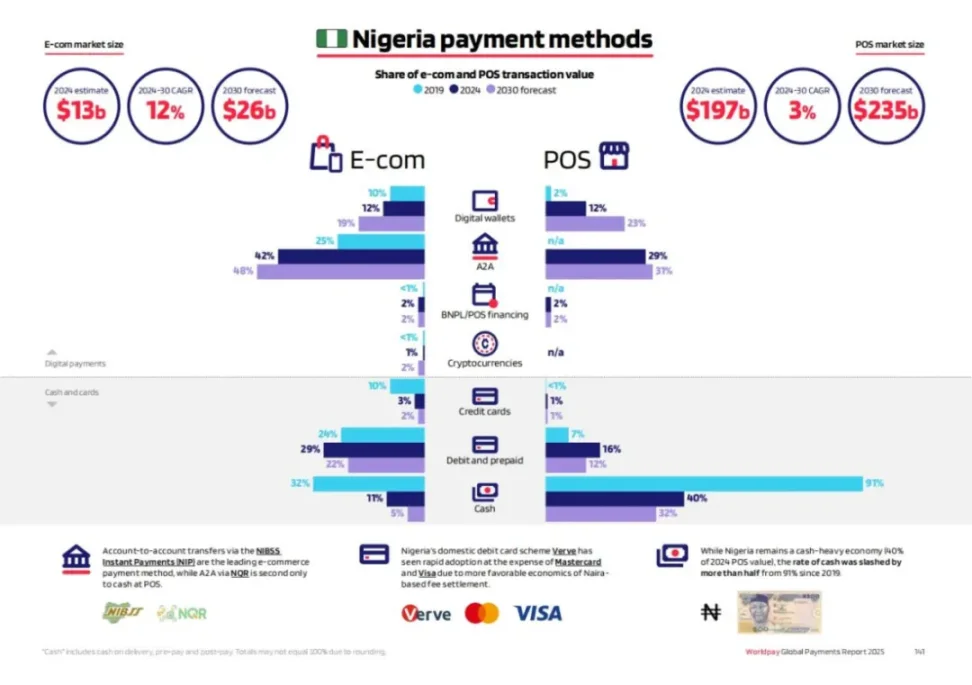

Therefore, in these markets—even Visa struggles to reach. As shown in our previous report (*10,000-Word Report on Web3 Payments: The Web3 Transformation of Cross-Border Consumer Payments*), payment preferences vary significantly by country. Interested readers should review those details.

Germany: Consumers are least willing to use credit or debit cards (only 32%), preferring digital app payment services (49%) and bank transfers/wire transfers (35%). This may reflect higher consumer demand for security and usability, as emphasized in the *2022 Report on Online Payment Methods in Western Europe*.

Philippines: Digital app payments are the top choice (49%), possibly due to 48.2% of consumers lacking access to traditional banking systems.

Similarly, Worldpay’s 2025 report shows that Visa/Mastercard penetration in Nigeria—one of Africa’s major economies—remains very low. Offline, cash still dominates.

(GPR 2025: the past, present and future of payments, WorldPay)

This is where Tether excels. While the Global North engages in an arms race, Tether has already deeply penetrated the Global South.

With 3 billion people globally still unbanked, and Tether already serving 450 million users, the opportunity is immense. Distinguishing between different stablecoin products and use cases is critical.

Going deep into Africa, Asia, and Latin America—investing in infrastructure—this innovative distribution channel and profound penetration into emerging markets is key to Tether’s leadership in the stablecoin space. Tether doesn’t just lead technologically; it has built an unprecedented global dollar distribution network—an advantage few recognize.

If Circle, after going public, suddenly finds itself surrounded by competitors from traditional finance and industrial giants,

Then Tether’s rivals come from the East’s “Belt and Road Initiative” :)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News